444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific water free urinals market represents a rapidly evolving segment within the region’s sustainable sanitation infrastructure landscape. This innovative market encompasses waterless urinal systems that eliminate the need for traditional flush mechanisms, offering significant water conservation benefits across commercial, institutional, and public facilities. The market has experienced substantial growth momentum driven by increasing environmental consciousness, stringent water conservation regulations, and rising adoption of green building practices throughout the Asia-Pacific region.

Market dynamics indicate robust expansion potential, with the sector demonstrating a compound annual growth rate (CAGR) of 8.2% across key regional markets. The technology’s appeal stems from its dual benefit of reducing water consumption while maintaining hygiene standards, making it particularly attractive for water-stressed regions within Asia-Pacific. Countries including Australia, Japan, Singapore, and India have emerged as leading adopters, with commercial real estate developers and facility managers increasingly recognizing the long-term operational benefits.

Regional adoption patterns show significant variation, with developed markets like Australia and Japan leading in premium segment penetration at approximately 35% market share, while emerging economies focus primarily on cost-effective solutions for public infrastructure projects. The market encompasses various technology approaches, including cartridge-based systems, liquid sealant solutions, and biological treatment mechanisms, each catering to specific application requirements and maintenance preferences.

The Asia-Pacific water free urinals market refers to the commercial ecosystem encompassing the manufacturing, distribution, installation, and maintenance of waterless urinal systems across the Asia-Pacific geographical region. These innovative sanitation solutions eliminate the traditional water flush mechanism, instead utilizing alternative technologies such as specialized trap seals, cartridge systems, or biological processes to maintain hygiene while preventing odor escape.

Water free urinals operate through various technological approaches, with the most common being cartridge-based systems that use replaceable components containing specialized sealants or biological agents. These systems create an effective barrier that allows liquid waste to pass through while preventing sewer gases from escaping back into the facility. The technology represents a significant advancement in sustainable sanitation infrastructure, offering facilities the opportunity to reduce water consumption by up to 40,000 liters annually per unit compared to traditional flush urinals.

Market scope encompasses residential, commercial, institutional, and public sector applications, with commercial office buildings, shopping centers, airports, and educational institutions representing the primary adoption segments. The technology’s relevance extends beyond simple water conservation, addressing broader sustainability goals, operational cost reduction, and compliance with increasingly stringent environmental regulations across Asia-Pacific markets.

Strategic market analysis reveals the Asia-Pacific water free urinals market as a high-growth segment within the broader sustainable sanitation technology landscape. The market benefits from converging trends including rapid urbanization, increasing environmental awareness, and supportive regulatory frameworks promoting water conservation across the region. Commercial adoption has accelerated significantly, with office buildings representing 42% of total installations across major metropolitan areas.

Technology evolution continues to drive market expansion, with manufacturers developing increasingly sophisticated solutions that address traditional concerns around maintenance complexity and odor control. Advanced cartridge systems now offer extended replacement intervals, while smart monitoring technologies enable predictive maintenance scheduling. These improvements have contributed to a 78% customer satisfaction rate among commercial facility managers, significantly higher than early-generation systems.

Regional growth patterns demonstrate strong momentum across both developed and emerging markets within Asia-Pacific. Australia and Japan lead in premium segment adoption, while countries like India, Thailand, and Vietnam show rapid growth in public sector installations. The market’s expansion is supported by increasing green building certifications, with waterless urinals contributing to LEED and BREEAM point accumulation for sustainable facility design.

Competitive landscape features a mix of established international players and emerging regional manufacturers, creating dynamic pricing pressures while driving continuous innovation. Market consolidation activities have increased, with strategic partnerships between technology providers and facility management companies becoming increasingly common to capture the growing demand for integrated sustainable sanitation solutions.

Market penetration analysis reveals significant growth opportunities across diverse application segments within the Asia-Pacific region. The following key insights demonstrate the market’s current dynamics and future potential:

Adoption barriers continue to diminish as technology improvements address historical concerns around odor control, maintenance complexity, and initial installation costs. Educational initiatives by manufacturers and industry associations have successfully increased awareness among facility managers and building owners about the long-term benefits of waterless urinal systems.

Water conservation imperatives represent the primary driver for Asia-Pacific water free urinals market expansion. The region faces increasing water scarcity challenges, with many countries implementing strict conservation measures and offering incentives for water-saving technologies. Commercial facilities can achieve water usage reductions of 15-25% through waterless urinal installations, making them attractive investments for cost-conscious facility managers.

Regulatory frameworks across the region increasingly mandate or incentivize water conservation measures in commercial and public buildings. Countries like Australia have implemented water efficiency requirements for commercial buildings, while Singapore’s building codes encourage the adoption of water-saving fixtures. These regulatory drivers create sustained demand for waterless urinal systems as building owners seek compliance with evolving environmental standards.

Sustainability initiatives within corporate and institutional sectors drive significant market demand. Organizations pursuing environmental certifications such as LEED, BREEAM, or local green building standards find waterless urinals contribute valuable points toward certification goals. The technology’s environmental benefits align with corporate social responsibility objectives, making adoption decisions easier for sustainability-focused organizations.

Operational cost benefits provide compelling economic justification for waterless urinal adoption. Beyond water savings, facilities experience reduced maintenance requirements for plumbing systems, lower sewage disposal costs, and decreased risk of water damage from plumbing failures. These operational advantages create positive return on investment calculations that support market growth across price-sensitive segments.

Urbanization trends throughout Asia-Pacific create increasing demand for efficient sanitation solutions in high-density developments. Rapid urban growth strains existing water infrastructure, making water-free technologies increasingly attractive for new construction projects and infrastructure upgrades in major metropolitan areas.

Initial installation costs remain a significant barrier to market adoption, particularly in price-sensitive segments and emerging markets. While waterless urinals offer long-term operational savings, the higher upfront investment compared to traditional fixtures can deter cost-conscious buyers. This challenge is particularly pronounced in public sector projects where budget constraints limit adoption of premium sustainable technologies.

Maintenance complexity concerns continue to influence adoption decisions, despite technological improvements. Some facility managers remain hesitant about waterless urinal systems due to perceived maintenance difficulties and the need for specialized service providers. The requirement for regular cartridge replacement and system monitoring can appear more complex than traditional flush urinals, creating adoption resistance.

Cultural acceptance barriers exist in certain markets where traditional sanitation practices are deeply ingrained. User acceptance can be challenging in regions where waterless urinals are unfamiliar, requiring extensive education and demonstration programs. Some users express concerns about hygiene and odor control, despite technological advances that address these issues effectively.

Limited service infrastructure in emerging markets constrains growth potential, as waterless urinal systems require specialized maintenance services and replacement parts availability. The lack of trained service technicians and reliable supply chains for consumables can create operational challenges for facility managers, particularly in remote or less developed regions.

Competition from alternative technologies poses ongoing challenges, with low-flow and dual-flush urinals offering water conservation benefits at lower initial costs. These competing technologies may satisfy basic water conservation requirements without the perceived complexity of waterless systems, potentially limiting market expansion in certain segments.

Smart building integration presents substantial growth opportunities as Asia-Pacific markets embrace IoT-enabled facility management systems. Waterless urinals equipped with sensors and connectivity features can provide valuable data on usage patterns, maintenance requirements, and water savings achievements. This integration capability positions waterless urinals as components of comprehensive smart building ecosystems, expanding their appeal to technology-forward facility managers.

Public infrastructure modernization across emerging Asia-Pacific markets creates significant demand potential for cost-effective waterless urinal solutions. Government initiatives to upgrade public facilities, schools, and transportation hubs provide substantial market opportunities, particularly when supported by international development funding focused on sustainable infrastructure projects.

Green building certification growth continues to drive market expansion as sustainability becomes increasingly important in commercial real estate development. The growing emphasis on environmental certifications creates sustained demand for waterless urinals as building owners seek to achieve higher sustainability ratings and attract environmentally conscious tenants.

Water crisis response in drought-affected regions offers accelerated adoption opportunities, with governments and organizations seeking immediate water conservation solutions. Climate change impacts on water availability create urgent demand for water-saving technologies, potentially fast-tracking adoption timelines and increasing willingness to invest in premium solutions.

Retrofit market potential remains largely untapped, with millions of existing commercial and institutional facilities representing conversion opportunities. As building owners seek to reduce operational costs and improve sustainability profiles, retrofitting existing restrooms with waterless urinals becomes increasingly attractive, particularly during scheduled renovation projects.

Supply chain evolution within the Asia-Pacific water free urinals market demonstrates increasing sophistication as manufacturers establish regional production and distribution networks. Local manufacturing capabilities are expanding in key markets like China and India, reducing costs and improving product availability. This localization trend enables more competitive pricing while supporting faster delivery and service response times.

Technology convergence with adjacent markets creates new opportunities and challenges for waterless urinal manufacturers. Integration with smart building systems, water management platforms, and facility maintenance software requires expanded technical capabilities and partnership strategies. Companies successfully navigating this convergence gain competitive advantages through comprehensive solution offerings.

Customer education initiatives by manufacturers and industry associations continue to address adoption barriers and expand market awareness. Demonstration projects, case studies, and educational programs help facility managers understand the benefits and operational requirements of waterless urinal systems. These efforts contribute to improved market acceptance rates of approximately 65% among educated prospects.

Regulatory landscape changes across the region create both opportunities and challenges for market participants. Evolving building codes, water conservation mandates, and environmental regulations require continuous adaptation of product offerings and marketing strategies. Companies that proactively engage with regulatory development processes gain advantages in market positioning and product development.

Competitive intensity continues to increase as new entrants recognize market growth potential and established players expand their presence. This competition drives innovation, improves product quality, and creates pricing pressures that benefit end customers while challenging profit margins for manufacturers.

Comprehensive market analysis for the Asia-Pacific water free urinals market employs multiple research methodologies to ensure accuracy and completeness of findings. Primary research activities include extensive interviews with industry stakeholders, including manufacturers, distributors, facility managers, and end users across key regional markets. These interviews provide insights into market dynamics, adoption drivers, and future growth potential.

Secondary research components encompass analysis of industry reports, government publications, regulatory documents, and company financial statements to establish market context and validate primary research findings. Trade association data, building permit information, and construction industry statistics provide quantitative foundations for market sizing and growth projections.

Market segmentation analysis utilizes both top-down and bottom-up approaches to ensure comprehensive coverage of all relevant market segments. Top-down analysis begins with overall sanitation fixture markets and applies waterless urinal penetration rates, while bottom-up analysis aggregates installation data from individual market segments and geographic regions.

Competitive landscape assessment involves detailed analysis of key market participants, including product portfolios, geographic presence, financial performance, and strategic initiatives. This analysis provides insights into market structure, competitive positioning, and likely future developments within the industry.

Trend analysis and forecasting incorporate multiple scenario modeling approaches to account for various market development possibilities. Economic indicators, regulatory changes, and technology advancement trajectories inform projection models that estimate future market growth under different conditions.

Australia and New Zealand represent the most mature markets within the Asia-Pacific region, with established adoption patterns and sophisticated distribution networks. These markets demonstrate premium segment penetration rates of 38%, driven by stringent water conservation regulations and high environmental awareness. Commercial office buildings and shopping centers show particularly strong adoption rates, with many new construction projects including waterless urinals as standard fixtures.

Japan’s market exhibits unique characteristics driven by technological sophistication and space optimization requirements. Japanese facilities prioritize advanced features such as automated monitoring systems and compact designs suitable for high-density urban environments. The market shows steady growth with particular strength in transportation hubs, commercial complexes, and institutional facilities.

China presents the largest growth opportunity within the region, with rapid urbanization and increasing environmental consciousness driving demand for sustainable sanitation solutions. Government initiatives promoting water conservation and green building practices support market expansion, particularly in tier-one and tier-two cities. The market shows strong potential in both new construction and retrofit applications.

India’s emerging market demonstrates significant potential driven by water scarcity concerns and government sustainability initiatives. Public sector adoption leads market development, with educational institutions and government facilities representing primary installation segments. The market shows annual growth rates exceeding 12% in major metropolitan areas.

Southeast Asian markets including Singapore, Thailand, Malaysia, and Vietnam show varying adoption patterns influenced by economic development levels and regulatory frameworks. Singapore leads in premium segment adoption, while other markets focus primarily on cost-effective solutions for public infrastructure projects.

Market leadership within the Asia-Pacific water free urinals sector features a diverse mix of international corporations and specialized regional manufacturers. The competitive environment demonstrates increasing consolidation as companies seek to expand geographic coverage and enhance service capabilities.

Strategic partnerships between manufacturers and facility management companies are becoming increasingly common, creating integrated service offerings that address customer concerns about maintenance complexity. These partnerships enable manufacturers to provide comprehensive solutions while expanding market reach through established service networks.

Innovation competition drives continuous product development, with companies investing in smart monitoring technologies, improved cartridge systems, and enhanced odor control mechanisms. Patent activity remains high as manufacturers seek to differentiate their offerings and protect technological advantages.

By Technology Type:

By Application Segment:

By End User Category:

Premium Segment Analysis reveals strong growth in developed Asia-Pacific markets where customers prioritize advanced features and comprehensive service support. Premium waterless urinals incorporate smart monitoring capabilities, extended maintenance intervals, and superior aesthetic design. This segment commands higher profit margins and demonstrates customer retention rates exceeding 85% due to superior performance and service quality.

Mid-Range Market Dynamics show balanced growth across diverse applications, with customers seeking reliable performance at moderate price points. This segment represents the largest volume opportunity, particularly in commercial office buildings and institutional facilities. Mid-range products focus on proven technology with standard maintenance requirements and competitive lifecycle costs.

Economy Segment Trends demonstrate rapid expansion in emerging markets where cost considerations dominate purchasing decisions. Basic waterless urinal systems provide essential water conservation benefits while minimizing initial investment requirements. This segment shows particular strength in public sector applications and retrofit projects with limited budgets.

Smart Technology Integration across all segments reflects growing demand for IoT-enabled facility management solutions. Smart waterless urinals provide usage analytics, maintenance alerts, and water savings tracking capabilities. This technology integration commands premium pricing while offering facility managers valuable operational insights and predictive maintenance capabilities.

Service Model Evolution shows increasing preference for comprehensive maintenance contracts rather than traditional product sales approaches. Customers value predictable maintenance costs and guaranteed performance levels, creating opportunities for recurring revenue models and stronger customer relationships.

Manufacturers benefit from expanding market opportunities driven by increasing environmental consciousness and regulatory support for water conservation technologies. The growing market enables economies of scale in production while supporting premium pricing for advanced features and comprehensive service offerings. Strategic partnerships with facility management companies create stable revenue streams and market expansion opportunities.

Facility Managers gain significant operational advantages through waterless urinal adoption, including reduced water costs, lower maintenance requirements, and improved sustainability metrics. Smart monitoring capabilities enable predictive maintenance scheduling and usage optimization, while comprehensive service contracts eliminate maintenance complexity concerns. These benefits support improved facility performance and cost management objectives.

Building Owners achieve multiple benefits including operational cost reduction, enhanced sustainability credentials, and improved tenant satisfaction. Waterless urinals contribute to green building certifications while reducing long-term operational expenses. The technology’s reliability and performance improvements support property value enhancement and competitive positioning in sustainability-conscious markets.

End Users experience improved restroom environments with consistent hygiene standards and reduced maintenance disruptions. Modern waterless urinal systems eliminate traditional concerns about odor and cleanliness while providing familiar user experiences. Educational initiatives help users understand and appreciate the environmental benefits of water conservation technologies.

Environmental Stakeholders benefit from significant water conservation achievements and reduced environmental impact from commercial and institutional facilities. MarkWide Research analysis indicates that widespread waterless urinal adoption could reduce regional water consumption by substantial percentages, supporting broader sustainability goals and water resource conservation objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart Technology Integration represents the most significant trend shaping the Asia-Pacific water free urinals market. Manufacturers are incorporating IoT sensors, wireless connectivity, and cloud-based monitoring systems that provide real-time usage data, maintenance alerts, and water savings tracking. This technological evolution transforms waterless urinals from simple fixtures into intelligent building components that contribute to comprehensive facility management systems.

Sustainability Certification Focus continues to drive market adoption as building owners and developers seek to achieve higher environmental ratings. Waterless urinals contribute valuable points toward LEED, BREEAM, and local green building certifications, making them increasingly standard components in sustainable construction projects. This trend shows particular strength in commercial real estate development across major Asia-Pacific cities.

Service Model Transformation reflects changing customer preferences toward comprehensive maintenance contracts rather than traditional product purchases. Facility managers increasingly prefer predictable service costs and guaranteed performance levels, leading manufacturers to develop subscription-based models that include installation, maintenance, and consumable replacement services.

Localization Strategies by international manufacturers demonstrate recognition of regional market differences and the need for customized solutions. Companies are establishing local production facilities, developing region-specific products, and partnering with local distributors to better serve diverse Asia-Pacific markets with varying requirements and price sensitivities.

Public Sector Adoption Acceleration shows governments across the region increasingly specifying waterless urinals in public infrastructure projects. This trend reflects growing awareness of water conservation benefits and lifecycle cost advantages, with public sector adoption often leading broader market acceptance in commercial and institutional segments.

Product Innovation Acceleration has intensified across the industry, with manufacturers launching advanced waterless urinal systems featuring improved cartridge technology, enhanced odor control mechanisms, and integrated smart monitoring capabilities. Recent developments include extended maintenance intervals, antimicrobial surface treatments, and modular design approaches that simplify installation and service procedures.

Strategic Partnership Expansion between waterless urinal manufacturers and facility management companies has created new market opportunities and service delivery models. These partnerships enable comprehensive solution offerings that address customer concerns about maintenance complexity while expanding market reach through established service networks and customer relationships.

Regional Manufacturing Investment by international companies demonstrates commitment to Asia-Pacific market growth and cost competitiveness. New production facilities in China, India, and Southeast Asia enable localized manufacturing, reduced logistics costs, and faster market response times while supporting competitive pricing strategies for regional markets.

Regulatory Framework Evolution across key markets has created more favorable conditions for waterless urinal adoption. Updated building codes, water conservation mandates, and green building incentive programs provide regulatory support that accelerates market growth and reduces adoption barriers for facility owners and developers.

Digital Platform Development by manufacturers enables remote monitoring, predictive maintenance, and usage analytics for waterless urinal systems. These digital capabilities provide facility managers with valuable operational insights while supporting proactive maintenance scheduling and performance optimization across multiple locations.

Market Entry Strategies for new participants should focus on differentiated value propositions that address specific regional needs and customer segments. MWR analysis suggests that successful market entry requires comprehensive understanding of local regulations, customer preferences, and competitive dynamics. Companies should consider strategic partnerships with established distributors or facility management firms to accelerate market penetration and reduce entry barriers.

Technology Investment Priorities should emphasize smart monitoring capabilities, improved maintenance efficiency, and enhanced user experience features. The market increasingly values integrated solutions that provide operational insights and predictive maintenance capabilities. Companies investing in IoT connectivity and data analytics platforms will gain competitive advantages in attracting technology-forward customers.

Geographic Expansion Recommendations suggest prioritizing markets with strong regulatory support for water conservation and established green building practices. Developed markets offer premium pricing opportunities, while emerging markets provide volume growth potential. Companies should adapt product offerings and pricing strategies to match local market conditions and customer requirements.

Service Model Development should focus on comprehensive maintenance contracts that address customer concerns about operational complexity. Successful companies will develop predictable service offerings that guarantee performance while providing customers with simplified operational management. This approach creates recurring revenue opportunities while strengthening customer relationships.

Partnership Strategy Focus should emphasize relationships with facility management companies, construction firms, and green building consultants who influence purchasing decisions. These partnerships provide market access and credibility while enabling integrated solution offerings that address comprehensive customer needs beyond simple product sales.

Market growth projections for the Asia-Pacific water free urinals market indicate sustained expansion driven by increasing environmental consciousness, regulatory support, and technology advancement. The market is expected to maintain robust growth momentum with projected CAGR of 9.1% through the forecast period, supported by expanding adoption across commercial, institutional, and public sector applications.

Technology evolution will continue to drive market development, with smart monitoring capabilities becoming standard features across all product segments. Integration with building management systems and IoT platforms will transform waterless urinals into intelligent facility components that provide valuable operational data and predictive maintenance capabilities. These technological advances will support premium pricing while improving customer satisfaction and retention rates.

Regional market maturation patterns suggest that developed markets will focus increasingly on premium solutions with advanced features, while emerging markets will drive volume growth through cost-effective basic systems. This bifurcation creates opportunities for manufacturers to develop differentiated product portfolios that address diverse market requirements and price sensitivities across the region.

Regulatory landscape evolution will continue to support market growth through strengthened water conservation requirements and green building incentives. Governments across the region are expected to implement more stringent environmental standards that favor water-saving technologies, creating sustained demand for waterless urinal systems in both new construction and retrofit applications.

Competitive dynamics will intensify as market growth attracts new entrants and drives consolidation among existing players. Successful companies will differentiate through technology innovation, comprehensive service offerings, and strategic partnerships that provide integrated solutions addressing broader facility management needs beyond simple fixture replacement.

The Asia-Pacific water free urinals market represents a dynamic and rapidly expanding segment within the region’s sustainable sanitation infrastructure landscape. Market growth is driven by compelling water conservation benefits, supportive regulatory frameworks, and increasing adoption of green building practices across commercial, institutional, and public sector applications. The technology’s evolution toward smart monitoring capabilities and comprehensive service models addresses traditional adoption barriers while creating new value propositions for facility managers and building owners.

Regional diversity within the Asia-Pacific market creates opportunities for differentiated strategies that address varying customer requirements, regulatory environments, and economic conditions. Developed markets demonstrate strong demand for premium solutions with advanced features, while emerging markets focus on cost-effective systems that provide essential water conservation benefits. This market segmentation enables manufacturers to develop comprehensive product portfolios that capture opportunities across diverse customer segments and geographic regions.

Future market success will depend on continued technology innovation, strategic partnership development, and comprehensive service model evolution. Companies that successfully integrate smart monitoring capabilities, develop predictable maintenance offerings, and establish strong regional partnerships will capture the greatest share of expanding market opportunities. The convergence of environmental consciousness, regulatory support, and technology advancement creates a favorable environment for sustained market growth and industry development across the Asia-Pacific region.

What is Water Free/ Waterless Urinals?

Water Free/ Waterless Urinals are innovative sanitation solutions that eliminate the need for water in flushing, utilizing advanced technology to manage waste efficiently. They are designed for various applications, including public restrooms, commercial buildings, and outdoor facilities.

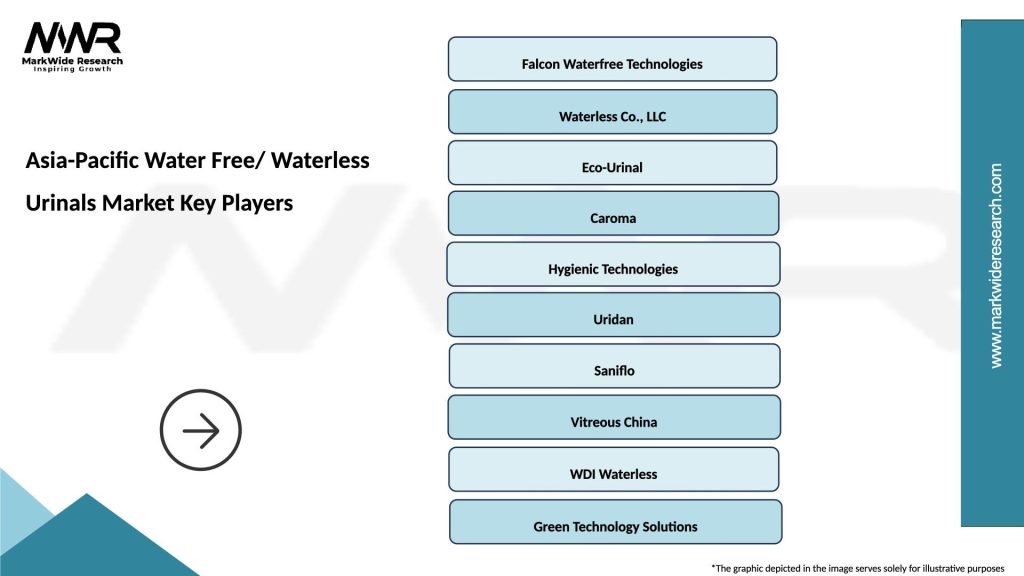

What are the key players in the Asia-Pacific Water Free/ Waterless Urinals Market?

Key players in the Asia-Pacific Water Free/ Waterless Urinals Market include companies like Waterless Co., Inc., Falcon Waterfree Technologies, and Eco Urinal, among others.

What are the growth factors driving the Asia-Pacific Water Free/ Waterless Urinals Market?

The growth of the Asia-Pacific Water Free/ Waterless Urinals Market is driven by increasing water scarcity, rising environmental awareness, and the need for cost-effective sanitation solutions in urban areas.

What challenges does the Asia-Pacific Water Free/ Waterless Urinals Market face?

Challenges in the Asia-Pacific Water Free/ Waterless Urinals Market include consumer resistance to new technologies, maintenance issues, and the need for proper education on their benefits and usage.

What opportunities exist in the Asia-Pacific Water Free/ Waterless Urinals Market?

Opportunities in the Asia-Pacific Water Free/ Waterless Urinals Market include expanding into emerging markets, increasing adoption in green building projects, and innovations in urinal design and functionality.

What trends are shaping the Asia-Pacific Water Free/ Waterless Urinals Market?

Trends in the Asia-Pacific Water Free/ Waterless Urinals Market include a growing focus on sustainability, advancements in odor control technologies, and the integration of smart features for enhanced user experience.

Asia-Pacific Water Free/ Waterless Urinals Market

| Segmentation Details | Description |

|---|---|

| Product Type | Wall-Mounted, Floor-Standing, Portable, Custom Designs |

| Technology | Vacuum, Gravity, Chemical, Mechanical |

| End User | Commercial Buildings, Educational Institutions, Public Restrooms, Industrial Facilities |

| Installation | New Construction, Retrofit, Temporary Setup, Permanent Installation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Water Free/ Waterless Urinals Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at