444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific sports promoter market represents one of the most dynamic and rapidly evolving segments within the global entertainment and sports industry. This comprehensive market encompasses organizations and individuals responsible for organizing, marketing, and managing sporting events across diverse disciplines including professional leagues, international tournaments, and grassroots competitions. The region’s unique blend of traditional sports culture and modern commercial entertainment has created unprecedented opportunities for sports promotion businesses.

Market dynamics in the Asia Pacific region are characterized by substantial growth driven by increasing disposable income, urbanization, and the rising popularity of both local and international sports. The market benefits from a diverse demographic profile, with countries like Japan, South Korea, and Australia leading in sports infrastructure development, while emerging markets such as India, Indonesia, and Vietnam present significant expansion opportunities.

Digital transformation has fundamentally reshaped how sports promoters operate, with social media marketing, streaming platforms, and mobile engagement becoming essential components of successful event promotion. The market is experiencing robust growth at a compound annual growth rate of 8.2%, reflecting the increasing commercialization of sports and the growing appetite for live entertainment experiences across the region.

Regional diversity presents both opportunities and challenges, as sports promoters must navigate varying cultural preferences, regulatory environments, and economic conditions. The market’s resilience was demonstrated during recent global disruptions, with innovative virtual and hybrid event formats maintaining audience engagement and revenue streams.

The Asia Pacific sports promoter market refers to the comprehensive ecosystem of businesses, organizations, and individuals engaged in the planning, marketing, and execution of sporting events across the Asia Pacific region. This market encompasses professional event management companies, independent promoters, sports marketing agencies, and venue operators who facilitate the connection between athletes, sponsors, and audiences.

Sports promoters serve as intermediaries who transform athletic competitions into commercially viable entertainment products. Their responsibilities include securing venues, managing athlete contracts, coordinating with broadcasters, developing marketing campaigns, and ensuring regulatory compliance. The market includes promoters specializing in various sports categories, from traditional Asian martial arts to international favorites like football, basketball, and tennis.

Commercial activities within this market extend beyond event organization to include sponsorship facilitation, merchandise development, digital content creation, and audience development strategies. Modern sports promoters increasingly function as comprehensive entertainment companies, leveraging multiple revenue streams to maximize event profitability and long-term brand development.

Strategic positioning within the Asia Pacific sports promoter market reveals a landscape characterized by rapid technological adoption, evolving consumer preferences, and increasing corporate investment in sports marketing. The market demonstrates remarkable resilience and adaptability, with promoters successfully integrating digital platforms and innovative engagement strategies to maintain growth momentum.

Key performance indicators show that approximately 73% of sports promoters in the region have expanded their digital marketing capabilities over the past three years, reflecting the critical importance of online audience engagement. The market benefits from strong government support for sports development, with several countries implementing policies to promote sports tourism and international event hosting.

Investment trends indicate growing interest from private equity firms and international entertainment companies seeking to capitalize on the region’s expanding middle class and increasing sports consumption. The market’s growth trajectory is supported by infrastructure development, with new stadiums and sports complexes creating additional opportunities for event promotion and management.

Competitive dynamics are evolving rapidly, with traditional promoters facing competition from technology-enabled platforms and international entertainment conglomerates. Success factors increasingly include data analytics capabilities, social media expertise, and the ability to create immersive fan experiences that extend beyond traditional event boundaries.

Market intelligence reveals several critical insights that define the current state and future direction of the Asia Pacific sports promoter market:

Economic prosperity across the Asia Pacific region serves as a fundamental driver for sports promoter market expansion. Rising disposable income levels enable consumers to allocate more resources toward entertainment and leisure activities, creating a larger addressable market for sporting events and related experiences.

Urbanization trends contribute significantly to market growth, as concentrated populations in major cities provide the critical mass necessary for successful event promotion. Urban centers offer superior infrastructure, transportation networks, and marketing reach, making them ideal locations for large-scale sporting events and regular league competitions.

Corporate sponsorship growth represents another crucial driver, with businesses increasingly recognizing sports marketing as an effective way to build brand awareness and connect with target demographics. The market benefits from approximately 67% of major corporations in the region allocating increased budgets to sports sponsorship and event marketing activities.

Media rights evolution has created new revenue streams for sports promoters, with streaming platforms and digital broadcasters competing for exclusive content. This competition drives up rights values and provides promoters with multiple monetization options for their events and properties.

Government initiatives supporting sports development and tourism create favorable operating conditions for promoters. Many countries are investing in sports infrastructure and implementing policies to attract international events, providing promoters with improved venues and regulatory support.

Regulatory complexity presents significant challenges for sports promoters operating across multiple jurisdictions within the Asia Pacific region. Varying licensing requirements, taxation policies, and broadcasting regulations create operational complexity and increase compliance costs for market participants.

Infrastructure limitations in certain markets restrict the ability to host large-scale events and limit audience capacity. While major cities boast world-class facilities, secondary markets often lack the necessary infrastructure to support professional sports promotion activities effectively.

Cultural sensitivity requirements demand careful navigation of local customs, religious considerations, and social norms when promoting events across diverse markets. Missteps in cultural adaptation can result in negative publicity and reduced audience acceptance.

Economic volatility in certain regional markets creates uncertainty for long-term planning and investment decisions. Currency fluctuations and economic downturns can impact corporate sponsorship budgets and consumer spending on entertainment activities.

Competition intensity from established entertainment options and emerging digital platforms creates challenges in audience acquisition and retention. Sports promoters must compete not only with other sporting events but also with movies, concerts, gaming, and social media for consumer attention and engagement.

Emerging market penetration offers substantial growth opportunities as developing economies in the region experience rising prosperity and increased interest in organized sports. Countries such as Vietnam, Bangladesh, and Myanmar represent untapped markets with significant potential for sports promotion development.

Technology integration presents opportunities for innovative promoters to differentiate their offerings through virtual reality experiences, augmented reality applications, and interactive digital platforms. These technologies can enhance fan engagement and create new revenue streams through premium digital experiences.

Women’s sports promotion represents a rapidly growing segment with significant commercial potential. The increasing popularity of women’s professional sports creates opportunities for specialized promoters to develop dedicated leagues, events, and marketing strategies targeting this underserved market.

Esports convergence offers opportunities for traditional sports promoters to expand into the rapidly growing competitive gaming sector. The integration of physical and digital sports creates hybrid entertainment formats that appeal to younger demographics and tech-savvy audiences.

Sports tourism development enables promoters to create comprehensive destination experiences that combine sporting events with travel, hospitality, and cultural activities. This approach maximizes revenue per participant and creates sustainable competitive advantages through unique value propositions.

Supply chain evolution within the sports promoter market reflects increasing sophistication and specialization among service providers. The ecosystem now includes specialized vendors for technology services, security, catering, transportation, and digital marketing, enabling promoters to focus on core competencies while accessing best-in-class support services.

Consumer behavior patterns demonstrate a shift toward experiential consumption, with audiences seeking immersive and memorable experiences rather than passive entertainment. This trend drives promoters to invest in enhanced venue amenities, interactive technologies, and personalized engagement strategies that create lasting emotional connections with participants.

Competitive landscape dynamics show increasing consolidation among larger promoters while simultaneously creating opportunities for niche specialists. Market leaders are pursuing acquisition strategies to expand geographic reach and service capabilities, while smaller promoters focus on specific sports, regions, or demographic segments.

Revenue model innovation is transforming how promoters generate income from their activities. Traditional ticket sales and sponsorship revenues are being supplemented by merchandise sales, digital content licensing, data monetization, and subscription-based fan engagement platforms, creating more diversified and resilient business models.

Partnership strategies are becoming increasingly important as promoters recognize the value of collaborative approaches to market development. Strategic alliances with broadcasters, technology companies, venue operators, and tourism boards enable promoters to access new capabilities and markets while sharing risks and costs.

Comprehensive market analysis for the Asia Pacific sports promoter market employs a multi-faceted research approach combining primary data collection, secondary source analysis, and industry expert consultations. The methodology ensures accurate representation of market conditions, trends, and future projections across diverse regional markets and sports categories.

Primary research activities include structured interviews with sports promoters, venue operators, corporate sponsors, and industry associations across major markets including Japan, China, India, Australia, and South Korea. Survey methodologies capture quantitative data on market size, growth rates, operational challenges, and strategic priorities from a representative sample of market participants.

Secondary research sources encompass industry publications, government statistics, corporate financial reports, and academic studies to provide comprehensive market context and historical trend analysis. Data validation processes ensure accuracy and reliability of information used in market projections and strategic recommendations.

Expert consultation panels featuring industry veterans, sports marketing professionals, and regional market specialists provide qualitative insights into market dynamics, competitive positioning, and emerging opportunities. These consultations help validate quantitative findings and provide strategic context for market developments.

Data analysis frameworks employ statistical modeling techniques to identify market patterns, correlation factors, and predictive indicators that inform growth projections and strategic recommendations. Advanced analytics capabilities enable segmentation analysis and regional comparison studies that support targeted market strategies.

East Asia markets including China, Japan, and South Korea represent the most mature and sophisticated segments of the regional sports promoter market. These markets benefit from advanced infrastructure, strong corporate sponsorship ecosystems, and established sports culture. Japan leads in operational excellence and fan engagement innovation, while China offers the largest addressable market with approximately 42% of regional market share.

Southeast Asia demonstrates the highest growth potential, with countries like Indonesia, Thailand, and Vietnam experiencing rapid economic development and increasing sports participation. The region’s young demographic profile and growing middle class create favorable conditions for sports promotion expansion, though infrastructure development remains a key success factor.

South Asia markets led by India present unique opportunities and challenges for sports promoters. Cricket dominance creates concentrated revenue opportunities, while emerging sports face market development challenges. The region’s large population and increasing digitalization support long-term growth prospects despite current infrastructure limitations.

Australia and New Zealand represent highly developed markets with sophisticated sports promotion ecosystems and strong regulatory frameworks. These markets serve as testing grounds for innovative approaches and provide stable revenue bases for regional expansion strategies.

Pacific Island nations offer niche opportunities for specialized sports promotion, particularly in rugby and traditional sports. While market size is limited, these regions provide unique cultural experiences and tourism integration opportunities for specialized promoters.

Market leadership in the Asia Pacific sports promoter sector is characterized by a mix of international entertainment conglomerates, regional specialists, and emerging technology-enabled platforms. The competitive environment reflects varying approaches to market development, with some companies pursuing broad geographic coverage while others focus on specific sports or demographic segments.

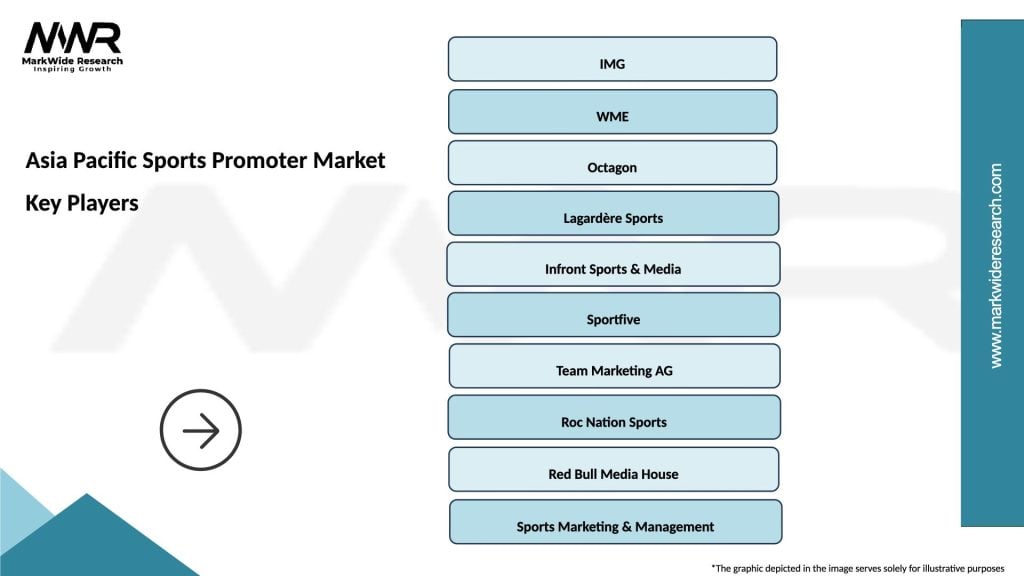

Major market participants include:

Competitive differentiation strategies focus on technological innovation, cultural expertise, and specialized service offerings. Leading companies invest heavily in data analytics capabilities, digital marketing platforms, and local market knowledge to maintain competitive advantages in increasingly sophisticated markets.

By Sport Category:

By Event Type:

By Revenue Model:

Professional League Promotion represents the most stable and predictable segment within the market, offering consistent revenue streams through season-long engagement cycles. Promoters in this category benefit from established fan bases, regular scheduling, and predictable operational requirements. Success factors include venue management expertise, broadcast production capabilities, and long-term sponsor relationship development.

Tournament and Event Promotion offers higher revenue potential but requires greater operational complexity and risk management capabilities. This category includes international championships, exhibition matches, and special events that generate significant media attention and tourism impact. Promoters must excel in project management, logistics coordination, and stakeholder relationship management.

Digital Sports Promotion represents the fastest-growing category, encompassing esports competitions, virtual events, and hybrid physical-digital experiences. This segment requires specialized technical expertise, understanding of gaming culture, and innovative engagement strategies. Growth rates in this category exceed 25% annually across major regional markets.

Corporate Sports Events provide stable revenue streams with premium pricing opportunities, serving businesses seeking team building activities, client entertainment, and employee engagement programs. This category requires strong relationship management skills and the ability to customize experiences for specific corporate objectives and cultures.

Youth and Amateur Sports promotion focuses on development and participation rather than commercial entertainment, though it provides important community engagement and talent pipeline benefits. Promoters in this category often work with government agencies, educational institutions, and sports federations to support grassroots development initiatives.

Sports Promoters benefit from expanding market opportunities, technological tools that enhance operational efficiency, and growing corporate investment in sports marketing. The market provides multiple revenue streams, geographic expansion opportunities, and the potential for significant brand development through successful event execution.

Athletes and Teams gain access to professional promotion services that maximize exposure, optimize revenue generation, and provide comprehensive support for career development. Professional promotion enhances athlete marketability and creates opportunities for endorsement deals and long-term brand partnerships.

Corporate Sponsors access targeted marketing opportunities that provide measurable return on investment through brand exposure, customer engagement, and market development. Sports promotion offers authentic ways to connect with specific demographic segments and build emotional brand connections.

Venue Operators benefit from increased utilization rates, premium event hosting opportunities, and long-term partnership relationships with successful promoters. Professional sports promotion brings consistent revenue streams and enhances venue reputation and market positioning.

Media Partners gain access to compelling content that drives audience engagement, advertising revenue, and subscriber growth. Sports promotion provides regular programming opportunities and exclusive content that differentiates media platforms in competitive markets.

Government and Tourism Agencies benefit from economic impact, international visibility, and tourism development opportunities created by successful sports promotion. Major events generate significant economic activity and enhance destination marketing efforts.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Transformation continues to reshape the sports promotion landscape, with promoters increasingly leveraging artificial intelligence, data analytics, and mobile platforms to enhance fan engagement and optimize operational efficiency. MarkWide Research indicates that approximately 78% of successful promoters have implemented comprehensive digital strategies within the past two years.

Sustainability Integration is becoming a critical differentiator as environmentally conscious consumers and corporate sponsors prioritize eco-friendly event practices. Promoters are implementing carbon-neutral initiatives, waste reduction programs, and sustainable venue management practices to appeal to socially responsible stakeholders.

Personalization and Customization trends reflect growing consumer expectations for tailored experiences and targeted content. Successful promoters are using data analytics to create personalized marketing messages, customized event experiences, and individualized engagement strategies that enhance fan loyalty and satisfaction.

Cross-Platform Integration enables promoters to create cohesive brand experiences across physical events, digital platforms, social media, and mobile applications. This approach maximizes audience reach and engagement while creating multiple touchpoints for sponsor activation and revenue generation.

Health and Wellness Focus drives increased interest in participatory sports and fitness-oriented events. Promoters are developing events that combine entertainment with health promotion, appealing to wellness-conscious consumers and corporate wellness programs.

Strategic Partnerships between traditional sports promoters and technology companies are creating innovative solutions for fan engagement, venue management, and operational efficiency. These collaborations combine sports expertise with technological capabilities to develop next-generation promotion platforms and services.

International Expansion initiatives by leading promoters are establishing regional networks and local partnerships to capitalize on emerging market opportunities. These expansion strategies focus on cultural adaptation, local talent development, and regulatory compliance to ensure successful market entry and sustainable growth.

Investment Activity from private equity firms and venture capital investors reflects growing confidence in the sports promotion sector’s growth potential. Recent investments focus on technology-enabled promoters, esports platforms, and companies with strong digital engagement capabilities.

Regulatory Developments across multiple jurisdictions are creating more standardized frameworks for sports promotion operations, reducing compliance complexity and facilitating cross-border event management. These changes support market consolidation and international expansion strategies.

Infrastructure Investments by governments and private developers are creating new venue opportunities and enhancing existing facilities to support larger and more sophisticated sporting events. These developments expand the addressable market for professional sports promotion services.

Technology Investment should be a priority for sports promoters seeking sustainable competitive advantages. Companies should focus on data analytics platforms, mobile engagement tools, and digital marketing capabilities that enable personalized fan experiences and operational optimization.

Market Diversification strategies can reduce risk and capitalize on emerging opportunities across different sports categories, geographic markets, and demographic segments. Successful promoters should develop expertise in multiple areas while maintaining core competencies in their primary markets.

Partnership Development with complementary service providers, technology companies, and local market specialists can accelerate growth and reduce operational complexity. Strategic alliances enable access to specialized capabilities and market knowledge without requiring significant internal investment.

Sustainability Integration should be incorporated into all aspects of event planning and promotion to meet evolving stakeholder expectations and regulatory requirements. Environmental responsibility can become a significant competitive differentiator and brand enhancement opportunity.

Talent Development programs should focus on building capabilities in digital marketing, data analytics, and cross-cultural communication to support expansion into new markets and sports categories. Human capital investment is critical for long-term success in this relationship-driven industry.

Market expansion prospects for the Asia Pacific sports promoter market remain exceptionally positive, driven by continued economic development, infrastructure investment, and growing sports participation across the region. The market is projected to maintain strong growth momentum with an expected compound annual growth rate of 8.7% over the next five years.

Technology integration will continue to drive innovation and operational efficiency improvements, with artificial intelligence, virtual reality, and blockchain technologies creating new opportunities for fan engagement and revenue generation. Early adopters of these technologies are expected to gain significant competitive advantages in audience acquisition and retention.

Demographic shifts toward younger, more digitally engaged audiences will require promoters to adapt their strategies and service offerings. The growing influence of Generation Z consumers will drive demand for interactive, social, and environmentally responsible sporting experiences.

Regional integration initiatives and improved transportation infrastructure will facilitate cross-border event promotion and audience development. These developments will enable promoters to create regional circuits and tournaments that maximize audience reach and commercial value.

Investment flows into the sector are expected to continue increasing, with both domestic and international investors recognizing the long-term growth potential of sports promotion in the Asia Pacific region. This capital availability will support expansion, technology development, and market consolidation activities.

The Asia Pacific sports promoter market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by economic development, technological innovation, and changing consumer preferences. The market’s diversity across sports categories, geographic regions, and demographic segments creates numerous opportunities for specialized promoters and integrated service providers.

Success factors in this competitive environment include technological sophistication, cultural expertise, operational excellence, and the ability to create compelling fan experiences that generate sustainable revenue streams. Companies that invest in digital capabilities, develop strong local partnerships, and maintain focus on customer satisfaction are positioned to capitalize on the market’s growth trajectory.

Future prospects remain highly favorable, with continued economic growth, infrastructure development, and sports participation increases supporting long-term market expansion. The integration of traditional sports promotion with digital technologies and emerging entertainment formats will create new opportunities for innovation and revenue generation.

Strategic positioning for long-term success requires balanced investment in technology, talent, and market development while maintaining operational excellence and stakeholder relationship management. The companies that successfully navigate cultural complexity, regulatory requirements, and competitive pressures will establish sustainable competitive advantages in this dynamic and rewarding market.

What is Sports Promoter?

Sports promoters are individuals or organizations that facilitate the organization and marketing of sports events, including managing athletes, securing sponsorships, and promoting competitions to audiences.

What are the key players in the Asia Pacific Sports Promoter Market?

Key players in the Asia Pacific Sports Promoter Market include IMG, Octagon, and Lagardère Sports, which are known for their extensive networks and expertise in event management and athlete representation, among others.

What are the growth factors driving the Asia Pacific Sports Promoter Market?

The Asia Pacific Sports Promoter Market is driven by increasing sports viewership, rising disposable incomes, and the growing popularity of sports events, which encourage investment in promotions and sponsorships.

What challenges does the Asia Pacific Sports Promoter Market face?

Challenges in the Asia Pacific Sports Promoter Market include intense competition among promoters, fluctuating economic conditions, and regulatory hurdles that can impact event organization and sponsorship deals.

What opportunities exist in the Asia Pacific Sports Promoter Market?

Opportunities in the Asia Pacific Sports Promoter Market include the rise of digital media for event promotion, the expansion of e-sports, and increasing interest in niche sports, which can attract new audiences and sponsors.

What trends are shaping the Asia Pacific Sports Promoter Market?

Trends in the Asia Pacific Sports Promoter Market include the integration of technology in event management, the focus on sustainability in sports events, and the growing influence of social media in engaging fans and promoting events.

Asia Pacific Sports Promoter Market

| Segmentation Details | Description |

|---|---|

| Service Type | Event Management, Sponsorship, Marketing, Consulting |

| End User | Sports Teams, Athletes, Organizations, Brands |

| Distribution Channel | Online Platforms, Direct Sales, Agencies, Partnerships |

| Customer Type | Corporate Clients, Individual Clients, Non-Profits, Government |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Sports Promoter Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at