444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific single-use packaging market represents one of the most dynamic and rapidly evolving segments in the global packaging industry. This expansive market encompasses a diverse range of disposable packaging solutions designed for immediate consumption and disposal, including food containers, beverage cups, takeaway packaging, and various consumer goods packaging. The region’s robust economic growth, coupled with changing consumer lifestyles and increasing urbanization, has positioned Asia Pacific as a critical hub for single-use packaging innovation and consumption.

Market dynamics in the Asia Pacific region are characterized by significant growth momentum, driven by the expanding food service industry, e-commerce proliferation, and rising disposable incomes across emerging economies. The market demonstrates remarkable diversity across different countries, with varying regulatory environments, consumer preferences, and sustainability initiatives shaping the competitive landscape. Growth projections indicate the market is expanding at a robust CAGR of 6.2%, reflecting strong demand fundamentals and technological advancements in packaging materials.

Regional variations play a crucial role in market development, with countries like China, India, Japan, and Southeast Asian nations each contributing unique growth drivers and challenges. The increasing adoption of convenience food culture, rapid urbanization, and the proliferation of quick-service restaurants have collectively fueled demand for innovative single-use packaging solutions. Sustainability concerns are increasingly influencing market trends, with manufacturers investing heavily in biodegradable and recyclable packaging alternatives to address environmental challenges.

The Asia Pacific single-use packaging market refers to the comprehensive ecosystem of disposable packaging products designed for immediate use and disposal across the Asia Pacific region. This market encompasses a wide spectrum of packaging solutions including food and beverage containers, takeaway packaging, disposable plates and cups, shopping bags, and various consumer product packaging designed for single-use applications.

Single-use packaging is characterized by its convenience, hygiene benefits, and cost-effectiveness for both consumers and businesses. These products are typically manufactured from materials such as plastic, paper, aluminum, and increasingly, biodegradable alternatives. The market serves diverse end-use industries including food service, retail, healthcare, e-commerce, and consumer goods, each with specific requirements for functionality, durability, and regulatory compliance.

Market scope extends beyond traditional packaging to include innovative solutions such as smart packaging with embedded sensors, temperature-controlled containers, and sustainable alternatives made from plant-based materials. The definition encompasses both rigid and flexible packaging formats, addressing the evolving needs of modern consumers who prioritize convenience, safety, and increasingly, environmental responsibility in their purchasing decisions.

Strategic market positioning reveals the Asia Pacific single-use packaging market as a cornerstone of the region’s broader packaging industry, driven by fundamental shifts in consumer behavior and business operations. The market’s expansion is underpinned by several key factors including rapid urbanization, growing middle-class populations, and the accelerating adoption of on-the-go consumption patterns across major economies.

Key market drivers include the explosive growth of food delivery services, which has increased by 78% adoption rate across major urban centers, and the expansion of modern retail formats. The COVID-19 pandemic has further accelerated demand for hygienic, single-use packaging solutions, particularly in food service and healthcare applications. E-commerce growth has contributed significantly to packaging demand, with online retail penetration reaching 35% in key markets.

Competitive dynamics are characterized by a mix of global multinational corporations and regional players, each competing on innovation, sustainability, and cost-effectiveness. Market leaders are investing heavily in research and development to create environmentally friendly alternatives while maintaining functionality and affordability. Regulatory pressures regarding plastic waste management are driving innovation in biodegradable and recyclable packaging solutions, creating both challenges and opportunities for market participants.

Future prospects indicate continued robust growth, supported by ongoing urbanization, rising disposable incomes, and evolving consumer preferences toward convenience-oriented lifestyles. The market is expected to witness significant transformation as sustainability becomes a primary consideration in packaging design and material selection.

Market segmentation analysis reveals distinct patterns across different product categories and geographic regions within Asia Pacific. The following key insights provide a comprehensive understanding of market dynamics:

Urbanization acceleration stands as the primary catalyst driving single-use packaging demand across Asia Pacific. Rapid urban population growth has fundamentally altered consumption patterns, with busy urban lifestyles creating unprecedented demand for convenient, portable packaging solutions. Metropolitan areas are experiencing significant expansion, leading to increased adoption of on-the-go food consumption and takeaway services that rely heavily on single-use packaging.

Food service industry expansion represents another critical growth driver, with the proliferation of quick-service restaurants, food delivery platforms, and casual dining establishments. The rise of food aggregator platforms and delivery services has created substantial demand for specialized packaging that maintains food quality during transportation while ensuring hygiene and convenience for consumers.

E-commerce proliferation has emerged as a transformative force, generating massive demand for protective packaging solutions. Online retail growth has necessitated innovative packaging designs that ensure product safety during shipping while minimizing material usage and environmental impact. Consumer electronics, fashion, and consumer goods sectors are driving demand for specialized single-use packaging solutions.

Changing demographics and lifestyle preferences, particularly among younger consumers, favor convenience-oriented products and services. Rising disposable incomes across emerging economies have enabled consumers to prioritize convenience and quality, driving demand for premium single-use packaging solutions. Health consciousness has also increased demand for hygienic, tamper-evident packaging across various applications.

Environmental concerns pose the most significant challenge to market growth, with increasing awareness of plastic pollution and its environmental impact. Governments across the region are implementing stringent regulations regarding single-use plastics, creating compliance challenges and additional costs for manufacturers. Plastic waste management issues have led to consumer backlash and regulatory restrictions that limit market expansion opportunities.

Raw material price volatility creates ongoing challenges for manufacturers, particularly those dependent on petroleum-based materials. Fluctuating oil prices directly impact production costs, affecting profit margins and pricing strategies. Supply chain disruptions, as experienced during the COVID-19 pandemic, have highlighted vulnerabilities in raw material sourcing and distribution networks.

Regulatory complexity across different countries within the Asia Pacific region creates compliance challenges for manufacturers operating in multiple markets. Varying standards for food safety, environmental protection, and waste management require significant investment in regulatory compliance and product adaptation. Import restrictions and trade barriers in certain countries further complicate market access strategies.

Competition from reusable alternatives is intensifying as consumers and businesses seek more sustainable packaging solutions. The growing popularity of reusable containers, bags, and packaging systems presents a direct challenge to single-use packaging demand. Corporate sustainability initiatives by major retailers and food service companies are driving shifts toward reusable and refillable packaging systems.

Sustainable packaging innovation presents the most significant growth opportunity, with increasing demand for biodegradable, compostable, and recyclable packaging solutions. Manufacturers investing in plant-based materials, bio-plastics, and innovative recycling technologies are well-positioned to capture market share as environmental regulations tighten and consumer preferences shift toward sustainable options.

Smart packaging integration offers substantial opportunities for differentiation and value creation. Technologies such as QR codes, NFC chips, and temperature sensors are enabling enhanced consumer engagement, supply chain visibility, and product authentication. Internet of Things (IoT) integration in packaging is creating new revenue streams and competitive advantages for innovative manufacturers.

Emerging market penetration in countries such as Vietnam, Thailand, Indonesia, and the Philippines presents significant growth potential. These markets are experiencing rapid economic development, urbanization, and adoption of modern retail formats, creating substantial demand for single-use packaging solutions. Infrastructure development in these regions is facilitating market access and distribution capabilities.

Customization and personalization trends are creating opportunities for premium packaging solutions. Brands are increasingly seeking unique packaging designs that enhance brand recognition and consumer experience. Digital printing technologies are enabling cost-effective customization and short-run production, opening new market segments for specialized packaging applications.

Supply and demand equilibrium in the Asia Pacific single-use packaging market is influenced by complex interactions between consumer behavior, regulatory frameworks, and technological advancement. The market demonstrates strong demand fundamentals driven by structural economic changes, while supply-side dynamics are shaped by manufacturing capabilities, raw material availability, and environmental considerations.

Competitive intensity varies significantly across different market segments and geographic regions. Food service packaging experiences intense competition due to standardized requirements and price sensitivity, while specialized applications such as pharmaceutical and electronics packaging command premium pricing and higher barriers to entry. Market consolidation trends are evident as larger players acquire regional manufacturers to expand geographic coverage and technological capabilities.

Innovation cycles are accelerating as manufacturers respond to environmental pressures and changing consumer preferences. Research and development investments are focusing on sustainable materials, functional improvements, and cost optimization. Technology adoption is driving efficiency improvements throughout the value chain, from raw material processing to final product delivery.

Regulatory evolution continues to reshape market dynamics, with governments implementing increasingly stringent environmental standards while supporting innovation in sustainable packaging. Policy frameworks are creating both challenges and opportunities, driving market transformation toward more environmentally responsible solutions while maintaining economic viability for industry participants.

Comprehensive market analysis employs a multi-faceted research approach combining primary and secondary research methodologies to ensure accuracy and reliability of market insights. The research framework incorporates quantitative and qualitative analysis techniques to provide a holistic understanding of market dynamics, competitive landscape, and future growth prospects.

Primary research activities include extensive interviews with industry executives, manufacturers, distributors, and end-users across key markets in the Asia Pacific region. Survey methodologies capture consumer preferences, purchasing behavior, and sustainability attitudes that influence market demand. Expert consultations with industry specialists provide insights into technological trends, regulatory developments, and competitive strategies.

Secondary research sources encompass industry reports, government publications, trade association data, and company financial statements. Market sizing and forecasting models incorporate historical data analysis, trend extrapolation, and econometric modeling to project future market development. Cross-validation techniques ensure data accuracy and consistency across multiple sources and research methodologies.

Geographic coverage includes detailed analysis of major markets including China, India, Japan, South Korea, Australia, and key Southeast Asian countries. Regional variations in market dynamics, regulatory environments, and consumer preferences are systematically analyzed to provide country-specific insights and growth projections.

China dominates the Asia Pacific single-use packaging market, representing the largest consumer base and manufacturing hub in the region. The country’s massive population, rapid urbanization, and expanding food service industry create substantial demand for diverse packaging solutions. Manufacturing capabilities in China serve both domestic consumption and export markets, with significant investments in sustainable packaging technologies and production capacity expansion.

India emerges as the second-largest market, driven by rapid economic growth, urbanization, and changing consumer lifestyles. The country’s young demographic profile and increasing adoption of modern retail formats create strong demand fundamentals. Government initiatives promoting domestic manufacturing and sustainable packaging are attracting significant investment in production facilities and technology development.

Japan maintains a mature but innovative market characterized by high-quality standards, advanced packaging technologies, and strong environmental consciousness. The country leads in sustainable packaging innovation and premium product segments. Aging population trends are driving demand for convenient packaging solutions, while strict environmental regulations promote adoption of eco-friendly alternatives.

Southeast Asian markets including Indonesia, Thailand, Vietnam, and the Philippines demonstrate strong growth potential driven by economic development, urbanization, and expanding middle-class populations. These markets are experiencing rapid adoption of modern retail formats and food service concepts, creating substantial opportunities for packaging manufacturers. Infrastructure development and foreign investment are facilitating market access and distribution capabilities across the region.

Market leadership is distributed among several global and regional players, each with distinct competitive advantages and market positioning strategies. The competitive environment is characterized by ongoing consolidation, technological innovation, and geographic expansion initiatives.

Strategic initiatives among leading players include investments in sustainable packaging technologies, geographic expansion through acquisitions and partnerships, and development of innovative product solutions. Research and development spending is increasing as companies compete on sustainability, functionality, and cost-effectiveness.

Product type segmentation reveals distinct market dynamics across different packaging categories, each with unique growth drivers and competitive characteristics:

By Material Type:

By Application:

By End-User Industry:

Food service packaging represents the most dynamic category, driven by the explosive growth of food delivery services and changing dining habits. This category includes takeaway containers, beverage cups, cutlery, and specialized packaging for hot and cold foods. Innovation focus centers on maintaining food quality during transportation, ensuring leak-proof performance, and incorporating sustainable materials without compromising functionality.

Retail packaging encompasses shopping bags, product wrapping, and promotional packaging used in traditional and modern retail environments. The category is experiencing transformation due to regulatory restrictions on plastic bags and growing consumer preference for reusable alternatives. Premium segments within retail packaging focus on brand enhancement and customer experience improvement.

E-commerce packaging has emerged as a high-growth category, driven by online shopping proliferation and need for protective packaging during shipping. This category includes corrugated boxes, bubble wrap, protective inserts, and branded packaging solutions. Sustainability initiatives are driving innovation in recyclable and biodegradable e-commerce packaging solutions.

Healthcare packaging maintains steady growth driven by aging populations and increasing healthcare consumption. This specialized category requires stringent quality standards, regulatory compliance, and tamper-evident features. Innovation trends include smart packaging with tracking capabilities and child-resistant designs for pharmaceutical applications.

Manufacturers benefit from diverse growth opportunities across multiple market segments and geographic regions. The expanding market provides opportunities for capacity utilization, product innovation, and geographic expansion. Economies of scale enable cost optimization and competitive pricing strategies, while technological advancement creates differentiation opportunities and premium pricing potential.

Retailers and food service operators gain access to innovative packaging solutions that enhance customer experience, improve operational efficiency, and support brand differentiation. Convenience benefits include reduced handling costs, improved food safety, and enhanced customer satisfaction through functional packaging design.

Consumers enjoy enhanced convenience, improved food safety, and access to innovative packaging features that improve product usability and storage. Hygiene benefits are particularly important in food service applications, while convenience features support busy urban lifestyles and on-the-go consumption patterns.

Environmental stakeholders benefit from increasing industry focus on sustainable packaging solutions, including biodegradable materials, recyclable designs, and reduced material usage. Innovation investments in sustainable technologies contribute to environmental protection while maintaining economic viability for industry participants.

Investors and financial stakeholders benefit from stable market growth, diverse revenue streams, and innovation-driven value creation opportunities. The market’s resilience during economic downturns and strong growth fundamentals provide attractive investment opportunities across the value chain.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend reshaping the single-use packaging market. Manufacturers are investing heavily in biodegradable materials, recyclable designs, and circular economy principles. Plant-based packaging solutions are gaining traction, with innovations in materials derived from agricultural waste, seaweed, and other renewable sources creating new market opportunities.

Smart packaging integration is revolutionizing traditional packaging concepts through incorporation of digital technologies. QR codes, NFC chips, and sensors are enabling enhanced consumer engagement, supply chain visibility, and product authentication. Internet of Things (IoT) connectivity is creating new revenue streams and competitive advantages for innovative manufacturers.

Customization and personalization trends are driving demand for unique packaging designs that enhance brand recognition and consumer experience. Digital printing technologies are enabling cost-effective customization and short-run production, opening new market segments for specialized packaging applications. Brand differentiation through packaging design is becoming increasingly important in competitive markets.

Convenience enhancement continues to drive innovation in packaging functionality, with features such as easy-open designs, portion control, and multi-functional packaging gaining popularity. Consumer lifestyle changes are driving demand for packaging solutions that support on-the-go consumption and busy urban lifestyles.

Regulatory compliance is becoming increasingly complex as governments implement stricter environmental standards and waste management requirements. Manufacturers are adapting through investment in sustainable technologies and compliance systems. Extended producer responsibility programs are driving industry collaboration on recycling and waste management initiatives.

Strategic acquisitions and partnerships are reshaping the competitive landscape as companies seek to expand geographic coverage, enhance technological capabilities, and access new market segments. MarkWide Research analysis indicates increasing consolidation activity as larger players acquire regional manufacturers to strengthen market position and operational efficiency.

Manufacturing capacity expansion is occurring across key markets to meet growing demand and support geographic expansion strategies. New production facilities are incorporating advanced technologies and sustainable manufacturing processes to improve efficiency and environmental performance. Investment trends show significant capital allocation toward sustainable packaging production capabilities.

Technology partnerships between packaging manufacturers and technology companies are accelerating innovation in smart packaging solutions. Collaborations focus on integrating sensors, tracking capabilities, and digital connectivity into traditional packaging formats. Research and development investments are increasing as companies compete on innovation and sustainability.

Regulatory developments across the region are driving industry adaptation and innovation. Government initiatives promoting sustainable packaging are creating both challenges and opportunities for market participants. Policy frameworks supporting domestic manufacturing and environmental protection are influencing investment decisions and strategic planning.

Sustainability initiatives by major retailers and food service companies are driving demand for environmentally friendly packaging solutions. Corporate commitments to reduce plastic waste and improve recyclability are creating market opportunities for innovative packaging manufacturers. Supply chain collaboration is increasing as companies work together to develop sustainable packaging solutions.

Strategic recommendations for market participants emphasize the critical importance of sustainability integration and innovation investment. Companies should prioritize development of biodegradable and recyclable packaging solutions to address regulatory requirements and consumer preferences. Research and development investments in sustainable materials and production processes will be essential for long-term competitive advantage.

Geographic expansion strategies should focus on emerging markets with strong growth potential and favorable demographic trends. Countries such as Vietnam, Indonesia, and the Philippines offer substantial opportunities for market penetration and capacity expansion. Local partnerships and joint ventures can facilitate market entry and regulatory compliance in new geographic markets.

Technology adoption should be accelerated to capture opportunities in smart packaging and digital integration. Investments in IoT connectivity, tracking capabilities, and consumer engagement technologies will create competitive differentiation and new revenue streams. Digital transformation initiatives should encompass both product innovation and operational efficiency improvements.

Supply chain optimization is essential for managing raw material costs and ensuring production continuity. Diversification of supplier networks and investment in vertical integration can reduce vulnerability to supply disruptions. Sustainability integration throughout the supply chain will be increasingly important for regulatory compliance and brand positioning.

Customer collaboration should be strengthened to develop customized solutions that meet specific application requirements and sustainability objectives. MWR analysis suggests that companies investing in customer partnership programs achieve superior market performance and customer retention rates.

Long-term growth prospects for the Asia Pacific single-use packaging market remain positive, supported by fundamental demographic and economic trends. Continued urbanization, rising disposable incomes, and evolving consumer lifestyles will sustain demand for convenient packaging solutions. Market evolution will be characterized by increasing emphasis on sustainability, technology integration, and regulatory compliance.

Sustainability transformation will accelerate as environmental regulations tighten and consumer awareness increases. The market is expected to witness significant shifts toward biodegradable materials, recyclable designs, and circular economy principles. Innovation investments in sustainable packaging technologies will create new market segments and competitive advantages for early adopters.

Technology integration will revolutionize traditional packaging concepts through smart packaging solutions and digital connectivity. The convergence of packaging and technology will create new value propositions and revenue streams. Digital transformation will encompass both product innovation and supply chain optimization, driving efficiency improvements and customer engagement.

Regional market dynamics will continue to evolve as emerging economies mature and develop sophisticated packaging requirements. China and India will remain dominant markets, while Southeast Asian countries will emerge as significant growth contributors. Market diversification across multiple countries will provide risk mitigation and expansion opportunities.

Competitive landscape evolution will be characterized by continued consolidation, strategic partnerships, and technology-driven differentiation. Companies that successfully integrate sustainability, innovation, and operational excellence will achieve superior market performance. MarkWide Research projections indicate that market leaders will be those who effectively balance environmental responsibility with economic viability and customer satisfaction.

The Asia Pacific single-use packaging market stands at a critical juncture, balancing robust growth opportunities with increasing environmental responsibilities and regulatory challenges. The market’s fundamental drivers remain strong, supported by urbanization, economic development, and evolving consumer lifestyles across the region. Strategic positioning for long-term success requires companies to embrace sustainability, invest in innovation, and adapt to changing market dynamics.

Market transformation toward sustainable packaging solutions presents both challenges and opportunities for industry participants. Companies that proactively invest in biodegradable materials, recyclable designs, and circular economy principles will be well-positioned to capture market share and achieve sustainable growth. Technology integration will become increasingly important for competitive differentiation and value creation.

Future success in the Asia Pacific single-use packaging market will depend on the ability to balance economic viability with environmental responsibility while meeting evolving customer requirements. The market’s continued evolution toward sustainability and innovation creates substantial opportunities for companies that can effectively navigate regulatory complexities and consumer expectations. Strategic investments in sustainable technologies, geographic expansion, and customer collaboration will be essential for achieving long-term market leadership and sustainable growth in this dynamic and evolving market landscape.

What is Single-use Packaging?

Single-use packaging refers to packaging materials that are designed to be used once and then discarded. This type of packaging is commonly used in various industries, including food and beverage, cosmetics, and pharmaceuticals, due to its convenience and cost-effectiveness.

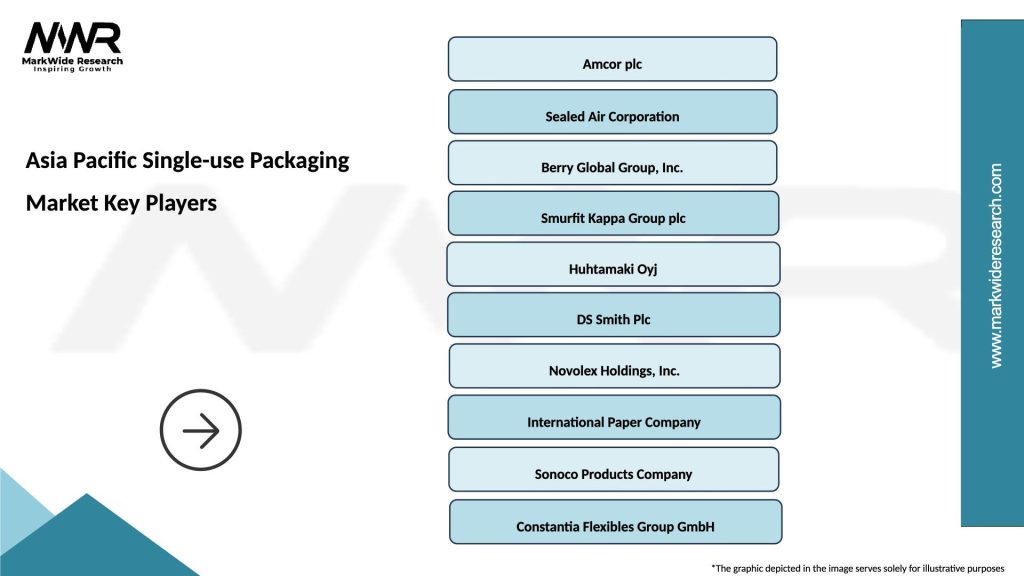

What are the key players in the Asia Pacific Single-use Packaging Market?

Key players in the Asia Pacific Single-use Packaging Market include Amcor, Sealed Air Corporation, and Tetra Pak, among others. These companies are known for their innovative packaging solutions and extensive distribution networks.

What are the main drivers of the Asia Pacific Single-use Packaging Market?

The main drivers of the Asia Pacific Single-use Packaging Market include the growing demand for convenience in food packaging, the rise of e-commerce, and increasing consumer preference for ready-to-eat meals. Additionally, sustainability initiatives are pushing companies to innovate in this space.

What challenges does the Asia Pacific Single-use Packaging Market face?

The Asia Pacific Single-use Packaging Market faces challenges such as increasing regulations on plastic use, environmental concerns regarding waste management, and competition from reusable packaging solutions. These factors can hinder market growth and innovation.

What opportunities exist in the Asia Pacific Single-use Packaging Market?

Opportunities in the Asia Pacific Single-use Packaging Market include the development of biodegradable and compostable packaging materials, as well as advancements in smart packaging technologies. These innovations can cater to environmentally conscious consumers and enhance product safety.

What trends are shaping the Asia Pacific Single-use Packaging Market?

Trends shaping the Asia Pacific Single-use Packaging Market include the increasing adoption of sustainable materials, the rise of personalized packaging solutions, and the integration of technology for enhanced consumer engagement. These trends reflect changing consumer preferences and regulatory pressures.

Asia Pacific Single-use Packaging Market

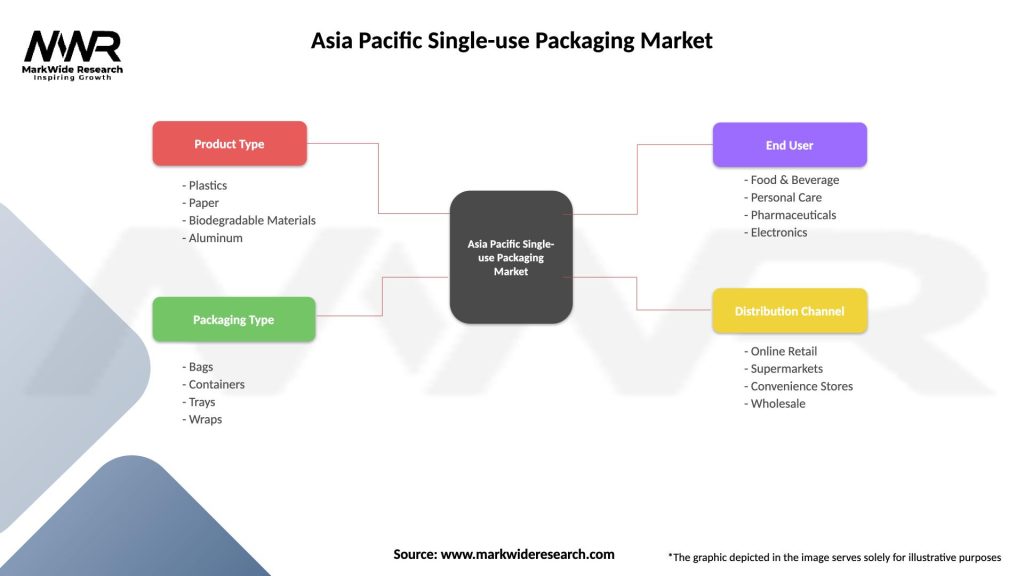

| Segmentation Details | Description |

|---|---|

| Product Type | Plastics, Paper, Biodegradable Materials, Aluminum |

| Packaging Type | Bags, Containers, Trays, Wraps |

| End User | Food & Beverage, Personal Care, Pharmaceuticals, Electronics |

| Distribution Channel | Online Retail, Supermarkets, Convenience Stores, Wholesale |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Single-use Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at