444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific small cell 5G market represents one of the most dynamic and rapidly evolving telecommunications infrastructure segments globally. This region has emerged as a critical battleground for next-generation wireless technology deployment, driven by unprecedented mobile data consumption, urbanization trends, and aggressive government digitalization initiatives. Small cell 5G networks are revolutionizing connectivity across major metropolitan areas, enabling ultra-low latency applications and supporting the massive Internet of Things (IoT) ecosystem that defines modern digital economies.

Market dynamics in the Asia-Pacific region are characterized by intense competition among telecommunications providers, substantial infrastructure investments, and rapidly advancing technological capabilities. The deployment of small cell 5G infrastructure has accelerated significantly, with adoption rates reaching 78% across major urban centers in leading markets such as South Korea, Japan, and Singapore. This technological transformation is fundamentally reshaping how businesses and consumers interact with digital services, creating unprecedented opportunities for innovation and economic growth.

Regional leadership in small cell 5G deployment varies significantly, with countries like China, South Korea, and Japan leading the charge in both infrastructure development and commercial implementation. The market exhibits strong growth momentum, with deployment rates increasing by 65% year-over-year across key metropolitan areas. This expansion is supported by favorable regulatory frameworks, substantial private sector investments, and growing consumer demand for enhanced mobile broadband experiences.

The Asia-Pacific small cell 5G market refers to the comprehensive ecosystem of miniaturized cellular base stations, supporting infrastructure, and related technologies that enable fifth-generation wireless connectivity across the Asia-Pacific region. These systems provide enhanced network capacity, improved coverage, and ultra-low latency communications in densely populated urban environments where traditional macro cell towers face limitations.

Small cell technology encompasses various deployment models including femtocells, picocells, and microcells, each designed to address specific coverage and capacity requirements. These solutions are particularly crucial in the Asia-Pacific region due to the high population density in major cities and the increasing demand for seamless connectivity across diverse applications ranging from autonomous vehicles to smart city infrastructure.

Market participants include telecommunications equipment manufacturers, network operators, system integrators, and technology solution providers who collectively contribute to the development, deployment, and maintenance of small cell 5G networks. The ecosystem also encompasses regulatory bodies, government agencies, and industry associations that establish standards and facilitate market development across different countries within the region.

Strategic market positioning in the Asia-Pacific small cell 5G sector reveals a landscape characterized by rapid technological advancement, substantial infrastructure investments, and increasing commercial deployment across multiple industry verticals. The market demonstrates strong fundamentals with network deployment efficiency improvements of 45% compared to traditional macro cell implementations, making small cell solutions increasingly attractive for telecommunications operators seeking to optimize their 5G rollout strategies.

Key market drivers include the exponential growth in mobile data traffic, the proliferation of IoT devices, and the increasing adoption of bandwidth-intensive applications such as augmented reality, virtual reality, and ultra-high-definition video streaming. Government initiatives promoting digital transformation and smart city development have further accelerated market growth, with public sector investments supporting infrastructure development across major metropolitan areas.

Competitive dynamics are intensifying as established telecommunications equipment vendors compete with emerging technology providers and regional specialists. Market consolidation trends are evident, with strategic partnerships and acquisitions becoming increasingly common as companies seek to strengthen their technological capabilities and expand their geographical presence. The market exhibits strong growth potential, supported by favorable regulatory environments and increasing private sector investments in next-generation wireless infrastructure.

Technological advancement represents the primary catalyst driving market evolution, with continuous improvements in small cell hardware, software, and integration capabilities. The following insights highlight critical market developments:

Market maturation is evident across leading Asia-Pacific markets, with established deployment models and proven business cases driving continued expansion. The integration of small cell technology with broader 5G ecosystem components is creating new opportunities for innovation and service differentiation.

Exponential data growth serves as the fundamental driver propelling small cell 5G market expansion across the Asia-Pacific region. Mobile data consumption has reached unprecedented levels, with video streaming, gaming, and social media applications generating massive bandwidth requirements that traditional network infrastructure cannot adequately support. This surge in data demand necessitates network densification through small cell deployment to maintain service quality and user satisfaction.

Urbanization trends across major Asia-Pacific cities are creating concentrated areas of high mobile traffic that require enhanced network capacity. Dense urban environments present unique challenges for wireless coverage, with tall buildings, narrow streets, and high user density creating coverage gaps and capacity constraints that small cell technology effectively addresses. The rapid development of smart cities and digital infrastructure initiatives further amplifies the need for comprehensive small cell networks.

Enterprise digital transformation is driving demand for reliable, high-performance wireless connectivity to support Industry 4.0 applications, IoT deployments, and mission-critical business operations. Manufacturing facilities, logistics centers, and commercial complexes require dedicated wireless infrastructure that can support real-time data processing, automated systems, and seamless connectivity across diverse applications.

Government initiatives promoting 5G adoption and digital economy development are providing substantial support for small cell infrastructure deployment. National broadband strategies, smart city programs, and economic digitalization policies are creating favorable regulatory environments and financial incentives that accelerate market growth and technology adoption across the region.

High deployment costs represent a significant barrier to widespread small cell 5G adoption, particularly for smaller telecommunications operators and emerging market players. The substantial capital investment required for equipment procurement, site preparation, and network integration can strain financial resources and delay deployment timelines. Additionally, ongoing operational expenses including site rental, power consumption, and maintenance costs create long-term financial commitments that require careful economic justification.

Regulatory complexities across different Asia-Pacific countries create challenges for standardized deployment approaches and cross-border technology implementation. Varying spectrum allocation policies, building codes, environmental regulations, and approval processes can significantly impact deployment schedules and increase administrative costs. The lack of harmonized standards and regulatory frameworks complicates multi-country deployment strategies for regional operators.

Technical integration challenges arise from the complexity of integrating small cell networks with existing macro cell infrastructure and legacy systems. Ensuring seamless handover, maintaining service quality, and managing network interference requires sophisticated technical expertise and advanced network management capabilities. The rapid pace of technological evolution also creates risks of equipment obsolescence and compatibility issues.

Site acquisition difficulties in densely populated urban areas present ongoing challenges for small cell deployment. Limited availability of suitable installation locations, property owner negotiations, and zoning restrictions can significantly delay project implementation. The aesthetic concerns of local communities and building owners regarding small cell installations also create additional barriers to deployment.

Emerging application verticals present substantial growth opportunities for small cell 5G technology providers, particularly in sectors requiring ultra-low latency and high-reliability connectivity. Autonomous vehicle networks, industrial automation, healthcare telemedicine, and immersive entertainment applications are creating new market segments with specific performance requirements that small cell technology can uniquely address.

Private network deployments represent a rapidly expanding opportunity as enterprises seek dedicated wireless infrastructure to support their digital transformation initiatives. Manufacturing facilities, ports, airports, and large commercial complexes are increasingly investing in private 5G networks that rely heavily on small cell technology to provide comprehensive coverage and capacity. This trend is creating new revenue streams for equipment vendors and system integrators.

Rural connectivity expansion offers significant market potential as governments and telecommunications operators work to bridge the digital divide. Small cell technology provides a cost-effective solution for extending 5G coverage to underserved rural and remote areas where traditional macro cell deployment may not be economically viable. Government subsidies and rural development programs are supporting these initiatives across multiple Asia-Pacific countries.

Technology convergence opportunities are emerging as small cell networks integrate with edge computing, artificial intelligence, and IoT platforms. These convergence trends are creating new service offerings and business models that extend beyond traditional connectivity services to include data processing, analytics, and application hosting capabilities. The integration of multiple technologies within small cell infrastructure is enabling new revenue opportunities and competitive differentiation.

Competitive intensity within the Asia-Pacific small cell 5G market continues to escalate as established telecommunications equipment vendors face increasing pressure from innovative technology startups and regional specialists. Market dynamics are characterized by rapid technological advancement, aggressive pricing strategies, and continuous product innovation as companies compete for market share in this high-growth sector.

Supply chain evolution is reshaping market dynamics as manufacturers optimize production processes, establish regional manufacturing capabilities, and develop strategic partnerships with component suppliers. The localization of supply chains is becoming increasingly important for market participants seeking to reduce costs, improve delivery times, and mitigate geopolitical risks that could impact component availability.

Customer requirements are becoming increasingly sophisticated as telecommunications operators and enterprise customers demand higher performance, greater flexibility, and improved cost-effectiveness from small cell solutions. The evolution of customer needs is driving continuous innovation in product design, feature sets, and service offerings as vendors compete to meet increasingly demanding specifications.

Regulatory evolution across Asia-Pacific markets is creating both opportunities and challenges for market participants. Governments are implementing policies to accelerate 5G deployment while also addressing security concerns, environmental considerations, and competitive fairness. These regulatory changes are influencing market dynamics by affecting technology standards, deployment requirements, and competitive positioning strategies.

Comprehensive market analysis for the Asia-Pacific small cell 5G market employs a multi-faceted research approach combining primary research, secondary data analysis, and industry expert insights. The methodology encompasses quantitative data collection through surveys and interviews with key market participants, including telecommunications operators, equipment vendors, system integrators, and technology solution providers across major Asia-Pacific countries.

Primary research activities include structured interviews with C-level executives, technical specialists, and procurement decision-makers from leading market participants. These interviews provide valuable insights into market trends, competitive dynamics, technology developments, and future growth prospects. Survey data collection focuses on deployment patterns, investment priorities, technology preferences, and market challenges across different customer segments and geographical regions.

Secondary research analysis incorporates comprehensive review of industry reports, government publications, regulatory filings, company financial statements, and technical documentation. This analysis provides historical market data, regulatory framework information, and competitive intelligence that supports primary research findings and enables comprehensive market assessment.

Data validation processes ensure research accuracy and reliability through triangulation of multiple data sources, expert review panels, and statistical analysis techniques. Market projections and trend analysis are validated through comparison with industry benchmarks and historical performance data to ensure realistic and actionable insights for market participants and stakeholders.

China dominates the Asia-Pacific small cell 5G market with the most extensive deployment infrastructure and aggressive expansion plans. The country’s massive urban population, government support for 5G development, and substantial telecommunications operator investments have created the world’s largest small cell deployment base. Chinese market share represents approximately 42% of regional small cell installations, driven by comprehensive smart city initiatives and industrial digitalization programs.

South Korea maintains technological leadership in small cell 5G innovation and deployment density, with the highest per-capita small cell installation rates in the region. The country’s advanced telecommunications infrastructure, early 5G commercial launch, and strong government support for digital transformation have established South Korea as a key market for premium small cell solutions and advanced network applications.

Japan demonstrates strong market potential with sophisticated technology requirements and substantial infrastructure investments supporting the digital economy. Japanese telecommunications operators are implementing comprehensive small cell networks to support high-density urban areas and prepare for major international events. The market exhibits strong demand for high-quality, reliable small cell solutions with advanced features and integration capabilities.

Southeast Asian markets including Singapore, Thailand, Malaysia, and Vietnam are experiencing rapid growth in small cell 5G adoption, with deployment rates increasing by 58% annually across major metropolitan areas. These markets benefit from favorable regulatory environments, increasing foreign investment, and growing demand for enhanced mobile connectivity to support economic development and digital transformation initiatives.

India represents the largest growth opportunity within the Asia-Pacific region, with massive population centers, increasing smartphone adoption, and government initiatives promoting digital connectivity. The Indian market is characterized by price-sensitive customers, diverse deployment requirements, and substantial long-term growth potential as telecommunications infrastructure continues to modernize and expand.

Market leadership in the Asia-Pacific small cell 5G sector is distributed among several key players, each bringing unique technological capabilities and market positioning strategies. The competitive landscape is characterized by intense innovation, strategic partnerships, and continuous product development as companies compete for market share in this rapidly growing sector.

Strategic partnerships are becoming increasingly important as companies seek to combine complementary technologies and expand their market reach. Collaboration between equipment vendors, software providers, and system integrators is creating comprehensive solution offerings that address diverse customer requirements and accelerate market adoption.

Innovation focus areas include artificial intelligence integration, edge computing capabilities, energy efficiency improvements, and enhanced network management features. Companies are investing heavily in research and development to maintain competitive advantages and address evolving customer needs in the rapidly changing 5G technology landscape.

Technology segmentation within the Asia-Pacific small cell 5G market encompasses multiple categories based on cell type, frequency bands, and deployment models. The market includes femtocells, picocells, and microcells, each serving specific coverage and capacity requirements across different deployment scenarios and customer applications.

By Cell Type:

By Frequency Band:

By Application:

Femtocell category demonstrates strong growth potential in residential and small business segments, driven by increasing work-from-home trends and demand for reliable indoor connectivity. These solutions offer cost-effective coverage enhancement for small areas while providing telecommunications operators with opportunities to offload traffic from macro cell networks. Market adoption is accelerating with deployment rates increasing by 52% year-over-year across residential applications.

Picocell segment represents the largest market category by deployment volume, addressing diverse requirements across enterprise, retail, and public venue applications. These solutions provide optimal balance between coverage area and capacity, making them suitable for shopping centers, office buildings, transportation hubs, and educational institutions. The segment benefits from strong enterprise digital transformation trends and increasing demand for private 5G networks.

Microcell category focuses on outdoor deployments and suburban coverage enhancement, providing cost-effective alternatives to traditional macro cell installations. These solutions are particularly valuable for extending 5G coverage along transportation corridors, in suburban residential areas, and for filling coverage gaps in existing network deployments. Government rural connectivity initiatives are driving significant growth in this category.

Indoor coverage solutions are experiencing rapid growth as building owners and enterprises recognize the importance of comprehensive wireless connectivity for tenant satisfaction and business operations. Advanced distributed antenna systems and indoor small cells are becoming standard features in new construction projects and building renovation initiatives across major Asia-Pacific cities.

Telecommunications operators benefit significantly from small cell 5G deployments through improved network capacity, enhanced coverage quality, and reduced per-bit transmission costs. These solutions enable operators to address growing data demand while optimizing capital expenditure and operational efficiency. Network performance improvements of 73% in high-traffic areas demonstrate the substantial operational benefits of small cell technology implementation.

Equipment vendors gain access to expanding market opportunities as small cell technology becomes essential for comprehensive 5G network deployment. The recurring revenue potential from maintenance, upgrades, and managed services creates sustainable business models beyond initial equipment sales. Vendor partnerships with telecommunications operators and system integrators provide stable revenue streams and market expansion opportunities.

Enterprise customers achieve enhanced wireless connectivity supporting digital transformation initiatives, improved employee productivity, and advanced application capabilities. Private 5G networks enabled by small cell technology provide enterprises with dedicated, secure, and high-performance wireless infrastructure tailored to specific business requirements and operational needs.

System integrators benefit from growing demand for comprehensive small cell deployment services, including site planning, installation, integration, and ongoing maintenance. The complexity of small cell network deployment creates substantial service opportunities for companies with specialized technical expertise and project management capabilities.

Government stakeholders achieve digital infrastructure development objectives, economic growth stimulation, and improved citizen services through enhanced wireless connectivity. Small cell networks support smart city initiatives, public safety communications, and digital inclusion programs that benefit entire communities and support long-term economic development goals.

Strengths:

Weaknesses:

Opportunities:

Threats:

Network densification acceleration represents the most significant trend shaping the Asia-Pacific small cell 5G market, with telecommunications operators implementing comprehensive deployment strategies to address exponential data growth and coverage requirements. This trend is driving unprecedented infrastructure investment and creating new business models focused on network-as-a-service offerings and infrastructure sharing arrangements.

Artificial intelligence integration is transforming small cell network management and optimization, enabling autonomous network operations, predictive maintenance, and dynamic resource allocation. AI-powered solutions are improving network efficiency by 38% while reducing operational costs through automated troubleshooting and performance optimization capabilities.

Edge computing convergence is creating new opportunities for small cell technology providers as networks evolve to support ultra-low latency applications and distributed computing architectures. The integration of computing capabilities within small cell infrastructure is enabling new service offerings and revenue streams beyond traditional connectivity services.

Sustainability focus is driving innovation in energy-efficient small cell solutions and renewable energy integration. Environmental considerations are becoming increasingly important for deployment decisions, with operators seeking solutions that minimize carbon footprint while maintaining high performance standards. Green technology adoption is accelerating across the region as companies respond to climate change commitments and regulatory requirements.

Open RAN adoption is promoting vendor ecosystem diversity and interoperability, creating opportunities for specialized component providers and software developers. This trend is reducing vendor lock-in risks while promoting innovation and competition within the small cell technology ecosystem.

Strategic partnerships between major telecommunications equipment vendors and regional system integrators are accelerating market development and technology deployment across the Asia-Pacific region. These collaborations combine global technology expertise with local market knowledge and deployment capabilities, creating comprehensive solution offerings that address diverse customer requirements and regulatory environments.

Government policy initiatives across multiple Asia-Pacific countries are establishing favorable regulatory frameworks for small cell deployment, including streamlined approval processes, infrastructure sharing requirements, and financial incentives for rural connectivity expansion. These policy developments are reducing deployment barriers and accelerating market growth across the region.

Technology standardization efforts through industry associations and regulatory bodies are promoting interoperability and reducing deployment complexity. The development of common technical standards and certification processes is facilitating vendor ecosystem development and reducing integration challenges for telecommunications operators and enterprise customers.

Investment acceleration from both private sector and government sources is providing substantial funding for small cell 5G infrastructure development. MarkWide Research analysis indicates that infrastructure investment levels have increased significantly, supporting comprehensive network deployment and technology advancement initiatives across major Asia-Pacific markets.

Innovation breakthroughs in antenna technology, signal processing, and network management software are improving small cell performance while reducing costs and complexity. These technological advances are enabling new deployment scenarios and application possibilities that were previously not economically viable.

Market participants should prioritize technology innovation and product differentiation to maintain competitive advantages in the rapidly evolving small cell 5G market. Companies should invest in research and development activities focused on emerging technologies such as artificial intelligence, edge computing, and advanced antenna systems to create unique value propositions and address evolving customer requirements.

Strategic partnerships with complementary technology providers, system integrators, and regional specialists can accelerate market expansion and improve competitive positioning. Companies should evaluate partnership opportunities that provide access to new markets, enhance technical capabilities, or create comprehensive solution offerings that address diverse customer needs across different industry verticals.

Customer-centric approach development is essential for success in the increasingly sophisticated small cell 5G market. Companies should invest in understanding specific customer requirements, developing customized solutions, and providing comprehensive support services that address the entire technology lifecycle from planning and deployment through ongoing maintenance and optimization.

Regulatory engagement across different Asia-Pacific markets is crucial for navigating complex approval processes and influencing policy development. Companies should establish relationships with regulatory authorities, participate in industry standards development, and contribute to policy discussions that shape market development and technology adoption frameworks.

Supply chain optimization strategies should focus on building resilient, cost-effective production and distribution capabilities that can respond to changing market conditions and customer demands. Companies should evaluate regional manufacturing opportunities, develop strategic supplier relationships, and implement risk management practices that ensure consistent product availability and quality.

Market expansion in the Asia-Pacific small cell 5G sector is expected to continue at an accelerated pace, driven by ongoing urbanization, increasing data consumption, and expanding application requirements across multiple industry verticals. MWR projections indicate that deployment growth rates will maintain strong momentum, with particularly robust expansion in emerging markets and rural connectivity initiatives.

Technology evolution will focus on enhanced integration capabilities, improved energy efficiency, and advanced network management features that address the growing complexity of 5G network deployments. The convergence of small cell technology with edge computing, artificial intelligence, and IoT platforms will create new service opportunities and business models that extend beyond traditional connectivity services.

Application diversification will drive market growth as small cell 5G networks enable new use cases in autonomous vehicles, industrial automation, healthcare, and immersive entertainment. These emerging applications will create specialized market segments with unique performance requirements and revenue opportunities for technology providers and service operators.

Regional market development will continue to vary significantly, with mature markets focusing on network optimization and advanced applications while emerging markets prioritize basic coverage expansion and infrastructure development. This diversity will create opportunities for different technology approaches and business models tailored to specific market conditions and customer requirements.

Competitive landscape evolution will be characterized by continued consolidation, strategic partnerships, and technology specialization as companies seek to establish sustainable competitive advantages. Market success will increasingly depend on the ability to provide comprehensive solutions, maintain technology leadership, and adapt to rapidly changing customer requirements and market conditions.

The Asia-Pacific small cell 5G market represents a transformative force in telecommunications infrastructure development, driven by unprecedented demand for enhanced wireless connectivity and supported by favorable regulatory environments and substantial investment commitments. This dynamic market continues to evolve rapidly, creating significant opportunities for technology providers, telecommunications operators, and service companies across the region.

Market fundamentals remain strong, with sustained growth momentum supported by urbanization trends, digital transformation initiatives, and emerging application requirements that demand high-performance wireless infrastructure. The successful deployment of small cell 5G networks is enabling new business models, improving operational efficiency, and supporting economic development across diverse industry sectors and geographical regions.

Strategic success in this market requires continuous innovation, customer-focused solution development, and adaptive business strategies that respond to evolving technology requirements and competitive dynamics. Companies that can effectively combine technological excellence with market understanding and operational capabilities will be best positioned to capitalize on the substantial growth opportunities within the Asia-Pacific small cell 5G market.

What is Small Cell 5G?

Small Cell 5G refers to low-powered cellular radio access nodes that operate in a range of a few hundred meters. They are essential for enhancing network capacity and coverage, particularly in densely populated urban areas.

What are the key players in the Asia-Pacific Small Cell 5G Market?

Key players in the Asia-Pacific Small Cell 5G Market include Huawei, Nokia, Ericsson, and ZTE, among others. These companies are actively involved in developing and deploying small cell technology to support the growing demand for 5G connectivity.

What are the main drivers of the Asia-Pacific Small Cell 5G Market?

The main drivers of the Asia-Pacific Small Cell 5G Market include the increasing demand for high-speed internet, the proliferation of IoT devices, and the need for enhanced mobile broadband services. These factors are pushing network operators to invest in small cell infrastructure.

What challenges does the Asia-Pacific Small Cell 5G Market face?

Challenges in the Asia-Pacific Small Cell 5G Market include regulatory hurdles, high deployment costs, and the need for extensive backhaul solutions. These factors can slow down the rollout of small cell networks in various regions.

What opportunities exist in the Asia-Pacific Small Cell 5G Market?

Opportunities in the Asia-Pacific Small Cell 5G Market include the expansion of smart city initiatives, the growth of augmented and virtual reality applications, and the increasing demand for enhanced mobile experiences. These trends are likely to drive further investment in small cell technology.

What trends are shaping the Asia-Pacific Small Cell 5G Market?

Trends shaping the Asia-Pacific Small Cell 5G Market include the integration of artificial intelligence for network optimization, the rise of private 5G networks, and advancements in small cell design for better energy efficiency. These innovations are crucial for meeting future connectivity demands.

Asia-Pacific Small Cell 5G Market

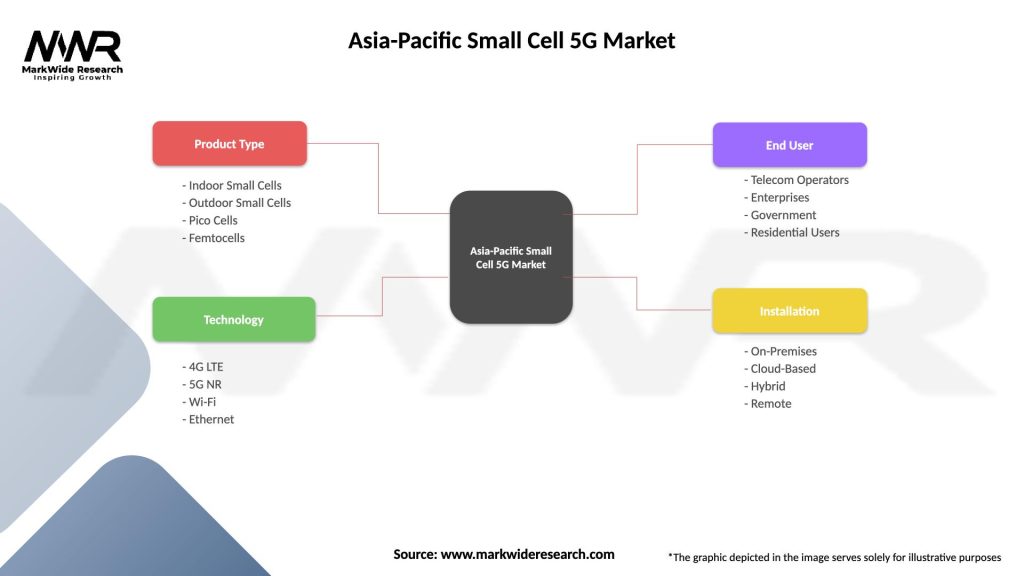

| Segmentation Details | Description |

|---|---|

| Product Type | Indoor Small Cells, Outdoor Small Cells, Pico Cells, Femtocells |

| Technology | 4G LTE, 5G NR, Wi-Fi, Ethernet |

| End User | Telecom Operators, Enterprises, Government, Residential Users |

| Installation | On-Premises, Cloud-Based, Hybrid, Remote |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Small Cell 5G Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at