444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific wearable medical device market represents one of the fastest-growing segments in the global healthcare technology landscape. This dynamic market encompasses a comprehensive range of connected health devices designed to monitor, track, and manage various health parameters in real-time. The region’s unique demographic profile, characterized by rapid urbanization, aging populations, and increasing health consciousness, has created an ideal environment for wearable medical technology adoption.

Market dynamics in the Asia Pacific region are driven by several key factors, including rising healthcare costs, growing prevalence of chronic diseases, and increasing consumer awareness about preventive healthcare. The market is experiencing robust growth with a projected CAGR of 12.8% through the forecast period, significantly outpacing global averages. Countries such as Japan, South Korea, China, and Australia are leading the adoption curve, while emerging markets like India, Thailand, and Vietnam are showing remarkable growth potential.

Technological advancement in the region has been remarkable, with local manufacturers and international players investing heavily in research and development. The integration of artificial intelligence, machine learning, and advanced sensor technologies has enhanced the accuracy and functionality of wearable medical devices, making them more appealing to both healthcare providers and consumers.

The Asia Pacific wearable medical device market refers to the comprehensive ecosystem of portable, connected health monitoring devices designed to track, measure, and analyze various physiological parameters across the Asia Pacific region. These devices encompass a wide range of products including smartwatches with health monitoring capabilities, fitness trackers, continuous glucose monitors, cardiac monitors, sleep tracking devices, and specialized medical wearables for chronic disease management.

Wearable medical devices are characterized by their ability to continuously collect health data, provide real-time feedback to users, and often transmit information to healthcare providers or health management platforms. The market includes both consumer-grade devices available through retail channels and clinical-grade devices prescribed by healthcare professionals for specific medical conditions.

Regional significance of this market lies in its potential to address the unique healthcare challenges faced by Asia Pacific countries, including aging populations, rising chronic disease prevalence, healthcare accessibility issues in remote areas, and the need for cost-effective healthcare solutions.

Market expansion in the Asia Pacific wearable medical device sector is being driven by unprecedented technological innovation and changing consumer healthcare behaviors. The region’s diverse market landscape presents both significant opportunities and unique challenges for manufacturers and healthcare providers alike.

Key growth drivers include the increasing adoption of digital health solutions, government initiatives promoting healthcare digitization, and rising consumer spending on health and wellness products. The market is witnessing a shift from basic fitness tracking to comprehensive health monitoring, with devices now capable of detecting early signs of various medical conditions.

Consumer adoption rates have accelerated significantly, with approximately 68% of urban consumers in major Asia Pacific markets now using some form of wearable health device. This adoption is particularly strong among younger demographics, though older populations are increasingly embracing these technologies for chronic disease management.

Competitive landscape features a mix of global technology giants, established medical device manufacturers, and innovative local startups. Companies are focusing on developing region-specific solutions that address local health concerns, regulatory requirements, and cultural preferences.

Market segmentation reveals distinct patterns across different device categories and geographical regions. The following key insights highlight the most significant trends shaping the Asia Pacific wearable medical device market:

Demographic transformation across the Asia Pacific region is creating unprecedented demand for wearable medical devices. The rapidly aging population, particularly in developed markets like Japan and South Korea, is driving demand for continuous health monitoring solutions that can help manage age-related health conditions and support independent living.

Rising chronic disease prevalence represents another significant driver, with diabetes, cardiovascular disease, and obesity rates increasing across the region. Wearable devices offer cost-effective solutions for continuous monitoring and early intervention, reducing the burden on healthcare systems while improving patient outcomes.

Healthcare digitization initiatives by governments throughout the region are accelerating market growth. Countries like Singapore, Australia, and South Korea have implemented comprehensive digital health strategies that include support for wearable medical device adoption and integration into national healthcare systems.

Consumer health awareness has reached new heights, particularly following the global health challenges of recent years. This heightened awareness has translated into increased willingness to invest in personal health monitoring technologies, with consumers viewing wearable devices as essential tools for maintaining wellness.

Technological advancement in sensor technology, battery life, and data analytics has made wearable medical devices more accurate, reliable, and user-friendly. These improvements have addressed many of the early concerns about device reliability and have expanded the range of health parameters that can be effectively monitored.

Regulatory complexity across different Asia Pacific countries presents significant challenges for manufacturers seeking to expand their market presence. Each country has distinct approval processes, data privacy requirements, and medical device regulations, creating barriers to rapid market entry and standardization.

Data privacy concerns remain a significant restraint, particularly in markets where consumers are increasingly aware of data security issues. The sensitive nature of health data requires robust security measures and transparent data handling practices, which can increase development costs and complexity.

Accuracy limitations of consumer-grade devices continue to impact market growth, as healthcare providers and patients require reliable, clinically validated measurements. The gap between consumer devices and medical-grade accuracy standards remains a challenge for broader clinical adoption.

Infrastructure limitations in developing markets across the region can restrict device functionality and data transmission capabilities. Poor internet connectivity, limited smartphone penetration, and inadequate healthcare IT infrastructure can limit the effectiveness of wearable medical devices.

Cost sensitivity in price-conscious markets can limit adoption rates, particularly for advanced devices with comprehensive monitoring capabilities. Balancing affordability with functionality remains a key challenge for manufacturers targeting mass market segments.

Emerging market penetration presents substantial opportunities for growth, particularly in countries like India, Indonesia, and Vietnam where smartphone adoption is rapidly increasing and healthcare awareness is growing. These markets offer significant potential for affordable, locally-adapted wearable medical devices.

Healthcare system integration opportunities are expanding as hospitals and clinics recognize the value of continuous patient monitoring. Remote patient monitoring programs, post-surgical care, and chronic disease management represent key areas where wearable devices can provide significant value to healthcare providers.

Artificial intelligence integration offers opportunities to enhance device capabilities through predictive analytics, personalized health insights, and automated health alerts. AI-powered features can differentiate products and provide additional value to both consumers and healthcare providers.

Corporate wellness expansion represents a growing opportunity as employers across the region invest in employee health programs. Wearable devices can support workplace wellness initiatives, reduce healthcare costs, and improve productivity, creating a compelling business case for enterprise adoption.

Specialized medical applications offer opportunities for niche market development, including devices for specific conditions like sleep disorders, mental health monitoring, and rehabilitation support. These specialized applications often command premium pricing and face less competition.

Supply chain evolution in the Asia Pacific wearable medical device market is characterized by increasing localization of manufacturing and component sourcing. This trend is driven by both cost optimization and supply chain resilience considerations, with countries like China, Taiwan, and South Korea emerging as key manufacturing hubs.

Innovation cycles are accelerating, with new product launches occurring more frequently and featuring increasingly sophisticated capabilities. The integration of advanced sensors, improved battery technology, and enhanced connectivity options is driving rapid product evolution and shorter replacement cycles.

Partnership dynamics between technology companies, healthcare providers, and pharmaceutical companies are reshaping the market landscape. These collaborations are enabling more comprehensive health solutions that combine device hardware, software platforms, and clinical expertise.

Regulatory harmonization efforts across the region are gradually reducing barriers to market entry and enabling more efficient product development processes. Regional cooperation initiatives are working toward standardized approval processes and mutual recognition agreements.

Consumer behavior patterns are evolving rapidly, with users becoming more sophisticated in their expectations for device functionality, data accuracy, and integration capabilities. This evolution is driving demand for more advanced features and pushing manufacturers to continuously innovate.

Comprehensive market analysis for the Asia Pacific wearable medical device market employs a multi-faceted research approach combining primary and secondary research methodologies. The research framework encompasses quantitative data collection, qualitative insights gathering, and extensive market validation processes.

Primary research activities include structured interviews with key industry stakeholders, including device manufacturers, healthcare providers, regulatory officials, and end-users across major Asia Pacific markets. Survey methodologies capture consumer preferences, adoption patterns, and usage behaviors across different demographic segments.

Secondary research sources encompass industry reports, government publications, regulatory filings, company financial statements, and academic research papers. Market data is cross-validated through multiple sources to ensure accuracy and reliability of findings.

Market sizing methodologies employ both top-down and bottom-up approaches, analyzing market segments by device type, application area, distribution channel, and geographical region. Growth projections are based on historical trends, current market dynamics, and forward-looking indicators.

Data validation processes include expert panel reviews, market participant feedback, and statistical analysis to ensure research findings accurately represent market realities and future trends.

China dominates the Asia Pacific wearable medical device market, representing approximately 38% of regional market share due to its large population, growing middle class, and strong manufacturing capabilities. The Chinese market is characterized by intense competition among local and international players, with companies like Xiaomi, Huawei, and Amazfit leading consumer adoption.

Japan represents the most mature market in the region, with high adoption rates among elderly populations and strong integration with healthcare systems. The Japanese market emphasizes clinical-grade accuracy and regulatory compliance, with companies like Omron and Terumo playing significant roles in medical device development.

South Korea demonstrates exceptional growth in smart health technologies, supported by advanced telecommunications infrastructure and government digital health initiatives. The market shows strong adoption of integrated health platforms and AI-powered health analytics.

India presents enormous growth potential with its large population and increasing healthcare awareness, though price sensitivity remains a key market characteristic. Local manufacturers are developing affordable solutions tailored to Indian health concerns and economic conditions.

Australia and New Zealand represent developed markets with high consumer spending power and strong regulatory frameworks. These markets emphasize clinical validation and integration with established healthcare systems.

Southeast Asian markets including Thailand, Malaysia, Singapore, and Indonesia are experiencing rapid growth driven by urbanization, rising incomes, and increasing health consciousness. These markets present opportunities for both premium and affordable device segments.

Market leadership in the Asia Pacific wearable medical device sector is distributed among several key categories of players, each bringing distinct strengths and market approaches. The competitive environment is characterized by rapid innovation, strategic partnerships, and increasing focus on regional customization.

Competitive strategies focus on product differentiation through advanced health monitoring capabilities, clinical validation, ecosystem integration, and regional market adaptation. Companies are investing heavily in research and development to maintain technological leadership and expand their health monitoring capabilities.

Device type segmentation reveals distinct market dynamics across different product categories, each serving specific user needs and market segments within the Asia Pacific region.

By Product Type:

By Application:

Smartwatch category continues to dominate the market with approximately 45% adoption rate among tech-savvy consumers. These devices offer the most comprehensive health monitoring capabilities combined with communication and productivity features, making them attractive to a broad consumer base.

Fitness tracker segment remains strong in price-sensitive markets, offering focused health monitoring capabilities at affordable price points. This category is particularly popular among younger demographics and first-time wearable device users.

Medical-grade devices are experiencing rapid growth as healthcare systems recognize their value for patient monitoring and chronic disease management. These devices typically require regulatory approval and clinical validation, commanding premium pricing but offering superior accuracy.

Specialized monitoring devices for specific conditions like diabetes and cardiac disorders represent high-growth niche segments. These devices often integrate with healthcare provider systems and offer clinical-grade monitoring capabilities.

Enterprise wellness devices are gaining traction as companies invest in employee health programs. These devices often feature corporate management platforms and privacy controls suitable for workplace deployment.

Healthcare providers benefit from wearable medical devices through improved patient monitoring capabilities, reduced healthcare costs, and enhanced treatment outcomes. Remote monitoring enables early intervention and reduces hospital readmissions while providing continuous patient data for better clinical decision-making.

Patients and consumers gain access to continuous health monitoring, personalized health insights, and greater control over their health management. Wearable devices enable proactive health management and early detection of potential health issues.

Device manufacturers benefit from expanding market opportunities, recurring revenue through software and services, and opportunities for healthcare system integration. The growing market provides multiple revenue streams and partnership opportunities.

Insurance companies can leverage wearable device data for risk assessment, premium optimization, and wellness program development. This data enables more accurate underwriting and encourages healthier behaviors among policyholders.

Employers benefit from reduced healthcare costs, improved employee wellness, and enhanced productivity through corporate wellness programs incorporating wearable devices. These programs can reduce absenteeism and improve employee satisfaction.

Government healthcare systems can reduce overall healthcare costs, improve population health monitoring, and enhance public health initiatives through widespread wearable device adoption and data integration.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is transforming wearable medical devices from simple data collectors to intelligent health advisors. AI-powered features include predictive health analytics, personalized recommendations, and automated health alerts, significantly enhancing device value and user engagement.

Clinical validation emphasis is driving manufacturers to invest in rigorous testing and regulatory approval processes. Healthcare providers increasingly demand clinically validated devices that can be trusted for patient care and treatment decisions.

Ecosystem integration is becoming crucial as consumers expect seamless connectivity between their wearable devices, smartphones, health apps, and healthcare providers. Comprehensive health platforms that integrate multiple data sources are gaining competitive advantage.

Personalization trends are leading to more customized health monitoring solutions that adapt to individual user needs, health conditions, and lifestyle patterns. Personalized health insights and recommendations are becoming key differentiators.

Enterprise adoption is accelerating as companies recognize the value of employee health monitoring for reducing healthcare costs and improving productivity. Corporate wellness programs increasingly incorporate wearable devices as core components.

Regulatory evolution across the region is creating clearer pathways for device approval while maintaining safety standards. Harmonization efforts are reducing barriers to market entry and enabling more efficient product development.

Strategic partnerships between technology companies and healthcare providers are reshaping the market landscape. Recent collaborations focus on integrating wearable device data into clinical workflows and developing specialized health monitoring solutions.

Regulatory approvals for medical-grade wearable devices are increasing across the region, with countries like Japan, Australia, and Singapore leading in establishing comprehensive approval frameworks. These approvals enable broader clinical adoption and healthcare system integration.

Investment activities in wearable medical device startups have intensified, with venture capital and corporate investment focusing on innovative health monitoring technologies and AI-powered health analytics platforms.

Product launches featuring advanced health monitoring capabilities continue at a rapid pace, with manufacturers introducing devices capable of monitoring blood oxygen levels, ECG readings, blood pressure, and other clinical parameters.

Market consolidation activities include acquisitions of specialized health technology companies by larger players seeking to expand their health monitoring capabilities and market presence.

Research collaborations between universities, research institutions, and industry players are advancing the development of next-generation wearable medical technologies, including non-invasive glucose monitoring and continuous blood pressure measurement.

MarkWide Research analysis indicates that companies should prioritize clinical validation and regulatory compliance to capture the growing healthcare provider market segment. Investment in rigorous testing and approval processes will differentiate products and enable premium pricing strategies.

Market expansion strategies should focus on emerging markets with tailored product offerings that address local health concerns and price sensitivity. Successful market entry requires understanding of local healthcare systems, regulatory requirements, and consumer preferences.

Technology investment in artificial intelligence and advanced analytics capabilities will be crucial for maintaining competitive advantage. Companies should focus on developing predictive health insights and personalized recommendations that add significant value for users.

Partnership development with healthcare providers, insurance companies, and corporate wellness programs can create new revenue streams and market opportunities. These partnerships enable access to professional markets and recurring revenue models.

Data privacy and security investments are essential for building consumer trust and meeting regulatory requirements. Companies should implement robust security measures and transparent data handling practices to address growing privacy concerns.

Ecosystem integration capabilities should be prioritized to meet consumer expectations for seamless health data management. Integration with popular health platforms and healthcare provider systems will enhance product appeal and user retention.

Market growth trajectory for the Asia Pacific wearable medical device market remains strongly positive, with continued expansion expected across all major market segments. The market is projected to maintain robust growth rates of approximately 11.5% CAGR over the next five years, driven by technological advancement and increasing health awareness.

Technology evolution will focus on enhanced accuracy, expanded monitoring capabilities, and improved user experience. Next-generation devices will likely incorporate non-invasive blood glucose monitoring, continuous blood pressure measurement, and advanced sleep analysis capabilities.

Healthcare integration will deepen as healthcare systems recognize the value of continuous patient monitoring and remote care capabilities. Integration with electronic health records and clinical decision support systems will become standard features.

Market maturation in developed countries will drive focus toward specialized medical applications and clinical-grade devices, while emerging markets will continue to drive volume growth through affordable consumer devices.

Regulatory harmonization efforts across the region will reduce barriers to market entry and enable more efficient product development and distribution strategies. Standardized approval processes will benefit both manufacturers and consumers.

MWR projections indicate that the market will increasingly segment into distinct categories serving different user needs, from basic fitness tracking to comprehensive medical monitoring, with each segment developing specialized features and capabilities.

The Asia Pacific wearable medical device market represents a dynamic and rapidly evolving sector with significant growth potential across diverse market segments and geographical regions. The convergence of technological advancement, demographic trends, and increasing health awareness creates a favorable environment for continued market expansion.

Key success factors for market participants include focus on clinical validation, regulatory compliance, and integration with healthcare ecosystems. Companies that can effectively balance innovation with reliability while addressing local market needs will be best positioned for long-term success.

Market opportunities remain substantial, particularly in emerging markets and specialized medical applications. The ongoing evolution toward personalized healthcare and preventive medicine will continue to drive demand for sophisticated wearable medical devices.

Future market development will be characterized by increased sophistication in health monitoring capabilities, deeper healthcare system integration, and expansion into new therapeutic areas. The market’s trajectory toward becoming an integral component of modern healthcare delivery appears well-established and sustainable.

What is Wearable Medical Device?

Wearable medical devices are electronic devices that can be worn on the body to monitor health metrics, track fitness levels, and provide medical data. They include products like smartwatches, fitness trackers, and health monitoring patches.

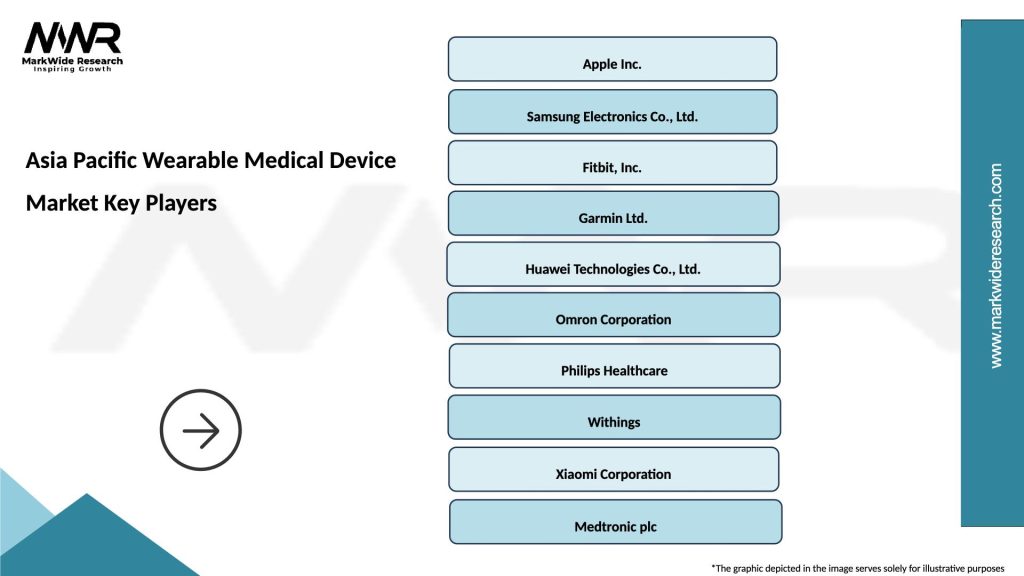

What are the key players in the Asia Pacific Wearable Medical Device Market?

Key players in the Asia Pacific Wearable Medical Device Market include companies like Fitbit, Apple, and Garmin, which are known for their innovative health tracking technologies and user-friendly designs, among others.

What are the growth factors driving the Asia Pacific Wearable Medical Device Market?

The growth of the Asia Pacific Wearable Medical Device Market is driven by increasing health awareness, the rise in chronic diseases, and advancements in technology that enhance device functionality and connectivity.

What challenges does the Asia Pacific Wearable Medical Device Market face?

Challenges in the Asia Pacific Wearable Medical Device Market include data privacy concerns, regulatory hurdles, and the need for continuous innovation to meet consumer expectations and technological advancements.

What future opportunities exist in the Asia Pacific Wearable Medical Device Market?

Future opportunities in the Asia Pacific Wearable Medical Device Market include the integration of artificial intelligence for personalized health insights, expansion into emerging markets, and the development of devices for remote patient monitoring.

What trends are shaping the Asia Pacific Wearable Medical Device Market?

Trends shaping the Asia Pacific Wearable Medical Device Market include the increasing adoption of telehealth services, the rise of fitness and wellness applications, and the growing demand for real-time health monitoring solutions.

Asia Pacific Wearable Medical Device Market

| Segmentation Details | Description |

|---|---|

| Product Type | Smartwatches, Fitness Trackers, Health Monitors, Smart Glasses |

| Technology | Bluetooth, NFC, Wi-Fi, Cellular |

| End User | Individuals, Healthcare Providers, Fitness Enthusiasts, Corporate Wellness Programs |

| Application | Chronic Disease Management, Fitness Tracking, Remote Patient Monitoring, Sleep Analysis |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Wearable Medical Device Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at