444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Asia-Pacific region is witnessing significant growth in the used car financing market. With increasing consumer demand for affordable and reliable transportation, the market for used cars has been thriving. Used car financing plays a crucial role in facilitating the purchase of pre-owned vehicles by offering financial assistance to buyers. This market overview provides insights into the meaning, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, key trends, the impact of Covid-19, key industry developments, analyst suggestions, future outlook, and a conclusion.

Meaning

Used car financing refers to the provision of loans or credit facilities to individuals or businesses for purchasing pre-owned vehicles. It enables buyers to overcome the financial barriers associated with buying a used car by providing them with the necessary funds. Used car financing companies or financial institutions offer various loan options, including installment loans, hire purchase agreements, and leasing options. These financing options typically involve a down payment and fixed monthly installments over a specific period.

Executive Summary

The Asia-Pacific used car financing market has experienced substantial growth in recent years. The increasing demand for affordable transportation, coupled with the rising popularity of used cars, has fueled the market’s expansion. Key market players have recognized this trend and have been focusing on providing innovative financing solutions to cater to the needs of buyers. The market’s growth is expected to continue, driven by favorable government policies, technological advancements, and changing consumer preferences.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Asia-Pacific used car financing market is driven by a combination of factors, including rising demand for affordable transportation, increasing disposable income, technological advancements, and favorable government policies. However, the market also faces challenges such as high interest rates, a stringent loan approval process, and market fragmentation. To capitalize on the opportunities, market players should leverage technology, expand into untapped markets, and foster collaborations. By doing so, they can enhance customer experience, increase market penetration, and drive the growth of the used car financing market in the Asia-Pacific region.

Regional Analysis

The Asia-Pacific used car financing market can be segmented into several key regions, including:

Each region within the Asia-Pacific market has its unique characteristics, regulations, and consumer preferences. Understanding these regional dynamics is essential for market players to tailor their strategies and offerings accordingly.

Competitive Landscape

Leading companies in the Asia-Pacific Used Car Financing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

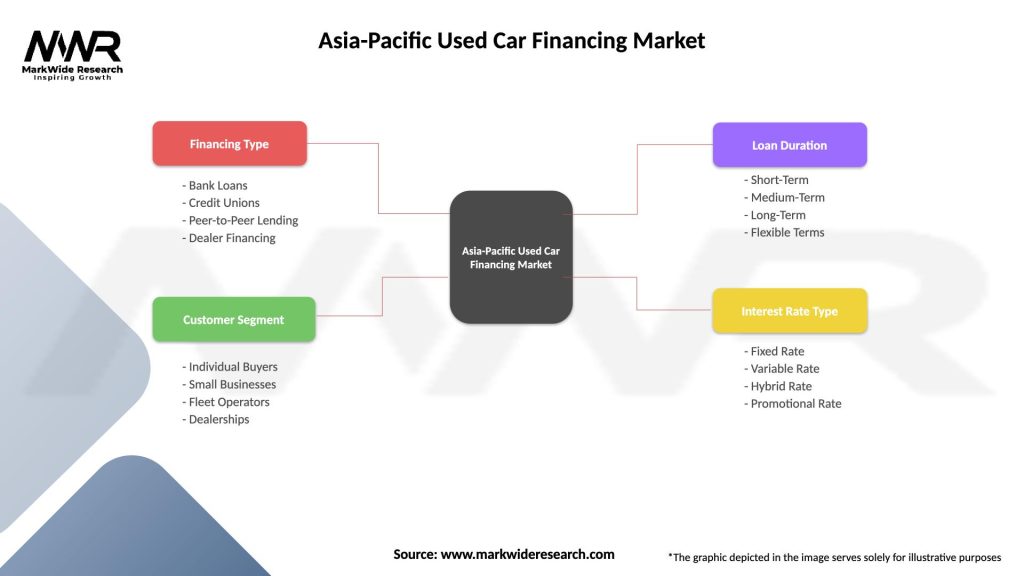

The Asia-Pacific used car financing market can be segmented based on various factors, including:

Category-wise Insights

Each category of used car financing offers distinct advantages and considerations, catering to the diverse needs and preferences of buyers in the Asia-Pacific region.

Key Benefits for Industry Participants and Stakeholders

The Asia-Pacific used car financing market offers several key benefits for industry participants and stakeholders:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the Asia-Pacific used car financing market. During the initial phases of the pandemic, there was a temporary slowdown in demand due to economic uncertainties and restrictions on movement. However, as economies started recovering and restrictions eased, the demand for used cars increased, driven by the need for personal transportation and the preference for more affordable options. Financial institutions and industry players adapted to the changing market conditions by implementing digital solutions, offering flexible payment options, and providing support to buyers facing financial difficulties. The pandemic accelerated the adoption of digital processes and online platforms, making the used car financing market more resilient and responsive to changing customer needs.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Asia-Pacific used car financing market looks promising, with sustained growth expected in the coming years. Factors such as rising demand for affordable transportation, increasing disposable income, and technological advancements will continue to drive market expansion. The integration of digital platforms, personalized financing solutions, and green financing initiatives will shape the future landscape of the market. However, industry players need to address challenges such as high interest rates, stringent loan approval processes, and market fragmentation to ensure sustained growth and customer satisfaction.

Conclusion

The Asia-Pacific used car financing market is experiencing robust growth, driven by increasing demand for affordable transportation and the popularity of used cars. The market offers a range of financing options, including installment loans, hire purchase agreements, and leasing options, catering to the diverse needs of buyers. Technological advancements, favorable government policies, and rising disposable income are key drivers of market expansion. However, challenges such as high interest rates and stringent loan approval processes exist. By embracing technology, expanding into untapped markets, and fostering collaborations, industry participants can enhance customer experience and capitalize on the opportunities in the Asia-Pacific used car financing market. The future outlook remains positive, with sustained growth expected and the potential for further innovation and market development.

What is Used Car Financing?

Used car financing refers to the various financial options available for purchasing pre-owned vehicles. This includes loans, leases, and other credit facilities that help consumers acquire used cars while managing their budgets effectively.

What are the key players in the Asia-Pacific Used Car Financing Market?

Key players in the Asia-Pacific Used Car Financing Market include major financial institutions and automotive companies such as Toyota Financial Services, Honda Financial Services, and HDFC Bank, among others.

What are the growth factors driving the Asia-Pacific Used Car Financing Market?

The growth of the Asia-Pacific Used Car Financing Market is driven by increasing consumer demand for affordable transportation, the rise of online car sales platforms, and favorable financing options offered by banks and financial institutions.

What challenges does the Asia-Pacific Used Car Financing Market face?

Challenges in the Asia-Pacific Used Car Financing Market include fluctuating interest rates, regulatory changes affecting lending practices, and the potential for increased default rates among borrowers.

What opportunities exist in the Asia-Pacific Used Car Financing Market?

Opportunities in the Asia-Pacific Used Car Financing Market include the expansion of digital financing solutions, partnerships between automotive dealers and financial institutions, and the growing trend of electric and hybrid used vehicles.

What trends are shaping the Asia-Pacific Used Car Financing Market?

Trends in the Asia-Pacific Used Car Financing Market include the increasing adoption of online financing applications, the rise of peer-to-peer lending platforms, and a shift towards more flexible repayment options for consumers.

Asia-Pacific Used Car Financing Market

| Segmentation Details | Description |

|---|---|

| Financing Type | Bank Loans, Credit Unions, Peer-to-Peer Lending, Dealer Financing |

| Customer Segment | Individual Buyers, Small Businesses, Fleet Operators, Dealerships |

| Loan Duration | Short-Term, Medium-Term, Long-Term, Flexible Terms |

| Interest Rate Type | Fixed Rate, Variable Rate, Hybrid Rate, Promotional Rate |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Used Car Financing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at