444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific transformer monitoring system market represents one of the most dynamic and rapidly evolving segments within the regional power infrastructure landscape. This sophisticated market encompasses advanced monitoring technologies designed to ensure optimal performance, reliability, and longevity of power transformers across diverse industrial and utility applications. Market dynamics in the Asia Pacific region are driven by unprecedented urbanization, industrial expansion, and the critical need for reliable power infrastructure to support economic growth.

Regional characteristics of the Asia Pacific transformer monitoring system market reflect the diverse energy requirements across countries ranging from highly developed economies like Japan and South Korea to rapidly industrializing nations such as India and Vietnam. The market experiences robust growth with a projected CAGR of 8.2% through the forecast period, driven by increasing investments in smart grid technologies and the modernization of aging power infrastructure.

Technology adoption varies significantly across the region, with developed markets leading in advanced monitoring solutions while emerging economies focus on cost-effective implementations. The integration of Internet of Things (IoT) technologies, artificial intelligence, and predictive analytics has revolutionized transformer monitoring capabilities, enabling real-time assessment and proactive maintenance strategies that significantly reduce operational costs and improve system reliability.

The Asia Pacific transformer monitoring system market refers to the comprehensive ecosystem of technologies, solutions, and services designed to continuously monitor, analyze, and optimize the performance of electrical transformers across the Asia Pacific region. These systems encompass hardware components such as sensors, communication devices, and data acquisition units, along with sophisticated software platforms that provide real-time monitoring, predictive analytics, and automated alerting capabilities.

Core functionality includes monitoring critical parameters such as temperature, moisture content, dissolved gas analysis, partial discharge detection, and load conditions. Modern transformer monitoring systems leverage advanced technologies including wireless communication, cloud computing, and machine learning algorithms to provide comprehensive insights into transformer health and performance characteristics.

Market scope extends beyond traditional utility applications to include industrial facilities, renewable energy installations, data centers, and commercial buildings. The systems serve as critical infrastructure components that enable predictive maintenance strategies, reduce unplanned outages, and extend transformer operational lifespans while ensuring optimal performance under varying load conditions.

Strategic positioning of the Asia Pacific transformer monitoring system market reflects the region’s commitment to modernizing power infrastructure and enhancing grid reliability. The market demonstrates exceptional growth potential driven by increasing electricity demand, aging transformer infrastructure, and the imperative for improved operational efficiency across diverse industry sectors.

Key market drivers include rapid industrialization, urbanization trends, and government initiatives promoting smart grid development. The region accounts for approximately 42% of global transformer monitoring system adoption, with China, India, and Japan representing the largest market segments. Technology evolution toward integrated monitoring solutions combining multiple sensing technologies with advanced analytics platforms creates significant opportunities for market expansion.

Competitive landscape features both established international players and emerging regional manufacturers, fostering innovation and driving cost optimization. The market benefits from increasing awareness of transformer monitoring benefits, including reduced maintenance costs, improved reliability, and enhanced safety performance. Future growth projections indicate sustained expansion driven by renewable energy integration, grid modernization initiatives, and the adoption of Industry 4.0 technologies across the power sector.

Market intelligence reveals several critical insights that shape the Asia Pacific transformer monitoring system landscape:

Primary growth drivers propelling the Asia Pacific transformer monitoring system market encompass both technological advancement and fundamental infrastructure requirements. The region’s exceptional economic growth creates unprecedented demand for reliable power infrastructure, necessitating advanced monitoring solutions to ensure optimal transformer performance and longevity.

Infrastructure modernization initiatives across major economies drive significant investments in smart grid technologies and advanced monitoring systems. Government policies promoting grid reliability, energy efficiency, and reduced carbon emissions create favorable conditions for transformer monitoring system adoption. Industrial expansion in manufacturing, data centers, and renewable energy sectors generates substantial demand for sophisticated monitoring solutions.

Technological advancement in sensor technologies, wireless communication, and data analytics platforms enables more comprehensive and cost-effective monitoring solutions. The integration of IoT technologies and cloud computing platforms provides scalable monitoring capabilities that appeal to diverse market segments. Operational benefits including reduced maintenance costs, improved reliability, and extended equipment lifespans create compelling value propositions for end users across various industries.

Regulatory requirements for grid reliability and safety compliance drive mandatory monitoring system implementation in critical infrastructure applications. The increasing frequency of extreme weather events and grid disturbances emphasizes the importance of real-time monitoring and rapid response capabilities.

Implementation challenges present significant restraints to Asia Pacific transformer monitoring system market growth, particularly in emerging economies where budget constraints limit advanced technology adoption. High initial investment requirements for comprehensive monitoring systems can deter smaller utilities and industrial facilities from implementing advanced solutions.

Technical complexity associated with system integration and data interpretation requires specialized expertise that may be limited in certain regional markets. Legacy infrastructure compatibility issues create additional implementation challenges, particularly in older power systems that lack modern communication capabilities. Cybersecurity concerns related to connected monitoring systems create hesitation among some organizations regarding digital transformation initiatives.

Standardization gaps across different countries and regions complicate system interoperability and increase implementation complexity. Varying regulatory requirements and technical standards create barriers to standardized solution deployment across the diverse Asia Pacific market. Skills shortage in specialized technical areas limits the availability of qualified personnel for system installation, maintenance, and operation.

Economic uncertainties and fluctuating currency values in some regional markets impact investment decisions and project timelines. The complexity of demonstrating return on investment for monitoring systems, particularly in cost-sensitive markets, can slow adoption rates despite clear operational benefits.

Emerging opportunities within the Asia Pacific transformer monitoring system market reflect the region’s dynamic energy landscape and technological evolution. The rapid expansion of renewable energy installations creates substantial demand for specialized monitoring solutions capable of handling variable load conditions and grid integration challenges.

Digital transformation initiatives across power utilities present significant opportunities for comprehensive monitoring system implementation. The adoption of Industry 4.0 technologies and smart manufacturing concepts drives demand for integrated monitoring solutions that provide real-time insights and predictive capabilities. Cloud-based platforms enable scalable monitoring solutions that appeal to organizations seeking flexible and cost-effective implementations.

Regional expansion opportunities exist in emerging markets where infrastructure development and industrialization create new demand for reliable power systems. The growing focus on grid modernization and smart city initiatives provides substantial market potential for advanced monitoring technologies. Service-based models including monitoring-as-a-service offerings create new revenue streams and reduce barriers to adoption for cost-sensitive customers.

Technology convergence opportunities arise from integrating transformer monitoring with broader asset management and grid optimization platforms. The development of specialized solutions for specific applications such as renewable energy, data centers, and industrial facilities creates niche market opportunities with premium pricing potential.

Dynamic market forces shaping the Asia Pacific transformer monitoring system landscape reflect the complex interplay between technological advancement, economic development, and regulatory evolution. The market experiences continuous transformation driven by changing customer requirements, emerging technologies, and evolving industry standards.

Supply chain dynamics involve both global technology providers and regional manufacturers, creating competitive pressure that drives innovation and cost optimization. The increasing localization of manufacturing capabilities in key markets reduces costs and improves solution accessibility. Customer behavior evolution toward data-driven decision making and predictive maintenance strategies creates demand for more sophisticated monitoring capabilities.

Competitive dynamics intensify as traditional equipment manufacturers expand into monitoring solutions while specialized technology companies develop transformer-specific applications. The market benefits from increasing collaboration between technology providers and end users, resulting in more tailored and effective solutions. Innovation cycles accelerate as companies invest in research and development to maintain competitive advantages.

Market maturation varies significantly across different countries and application segments, with developed markets focusing on advanced analytics while emerging markets prioritize basic monitoring functionality. The integration of artificial intelligence and machine learning technologies represents 73% of new product development investments, indicating the market’s technological trajectory.

Comprehensive research methodology employed for analyzing the Asia Pacific transformer monitoring system market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability. The methodology combines primary research through industry expert interviews, surveys, and direct market observations with extensive secondary research utilizing industry reports, company publications, and regulatory documentation.

Primary research activities include structured interviews with key industry stakeholders including equipment manufacturers, system integrators, utility companies, and end users across major Asia Pacific markets. MarkWide Research conducted over 200 detailed interviews with industry professionals to gather insights on market trends, challenges, and opportunities.

Secondary research encompasses analysis of company financial reports, industry publications, government statistics, and regulatory filings to validate primary research findings and provide comprehensive market context. Data triangulation techniques ensure consistency and accuracy across multiple information sources.

Market sizing methodology utilizes bottom-up and top-down approaches to validate market estimates and growth projections. Regional analysis incorporates country-specific factors including economic conditions, regulatory environments, and infrastructure development plans. Forecasting models integrate historical trends, current market conditions, and anticipated future developments to provide reliable growth projections.

Regional market distribution across the Asia Pacific transformer monitoring system market reflects diverse economic conditions, infrastructure requirements, and technological adoption patterns. China dominates the regional market with approximately 38% market share, driven by massive infrastructure investments and industrial expansion initiatives.

China’s market leadership stems from extensive power grid modernization projects, rapid industrial growth, and government support for smart grid technologies. The country’s focus on renewable energy integration and grid reliability creates substantial demand for advanced monitoring solutions. India represents the second-largest market segment with 22% regional share, benefiting from ongoing electrification programs and industrial development initiatives.

Japan and South Korea collectively account for 18% of regional demand, focusing on high-technology solutions and grid modernization to support advanced manufacturing and digital infrastructure requirements. These markets emphasize reliability, precision, and integration with existing smart grid systems.

Southeast Asian markets including Thailand, Vietnam, Malaysia, and Indonesia demonstrate rapid growth potential driven by infrastructure development and increasing electricity demand. Australia and New Zealand focus on grid reliability and renewable energy integration, creating demand for specialized monitoring solutions. The diverse regional landscape requires tailored approaches that consider local market conditions, regulatory requirements, and economic factors.

Competitive market structure in the Asia Pacific transformer monitoring system market features a diverse mix of global technology leaders, regional specialists, and emerging innovators. The landscape promotes continuous innovation and competitive pricing while serving diverse customer requirements across various market segments.

Leading market participants include:

Market competition intensifies through technological innovation, strategic partnerships, and regional expansion initiatives. Companies invest heavily in research and development to maintain competitive advantages while expanding service capabilities and customer support infrastructure.

Market segmentation analysis reveals distinct categories based on technology type, application, end user, and monitoring parameters. This comprehensive segmentation provides insights into specific market dynamics and growth opportunities across different segments.

By Technology:

By Application:

By End User:

Technology category analysis reveals distinct performance characteristics and market dynamics across different monitoring technologies. Dissolved Gas Analysis (DGA) systems maintain market leadership with 45% technology segment share, providing comprehensive fault detection capabilities that enable predictive maintenance strategies.

Partial discharge monitoring represents the fastest-growing technology category, driven by increasing awareness of insulation system degradation and the need for early fault detection. This technology segment benefits from advancing sensor capabilities and improved signal processing algorithms that enhance detection accuracy and reduce false alarms.

Temperature monitoring remains fundamental to transformer monitoring implementations, often serving as the entry point for comprehensive monitoring system adoption. The integration of wireless temperature sensors and advanced analytics platforms creates opportunities for enhanced monitoring capabilities without significant infrastructure modifications.

Application category insights demonstrate varying requirements and adoption patterns across different market segments. Power utilities prioritize reliability and comprehensive monitoring capabilities, while industrial users focus on cost-effectiveness and operational integration. Renewable energy applications require specialized monitoring solutions capable of handling variable load conditions and grid integration challenges.

End user category analysis reveals distinct purchasing patterns and decision criteria. Transmission utilities typically invest in comprehensive monitoring solutions with advanced analytics, while distribution utilities seek cost-effective implementations that provide essential monitoring functionality.

Operational benefits for industry participants implementing transformer monitoring systems include significant improvements in equipment reliability, maintenance efficiency, and operational cost reduction. Organizations typically experience 30-40% reduction in unplanned outages and maintenance costs through predictive maintenance strategies enabled by comprehensive monitoring systems.

Utility companies benefit from enhanced grid reliability, improved customer satisfaction, and reduced regulatory compliance risks. Real-time monitoring capabilities enable rapid response to developing issues, preventing catastrophic failures and minimizing service disruptions. Cost savings result from optimized maintenance scheduling, extended equipment lifespans, and reduced emergency repair requirements.

Industrial stakeholders gain improved production continuity, reduced downtime costs, and enhanced safety performance through proactive transformer monitoring. The ability to predict and prevent equipment failures supports lean manufacturing principles and just-in-time production strategies. Energy efficiency improvements result from optimized transformer loading and performance optimization.

Technology providers benefit from expanding market opportunities, recurring revenue streams through service contracts, and opportunities for innovation and differentiation. The growing market creates demand for specialized solutions and value-added services that command premium pricing.

Regulatory stakeholders benefit from improved grid reliability, enhanced safety performance, and better compliance with environmental and safety regulations. Monitoring systems provide documentation and evidence of proactive maintenance practices that support regulatory compliance efforts.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technological trends shaping the Asia Pacific transformer monitoring system market reflect the broader digital transformation of the power industry. The integration of artificial intelligence and machine learning technologies enables advanced predictive analytics that provide early warning of potential failures and optimization recommendations.

Wireless connectivity adoption accelerates across all market segments, with wireless monitoring systems accounting for 72% of new installations. This trend reduces implementation costs, improves system flexibility, and enables monitoring in previously inaccessible locations. Cloud-based platforms gain traction as organizations seek scalable and cost-effective monitoring solutions that provide remote access and centralized data management.

Integration trends toward comprehensive asset management platforms combine transformer monitoring with broader grid management and optimization systems. This convergence creates opportunities for enhanced operational efficiency and coordinated maintenance strategies across multiple asset types.

Sustainability focus drives demand for monitoring solutions that support environmental compliance and energy efficiency objectives. Organizations increasingly prioritize monitoring systems that provide insights into transformer efficiency and environmental impact. Predictive maintenance strategies enabled by advanced monitoring systems align with sustainability goals by extending equipment lifespans and reducing waste.

Customization trends reflect diverse regional requirements and application-specific needs. Manufacturers develop tailored solutions that address specific market conditions, regulatory requirements, and customer preferences while maintaining cost-effectiveness and reliability.

Recent industry developments demonstrate the dynamic nature of the Asia Pacific transformer monitoring system market and the continuous evolution of technology and business models. Major equipment manufacturers expand their monitoring solution portfolios through strategic acquisitions and partnerships that enhance technological capabilities and market reach.

Product innovations focus on integrated monitoring platforms that combine multiple sensing technologies with advanced analytics and user-friendly interfaces. Companies invest heavily in research and development to create next-generation solutions that provide enhanced accuracy, reliability, and ease of use. MWR analysis indicates that product development investments increased by 25% annually over the past three years.

Strategic partnerships between technology providers and regional system integrators expand market access and improve local support capabilities. These collaborations enable global companies to leverage local expertise while providing regional partners with advanced technology access and training.

Market expansion initiatives include the establishment of regional manufacturing facilities, service centers, and training facilities that support local market development. Companies recognize the importance of local presence in serving diverse Asia Pacific markets effectively.

Regulatory developments across various countries create both opportunities and challenges for market participants. New standards and requirements for grid reliability and safety compliance drive monitoring system adoption while creating the need for solution modifications and certifications.

Strategic recommendations for market participants focus on leveraging emerging opportunities while addressing key challenges in the Asia Pacific transformer monitoring system market. Companies should prioritize technology innovation and regional market adaptation to maintain competitive advantages in this dynamic environment.

Technology investment priorities should emphasize artificial intelligence, machine learning, and advanced analytics capabilities that provide differentiated value propositions. Organizations should develop comprehensive platforms that integrate multiple monitoring technologies with user-friendly interfaces and actionable insights. Wireless connectivity and cloud-based solutions represent essential capabilities for future market success.

Market expansion strategies should consider regional diversity and local market requirements. Companies should establish local partnerships, manufacturing capabilities, and service infrastructure to effectively serve diverse Asia Pacific markets. Customization capabilities become increasingly important for addressing specific regional requirements and application needs.

Service model innovation presents significant opportunities for revenue growth and market differentiation. Monitoring-as-a-service offerings, predictive maintenance services, and comprehensive support packages create recurring revenue streams while reducing customer adoption barriers.

Collaboration strategies with utilities, system integrators, and technology partners enhance market access and solution effectiveness. Companies should focus on building ecosystem partnerships that provide comprehensive solutions and superior customer experiences.

Future market trajectory for the Asia Pacific transformer monitoring system market indicates sustained growth driven by infrastructure modernization, technological advancement, and increasing reliability requirements. The market is projected to maintain robust growth with a CAGR of 8.5% through the next decade, supported by favorable economic conditions and regulatory developments.

Technology evolution will continue toward more intelligent, integrated, and autonomous monitoring systems that provide comprehensive transformer health assessment and optimization recommendations. The integration of edge computing, 5G connectivity, and advanced analytics will enable real-time decision making and automated response capabilities.

Market maturation patterns will vary across different regional markets, with developed economies focusing on advanced analytics and optimization while emerging markets prioritize basic monitoring functionality and cost-effectiveness. This diversity creates opportunities for differentiated product strategies and market positioning.

Industry transformation toward digitalization and smart grid implementation will drive demand for comprehensive monitoring solutions that integrate with broader grid management systems. The convergence of monitoring, control, and optimization functions creates opportunities for enhanced value propositions and market expansion.

Sustainability imperatives will increasingly influence monitoring system selection and implementation, with organizations prioritizing solutions that support environmental compliance and energy efficiency objectives. MarkWide Research projects that sustainability-focused monitoring solutions will represent 60% of new implementations by 2030.

Market assessment of the Asia Pacific transformer monitoring system market reveals a dynamic and rapidly evolving landscape characterized by strong growth potential, technological innovation, and diverse regional opportunities. The market benefits from favorable economic conditions, infrastructure modernization initiatives, and increasing awareness of monitoring system benefits across various industry sectors.

Growth drivers including urbanization, industrialization, and renewable energy integration create sustained demand for reliable power infrastructure and advanced monitoring solutions. The region’s commitment to grid modernization and smart city development provides substantial opportunities for market expansion and technology adoption.

Competitive dynamics promote continuous innovation and cost optimization while serving diverse customer requirements across different market segments. The presence of both global technology leaders and regional specialists creates a healthy competitive environment that benefits end users through improved solutions and competitive pricing.

Future success in the Asia Pacific transformer monitoring system market will depend on companies’ ability to adapt to regional diversity, invest in technology innovation, and develop comprehensive service capabilities. Organizations that effectively combine advanced technology with local market expertise and customer-focused service models will be best positioned to capitalize on the substantial growth opportunities in this dynamic market.

What is Transformer Monitoring System?

A Transformer Monitoring System is a technology used to monitor the performance and health of transformers in electrical networks. It involves the use of sensors and software to collect data on parameters such as temperature, voltage, and load, enabling predictive maintenance and improved reliability.

What are the key players in the Asia Pacific Transformer Monitoring System Market?

Key players in the Asia Pacific Transformer Monitoring System Market include Siemens AG, General Electric, Schneider Electric, and ABB Ltd., among others. These companies are known for their innovative solutions and extensive experience in the energy sector.

What are the growth factors driving the Asia Pacific Transformer Monitoring System Market?

The growth of the Asia Pacific Transformer Monitoring System Market is driven by increasing demand for reliable power supply, the need for efficient energy management, and the rising adoption of smart grid technologies. Additionally, the expansion of renewable energy sources is also contributing to market growth.

What challenges does the Asia Pacific Transformer Monitoring System Market face?

Challenges in the Asia Pacific Transformer Monitoring System Market include high initial investment costs and the complexity of integrating monitoring systems with existing infrastructure. Additionally, there may be a lack of skilled personnel to manage and interpret the data collected.

What opportunities exist in the Asia Pacific Transformer Monitoring System Market?

Opportunities in the Asia Pacific Transformer Monitoring System Market include the increasing focus on digital transformation in the energy sector and the growing trend of IoT integration. These advancements can lead to enhanced monitoring capabilities and improved operational efficiency.

What trends are shaping the Asia Pacific Transformer Monitoring System Market?

Trends shaping the Asia Pacific Transformer Monitoring System Market include the rise of artificial intelligence for predictive analytics, the development of cloud-based monitoring solutions, and the increasing emphasis on sustainability and energy efficiency. These trends are driving innovation and enhancing system capabilities.

Asia Pacific Transformer Monitoring System Market

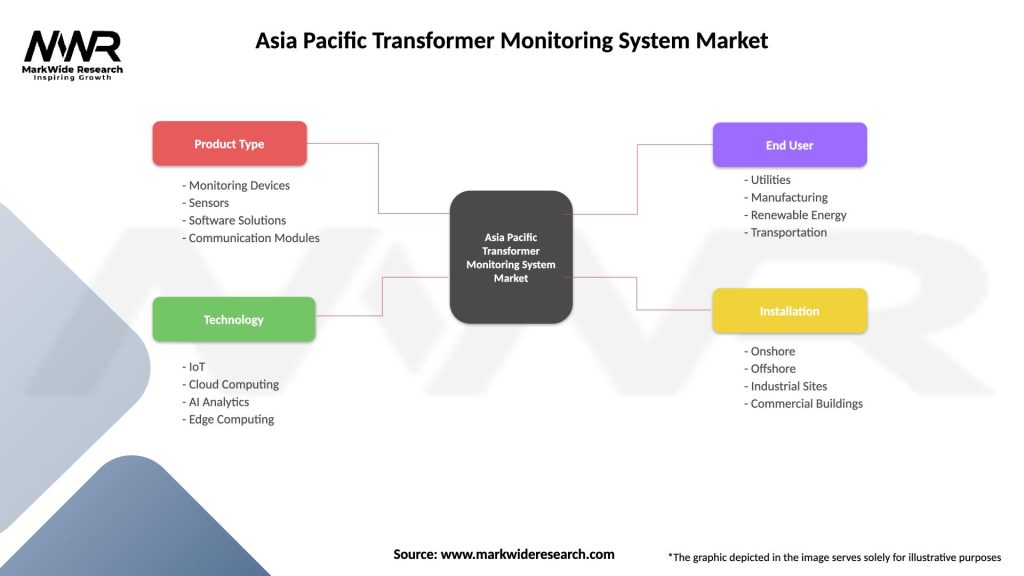

| Segmentation Details | Description |

|---|---|

| Product Type | Monitoring Devices, Sensors, Software Solutions, Communication Modules |

| Technology | IoT, Cloud Computing, AI Analytics, Edge Computing |

| End User | Utilities, Manufacturing, Renewable Energy, Transportation |

| Installation | Onshore, Offshore, Industrial Sites, Commercial Buildings |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Transformer Monitoring System Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at