444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific wellness travel market represents one of the most dynamic and rapidly expanding segments within the global tourism industry. This comprehensive market encompasses a diverse range of wellness-focused travel experiences, from traditional spa retreats and meditation centers to cutting-edge health resorts and holistic healing destinations. The region’s unique blend of ancient wellness traditions and modern therapeutic innovations has positioned it as a premier destination for health-conscious travelers seeking transformative experiences.

Market dynamics indicate that the Asia Pacific region is experiencing unprecedented growth in wellness tourism, driven by increasing consumer awareness of mental and physical well-being. The market benefits from the region’s rich cultural heritage in traditional healing practices, including Ayurveda, Traditional Chinese Medicine, and various indigenous wellness methodologies. Countries such as Thailand, India, Indonesia, Japan, and South Korea have emerged as leading wellness destinations, each offering distinctive therapeutic approaches and cultural experiences.

Growth projections suggest the market is expanding at a robust CAGR of 8.2%, significantly outpacing traditional tourism segments. This growth trajectory reflects changing consumer preferences toward experiential travel that prioritizes health, mindfulness, and personal transformation. The region’s strategic advantages include diverse natural landscapes, established hospitality infrastructure, competitive pricing, and deep-rooted wellness philosophies that resonate with both domestic and international travelers.

The Asia Pacific wellness travel market refers to the comprehensive ecosystem of travel experiences specifically designed to promote physical, mental, and spiritual well-being across the Asia Pacific region. This market encompasses various segments including spa tourism, medical wellness travel, spiritual and mindfulness retreats, fitness and adventure wellness, and holistic healing experiences that combine traditional Asian practices with modern wellness approaches.

Wellness travel in this context extends beyond conventional spa services to include immersive experiences such as yoga and meditation retreats, detoxification programs, traditional healing therapies, thermal springs visits, and wellness-focused adventure activities. The market integrates accommodation, transportation, wellness services, healthy cuisine, and cultural experiences into cohesive packages that address travelers’ holistic well-being needs.

Regional characteristics distinguish the Asia Pacific wellness travel market through its emphasis on traditional healing systems, natural therapeutic resources, and cultural authenticity. The market leverages the region’s biodiversity, from tropical rainforests and pristine beaches to mountain retreats and hot springs, creating diverse wellness environments that cater to various therapeutic and recreational preferences.

Strategic analysis reveals that the Asia Pacific wellness travel market has evolved into a sophisticated industry segment that successfully bridges traditional healing practices with contemporary wellness trends. The market demonstrates exceptional resilience and adaptability, having successfully navigated recent global challenges while maintaining strong growth momentum and expanding its international appeal.

Key performance indicators show that wellness travelers in the Asia Pacific region typically spend 35% more than conventional tourists, indicating the premium nature of wellness travel experiences. The market benefits from strong government support across multiple countries, with nations implementing policies to promote wellness tourism as a strategic economic sector. Thailand’s wellness tourism initiatives, India’s medical tourism programs, and Japan’s hot spring tourism development exemplify this supportive regulatory environment.

Market segmentation reveals diverse consumer preferences, with spiritual and mindfulness retreats representing the fastest-growing segment, followed by medical wellness and spa tourism. The demographic profile shows increasing participation from millennials and Generation Z travelers, who prioritize authentic experiences and sustainable tourism practices. This younger demographic shift is driving innovation in wellness travel offerings and digital integration.

Competitive landscape features a mix of established luxury resort chains, boutique wellness properties, and specialized wellness tour operators. The market’s fragmented nature creates opportunities for both large-scale operators and niche providers to establish strong market positions through differentiated offerings and targeted marketing strategies.

Consumer behavior analysis indicates several transformative trends shaping the Asia Pacific wellness travel market. The following insights highlight the most significant market developments:

Emerging trends include the integration of wearable technology for health monitoring, the rise of wellness workations combining remote work with wellness experiences, and increasing demand for mental health-focused travel programs. These developments reflect the market’s evolution toward more sophisticated and holistic wellness offerings.

Primary growth drivers propelling the Asia Pacific wellness travel market include increasing health consciousness among consumers, rising disposable incomes across the region, and growing awareness of mental health importance. The COVID-19 pandemic has significantly accelerated these trends, with travelers prioritizing health and well-being more than ever before.

Demographic shifts contribute substantially to market expansion, particularly the aging population in developed Asia Pacific countries seeking health-focused travel experiences. Simultaneously, younger demographics are driving demand for authentic, transformative wellness experiences that combine adventure, culture, and personal development. This dual demographic demand creates a robust market foundation with diverse growth opportunities.

Economic factors supporting market growth include the region’s expanding middle class, increased urbanization leading to wellness-seeking behavior, and favorable exchange rates that make Asia Pacific destinations attractive to international wellness travelers. Government initiatives promoting wellness tourism through infrastructure development, marketing campaigns, and regulatory support further accelerate market expansion.

Technological advancement enables more sophisticated wellness travel experiences through personalized health monitoring, virtual reality meditation programs, and AI-powered wellness recommendations. Digital platforms facilitate easier booking, customization, and sharing of wellness travel experiences, expanding market reach and accessibility.

Cultural authenticity serves as a unique competitive advantage for the Asia Pacific region, with traditional healing practices like Ayurveda, Traditional Chinese Medicine, and indigenous therapies attracting international travelers seeking authentic wellness experiences unavailable in their home countries.

Economic volatility presents significant challenges to the Asia Pacific wellness travel market, as wellness travel is often considered discretionary spending that consumers may reduce during economic uncertainty. Currency fluctuations, inflation, and economic downturns in key source markets can substantially impact travel demand and spending patterns.

Regulatory complexities across different Asia Pacific countries create operational challenges for wellness travel providers. Varying health and safety standards, licensing requirements for wellness practitioners, and different tourism regulations can complicate multi-country wellness travel programs and increase compliance costs.

Quality standardization remains a persistent challenge, with significant variations in service quality, practitioner qualifications, and facility standards across the region. This inconsistency can impact consumer confidence and limit market growth, particularly among international travelers who expect consistent quality standards.

Infrastructure limitations in some destinations restrict market development, including inadequate transportation connectivity, limited healthcare facilities, and insufficient accommodation options that meet international wellness travel standards. These constraints particularly affect emerging wellness destinations seeking to establish market presence.

Cultural barriers and language differences can limit accessibility for international travelers, while misconceptions about traditional healing practices may deter some potential wellness tourists. Additionally, seasonal weather patterns and natural disasters in certain regions create operational challenges and impact travel planning.

Emerging market segments present substantial growth opportunities, particularly in corporate wellness travel, where companies increasingly invest in employee wellness programs that include travel components. This B2B segment offers higher-value, repeat business opportunities with potential for long-term partnerships and customized program development.

Technology integration creates opportunities for innovative wellness travel experiences, including virtual reality meditation sessions, AI-powered personalized wellness recommendations, and wearable technology integration for real-time health monitoring during travel. These technological enhancements can differentiate offerings and attract tech-savvy wellness travelers.

Sustainable wellness tourism represents a rapidly growing opportunity, with environmentally conscious travelers seeking eco-friendly wellness experiences. Destinations that successfully combine sustainability with authentic wellness practices can capture this premium market segment and build strong brand loyalty.

Medical tourism integration offers significant expansion potential, particularly in countries with advanced healthcare systems like Singapore, South Korea, and Thailand. Combining medical procedures with wellness recovery programs creates comprehensive health travel packages that appeal to international patients seeking holistic healing experiences.

Digital wellness platforms provide opportunities for market expansion through online wellness consultations, virtual wellness programs, and hybrid travel experiences that combine physical and digital components. These platforms can extend market reach and provide ongoing engagement with wellness travelers beyond their physical trips.

Supply and demand dynamics in the Asia Pacific wellness travel market demonstrate strong demand growth outpacing supply development in many destinations. This imbalance creates opportunities for new market entrants while potentially driving price increases for premium wellness experiences. MarkWide Research analysis indicates that demand for authentic wellness experiences continues to exceed available capacity in popular destinations.

Competitive dynamics show increasing consolidation among larger operators while simultaneously creating space for specialized boutique providers. Traditional hospitality companies are expanding into wellness travel through acquisitions, partnerships, and organic development, intensifying competition while also raising overall market standards and professionalism.

Seasonal patterns significantly influence market dynamics, with peak seasons varying across different countries and wellness segments. Understanding these patterns enables operators to optimize pricing strategies, manage capacity, and develop complementary offerings during off-peak periods to maintain consistent revenue streams.

Innovation cycles drive continuous market evolution, with new wellness practices, technologies, and destination developments regularly entering the market. This constant innovation creates opportunities for differentiation while requiring ongoing investment in staff training, facility upgrades, and service development to remain competitive.

Partnership ecosystems play crucial roles in market dynamics, with successful wellness travel providers developing comprehensive networks including accommodation partners, wellness practitioners, transportation providers, and local cultural attractions to create seamless, integrated experiences for travelers.

Comprehensive research approach employed for analyzing the Asia Pacific wellness travel market combines primary and secondary research methodologies to ensure accurate, current, and actionable market insights. The research framework incorporates quantitative data analysis, qualitative stakeholder interviews, and industry expert consultations to provide a holistic market perspective.

Primary research components include extensive surveys of wellness travelers, in-depth interviews with industry operators, focus groups with target demographics, and field research at key wellness destinations across the Asia Pacific region. This primary research provides firsthand insights into consumer preferences, operational challenges, and emerging trends that shape market development.

Secondary research sources encompass government tourism statistics, industry association reports, academic studies on wellness tourism, and analysis of competitor strategies and market positioning. This secondary research provides context, historical trends, and comparative analysis that supports primary research findings.

Data validation processes ensure research accuracy through triangulation of multiple data sources, expert review panels, and statistical verification of quantitative findings. The methodology includes regular updates to reflect rapidly changing market conditions and emerging trends in the dynamic wellness travel sector.

Geographic coverage spans major Asia Pacific markets including China, Japan, India, Thailand, Indonesia, Singapore, South Korea, Australia, Malaysia, and emerging destinations, providing comprehensive regional analysis while identifying country-specific opportunities and challenges.

Southeast Asia dominates the Asia Pacific wellness travel market, with Thailand leading as the region’s premier wellness destination. Thailand’s market share represents approximately 32% of regional wellness travel, driven by its established spa industry, traditional Thai massage heritage, and comprehensive wellness infrastructure. Indonesia follows with strong growth in luxury wellness resorts and spiritual retreat offerings, particularly in Bali and Java.

South Asia shows exceptional growth potential, with India emerging as a major wellness destination through its authentic Ayurvedic traditions and yoga heritage. India’s wellness travel segment has grown by 24% annually over recent years, attracting international travelers seeking traditional healing experiences. Sri Lanka and Nepal are developing niche positions in spiritual and adventure wellness tourism respectively.

East Asia presents diverse wellness travel opportunities, with Japan leading in hot spring tourism and traditional wellness practices. South Korea has gained prominence in medical wellness tourism and K-beauty related wellness experiences. China’s domestic wellness travel market shows tremendous potential, with increasing outbound wellness travel as travel restrictions ease.

Oceania contributes significantly through Australia’s luxury wellness resorts and New Zealand’s adventure wellness offerings. Australia’s wellness travel market emphasizes indigenous healing practices and eco-wellness experiences, while New Zealand focuses on outdoor wellness activities and thermal spring destinations.

Emerging markets including Vietnam, Philippines, and Cambodia are developing wellness tourism capabilities, leveraging natural resources and cultural heritage to create unique wellness travel propositions. These markets show potential for significant growth as infrastructure develops and international awareness increases.

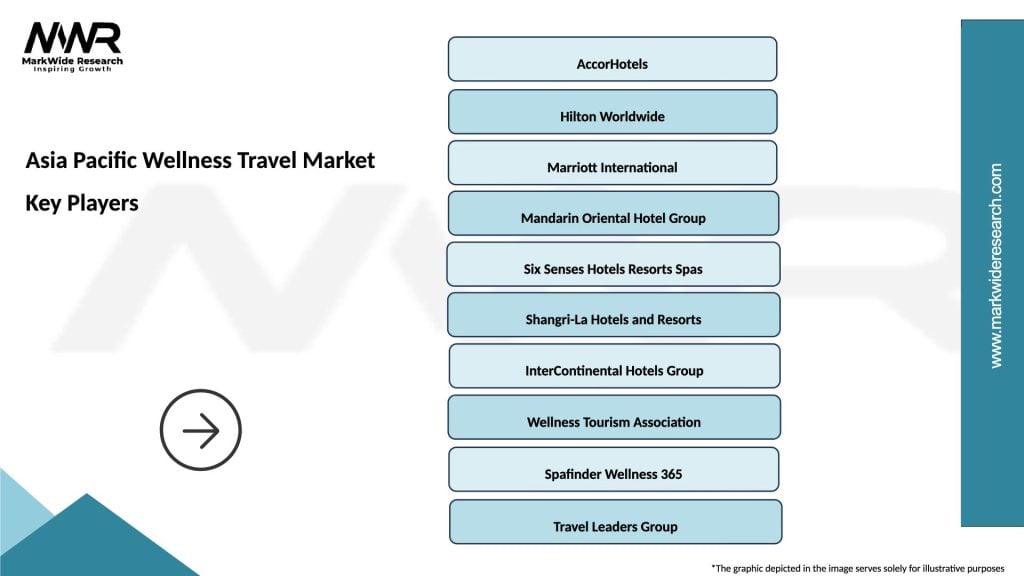

Market leaders in the Asia Pacific wellness travel sector include a diverse mix of international hotel chains, specialized wellness resort operators, and regional hospitality companies. The competitive landscape demonstrates both consolidation trends and opportunities for specialized providers to establish strong market positions.

Competitive strategies focus on differentiation through authentic cultural experiences, sustainable practices, personalized wellness programs, and integration of traditional healing practices with modern amenities. Many operators are investing in staff training, facility upgrades, and technology integration to enhance guest experiences and operational efficiency.

Market positioning varies from ultra-luxury transformative retreats to accessible wellness experiences, with successful operators clearly defining their target segments and value propositions. The competitive landscape continues evolving as new entrants introduce innovative concepts and established players expand their wellness offerings.

By Wellness Type: The Asia Pacific wellness travel market segments into several distinct categories, each serving different consumer needs and preferences. Spa and beauty wellness represents the largest segment, encompassing traditional spa services, beauty treatments, and aesthetic wellness programs. Medical wellness includes health screenings, medical treatments combined with recovery programs, and preventive health services.

Spiritual and mindfulness wellness focuses on meditation retreats, yoga programs, spiritual journeys, and mindfulness training. This segment shows particularly strong growth among younger demographics seeking authentic spiritual experiences. Fitness and adventure wellness combines physical activities with wellness practices, including hiking retreats, martial arts training, and outdoor wellness adventures.

By Accommodation Type: Luxury wellness resorts dominate the premium segment, offering comprehensive wellness programs in exclusive settings. Boutique wellness hotels provide intimate, specialized experiences with personalized service. Wellness retreat centers focus specifically on transformative wellness programs, while integrated wellness offerings in conventional hotels serve travelers seeking wellness amenities alongside traditional hospitality services.

By Duration: Short wellness breaks (1-3 days) cater to urban professionals seeking quick rejuvenation, while week-long wellness programs allow for deeper transformation and habit formation. Extended wellness journeys (2+ weeks) serve travelers seeking comprehensive lifestyle changes and intensive healing programs.

By Demographics: Segmentation by age reveals distinct preferences, with millennials favoring authentic, Instagram-worthy experiences, Generation X seeking stress relief and work-life balance, and baby boomers focusing on health maintenance and luxury comfort. Gender segmentation shows women representing 67% of wellness travelers, though male participation is growing rapidly.

Spa and Beauty Wellness remains the foundational category of the Asia Pacific wellness travel market, leveraging the region’s rich traditions in massage therapy, herbal treatments, and beauty practices. This category benefits from strong cultural authenticity, with treatments like Thai massage, Balinese spa rituals, and Japanese onsen experiences attracting international travelers seeking unique wellness experiences unavailable in their home countries.

Medical Wellness Tourism represents a high-growth category, particularly in countries with advanced healthcare systems and cost advantages. Thailand, Singapore, and South Korea lead this segment, offering comprehensive medical wellness packages that combine medical procedures with recovery and wellness programs. This category attracts international patients seeking quality healthcare combined with vacation experiences.

Spiritual and Mindfulness Wellness capitalizes on Asia’s reputation as the birthplace of major spiritual traditions. India leads this category through authentic yoga and meditation programs, while Buddhist meditation retreats in Thailand, Myanmar, and Bhutan attract seekers of spiritual transformation. This category shows strong growth among stressed urban professionals seeking mental wellness solutions.

Adventure and Fitness Wellness combines the region’s diverse natural landscapes with wellness practices, creating unique experiences like mountain yoga retreats, surfing wellness programs, and martial arts training camps. This category appeals to active travelers seeking physical challenges combined with wellness benefits.

Detox and Cleansing Programs have gained popularity as travelers seek to reset their health and lifestyle habits. These programs often incorporate traditional healing practices, organic nutrition, and natural therapies, with destinations like Thailand and India offering comprehensive detoxification experiences in serene natural settings.

Revenue diversification represents a primary benefit for hospitality operators entering the wellness travel market, as wellness services typically command premium pricing and generate higher profit margins than conventional accommodation services. Wellness travelers also demonstrate lower price sensitivity and higher loyalty rates, contributing to more stable revenue streams.

Extended stay patterns benefit accommodation providers, as wellness travelers typically book longer stays than conventional tourists, improving occupancy rates and reducing marketing costs per guest. The average wellness trip duration of 7.3 days significantly exceeds conventional leisure travel, maximizing revenue per guest and operational efficiency.

Year-round demand helps destinations and operators manage seasonality challenges, as wellness travel shows less seasonal variation than conventional tourism. This consistent demand enables better staff retention, improved facility utilization, and more predictable business planning across different market segments.

Brand differentiation opportunities allow operators to establish unique market positions through specialized wellness offerings, authentic cultural experiences, and innovative treatment programs. This differentiation supports premium pricing strategies and reduces direct competition with conventional hospitality providers.

Cross-selling opportunities enable wellness travel providers to offer comprehensive packages including accommodation, treatments, dining, activities, and retail products, increasing average spending per guest and improving overall profitability. Successful operators develop integrated ecosystems that maximize guest engagement and spending throughout their wellness journey.

Community development benefits include job creation, skills development, and cultural preservation, as wellness tourism often emphasizes local traditions, ingredients, and practices. This creates positive economic impacts for local communities while enhancing the authenticity of wellness travel experiences.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalization revolution dominates current market trends, with wellness travelers increasingly demanding customized experiences tailored to their specific health goals, preferences, and lifestyle needs. Advanced health assessments, genetic testing, and AI-powered recommendations enable providers to create highly personalized wellness programs that deliver superior results and satisfaction.

Digital wellness integration transforms traditional wellness travel through wearable technology, mobile health apps, and virtual reality experiences. Travelers can now monitor their health metrics in real-time, access guided meditation through VR, and maintain wellness routines through digital platforms before, during, and after their trips.

Sustainable wellness tourism gains momentum as environmentally conscious travelers seek eco-friendly wellness experiences that minimize environmental impact while maximizing personal well-being. This trend drives demand for organic food, renewable energy, waste reduction, and conservation-focused wellness programs.

Wellness workations emerge as a significant trend, combining remote work capabilities with wellness experiences. This trend, accelerated by remote work adoption, enables longer stays and creates new market opportunities for destinations that can provide reliable internet connectivity alongside wellness amenities.

Mental health focus intensifies as travelers prioritize psychological well-being alongside physical health. Stress reduction, anxiety management, and mental resilience programs become central to wellness travel offerings, reflecting growing awareness of mental health importance in overall wellness.

Authentic cultural immersion drives demand for genuine local wellness practices, traditional healing methods, and cultural learning experiences. Travelers seek meaningful connections with local communities and authentic understanding of traditional wellness philosophies rather than superficial spa treatments.

Strategic partnerships between wellness travel providers and healthcare institutions create comprehensive wellness ecosystems that combine leisure travel with serious health improvement programs. These partnerships enable evidence-based wellness programs and medical oversight that enhance credibility and results.

Technology investments accelerate across the industry, with major operators implementing AI-powered personalization systems, virtual reality meditation programs, and comprehensive health monitoring platforms. MWR data indicates that technology adoption in wellness travel has increased by 156% over the past two years.

Certification programs develop to standardize wellness travel quality and practitioner qualifications across the Asia Pacific region. Industry associations and government bodies collaborate to establish recognized standards that enhance consumer confidence and facilitate international marketing.

Sustainability initiatives expand as operators implement comprehensive environmental programs including renewable energy adoption, waste reduction, water conservation, and local sourcing. These initiatives respond to growing consumer demand for responsible travel while reducing operational costs.

Market consolidation continues as larger hospitality groups acquire specialized wellness operators to expand their wellness capabilities, while boutique operators form alliances to compete more effectively with larger players. This consolidation improves service standards while maintaining diversity in wellness offerings.

Government initiatives support market development through infrastructure investments, marketing campaigns, and regulatory frameworks that promote wellness tourism. Countries like Thailand, India, and South Korea have launched comprehensive wellness tourism development programs with significant budget allocations.

Investment prioritization should focus on technology integration, staff training, and facility upgrades that enhance guest experiences while improving operational efficiency. Operators should particularly invest in personalization capabilities, digital health monitoring, and sustainable practices that differentiate their offerings in an increasingly competitive market.

Market positioning strategies should emphasize authentic cultural experiences, specialized wellness expertise, and measurable health outcomes rather than generic spa services. Successful operators will develop clear value propositions that resonate with specific target segments and communicate unique benefits effectively.

Partnership development represents a critical success factor, with operators needing to build comprehensive ecosystems including healthcare providers, local wellness practitioners, transportation services, and cultural attractions. These partnerships enable integrated experiences that exceed guest expectations while sharing operational costs and risks.

Quality standardization initiatives should be prioritized to build consumer confidence and facilitate international marketing. Operators should implement recognized certification programs, invest in staff training, and establish consistent service standards that meet international expectations while maintaining cultural authenticity.

Digital marketing strategies must leverage social media, influencer partnerships, and content marketing to reach target demographics effectively. Given that 89% of wellness travel decisions are influenced by digital word-of-mouth, operators should invest in comprehensive digital marketing programs that showcase authentic experiences and guest testimonials.

Sustainability integration should be viewed as a competitive necessity rather than optional enhancement, with operators implementing comprehensive environmental programs that appeal to conscious consumers while reducing operational costs and regulatory risks.

Growth projections indicate the Asia Pacific wellness travel market will continue expanding at an accelerated pace, driven by increasing health consciousness, rising disposable incomes, and growing recognition of wellness travel benefits. The market is expected to maintain its 8.2% CAGR over the next five years, with particularly strong growth in emerging destinations and innovative wellness segments.

Technology evolution will fundamentally transform wellness travel experiences through advanced personalization, virtual reality integration, and comprehensive health monitoring. Future wellness travelers will expect seamless digital integration that enhances rather than replaces human interaction and cultural authenticity.

Market maturation will lead to increased specialization, with operators focusing on specific wellness niches, demographic segments, or therapeutic approaches. This specialization will enable deeper expertise development and more effective marketing while creating opportunities for collaboration between complementary providers.

Sustainability requirements will become mandatory rather than optional, with travelers increasingly choosing operators based on environmental and social responsibility credentials. Future market leaders will be those who successfully integrate sustainability into their core business models while maintaining exceptional guest experiences.

Regional expansion will see emerging destinations in Vietnam, Philippines, Cambodia, and Myanmar developing significant wellness tourism capabilities, creating new opportunities while intensifying competition. These emerging markets will leverage unique cultural assets and natural resources to establish distinctive market positions.

Integration trends will blur boundaries between wellness travel, medical tourism, and conventional hospitality, creating comprehensive health and wellness ecosystems that serve diverse consumer needs through integrated service offerings and strategic partnerships.

The Asia Pacific wellness travel market represents one of the most dynamic and promising segments within the global tourism industry, combining the region’s rich cultural heritage with modern wellness innovations to create transformative travel experiences. The market’s robust growth trajectory, supported by increasing health consciousness, rising disposable incomes, and strong government support, positions it for continued expansion and evolution.

Strategic opportunities abound for operators who can successfully balance authentic cultural experiences with modern amenities, sustainable practices with luxury comfort, and personalized services with operational efficiency. The market rewards innovation, quality, and authenticity while punishing generic offerings and inconsistent service standards.

Success factors in this evolving market include technology integration, sustainability commitment, cultural authenticity, quality standardization, and strategic partnerships that create comprehensive wellness ecosystems. Operators who master these elements while maintaining focus on guest transformation and well-being will establish strong competitive positions and sustainable growth.

The future of the Asia Pacific wellness travel market promises continued innovation, expansion, and sophistication as it evolves to meet changing consumer needs and preferences. This evolution creates opportunities for both established operators and new entrants who can contribute unique value propositions to the diverse and growing wellness travel ecosystem across the Asia Pacific region.

What is Wellness Travel?

Wellness Travel refers to travel experiences that prioritize health and well-being, often including activities such as spa treatments, yoga retreats, and holistic health programs. This type of travel focuses on rejuvenation and personal growth, appealing to individuals seeking to enhance their physical and mental health.

What are the key players in the Asia Pacific Wellness Travel Market?

Key players in the Asia Pacific Wellness Travel Market include companies like Six Senses, Banyan Tree, and Ananda in the Himalayas, which offer specialized wellness programs and retreats. These companies focus on providing unique experiences that cater to health-conscious travelers, among others.

What are the main drivers of the Asia Pacific Wellness Travel Market?

The main drivers of the Asia Pacific Wellness Travel Market include the increasing awareness of health and wellness, the rise in disposable income among consumers, and the growing trend of holistic living. Additionally, the demand for stress relief and mental well-being is propelling growth in this sector.

What challenges does the Asia Pacific Wellness Travel Market face?

Challenges in the Asia Pacific Wellness Travel Market include the high competition among wellness providers and the need for continuous innovation to meet evolving consumer preferences. Additionally, economic fluctuations can impact travel budgets, affecting market growth.

What opportunities exist in the Asia Pacific Wellness Travel Market?

Opportunities in the Asia Pacific Wellness Travel Market include the expansion of wellness tourism offerings in emerging destinations and the integration of technology in wellness services. There is also potential for collaboration with local health practitioners to enhance authenticity and appeal.

What trends are shaping the Asia Pacific Wellness Travel Market?

Trends shaping the Asia Pacific Wellness Travel Market include the rise of personalized wellness experiences, the incorporation of sustainable practices in wellness retreats, and the growing popularity of digital detox programs. These trends reflect a shift towards more mindful and responsible travel choices.

Asia Pacific Wellness Travel Market

| Segmentation Details | Description |

|---|---|

| Service Type | Medical Tourism, Spa Retreats, Adventure Wellness, Yoga Retreats |

| Customer Type | Corporate Travelers, Families, Solo Travelers, Seniors |

| Distribution Channel | Online Travel Agencies, Direct Bookings, Travel Agents, Wellness Resorts |

| Price Tier | Luxury, Mid-Range, Budget, Premium |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Wellness Travel Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at