444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific sleep tech devices market represents one of the fastest-growing segments in the global healthcare technology landscape, driven by increasing awareness of sleep disorders and rising adoption of digital health solutions. This dynamic market encompasses a comprehensive range of innovative devices designed to monitor, analyze, and improve sleep quality across diverse consumer segments. Sleep technology devices in the Asia Pacific region include wearable sleep trackers, smart mattresses, sleep monitoring apps, CPAP machines, and advanced diagnostic equipment that leverage artificial intelligence and machine learning capabilities.

Market dynamics indicate robust growth potential, with the region experiencing a 12.5% CAGR in sleep tech device adoption over recent years. The proliferation of smartphone technology, increasing disposable income, and growing health consciousness among consumers have created favorable conditions for market expansion. Key markets including China, Japan, South Korea, India, and Australia are witnessing significant investments in sleep health infrastructure and consumer education initiatives.

Regional characteristics demonstrate varying adoption patterns, with developed markets like Japan and South Korea leading in premium device penetration, while emerging economies focus on affordable, smartphone-integrated solutions. The market benefits from strong manufacturing capabilities within the region, particularly in China and Taiwan, which serve as global production hubs for consumer electronics and medical devices.

The Asia Pacific sleep tech devices market refers to the comprehensive ecosystem of technological solutions designed to monitor, analyze, and improve sleep quality and address sleep-related disorders across the Asia Pacific region. This market encompasses both consumer-grade devices for personal sleep optimization and clinical-grade equipment for medical diagnosis and treatment of sleep disorders.

Sleep tech devices integrate advanced sensors, artificial intelligence, and connectivity features to provide users with detailed insights into their sleep patterns, duration, quality, and potential disturbances. These devices range from simple wearable fitness trackers with sleep monitoring capabilities to sophisticated polysomnography equipment used in sleep clinics and hospitals throughout the region.

Market scope includes various product categories such as wearable devices, non-wearable monitors, smartphone applications, smart home integration systems, and therapeutic devices. The technology leverages multiple data collection methods including accelerometry, heart rate monitoring, respiratory pattern analysis, and environmental factor tracking to deliver comprehensive sleep health assessments.

Market expansion in the Asia Pacific sleep tech devices sector demonstrates exceptional momentum, driven by increasing prevalence of sleep disorders and growing consumer awareness of sleep health importance. The region’s diverse demographic profile, ranging from aging populations in developed countries to young, tech-savvy consumers in emerging markets, creates multiple growth opportunities for device manufacturers and service providers.

Technology adoption patterns reveal strong preference for integrated solutions that combine sleep monitoring with broader health and wellness tracking capabilities. Consumers increasingly seek devices that provide actionable insights and personalized recommendations rather than basic data collection. This trend has accelerated the development of AI-powered sleep coaching platforms and smart home integration features.

Competitive landscape features both established global technology companies and innovative regional startups, creating a dynamic environment for product development and market penetration. The market benefits from strong research and development capabilities within the region, particularly in countries with advanced semiconductor and consumer electronics industries.

Growth projections indicate sustained expansion across all major product categories, with wearable devices maintaining the largest market share while smart mattresses and environmental monitoring systems show the highest growth rates. Consumer spending on sleep tech devices has increased by 38% annually in key metropolitan areas, reflecting growing prioritization of sleep health among urban populations.

Sleep disorder prevalence continues to increase across Asia Pacific countries, driven by urbanization, lifestyle changes, and work-related stress factors. Studies indicate that 45% of adults in major metropolitan areas experience some form of sleep disturbance, creating substantial demand for monitoring and intervention technologies. The growing recognition of sleep’s impact on mental health, immune function, and cognitive performance motivates consumers to invest in sleep optimization solutions.

Technological advancement in sensor miniaturization, battery life, and data processing capabilities enables the development of more sophisticated and user-friendly sleep monitoring devices. Integration with artificial intelligence and machine learning platforms allows for personalized sleep coaching and predictive health insights that add significant value for consumers seeking comprehensive wellness solutions.

Healthcare system evolution toward preventive care and patient-centered approaches creates opportunities for sleep tech devices to play important roles in early detection and management of sleep-related health conditions. Healthcare providers increasingly recognize the value of continuous monitoring data in developing effective treatment plans and tracking patient progress over time.

Digital health adoption accelerated significantly following global health events, with consumers becoming more comfortable using technology for health monitoring and management. This cultural shift toward digital health solutions creates favorable conditions for sleep tech device adoption across diverse consumer segments and age groups throughout the region.

Privacy concerns regarding personal health data collection and storage present significant challenges for sleep tech device adoption, particularly among consumers who are cautious about sharing intimate behavioral patterns with technology companies. Data security incidents and unclear privacy policies can undermine consumer confidence and limit market penetration in privacy-conscious segments.

Accuracy limitations of consumer-grade sleep monitoring devices compared to clinical polysomnography equipment create skepticism among healthcare professionals and informed consumers. Inconsistent measurements and false readings can lead to user frustration and abandonment of sleep tracking habits, particularly when devices fail to provide reliable baseline measurements.

Cost barriers remain significant for premium sleep tech devices, especially in price-sensitive markets where consumers prioritize essential healthcare spending over wellness optimization tools. High-end smart mattresses and clinical-grade monitoring equipment require substantial investments that may not be accessible to broad consumer segments in emerging economies.

Cultural factors in certain Asia Pacific markets may limit acceptance of sleep monitoring technologies, particularly among older demographics who prefer traditional approaches to health management. Resistance to technology adoption and concerns about device dependency can slow market penetration in conservative consumer segments.

Aging population demographics across developed Asia Pacific countries create substantial opportunities for sleep tech companies to develop specialized solutions for age-related sleep disorders and health monitoring needs. The growing senior population requires user-friendly devices with larger displays, simplified interfaces, and integration with existing healthcare management systems.

Corporate wellness expansion presents significant B2B market opportunities as employers increasingly recognize sleep health’s impact on productivity, absenteeism, and healthcare costs. Companies are investing in comprehensive wellness programs that include sleep education, monitoring devices, and workplace environment optimization to improve employee well-being and performance.

Healthcare integration opportunities continue expanding as medical systems adopt digital health technologies and remote patient monitoring capabilities. Sleep tech devices that meet clinical standards and provide healthcare-grade data can access new revenue streams through medical device channels and insurance reimbursement programs.

Smart home ecosystem development creates opportunities for sleep tech companies to integrate their solutions with broader home automation platforms, enabling comprehensive sleep environment optimization through lighting, temperature, and noise control systems that work together to improve sleep quality.

Competitive intensity in the Asia Pacific sleep tech devices market continues to increase as both established technology companies and innovative startups compete for market share across diverse product categories. This competition drives rapid innovation cycles, feature enhancement, and price optimization that benefit consumers while challenging companies to differentiate their offerings through unique value propositions.

Supply chain considerations play crucial roles in market dynamics, with many companies leveraging the region’s strong manufacturing capabilities while managing component sourcing, quality control, and distribution logistics across diverse geographic markets with varying regulatory requirements and consumer preferences.

Regulatory evolution across Asia Pacific countries creates dynamic market conditions as governments develop frameworks for digital health devices, data privacy protection, and medical device classification. Companies must navigate varying regulatory landscapes while maintaining product consistency and compliance across multiple jurisdictions.

Consumer behavior patterns demonstrate increasing sophistication in sleep tech device selection, with users seeking comprehensive solutions that integrate multiple health metrics, provide actionable insights, and connect with broader wellness ecosystems. This trend drives demand for platform-based approaches rather than standalone device offerings.

Primary research methodologies employed in analyzing the Asia Pacific sleep tech devices market include comprehensive surveys of consumers, healthcare professionals, and industry stakeholders across major regional markets. Direct interviews with device manufacturers, distributors, and retail partners provide insights into market trends, competitive dynamics, and growth projections that inform strategic analysis.

Secondary research incorporates analysis of industry reports, regulatory filings, patent applications, and academic studies related to sleep health and technology adoption patterns. Market data collection includes retail sales tracking, e-commerce analytics, and consumer behavior studies that reveal purchasing patterns and product preference trends across different demographic segments.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources, expert consultations, and statistical analysis techniques that account for regional variations and market-specific factors. MarkWide Research employs rigorous quality control measures to verify data integrity and analytical conclusions throughout the research process.

Market modeling approaches utilize both quantitative and qualitative analysis techniques to project future market trends, identify growth opportunities, and assess competitive positioning across various product categories and geographic segments within the Asia Pacific region.

China dominates the Asia Pacific sleep tech devices market with approximately 35% market share, driven by large population base, growing middle class, and strong domestic manufacturing capabilities. Chinese consumers demonstrate high adoption rates for smartphone-integrated sleep monitoring solutions, while the country’s robust e-commerce infrastructure facilitates widespread product distribution and consumer education initiatives.

Japan represents the premium segment leader with sophisticated consumer preferences for high-quality, feature-rich sleep tech devices. The country’s aging population drives demand for medical-grade monitoring equipment, while tech-savvy younger demographics embrace wearable devices and smart home integration solutions. Japanese companies contribute significant innovation in sensor technology and user interface design.

South Korea demonstrates exceptional growth in smart sleep solutions, with 28% annual adoption rate increases driven by high smartphone penetration and consumer interest in health optimization technologies. The country’s advanced telecommunications infrastructure supports connected device ecosystems and real-time data analysis capabilities.

India shows rapid market expansion potential with growing urban middle class and increasing health awareness, though price sensitivity requires focus on affordable, value-oriented product offerings. The market benefits from strong software development capabilities and growing domestic manufacturing initiatives in electronics and medical devices.

Australia and Southeast Asian markets contribute steady growth through diverse consumer segments ranging from health-conscious professionals to aging populations seeking sleep disorder management solutions. These markets demonstrate preference for clinically validated devices with healthcare provider endorsements.

Market leadership in the Asia Pacific sleep tech devices sector features a diverse mix of global technology companies, specialized health device manufacturers, and innovative regional startups that compete across multiple product categories and price segments.

Competitive strategies focus on product differentiation through advanced sensor technology, artificial intelligence integration, and comprehensive health platform development. Companies increasingly pursue partnerships with healthcare providers, research institutions, and wellness program administrators to expand market reach and validate product effectiveness.

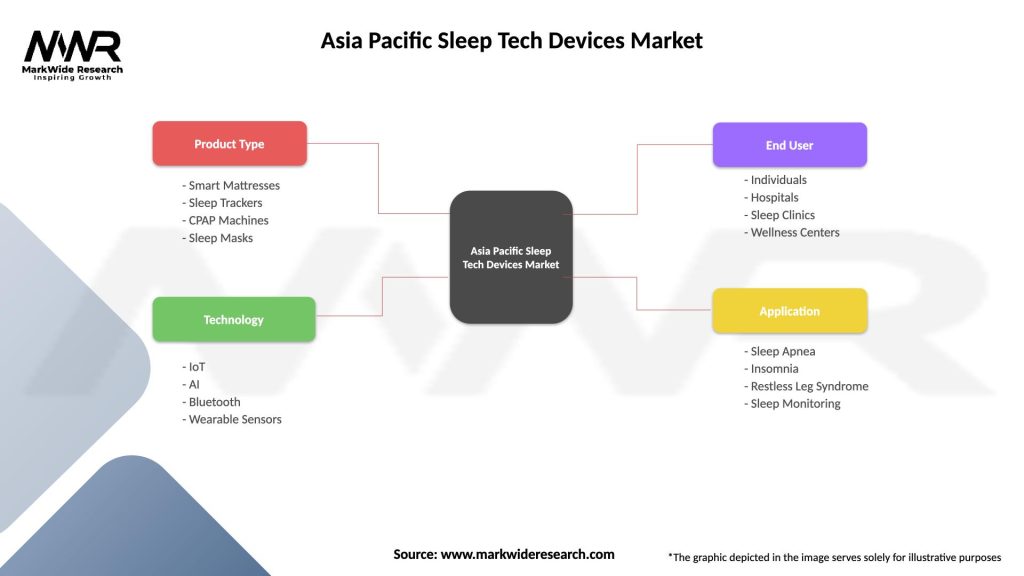

By Product Type:

By Technology:

By End User:

Wearable devices maintain the largest market segment with 52% market share, driven by consumer preference for multi-functional devices that combine sleep monitoring with fitness tracking, communication, and entertainment features. Advanced wearables incorporate heart rate variability analysis, blood oxygen monitoring, and temperature sensing to provide comprehensive sleep health assessments.

Smart mattresses represent the fastest-growing category with 24% annual growth rate, appealing to consumers seeking passive monitoring solutions that don’t require wearing devices during sleep. These products integrate multiple sensor types, climate control systems, and partner sleep tracking capabilities that provide detailed insights without user intervention requirements.

Mobile applications serve as essential companion platforms for hardware devices while also functioning as standalone sleep tracking solutions using smartphone sensors. App-based solutions benefit from low barrier to entry, frequent updates, and integration with broader health and wellness ecosystems that enhance user engagement and retention.

Clinical devices address growing demand from healthcare providers for accurate sleep disorder diagnosis and treatment monitoring. This segment benefits from increasing recognition of sleep health importance in medical practice and expanding insurance coverage for sleep-related medical interventions across developed Asia Pacific markets.

Device manufacturers benefit from expanding market opportunities across diverse consumer segments, enabling product portfolio diversification and revenue growth through both consumer and healthcare channels. The market’s growth trajectory supports sustained investment in research and development activities that drive technological advancement and competitive differentiation.

Healthcare providers gain access to continuous patient monitoring data that enhances diagnostic accuracy and treatment effectiveness for sleep-related disorders. Integration with electronic health records and telemedicine platforms improves patient care coordination while reducing costs associated with traditional sleep study procedures.

Consumers experience improved sleep quality and overall health outcomes through personalized insights, behavioral coaching, and early detection of potential sleep disorders. Access to comprehensive sleep data empowers individuals to make informed lifestyle decisions and seek appropriate medical intervention when necessary.

Employers realize significant returns on investment through workplace wellness programs that include sleep health components, resulting in reduced absenteeism, improved productivity, and lower healthcare costs. Employee engagement with sleep optimization tools contributes to overall workplace satisfaction and retention rates.

Insurance providers can leverage sleep tech device data to develop more accurate risk assessments and personalized premium structures while encouraging preventive health behaviors that reduce long-term healthcare costs and improve member health outcomes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend shaping the Asia Pacific sleep tech devices market, with companies increasingly incorporating machine learning algorithms that provide personalized sleep coaching, predictive health insights, and automated optimization recommendations. AI-powered platforms analyze complex sleep patterns and environmental factors to deliver actionable guidance that goes beyond basic data collection.

Ecosystem connectivity drives demand for devices that integrate seamlessly with smart home platforms, healthcare systems, and wellness applications. Consumers prefer comprehensive solutions that coordinate multiple aspects of their sleep environment, from lighting and temperature control to noise management and air quality optimization.

Clinical validation becomes increasingly important as consumers and healthcare providers seek evidence-based sleep monitoring solutions. Companies invest in clinical studies and medical partnerships to demonstrate device accuracy and therapeutic value, particularly for applications related to sleep disorder diagnosis and treatment monitoring.

Subscription services emerge as important revenue models, with companies offering premium analytics, personalized coaching, and advanced features through recurring payment structures. This trend enables continuous product improvement and enhanced user engagement while providing predictable revenue streams for device manufacturers.

Workplace integration expands as employers recognize sleep health’s impact on productivity and employee well-being. Corporate wellness programs increasingly include sleep monitoring components, creating new market segments and distribution channels for sleep tech device providers.

Product launches in recent periods demonstrate significant innovation in sensor technology, with companies introducing devices that monitor previously unmeasurable sleep parameters such as sleep position, snoring intensity, and respiratory patterns. These advanced monitoring capabilities provide more comprehensive sleep health assessments and enable early detection of potential sleep disorders.

Strategic partnerships between technology companies and healthcare providers create new pathways for clinical validation and market access. MWR analysis indicates that companies pursuing healthcare partnerships achieve 40% higher adoption rates among health-conscious consumers compared to those focusing solely on consumer electronics channels.

Regulatory approvals for medical-grade sleep monitoring devices expand market opportunities in clinical settings while enhancing consumer confidence in device accuracy and reliability. Several Asia Pacific countries have streamlined approval processes for digital health devices, accelerating time-to-market for innovative sleep tech solutions.

Investment activity in sleep tech startups reaches record levels, with venture capital firms and strategic investors recognizing the sector’s growth potential and market expansion opportunities. This funding supports research and development activities, clinical studies, and market expansion initiatives across the region.

Technology acquisitions by major consumer electronics companies demonstrate strategic focus on sleep health as a key differentiator in competitive wearable device markets. These acquisitions bring specialized expertise and intellectual property that enhance product capabilities and market positioning.

Market entry strategies should focus on addressing specific regional preferences and price sensitivity levels across diverse Asia Pacific markets. Companies entering emerging markets should prioritize affordable, smartphone-integrated solutions, while developed markets offer opportunities for premium, feature-rich devices with advanced analytics capabilities.

Product development priorities should emphasize accuracy improvement, battery life extension, and user experience optimization to address current market limitations. Integration with artificial intelligence platforms and healthcare systems will become increasingly important for competitive differentiation and market success.

Partnership development with healthcare providers, wellness program administrators, and research institutions can accelerate market adoption and provide clinical validation that enhances product credibility. These partnerships also create new revenue opportunities and distribution channels beyond traditional consumer electronics retail.

Data privacy and security measures must be prioritized to address consumer concerns and regulatory requirements across different Asia Pacific jurisdictions. Transparent privacy policies and robust security infrastructure will become essential competitive advantages in privacy-conscious market segments.

Localization efforts should account for cultural preferences, language requirements, and healthcare system integration needs across different countries. Successful companies will adapt their products and marketing approaches to align with local market characteristics and consumer expectations.

Market expansion projections indicate sustained growth across all major product categories, with particular strength in AI-powered devices and healthcare-integrated solutions. The market is expected to maintain robust growth momentum driven by increasing health awareness, technological advancement, and expanding applications in clinical and workplace settings.

Technology evolution will focus on improving measurement accuracy, extending battery life, and enhancing user experience through more intuitive interfaces and personalized recommendations. Integration with emerging technologies such as 5G connectivity and edge computing will enable real-time analysis and immediate feedback capabilities.

Healthcare integration opportunities will expand as medical systems adopt digital health technologies and remote patient monitoring becomes standard practice. Sleep tech devices that meet clinical standards and provide healthcare-grade data will access new revenue streams through medical device channels and insurance reimbursement programs.

Regional market development will see continued growth in established markets like Japan and South Korea, while emerging economies including India and Southeast Asian countries present significant expansion opportunities. MarkWide Research projects that emerging markets will account for 60% of new user adoption over the next five years, driven by increasing smartphone penetration and growing middle-class populations.

Innovation focus will shift toward comprehensive sleep health platforms that integrate monitoring, analysis, intervention, and outcome tracking capabilities. Companies that successfully develop ecosystem approaches connecting devices, applications, and services will achieve competitive advantages in user engagement and retention.

The Asia Pacific sleep tech devices market represents a dynamic and rapidly expanding sector with exceptional growth potential driven by increasing health awareness, technological innovation, and diverse consumer needs across the region. Market participants benefit from strong manufacturing capabilities, growing healthcare integration opportunities, and expanding applications in both consumer and clinical settings.

Success factors for companies operating in this market include focus on accuracy improvement, user experience optimization, and strategic partnerships with healthcare providers and wellness program administrators. The integration of artificial intelligence capabilities and comprehensive ecosystem approaches will become increasingly important for competitive differentiation and market leadership.

Future growth will be supported by demographic trends, technological advancement, and expanding recognition of sleep health importance among consumers, employers, and healthcare providers. Companies that successfully navigate regulatory requirements, address privacy concerns, and deliver clinically validated solutions will capture the greatest opportunities in this evolving market landscape.

What is Sleep Tech Devices?

Sleep Tech Devices refer to a range of technologies designed to improve sleep quality and monitor sleep patterns. These devices include sleep trackers, smart mattresses, and sleep aids that utilize various technologies to enhance the sleep experience.

What are the key players in the Asia Pacific Sleep Tech Devices Market?

Key players in the Asia Pacific Sleep Tech Devices Market include Philips, Sleep Number, Fitbit, and Xiaomi, among others. These companies are known for their innovative products that cater to the growing demand for sleep improvement solutions.

What are the main drivers of the Asia Pacific Sleep Tech Devices Market?

The main drivers of the Asia Pacific Sleep Tech Devices Market include increasing awareness of sleep disorders, the rise in health consciousness among consumers, and advancements in technology that enhance sleep monitoring and improvement.

What challenges does the Asia Pacific Sleep Tech Devices Market face?

Challenges in the Asia Pacific Sleep Tech Devices Market include high costs of advanced sleep technologies, varying consumer acceptance levels, and competition from traditional sleep aids. These factors can hinder market growth and adoption.

What opportunities exist in the Asia Pacific Sleep Tech Devices Market?

Opportunities in the Asia Pacific Sleep Tech Devices Market include the potential for product innovation, the integration of artificial intelligence in sleep monitoring, and the growing trend of personalized health solutions. These factors can drive future growth.

What trends are shaping the Asia Pacific Sleep Tech Devices Market?

Trends shaping the Asia Pacific Sleep Tech Devices Market include the increasing use of wearable technology for sleep tracking, the development of smart home devices that promote better sleep environments, and a focus on holistic health approaches that incorporate sleep wellness.

Asia Pacific Sleep Tech Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Smart Mattresses, Sleep Trackers, CPAP Machines, Sleep Masks |

| Technology | IoT, AI, Bluetooth, Wearable Sensors |

| End User | Individuals, Hospitals, Sleep Clinics, Wellness Centers |

| Application | Sleep Apnea, Insomnia, Restless Leg Syndrome, Sleep Monitoring |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Sleep Tech Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at