444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific student accommodation market represents one of the fastest-growing segments within the regional real estate and education sectors. This dynamic market encompasses purpose-built student accommodation (PBSA), university-managed housing, and private rental properties specifically catering to domestic and international students across major educational hubs. The region’s robust economic growth, increasing international student mobility, and expanding higher education infrastructure have created unprecedented demand for quality student housing solutions.

Market dynamics indicate that the Asia-Pacific region is experiencing a 12.5% annual growth rate in student accommodation demand, driven primarily by countries like Australia, Singapore, Japan, and emerging markets including Vietnam and Thailand. The sector benefits from strong government support for education internationalization, rising disposable incomes among middle-class families, and evolving student preferences toward modern, amenity-rich living environments.

International student enrollment continues to surge across the region, with Australia and Singapore leading as preferred destinations. The market demonstrates remarkable resilience and adaptability, incorporating technological innovations, sustainable building practices, and flexible accommodation models to meet diverse student needs. This growth trajectory positions the Asia-Pacific student accommodation market as a critical component of the broader education and real estate ecosystem.

The Asia-Pacific student accommodation market refers to the comprehensive ecosystem of housing solutions specifically designed and operated to serve the residential needs of tertiary education students across the Asia-Pacific region. This market encompasses various accommodation types including purpose-built student accommodation facilities, university-owned dormitories, private rental properties, homestay programs, and co-living spaces that cater to both domestic and international students pursuing higher education.

Student accommodation providers within this market offer comprehensive services beyond basic housing, including meal plans, recreational facilities, study spaces, security services, and community-building programs. The market operates through multiple stakeholder categories including institutional investors, specialized student housing operators, universities, private developers, and property management companies working collaboratively to address the growing demand for quality student housing solutions.

Market participants focus on creating environments that support academic success, cultural integration, and personal development while ensuring safety, affordability, and convenience for students from diverse backgrounds and nationalities.

Strategic analysis reveals that the Asia-Pacific student accommodation market is undergoing transformational growth, driven by increasing international education demand and evolving student lifestyle preferences. The market demonstrates strong fundamentals with 68% occupancy rates maintained across major metropolitan areas, indicating robust demand-supply dynamics and investor confidence in the sector’s long-term viability.

Key market drivers include government initiatives promoting education exports, rising middle-class populations seeking quality education abroad, and institutional investor interest in alternative real estate assets. The sector benefits from demographic trends showing increased youth populations in emerging economies and growing acceptance of international education as a pathway to career advancement.

Investment flows into the sector have intensified, with private equity firms, sovereign wealth funds, and real estate investment trusts recognizing student accommodation as a defensive asset class with stable returns. The market’s resilience during economic uncertainties, combined with long-term demographic trends supporting education demand, positions it favorably for sustained growth across the forecast period.

Market intelligence indicates several critical insights shaping the Asia-Pacific student accommodation landscape:

International education expansion serves as the primary catalyst driving Asia-Pacific student accommodation demand. Government policies across the region actively promote education as an export industry, with countries like Australia, Singapore, and New Zealand implementing streamlined visa processes and post-graduation work opportunities to attract international students. This policy support creates sustained demand for quality accommodation infrastructure.

Economic prosperity in emerging Asia-Pacific markets has enabled middle-class families to invest in international education for their children. Rising disposable incomes, coupled with cultural emphasis on educational achievement, drive consistent demand for overseas study opportunities. The growing recognition of international qualifications in domestic job markets further reinforces this trend.

Urbanization patterns concentrate educational institutions in major metropolitan areas, creating natural accommodation clusters around university campuses. This geographic concentration enables economies of scale for accommodation providers while generating consistent demand from both domestic students relocating for education and international students requiring housing solutions.

Institutional investment interest in alternative real estate assets has identified student accommodation as an attractive defensive investment with stable cash flows and inflation-hedging characteristics. This capital influx enables market expansion and quality improvements across accommodation offerings.

Regulatory complexities across different Asia-Pacific jurisdictions create operational challenges for accommodation providers seeking regional expansion. Varying building codes, safety standards, and foreign investment restrictions require significant compliance investments and local expertise, potentially limiting market entry for international operators.

High capital requirements for developing quality student accommodation facilities present barriers to entry, particularly in prime urban locations where land costs are prohibitive. The specialized nature of student housing, requiring specific amenities and services, increases development costs compared to traditional residential projects.

Cultural sensitivity challenges arise when accommodating diverse international student populations with varying lifestyle preferences, dietary requirements, and social norms. Providers must invest in cultural training and facility customization to ensure inclusive environments, increasing operational complexity and costs.

Economic volatility in source countries for international students can impact enrollment numbers and accommodation demand. Currency fluctuations, political instability, and economic downturns in key markets like China and India can significantly affect student mobility and spending capacity, creating demand uncertainty for accommodation providers.

Emerging market expansion presents significant growth opportunities as countries like Vietnam, Thailand, and Indonesia develop their higher education sectors and attract increasing international student populations. These markets offer lower entry costs and less saturated competitive landscapes compared to established destinations.

Technology integration opportunities enable accommodation providers to differentiate through smart building features, mobile applications for service delivery, and data analytics for personalized student experiences. The 85% smartphone penetration among student demographics creates natural adoption pathways for digital service innovations.

Public-private partnerships with universities and government agencies offer opportunities to develop large-scale accommodation projects with reduced risk profiles. These collaborations can provide land access, regulatory support, and guaranteed occupancy levels, creating attractive investment propositions.

Sustainable development initiatives align with growing environmental consciousness among students and institutional sustainability commitments. Green building certifications, renewable energy integration, and waste reduction programs create competitive advantages while potentially qualifying for government incentives and preferential financing.

Supply-demand imbalances characterize many Asia-Pacific student accommodation markets, with demand consistently outpacing supply in major educational hubs. This dynamic creates pricing power for existing operators while attracting new market entrants seeking to capitalize on unmet demand. The 92% average occupancy rates in tier-one cities demonstrate the market’s fundamental strength.

Competitive intensity is increasing as traditional real estate developers, hospitality operators, and specialized student housing companies compete for market share. This competition drives innovation in service delivery, amenity offerings, and pricing models, ultimately benefiting student consumers through improved accommodation options.

Operational efficiency improvements through technology adoption and economies of scale enable providers to maintain profitability while offering competitive pricing. Centralized booking systems, automated maintenance scheduling, and digital payment platforms reduce operational costs and improve service quality.

Market consolidation trends are emerging as larger operators acquire smaller competitors to achieve scale advantages and geographic diversification. This consolidation creates opportunities for institutional investors to partner with established operators for market expansion while reducing individual project risks.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Asia-Pacific student accommodation market. Primary research involves direct engagement with key market participants including accommodation providers, university administrators, student representatives, and industry investors through structured interviews and surveys.

Secondary research encompasses analysis of government education statistics, university enrollment data, real estate market reports, and industry publications to establish market sizing and trend identification. This approach ensures comprehensive coverage of market dynamics across different countries and accommodation segments within the Asia-Pacific region.

Data validation processes include cross-referencing multiple sources, expert consultations, and statistical analysis to ensure accuracy and reliability of market insights. The methodology incorporates both quantitative metrics and qualitative assessments to provide balanced perspectives on market opportunities and challenges.

Regional expertise is leveraged through partnerships with local research organizations and industry associations across key Asia-Pacific markets, ensuring cultural context and regulatory nuances are properly reflected in the analysis.

Australia dominates the Asia-Pacific student accommodation market, accounting for approximately 45% of regional demand, driven by its established international education sector and government support for education exports. Major cities including Sydney, Melbourne, and Brisbane demonstrate consistent accommodation shortages, creating premium pricing opportunities for quality providers.

Singapore represents a rapidly growing market segment with 18% market share, benefiting from its strategic location, English-language education system, and government initiatives to become a regional education hub. The city-state’s limited land availability creates high-density accommodation solutions and premium pricing structures.

Japan’s market is experiencing renewed growth following government internationalization policies and increased English-language program offerings. The market benefits from cultural appeal to Asian students and strong safety standards, though language barriers and cultural adaptation requirements present operational challenges.

Emerging markets including Thailand, Vietnam, and Indonesia collectively represent 22% of regional growth potential, driven by expanding higher education sectors and increasing international partnerships with established universities. These markets offer attractive entry valuations and government support for education infrastructure development.

Market leadership is distributed among several key player categories, each bringing distinct competitive advantages and operational approaches to the Asia-Pacific student accommodation sector:

Competitive strategies focus on location optimization, service differentiation, and technology integration to attract and retain student residents while maintaining operational efficiency and profitability.

By Accommodation Type:

By Student Type:

By Price Segment:

Purpose-Built Student Accommodation represents the fastest-growing segment, driven by investor interest and student preferences for modern, amenity-rich living environments. This category benefits from economies of scale, professional management, and standardized service delivery, creating competitive advantages over traditional rental options.

International student accommodation commands premium pricing due to specialized services including cultural orientation, language support, and visa assistance. Providers in this segment invest heavily in multicultural staff training and facility customization to meet diverse student needs and preferences.

Premium accommodation facilities demonstrate strong performance with 95% occupancy rates in major markets, indicating student willingness to pay for quality amenities, prime locations, and comprehensive services. This segment attracts institutional investors seeking stable returns and capital appreciation potential.

Co-living spaces are gaining traction among younger students seeking flexible lease terms and community interaction opportunities. This emerging category combines accommodation with social networking, professional development, and cultural exchange programs to create differentiated value propositions.

For Investors:

For Students:

For Universities:

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation is reshaping student accommodation operations through mobile applications, IoT integration, and data analytics. Smart building technologies enable energy efficiency, predictive maintenance, and personalized student experiences while reducing operational costs. The trend toward contactless services and digital payment systems accelerated following global health concerns.

Sustainability focus has become a key differentiator as environmentally conscious students seek accommodation providers committed to green building practices and carbon footprint reduction. Solar energy integration, water conservation systems, and waste reduction programs are becoming standard features in new developments.

Community-centric design emphasizes social interaction spaces, collaborative study areas, and cultural exchange programs to address student preferences for meaningful connections and personal development opportunities. This trend reflects changing student values prioritizing experiences and relationships alongside academic achievement.

Flexible accommodation models are emerging to address diverse student needs including short-term stays, co-living arrangements, and hybrid work-study environments. According to MarkWide Research analysis, flexible lease terms and customizable service packages are becoming increasingly important for student retention and satisfaction.

Strategic partnerships between accommodation providers and universities are expanding, creating integrated campus ecosystems that enhance student experience while providing stable revenue streams for operators. These collaborations often include shared facility development, joint marketing initiatives, and coordinated student support services.

Technology investments in artificial intelligence and machine learning are enabling predictive analytics for demand forecasting, dynamic pricing optimization, and personalized service delivery. These innovations help providers maximize occupancy rates while improving operational efficiency and student satisfaction levels.

Sustainable development initiatives are gaining momentum with green building certifications becoming standard requirements for new projects. Energy-efficient systems, renewable energy integration, and sustainable material usage are creating competitive advantages while reducing long-term operational costs.

Market consolidation activities include strategic acquisitions and joint ventures as operators seek scale advantages and geographic diversification. These transactions enable resource sharing, best practice implementation, and risk distribution across multiple markets and property types.

Market entry strategies should prioritize partnership development with established local operators or universities to navigate regulatory requirements and cultural nuances effectively. New entrants benefit from leveraging local expertise while contributing capital and operational best practices to create mutually beneficial arrangements.

Investment focus should emphasize prime locations near major universities and transportation hubs, as location remains the primary factor in student accommodation selection. Properties within walking distance of campus or with convenient public transport access command premium pricing and maintain higher occupancy rates.

Technology adoption represents a critical success factor for long-term competitiveness. Providers should invest in comprehensive digital platforms that integrate booking, payment, communication, and service delivery to meet student expectations for seamless digital experiences.

Sustainability integration should be considered from project inception rather than retrofitted, as green building features become increasingly important for student attraction and regulatory compliance. Early adoption of sustainable practices creates competitive advantages and potential cost savings over facility lifecycles.

Market expansion is projected to continue across the Asia-Pacific region, with emerging markets like Vietnam, Thailand, and Indonesia expected to contribute significantly to growth. These markets benefit from expanding higher education sectors, increasing international partnerships, and government support for education infrastructure development.

Demographic trends support sustained demand growth, with youth populations in key source countries continuing to expand and middle-class prosperity enabling international education investments. The 15% projected growth in international student mobility over the next five years creates substantial accommodation demand across the region.

Technology integration will accelerate, with artificial intelligence, virtual reality, and blockchain technologies creating new opportunities for service delivery innovation and operational optimization. MWR projects that smart building features will become standard across 80% of new developments within the next three years.

Sustainability requirements will intensify as governments implement stricter environmental regulations and students increasingly prioritize eco-friendly accommodation options. Carbon-neutral operations and circular economy principles are expected to become competitive necessities rather than differentiators.

The Asia-Pacific student accommodation market presents compelling growth opportunities driven by fundamental demographic trends, government policy support, and evolving student preferences. The sector’s defensive characteristics, combined with strong demand fundamentals and institutional investor interest, position it favorably for sustained expansion across the forecast period.

Success factors include strategic location selection, technology integration, sustainability focus, and cultural sensitivity in service delivery. Operators who can effectively combine these elements while maintaining operational efficiency and financial discipline are best positioned to capitalize on market opportunities and achieve sustainable competitive advantages.

Market evolution toward more sophisticated, technology-enabled, and environmentally conscious accommodation solutions reflects broader societal trends and student expectations. The sector’s ability to adapt to changing requirements while maintaining affordability and accessibility will determine long-term success and contribution to regional education ecosystem development.

Investment prospects remain attractive for stakeholders seeking exposure to Asia-Pacific demographic trends and education sector growth. The combination of stable cash flows, capital appreciation potential, and positive social impact creates compelling value propositions for diverse investor types seeking alternative real estate opportunities in this dynamic and growing market segment.

What is Student Accommodation?

Student accommodation refers to housing specifically designed for students, typically located near educational institutions. This can include dormitories, shared apartments, and private rentals that cater to the needs of students.

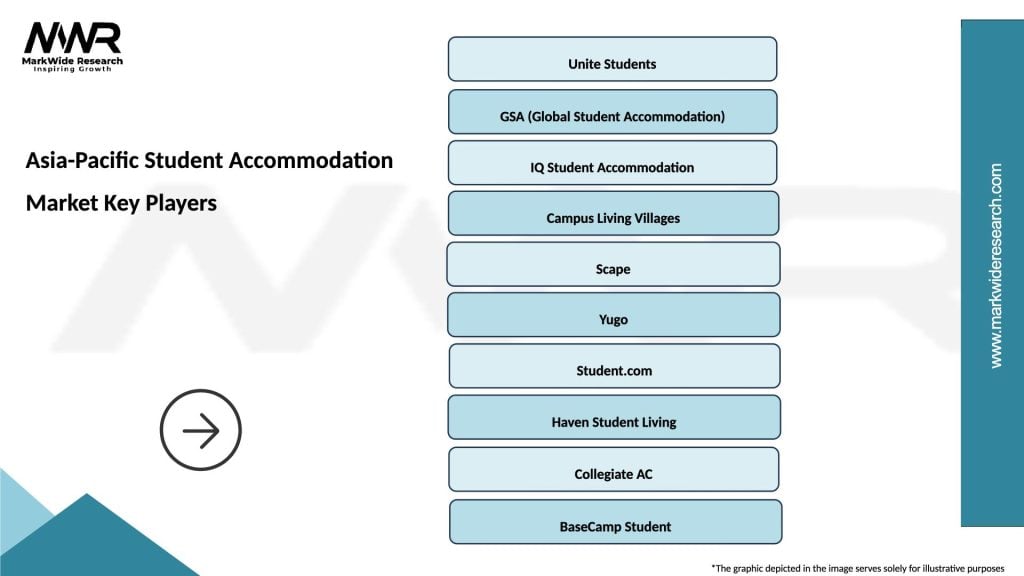

What are the key players in the Asia-Pacific Student Accommodation Market?

Key players in the Asia-Pacific Student Accommodation Market include companies like Unilodgers, The Student Housing Company, and GSA, which provide various housing options for students across the region, among others.

What are the main drivers of growth in the Asia-Pacific Student Accommodation Market?

The growth of the Asia-Pacific Student Accommodation Market is driven by increasing student enrollment in higher education, a rise in international students, and the demand for quality living conditions that support academic success.

What challenges does the Asia-Pacific Student Accommodation Market face?

Challenges in the Asia-Pacific Student Accommodation Market include regulatory hurdles, fluctuating demand due to changing student demographics, and competition from alternative housing options such as private rentals.

What opportunities exist in the Asia-Pacific Student Accommodation Market?

Opportunities in the Asia-Pacific Student Accommodation Market include the expansion of purpose-built student housing, the integration of technology for enhanced living experiences, and the potential for partnerships with educational institutions.

What trends are shaping the Asia-Pacific Student Accommodation Market?

Trends in the Asia-Pacific Student Accommodation Market include a growing preference for eco-friendly housing solutions, increased focus on community living, and the incorporation of smart technologies to improve student experiences.

Asia-Pacific Student Accommodation Market

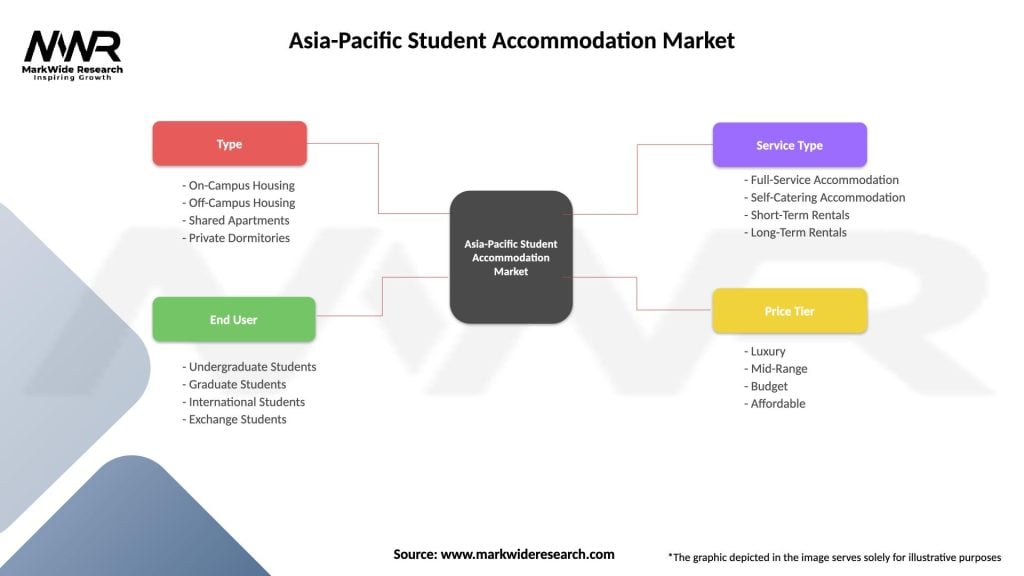

| Segmentation Details | Description |

|---|---|

| Type | On-Campus Housing, Off-Campus Housing, Shared Apartments, Private Dormitories |

| End User | Undergraduate Students, Graduate Students, International Students, Exchange Students |

| Service Type | Full-Service Accommodation, Self-Catering Accommodation, Short-Term Rentals, Long-Term Rentals |

| Price Tier | Luxury, Mid-Range, Budget, Affordable |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Student Accommodation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at