444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific wireless charging market represents one of the most dynamic and rapidly evolving technology sectors in the region, driven by unprecedented consumer adoption of smart devices and the growing demand for convenient charging solutions. This transformative market encompasses a comprehensive range of wireless power transfer technologies, including inductive charging, resonant charging, and radio frequency charging systems that are revolutionizing how consumers and businesses approach device power management.

Market dynamics in the Asia-Pacific region are characterized by robust technological innovation, with countries like China, Japan, and South Korea leading the charge in wireless charging infrastructure development. The region’s wireless charging ecosystem is experiencing remarkable growth, with adoption rates reaching 78% among smartphone users in major metropolitan areas. This surge is primarily attributed to the increasing integration of wireless charging capabilities in consumer electronics, automotive applications, and industrial equipment.

Regional leadership in manufacturing and technology development has positioned Asia-Pacific as a global hub for wireless charging innovation. The market benefits from strong government support for advanced technology adoption, substantial investments in research and development, and a highly competitive landscape that drives continuous innovation. Consumer preference for seamless, cable-free charging experiences has accelerated market penetration across diverse application segments.

Infrastructure development across the region has been particularly noteworthy, with public wireless charging stations experiencing 65% year-over-year growth in deployment. This expansion is supported by strategic partnerships between technology providers, telecommunications companies, and retail establishments, creating an extensive network of charging solutions that enhance user convenience and accessibility.

The Asia-Pacific wireless charging market refers to the comprehensive ecosystem of contactless power transfer technologies, devices, and infrastructure solutions that enable the charging of electronic devices without the need for physical cable connections across the Asia-Pacific geographical region. This market encompasses the development, manufacturing, distribution, and deployment of wireless charging systems that utilize electromagnetic fields to transfer energy between a charging pad or station and compatible devices.

Wireless charging technology operates on the principle of electromagnetic induction, where an alternating current in a transmitter coil creates a magnetic field that induces a current in a receiver coil within the device being charged. This technology has evolved to include various standards such as Qi wireless charging, PMA (Power Matters Alliance), and proprietary solutions developed by leading technology companies throughout the Asia-Pacific region.

Market scope extends beyond consumer electronics to include automotive wireless charging systems, industrial applications, medical devices, and emerging Internet of Things (IoT) applications. The Asia-Pacific region’s unique position as a global manufacturing hub and technology innovation center makes it a critical market for wireless charging advancement and adoption.

Strategic market positioning of the Asia-Pacific wireless charging sector demonstrates exceptional growth potential, driven by technological advancement, consumer adoption, and infrastructure development. The region’s market leadership is evidenced by the presence of major technology manufacturers, innovative startups, and comprehensive supply chain networks that support the entire wireless charging ecosystem.

Key growth drivers include the rapid proliferation of smartphones and wearable devices, increasing consumer demand for convenient charging solutions, and the integration of wireless charging capabilities in automotive and public infrastructure. The market benefits from strong government initiatives promoting advanced technology adoption and significant investments in research and development activities.

Competitive landscape features both established multinational corporations and emerging regional players, creating a dynamic environment that fosters innovation and technological advancement. Market leaders are focusing on improving charging efficiency, reducing costs, and expanding compatibility across diverse device categories to capture larger market shares.

Regional advantages include advanced manufacturing capabilities, strong consumer electronics markets, and progressive regulatory environments that support technology innovation. The Asia-Pacific region’s position as a global technology hub provides unique opportunities for wireless charging market expansion and technological leadership.

Consumer adoption patterns reveal significant insights into wireless charging market dynamics across the Asia-Pacific region. The following key insights demonstrate the market’s current state and future trajectory:

Technological advancement serves as the primary catalyst driving Asia-Pacific wireless charging market expansion. The continuous evolution of wireless power transfer technologies, including improvements in charging speed, efficiency, and compatibility, has significantly enhanced user experience and market appeal. Advanced semiconductor technologies and innovative coil designs have enabled the development of more compact, efficient, and cost-effective wireless charging solutions.

Consumer electronics proliferation across the Asia-Pacific region creates substantial demand for wireless charging solutions. The widespread adoption of smartphones, tablets, wearable devices, and other portable electronics has established a large and growing user base that values convenient charging options. This trend is particularly pronounced in technologically advanced markets such as Japan, South Korea, and urban areas of China.

Infrastructure development initiatives by governments and private sector organizations are accelerating wireless charging adoption. Public-private partnerships have facilitated the deployment of wireless charging stations in airports, shopping centers, restaurants, and public transportation systems, creating an ecosystem that supports widespread technology adoption and user convenience.

Automotive industry integration represents a significant growth driver, with major vehicle manufacturers incorporating wireless charging systems as standard or optional features. The convergence of automotive technology and consumer electronics has created new opportunities for wireless charging applications, including electric vehicle charging and in-vehicle device charging solutions.

Cost reduction trends have made wireless charging technology more accessible to broader consumer segments. Manufacturing scale economies, component standardization, and technological improvements have contributed to significant cost reductions, enabling wider market penetration and adoption across various price points and application categories.

Technical limitations continue to present challenges for wireless charging market expansion. Issues such as charging speed limitations compared to wired solutions, positioning requirements for optimal charging efficiency, and compatibility constraints across different device manufacturers can impact user experience and adoption rates. These technical challenges require ongoing research and development investments to address effectively.

Cost considerations remain a significant barrier for mass market adoption, particularly in price-sensitive segments and developing markets within the Asia-Pacific region. While costs have decreased substantially, wireless charging solutions still command premium pricing compared to traditional wired charging alternatives, potentially limiting adoption among cost-conscious consumers and applications.

Standardization challenges create market fragmentation and consumer confusion. The existence of multiple wireless charging standards and proprietary solutions can complicate device compatibility and infrastructure development, potentially slowing widespread adoption and creating barriers to seamless user experiences across different brands and platforms.

Infrastructure requirements for widespread wireless charging adoption necessitate significant investments in charging station deployment and maintenance. The need for extensive infrastructure development, particularly in rural and less developed areas, can slow market penetration and limit accessibility for certain consumer segments.

Energy efficiency concerns related to power loss during wireless transmission continue to influence consumer and environmental considerations. Although efficiency has improved significantly, wireless charging systems still experience some energy loss compared to direct wired connections, which can impact adoption among environmentally conscious consumers and cost-sensitive applications.

Emerging application segments present substantial growth opportunities for wireless charging technology expansion. The Internet of Things (IoT) ecosystem, smart home devices, medical equipment, and industrial automation systems offer new markets for wireless charging integration. These applications benefit from the convenience and reliability of contactless power transfer, creating opportunities for specialized wireless charging solutions.

Electric vehicle charging represents a transformative opportunity for the wireless charging market. As electric vehicle adoption accelerates across the Asia-Pacific region, wireless charging systems for automotive applications could revolutionize vehicle charging infrastructure and user experience. This opportunity includes both stationary wireless charging for parked vehicles and potential dynamic charging for vehicles in motion.

Smart city initiatives throughout the Asia-Pacific region create opportunities for integrated wireless charging infrastructure development. Urban planning projects that incorporate wireless charging capabilities into public spaces, transportation systems, and commercial areas can drive large-scale adoption and create new revenue streams for technology providers and infrastructure developers.

Healthcare applications offer specialized opportunities for wireless charging technology deployment. Medical devices, patient monitoring equipment, and healthcare IoT systems can benefit from reliable, contactless charging solutions that reduce infection risks and improve device reliability in clinical environments.

Industrial automation and robotics applications present opportunities for wireless charging integration in manufacturing and logistics environments. Automated guided vehicles, robotic systems, and industrial IoT devices can benefit from wireless charging solutions that eliminate wear-prone charging contacts and reduce maintenance requirements.

Competitive intensity within the Asia-Pacific wireless charging market drives continuous innovation and technological advancement. Market participants are investing heavily in research and development to improve charging efficiency, reduce costs, and expand application compatibility. This competitive environment benefits consumers through improved products and services while creating opportunities for market differentiation and growth.

Supply chain integration has become increasingly sophisticated, with manufacturers developing comprehensive ecosystems that include charging hardware, software solutions, and infrastructure services. Vertical integration strategies enable companies to control quality, reduce costs, and accelerate innovation cycles while providing integrated solutions that meet diverse customer requirements.

Regulatory environment across Asia-Pacific countries generally supports wireless charging technology development and deployment. Government initiatives promoting advanced technology adoption, energy efficiency standards, and infrastructure development create favorable conditions for market growth and investment attraction.

Consumer behavior evolution demonstrates increasing acceptance and preference for wireless charging solutions. As users become more familiar with the technology and experience its benefits, adoption rates continue to accelerate across various demographic segments and application categories. This behavioral shift supports sustained market growth and expansion opportunities.

Technology convergence with other advanced technologies such as artificial intelligence, IoT connectivity, and smart grid systems creates synergistic opportunities for wireless charging market expansion. These convergence trends enable the development of intelligent charging solutions that optimize power delivery, monitor device status, and integrate with broader technology ecosystems.

Comprehensive market analysis for the Asia-Pacific wireless charging market employs a multi-faceted research approach that combines primary and secondary research methodologies to ensure accuracy and reliability of market insights. The research framework incorporates quantitative and qualitative analysis techniques to provide a complete understanding of market dynamics, trends, and opportunities.

Primary research activities include extensive interviews with industry executives, technology developers, manufacturers, and end-users across key Asia-Pacific markets. These interviews provide firsthand insights into market challenges, opportunities, and strategic priorities that shape industry development. Survey research among consumers and business users helps quantify adoption patterns, preferences, and satisfaction levels.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, regulatory documents, and academic research publications. This comprehensive secondary research foundation ensures that market analysis is grounded in verified data and established industry knowledge while identifying emerging trends and technological developments.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop accurate market projections and growth forecasts. These analytical approaches consider multiple variables including technological advancement rates, adoption curves, competitive dynamics, and economic factors that influence market development.

Data validation processes ensure research accuracy through cross-verification of information sources, expert review panels, and consistency checks across different research methodologies. This rigorous validation approach maintains research quality and reliability while providing confidence in market insights and recommendations.

China dominates the Asia-Pacific wireless charging market with the largest manufacturing base and rapidly growing consumer adoption. The country’s market leadership is supported by major technology companies, extensive manufacturing capabilities, and strong government support for advanced technology development. Chinese manufacturers have achieved significant cost advantages while continuously improving technology performance and reliability.

Japan maintains its position as a technology innovation leader, with companies developing advanced wireless charging solutions and setting industry standards. The Japanese market is characterized by high consumer acceptance of new technologies, premium product positioning, and strong focus on quality and reliability. Japanese companies are particularly active in automotive wireless charging applications and industrial solutions.

South Korea demonstrates exceptional market penetration rates, with wireless charging technology widely adopted across consumer electronics and automotive applications. The country’s advanced telecommunications infrastructure and tech-savvy consumer base create favorable conditions for rapid technology adoption and market growth. Korean companies are leading in smartphone wireless charging integration and public infrastructure deployment.

India represents a high-growth opportunity market with increasing smartphone penetration and growing consumer awareness of wireless charging benefits. The Indian market is price-sensitive but shows strong potential for volume growth as costs continue to decrease and local manufacturing capabilities expand. Government initiatives supporting digital technology adoption further enhance market prospects.

Southeast Asian markets including Singapore, Malaysia, Thailand, and Indonesia show varying adoption patterns based on economic development levels and consumer preferences. Urban areas demonstrate higher adoption rates while rural markets present longer-term growth opportunities as infrastructure development progresses and technology costs decline.

Market leadership in the Asia-Pacific wireless charging sector is characterized by a diverse mix of multinational corporations, regional technology companies, and innovative startups that contribute to a dynamic competitive environment. The competitive landscape reflects the region’s role as both a major manufacturing hub and a significant consumer market for wireless charging technologies.

Competitive strategies focus on technological differentiation, cost optimization, and market expansion through strategic partnerships and acquisitions. Companies are investing heavily in research and development to improve charging efficiency, reduce costs, and expand application compatibility while building comprehensive solution portfolios.

Technology-based segmentation reveals distinct market categories with varying growth patterns and application focus areas. Each technology segment addresses specific user requirements and application constraints while contributing to overall market expansion and development.

By Technology:

By Application:

By Power Range:

Consumer electronics category continues to drive the majority of wireless charging market growth, with smartphones leading adoption rates and setting technology standards. This category benefits from high replacement rates, continuous feature upgrades, and strong consumer preference for convenience. Premium smartphone segments have achieved near-universal wireless charging integration, while mid-range devices are rapidly adopting the technology as costs decrease.

Automotive applications represent the fastest-growing category with significant long-term potential. In-vehicle wireless charging for smartphones and other devices has become increasingly common, while electric vehicle wireless charging systems are emerging as a transformative technology. This category requires specialized solutions addressing automotive environmental requirements, safety standards, and integration challenges.

Wearable devices demonstrate unique wireless charging requirements due to size constraints, battery limitations, and user experience considerations. Smartwatches, fitness trackers, and wireless earbuds have adopted proprietary wireless charging solutions that prioritize compact design and user convenience. This category shows strong growth potential as wearable device adoption continues to expand.

Industrial and commercial applications offer specialized opportunities for wireless charging technology deployment. These applications often require ruggedized solutions, higher power levels, and integration with existing systems. Industrial robotics, automated guided vehicles, and commercial equipment benefit from wireless charging systems that reduce maintenance requirements and improve operational reliability.

Infrastructure and public charging category encompasses charging stations in public spaces, commercial establishments, and transportation hubs. This category requires standardized solutions, robust construction, and integration with payment and management systems. Growth in this category supports broader wireless charging adoption by improving accessibility and user convenience.

Manufacturers benefit from wireless charging market participation through product differentiation opportunities, premium pricing potential, and access to growing market segments. Integration of wireless charging capabilities enables manufacturers to enhance product appeal, improve user experience, and command higher margins while building competitive advantages in crowded markets.

Technology providers gain opportunities to license intellectual property, supply critical components, and develop comprehensive solution portfolios. The wireless charging ecosystem creates multiple revenue streams through hardware sales, licensing agreements, and ongoing technology development partnerships with device manufacturers and infrastructure providers.

Infrastructure operators can generate new revenue streams through public charging services while enhancing customer experience and facility attractiveness. Wireless charging infrastructure creates opportunities for subscription services, advertising revenue, and customer data insights that support business model innovation and growth.

End users benefit from improved convenience, reduced cable wear and replacement costs, and enhanced device longevity through reduced connector wear. Wireless charging technology eliminates the hassle of cable management while providing reliable charging solutions that integrate seamlessly into daily routines and work environments.

Ecosystem partners including retailers, service providers, and system integrators gain opportunities to offer value-added services, enhance customer relationships, and participate in growing technology markets. The wireless charging ecosystem creates partnership opportunities that extend beyond traditional technology supply chains.

Strengths:

Weaknesses:

Opportunities:

Threats:

Fast wireless charging has emerged as a critical trend, with manufacturers developing solutions that approach wired charging speeds while maintaining the convenience of contactless power transfer. Advanced charging protocols and improved power management systems are enabling 15W to 50W wireless charging capabilities that address previous speed limitations and enhance user experience.

Multi-device charging platforms are gaining popularity as consumers seek solutions that can simultaneously charge multiple devices. These platforms integrate smartphone, smartwatch, and wireless earbud charging capabilities in single units, optimizing space utilization and providing comprehensive charging solutions for modern device ecosystems.

Automotive integration acceleration represents a significant trend with vehicle manufacturers incorporating wireless charging as standard equipment rather than optional features. This trend extends beyond in-vehicle device charging to include electric vehicle wireless charging systems that could revolutionize automotive charging infrastructure and user experience.

Public infrastructure expansion continues to accelerate with wireless charging stations appearing in airports, restaurants, hotels, and public transportation systems. This infrastructure development creates a network effect that supports broader technology adoption by ensuring charging availability in key locations where users spend time.

Smart charging features incorporating artificial intelligence and IoT connectivity are emerging to optimize charging efficiency, monitor device health, and provide user insights. These intelligent systems can adjust charging parameters based on device requirements, usage patterns, and environmental conditions to maximize performance and battery longevity.

Standardization progress has accelerated with major technology companies collaborating on universal wireless charging standards that promote interoperability and reduce consumer confusion. The Wireless Power Consortium’s Qi standard has gained widespread adoption, while new standards for higher power applications are under development to address automotive and industrial requirements.

Manufacturing partnerships between technology companies and component suppliers are expanding to support growing market demand and reduce costs. These partnerships focus on developing integrated solutions that combine charging hardware, software, and user interface components while optimizing manufacturing efficiency and quality control.

Investment acceleration in wireless charging technology development has increased significantly, with both private and public funding supporting research into advanced charging methods, efficiency improvements, and new application development. MarkWide Research analysis indicates substantial venture capital and corporate investment flowing into wireless charging startups and established companies.

Regulatory framework development across Asia-Pacific countries is establishing guidelines for wireless charging system deployment, electromagnetic compatibility requirements, and safety standards. These regulatory developments provide clarity for manufacturers and infrastructure developers while ensuring consumer protection and technology reliability.

Technology convergence with other advanced technologies including 5G connectivity, edge computing, and smart grid systems is creating new opportunities for integrated wireless charging solutions. These convergence trends enable the development of intelligent charging networks that optimize power delivery and integrate with broader technology ecosystems.

Strategic positioning recommendations for market participants emphasize the importance of focusing on specific application segments where wireless charging provides clear value propositions. Companies should prioritize development of solutions that address real user pain points while building sustainable competitive advantages through technology innovation and cost optimization.

Investment priorities should focus on improving charging efficiency, reducing costs, and expanding compatibility across device categories. Research and development investments in advanced materials, power management systems, and manufacturing processes can drive technology leadership and market share growth in competitive markets.

Partnership strategies are essential for success in the wireless charging ecosystem, with companies benefiting from collaborations with device manufacturers, infrastructure providers, and technology platform companies. Strategic partnerships can accelerate market entry, reduce development costs, and provide access to distribution channels and customer bases.

Market entry approaches should consider regional differences in consumer preferences, regulatory requirements, and competitive dynamics. Companies entering new markets should adapt their strategies to local conditions while leveraging global technology platforms and manufacturing capabilities to achieve cost competitiveness.

Technology roadmap planning should anticipate future market requirements including higher power levels, improved efficiency, and integration with emerging technologies. Long-term technology development should align with market evolution trends while maintaining flexibility to adapt to changing customer requirements and competitive dynamics.

Market evolution over the next five years is expected to be characterized by continued technology advancement, expanding application segments, and increasing integration with other advanced technologies. The Asia-Pacific wireless charging market is projected to maintain strong growth momentum with compound annual growth rates exceeding 20% in key segments including automotive and industrial applications.

Technology advancement will focus on addressing current limitations including charging speed, efficiency, and spatial freedom while expanding power level capabilities for new applications. Breakthrough technologies in materials science, power electronics, and system integration are expected to enable significant performance improvements and cost reductions.

Application expansion beyond current consumer electronics and automotive segments will drive market growth through IoT devices, industrial automation, healthcare equipment, and smart infrastructure applications. These emerging applications will require specialized wireless charging solutions that address unique requirements and operating environments.

Infrastructure development will accelerate as public and private sector investments create comprehensive wireless charging networks that support widespread technology adoption. Smart city initiatives and transportation electrification will drive large-scale infrastructure deployment that transforms user experience and market dynamics.

Regional market dynamics will continue to evolve with developing markets showing accelerated adoption as technology costs decrease and infrastructure expands. MWR projections indicate that emerging markets will contribute increasingly to overall market growth while developed markets focus on premium applications and advanced technology deployment.

The Asia-Pacific wireless charging market represents a dynamic and rapidly evolving technology sector with substantial growth potential across multiple application segments and geographic markets. The region’s unique combination of advanced manufacturing capabilities, innovative technology companies, and large consumer markets creates favorable conditions for continued market expansion and technology leadership.

Market fundamentals remain strong with increasing consumer adoption, expanding application opportunities, and continuous technology advancement driving sustained growth momentum. The successful resolution of current technology limitations through ongoing research and development efforts will further accelerate market adoption and create new opportunities for industry participants.

Strategic success in this market requires focus on technology innovation, cost optimization, and strategic partnerships that enable companies to capture opportunities while addressing evolving customer requirements. The wireless charging ecosystem offers multiple entry points and business models that can support diverse company strategies and market positioning approaches.

Future prospects for the Asia-Pacific wireless charging market remain highly positive, with emerging applications, infrastructure development, and technology convergence trends creating substantial opportunities for growth and innovation. Companies that successfully navigate current challenges while positioning for future opportunities will be well-positioned to participate in this transformative market evolution.

What is Wireless Charging?

Wireless charging refers to the process of charging electronic devices without the need for physical connectors. This technology uses electromagnetic fields to transfer energy between a charging pad and a compatible device, commonly seen in smartphones, electric vehicles, and wearable devices.

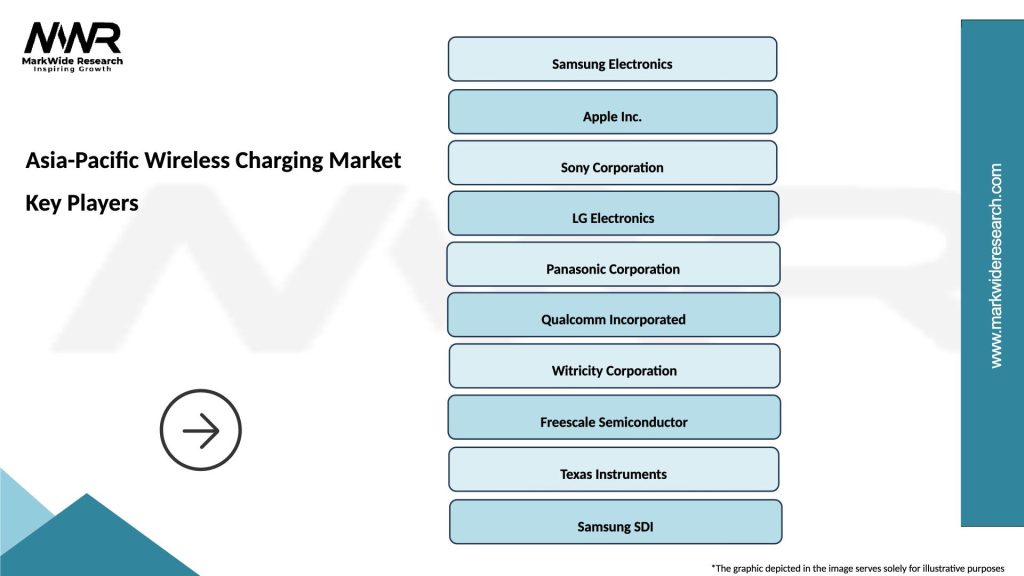

What are the key players in the Asia-Pacific Wireless Charging Market?

Key players in the Asia-Pacific Wireless Charging Market include companies like Samsung Electronics, Qualcomm Technologies, and NXP Semiconductors, among others.

What are the main drivers of the Asia-Pacific Wireless Charging Market?

The main drivers of the Asia-Pacific Wireless Charging Market include the increasing adoption of electric vehicles, the growing demand for convenience in charging solutions, and advancements in wireless charging technology that enhance efficiency and compatibility.

What challenges does the Asia-Pacific Wireless Charging Market face?

Challenges in the Asia-Pacific Wireless Charging Market include the high cost of implementation, limited compatibility with existing devices, and concerns regarding charging speed compared to traditional wired methods.

What opportunities exist in the Asia-Pacific Wireless Charging Market?

Opportunities in the Asia-Pacific Wireless Charging Market include the expansion of smart home devices, the integration of wireless charging in public spaces, and the potential for innovation in charging standards and technologies.

What trends are shaping the Asia-Pacific Wireless Charging Market?

Trends shaping the Asia-Pacific Wireless Charging Market include the rise of fast wireless charging solutions, the development of multi-device charging stations, and increasing collaborations between technology companies to enhance interoperability.

Asia-Pacific Wireless Charging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Smartphones, Wearables, Electric Vehicles, Laptops |

| Technology | Inductive Charging, Resonant Charging, Radio Frequency, Magnetic Field |

| End User | Consumer Electronics, Automotive OEMs, Healthcare Facilities, Industrial Equipment |

| Installation | Residential, Commercial, Public Infrastructure, Automotive |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Wireless Charging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at