444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific soy protein concentrate market represents one of the most dynamic and rapidly expanding segments within the global plant-based protein industry. This region has emerged as a powerhouse for soy protein concentrate production and consumption, driven by increasing health consciousness, rising disposable incomes, and growing awareness of sustainable protein alternatives. The market encompasses a diverse range of applications, from food and beverage manufacturing to animal feed production, with significant growth momentum across multiple countries including China, Japan, India, Australia, and Southeast Asian nations.

Market dynamics in the Asia-Pacific region are characterized by robust demand from both traditional food industries and emerging plant-based product sectors. The region’s established soybean cultivation infrastructure, combined with advanced processing technologies, has positioned Asia-Pacific as a critical hub for soy protein concentrate manufacturing. Current market trends indicate a compound annual growth rate (CAGR) of 8.2% for the forecast period, reflecting strong consumer adoption and industrial demand across diverse applications.

Regional consumption patterns vary significantly across Asia-Pacific countries, with developed markets like Japan and Australia showing preference for premium, functional soy protein concentrates, while emerging economies focus on cost-effective protein solutions for mass market applications. The market’s expansion is further supported by increasing investments in processing infrastructure, technological innovations in protein extraction methods, and growing export opportunities to global markets.

The Asia-Pacific soy protein concentrate market refers to the regional industry focused on the production, distribution, and consumption of concentrated soy protein products derived from soybeans through advanced processing techniques. Soy protein concentrate typically contains 65-70% protein content and serves as a versatile ingredient in food manufacturing, nutritional supplements, and animal feed applications across the Asia-Pacific region.

Soy protein concentrate is produced through various extraction methods, including aqueous washing, acid precipitation, and alcohol extraction, resulting in a product with enhanced functional properties such as improved solubility, emulsification, and gel formation capabilities. This processed protein ingredient offers manufacturers a cost-effective alternative to animal-based proteins while providing essential amino acids and nutritional benefits to end consumers.

Market scope encompasses all commercial activities related to soy protein concentrate within the Asia-Pacific region, including raw material sourcing, processing operations, product development, distribution networks, and end-user applications. The market serves diverse industries ranging from traditional food processing to emerging plant-based meat alternatives, reflecting the versatility and growing importance of soy protein concentrate in regional protein supply chains.

The Asia-Pacific soy protein concentrate market demonstrates exceptional growth potential, driven by fundamental shifts in consumer preferences toward plant-based proteins and increasing industrial demand for functional protein ingredients. The region’s strategic advantages include established soybean production capabilities, advanced processing infrastructure, and growing consumer acceptance of soy-based products across diverse cultural contexts.

Key market drivers include rising health consciousness among consumers, increasing adoption of vegetarian and flexitarian diets, and growing demand from food manufacturers seeking sustainable protein alternatives. The market benefits from strong government support for agricultural innovation and protein security initiatives across multiple Asia-Pacific countries. Industrial applications continue to expand beyond traditional food uses into specialized sectors including sports nutrition, functional foods, and premium pet food products.

Competitive landscape features a mix of established multinational corporations and emerging regional players, with increasing focus on product innovation, quality enhancement, and sustainable production practices. Market consolidation trends indicate strategic partnerships and acquisitions aimed at expanding processing capabilities and distribution networks. The market’s future trajectory suggests continued expansion driven by technological advancements in protein processing and growing export opportunities to global markets.

Strategic market insights reveal several critical trends shaping the Asia-Pacific soy protein concentrate industry. The market demonstrates strong resilience and adaptability, with manufacturers increasingly focusing on product differentiation and value-added applications to capture premium market segments.

Primary market drivers propelling the Asia-Pacific soy protein concentrate market include fundamental demographic and economic trends that support sustained growth across the region. The increasing urbanization and rising middle-class population create favorable conditions for protein market expansion.

Health and wellness trends represent the most significant driver, with consumers increasingly seeking plant-based protein alternatives to support healthy lifestyles. The growing awareness of cardiovascular health benefits, weight management advantages, and digestive wellness associated with soy protein consumption drives market demand. Nutritional research continues to validate the health benefits of soy protein, supporting consumer confidence and market growth.

Industrial demand growth from food and beverage manufacturers seeking functional protein ingredients drives significant market expansion. The versatility of soy protein concentrate in applications ranging from meat alternatives to dairy substitutes creates multiple growth opportunities. Food processing innovations requiring specialized protein ingredients further stimulate market demand across diverse applications.

Economic factors including favorable pricing compared to animal proteins and government support for agricultural development contribute to market growth. The region’s competitive advantage in soybean production and processing creates cost efficiencies that support market expansion. Export opportunities to protein-deficient regions provide additional growth drivers for Asia-Pacific producers.

Market restraints facing the Asia-Pacific soy protein concentrate industry include several challenges that could potentially limit growth momentum. These constraints require strategic attention from industry participants to ensure continued market development.

Consumer perception challenges related to soy products, including concerns about genetic modification and processing methods, create market resistance in certain segments. Traditional dietary preferences in some Asia-Pacific cultures may limit adoption rates for soy-based protein products. Taste and texture limitations of soy protein concentrate compared to animal proteins continue to challenge product developers and manufacturers.

Regulatory complexities across different Asia-Pacific countries create compliance challenges for manufacturers operating in multiple markets. Varying food safety standards, labeling requirements, and import regulations increase operational complexity and costs. Quality standardization issues across different suppliers and regions may impact product consistency and market confidence.

Supply chain vulnerabilities including weather-dependent soybean production and transportation challenges can impact market stability. Competition from alternative plant proteins such as pea protein and wheat protein creates market pressure. Price volatility in raw soybean markets affects production costs and profit margins for soy protein concentrate manufacturers.

Significant market opportunities exist within the Asia-Pacific soy protein concentrate market, driven by emerging applications, technological innovations, and evolving consumer preferences. These opportunities present substantial growth potential for industry participants.

Plant-based meat alternatives represent the most promising growth opportunity, with increasing consumer interest in sustainable protein sources driving demand for high-quality soy protein concentrates. The expanding flexitarian population across Asia-Pacific countries creates substantial market potential for innovative protein products. Premium positioning opportunities exist for manufacturers developing specialized formulations targeting health-conscious consumers.

Functional food applications offer significant growth potential, with opportunities in sports nutrition, elderly nutrition, and specialized dietary products. The growing awareness of protein’s role in healthy aging creates opportunities for targeted product development. Ingredient innovation in areas such as protein hydrolysates and modified functional properties opens new market segments.

Export market expansion presents substantial opportunities for Asia-Pacific producers to serve growing global demand for plant-based proteins. Strategic partnerships with international food manufacturers create opportunities for long-term supply agreements. Technology licensing and joint venture opportunities enable market expansion while sharing development costs and risks.

Market dynamics in the Asia-Pacific soy protein concentrate industry reflect complex interactions between supply and demand factors, technological developments, and regulatory influences. These dynamics create both challenges and opportunities for market participants.

Supply-side dynamics are influenced by soybean production cycles, processing capacity utilization, and technological improvements in extraction efficiency. The region’s established agricultural infrastructure provides supply stability, while investments in processing technology enhance product quality and yield. Production efficiency improvements of approximately 15-20% through advanced processing methods contribute to competitive positioning.

Demand-side dynamics reflect changing consumer preferences, industrial requirements, and economic conditions across different Asia-Pacific markets. The growing food processing industry creates steady demand growth, while emerging applications in plant-based products drive premium segment expansion. Seasonal demand variations in certain applications require strategic inventory management and production planning.

Competitive dynamics involve ongoing innovation in product development, quality enhancement, and cost optimization. Market participants compete on factors including protein functionality, price competitiveness, and supply reliability. Strategic partnerships between producers and end-users create stable demand relationships while driving product innovation.

Comprehensive research methodology employed for analyzing the Asia-Pacific soy protein concentrate market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability of market insights. The methodology combines quantitative analysis with qualitative assessment to provide complete market understanding.

Primary research activities include extensive interviews with industry executives, manufacturers, distributors, and end-users across key Asia-Pacific markets. Survey data collection from food processors, nutritional supplement manufacturers, and animal feed producers provides direct market insights. Expert consultations with agricultural specialists, food technologists, and market analysts enhance research depth and accuracy.

Secondary research analysis encompasses comprehensive review of industry publications, government statistics, trade association reports, and academic research papers. Market data validation through multiple independent sources ensures information reliability and consistency. Historical trend analysis provides context for current market conditions and future projections.

Analytical frameworks include market segmentation analysis, competitive positioning assessment, and growth driver evaluation. Statistical modeling techniques support market forecasting and trend identification. Data triangulation methods ensure research findings accuracy through cross-verification of information from multiple sources and analytical approaches.

Regional market analysis reveals significant variations in soy protein concentrate demand, production capabilities, and growth opportunities across different Asia-Pacific countries. Each market demonstrates unique characteristics influenced by local economic conditions, dietary preferences, and industrial development levels.

China dominates the regional market with approximately 45% market share, driven by large-scale soybean processing infrastructure and growing domestic demand for plant-based proteins. The country’s established food processing industry and increasing health consciousness among consumers support continued market expansion. Chinese manufacturers are increasingly focusing on export opportunities and product quality improvements to compete in international markets.

Japan represents a premium market segment with strong demand for high-quality, functional soy protein concentrates in specialized applications. The country’s aging population drives demand for nutritional products containing soy protein concentrate. Japanese consumers demonstrate willingness to pay premium prices for superior quality and innovative protein products.

India shows rapid growth potential with increasing adoption of processed foods and growing awareness of plant-based nutrition. The country’s large vegetarian population provides natural market demand for soy protein products. Indian market growth is supported by expanding food processing industry and rising disposable incomes among urban consumers.

Southeast Asian markets including Thailand, Vietnam, and Indonesia demonstrate strong growth momentum driven by economic development and changing dietary patterns. These markets offer opportunities for both domestic consumption and export-oriented production. Regional integration through trade agreements facilitates market access and supply chain optimization.

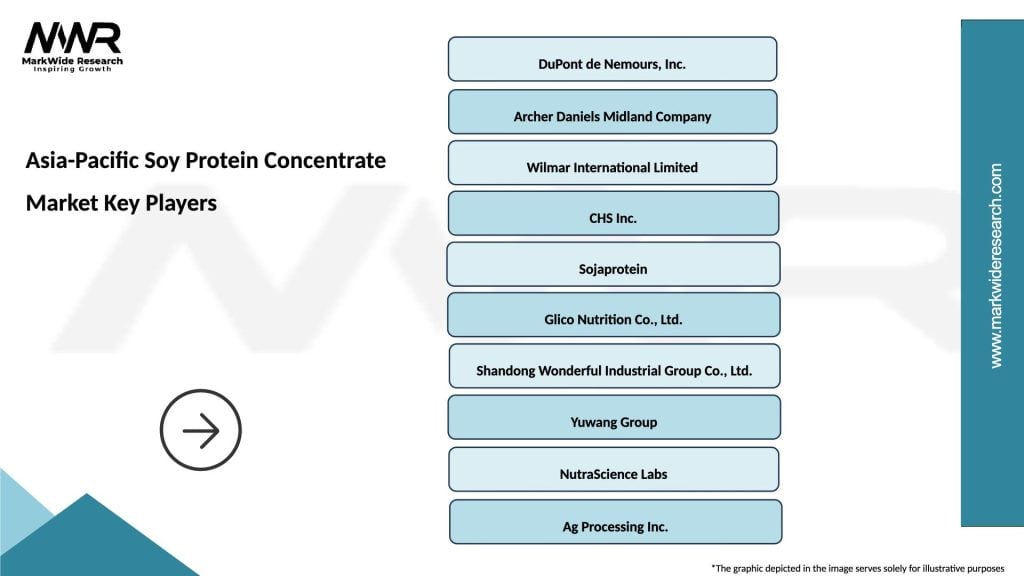

The competitive landscape of the Asia-Pacific soy protein concentrate market features a diverse mix of multinational corporations, regional leaders, and specialized manufacturers competing across different market segments and applications.

Competitive strategies include product innovation, capacity expansion, strategic partnerships, and vertical integration initiatives. Market leaders focus on developing specialized formulations for emerging applications while maintaining cost competitiveness in traditional segments. Technology investments in processing efficiency and product quality enhancement drive competitive differentiation.

Market segmentation analysis reveals distinct categories within the Asia-Pacific soy protein concentrate market, each characterized by specific applications, quality requirements, and growth dynamics. Understanding these segments enables targeted strategies and market positioning.

By Protein Content:

By Application:

By Processing Method:

Category-wise market insights provide detailed understanding of performance variations across different soy protein concentrate segments, revealing opportunities for targeted growth strategies and product development initiatives.

Food and Beverage Category represents the largest market segment, accounting for approximately 60% of total consumption across the Asia-Pacific region. This category demonstrates strong growth driven by increasing demand for plant-based meat alternatives and dairy substitutes. Innovation opportunities exist in developing specialized formulations for specific food applications, including improved taste profiles and enhanced functional properties.

Animal Feed Category maintains steady demand growth, particularly in aquaculture applications where soy protein concentrate provides essential amino acids for fish and shrimp production. The segment benefits from expanding aquaculture industry across Southeast Asia and growing demand for sustainable protein sources in animal nutrition. Quality requirements continue to increase as feed manufacturers focus on animal health and growth performance optimization.

Nutritional Supplements Category shows the highest growth rate at approximately 12% annually, driven by increasing health consciousness and aging population demographics. This premium segment offers higher profit margins and opportunities for product differentiation through specialized formulations. Regulatory compliance requirements in this category drive quality improvements across the entire supply chain.

Industrial Applications Category represents emerging opportunities in technical applications including biodegradable plastics, adhesives, and specialty chemicals. While currently small, this segment offers potential for high-value applications and market diversification. Research and development investments in this category could create new revenue streams for manufacturers.

Industry participants and stakeholders in the Asia-Pacific soy protein concentrate market enjoy numerous benefits from market participation, including revenue growth opportunities, technological advancement access, and strategic positioning advantages.

Manufacturers benefit from growing market demand, enabling capacity utilization optimization and economies of scale realization. The expanding application base provides opportunities for product portfolio diversification and risk mitigation across multiple market segments. Technology investments in processing efficiency create competitive advantages and improved profit margins through cost reduction and quality enhancement.

Suppliers and distributors gain from stable demand growth and expanding distribution networks across the region. The market’s growth trajectory provides opportunities for long-term partnerships and strategic relationships with key customers. Supply chain optimization initiatives create value through improved logistics efficiency and reduced distribution costs.

End-users benefit from improved product availability, quality consistency, and competitive pricing resulting from market competition and technological advancement. Food manufacturers gain access to versatile protein ingredients enabling product innovation and market differentiation. Nutritional supplement companies benefit from high-quality protein sources supporting premium product development.

Investors and financial stakeholders benefit from market growth potential and attractive return opportunities in a expanding industry. The market’s resilience and growth trajectory provide investment security while offering participation in sustainable protein industry development. Strategic partnerships and acquisition opportunities enable portfolio diversification and market access expansion.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the Asia-Pacific soy protein concentrate industry reflect evolving consumer preferences, technological innovations, and strategic industry developments that will influence future market direction.

Clean Label Movement drives increasing demand for minimally processed soy protein concentrates with transparent ingredient sourcing and production methods. Consumers increasingly scrutinize food labels, creating opportunities for manufacturers emphasizing natural processing methods and organic certification. Traceability requirements are becoming standard across premium market segments, requiring supply chain transparency and quality documentation.

Functional Enhancement Trends focus on developing soy protein concentrates with improved solubility, emulsification, and gel formation properties. Manufacturers invest in research and development to create specialized formulations for specific applications. Protein modification techniques enable customization of functional properties to meet precise customer requirements across diverse applications.

Sustainability Integration becomes increasingly important as consumers and businesses prioritize environmentally responsible protein sources. Manufacturers implement sustainable production practices, reduce water usage, and minimize carbon footprint throughout the supply chain. Circular economy principles drive innovation in waste reduction and byproduct utilization, creating additional value streams.

Digital Transformation influences market operations through implementation of advanced analytics, supply chain optimization, and customer relationship management systems. Industry 4.0 technologies enable predictive maintenance, quality monitoring, and production efficiency improvements across processing facilities.

Recent industry developments demonstrate the dynamic nature of the Asia-Pacific soy protein concentrate market, with significant investments, technological innovations, and strategic initiatives shaping market evolution.

Capacity Expansion Projects across major producing countries indicate strong confidence in market growth prospects. Leading manufacturers announce substantial investments in new processing facilities and equipment upgrades to meet growing demand. MarkWide Research analysis indicates that regional processing capacity is expected to increase by approximately 25% over the next three years through these expansion initiatives.

Technology Partnerships between equipment manufacturers and protein processors drive innovation in extraction efficiency and product quality. Collaborative research projects focus on developing next-generation processing technologies that improve yield and reduce environmental impact. Automation investments enhance production consistency and reduce labor costs across processing operations.

Strategic Acquisitions and joint ventures reshape competitive landscape as companies seek to expand market presence and capabilities. International players acquire regional manufacturers to gain local market access and production capabilities. Vertical integration strategies enable better supply chain control and quality assurance throughout the value chain.

Regulatory Harmonization Efforts across Asia-Pacific countries aim to standardize quality requirements and facilitate trade. Government initiatives support industry development through research funding and infrastructure investments. Export promotion programs help regional manufacturers access international markets and compete globally.

Strategic recommendations for Asia-Pacific soy protein concentrate market participants focus on leveraging growth opportunities while addressing market challenges through targeted initiatives and strategic positioning.

Product Innovation Priority should focus on developing specialized formulations for emerging applications, particularly in plant-based meat alternatives and functional foods. Companies should invest in research and development capabilities to create differentiated products with enhanced functional properties. Customer collaboration in product development ensures market relevance and application success.

Quality Standardization Initiatives are essential for building market confidence and enabling premium positioning. Manufacturers should implement comprehensive quality management systems and pursue international certifications. Supply chain transparency becomes increasingly important for meeting customer requirements and regulatory compliance.

Market Diversification Strategies should explore opportunities beyond traditional applications, including technical and industrial uses for soy protein concentrate. Geographic diversification across Asia-Pacific countries reduces market concentration risk and captures growth opportunities. Export market development provides additional revenue streams and market expansion possibilities.

Sustainability Integration should become central to business strategy, addressing environmental concerns while creating competitive advantages. Companies should implement sustainable production practices and communicate environmental benefits to stakeholders. Circular economy approaches create additional value while reducing environmental impact.

The future outlook for the Asia-Pacific soy protein concentrate market appears highly positive, with multiple growth drivers supporting sustained expansion across diverse applications and geographic markets. MWR projections indicate continued strong growth momentum driven by fundamental market trends and emerging opportunities.

Market expansion is expected to accelerate through increasing adoption of plant-based proteins and growing industrial demand for functional protein ingredients. The region’s competitive advantages in production costs and processing capabilities position Asia-Pacific as a global leader in soy protein concentrate supply. Innovation investments will drive product development and market differentiation opportunities.

Technology advancement will continue transforming production processes, improving efficiency and product quality while reducing environmental impact. Advanced extraction methods and processing technologies will enable development of specialized products for premium applications. Automation integration will enhance production consistency and cost competitiveness.

Regional integration through trade agreements and harmonized standards will facilitate market access and supply chain optimization. Growing middle-class populations across Asia-Pacific countries will drive sustained demand growth for protein products. Export opportunities to global markets will provide additional growth drivers for regional producers.

Sustainability focus will become increasingly important, with companies implementing environmentally responsible practices and developing sustainable product offerings. Consumer awareness of environmental issues will drive demand for sustainably produced protein ingredients. Regulatory support for sustainable agriculture and processing will create favorable conditions for market development.

The Asia-Pacific soy protein concentrate market represents a dynamic and rapidly growing industry with substantial opportunities for continued expansion across multiple applications and geographic regions. The market’s strong fundamentals, including established production infrastructure, growing consumer demand, and technological innovation capabilities, position it for sustained growth in the coming years.

Key success factors for market participants include product innovation, quality excellence, strategic positioning, and sustainability integration. Companies that effectively leverage these factors while addressing market challenges will be well-positioned to capture growth opportunities and build competitive advantages. The market’s evolution toward premium applications and specialized formulations creates opportunities for value creation and differentiation.

Strategic priorities should focus on meeting evolving customer requirements through product development, quality enhancement, and service excellence. The growing importance of sustainability and environmental responsibility requires integration of these considerations into business strategy and operations. Market participants must balance growth ambitions with operational excellence and stakeholder value creation.

Future market development will be shaped by technological advancement, regulatory evolution, and changing consumer preferences toward sustainable protein sources. The Asia-Pacific region’s strategic advantages in cost competitiveness and production capabilities provide strong foundations for continued market leadership in the global soy protein concentrate industry. Success will require adaptability, innovation, and strategic focus on emerging opportunities while maintaining operational excellence and customer satisfaction.

What is Soy Protein Concentrate?

Soy Protein Concentrate is a high-protein ingredient derived from soybeans, commonly used in food products for its nutritional benefits and functional properties. It is often utilized in meat alternatives, dairy products, and protein supplements.

What are the key players in the Asia-Pacific Soy Protein Concentrate Market?

Key players in the Asia-Pacific Soy Protein Concentrate Market include Cargill, Archer Daniels Midland Company, DuPont, and CHS Inc., among others.

What are the growth factors driving the Asia-Pacific Soy Protein Concentrate Market?

The growth of the Asia-Pacific Soy Protein Concentrate Market is driven by increasing health consciousness among consumers, the rising demand for plant-based protein sources, and the expansion of the food and beverage industry.

What challenges does the Asia-Pacific Soy Protein Concentrate Market face?

Challenges in the Asia-Pacific Soy Protein Concentrate Market include fluctuating raw material prices, competition from other protein sources, and potential allergenic reactions among consumers.

What opportunities exist in the Asia-Pacific Soy Protein Concentrate Market?

Opportunities in the Asia-Pacific Soy Protein Concentrate Market include the growing trend of veganism, innovations in food technology, and the increasing incorporation of soy protein in functional foods and dietary supplements.

What trends are shaping the Asia-Pacific Soy Protein Concentrate Market?

Trends in the Asia-Pacific Soy Protein Concentrate Market include the rise of clean label products, the development of new soy protein formulations, and the increasing focus on sustainability in food production.

Asia-Pacific Soy Protein Concentrate Market

| Segmentation Details | Description |

|---|---|

| Product Type | Isolates, Concentrates, Textured Soy Protein, Soy Flour |

| End User | Food & Beverage, Nutraceuticals, Animal Feed, Personal Care |

| Application | Meat Alternatives, Dairy Alternatives, Protein Supplements, Bakery Products |

| Packaging Type | Bags, Tetra Packs, Bulk Containers, Sachets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Soy Protein Concentrate Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at