444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific weight management market represents one of the most dynamic and rapidly expanding healthcare segments in the region, driven by increasing obesity rates, growing health consciousness, and rising disposable incomes. This comprehensive market encompasses a diverse range of products and services including dietary supplements, meal replacement products, fitness equipment, weight management programs, and surgical interventions designed to help individuals achieve and maintain healthy body weight.

Market dynamics in the Asia Pacific region are particularly influenced by urbanization trends, changing lifestyle patterns, and the increasing prevalence of lifestyle-related diseases. The market is experiencing robust growth with a projected CAGR of 8.2% through the forecast period, reflecting the region’s commitment to addressing weight-related health challenges. Countries such as China, Japan, India, and Australia are leading the market expansion, each contributing unique demographic and economic factors that drive demand for weight management solutions.

Consumer behavior in the Asia Pacific weight management market is characterized by a growing preference for natural and organic products, increased adoption of digital health platforms, and rising awareness about preventive healthcare. The market benefits from approximately 67% of consumers actively seeking weight management solutions, with particular emphasis on products that align with traditional health practices and modern scientific approaches.

The Asia Pacific weight management market refers to the comprehensive ecosystem of products, services, and solutions designed to help individuals in the Asia Pacific region achieve, maintain, or reduce body weight for health, aesthetic, or medical purposes. This market encompasses various categories including nutritional supplements, meal replacement products, fitness equipment, weight loss programs, bariatric surgery, and digital health applications specifically tailored to address weight-related concerns.

Weight management solutions in this context include both preventive and therapeutic approaches, ranging from over-the-counter dietary supplements and fitness programs to medically supervised interventions and surgical procedures. The market serves diverse consumer segments including individuals seeking weight loss, weight maintenance, muscle gain, and overall health improvement through structured weight management approaches.

Regional characteristics of the Asia Pacific weight management market include cultural preferences for natural ingredients, integration of traditional medicine principles, and adaptation to local dietary habits and lifestyle patterns. The market addresses unique regional challenges such as varying obesity rates across countries, different regulatory frameworks, and diverse consumer purchasing behaviors influenced by economic development levels and cultural factors.

Strategic market positioning in the Asia Pacific weight management sector reveals a landscape characterized by significant growth opportunities, evolving consumer preferences, and increasing investment in innovative solutions. The market demonstrates strong momentum driven by rising obesity rates, growing health awareness, and expanding middle-class populations across key regional markets.

Key growth drivers include the increasing prevalence of lifestyle diseases, with approximately 42% of urban populations in major Asia Pacific cities reporting weight-related health concerns. The market benefits from technological advancement in digital health platforms, personalized nutrition solutions, and the integration of artificial intelligence in weight management programs. Consumer spending patterns show a marked shift toward premium and scientifically-backed products, with 58% of consumers willing to invest in higher-quality weight management solutions.

Market segmentation reveals diverse opportunities across product categories, with dietary supplements maintaining the largest market share, followed by meal replacement products and fitness equipment. The services segment, including weight management programs and digital platforms, represents the fastest-growing category, reflecting changing consumer preferences for comprehensive, personalized approaches to weight management.

Competitive dynamics feature a mix of international brands, regional players, and emerging startups, creating a vibrant ecosystem that drives innovation and market expansion. The market outlook remains highly positive, supported by favorable demographic trends, increasing healthcare spending, and growing government initiatives promoting healthy lifestyle adoption across the Asia Pacific region.

Consumer demographics in the Asia Pacific weight management market reveal several critical insights that shape market development and product positioning strategies:

Technology integration emerges as a defining characteristic of the modern Asia Pacific weight management market, with consumers increasingly seeking connected solutions that provide real-time monitoring, personalized recommendations, and community support features.

Rising obesity rates across the Asia Pacific region serve as the primary catalyst for weight management market expansion. Countries including China, India, and Southeast Asian nations are experiencing unprecedented increases in overweight and obese populations, driven by urbanization, sedentary lifestyles, and dietary changes. This demographic shift creates substantial demand for effective weight management solutions across all market segments.

Increasing health consciousness among consumers represents another significant market driver, particularly among younger demographics who prioritize preventive healthcare and wellness. The growing awareness of the connection between weight management and chronic disease prevention motivates consumers to invest in products and services that support long-term health outcomes. Social media influence and celebrity endorsements further amplify this trend, creating aspirational demand for weight management solutions.

Economic development and rising disposable incomes across the region enable greater consumer spending on health and wellness products. The expanding middle class in countries such as China, India, and Vietnam demonstrates increased willingness to invest in premium weight management solutions, driving market premiumization and innovation.

Government initiatives promoting healthy lifestyles and obesity prevention create supportive regulatory environments for weight management market growth. Public health campaigns, workplace wellness programs, and healthcare policy reforms emphasize the importance of weight management, legitimizing market expansion and encouraging consumer participation.

Technological advancement in digital health platforms, wearable devices, and personalized nutrition solutions enhances the effectiveness and appeal of weight management programs. The integration of artificial intelligence, machine learning, and data analytics creates more sophisticated and personalized approaches to weight management, attracting tech-savvy consumers and improving success rates.

Regulatory complexity across different Asia Pacific countries presents significant challenges for weight management market participants. Varying approval processes, ingredient restrictions, and marketing regulations create barriers to market entry and product standardization. Companies must navigate diverse regulatory landscapes, increasing compliance costs and limiting the speed of market expansion.

Cultural barriers and traditional dietary practices in certain regions may resist adoption of Western-style weight management approaches. Consumer skepticism toward synthetic ingredients, unfamiliar product formats, and foreign brands can limit market penetration, particularly in rural and traditional communities where conventional dietary practices remain deeply rooted.

Economic disparities within the region create uneven market development, with premium weight management products remaining inaccessible to large population segments in developing countries. Price sensitivity among lower-income consumers limits market expansion and forces companies to develop different product strategies for various economic segments.

Safety concerns and negative publicity surrounding certain weight management products, particularly those containing controversial ingredients or making unsubstantiated claims, can damage consumer confidence and trigger regulatory crackdowns. High-profile product recalls or adverse event reports can significantly impact market growth and consumer trust.

Competition from alternative approaches including traditional medicine, home remedies, and free digital resources creates challenges for commercial weight management solutions. Consumers may opt for lower-cost or culturally familiar alternatives, limiting the addressable market for commercial products and services.

Digital transformation presents unprecedented opportunities for weight management market expansion through innovative technology solutions. The development of comprehensive digital platforms combining tracking, coaching, community support, and product integration can create new revenue streams and improve customer engagement. Mobile applications, wearable device integration, and telemedicine services offer scalable solutions that can reach broader consumer bases while reducing operational costs.

Personalization trends create opportunities for customized weight management solutions based on individual genetic profiles, metabolic characteristics, and lifestyle preferences. Advanced testing technologies and data analytics enable the development of highly targeted products and programs that deliver superior results, justifying premium pricing and building stronger customer loyalty.

Emerging market penetration in countries such as Vietnam, Thailand, Indonesia, and Philippines offers significant growth potential as economic development increases consumer purchasing power and health awareness. These markets present opportunities for both premium and value-oriented products, depending on market entry strategies and local adaptation approaches.

Corporate wellness programs represent a substantial B2B opportunity as employers increasingly recognize the importance of employee health and productivity. Weight management solutions integrated into workplace wellness initiatives can create stable revenue streams while reaching large consumer groups through employer-sponsored programs.

Integration with healthcare systems offers opportunities for weight management solutions to become part of formal medical treatment protocols. Partnerships with healthcare providers, insurance companies, and medical institutions can legitimize weight management approaches while creating new distribution channels and reimbursement opportunities.

Supply chain evolution in the Asia Pacific weight management market reflects increasing sophistication and regional integration. Manufacturers are establishing local production facilities to reduce costs, improve quality control, and respond more quickly to market demands. The development of regional supply networks enables better inventory management and reduces dependency on single-source suppliers, creating more resilient market structures.

Consumer behavior patterns demonstrate increasing sophistication and demand for evidence-based solutions. Modern consumers conduct extensive research before purchasing weight management products, seeking clinical validation, ingredient transparency, and user reviews. This trend drives companies to invest more heavily in research and development, clinical studies, and transparent marketing communications.

Distribution channel transformation shows a clear shift toward omnichannel approaches that combine online and offline touchpoints. E-commerce platforms account for an increasing share of weight management product sales, while traditional retail channels adapt by offering enhanced customer service, product education, and experiential marketing. The integration of digital and physical channels creates more comprehensive customer journeys and improved market reach.

Innovation cycles in the weight management market are accelerating, driven by technological advancement and competitive pressure. Companies are investing in research and development to create differentiated products, improve efficacy, and address emerging consumer needs. The pace of innovation requires continuous adaptation and significant investment in product development capabilities.

Partnership strategies are becoming increasingly important as companies seek to leverage complementary capabilities and market access. Strategic alliances between product manufacturers, technology companies, healthcare providers, and distribution partners create synergies that enhance market competitiveness and accelerate growth.

Comprehensive market analysis for the Asia Pacific weight management market employs a multi-faceted research approach combining primary and secondary research methodologies. The research framework incorporates quantitative data collection through consumer surveys, industry interviews, and market sizing exercises, complemented by qualitative insights from focus groups, expert consultations, and case study analysis.

Primary research activities include structured interviews with industry executives, healthcare professionals, and key opinion leaders across major Asia Pacific markets. Consumer surveys targeting diverse demographic groups provide insights into purchasing behavior, product preferences, and unmet needs. Retail audits and point-of-sale data collection ensure accurate market sizing and competitive positioning analysis.

Secondary research sources encompass industry reports, government statistics, academic publications, and company financial statements. Regulatory filings, patent databases, and clinical trial registries provide additional insights into market trends and innovation pipelines. MarkWide Research proprietary databases and analytical tools enhance data accuracy and provide comprehensive market coverage.

Data validation processes include triangulation of multiple data sources, expert review panels, and statistical analysis to ensure research accuracy and reliability. Market forecasting models incorporate historical trends, economic indicators, and demographic projections to provide robust future market estimates. Quality assurance protocols ensure consistency and accuracy across all research outputs.

Regional coverage includes detailed analysis of major Asia Pacific markets including China, Japan, India, Australia, South Korea, and key Southeast Asian countries. Country-specific research addresses local market characteristics, regulatory environments, and competitive dynamics to provide comprehensive regional insights.

China dominates the Asia Pacific weight management market, representing approximately 38% of regional market share due to its large population, growing middle class, and increasing health consciousness. The Chinese market demonstrates strong demand for both traditional and modern weight management approaches, with particular growth in digital health platforms and premium supplement categories. E-commerce penetration reaches exceptional levels, with online channels accounting for the majority of weight management product sales.

Japan maintains a mature and sophisticated weight management market characterized by high-quality products, advanced technology integration, and strong regulatory oversight. Japanese consumers demonstrate preference for scientifically-validated products and innovative delivery formats. The aging population creates unique market dynamics, with increasing focus on healthy aging and metabolic health management solutions.

India represents the fastest-growing weight management market in the region, driven by rapid urbanization, increasing obesity rates, and rising disposable incomes. The market shows strong preference for natural and Ayurvedic-based products, creating opportunities for traditional ingredient integration. Digital health adoption is accelerating rapidly, particularly among younger urban consumers.

Australia and New Zealand demonstrate mature markets with high consumer awareness and premium product preferences. These markets lead in organic and natural product adoption, with consumers willing to pay premium prices for high-quality, sustainably-sourced weight management solutions. Regulatory frameworks are well-established and support market stability.

Southeast Asian markets including Thailand, Indonesia, Malaysia, and Philippines show emerging market characteristics with rapid growth potential. These markets benefit from increasing economic development, growing health awareness, and expanding retail infrastructure. Cultural preferences for natural ingredients and traditional health practices influence product development and marketing strategies.

Market leadership in the Asia Pacific weight management sector is distributed among several key categories of players, each bringing distinct competitive advantages and market positioning strategies:

Regional players also maintain significant market positions, particularly companies that leverage local market knowledge, cultural preferences, and established distribution networks. These companies often focus on specific market segments or geographic regions where they can compete effectively against global brands.

Emerging competitors include technology-focused startups developing digital health platforms, personalized nutrition companies, and direct-to-consumer brands that leverage social media marketing and influencer partnerships to build market presence.

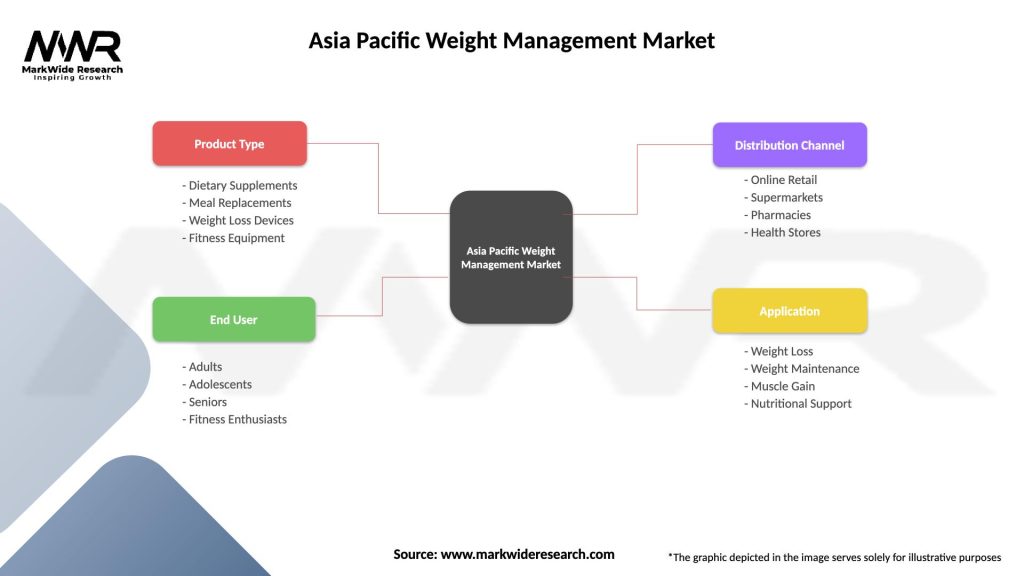

By Product Type:

By Distribution Channel:

By End User:

Dietary Supplements Category maintains market leadership through continuous innovation in ingredient science, delivery formats, and targeted formulations. The category benefits from consumer preference for convenient, portable solutions that integrate easily into daily routines. Natural and plant-based supplements show particularly strong growth, driven by consumer concerns about synthetic ingredients and preference for traditional medicine approaches.

Meal Replacement Products demonstrate strong growth potential, particularly in urban markets where busy lifestyles create demand for convenient, nutritionally-balanced meal solutions. Product innovation focuses on taste improvement, nutritional optimization, and format diversification to appeal to different consumer preferences and usage occasions.

Digital Health Platforms represent the fastest-growing category, leveraging smartphone penetration and consumer comfort with digital health solutions. These platforms combine tracking, coaching, community support, and product integration to create comprehensive weight management ecosystems that improve user engagement and success rates.

Fitness Equipment Category shows steady growth driven by home fitness trends and increasing consumer investment in personal health infrastructure. Smart fitness equipment with connectivity features and integrated coaching capabilities commands premium pricing and demonstrates strong consumer adoption rates.

Professional Services including nutritionist consultations, personal training, and medical weight management programs show growth in premium market segments where consumers seek personalized, expert-guided approaches to weight management.

Manufacturers and Suppliers benefit from expanding market opportunities, increasing consumer demand, and premium pricing potential for innovative products. The growing market enables companies to invest in research and development, expand production capacity, and develop new product categories that address evolving consumer needs.

Retailers and Distributors gain access to high-margin product categories with strong consumer demand and repeat purchase patterns. Weight management products typically offer better profit margins than commodity health products while generating consistent customer traffic and cross-selling opportunities.

Healthcare Providers can integrate weight management solutions into comprehensive patient care programs, improving health outcomes while creating additional revenue streams. The growing recognition of weight management’s role in preventing chronic diseases supports reimbursement opportunities and professional development.

Technology Companies find significant opportunities in developing digital health platforms, wearable devices, and data analytics solutions that enhance weight management effectiveness. The integration of technology with traditional weight management approaches creates new market categories and business models.

Consumers benefit from increased product choice, improved solution effectiveness, and greater accessibility to weight management resources. Market competition drives innovation, quality improvement, and price optimization, creating better value propositions for end users.

Investors can access a growing market with strong demographic tailwinds, increasing consumer spending, and multiple investment opportunities across different market segments and business models.

Strengths:

Weaknesses:

Opportunities:

Threats:

Natural and Clean Label Movement dominates product development trends, with consumers increasingly seeking weight management solutions made from natural, organic, and minimally processed ingredients. This trend drives reformulation of existing products and development of new product lines that emphasize ingredient transparency, sustainability, and traditional medicine integration.

Personalization and Precision Nutrition emerge as key differentiators, with companies investing in genetic testing, metabolic profiling, and data analytics to create customized weight management solutions. Personalized approaches demonstrate superior efficacy and justify premium pricing while building stronger customer relationships and loyalty.

Digital Health Integration transforms the weight management landscape through mobile applications, wearable devices, and connected health platforms. Digital solutions provide real-time monitoring, personalized coaching, and community support that enhance traditional product effectiveness while creating new business models and revenue streams.

Holistic Wellness Approach expands weight management beyond simple calorie restriction to encompass mental health, sleep optimization, stress management, and lifestyle modification. This comprehensive approach appeals to health-conscious consumers seeking sustainable, long-term solutions rather than quick fixes.

Sustainable and Ethical Practices become increasingly important as consumers consider environmental impact and social responsibility in purchasing decisions. Companies adopting sustainable sourcing, eco-friendly packaging, and ethical business practices gain competitive advantages and appeal to environmentally conscious consumers.

Convenience and On-the-Go Solutions address busy urban lifestyles through portable, ready-to-consume products and flexible program formats that accommodate demanding schedules and travel requirements.

Strategic partnerships between weight management companies and technology firms accelerate digital transformation and create integrated solutions that combine physical products with digital services. These collaborations leverage complementary capabilities and market access to create more comprehensive consumer offerings.

Regulatory developments across Asia Pacific countries continue to evolve, with governments implementing stricter quality standards, labeling requirements, and marketing guidelines for weight management products. Companies must adapt to changing regulatory landscapes while maintaining compliance across multiple jurisdictions.

Investment activity in the weight management sector remains strong, with venture capital and private equity firms supporting innovative startups and established companies expanding their market presence. Funding focuses particularly on technology-enabled solutions and personalized nutrition approaches.

Clinical research advancement provides stronger scientific validation for weight management approaches, supporting product claims and building consumer confidence. Companies increasingly invest in clinical studies to differentiate their products and support regulatory approval processes.

Distribution channel evolution continues with e-commerce platforms gaining market share while traditional retail channels adapt through enhanced customer service, product education, and omnichannel integration strategies.

Product innovation cycles accelerate as companies respond to changing consumer preferences, regulatory requirements, and competitive pressure through continuous research and development investment.

Market entry strategies for new participants should focus on differentiation through innovation, quality, and consumer education rather than competing solely on price. MarkWide Research analysis indicates that successful market entry requires significant investment in brand building, regulatory compliance, and distribution network development.

Product development priorities should emphasize natural ingredients, scientific validation, and technology integration to meet evolving consumer expectations. Companies should invest in clinical research to support product claims and build consumer confidence in an increasingly skeptical market environment.

Digital transformation represents a critical success factor for long-term competitiveness, requiring investment in technology platforms, data analytics capabilities, and digital marketing expertise. Companies should develop comprehensive digital strategies that enhance customer experience and create new revenue opportunities.

Regional expansion should prioritize markets with favorable demographics, regulatory environments, and economic development trends. Companies should adapt products and marketing strategies to local preferences while maintaining core brand positioning and quality standards.

Partnership strategies can accelerate market development and reduce investment requirements through collaboration with complementary businesses, healthcare providers, and technology companies. Strategic alliances should focus on creating mutual value and enhancing customer offerings.

Sustainability initiatives should be integrated into business strategies to appeal to environmentally conscious consumers and prepare for future regulatory requirements related to environmental impact and social responsibility.

Long-term growth prospects for the Asia Pacific weight management market remain highly positive, supported by favorable demographic trends, increasing health consciousness, and continued economic development across the region. The market is expected to maintain robust growth rates with a projected CAGR of 8.2% through the next decade, driven by expanding consumer bases and increasing per-capita spending on health and wellness products.

Technology integration will continue to transform the market landscape, with artificial intelligence, machine learning, and personalized medicine approaches becoming standard features of advanced weight management solutions. Digital health platforms will likely capture increasing market share while traditional product categories adapt through technology integration and enhanced user experience.

Market consolidation may accelerate as larger companies acquire innovative startups and smaller competitors to expand their technology capabilities, product portfolios, and market reach. This consolidation could create more comprehensive solution providers while maintaining competitive dynamics through continued innovation and market entry by new participants.

Regulatory evolution will likely result in stricter quality standards and more comprehensive oversight of weight management products and services. Companies that proactively invest in compliance, quality assurance, and clinical validation will be better positioned to succeed in the evolving regulatory environment.

Consumer sophistication will continue to increase, driving demand for evidence-based solutions, transparent ingredient sourcing, and personalized approaches. Companies must invest in research and development, consumer education, and brand building to meet these evolving expectations and maintain competitive positioning.

The Asia Pacific weight management market represents a dynamic and rapidly expanding sector with substantial growth opportunities driven by increasing obesity rates, rising health consciousness, and favorable economic trends across the region. Market participants benefit from diverse product categories, multiple distribution channels, and growing consumer willingness to invest in health and wellness solutions.

Success factors in this competitive market include product innovation, quality assurance, regulatory compliance, and effective consumer education. Companies that leverage technology integration, personalization trends, and sustainable business practices will be best positioned to capture market opportunities and build long-term competitive advantages.

The market outlook remains highly positive, with continued growth expected across all major product categories and geographic regions. MWR analysis indicates that companies investing in research and development, digital transformation, and strategic partnerships will achieve superior performance in this evolving market landscape. The Asia Pacific weight management market offers significant opportunities for established players and new entrants willing to adapt to changing consumer preferences and regulatory requirements while maintaining focus on product efficacy and consumer satisfaction.

What is Weight Management?

Weight management refers to the process of adopting long-term lifestyle modifications to maintain a healthy body weight. This includes dietary changes, physical activity, and behavioral strategies to prevent obesity and related health issues.

What are the key players in the Asia Pacific Weight Management Market?

Key players in the Asia Pacific Weight Management Market include Herbalife, Weight Watchers, and Nutrisystem, among others. These companies offer a range of products and services aimed at helping consumers achieve and maintain their weight goals.

What are the main drivers of the Asia Pacific Weight Management Market?

The main drivers of the Asia Pacific Weight Management Market include the rising prevalence of obesity, increasing health awareness among consumers, and the growing demand for weight management products and services. Additionally, lifestyle changes and urbanization contribute to this market’s growth.

What challenges does the Asia Pacific Weight Management Market face?

The Asia Pacific Weight Management Market faces challenges such as cultural attitudes towards body image, the availability of unhealthy food options, and the lack of access to professional weight management services. These factors can hinder effective weight management efforts.

What opportunities exist in the Asia Pacific Weight Management Market?

Opportunities in the Asia Pacific Weight Management Market include the development of innovative weight management solutions, the rise of digital health platforms, and increasing partnerships between health professionals and weight management companies. These trends can enhance consumer engagement and effectiveness.

What trends are shaping the Asia Pacific Weight Management Market?

Trends shaping the Asia Pacific Weight Management Market include the growing popularity of plant-based diets, the integration of technology in weight management solutions, and an increased focus on holistic health approaches. These trends reflect changing consumer preferences and lifestyles.

Asia Pacific Weight Management Market

| Segmentation Details | Description |

|---|---|

| Product Type | Dietary Supplements, Meal Replacements, Weight Loss Devices, Fitness Equipment |

| End User | Adults, Adolescents, Seniors, Fitness Enthusiasts |

| Distribution Channel | Online Retail, Supermarkets, Pharmacies, Health Stores |

| Application | Weight Loss, Weight Maintenance, Muscle Gain, Nutritional Support |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Weight Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at