444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific workforce management software market represents one of the most dynamic and rapidly evolving segments in the global enterprise software landscape. This comprehensive market encompasses sophisticated digital solutions designed to optimize human resource operations, streamline employee scheduling, enhance productivity tracking, and facilitate seamless workforce coordination across diverse organizational structures. The region’s unique blend of technological advancement, diverse workforce demographics, and varying regulatory environments creates a complex yet highly opportunistic market environment.

Market dynamics in the Asia-Pacific region are characterized by accelerating digital transformation initiatives, increasing adoption of cloud-based solutions, and growing emphasis on data-driven workforce optimization. Organizations across industries are recognizing the critical importance of efficient workforce management systems in maintaining competitive advantage and operational excellence. The market demonstrates robust growth potential with projected expansion rates of 12.5% CAGR over the forecast period, driven by technological innovation and increasing enterprise digitization.

Regional diversity presents both opportunities and challenges, with developed markets like Japan, Australia, and South Korea leading in technology adoption, while emerging economies including India, Southeast Asian nations, and China show tremendous growth potential. This heterogeneous landscape requires workforce management software providers to develop flexible, scalable solutions that can adapt to varying market conditions, regulatory requirements, and cultural preferences across different countries and territories.

The Asia-Pacific workforce management software market refers to the comprehensive ecosystem of digital solutions, platforms, and technologies designed to optimize human resource management, employee scheduling, time tracking, performance monitoring, and workforce analytics across organizations operating within the Asia-Pacific geographical region. These sophisticated software systems integrate multiple functionalities including employee scheduling, time and attendance tracking, labor cost management, compliance monitoring, and predictive workforce analytics.

Core functionalities encompass automated scheduling algorithms, real-time workforce visibility, mobile accessibility, integration capabilities with existing enterprise systems, and advanced reporting mechanisms. The software solutions serve diverse organizational needs ranging from small businesses to large multinational corporations, addressing specific challenges related to workforce optimization, regulatory compliance, cost management, and operational efficiency enhancement.

Market scope includes various deployment models such as cloud-based solutions, on-premises installations, and hybrid configurations, catering to different organizational preferences and technical requirements. The comprehensive nature of these solutions enables organizations to achieve significant improvements in workforce productivity, cost optimization, and strategic human resource management across the diverse Asia-Pacific business landscape.

Strategic market positioning reveals the Asia-Pacific workforce management software market as a high-growth, technology-driven sector experiencing unprecedented expansion due to digital transformation initiatives and evolving workplace dynamics. The market demonstrates exceptional resilience and adaptability, with organizations increasingly recognizing workforce management software as essential infrastructure rather than optional technology enhancement.

Key growth drivers include accelerating cloud adoption rates of 68% annually, increasing mobile workforce requirements, stringent regulatory compliance needs, and growing emphasis on data-driven decision making in human resource management. Organizations across industries are investing heavily in comprehensive workforce management solutions to address challenges related to employee productivity, cost optimization, and operational efficiency.

Market segmentation reveals diverse opportunities across industry verticals, deployment models, and organizational sizes. Manufacturing, retail, healthcare, and professional services sectors represent the largest adoption segments, while emerging industries including e-commerce, logistics, and financial services show rapid growth potential. The competitive landscape features both established global providers and innovative regional players developing specialized solutions for local market requirements.

Future trajectory indicates sustained growth momentum driven by technological advancement, increasing workforce complexity, and evolving organizational needs. Market participants are focusing on artificial intelligence integration, predictive analytics capabilities, and enhanced user experience to maintain competitive positioning in this dynamic market environment.

Technological innovation serves as the primary catalyst driving market evolution, with organizations increasingly adopting sophisticated workforce management solutions to address complex operational challenges. The following key insights provide comprehensive understanding of market dynamics:

Digital transformation initiatives across Asia-Pacific organizations represent the most significant driver propelling workforce management software adoption. Companies are recognizing that traditional manual processes and legacy systems cannot support modern workforce requirements, leading to substantial investments in comprehensive digital solutions that enhance operational efficiency and strategic decision-making capabilities.

Regulatory compliance requirements create compelling demand for automated workforce management solutions, particularly in markets with complex labor laws and varying jurisdictional requirements. Organizations must navigate intricate compliance landscapes while maintaining operational efficiency, making sophisticated software solutions essential for risk mitigation and regulatory adherence.

Cost optimization pressures drive organizations to seek workforce management solutions that can identify inefficiencies, optimize labor costs, and improve resource allocation. The ability to achieve 25-30% reduction in administrative overhead through automation makes these solutions attractive investments for cost-conscious organizations across the region.

Remote work proliferation has fundamentally changed workforce management requirements, creating demand for solutions that can effectively manage distributed teams, track productivity across multiple locations, and maintain organizational cohesion in hybrid work environments. This shift has accelerated software adoption rates significantly.

Data-driven decision making trends encourage organizations to invest in workforce management solutions that provide comprehensive analytics, predictive insights, and real-time visibility into workforce performance. The ability to make informed decisions based on accurate data has become a competitive necessity rather than a luxury.

Implementation complexity presents significant challenges for organizations considering workforce management software adoption, particularly for companies with limited technical expertise or complex existing system architectures. The integration process can be time-consuming and resource-intensive, creating hesitation among potential adopters who fear operational disruption during transition periods.

High initial investment costs represent a substantial barrier, especially for small and medium-sized enterprises with limited technology budgets. While long-term benefits are significant, the upfront costs associated with software licensing, implementation, training, and system integration can be prohibitive for organizations with constrained financial resources.

Data security concerns create reluctance among organizations handling sensitive employee information, particularly in industries with strict privacy requirements. The need to ensure robust data protection while maintaining system accessibility creates complex technical and compliance challenges that some organizations find difficult to navigate.

Change management resistance from employees and management can significantly impact successful implementation and adoption. Organizations often encounter cultural resistance to new technologies, requiring substantial change management efforts and training investments to achieve desired outcomes.

Vendor selection complexity in a crowded market with numerous solution providers creates decision-making challenges for organizations. The difficulty in evaluating different platforms, understanding feature differences, and selecting appropriate solutions can delay adoption decisions and implementation timelines.

Artificial intelligence integration presents tremendous opportunities for workforce management software providers to develop innovative solutions that can predict workforce needs, optimize scheduling algorithms, and provide intelligent recommendations for human resource decisions. Organizations are increasingly interested in AI-powered solutions that can enhance decision-making accuracy and operational efficiency.

Industry-specific customization opportunities exist for software providers willing to develop specialized solutions addressing unique requirements in healthcare, manufacturing, retail, hospitality, and professional services sectors. Tailored functionality can command premium pricing while providing superior value to industry-specific customers.

Small business market expansion represents significant untapped potential, as many SMEs in the Asia-Pacific region have not yet adopted comprehensive workforce management solutions. Developing affordable, easy-to-implement solutions for this segment could unlock substantial market growth opportunities.

Mobile-first solutions create opportunities for providers who can develop sophisticated mobile applications that provide full workforce management functionality on smartphones and tablets. The increasing prevalence of mobile-first workforces makes this capability increasingly valuable.

Regional expansion opportunities exist for successful providers to expand into emerging markets within the Asia-Pacific region, where digital transformation is accelerating and organizations are beginning to recognize the value of comprehensive workforce management solutions.

Competitive intensity in the Asia-Pacific workforce management software market continues to escalate as established global providers compete with innovative regional players and emerging technology companies. This dynamic environment drives continuous innovation, feature enhancement, and competitive pricing strategies that benefit end-users through improved solution quality and value propositions.

Technology evolution significantly influences market dynamics, with rapid advancement in cloud computing, artificial intelligence, mobile technology, and data analytics creating new possibilities for workforce management solutions. Providers must continuously invest in research and development to maintain competitive positioning and meet evolving customer expectations.

Customer expectations are continuously rising, with organizations demanding more sophisticated functionality, better user experiences, and seamless integration capabilities. This trend drives providers to enhance their solutions continuously while maintaining competitive pricing structures in an increasingly price-sensitive market environment.

Regulatory changes across different Asia-Pacific markets create both challenges and opportunities for workforce management software providers. Staying current with evolving labor laws, compliance requirements, and regulatory frameworks requires ongoing investment but also creates opportunities for providers who can effectively address these complex requirements.

Market consolidation trends are emerging as larger providers acquire smaller specialized companies to expand their capabilities and market reach. This consolidation activity is reshaping the competitive landscape while creating opportunities for remaining independent providers to differentiate themselves through specialized offerings.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the Asia-Pacific workforce management software market. The research approach combined primary and secondary research techniques, leveraging both quantitative and qualitative data sources to develop a complete understanding of market dynamics, trends, and opportunities.

Primary research activities included extensive interviews with industry executives, software providers, end-users, and technology experts across major Asia-Pacific markets. These interviews provided valuable insights into market trends, customer requirements, competitive dynamics, and future growth prospects from multiple stakeholder perspectives.

Secondary research encompassed comprehensive analysis of industry reports, company financial statements, regulatory documents, technology publications, and market databases. This research provided quantitative market data, historical trends, and comparative analysis across different market segments and geographical regions.

Data validation processes ensured accuracy and reliability through triangulation of information sources, expert review panels, and statistical analysis techniques. Multiple data points were cross-referenced to verify findings and eliminate potential biases or inaccuracies in the research conclusions.

Market modeling utilized advanced analytical techniques to project future market trends, growth rates, and opportunity assessments. These models incorporated multiple variables including economic indicators, technology adoption rates, regulatory changes, and competitive dynamics to provide comprehensive market forecasts.

China represents the largest individual market within the Asia-Pacific region, accounting for approximately 35% of regional market share due to its massive manufacturing base, large workforce, and accelerating digital transformation initiatives. Chinese organizations are increasingly adopting sophisticated workforce management solutions to address complex operational challenges and regulatory compliance requirements.

Japan demonstrates high technology adoption rates and sophisticated workforce management requirements, representing a mature market with emphasis on advanced features, integration capabilities, and user experience. Japanese organizations prioritize quality and reliability, creating opportunities for premium workforce management solutions with comprehensive functionality.

India showcases tremendous growth potential with rapidly expanding IT services, manufacturing, and business process outsourcing sectors driving demand for comprehensive workforce management solutions. The market benefits from increasing digitization initiatives and growing recognition of workforce optimization benefits among Indian organizations.

Australia and New Zealand represent mature markets with high technology adoption rates and sophisticated regulatory requirements. These markets demonstrate strong demand for cloud-based solutions, mobile accessibility, and comprehensive compliance features, making them attractive targets for premium workforce management software providers.

Southeast Asian markets including Singapore, Malaysia, Thailand, and Indonesia show accelerating growth driven by economic development, industrialization, and increasing technology adoption. These emerging markets present significant opportunities for workforce management software providers willing to adapt their solutions to local requirements and market conditions.

Market leadership is distributed among several key players who have established strong positions through comprehensive solution portfolios, extensive customer bases, and continuous innovation investments. The competitive landscape features both global technology giants and specialized workforce management software providers competing for market share.

Competitive strategies focus on product innovation, market expansion, strategic partnerships, and customer experience enhancement. Providers are investing heavily in artificial intelligence, mobile capabilities, and industry-specific functionality to differentiate their offerings and maintain competitive positioning.

Regional players are gaining market share by developing solutions specifically tailored to local market requirements, regulatory compliance needs, and cultural preferences. These providers often offer more competitive pricing and personalized service levels compared to global competitors.

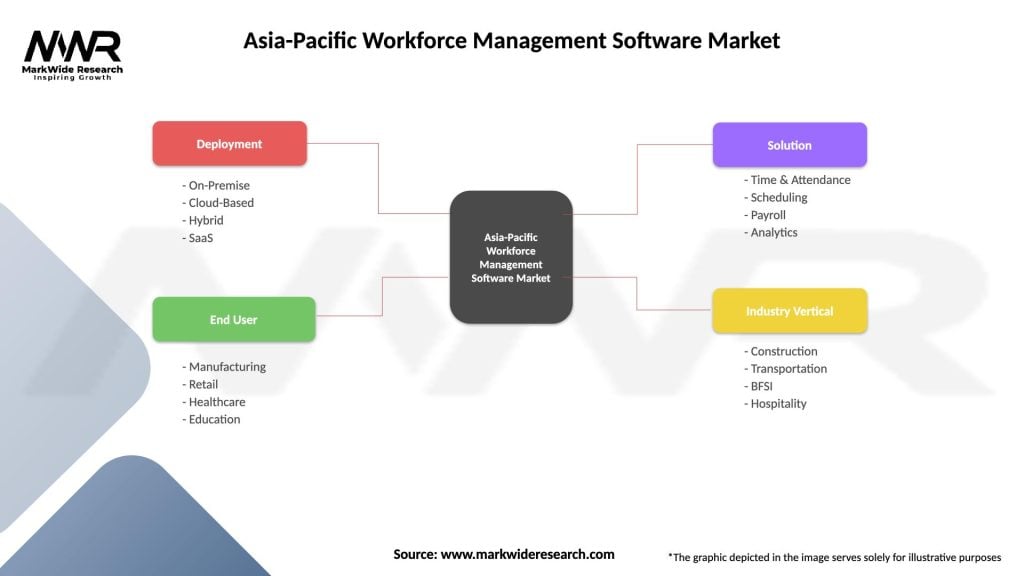

By Deployment Model: The market segments into cloud-based, on-premises, and hybrid deployment options, with cloud-based solutions representing the fastest-growing segment due to scalability, cost-effectiveness, and ease of implementation. Organizations increasingly prefer cloud deployment for its flexibility and reduced infrastructure requirements.

By Organization Size: Market segmentation includes large enterprises, medium-sized businesses, and small businesses, each with distinct requirements and budget constraints. Large enterprises demand comprehensive functionality and extensive customization, while SMEs prioritize affordability and ease of use.

By Industry Vertical: Key industry segments include manufacturing, retail, healthcare, professional services, hospitality, logistics, and financial services. Each industry has specific workforce management requirements, compliance needs, and operational challenges that influence software selection criteria.

By Functionality: Core functional segments encompass time and attendance tracking, employee scheduling, performance management, analytics and reporting, mobile access, and integration capabilities. Organizations typically prioritize different functionalities based on their specific operational requirements and strategic objectives.

By End-User: Market segmentation includes HR departments, operations managers, executives, and employees, each with different user experience requirements and functional priorities. Successful solutions must address the needs of all user groups effectively.

Cloud-Based Solutions dominate market growth with organizations increasingly recognizing the benefits of cloud deployment including reduced infrastructure costs, automatic updates, scalability, and enhanced accessibility. Cloud solutions enable organizations to implement workforce management capabilities quickly while minimizing technical complexity and ongoing maintenance requirements.

Mobile Applications have become essential components of workforce management solutions, with employees and managers expecting comprehensive functionality through smartphone and tablet applications. Mobile-first design approaches are becoming standard requirements for successful workforce management software implementations.

Analytics and Reporting capabilities represent high-value functionality that organizations use to optimize workforce performance, identify trends, and make data-driven decisions. Advanced analytics features including predictive modeling and real-time dashboards are increasingly important for competitive differentiation.

Integration Platforms enable workforce management solutions to connect seamlessly with existing enterprise systems including ERP, HRIS, payroll, and business intelligence platforms. Comprehensive integration capabilities are essential for organizations seeking to maximize their technology investments and avoid data silos.

Industry-Specific Solutions address unique requirements in healthcare, manufacturing, retail, and professional services sectors. Specialized functionality for regulatory compliance, shift management, and industry-specific workflows creates opportunities for premium pricing and customer loyalty.

Operational Efficiency Enhancement enables organizations to streamline workforce management processes, reduce administrative overhead, and optimize resource allocation. Automated scheduling, time tracking, and reporting capabilities eliminate manual processes while improving accuracy and reducing errors.

Cost Optimization through improved workforce utilization, reduced overtime expenses, and enhanced productivity tracking helps organizations achieve significant cost savings. Studies indicate organizations can achieve 15-20% reduction in labor costs through effective workforce management software implementation.

Compliance Assurance provides organizations with automated compliance monitoring, regulatory reporting, and audit trail capabilities that reduce legal risks and ensure adherence to complex labor laws across different Asia-Pacific jurisdictions.

Employee Satisfaction improves through transparent scheduling, self-service capabilities, mobile access, and fair workforce management practices. Enhanced employee experience leads to improved retention rates and higher productivity levels.

Strategic Decision Making benefits from comprehensive workforce analytics, performance metrics, and predictive insights that enable data-driven human resource decisions. Real-time visibility into workforce performance supports strategic planning and operational optimization.

Scalability Support allows organizations to expand their workforce management capabilities as they grow, adding new locations, employees, and functionality without significant system overhauls or infrastructure investments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents the most significant trend transforming workforce management software capabilities. AI-powered features including predictive scheduling, performance optimization, and automated decision-making are becoming standard expectations rather than premium features, driving innovation across the market.

Mobile-First Design has evolved from a nice-to-have feature to an essential requirement, with organizations expecting comprehensive workforce management functionality through native mobile applications. This trend reflects changing workforce demographics and increasing remote work adoption.

Real-Time Analytics capabilities are becoming increasingly sophisticated, with organizations demanding instant visibility into workforce performance, cost metrics, and operational efficiency indicators. Real-time dashboards and predictive analytics are essential for competitive differentiation.

Industry Specialization trends show providers developing solutions specifically tailored to healthcare, manufacturing, retail, and professional services sectors. Specialized functionality commands premium pricing while providing superior value to industry-specific customers.

Integration Platform Approach enables workforce management solutions to serve as central hubs connecting multiple enterprise systems. Comprehensive API capabilities and pre-built connectors are becoming standard requirements for enterprise customers.

Employee Self-Service functionality empowers workers to manage their own schedules, request time off, and access performance information through intuitive interfaces. This trend reduces administrative overhead while improving employee satisfaction and engagement levels.

Strategic acquisitions continue to reshape the competitive landscape as larger providers acquire specialized companies to expand their capabilities and market reach. Recent acquisition activity demonstrates the industry’s consolidation trend and the premium valuations placed on innovative workforce management technologies.

Product innovation focuses on artificial intelligence integration, enhanced user experiences, and industry-specific functionality. Leading providers are investing heavily in research and development to maintain competitive positioning and address evolving customer requirements.

Partnership agreements between workforce management software providers and system integrators, consulting firms, and technology platforms are expanding market reach and implementation capabilities. These partnerships enable providers to serve larger customers and complex implementation requirements more effectively.

Regulatory compliance enhancements address evolving labor laws and compliance requirements across different Asia-Pacific markets. Providers are investing in automated compliance monitoring and reporting capabilities to help customers navigate complex regulatory environments.

Cloud migration initiatives by major providers demonstrate the industry’s commitment to cloud-first strategies. Legacy on-premises solutions are being redesigned for cloud deployment to provide better scalability, accessibility, and cost-effectiveness.

MarkWide Research recommends that organizations evaluating workforce management software solutions prioritize cloud-based platforms with comprehensive mobile capabilities and robust integration features. The ability to scale efficiently while maintaining user experience quality will be critical for long-term success.

Investment priorities should focus on solutions that offer artificial intelligence capabilities, predictive analytics, and industry-specific functionality. Organizations that select advanced platforms with AI integration will achieve superior operational efficiency and competitive advantage compared to those using basic workforce management tools.

Implementation strategies must include comprehensive change management programs, extensive user training, and phased rollout approaches to ensure successful adoption. Organizations should allocate sufficient resources for change management to maximize their workforce management software investment returns.

Vendor selection should emphasize providers with strong regional presence, local support capabilities, and demonstrated experience in similar industry implementations. Cultural fit and local market understanding are critical factors for successful workforce management software deployments in Asia-Pacific markets.

Future-proofing considerations include selecting platforms with open architecture, extensive API capabilities, and regular update cycles. Organizations should choose solutions that can evolve with changing business requirements and technological advancement to avoid costly system replacements.

Market trajectory indicates sustained growth momentum driven by accelerating digital transformation initiatives, increasing workforce complexity, and evolving organizational requirements. The Asia-Pacific workforce management software market is projected to maintain robust expansion with compound annual growth rates exceeding 12% over the next five years.

Technology evolution will continue driving market innovation, with artificial intelligence, machine learning, and advanced analytics becoming standard features rather than premium capabilities. Organizations will increasingly expect sophisticated predictive functionality and automated decision-making support from their workforce management solutions.

Market expansion opportunities exist in emerging Asia-Pacific economies where digital transformation is accelerating and organizations are beginning to recognize workforce management software value propositions. Providers who can adapt their solutions to local market requirements will capture significant growth opportunities.

Industry convergence trends suggest workforce management software will increasingly integrate with broader human capital management platforms, creating comprehensive solutions that address multiple HR functions through unified interfaces and shared data repositories.

MWR analysis indicates that successful market participants will differentiate themselves through superior user experiences, industry-specific functionality, and comprehensive integration capabilities. Organizations that invest in advanced workforce management solutions will achieve sustainable competitive advantages through optimized workforce performance and operational efficiency.

The Asia-Pacific workforce management software market represents a dynamic and rapidly evolving sector with tremendous growth potential driven by digital transformation initiatives, technological innovation, and changing workforce requirements. Organizations across the region are increasingly recognizing workforce management software as essential infrastructure for operational excellence and competitive advantage.

Market fundamentals remain strong with robust demand from diverse industry verticals, accelerating cloud adoption, and increasing emphasis on data-driven workforce optimization. The combination of technological advancement and evolving organizational needs creates sustained growth momentum that benefits both software providers and end-user organizations.

Success factors for market participants include continuous innovation investment, comprehensive solution portfolios, strong regional presence, and deep understanding of local market requirements. Organizations that prioritize user experience, integration capabilities, and industry-specific functionality will achieve superior market positioning and customer satisfaction.

The future outlook remains highly positive, with MarkWide Research projecting continued market expansion driven by artificial intelligence integration, mobile-first solutions, and increasing workforce complexity. Organizations investing in advanced workforce management software solutions will achieve significant operational benefits and competitive advantages in the evolving Asia-Pacific business landscape.

What is Workforce Management Software?

Workforce Management Software refers to tools and systems that help organizations manage their workforce effectively. This includes scheduling, time tracking, attendance management, and performance monitoring to optimize labor costs and improve productivity.

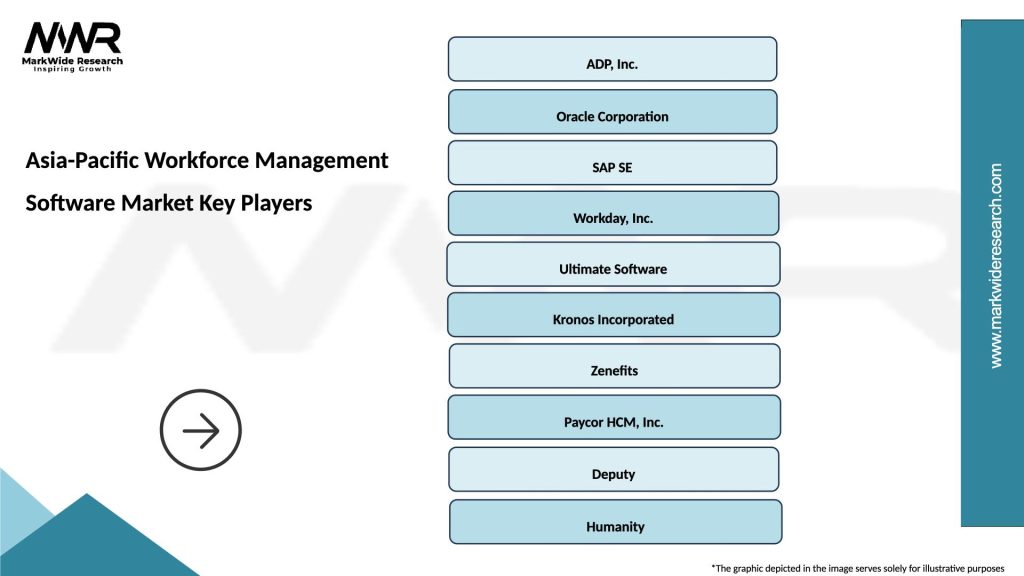

What are the key players in the Asia-Pacific Workforce Management Software Market?

Key players in the Asia-Pacific Workforce Management Software Market include ADP, Kronos, SAP, and Oracle, among others. These companies offer a range of solutions tailored to various industries, enhancing operational efficiency and employee engagement.

What are the growth factors driving the Asia-Pacific Workforce Management Software Market?

The growth of the Asia-Pacific Workforce Management Software Market is driven by the increasing need for operational efficiency, the rise of remote work, and advancements in cloud technology. Additionally, businesses are focusing on employee satisfaction and compliance with labor regulations.

What challenges does the Asia-Pacific Workforce Management Software Market face?

Challenges in the Asia-Pacific Workforce Management Software Market include data security concerns, integration issues with existing systems, and the need for continuous updates to meet changing labor laws. These factors can hinder the adoption of new technologies.

What opportunities exist in the Asia-Pacific Workforce Management Software Market?

Opportunities in the Asia-Pacific Workforce Management Software Market include the growing demand for AI-driven analytics, mobile workforce solutions, and the expansion of small and medium-sized enterprises adopting these technologies. This presents a chance for innovation and market growth.

What trends are shaping the Asia-Pacific Workforce Management Software Market?

Trends shaping the Asia-Pacific Workforce Management Software Market include the increasing use of artificial intelligence for predictive analytics, the rise of mobile applications for workforce management, and a focus on employee wellness programs. These trends are transforming how organizations manage their workforce.

Asia-Pacific Workforce Management Software Market

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premise, Cloud-Based, Hybrid, SaaS |

| End User | Manufacturing, Retail, Healthcare, Education |

| Solution | Time & Attendance, Scheduling, Payroll, Analytics |

| Industry Vertical | Construction, Transportation, BFSI, Hospitality |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Workforce Management Software Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at