444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific smart watch market represents one of the most dynamic and rapidly evolving segments within the global wearable technology landscape. This region has emerged as a powerhouse for smart watch adoption, driven by increasing health consciousness, technological advancement, and rising disposable incomes across key economies. The market encompasses a diverse range of products from basic fitness trackers to sophisticated health monitoring devices that integrate seamlessly with smartphones and other connected devices.

Regional dynamics indicate that countries like China, Japan, South Korea, and India are leading the charge in smart watch adoption, with each market presenting unique characteristics and consumer preferences. The Asia Pacific region benefits from being home to several major smart watch manufacturers, creating a competitive ecosystem that drives innovation and keeps prices accessible to a broader consumer base.

Market penetration continues to accelerate as consumers increasingly recognize the value proposition of smart watches beyond simple timekeeping. Features such as health monitoring, fitness tracking, mobile payments, and communication capabilities have transformed these devices into essential lifestyle accessories. The region’s tech-savvy population and early adoption of mobile technologies create an ideal environment for smart watch market expansion.

Growth trajectories across different Asia Pacific markets vary significantly, with developed economies like Japan and South Korea showing mature adoption patterns, while emerging markets such as India and Southeast Asian countries present substantial growth opportunities. This diversity creates a complex but lucrative market landscape for manufacturers and technology providers.

The Asia Pacific smart watch market refers to the regional segment encompassing the design, manufacturing, distribution, and consumption of wearable computing devices that combine traditional timekeeping with advanced digital functionalities across Asia Pacific countries. These devices typically feature touchscreen interfaces, wireless connectivity, health monitoring sensors, and integration capabilities with smartphones and other digital ecosystems.

Smart watches in this market context include various categories ranging from fitness-focused wearables to comprehensive health monitoring devices, luxury smart timepieces, and specialized applications for specific user segments. The market encompasses both hardware components and associated software services, including mobile applications, cloud-based health platforms, and subscription-based premium features.

Regional characteristics define this market through unique consumer preferences, regulatory environments, distribution channels, and technological infrastructure that distinguish Asia Pacific from other global markets. The market includes both international brands and domestic manufacturers, creating a competitive landscape that drives innovation and market accessibility.

Market dynamics in the Asia Pacific smart watch sector demonstrate robust growth momentum driven by technological innovation, increasing health awareness, and expanding digital lifestyle adoption. The region’s diverse economic landscape provides opportunities for both premium and affordable smart watch segments, with manufacturers adapting their strategies to meet varied consumer needs and purchasing power across different countries.

Key growth drivers include the rising prevalence of lifestyle diseases, government initiatives promoting digital health, increasing smartphone penetration, and growing consumer awareness of preventive healthcare. The integration of advanced features such as ECG monitoring, blood oxygen measurement, and sleep tracking has expanded the market beyond traditional fitness enthusiasts to include health-conscious consumers of all ages.

Competitive landscape features a mix of global technology giants and regional players, with companies like Apple, Samsung, Huawei, Xiaomi, and Fitbit competing alongside emerging local brands. This competition has resulted in rapid feature development, improved battery life, enhanced design aesthetics, and more competitive pricing strategies.

Market segmentation reveals distinct preferences across different age groups, income levels, and geographic regions within Asia Pacific. Premium segments focus on advanced health monitoring and luxury design elements, while mass market segments emphasize affordability, basic fitness tracking, and long battery life.

Consumer adoption patterns across Asia Pacific markets reveal several critical insights that shape market development strategies. The following key insights demonstrate the market’s evolution and future potential:

Health consciousness revolution across Asia Pacific countries represents the primary driver for smart watch adoption. Rising awareness of preventive healthcare, coupled with increasing incidence of lifestyle-related diseases, has created strong demand for continuous health monitoring capabilities. Consumers increasingly view smart watches as essential tools for maintaining healthy lifestyles and early detection of potential health issues.

Technological advancement continues to drive market expansion through improved sensor accuracy, enhanced processing power, and extended battery life. The integration of advanced features such as electrocardiogram monitoring, blood oxygen saturation measurement, and fall detection has elevated smart watches from simple fitness trackers to comprehensive health monitoring devices.

Digital payment adoption throughout the region has accelerated smart watch utility beyond health and fitness applications. The convenience of contactless payments through wearable devices appeals to consumers in markets with high mobile payment penetration, particularly in China, South Korea, and urban areas across Southeast Asia.

Government initiatives promoting digital health and wellness programs provide additional market stimulus. Several Asia Pacific governments have launched public health campaigns that encourage the use of wearable technology for population health monitoring and preventive care initiatives.

Smartphone ecosystem integration creates synergistic benefits that enhance the value proposition of smart watches. As smartphone penetration continues to grow across the region, consumers increasingly appreciate the convenience of receiving notifications, controlling music, and accessing apps directly from their wrists.

Price sensitivity in several Asia Pacific markets continues to limit widespread adoption of premium smart watch models. Despite growing disposable incomes, many consumers in emerging economies remain cautious about investing in wearable technology, particularly when compared to essential technology purchases like smartphones.

Battery life limitations present ongoing challenges for user satisfaction and market acceptance. Despite improvements in battery technology, many smart watches still require daily charging, which some consumers find inconvenient compared to traditional watches that require minimal maintenance.

Data privacy concerns have emerged as significant barriers to adoption, particularly regarding health data collection and sharing. Consumers express apprehension about how their personal health information is stored, processed, and potentially shared with third parties, including insurance companies and healthcare providers.

Cultural preferences for traditional timepieces in certain market segments create resistance to smart watch adoption. Some consumers, particularly in older demographics, prefer the aesthetic and symbolic value of conventional watches over digital alternatives.

Technical complexity can overwhelm less tech-savvy consumers, particularly in markets with lower digital literacy rates. The learning curve associated with setting up and optimizing smart watch features may deter potential users who prefer simpler, more intuitive devices.

Emerging market penetration presents substantial growth opportunities as smartphone adoption continues to expand across Southeast Asia, India, and other developing economies within the region. These markets offer significant potential for affordable smart watch models that provide essential features without premium pricing.

Healthcare integration opportunities are expanding as healthcare systems across Asia Pacific increasingly embrace digital health solutions. Partnerships between smart watch manufacturers and healthcare providers could create new revenue streams through remote patient monitoring and chronic disease management programs.

Enterprise wellness programs represent an underexplored market segment with significant potential. Companies across the region are increasingly investing in employee wellness initiatives, creating opportunities for bulk smart watch deployments and specialized corporate health monitoring solutions.

Elderly care applications present growing opportunities as Asia Pacific populations age rapidly. Smart watches designed specifically for senior citizens, featuring fall detection, medication reminders, and emergency communication capabilities, could address critical market needs.

Sports and fitness partnerships offer opportunities for specialized smart watch applications. Collaborations with professional sports leagues, fitness chains, and athletic organizations could drive adoption among specific user segments and create brand differentiation opportunities.

Competitive intensity within the Asia Pacific smart watch market continues to escalate as both global and regional players vie for market share. This competition drives rapid innovation cycles, with manufacturers regularly introducing new features, improved designs, and more competitive pricing strategies to maintain market position.

Supply chain dynamics play crucial roles in market development, with many Asia Pacific countries serving as both manufacturing hubs and consumer markets. This dual role creates advantages in terms of cost efficiency and market responsiveness, while also presenting challenges related to component sourcing and quality control.

Regulatory environment variations across different Asia Pacific markets create complex compliance requirements for manufacturers. Health data regulations, import duties, and certification requirements differ significantly between countries, influencing market entry strategies and product development approaches.

Consumer behavior evolution demonstrates increasing sophistication in smart watch usage patterns. Early adopters who initially purchased devices primarily for fitness tracking now utilize comprehensive feature sets including mobile payments, communication, and productivity applications.

Technology convergence trends indicate growing integration between smart watches and other connected devices within the Internet of Things ecosystem. This convergence creates opportunities for enhanced functionality while also increasing complexity in product development and user experience design.

Comprehensive market analysis for the Asia Pacific smart watch market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research involves direct engagement with industry stakeholders, including manufacturers, distributors, retailers, and end consumers across key markets within the region.

Primary data collection encompasses structured interviews with industry executives, consumer surveys across different demographic segments, and focus group discussions to understand user preferences and adoption barriers. This approach provides qualitative insights that complement quantitative market data.

Secondary research involves analysis of industry reports, company financial statements, regulatory filings, and trade association data to establish market baselines and validate primary research findings. This methodology ensures comprehensive coverage of market dynamics and competitive landscapes.

Market segmentation analysis utilizes both demographic and psychographic variables to identify distinct consumer groups and their specific needs. This approach enables more precise market sizing and opportunity identification across different product categories and geographic regions.

Trend analysis incorporates historical data review, current market assessment, and forward-looking projections based on identified growth drivers and market constraints. MarkWide Research methodology emphasizes data triangulation to ensure reliability and accuracy of market projections.

China dominates the Asia Pacific smart watch market with approximately 45% market share, driven by strong domestic manufacturing capabilities, high smartphone penetration, and growing health consciousness among urban populations. Chinese consumers demonstrate strong preference for feature-rich devices at competitive price points, with local brands like Huawei and Xiaomi competing effectively against international players.

Japan represents a mature market characterized by premium product preferences and high adoption rates among tech-savvy consumers. The market shows 78% smartphone integration with smart watches, indicating sophisticated usage patterns and ecosystem adoption. Japanese consumers prioritize build quality, design aesthetics, and advanced health monitoring features.

South Korea demonstrates strong growth momentum with 12% annual adoption rate increases, supported by advanced telecommunications infrastructure and high consumer technology acceptance. The market benefits from domestic manufacturing presence and strong integration with mobile payment systems.

India presents significant growth potential with rapidly expanding middle-class populations and increasing health awareness. The market shows 35% year-over-year growth in affordable smart watch segments, driven by local manufacturing initiatives and competitive pricing strategies from both domestic and international brands.

Southeast Asian markets including Thailand, Malaysia, Singapore, and Indonesia collectively represent emerging opportunities with 28% combined market growth. These markets demonstrate varying adoption patterns based on economic development levels and consumer technology readiness.

Australia and New Zealand show mature market characteristics with focus on premium features and health monitoring capabilities. These markets demonstrate 65% consumer satisfaction rates with current smart watch offerings, indicating successful product-market fit.

Market leadership in the Asia Pacific smart watch sector is contested among several key players, each bringing distinct strengths and market positioning strategies. The competitive environment continues to evolve rapidly with new entrants and innovative product offerings.

Competitive strategies vary significantly across different market segments and geographic regions. Premium brands focus on advanced features and ecosystem integration, while mass market players emphasize affordability and essential functionality.

By Technology:

By Application:

By Price Range:

By End User:

Health and Fitness Category dominates the Asia Pacific smart watch market, representing the largest segment by both volume and revenue. This category benefits from increasing health consciousness and growing awareness of preventive healthcare benefits. Advanced features such as heart rate monitoring, sleep tracking, and stress management appeal to health-conscious consumers across all age groups.

Premium Smart Watch Category shows strong performance in developed markets like Japan, South Korea, and urban China. These devices command higher margins and demonstrate strong brand loyalty among consumers who value advanced features, premium materials, and comprehensive ecosystem integration.

Fitness Tracker Category maintains significant market presence, particularly in price-sensitive segments and among first-time wearable device users. These devices offer essential health monitoring features at accessible price points, serving as entry-level products that may lead to future premium upgrades.

Hybrid Smart Watch Category appeals to consumers who prefer traditional watch aesthetics while wanting basic smart features. This category performs well among older demographics and fashion-conscious consumers who prioritize style over comprehensive functionality.

Sports-Specific Category targets athletic enthusiasts and professional athletes with specialized features for specific sports and activities. These devices often include GPS tracking, advanced performance metrics, and sport-specific training programs.

Manufacturers benefit from expanding market opportunities across diverse Asia Pacific economies, enabling revenue growth through both premium and mass market segments. The region’s manufacturing capabilities provide cost advantages and supply chain efficiencies that enhance competitive positioning globally.

Retailers gain from increasing consumer demand and higher-margin product categories that enhance overall profitability. Smart watches create opportunities for cross-selling accessories and services while building stronger customer relationships through technology consultation and support services.

Healthcare providers can leverage smart watch data for improved patient monitoring, preventive care programs, and population health management initiatives. Integration with electronic health records and telemedicine platforms creates new service delivery models and revenue opportunities.

Consumers receive enhanced health monitoring capabilities, improved lifestyle management tools, and convenient access to digital services through wearable technology. The expanding feature sets and improving affordability make smart watches increasingly valuable lifestyle accessories.

Technology ecosystem partners including app developers, cloud service providers, and payment processors benefit from expanding platforms and user bases that create new business opportunities and revenue streams.

Insurance companies can utilize smart watch data for risk assessment, wellness program development, and personalized insurance products that better reflect individual health behaviors and outcomes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Advanced Health Monitoring continues to evolve with integration of medical-grade sensors and FDA-approved health features. Smart watches increasingly offer ECG monitoring, blood oxygen measurement, and sleep apnea detection, transforming these devices into comprehensive health management tools.

Extended Battery Life improvements address one of the primary consumer concerns about smart watch adoption. Manufacturers are implementing more efficient processors, optimized software, and improved battery technologies to achieve multi-day usage without compromising functionality.

Fashion Integration trends show smart watches becoming more style-conscious with luxury brand partnerships, customizable designs, and premium materials. This trend appeals to fashion-forward consumers who want technology that complements their personal style.

Ecosystem Expansion demonstrates growing integration between smart watches and other connected devices including smart homes, automobiles, and IoT applications. This connectivity creates more comprehensive user experiences and increases device utility.

AI and Machine Learning integration enables more personalized health insights, predictive analytics, and automated coaching features. These capabilities enhance user engagement and provide more valuable health and fitness guidance.

Contactless Payment Growth accelerates smart watch adoption in markets with high mobile payment penetration. The convenience of wrist-based payments appeals to consumers seeking streamlined transaction experiences.

Regulatory approvals for medical-grade features have expanded smart watch capabilities in health monitoring applications. Recent approvals for ECG monitoring and irregular heart rhythm detection have elevated smart watches from fitness accessories to legitimate health monitoring devices.

Manufacturing partnerships between global brands and Asia Pacific manufacturers continue to evolve, with increased focus on local market customization and regional feature preferences. These partnerships enable better market responsiveness and cost optimization.

Healthcare collaborations between smart watch manufacturers and medical institutions are expanding, creating opportunities for clinical validation of health monitoring features and integration with healthcare delivery systems.

Technology breakthroughs in sensor miniaturization, battery efficiency, and processing power continue to enhance smart watch capabilities while reducing size and power consumption. These advances enable more sophisticated features in increasingly compact form factors.

Market consolidation activities include strategic acquisitions and partnerships that strengthen competitive positions and expand market reach. These developments reshape the competitive landscape and influence future market dynamics.

Sustainability initiatives are becoming increasingly important as manufacturers address environmental concerns through recycling programs, sustainable materials, and energy-efficient designs that appeal to environmentally conscious consumers.

Market entry strategies should focus on understanding local consumer preferences and price sensitivity levels across different Asia Pacific markets. MarkWide Research analysis suggests that successful market penetration requires tailored approaches for each country’s unique characteristics and consumer behaviors.

Product development priorities should emphasize battery life improvements, health monitoring accuracy, and local language support to address primary consumer concerns and adoption barriers. Companies should invest in features that provide clear value propositions for target market segments.

Partnership opportunities with healthcare providers, fitness organizations, and enterprise wellness programs can create new revenue streams and market differentiation. These partnerships also provide validation for health monitoring features and expand potential user bases.

Pricing strategies must balance feature richness with market accessibility, particularly in price-sensitive segments. Tiered product portfolios that offer multiple price points can capture broader market segments while maintaining premium positioning for advanced features.

Distribution channel optimization should include both online and offline retail strategies, with emphasis on experiential retail environments where consumers can test devices and understand feature benefits before purchasing.

Brand building initiatives should focus on health and wellness positioning rather than purely technology-focused messaging. Consumer education about health benefits and lifestyle improvements can drive adoption beyond early technology adopters.

Market growth projections indicate continued expansion across Asia Pacific markets, with emerging economies expected to drive significant volume growth while developed markets focus on premium feature adoption. The overall market trajectory remains positive despite varying growth rates across different countries and segments.

Technology evolution will likely focus on health monitoring advancement, with potential integration of non-invasive glucose monitoring, blood pressure measurement, and other medical-grade capabilities. These developments could transform smart watches into essential healthcare devices rather than optional lifestyle accessories.

Market maturation patterns suggest that early adopter markets will transition toward replacement cycles and premium feature upgrades, while emerging markets will continue experiencing first-time adoption growth. This dynamic creates opportunities for different product positioning strategies.

Ecosystem integration will deepen as smart watches become central components of comprehensive digital health and lifestyle management systems. Integration with smart homes, connected cars, and workplace systems will enhance device utility and user engagement.

Regulatory developments may establish clearer frameworks for health data management and medical device classification, potentially creating both opportunities and compliance requirements for manufacturers. These changes could influence product development priorities and market entry strategies.

Competitive landscape evolution will likely see continued consolidation among smaller players while major brands strengthen their market positions through innovation and ecosystem development. New entrants may focus on specialized applications or underserved market segments.

The Asia Pacific smart watch market represents a dynamic and rapidly evolving sector with substantial growth potential across diverse economic and cultural landscapes. The region’s unique combination of manufacturing capabilities, technology adoption readiness, and expanding middle-class populations creates favorable conditions for continued market expansion.

Market drivers including health consciousness, technological advancement, and digital lifestyle adoption continue to fuel demand across multiple consumer segments. While challenges such as price sensitivity and cultural preferences exist, the overall trajectory remains strongly positive with emerging opportunities in healthcare integration and enterprise applications.

Success factors for market participants include understanding local market nuances, developing appropriate pricing strategies, and creating products that address specific regional needs and preferences. The diversity of Asia Pacific markets requires flexible approaches that can adapt to varying consumer behaviors and economic conditions.

Future prospects indicate continued innovation in health monitoring capabilities, improved battery technology, and deeper ecosystem integration that will enhance smart watch utility and appeal. As the market matures, successful companies will be those that can balance advanced features with accessibility while building strong brand relationships with consumers across the region’s diverse markets.

What is Smart Watch?

A smart watch is a wearable device that combines the functionality of a traditional watch with advanced features such as fitness tracking, notifications, and connectivity to smartphones. These devices often include health monitoring capabilities, GPS, and various applications for enhanced user experience.

What are the key players in the Asia Pacific Smart Watch Market?

Key players in the Asia Pacific Smart Watch Market include Apple, Samsung, Garmin, and Fitbit, among others. These companies are known for their innovative designs and technology integration in smart watches, catering to a diverse consumer base.

What are the growth factors driving the Asia Pacific Smart Watch Market?

The Asia Pacific Smart Watch Market is driven by increasing health awareness, the rising popularity of fitness tracking, and advancements in technology. Additionally, the growing demand for connected devices and the integration of smart features in watches contribute to market growth.

What challenges does the Asia Pacific Smart Watch Market face?

Challenges in the Asia Pacific Smart Watch Market include high competition among manufacturers, rapid technological changes, and consumer concerns regarding battery life and device durability. These factors can impact market penetration and consumer adoption rates.

What opportunities exist in the Asia Pacific Smart Watch Market?

Opportunities in the Asia Pacific Smart Watch Market include the expansion of e-commerce platforms, increasing demand for health and wellness applications, and the potential for integration with smart home devices. These trends can enhance user engagement and drive sales.

What trends are shaping the Asia Pacific Smart Watch Market?

Trends shaping the Asia Pacific Smart Watch Market include the rise of customizable watch faces, the integration of advanced health monitoring features, and the growing popularity of hybrid smart watches. These innovations cater to diverse consumer preferences and enhance functionality.

Asia Pacific Smart Watch Market

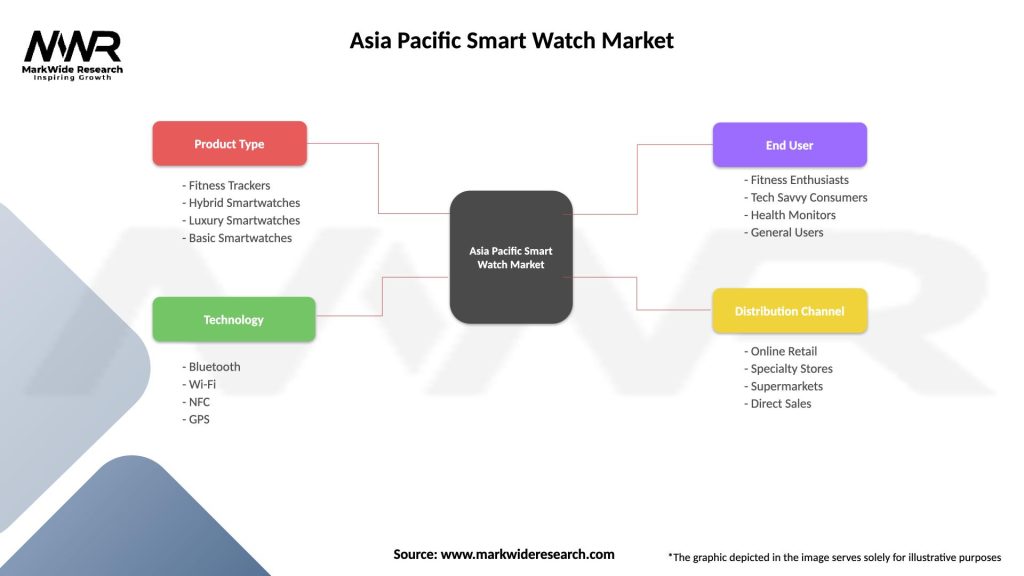

| Segmentation Details | Description |

|---|---|

| Product Type | Fitness Trackers, Hybrid Smartwatches, Luxury Smartwatches, Basic Smartwatches |

| Technology | Bluetooth, Wi-Fi, NFC, GPS |

| End User | Fitness Enthusiasts, Tech Savvy Consumers, Health Monitors, General Users |

| Distribution Channel | Online Retail, Specialty Stores, Supermarkets, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Smart Watch Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at