444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific video conferencing hardware market represents one of the most dynamic and rapidly evolving segments in the global communication technology landscape. This market encompasses a comprehensive range of hardware solutions including video conferencing systems, cameras, microphones, displays, and integrated communication platforms designed to facilitate seamless remote collaboration across diverse business environments. The region’s unique position as a technology innovation hub, combined with its diverse economic landscape spanning developed economies like Japan and South Korea to emerging markets such as India and Southeast Asian nations, creates a complex yet highly promising market environment.

Market dynamics in the Asia Pacific region are characterized by unprecedented digital transformation initiatives, accelerated by recent global events that have fundamentally shifted workplace communication paradigms. The market demonstrates robust growth potential, with industry analysts projecting a compound annual growth rate (CAGR) of 12.5% through the forecast period. This growth trajectory reflects the region’s increasing adoption of hybrid work models, expanding enterprise digitization efforts, and growing emphasis on cost-effective communication solutions that can bridge geographical distances across the vast Asia Pacific landscape.

Regional diversity significantly influences market development patterns, with countries like China leading in manufacturing capabilities while nations such as Singapore and Australia drive innovation in enterprise solutions. The market’s evolution is further accelerated by substantial investments in telecommunications infrastructure, 5G network deployment, and cloud computing technologies that enhance video conferencing hardware performance and accessibility across various industry verticals.

The Asia Pacific video conferencing hardware market refers to the comprehensive ecosystem of physical communication technology solutions designed to enable real-time audio and visual collaboration across distributed teams and organizations throughout the Asia Pacific region. This market encompasses specialized hardware components including high-definition cameras, professional-grade microphones, interactive displays, codec systems, and integrated conferencing platforms that facilitate seamless remote communication experiences.

Hardware solutions within this market range from simple plug-and-play devices suitable for small business environments to sophisticated enterprise-grade systems capable of supporting large-scale multinational conferences with advanced features such as artificial intelligence-powered noise cancellation, automatic speaker tracking, and multi-point connectivity. The market also includes peripheral devices, mounting systems, and specialized accessories that enhance overall video conferencing experiences while ensuring compatibility across diverse technological environments prevalent throughout Asia Pacific markets.

Geographic scope encompasses major economies including China, Japan, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, and other emerging markets where digital communication infrastructure continues expanding rapidly. The market definition extends beyond traditional corporate applications to include educational institutions, healthcare facilities, government organizations, and consumer segments that increasingly rely on professional-grade video conferencing hardware for various communication needs.

Strategic market positioning reveals the Asia Pacific video conferencing hardware market as a critical component of the region’s broader digital transformation landscape. The market demonstrates exceptional resilience and growth potential, driven by fundamental shifts in workplace communication patterns, educational delivery methods, and healthcare service provision. Current market conditions indicate strong demand across multiple industry verticals, with enterprise adoption rates reaching 78% among large organizations and small-to-medium enterprises showing accelerating adoption patterns.

Technology innovation serves as a primary market differentiator, with leading manufacturers focusing on artificial intelligence integration, cloud connectivity, and user experience optimization. The market benefits from Asia Pacific’s position as a global technology manufacturing hub, enabling cost-effective production while maintaining high quality standards. Regional players increasingly compete with established international brands by offering localized solutions that address specific cultural and business requirements prevalent across diverse Asia Pacific markets.

Market segmentation reveals distinct growth patterns across different hardware categories, with integrated conferencing systems and high-definition cameras leading adoption rates. The enterprise segment continues dominating market share, while educational and healthcare sectors demonstrate the fastest growth rates. Geographic distribution shows China and Japan as leading markets by volume, while Australia and Singapore lead in per-capita adoption rates and premium solution preferences.

Primary market drivers encompass several interconnected factors that collectively propel sustained market growth across the Asia Pacific region:

Market intelligence indicates that hardware quality expectations continue rising, with users demanding ultra-high-definition video capabilities, superior audio processing, and seamless integration with existing technology ecosystems. The market also shows increasing preference for solutions that offer scalability, allowing organizations to expand their video conferencing capabilities as needs evolve.

Technological advancement represents the most significant driver propelling Asia Pacific video conferencing hardware market growth. The region’s rapid adoption of cutting-edge technologies including artificial intelligence, machine learning, and advanced image processing creates demand for sophisticated hardware solutions that can leverage these capabilities effectively. Organizations increasingly seek hardware that offers intelligent features such as automatic framing, noise suppression, and real-time language translation, driving manufacturers to develop more advanced and feature-rich products.

Workforce transformation fundamentally reshapes communication requirements across Asia Pacific markets. The permanent shift toward hybrid and remote work models, accelerated by global events and changing employee expectations, creates sustained demand for professional-grade video conferencing hardware. Companies recognize that effective remote collaboration requires investment in high-quality hardware that can deliver experiences comparable to in-person meetings, driving adoption of premium conferencing solutions across all organization sizes.

Economic efficiency considerations increasingly influence hardware procurement decisions as organizations seek to optimize operational costs while maintaining communication effectiveness. Video conferencing hardware offers compelling return on investment through reduced travel expenses, improved meeting efficiency, and enhanced collaboration capabilities. According to MarkWide Research analysis, organizations report average cost savings of 35% annually through strategic video conferencing hardware deployment, making these solutions increasingly attractive across budget-conscious Asia Pacific markets.

Infrastructure development across the region creates favorable conditions for video conferencing hardware adoption. Ongoing investments in high-speed internet connectivity, 5G network deployment, and cloud computing infrastructure enhance the performance and reliability of video conferencing solutions. This infrastructure improvement enables organizations to deploy more sophisticated hardware solutions while ensuring consistent performance across diverse geographic locations throughout the Asia Pacific region.

Implementation complexity poses significant challenges for organizations considering video conferencing hardware deployment. Many businesses struggle with technical integration requirements, compatibility issues with existing systems, and the need for specialized IT support to maintain optimal performance. These challenges are particularly pronounced in smaller organizations that may lack dedicated IT resources, creating barriers to adoption despite clear business benefits.

Initial investment costs continue constraining market growth, particularly among small and medium enterprises that represent a substantial portion of the Asia Pacific business landscape. While hardware costs have decreased over time, comprehensive video conferencing solutions still require significant upfront investments that may strain limited budgets. Organizations must also consider ongoing maintenance costs, software licensing fees, and periodic hardware upgrades, creating total cost of ownership concerns that can delay adoption decisions.

Cultural and linguistic barriers present unique challenges in the diverse Asia Pacific market. Different communication styles, language preferences, and cultural norms across the region can complicate video conferencing hardware deployment and usage. Organizations operating across multiple countries must consider these factors when selecting hardware solutions, often requiring additional customization or localization that increases complexity and costs.

Security and privacy concerns increasingly influence hardware selection decisions as organizations become more aware of potential vulnerabilities in communication systems. Regulatory requirements vary significantly across Asia Pacific countries, creating compliance challenges for multinational organizations. These concerns are particularly acute in industries such as healthcare, finance, and government, where data protection requirements may limit hardware options or require additional security features that increase costs and complexity.

Emerging market penetration presents substantial growth opportunities as developing economies throughout Southeast Asia, India, and other regions continue expanding their digital infrastructure. These markets demonstrate increasing demand for cost-effective video conferencing hardware solutions that can support growing business sectors and educational institutions. Manufacturers who can develop products specifically tailored to these markets’ unique requirements and budget constraints stand to capture significant market share in high-growth regions.

Industry-specific solutions offer lucrative opportunities for specialized hardware development. Healthcare telemedicine applications require unique features such as medical-grade displays and specialized cameras for diagnostic purposes. Educational institutions need hardware optimized for classroom environments and distance learning applications. Manufacturing and industrial sectors require ruggedized solutions capable of operating in challenging environments. These specialized requirements create opportunities for manufacturers to develop niche products with premium pricing potential.

Integration with emerging technologies creates new market segments and revenue opportunities. The convergence of video conferencing hardware with artificial intelligence, augmented reality, virtual reality, and Internet of Things technologies opens possibilities for innovative product development. Organizations increasingly seek hardware solutions that can support advanced applications such as virtual collaboration spaces, AI-powered meeting analytics, and immersive communication experiences.

Small business market expansion represents a significant untapped opportunity as affordable, easy-to-deploy solutions become available. The vast number of small and medium enterprises across Asia Pacific creates substantial market potential for manufacturers who can develop simplified, cost-effective hardware solutions that require minimal technical expertise to implement and maintain. Cloud-based management and plug-and-play functionality can help overcome traditional barriers to adoption in this segment.

Supply chain evolution significantly impacts market dynamics as manufacturers adapt to changing global trade patterns and regional production capabilities. The Asia Pacific region’s role as a major manufacturing hub for electronic components provides advantages in terms of cost and availability, but also creates dependencies on regional supply chains. Recent disruptions have prompted manufacturers to diversify production locations and develop more resilient supply chain strategies, influencing product availability and pricing across different markets.

Competitive landscape shifts reflect the market’s maturation and the entry of new players offering innovative solutions. Traditional hardware manufacturers face increasing competition from software companies expanding into hardware, cloud service providers developing integrated solutions, and regional manufacturers offering localized products. This competition drives innovation while putting pressure on pricing, ultimately benefiting end users through improved products and more competitive pricing structures.

Technology convergence reshapes market boundaries as video conferencing hardware increasingly integrates with other communication and collaboration technologies. The lines between video conferencing systems, digital displays, audio equipment, and computing platforms continue blurring, creating opportunities for comprehensive solution providers while challenging traditional hardware categories. This convergence requires manufacturers to develop broader technical capabilities and strategic partnerships to remain competitive.

Regulatory environment changes across different Asia Pacific countries influence market development patterns. Data localization requirements, security standards, and telecommunications regulations vary significantly between markets, requiring manufacturers to adapt products and strategies accordingly. These regulatory differences create both challenges and opportunities, as companies that can navigate complex compliance requirements may gain competitive advantages in specific markets.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research involves extensive surveys and interviews with key stakeholders including hardware manufacturers, system integrators, end-user organizations, and industry experts across major Asia Pacific markets. This primary research provides firsthand insights into market trends, customer preferences, and emerging requirements that shape market development.

Secondary research methodology incorporates analysis of industry reports, company financial statements, government publications, and trade association data to validate primary research findings and provide comprehensive market context. This approach ensures that market analysis reflects both current conditions and historical trends that influence future market development patterns across the diverse Asia Pacific region.

Data validation processes include cross-referencing information from multiple sources, conducting follow-up interviews to clarify findings, and employing statistical analysis techniques to identify patterns and trends. Market sizing and forecasting utilize established econometric models adapted for regional characteristics and validated through expert consultation and historical performance analysis.

Geographic coverage encompasses detailed analysis of major markets including China, Japan, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, and other significant economies throughout the region. This comprehensive geographic approach ensures that market analysis reflects the diversity and complexity of the Asia Pacific video conferencing hardware market while identifying region-specific trends and opportunities.

China dominates the Asia Pacific video conferencing hardware market through its combination of massive domestic demand and significant manufacturing capabilities. The country’s rapid digital transformation initiatives, supported by government policies promoting technology adoption, create substantial market opportunities. Chinese manufacturers have emerged as major players in the global market, offering competitive solutions that combine advanced features with cost-effective pricing. The domestic market benefits from strong enterprise adoption rates of 82% among large corporations and growing small business segment penetration.

Japan represents a mature market characterized by high technology adoption rates and preference for premium quality solutions. Japanese organizations prioritize reliability and advanced features, creating demand for sophisticated video conferencing hardware systems. The market shows strong growth in healthcare and educational sectors, driven by aging population demographics and digital education initiatives. Corporate adoption focuses on solutions that integrate seamlessly with existing technology infrastructure and support traditional business communication practices.

India demonstrates exceptional growth potential driven by rapid economic development, expanding IT sector, and increasing adoption of digital communication technologies. The market benefits from a large and growing base of technology-savvy businesses and educational institutions seeking cost-effective video conferencing solutions. Government digitization initiatives and smart city projects create additional demand for video conferencing hardware across public sector applications. Market growth is supported by improving telecommunications infrastructure and increasing internet penetration rates.

Australia and Singapore lead the region in per-capita adoption rates and preference for premium video conferencing hardware solutions. These markets demonstrate sophisticated user requirements and willingness to invest in high-quality systems that support advanced collaboration features. Both countries serve as regional hubs for multinational corporations, creating demand for enterprise-grade solutions that can support complex organizational structures and international communication requirements.

Southeast Asian markets including Thailand, Malaysia, Indonesia, and Vietnam show rapid growth driven by expanding economies and increasing business digitization. These markets demonstrate growing demand for mid-range video conferencing hardware solutions that balance functionality with affordability. Regional market share distribution shows 45% concentration in enterprise segments with education and healthcare sectors showing the fastest adoption rates.

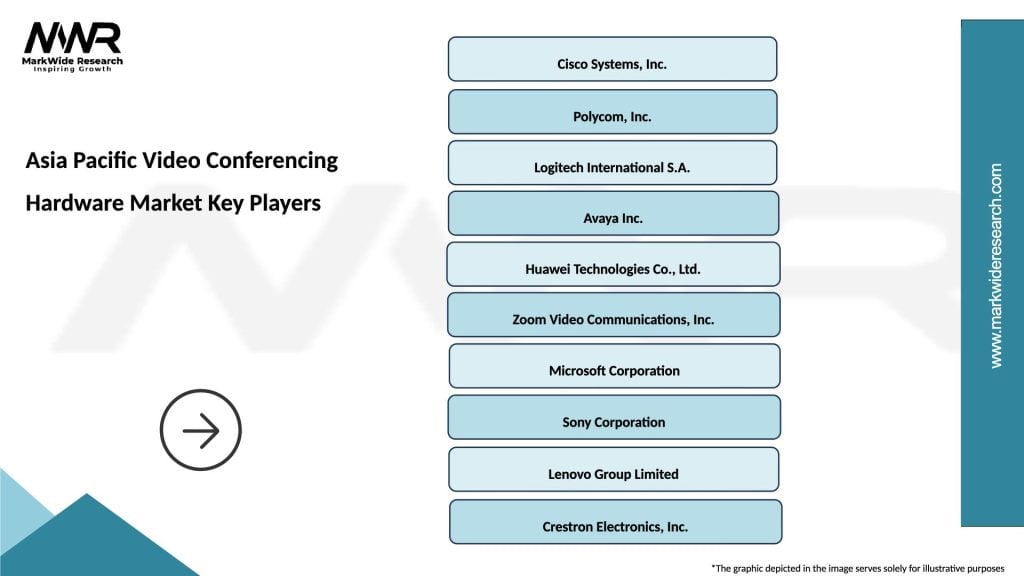

Market leadership is distributed among several key players who have established strong positions through different strategic approaches and regional focus areas:

Competitive strategies vary significantly across different market segments and geographic regions. Leading companies focus on innovation in areas such as artificial intelligence integration, cloud connectivity, and user experience optimization. Regional players compete through localized product development, competitive pricing, and specialized customer support services tailored to specific market requirements.

Strategic partnerships play increasingly important roles in competitive positioning as companies seek to offer comprehensive solutions that integrate hardware with software platforms, cloud services, and professional services. These partnerships enable companies to address complex customer requirements while leveraging complementary capabilities and market reach.

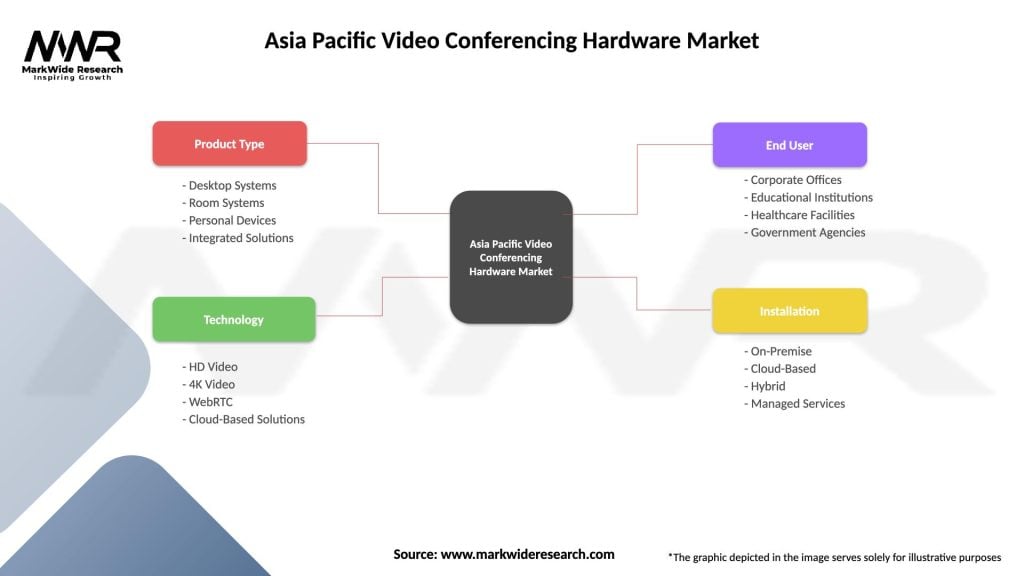

By Product Type:

By Application:

By Organization Size:

By Technology:

Integrated conferencing systems represent the largest and fastest-growing segment, driven by user preferences for complete solutions that minimize complexity and integration challenges. These systems typically combine high-definition cameras, professional audio equipment, and processing capabilities in unified packages that can be easily deployed in various meeting environments. Market adoption rates reach 68% among enterprise customers who value the simplified procurement and management advantages these integrated solutions provide.

Professional camera systems show strong growth driven by increasing quality expectations and the need for advanced features such as automatic tracking, multiple viewing angles, and integration with artificial intelligence systems. PTZ (pan-tilt-zoom) cameras gain particular traction in large meeting rooms and auditorium applications where flexibility and remote control capabilities are essential. The segment benefits from technological advances that deliver broadcast-quality video at increasingly affordable price points.

Audio equipment categories demonstrate steady growth as organizations recognize the critical importance of clear audio quality in video conferencing effectiveness. Specialized conferencing microphones with noise cancellation, echo suppression, and automatic gain control features become standard requirements. Ceiling-mounted and table-top microphone arrays gain popularity in larger meeting spaces where traditional solutions prove inadequate.

Display technology segments evolve rapidly with the introduction of interactive displays, ultra-wide monitors, and specialized conferencing screens. These products integrate touch capabilities, wireless connectivity, and collaboration software to create comprehensive meeting room solutions. The trend toward larger, higher-resolution displays reflects user preferences for immersive conferencing experiences that closely replicate in-person meeting dynamics.

Manufacturers benefit from expanding market opportunities driven by sustained demand growth across multiple industry verticals and geographic regions. The market’s evolution toward more sophisticated, feature-rich products enables premium pricing strategies while technological advances create opportunities for product differentiation and competitive advantage. Regional manufacturing capabilities in Asia Pacific provide cost advantages and supply chain efficiencies that enhance profitability and market competitiveness.

System integrators and resellers gain from increasing demand for professional installation, configuration, and support services as video conferencing hardware becomes more sophisticated. The complexity of modern conferencing systems creates opportunities for value-added services including custom integration, training, and ongoing technical support. These service opportunities often provide higher margins and more stable revenue streams than hardware sales alone.

End-user organizations realize substantial benefits through improved communication efficiency, reduced travel costs, and enhanced collaboration capabilities. MWR research indicates that organizations implementing comprehensive video conferencing hardware solutions report productivity improvements of 25% on average, along with significant cost savings and improved employee satisfaction. The technology enables organizations to access broader talent pools, reduce facility requirements, and respond more quickly to market opportunities.

Technology partners including software developers, cloud service providers, and telecommunications companies benefit from the growing ecosystem surrounding video conferencing hardware. Integration opportunities with artificial intelligence, cloud platforms, and unified communication systems create new revenue streams and strengthen customer relationships. These partnerships often lead to long-term strategic relationships that provide stable business foundations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as the most significant trend reshaping video conferencing hardware capabilities. Modern systems incorporate AI-powered features such as automatic speaker tracking, intelligent framing, noise suppression, and real-time language translation. These capabilities enhance user experiences while reducing the technical expertise required for effective system operation. AI integration also enables predictive maintenance, usage analytics, and automated system optimization that improve reliability and performance.

Cloud connectivity evolution transforms how video conferencing hardware integrates with broader communication ecosystems. Modern devices feature native cloud integration that enables centralized management, automatic updates, and seamless integration with cloud-based communication platforms. This trend reduces IT management overhead while enabling more flexible deployment models and improved scalability for growing organizations.

User experience focus drives hardware design toward simplified operation and intuitive interfaces that require minimal training. One-touch meeting start, automatic system configuration, and intelligent device detection become standard features that eliminate common user frustrations. This trend particularly benefits organizations with diverse user populations and varying technical skill levels.

Sustainability considerations increasingly influence hardware design and procurement decisions as organizations prioritize environmental responsibility. Energy-efficient components, recyclable materials, and longer product lifecycles become important selection criteria. Manufacturers respond by developing more sustainable products and implementing take-back programs for end-of-life equipment.

Hybrid meeting optimization represents a critical trend as organizations adapt to permanent hybrid work models. Hardware solutions increasingly focus on creating equitable experiences for both in-person and remote participants through advanced camera positioning, intelligent audio processing, and specialized display configurations. This trend drives demand for more sophisticated systems that can handle complex meeting dynamics effectively.

Strategic acquisitions reshape the competitive landscape as major players seek to expand capabilities and market reach. Recent consolidation activities focus on combining hardware expertise with software capabilities, creating comprehensive solution providers that can address complex customer requirements. These acquisitions often target specialized technology companies with innovative AI, cloud, or user experience capabilities that enhance existing product portfolios.

Partnership expansions between hardware manufacturers and software platform providers create integrated solutions that simplify deployment and management. These partnerships often result in optimized hardware designs that work seamlessly with specific software platforms while maintaining compatibility with other systems. Strategic alliances also extend to telecommunications providers and system integrators who help expand market reach and customer support capabilities.

Product innovation cycles accelerate as manufacturers compete to introduce advanced features and capabilities. Recent developments include 8K video capability, advanced AI features, improved low-light performance, and enhanced wireless connectivity options. These innovations often focus on addressing specific market requirements such as large room coverage, outdoor applications, or specialized industry needs.

Regional expansion initiatives by international manufacturers focus on establishing stronger presence in high-growth Asia Pacific markets. These initiatives typically involve local partnerships, regional manufacturing facilities, and customized products that address specific market requirements. Expansion efforts often include substantial investments in local support infrastructure and customer service capabilities.

Market entry strategies should focus on understanding specific regional requirements and cultural preferences that influence video conferencing hardware adoption. Companies entering Asia Pacific markets benefit from partnering with established local distributors who understand regulatory requirements and customer preferences. Successful market entry often requires product customization that addresses local language support, connectivity standards, and pricing expectations.

Product development priorities should emphasize user experience simplification and AI-powered features that reduce technical complexity while enhancing functionality. Organizations increasingly prefer solutions that require minimal IT support and can be easily managed by non-technical users. Development efforts should also focus on cloud integration capabilities that enable centralized management and automatic updates.

Pricing strategies must account for significant price sensitivity across many Asia Pacific markets while maintaining profitability and supporting ongoing innovation investments. Successful companies often develop tiered product portfolios that address different market segments with appropriate feature sets and pricing levels. Value-based pricing approaches that demonstrate clear return on investment often prove more effective than cost-plus pricing models.

Customer support infrastructure requires substantial investment in local capabilities that can provide timely technical support and professional services. The complexity of modern video conferencing hardware creates demand for specialized support services that many organizations cannot provide internally. Companies that invest in comprehensive support capabilities often achieve higher customer satisfaction and retention rates.

Technology roadmap planning should anticipate rapid evolution in AI capabilities, cloud integration, and user interface design. Organizations that can successfully integrate emerging technologies while maintaining backward compatibility and ease of use will likely achieve competitive advantages. Long-term planning should also consider sustainability requirements and circular economy principles that increasingly influence procurement decisions.

Market growth trajectory indicates sustained expansion driven by permanent changes in workplace communication patterns and ongoing digital transformation initiatives across Asia Pacific markets. The market is expected to maintain robust growth rates exceeding 12% annually through the forecast period, supported by increasing adoption across small business segments and emerging market penetration. Growth patterns suggest particular strength in education and healthcare applications where video conferencing hardware enables new service delivery models.

Technology evolution will likely focus on further AI integration, enhanced cloud connectivity, and improved user experiences that require minimal technical expertise. Future hardware generations may incorporate advanced features such as holographic displays, augmented reality integration, and biometric authentication that create more immersive and secure communication experiences. These technological advances will likely drive replacement cycles and create opportunities for premium product positioning.

Market consolidation may continue as companies seek to achieve scale advantages and comprehensive solution capabilities. Successful companies will likely be those that can combine hardware excellence with software capabilities, cloud services, and professional support in integrated offerings. This consolidation trend may create opportunities for specialized niche players who focus on specific industry verticals or unique technical capabilities.

Regional market development will likely see continued growth in emerging economies as infrastructure improvements and economic development create new opportunities. According to MarkWide Research projections, emerging markets could account for 55% of regional growth over the next five years, driven by expanding business sectors and educational institution investments. These markets will likely drive demand for cost-effective solutions that balance functionality with affordability.

Industry transformation toward hybrid work models appears permanent, creating sustained demand for video conferencing hardware that can support flexible workplace arrangements. Organizations will likely continue investing in solutions that enable seamless collaboration between distributed teams while maintaining productivity and engagement levels comparable to traditional in-person work environments.

The Asia Pacific video conferencing hardware market represents a dynamic and rapidly evolving sector that reflects broader digital transformation trends across the region. Market analysis reveals strong growth potential driven by permanent workplace changes, educational technology adoption, healthcare digitization, and ongoing infrastructure development. The market’s diversity across different countries and industry segments creates both opportunities and challenges for manufacturers and service providers seeking to establish successful market positions.

Strategic success factors include understanding regional market differences, developing user-friendly solutions that minimize technical complexity, and building comprehensive support infrastructure that addresses diverse customer requirements. Companies that can effectively combine hardware innovation with software integration, cloud connectivity, and professional services are likely to achieve sustainable competitive advantages in this evolving market landscape.

Future market development will likely be shaped by continued technology innovation, particularly in artificial intelligence and cloud integration, along with expanding adoption across emerging markets and small business segments. The market’s long-term outlook remains positive, supported by fundamental changes in communication patterns and ongoing digital infrastructure development across the Asia Pacific region. Organizations that can adapt to evolving customer requirements while maintaining focus on quality, reliability, and user experience will be well-positioned to capitalize on sustained market growth opportunities.

What is Video Conferencing Hardware?

Video Conferencing Hardware refers to the physical devices used to facilitate video communication over the internet. This includes cameras, microphones, speakers, and dedicated video conferencing systems that enable real-time visual and audio interaction between users in different locations.

What are the key players in the Asia Pacific Video Conferencing Hardware Market?

Key players in the Asia Pacific Video Conferencing Hardware Market include Cisco Systems, Logitech, Polycom, and Avaya, among others. These companies are known for their innovative solutions and extensive product offerings in the video conferencing space.

What are the main drivers of growth in the Asia Pacific Video Conferencing Hardware Market?

The growth of the Asia Pacific Video Conferencing Hardware Market is driven by the increasing demand for remote communication solutions, the rise of remote work culture, and advancements in technology that enhance video quality and user experience. Additionally, the expansion of businesses in the region is contributing to this growth.

What challenges does the Asia Pacific Video Conferencing Hardware Market face?

The Asia Pacific Video Conferencing Hardware Market faces challenges such as high initial setup costs, compatibility issues between different systems, and concerns regarding data security and privacy. These factors can hinder widespread adoption among smaller businesses.

What opportunities exist in the Asia Pacific Video Conferencing Hardware Market?

Opportunities in the Asia Pacific Video Conferencing Hardware Market include the growing trend of hybrid work environments, increasing investments in digital transformation, and the demand for enhanced collaboration tools. These factors are likely to drive innovation and expansion in the market.

What trends are shaping the Asia Pacific Video Conferencing Hardware Market?

Trends shaping the Asia Pacific Video Conferencing Hardware Market include the integration of artificial intelligence for improved user experience, the rise of cloud-based solutions, and the increasing use of mobile devices for video conferencing. These trends are transforming how businesses approach remote communication.

Asia Pacific Video Conferencing Hardware Market

| Segmentation Details | Description |

|---|---|

| Product Type | Desktop Systems, Room Systems, Personal Devices, Integrated Solutions |

| Technology | HD Video, 4K Video, WebRTC, Cloud-Based Solutions |

| End User | Corporate Offices, Educational Institutions, Healthcare Facilities, Government Agencies |

| Installation | On-Premise, Cloud-Based, Hybrid, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Video Conferencing Hardware Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at