444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific smart card market represents one of the most dynamic and rapidly evolving segments within the global digital payment and identification ecosystem. This comprehensive market encompasses various smart card technologies including contact cards, contactless cards, and dual-interface cards that serve multiple applications across financial services, government identification, transportation, healthcare, and telecommunications sectors. The region’s robust economic growth, increasing digitalization initiatives, and growing adoption of cashless payment systems have positioned Asia Pacific as a leading market for smart card technologies.

Market dynamics in the Asia Pacific region are characterized by strong government support for digital transformation initiatives, rising smartphone penetration rates, and increasing consumer preference for convenient payment solutions. Countries such as China, India, Japan, South Korea, and Singapore are driving significant adoption rates, with contactless payment adoption reaching approximately 78% penetration in major urban centers. The integration of smart card technology with mobile payment platforms and Internet of Things (IoT) applications has created new opportunities for market expansion and technological innovation.

Regional growth patterns indicate that the Asia Pacific smart card market is experiencing substantial momentum driven by government digitization programs, banking sector modernization, and increasing consumer awareness about secure payment technologies. The market benefits from favorable regulatory frameworks, technological infrastructure development, and strategic partnerships between financial institutions and technology providers across the region.

The Asia Pacific smart card market refers to the comprehensive ecosystem of integrated circuit cards and related technologies that enable secure data storage, processing, and communication across various applications within the Asia Pacific geographical region. These sophisticated cards contain embedded microprocessors or memory chips that can store and process data, authenticate users, and facilitate secure transactions across multiple industries and use cases.

Smart card technology encompasses various form factors including traditional plastic cards, mobile-embedded secure elements, and wearable devices that incorporate smart card functionality. The market includes both hardware components such as chips, card bodies, and antennas, as well as software solutions including operating systems, applications, and security protocols that enable smart card functionality across diverse applications.

Application scope within the Asia Pacific market extends across financial services for payment cards and digital wallets, government services for national identification and e-passports, transportation systems for fare collection and access control, healthcare for patient identification and medical records, and telecommunications for SIM cards and subscriber authentication. This broad application spectrum demonstrates the versatility and growing importance of smart card technology in the region’s digital transformation journey.

Strategic market positioning reveals that the Asia Pacific smart card market has emerged as a critical component of the region’s digital infrastructure, supporting various government initiatives, financial inclusion programs, and commercial applications. The market demonstrates strong growth potential driven by increasing adoption of contactless payment systems, government digitization projects, and rising consumer demand for secure and convenient transaction methods.

Key growth drivers include rapid urbanization, expanding middle-class population, increasing smartphone penetration, and supportive government policies promoting cashless economies. The market benefits from technological advancements in near-field communication (NFC), biometric authentication, and mobile payment integration, which have enhanced the functionality and appeal of smart card solutions across diverse applications.

Market segmentation analysis indicates that contactless smart cards represent the fastest-growing segment, with adoption rates increasing by approximately 15% annually across major Asia Pacific markets. Financial services applications continue to dominate market demand, while government identification and transportation applications show significant growth potential driven by smart city initiatives and infrastructure development projects.

Competitive landscape features a mix of global technology leaders and regional specialists, with companies focusing on innovation in security features, manufacturing efficiency, and application-specific solutions. Strategic partnerships between card manufacturers, semiconductor companies, and system integrators are driving market development and technological advancement across the region.

Technology adoption patterns across the Asia Pacific smart card market reveal several critical insights that shape market dynamics and future growth prospects:

Market maturity levels vary significantly across different Asia Pacific countries, with developed markets like Japan and South Korea showing high penetration rates while emerging markets present substantial growth opportunities. This diversity creates opportunities for tailored solutions and phased market entry strategies for technology providers and service companies.

Digital transformation initiatives across Asia Pacific governments are serving as primary catalysts for smart card market growth. National digitization programs, e-governance initiatives, and smart city projects are creating substantial demand for secure identification and authentication solutions. These government-led initiatives often include large-scale smart card deployments for citizen services, healthcare systems, and public transportation networks.

Financial sector modernization represents another significant driver, with banks and financial institutions upgrading payment infrastructure to support contactless transactions, mobile payments, and enhanced security features. The shift toward cashless economies, accelerated by recent global events, has increased consumer acceptance and demand for smart card-based payment solutions across the region.

Technological advancement in areas such as near-field communication, biometric authentication, and mobile device integration is expanding the functionality and appeal of smart card solutions. These innovations enable new applications and use cases while improving user experience and security, driving broader market adoption across various sectors.

Consumer behavior evolution toward digital and contactless payment preferences is creating sustained demand for smart card technologies. Increasing smartphone penetration, growing e-commerce adoption, and changing lifestyle patterns are supporting market growth and encouraging innovation in smart card applications and services.

Regulatory support from governments across the Asia Pacific region through favorable policies, standards development, and infrastructure investment is facilitating market development. Regulatory frameworks that promote digital payments, data security, and interoperability are creating conducive environments for smart card technology adoption and market expansion.

High implementation costs associated with smart card infrastructure development and deployment can limit adoption, particularly in price-sensitive markets and smaller organizations. The initial investment required for card production equipment, security systems, and integration with existing infrastructure can be substantial, potentially slowing market penetration in certain segments.

Technical complexity and integration challenges can create barriers to adoption, especially for organizations with legacy systems or limited technical expertise. The need for specialized knowledge in security protocols, system integration, and ongoing maintenance can complicate implementation processes and increase total cost of ownership.

Security concerns and potential vulnerabilities in smart card systems can impact consumer confidence and market adoption. While smart cards offer enhanced security compared to traditional payment methods, concerns about data breaches, fraud, and privacy protection can influence consumer acceptance and regulatory approval processes.

Standardization challenges across different countries, applications, and technology platforms can limit interoperability and increase development costs. The lack of unified standards for certain applications can create fragmentation in the market and complicate cross-border or multi-application implementations.

Competition from alternative technologies such as mobile payment apps, biometric authentication systems, and blockchain-based solutions can potentially limit smart card market growth in certain applications. The rapid evolution of digital payment technologies creates ongoing competitive pressure and requires continuous innovation from smart card providers.

Emerging market expansion presents significant opportunities for smart card technology providers, with countries across Southeast Asia, South Asia, and other developing regions showing strong potential for adoption. These markets often have large unbanked populations, growing digital infrastructure, and government initiatives supporting financial inclusion and digitization.

Internet of Things integration creates new application possibilities for smart card technology in areas such as smart homes, connected vehicles, industrial automation, and healthcare monitoring. The convergence of smart card security features with IoT connectivity opens up innovative use cases and market segments beyond traditional applications.

Biometric authentication integration offers opportunities to enhance smart card security and functionality while addressing growing concerns about identity verification and fraud prevention. The combination of smart card technology with fingerprint, facial recognition, or other biometric systems can create more secure and user-friendly solutions.

Sustainable technology development presents opportunities for companies that can develop environmentally friendly smart card solutions, including biodegradable materials, energy-efficient manufacturing processes, and recycling programs. Growing environmental awareness among consumers and organizations creates demand for sustainable technology alternatives.

Cross-industry collaboration opportunities exist for smart card providers to partner with telecommunications companies, technology platforms, and service providers to create integrated solutions that span multiple applications and industries. These partnerships can accelerate market adoption and create new revenue streams through value-added services.

Supply chain dynamics in the Asia Pacific smart card market are characterized by complex relationships between semiconductor manufacturers, card producers, system integrators, and end-user organizations. The region benefits from strong manufacturing capabilities, particularly in countries like China, South Korea, and Taiwan, which house major semiconductor and electronics production facilities.

Demand patterns show seasonal variations related to government procurement cycles, financial institution upgrade schedules, and consumer spending patterns. Peak demand periods often coincide with new product launches, regulatory compliance deadlines, and major infrastructure projects across the region.

Technology evolution cycles are accelerating, with new features and capabilities being introduced regularly to address changing security requirements, user preferences, and application needs. According to MarkWide Research analysis, technology refresh cycles have shortened to approximately 3-4 years for major smart card implementations, driving continuous innovation and market activity.

Price dynamics reflect ongoing cost optimization efforts by manufacturers, economies of scale in production, and competitive pressure from alternative technologies. The market shows gradual price reductions for standard smart card products while premium solutions with advanced features maintain higher price points and margins.

Market consolidation trends indicate ongoing merger and acquisition activity as companies seek to expand capabilities, geographic reach, and market share. Strategic partnerships and joint ventures are also common as organizations collaborate to address complex technical requirements and market opportunities.

Primary research methodology employed for analyzing the Asia Pacific smart card market includes comprehensive surveys and interviews with key industry stakeholders, including smart card manufacturers, technology providers, system integrators, financial institutions, government agencies, and end-user organizations across major Asia Pacific markets.

Secondary research sources encompass industry reports, government publications, regulatory filings, company annual reports, technology standards documentation, and academic research papers related to smart card technology and applications. This comprehensive approach ensures thorough coverage of market dynamics, technological trends, and competitive landscape factors.

Data validation processes include cross-referencing information from multiple sources, conducting follow-up interviews with industry experts, and analyzing historical market data to identify trends and patterns. Statistical analysis techniques are applied to ensure data accuracy and reliability in market projections and trend analysis.

Market sizing methodology utilizes bottom-up and top-down approaches, analyzing demand from various application segments, regional markets, and technology categories. The research incorporates feedback from industry participants to validate market estimates and growth projections across different market segments.

Competitive analysis framework examines market share data, product portfolios, strategic initiatives, financial performance, and market positioning of key players in the Asia Pacific smart card market. This analysis provides insights into competitive dynamics and strategic opportunities for market participants.

China market leadership is evident in the Asia Pacific smart card landscape, with the country representing approximately 35% regional market share driven by massive government digitization initiatives, extensive mobile payment adoption, and large-scale transportation system modernization projects. The Chinese market benefits from strong domestic manufacturing capabilities and supportive government policies promoting cashless payment systems.

India’s emerging potential shows significant growth momentum supported by government initiatives such as digital identity programs, financial inclusion campaigns, and smart city development projects. The Indian market demonstrates strong adoption rates for contactless payment systems and government identification applications, with rural market penetration increasing steadily.

Japan and South Korea represent mature markets with high technology adoption rates and sophisticated smart card applications across transportation, retail, and government services. These markets focus on advanced features such as biometric integration, mobile wallet connectivity, and enhanced security protocols, serving as innovation leaders for the broader region.

Southeast Asian markets including Singapore, Malaysia, Thailand, and Indonesia show diverse growth patterns with Singapore leading in financial services applications while other countries focus on government identification and transportation system modernization. Regional economic integration initiatives are driving demand for interoperable smart card solutions.

Australia and New Zealand demonstrate steady market growth with emphasis on contactless payment adoption, government service digitization, and transportation system upgrades. These markets prioritize security features and regulatory compliance, creating opportunities for premium smart card solutions and services.

Market leadership structure in the Asia Pacific smart card market features a combination of global technology leaders and regional specialists, each bringing unique strengths and market positioning strategies:

Strategic positioning among market leaders emphasizes innovation in security features, manufacturing efficiency, and application-specific solutions. Companies are investing in research and development to address emerging requirements such as biometric integration, mobile connectivity, and enhanced data protection capabilities.

Partnership strategies play crucial roles in market development, with smart card manufacturers collaborating with semiconductor companies, system integrators, and technology platforms to deliver comprehensive solutions. These partnerships enable companies to address complex customer requirements and expand market reach across different application segments.

By Technology Type:

By Application Sector:

By End-User Industry:

Financial Services Dominance: The financial services segment maintains the largest market share within the Asia Pacific smart card market, driven by extensive adoption of contactless payment cards, digital wallet integration, and mobile banking applications. This segment benefits from regulatory support for secure payment systems and growing consumer preference for cashless transactions, with payment card adoption rates reaching approximately 82% in developed Asia Pacific markets.

Government Identification Growth: Government identification applications represent the fastest-growing segment, supported by national digitization initiatives, e-governance programs, and citizen service modernization projects. Countries across the region are implementing large-scale identity card programs that incorporate smart card technology for enhanced security and functionality.

Transportation System Modernization: Smart card adoption in transportation applications is accelerating as cities across Asia Pacific upgrade public transit systems to support contactless fare collection, integrated mobility services, and smart city initiatives. This segment shows particular strength in major urban centers with extensive public transportation networks.

Healthcare Application Emergence: Healthcare applications for smart cards are gaining momentum as healthcare systems digitize patient records, implement secure access controls, and enhance service delivery efficiency. This segment shows significant growth potential driven by healthcare modernization initiatives and regulatory requirements for secure patient data management.

Enterprise Security Focus: Enterprise access control applications are expanding as organizations prioritize security, implement remote work solutions, and upgrade physical and logical access control systems. Smart card technology provides enhanced security features compared to traditional access control methods while supporting integration with modern IT infrastructure.

Enhanced Security Capabilities: Smart card technology provides superior security features compared to traditional payment and identification methods, including encryption, secure data storage, and tamper-resistant hardware. These security enhancements protect against fraud, unauthorized access, and data breaches while ensuring compliance with regulatory requirements and industry standards.

Operational Efficiency Improvements: Implementation of smart card systems can significantly improve operational efficiency through automated processes, reduced manual handling, and streamlined transaction processing. Organizations report efficiency improvements of up to 40% in transaction processing times and administrative overhead reduction through smart card adoption.

Cost Reduction Opportunities: While initial implementation costs can be substantial, smart card systems often provide long-term cost savings through reduced cash handling, lower fraud losses, improved process automation, and decreased administrative overhead. These cost benefits become more significant as deployment scales increase and operational efficiencies are realized.

Customer Experience Enhancement: Smart card technology enables faster, more convenient transactions and services, improving customer satisfaction and engagement. Contactless payment capabilities, reduced transaction times, and integrated service access contribute to enhanced user experiences across various applications and industries.

Scalability and Flexibility: Smart card platforms provide scalable solutions that can accommodate growing user bases, additional applications, and evolving security requirements. This flexibility enables organizations to expand services, integrate new capabilities, and adapt to changing market conditions without major system overhauls.

Regulatory Compliance Support: Smart card technology helps organizations meet regulatory requirements for data security, privacy protection, and transaction authentication across various industries and jurisdictions. Built-in security features and audit capabilities support compliance with financial regulations, government standards, and industry-specific requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Contactless Technology Dominance: The shift toward contactless smart card technology continues to accelerate across Asia Pacific markets, driven by consumer preference for convenient, fast transactions and enhanced hygiene considerations. This trend is particularly evident in retail payments, public transportation, and access control applications where speed and convenience are prioritized.

Mobile Integration Advancement: Integration of smart card functionality with mobile devices and digital wallets is becoming increasingly sophisticated, enabling seamless user experiences across physical and digital payment channels. This convergence creates opportunities for enhanced services and expanded application possibilities while maintaining security standards.

Biometric Authentication Integration: The incorporation of biometric authentication features such as fingerprint recognition and facial identification with smart card technology is gaining momentum, addressing growing security requirements and user authentication needs. This trend is particularly strong in government identification and high-security access control applications.

Sustainability Focus: Environmental considerations are driving development of eco-friendly smart card materials, manufacturing processes, and end-of-life recycling programs. Companies are investing in sustainable alternatives to traditional plastic cards and implementing circular economy principles in product development and manufacturing.

Cross-Platform Interoperability: Increasing demand for smart card solutions that work across multiple applications, platforms, and geographic regions is driving standardization efforts and technical innovation. This trend supports regional integration initiatives and enhances user convenience through unified access solutions.

Enhanced Security Features: Continuous advancement in security capabilities including advanced encryption, secure element technology, and anti-counterfeiting measures addresses evolving threat landscapes and regulatory requirements. These enhancements maintain smart card technology’s competitive advantage in security-critical applications.

Strategic Partnership Expansion: Major smart card manufacturers are forming strategic alliances with technology companies, financial institutions, and government agencies to develop comprehensive solutions and expand market reach. These partnerships enable companies to leverage complementary capabilities and address complex customer requirements more effectively.

Manufacturing Capacity Investment: Significant investments in manufacturing capacity expansion and technology upgrades are occurring across Asia Pacific markets to meet growing demand and improve production efficiency. Companies are establishing new facilities and upgrading existing operations to support market growth and technological advancement.

Research and Development Focus: Increased investment in research and development activities is driving innovation in smart card technology, security features, and application development. Companies are focusing on next-generation capabilities including quantum-resistant security, advanced biometrics, and IoT integration to maintain competitive advantages.

Regulatory Framework Evolution: Governments across the Asia Pacific region are updating regulatory frameworks to support smart card adoption, ensure security standards, and promote interoperability. These regulatory developments create more favorable environments for market growth while establishing clear compliance requirements for industry participants.

Technology Standardization Initiatives: Industry organizations and standards bodies are working to establish unified technical standards for smart card applications, security protocols, and interoperability requirements. These standardization efforts aim to reduce fragmentation and enable broader market adoption across different countries and applications.

Acquisition and Consolidation Activity: Ongoing merger and acquisition activity in the smart card industry is reshaping the competitive landscape as companies seek to expand capabilities, geographic presence, and market share. This consolidation trend is creating larger, more comprehensive solution providers while driving innovation through combined expertise and resources.

Market Entry Strategy: Companies considering entry into the Asia Pacific smart card market should focus on specific application segments and geographic regions where they can establish competitive advantages. MWR analysis suggests that successful market entry requires strong local partnerships, understanding of regulatory requirements, and tailored solutions that address specific regional needs and preferences.

Technology Investment Priorities: Organizations should prioritize investment in contactless technology, mobile integration capabilities, and advanced security features to remain competitive in the evolving market landscape. Focus areas should include biometric integration, IoT connectivity, and sustainable product development to address emerging customer requirements and market trends.

Partnership Development: Strategic partnerships with local technology providers, system integrators, and industry specialists are essential for success in diverse Asia Pacific markets. These partnerships provide market knowledge, regulatory expertise, and customer relationships that are crucial for effective market penetration and business development.

Regulatory Compliance Focus: Companies must maintain strong focus on regulatory compliance and security standards across different Asia Pacific markets, as requirements vary significantly between countries and applications. Investment in compliance capabilities and security expertise is essential for long-term market success and customer trust.

Innovation Investment: Continuous investment in research and development is necessary to maintain competitive positioning and address evolving customer requirements. Companies should focus on emerging technologies such as quantum-resistant security, advanced biometrics, and sustainable materials to prepare for future market demands.

Customer Education: Investment in customer education and market development activities can accelerate adoption and create new market opportunities. Companies should focus on demonstrating value propositions, addressing security concerns, and highlighting benefits of smart card technology compared to alternative solutions.

Growth trajectory projections for the Asia Pacific smart card market indicate sustained expansion driven by continued digitalization, government modernization initiatives, and evolving consumer preferences. The market is expected to maintain robust growth momentum with projected annual growth rates of approximately 8-12% across major application segments and geographic regions over the next five years.

Technology evolution will continue to shape market dynamics, with contactless capabilities, mobile integration, and biometric authentication becoming standard features across most smart card applications. Advanced security features and IoT connectivity will drive premium market segments while cost optimization will support mass market adoption in emerging economies.

Application expansion is expected to create new market opportunities beyond traditional financial services and government identification, with healthcare, education, and enterprise applications showing significant growth potential. The convergence of smart card technology with emerging applications such as digital identity, supply chain management, and smart city services will create additional market segments.

Regional market development will show varying patterns, with mature markets focusing on advanced features and premium applications while emerging markets emphasize basic functionality and cost-effective solutions. Cross-border integration initiatives and regional economic cooperation will drive demand for interoperable smart card solutions.

Competitive landscape evolution will likely feature continued consolidation, strategic partnerships, and technology convergence as companies seek to provide comprehensive solutions and expand market reach. Innovation in security, sustainability, and user experience will become key differentiators for market success.

Market challenges including security threats, regulatory changes, and competition from alternative technologies will require ongoing attention and investment from industry participants. Companies that successfully address these challenges while capitalizing on growth opportunities will be well-positioned for long-term success in the dynamic Asia Pacific smart card market.

The Asia Pacific smart card market represents a dynamic and rapidly evolving sector that plays a crucial role in the region’s digital transformation journey. With strong government support, increasing consumer adoption, and continuous technological advancement, the market demonstrates substantial growth potential across diverse applications and geographic regions. The combination of established technology foundations, growing digital economy, and emerging application opportunities creates a favorable environment for sustained market expansion.

Strategic success factors for market participants include focus on innovation, strategic partnerships, regulatory compliance, and customer-centric solutions that address specific regional requirements and preferences. Companies that can effectively navigate the complex regulatory landscape, leverage local partnerships, and invest in emerging technologies will be well-positioned to capture growth opportunities and establish competitive advantages in this dynamic market environment.

Future market development will be shaped by continued technological evolution, expanding application scope, and increasing integration with digital platforms and emerging technologies. The Asia Pacific smart card market is poised for continued growth and innovation, driven by supportive market conditions, evolving customer needs, and ongoing investment in digital infrastructure and security solutions across the region.

What is Smart Card?

Smart cards are secure, portable devices that store and process data, often used for identification, payment, and access control. They can be embedded with microprocessors or memory chips, enabling various applications across different sectors.

What are the key players in the Asia Pacific Smart Card Market?

Key players in the Asia Pacific Smart Card Market include Gemalto, NXP Semiconductors, and Infineon Technologies, which are known for their innovative solutions in secure transactions and identity management, among others.

What are the growth factors driving the Asia Pacific Smart Card Market?

The growth of the Asia Pacific Smart Card Market is driven by increasing demand for secure payment solutions, the rise of contactless technology, and the expansion of digital identity initiatives across various industries.

What challenges does the Asia Pacific Smart Card Market face?

Challenges in the Asia Pacific Smart Card Market include concerns over data security and privacy, the high cost of implementation for businesses, and the need for interoperability among different smart card systems.

What opportunities exist in the Asia Pacific Smart Card Market?

Opportunities in the Asia Pacific Smart Card Market include the growing adoption of smart cards in healthcare for patient identification, the expansion of public transportation systems utilizing smart card technology, and advancements in mobile payment solutions.

What trends are shaping the Asia Pacific Smart Card Market?

Trends in the Asia Pacific Smart Card Market include the increasing integration of biometric authentication for enhanced security, the shift towards mobile wallets and digital cards, and the development of eco-friendly smart card materials.

Asia Pacific Smart Card Market

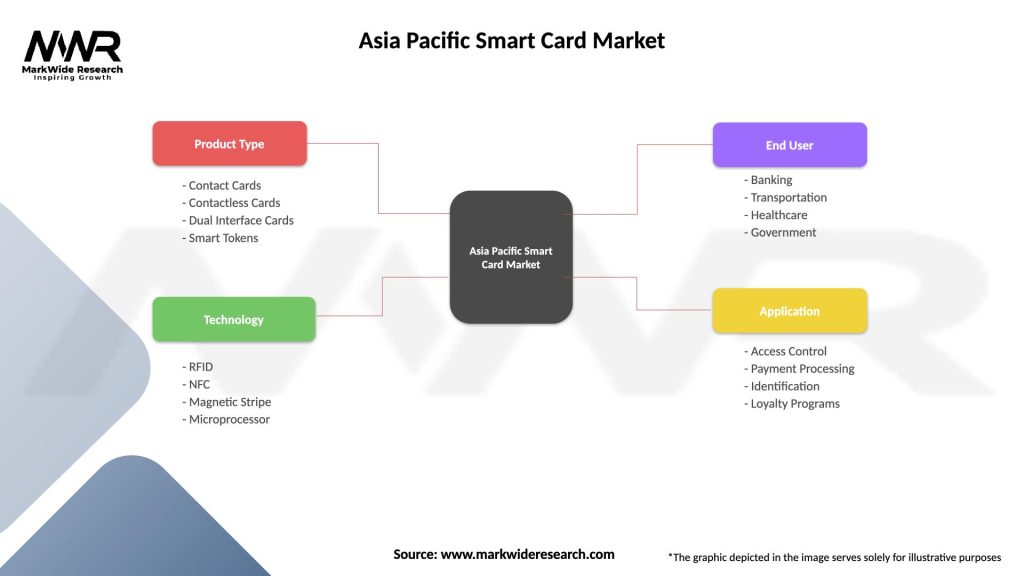

| Segmentation Details | Description |

|---|---|

| Product Type | Contact Cards, Contactless Cards, Dual Interface Cards, Smart Tokens |

| Technology | RFID, NFC, Magnetic Stripe, Microprocessor |

| End User | Banking, Transportation, Healthcare, Government |

| Application | Access Control, Payment Processing, Identification, Loyalty Programs |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Smart Card Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at