444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific smart office market represents a transformative segment within the region’s rapidly evolving commercial real estate and technology landscape. This dynamic market encompasses integrated solutions that leverage Internet of Things (IoT) devices, artificial intelligence, cloud computing, and advanced automation systems to create intelligent workplace environments. Smart office technologies are revolutionizing how businesses operate across major economies including China, Japan, India, South Korea, and Australia, driving unprecedented efficiency gains and employee satisfaction improvements.

Market dynamics indicate robust growth momentum, with the region experiencing a 12.8% compound annual growth rate in smart office technology adoption. The convergence of digital transformation initiatives, sustainability mandates, and post-pandemic workplace evolution has accelerated demand for intelligent building solutions. Enterprise organizations are increasingly investing in smart lighting systems, occupancy sensors, climate control automation, and integrated workspace management platforms to optimize operational efficiency and enhance employee experiences.

Regional leadership in smart office implementation varies significantly, with Singapore and Hong Kong demonstrating 78% adoption rates among Grade A commercial buildings, while emerging markets like Vietnam and Thailand show 35% penetration rates but rapid acceleration in deployment. The market encompasses diverse technology categories including building management systems, energy management solutions, security and access control, and collaborative workspace technologies that collectively reshape traditional office environments into responsive, data-driven ecosystems.

The Asia Pacific smart office market refers to the comprehensive ecosystem of interconnected technologies, systems, and solutions designed to create intelligent, responsive, and efficient workplace environments across the Asia Pacific region. This market encompasses hardware, software, and services that enable buildings and office spaces to automatically adjust lighting, temperature, security, and other environmental factors based on occupancy patterns, user preferences, and operational requirements.

Smart office solutions integrate multiple technological components including IoT sensors, cloud-based analytics platforms, mobile applications, and automated control systems to deliver seamless workplace experiences. These technologies enable real-time monitoring, predictive maintenance, energy optimization, and enhanced collaboration capabilities that transform traditional static office environments into dynamic, adaptive spaces that respond intelligently to user needs and business objectives.

Strategic market positioning reveals the Asia Pacific smart office market as a critical growth driver within the broader digital transformation landscape. The market demonstrates exceptional momentum driven by increasing urbanization, rising energy costs, and evolving workforce expectations for technology-enabled workplace experiences. Key market segments including building automation, workspace analytics, and collaborative technologies are experiencing accelerated adoption across diverse industry verticals.

Technology convergence represents a fundamental market characteristic, with artificial intelligence, machine learning, and IoT integration creating sophisticated ecosystem solutions. Major market participants are developing comprehensive platforms that combine energy management, space utilization optimization, and employee wellness monitoring capabilities. Regional variations in adoption patterns reflect different regulatory environments, infrastructure maturity levels, and economic development stages across Asia Pacific countries.

Investment trends indicate substantial capital allocation toward smart office infrastructure, with enterprises prioritizing solutions that deliver measurable returns on investment through energy savings, productivity improvements, and operational efficiency gains. The market benefits from supportive government policies promoting smart city initiatives and sustainable building practices across multiple Asia Pacific jurisdictions.

Market intelligence reveals several critical insights shaping the Asia Pacific smart office landscape:

Digital transformation initiatives serve as the primary catalyst propelling Asia Pacific smart office market expansion. Organizations across the region are embracing comprehensive digitization strategies that encompass workplace modernization as a core component. Enterprise leaders recognize that intelligent office environments directly contribute to employee productivity, operational efficiency, and competitive advantage in increasingly dynamic business landscapes.

Energy cost optimization represents another significant market driver, particularly as utility expenses continue rising across major Asia Pacific markets. Smart office technologies deliver substantial energy savings through automated lighting control, HVAC optimization, and intelligent power management systems. Corporate sustainability mandates further amplify this driver, with organizations seeking measurable environmental impact reductions through technology-enabled efficiency improvements.

Workforce evolution demands are reshaping workplace expectations, with younger employees expecting technology-rich environments that support flexible working arrangements and seamless digital experiences. The growing emphasis on employee wellness and satisfaction drives investment in smart office solutions that can monitor air quality, optimize lighting conditions, and provide personalized environmental controls.

Regulatory support from governments promoting smart city development and sustainable building practices creates favorable market conditions. Many Asia Pacific countries offer incentives for smart building implementations and mandate energy efficiency standards that encourage smart office technology adoption.

Implementation complexity poses significant challenges for organizations considering smart office deployments. The integration of multiple technology systems, legacy infrastructure compatibility issues, and the need for specialized technical expertise can create substantial barriers to adoption. System integration challenges often result in extended deployment timelines and higher-than-anticipated implementation costs that discourage potential adopters.

Cybersecurity concerns represent growing restraints as smart office systems create expanded attack surfaces for potential security breaches. Organizations must invest heavily in cybersecurity measures and ongoing monitoring capabilities to protect sensitive data and maintain system integrity. Data privacy regulations across different Asia Pacific jurisdictions add compliance complexity that can slow market adoption.

High initial investment requirements continue to limit market penetration, particularly among small and medium-sized enterprises. While smart office solutions deliver long-term operational savings, the upfront capital requirements for comprehensive implementations can be prohibitive for organizations with limited technology budgets.

Skills shortage in specialized areas such as IoT system management, data analytics, and building automation creates operational challenges for organizations seeking to maximize their smart office investments. The limited availability of qualified technical personnel can impact system performance and return on investment realization.

Artificial intelligence integration presents substantial opportunities for market expansion as AI-powered analytics become more sophisticated and accessible. Advanced machine learning algorithms can optimize building operations, predict maintenance requirements, and provide actionable insights that significantly enhance operational efficiency. Predictive analytics capabilities enable proactive facility management that reduces downtime and improves user experiences.

Edge computing adoption creates opportunities for more responsive and secure smart office solutions. By processing data locally rather than relying solely on cloud-based systems, edge computing reduces latency, improves system reliability, and addresses data privacy concerns. This technological advancement opens new possibilities for real-time optimization and enhanced user experiences.

Sustainability integration opportunities are expanding as organizations seek comprehensive solutions that address environmental, social, and governance (ESG) objectives. Smart office technologies that can demonstrate measurable sustainability impacts through carbon footprint reduction, waste minimization, and resource optimization align with growing corporate responsibility initiatives.

Market expansion into emerging Asia Pacific economies presents significant growth opportunities as these markets develop modern commercial real estate sectors and embrace digital transformation initiatives. Countries experiencing rapid urbanization and economic growth represent untapped potential for smart office solution providers.

Competitive dynamics within the Asia Pacific smart office market reflect a complex ecosystem of established technology providers, emerging startups, and regional specialists. Market consolidation trends are evident as larger players acquire specialized solution providers to create comprehensive platform offerings. This consolidation enables more integrated solutions but also creates challenges for smaller market participants seeking to maintain competitive positioning.

Technology evolution continues at a rapid pace, with new capabilities in artificial intelligence, machine learning, and IoT connectivity regularly transforming market expectations. Solution providers must continuously innovate to maintain relevance and competitive advantage in this dynamic environment. The integration of emerging technologies such as 5G connectivity and advanced sensor technologies creates new possibilities for smart office applications.

Customer expectations are evolving toward more comprehensive, user-friendly solutions that deliver immediate value and long-term scalability. Organizations increasingly demand solutions that can demonstrate clear return on investment through measurable efficiency improvements and cost savings. Vendor selection criteria emphasize proven implementation experience, ongoing support capabilities, and integration flexibility.

Partnership strategies are becoming increasingly important as no single vendor can address all aspects of comprehensive smart office implementations. Strategic alliances between technology providers, system integrators, and facility management companies create more robust solution offerings that can address diverse customer requirements.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Asia Pacific smart office market. Primary research includes extensive interviews with industry executives, technology providers, end-users, and market experts across key Asia Pacific countries. These interviews provide qualitative insights into market trends, challenges, and opportunities that quantitative data alone cannot capture.

Secondary research encompasses analysis of industry reports, company financial statements, government publications, and academic research to establish market context and validate primary research findings. Data triangulation techniques ensure consistency and reliability across multiple information sources, enhancing the overall accuracy of market assessments.

Market sizing methodologies utilize bottom-up and top-down approaches to establish comprehensive market perspectives. Bottom-up analysis examines individual market segments and geographic regions to build aggregate market understanding, while top-down analysis validates these findings through macroeconomic and industry-level assessments.

Quantitative analysis incorporates statistical modeling techniques to identify market trends, growth patterns, and correlation relationships between different market variables. Advanced analytics tools enable sophisticated market forecasting and scenario analysis that support strategic decision-making processes.

China dominates the Asia Pacific smart office market with 42% regional market share, driven by massive urbanization initiatives and government support for smart city development. Major cities including Beijing, Shanghai, and Shenzhen demonstrate advanced smart office implementations across commercial real estate developments. Chinese technology companies are developing innovative solutions tailored to local market requirements while expanding internationally.

Japan represents a mature market characterized by high technology adoption rates and sophisticated building automation systems. The country’s focus on energy efficiency and disaster preparedness drives demand for resilient smart office solutions. Japanese enterprises prioritize reliability and long-term performance in their technology investments, creating opportunities for premium solution providers.

India showcases rapid market growth driven by expanding IT services sector and increasing foreign investment in commercial real estate. Major metropolitan areas including Mumbai, Bangalore, and Delhi are experiencing significant smart office deployments. Cost-sensitive market dynamics favor solutions that demonstrate clear return on investment and scalable implementation approaches.

Southeast Asian markets including Singapore, Malaysia, and Thailand show strong growth potential with 28% annual adoption rate increases. Singapore leads regional innovation with government initiatives promoting smart building technologies. ASEAN economic integration creates opportunities for standardized solutions across multiple markets.

Australia and New Zealand demonstrate mature market characteristics with emphasis on sustainability and employee wellness applications. These markets prioritize solutions that support flexible working arrangements and environmental compliance requirements.

Market leadership within the Asia Pacific smart office sector encompasses both global technology giants and specialized regional providers. The competitive landscape reflects diverse approaches to smart office solutions, ranging from comprehensive integrated platforms to specialized point solutions addressing specific market needs.

Regional competitors including Asian technology companies are gaining market share through localized solutions and competitive pricing strategies. These companies often provide better understanding of local market requirements and regulatory compliance needs.

Technology segmentation reveals distinct market categories with varying growth trajectories and adoption patterns:

By Technology:

By Application:

By End-User Industry:

Building Management Systems represent the largest market category, accounting for 38% of total smart office implementations. These comprehensive platforms provide centralized control over multiple building systems and serve as the foundation for integrated smart office deployments. Advanced BMS solutions incorporate artificial intelligence capabilities that enable predictive optimization and automated decision-making processes.

Lighting Control Systems demonstrate strong growth momentum driven by LED technology adoption and energy efficiency mandates. Smart lighting solutions provide immediate energy savings while enabling personalized workspace environments. Circadian lighting systems that adjust color temperature throughout the day are gaining popularity for their employee wellness benefits.

HVAC Control Systems focus on optimizing energy consumption while maintaining optimal comfort levels. These systems utilize occupancy sensors and weather data to automatically adjust temperature and air quality settings. Zone-based control capabilities enable precise environmental management that reduces energy waste and improves user satisfaction.

Security and Access Control solutions are evolving toward mobile-first approaches that eliminate traditional key cards and enable seamless building access. Biometric authentication and facial recognition technologies are becoming standard features in premium smart office implementations.

Audio-Visual Systems support hybrid workplace models by enabling seamless collaboration between on-site and remote employees. Advanced AV solutions incorporate artificial intelligence for automatic camera tracking and audio optimization during video conferences.

Property owners and developers realize substantial benefits through increased asset values and reduced operational costs. Smart office technologies enable premium rental rates while attracting high-quality tenants seeking modern workplace environments. Operational efficiency improvements reduce facility management costs and extend equipment lifecycles through predictive maintenance capabilities.

Corporate tenants benefit from enhanced employee productivity, reduced energy costs, and improved workplace satisfaction. Smart office solutions enable flexible space utilization that adapts to changing business requirements. Data-driven insights support informed decision-making regarding space planning and resource allocation.

Technology vendors access expanding market opportunities as organizations prioritize digital transformation initiatives. The recurring revenue model associated with software-as-a-service offerings provides predictable income streams. Partnership opportunities with system integrators and facility management companies create additional revenue channels.

Employees experience improved workplace comfort, convenience, and productivity through personalized environmental controls and streamlined facility services. Mobile applications enable easy access to building services and real-time information about space availability and environmental conditions.

Facility managers gain comprehensive visibility into building operations and can proactively address maintenance issues before they impact occupants. Automated systems reduce manual intervention requirements while providing detailed analytics for continuous improvement initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents the most significant trend transforming smart office capabilities. AI-powered systems can learn from occupancy patterns, weather conditions, and user preferences to automatically optimize building operations. Machine learning algorithms continuously improve system performance and can predict maintenance requirements before equipment failures occur.

Sustainability Integration is becoming a core requirement rather than an optional feature. Organizations are seeking smart office solutions that can demonstrate measurable environmental impact reductions and support corporate ESG objectives. Carbon footprint tracking and renewable energy integration capabilities are increasingly important selection criteria.

Mobile-First Design approaches prioritize smartphone and tablet interfaces for building control and service access. Modern smart office solutions provide comprehensive mobile applications that enable employees to control their workspace environment, book meeting rooms, and access building services. User experience design focuses on intuitive interfaces that require minimal training.

Edge Computing Adoption addresses latency and security concerns by processing data locally rather than relying solely on cloud-based systems. This approach enables real-time responses to changing conditions while reducing bandwidth requirements and improving system reliability.

Wellness Technology Integration incorporates air quality monitoring, circadian lighting, and acoustic optimization to support employee health and productivity. These solutions demonstrate measurable impacts on employee satisfaction and retention rates.

Strategic partnerships between technology providers and facility management companies are creating comprehensive solution offerings that address the entire smart office lifecycle. These collaborations combine technology expertise with operational experience to deliver more effective implementations.

Acquisition activity continues as larger technology companies seek to expand their smart office capabilities through strategic purchases of specialized solution providers. Recent acquisitions focus on artificial intelligence, analytics, and user experience technologies that enhance platform capabilities.

Standards development initiatives are progressing to address interoperability challenges and enable more seamless integration between different vendor solutions. Industry organizations are working to establish common protocols and data formats that facilitate multi-vendor deployments.

Government initiatives across Asia Pacific countries are promoting smart building adoption through incentive programs and regulatory requirements. Singapore’s Smart Nation initiative and China’s smart city development programs create favorable market conditions for technology adoption.

Investment funding for smart office startups remains strong, with venture capital firms recognizing the long-term growth potential of workplace technology solutions. Recent funding rounds focus on companies developing AI-powered analytics and user experience innovations.

MarkWide Research recommends that organizations considering smart office implementations should prioritize solutions that demonstrate clear return on investment through measurable efficiency improvements. Phased deployment approaches can reduce implementation risks while enabling organizations to learn and adapt their strategies based on initial results.

Technology selection should emphasize platforms that can integrate with existing building systems and accommodate future expansion requirements. Organizations should avoid point solutions that create data silos and instead focus on comprehensive platforms that enable holistic building optimization.

Vendor evaluation processes should include thorough assessment of implementation experience, ongoing support capabilities, and financial stability. The smart office market includes many emerging companies that may lack the resources to support long-term customer relationships.

Change management initiatives are critical for successful smart office deployments. Organizations should invest in employee training and communication programs that help users understand and adopt new technologies effectively.

Security considerations must be integrated into smart office planning from the initial design phase rather than added as an afterthought. Comprehensive cybersecurity strategies should address both technology vulnerabilities and operational procedures.

Market evolution toward more intelligent and autonomous building systems will continue accelerating as artificial intelligence capabilities become more sophisticated and accessible. Predictive analytics will enable buildings to anticipate occupant needs and optimize operations proactively rather than reactively responding to changing conditions.

Integration convergence will blur traditional boundaries between different building systems as comprehensive platforms manage lighting, HVAC, security, and communications through unified interfaces. This convergence will enable more sophisticated optimization strategies that consider multiple variables simultaneously.

Sustainability requirements will become increasingly stringent as governments implement more aggressive environmental regulations and organizations commit to carbon neutrality objectives. Smart office solutions will need to demonstrate measurable environmental impact reductions and support comprehensive sustainability reporting.

User experience evolution will focus on creating more personalized and intuitive workplace environments that adapt to individual preferences and work patterns. Biometric monitoring and environmental sensing will enable buildings to automatically adjust conditions based on occupant stress levels and comfort preferences.

Market expansion into emerging Asia Pacific economies will accelerate as these countries develop modern commercial real estate sectors and embrace digital transformation initiatives. The market is projected to maintain robust double-digit growth rates across most regional markets through the forecast period.

The Asia Pacific smart office market represents a transformative force reshaping workplace environments across the region’s diverse economies. Technology convergence combining IoT, artificial intelligence, and cloud computing is creating unprecedented opportunities for operational efficiency improvements and enhanced user experiences. Market growth momentum remains strong, driven by digital transformation initiatives, sustainability mandates, and evolving workforce expectations.

Regional market dynamics reflect varying adoption patterns and growth trajectories across different countries, with mature markets like Japan and Singapore leading innovation while emerging economies demonstrate rapid catch-up potential. Competitive landscapes continue evolving as established technology providers and emerging specialists compete to deliver comprehensive solutions that address diverse customer requirements.

Future market success will depend on solution providers’ ability to deliver integrated platforms that demonstrate clear return on investment while addressing security, sustainability, and user experience requirements. Organizations that embrace smart office technologies strategically will gain competitive advantages through improved operational efficiency, enhanced employee satisfaction, and reduced environmental impact. The Asia Pacific smart office market is positioned for continued expansion as technology capabilities advance and market adoption accelerates across the region’s dynamic business landscape.

What is Smart Office?

Smart Office refers to a modern workspace that utilizes advanced technologies to enhance productivity, efficiency, and comfort. This includes the integration of IoT devices, automation systems, and data analytics to create a more responsive and adaptable work environment.

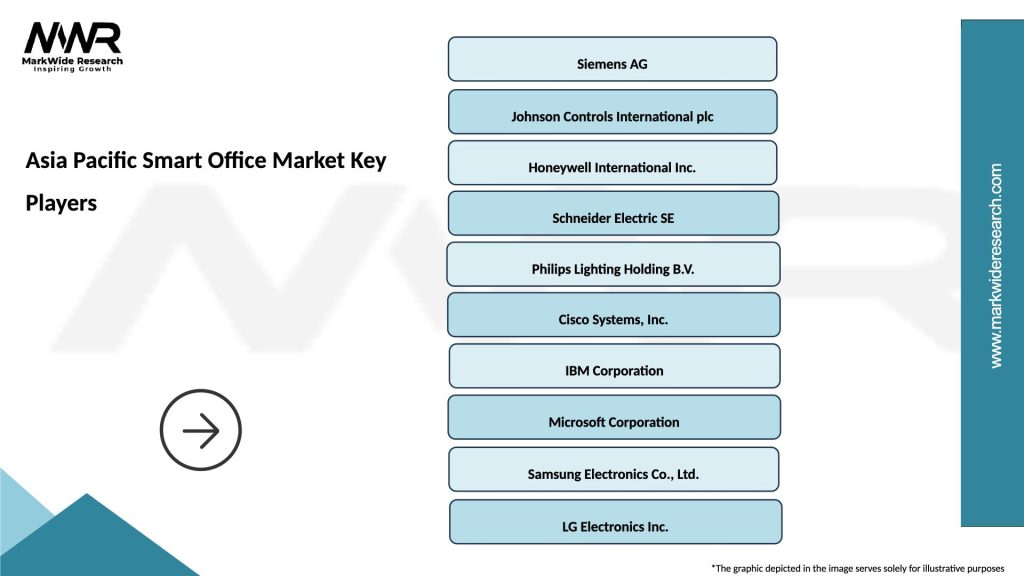

What are the key players in the Asia Pacific Smart Office Market?

Key players in the Asia Pacific Smart Office Market include companies like Siemens, Johnson Controls, and Schneider Electric, which provide innovative solutions for smart building management and automation, among others.

What are the main drivers of growth in the Asia Pacific Smart Office Market?

The main drivers of growth in the Asia Pacific Smart Office Market include the increasing demand for energy-efficient solutions, the rise of remote work trends, and the need for enhanced employee productivity through smart technologies.

What challenges does the Asia Pacific Smart Office Market face?

Challenges in the Asia Pacific Smart Office Market include high initial investment costs, the complexity of integrating new technologies with existing systems, and concerns regarding data security and privacy.

What opportunities exist in the Asia Pacific Smart Office Market?

Opportunities in the Asia Pacific Smart Office Market include the growing trend of sustainable building practices, advancements in AI and machine learning for workspace optimization, and the increasing adoption of smart technologies in various industries.

What trends are shaping the Asia Pacific Smart Office Market?

Trends shaping the Asia Pacific Smart Office Market include the rise of flexible workspaces, the integration of wellness-focused designs, and the use of smart technologies to enhance collaboration and communication among employees.

Asia Pacific Smart Office Market

| Segmentation Details | Description |

|---|---|

| Product Type | Smart Lighting, Smart Thermostats, Smart Security Systems, Smart HVAC |

| Technology | IoT, AI, Cloud Computing, Big Data |

| End User | Corporate Offices, Co-working Spaces, Educational Institutions, Government Buildings |

| Deployment | On-premises, Cloud-based, Hybrid, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Smart Office Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at