444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific water and wastewater treatment market represents one of the most dynamic and rapidly expanding sectors in the global environmental technology landscape. This comprehensive market encompasses a wide range of technologies, equipment, and services designed to address the growing water scarcity challenges and environmental concerns across the region. Market dynamics indicate substantial growth potential driven by increasing urbanization, industrial expansion, and stringent environmental regulations.

Regional growth patterns demonstrate significant momentum, with the market experiencing a robust 8.2% CAGR over the forecast period. This expansion reflects the urgent need for sustainable water management solutions across diverse economies, from developed nations like Japan and Australia to rapidly industrializing countries such as India and Vietnam. Government initiatives and private sector investments continue to fuel market development, creating opportunities for innovative treatment technologies and comprehensive infrastructure solutions.

Technology adoption rates vary significantly across different countries within the Asia-Pacific region, with advanced membrane technologies showing 65% higher adoption in developed markets compared to emerging economies. The market encompasses municipal water treatment, industrial wastewater management, and specialized treatment solutions for various sectors including pharmaceuticals, textiles, and food processing industries.

The Asia-Pacific water and wastewater treatment market refers to the comprehensive ecosystem of technologies, equipment, services, and infrastructure solutions designed to purify, treat, and manage water resources across the Asia-Pacific region. This market encompasses both potable water treatment systems that ensure safe drinking water supply and wastewater treatment facilities that process industrial and municipal effluents before discharge or reuse.

Treatment processes include physical, chemical, and biological methods employed to remove contaminants, pathogens, and pollutants from water sources. The market covers primary treatment systems that remove large particles and debris, secondary treatment processes that eliminate organic matter through biological processes, and tertiary treatment technologies that provide advanced purification for specific applications or stringent discharge requirements.

Market scope extends beyond traditional treatment equipment to include monitoring systems, automation technologies, maintenance services, and consulting solutions. This comprehensive approach addresses the entire water cycle, from source water treatment and distribution to wastewater collection, treatment, and safe disposal or beneficial reuse applications.

Strategic market analysis reveals the Asia-Pacific water and wastewater treatment market as a critical component of regional infrastructure development and environmental sustainability initiatives. The market demonstrates exceptional growth potential driven by increasing water stress, rapid urbanization, and evolving regulatory frameworks across diverse economies within the region.

Key market drivers include population growth exceeding 1.2% annually in several countries, industrial expansion requiring advanced treatment solutions, and government mandates for improved water quality standards. The market benefits from technological innovations in membrane filtration, biological treatment processes, and smart monitoring systems that enhance operational efficiency and treatment effectiveness.

Investment patterns show significant capital allocation toward municipal infrastructure upgrades, industrial treatment facility expansion, and emerging technologies such as advanced oxidation processes and resource recovery systems. Public-private partnerships play an increasingly important role in financing large-scale treatment projects, particularly in developing economies where infrastructure gaps remain substantial.

Competitive dynamics feature a mix of global technology providers, regional equipment manufacturers, and specialized service companies. Market consolidation trends indicate growing emphasis on comprehensive solution providers capable of delivering integrated treatment systems, ongoing maintenance services, and performance optimization capabilities.

Market intelligence reveals several critical insights that shape the Asia-Pacific water and wastewater treatment landscape. These insights provide valuable guidance for stakeholders seeking to understand market dynamics and identify strategic opportunities within this rapidly evolving sector.

Population growth serves as the primary catalyst for water and wastewater treatment market expansion across the Asia-Pacific region. Rapid urbanization creates concentrated demand for municipal water services and generates substantial volumes of wastewater requiring treatment before discharge. Urban population growth rates exceeding 3.5% annually in several major cities necessitate significant infrastructure investments and capacity expansions.

Industrial development across manufacturing, pharmaceuticals, textiles, and food processing sectors generates diverse wastewater streams requiring specialized treatment approaches. Each industry presents unique challenges related to contaminant types, discharge volumes, and regulatory compliance requirements. Manufacturing sector growth particularly in countries like Vietnam, Bangladesh, and Indonesia drives demand for comprehensive industrial wastewater treatment solutions.

Environmental regulations become increasingly stringent as governments prioritize water quality protection and pollution control. New discharge standards, water reuse mandates, and environmental impact assessments create compliance requirements that drive technology adoption and infrastructure upgrades. Regulatory enforcement mechanisms ensure sustained demand for advanced treatment capabilities.

Water scarcity concerns motivate investments in water recycling, reuse technologies, and efficient treatment processes that maximize resource utilization. Climate change impacts, including altered precipitation patterns and increased drought frequency, emphasize the importance of sustainable water management practices and treatment infrastructure resilience.

High capital requirements present significant barriers to market entry and project development, particularly for comprehensive treatment facilities serving large populations or industrial complexes. Initial investment costs for advanced treatment technologies, infrastructure development, and regulatory compliance can be substantial, limiting adoption in cost-sensitive markets or regions with limited financing options.

Technical complexity associated with modern treatment systems requires specialized expertise for design, installation, operation, and maintenance. Skills gaps in certain regions create challenges for technology deployment and long-term operational success. Workforce development needs include technical training, certification programs, and ongoing professional development to support market growth.

Energy consumption concerns related to treatment processes, particularly energy-intensive technologies like reverse osmosis and advanced oxidation, create operational cost challenges and environmental considerations. Rising energy costs and carbon footprint concerns influence technology selection and operational strategies, potentially limiting adoption of certain treatment approaches.

Regulatory variations across different countries within the Asia-Pacific region create complexity for multinational projects and technology standardization efforts. Differing standards, approval processes, and compliance requirements can slow project development and increase implementation costs for treatment solution providers.

Smart technology integration presents substantial opportunities for market differentiation and operational optimization. Internet of Things (IoT) sensors, artificial intelligence algorithms, and automated control systems enable real-time monitoring, predictive maintenance, and performance optimization that reduce operational costs and improve treatment effectiveness. Digital transformation initiatives create new revenue streams and competitive advantages.

Decentralized treatment solutions offer opportunities to serve remote communities, industrial facilities, and areas where centralized infrastructure is not economically viable. Modular treatment systems, containerized solutions, and on-site treatment technologies provide flexible alternatives that can be rapidly deployed and easily scaled based on changing requirements.

Resource recovery technologies create value-added opportunities through extraction of useful materials from wastewater streams. Nutrient recovery, biogas production, and water reuse applications transform waste streams into valuable resources, improving project economics and supporting circular economy principles. Value creation through resource recovery enhances overall project viability.

Public-private partnerships provide mechanisms for financing large-scale infrastructure projects while leveraging private sector expertise and efficiency. These collaborative arrangements enable governments to access advanced technologies and professional management capabilities while sharing project risks and ensuring long-term operational sustainability.

Supply chain dynamics within the Asia-Pacific water and wastewater treatment market reflect complex interactions between technology providers, equipment manufacturers, system integrators, and service companies. Regional manufacturing capabilities continue to expand, with local production facilities reducing costs and improving supply chain resilience for standard equipment and components.

Technology transfer mechanisms facilitate knowledge sharing and capability development across the region. Joint ventures, licensing agreements, and technical partnerships enable emerging markets to access advanced treatment technologies while building local expertise and manufacturing capacity. Collaboration models support sustainable market development and technology localization.

Competitive intensity varies significantly across different market segments and geographic regions. Established markets feature intense competition among global technology leaders, while emerging markets offer opportunities for regional players and innovative solution providers. Market consolidation trends indicate growing emphasis on comprehensive service capabilities and long-term customer relationships.

Innovation cycles accelerate as market demands drive continuous technology improvement and cost reduction. Research and development investments focus on energy efficiency, treatment effectiveness, operational simplicity, and environmental sustainability. Technology advancement rates demonstrate 15-20% annual improvement in key performance metrics for leading treatment technologies.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Asia-Pacific water and wastewater treatment market. Primary research activities include extensive interviews with industry executives, technology providers, government officials, and end-users across major markets within the region.

Secondary research encompasses analysis of government publications, industry reports, regulatory documents, and company financial statements to validate market trends and quantify market dynamics. Data triangulation methods ensure consistency and accuracy across multiple information sources and research approaches.

Market modeling techniques incorporate economic indicators, demographic trends, regulatory developments, and technology adoption patterns to project future market conditions and growth trajectories. Statistical analysis methods validate relationships between market drivers and growth outcomes across different countries and market segments.

Expert validation processes involve review and feedback from industry specialists, academic researchers, and market participants to ensure research findings accurately reflect current market conditions and future prospects. Quality assurance protocols maintain high standards for data accuracy and analytical rigor throughout the research process.

China dominates the Asia-Pacific water and wastewater treatment market with approximately 45% market share, driven by massive infrastructure investments, strict environmental regulations, and rapid industrial growth. The country’s commitment to pollution control and water quality improvement creates substantial demand for advanced treatment technologies and comprehensive infrastructure development.

India represents the second-largest market opportunity with significant growth potential driven by urbanization, industrial expansion, and government initiatives such as the Clean Ganga Mission and Swachh Bharat Abhiyan. Market growth rates in India exceed 12% annually as infrastructure development accelerates and regulatory enforcement strengthens.

Japan and Australia demonstrate mature markets characterized by advanced technology adoption, stringent quality standards, and emphasis on operational efficiency and sustainability. These markets drive innovation in treatment technologies and serve as testing grounds for next-generation solutions before broader regional deployment.

Southeast Asian countries including Indonesia, Thailand, Vietnam, and Malaysia show rapid market development driven by economic growth, urbanization, and increasing environmental awareness. Regional cooperation initiatives facilitate technology transfer and best practice sharing across these emerging markets.

South Korea focuses on advanced technology development and export capabilities, serving as a regional hub for innovative treatment solutions and smart water management systems. The country’s emphasis on technology leadership creates opportunities for global market expansion and technology commercialization.

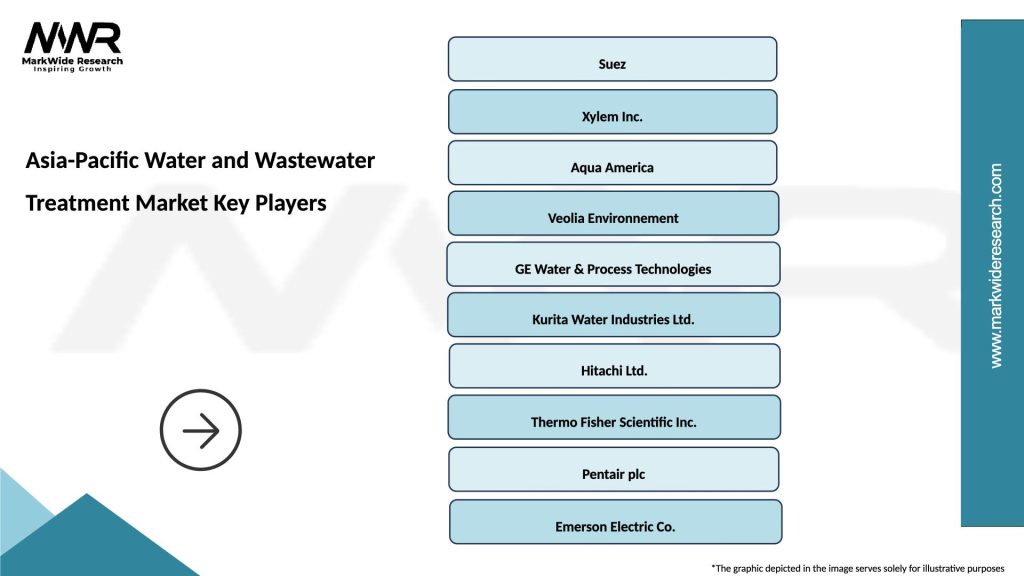

Market leadership within the Asia-Pacific water and wastewater treatment sector features a diverse mix of global technology providers, regional specialists, and emerging solution developers. Competition intensifies as market growth attracts new entrants and drives innovation across all market segments.

Strategic partnerships and joint ventures enable companies to combine technological expertise, local market knowledge, and financial resources to compete effectively in diverse market conditions. Collaboration strategies facilitate market entry, technology transfer, and risk sharing for large-scale infrastructure projects.

Technology segmentation reveals distinct market categories based on treatment approaches and applications. Each technology segment addresses specific treatment requirements and market needs, creating diverse opportunities for specialized solution providers and comprehensive system integrators.

By Technology:

By Application:

By End-User:

Membrane technology category demonstrates the strongest growth trajectory within the Asia-Pacific water and wastewater treatment market, driven by superior treatment performance, declining costs, and increasing adoption across diverse applications. Membrane system efficiency improvements of 25-30% over the past five years enhance economic viability and expand market opportunities.

Biological treatment systems maintain significant market presence due to cost-effectiveness, environmental sustainability, and proven performance for organic matter removal. Advanced biological processes, including membrane bioreactors and moving bed biofilm reactors, offer enhanced treatment capabilities while maintaining operational simplicity and reliability.

Smart monitoring and control systems emerge as high-growth categories driven by digitalization trends and operational optimization requirements. These systems enable real-time performance monitoring, predictive maintenance, and automated process control that improve treatment effectiveness while reducing operational costs and environmental impact.

Decentralized treatment solutions gain market traction as alternatives to centralized infrastructure, particularly in remote areas, industrial facilities, and regions with challenging geographic conditions. Modular systems, package plants, and containerized treatment units provide flexible deployment options and rapid implementation capabilities.

Resource recovery technologies represent emerging categories with significant growth potential as circular economy principles gain acceptance. Nutrient recovery systems, biogas production facilities, and water reuse technologies create additional value streams while supporting environmental sustainability objectives.

Technology providers benefit from expanding market opportunities driven by infrastructure development, regulatory requirements, and increasing environmental awareness across the Asia-Pacific region. Market expansion creates opportunities for revenue growth, technology deployment, and long-term customer relationships through comprehensive service offerings.

Equipment manufacturers gain access to growing demand for treatment systems, components, and replacement parts as installed capacity expands and existing facilities require upgrades or maintenance. Manufacturing localization opportunities reduce costs and improve supply chain efficiency while supporting regional economic development.

Service companies benefit from increasing demand for operation and maintenance services, performance optimization, and technical support as treatment facility complexity increases and operators seek to maximize system performance. Service revenue streams provide stable, long-term income opportunities with strong customer relationships.

Government entities achieve environmental protection objectives, public health improvements, and economic development goals through strategic investments in water and wastewater treatment infrastructure. Public benefits include improved water quality, reduced pollution, and enhanced quality of life for citizens.

End-users gain access to reliable water supplies, regulatory compliance capabilities, and operational cost reductions through advanced treatment technologies and professional service support. Operational benefits include improved efficiency, reduced maintenance requirements, and enhanced environmental performance.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as the dominant trend reshaping the Asia-Pacific water and wastewater treatment market. Smart water systems incorporating IoT sensors, cloud computing, and artificial intelligence enable real-time monitoring, predictive analytics, and automated control capabilities that optimize treatment performance while reducing operational costs and environmental impact.

Sustainability focus drives adoption of energy-efficient technologies, renewable energy integration, and circular economy principles throughout the treatment process. Green infrastructure approaches, including constructed wetlands and nature-based solutions, gain acceptance as cost-effective alternatives that provide environmental co-benefits beyond water treatment.

Decentralization trends promote distributed treatment systems that serve local communities, industrial facilities, and specific applications without requiring extensive centralized infrastructure. Modular treatment systems offer flexibility, rapid deployment, and scalability advantages that address diverse market requirements and geographic constraints.

Resource recovery integration transforms wastewater from waste streams into valuable resource sources through nutrient extraction, biogas production, and water reuse applications. Circular economy principles create additional revenue streams while supporting environmental sustainability and resource conservation objectives.

Regulatory harmonization efforts across the region promote technology standardization, facilitate trade, and reduce compliance complexity for multinational projects. Standards alignment enables economies of scale and technology transfer while maintaining environmental protection and public health objectives.

Technology partnerships between global leaders and regional companies accelerate innovation and market penetration across the Asia-Pacific region. Recent collaborations focus on membrane technology advancement, smart system integration, and sustainable treatment solutions that address local market requirements while leveraging international expertise.

Infrastructure investments by governments and development banks support large-scale treatment facility construction and existing system upgrades. MarkWide Research analysis indicates that public sector commitments to water infrastructure development create substantial market opportunities for technology providers and service companies throughout the region.

Regulatory developments include stricter discharge standards, water reuse mandates, and environmental impact requirements that drive demand for advanced treatment technologies. New regulations in major markets such as China, India, and Southeast Asian countries create compliance requirements that support market growth and technology adoption.

Innovation initiatives focus on energy efficiency improvements, treatment process optimization, and cost reduction strategies that enhance market accessibility and adoption rates. Research and development investments by leading companies and academic institutions advance next-generation technologies and treatment approaches.

Market consolidation activities include strategic acquisitions, joint ventures, and partnership agreements that strengthen competitive positions and expand service capabilities. These developments create more comprehensive solution providers capable of addressing complex treatment requirements and long-term customer relationships.

Strategic positioning recommendations emphasize the importance of developing comprehensive solution capabilities that combine advanced technologies, professional services, and long-term customer support. Market leaders should focus on building integrated offerings that address entire treatment value chains rather than competing solely on individual product features or pricing.

Geographic expansion strategies should prioritize emerging markets with strong growth potential while maintaining presence in mature markets that drive innovation and provide stable revenue streams. Market entry approaches should consider local partnerships, joint ventures, and technology transfer arrangements that leverage regional expertise and market knowledge.

Technology investment priorities should focus on digitalization, energy efficiency, and sustainability features that align with market trends and customer requirements. Innovation strategies should balance advanced technology development with practical implementation considerations and cost-effectiveness requirements.

Service capabilities development represents a critical success factor as customers seek comprehensive support throughout treatment system lifecycles. Service offerings should include design and engineering, installation and commissioning, operation and maintenance, and performance optimization services that create long-term customer relationships.

Partnership strategies should emphasize collaboration with local companies, government entities, and financial institutions to access market opportunities, share risks, and leverage complementary capabilities. Strategic alliances enable market penetration while building sustainable competitive advantages in diverse market conditions.

Market trajectory indicates continued strong growth for the Asia-Pacific water and wastewater treatment market driven by sustained urbanization, industrial development, and environmental protection requirements. Long-term projections suggest market expansion will accelerate as emerging economies invest in infrastructure development and mature markets upgrade existing facilities with advanced technologies.

Technology evolution will focus on smart systems integration, energy efficiency improvements, and resource recovery capabilities that address sustainability objectives while reducing operational costs. Innovation cycles are expected to accelerate as market competition intensifies and customer requirements become more sophisticated and demanding.

Regional development patterns will continue to vary significantly, with China and India driving volume growth while developed markets such as Japan and Australia lead technology advancement and premium solution adoption. Market maturation in emerging economies will create opportunities for advanced technology deployment and comprehensive service offerings.

Investment flows will increasingly favor projects that demonstrate clear environmental benefits, economic viability, and social impact. MWR analysis indicates that financing mechanisms will evolve to support innovative project structures, including performance-based contracts and outcome-focused partnerships that align stakeholder interests.

Regulatory frameworks will continue to strengthen across the region, creating consistent demand for advanced treatment capabilities while promoting technology standardization and best practice adoption. Policy coordination efforts will facilitate regional cooperation and technology transfer initiatives that support sustainable market development.

The Asia-Pacific water and wastewater treatment market represents a dynamic and rapidly expanding sector with exceptional growth potential driven by fundamental demographic, economic, and environmental trends. Market opportunities span diverse technology categories, application segments, and geographic regions, creating multiple pathways for successful market participation and value creation.

Strategic success factors include comprehensive solution capabilities, strong service offerings, local market expertise, and continuous innovation that addresses evolving customer requirements and regulatory standards. Companies that effectively combine advanced technologies with professional services and long-term customer support will be best positioned to capitalize on market opportunities and achieve sustainable competitive advantages.

Future market development will be characterized by increasing sophistication, sustainability focus, and digitalization that transforms traditional treatment approaches into smart, efficient, and environmentally responsible solutions. MarkWide Research projects that market leaders will emerge from companies that successfully navigate these trends while building strong regional presence and customer relationships across diverse market conditions and requirements.

What is Water and Wastewater Treatment?

Water and wastewater treatment refers to the processes used to make water safe for consumption and to treat wastewater before it is released back into the environment. This includes various methods such as filtration, chemical treatment, and biological processes to remove contaminants.

What are the key players in the Asia-Pacific Water and Wastewater Treatment Market?

Key players in the Asia-Pacific Water and Wastewater Treatment Market include Veolia Environnement, SUEZ, Xylem Inc., and Ecolab, among others. These companies are involved in providing innovative solutions and technologies for efficient water management.

What are the main drivers of the Asia-Pacific Water and Wastewater Treatment Market?

The main drivers of the Asia-Pacific Water and Wastewater Treatment Market include increasing urbanization, rising water scarcity, and stringent government regulations on water quality. These factors are pushing for advanced treatment technologies and infrastructure development.

What challenges does the Asia-Pacific Water and Wastewater Treatment Market face?

Challenges in the Asia-Pacific Water and Wastewater Treatment Market include high capital costs for infrastructure development and maintenance, as well as the need for skilled labor to operate advanced treatment systems. Additionally, varying regulatory standards across countries can complicate compliance.

What opportunities exist in the Asia-Pacific Water and Wastewater Treatment Market?

Opportunities in the Asia-Pacific Water and Wastewater Treatment Market include the adoption of smart water management technologies and the increasing focus on sustainable practices. There is also potential for growth in decentralized treatment solutions and water recycling initiatives.

What trends are shaping the Asia-Pacific Water and Wastewater Treatment Market?

Trends shaping the Asia-Pacific Water and Wastewater Treatment Market include the integration of digital technologies such as IoT for real-time monitoring, the use of advanced filtration materials, and a growing emphasis on energy-efficient treatment processes. These innovations aim to enhance operational efficiency and reduce environmental impact.

Asia-Pacific Water and Wastewater Treatment Market

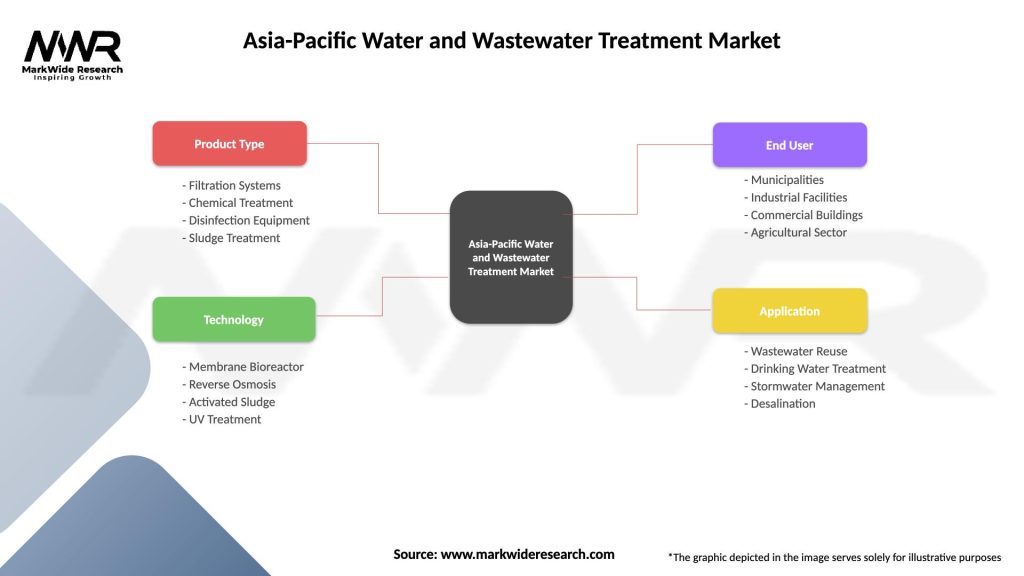

| Segmentation Details | Description |

|---|---|

| Product Type | Filtration Systems, Chemical Treatment, Disinfection Equipment, Sludge Treatment |

| Technology | Membrane Bioreactor, Reverse Osmosis, Activated Sludge, UV Treatment |

| End User | Municipalities, Industrial Facilities, Commercial Buildings, Agricultural Sector |

| Application | Wastewater Reuse, Drinking Water Treatment, Stormwater Management, Desalination |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Water and Wastewater Treatment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at