444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific silica sand market represents one of the most dynamic and rapidly expanding segments within the global industrial minerals sector. This region has emerged as a dominant force in silica sand production and consumption, driven by robust industrialization, infrastructure development, and technological advancement across multiple sectors. Silica sand, primarily composed of silicon dioxide, serves as a critical raw material for numerous industries including glass manufacturing, foundry operations, hydraulic fracturing, construction, and electronics.

Market dynamics in the Asia-Pacific region are characterized by strong demand from emerging economies, particularly China, India, Japan, and Southeast Asian nations. The region’s manufacturing prowess and continuous industrial expansion have created substantial opportunities for silica sand suppliers and processors. Growth rates in this market segment have consistently outpaced global averages, with the region experiencing a compound annual growth rate of 6.2% over recent years.

Regional distribution shows China commanding approximately 45% market share within the Asia-Pacific silica sand market, followed by India with 18% market share, and Japan contributing 12% market share. The remaining market share is distributed among other significant players including South Korea, Australia, Thailand, and Vietnam. This distribution reflects the varying levels of industrial development and resource availability across the region.

The Asia-Pacific silica sand market refers to the comprehensive ecosystem encompassing extraction, processing, distribution, and consumption of silica sand across the Asia-Pacific geographical region. Silica sand is a granular material composed primarily of finely divided rock and mineral particles, predominantly featuring silicon dioxide content ranging from 95% to 99.5% purity levels.

Industrial applications define the market’s scope, spanning from traditional uses in glass manufacturing and foundry operations to advanced applications in semiconductor production, solar panel manufacturing, and specialized filtration systems. The market encompasses various grades and specifications of silica sand, each tailored to meet specific industry requirements and quality standards.

Geographic coverage includes major economies such as China, Japan, India, South Korea, Australia, Indonesia, Thailand, Malaysia, Singapore, Philippines, and Vietnam. Each country contributes unique characteristics to the overall market dynamics, whether through resource availability, manufacturing capabilities, or consumption patterns.

Strategic positioning of the Asia-Pacific silica sand market reflects its critical role in supporting the region’s industrial growth and technological advancement. The market has demonstrated remarkable resilience and adaptability, successfully navigating global economic uncertainties while maintaining steady growth trajectories across multiple application segments.

Key performance indicators highlight the market’s robust fundamentals, with demand growth rates consistently exceeding supply expansion by 2.3 percentage points annually. This supply-demand imbalance has created favorable market conditions for established players while attracting new entrants seeking to capitalize on emerging opportunities.

Industry consolidation trends show increasing vertical integration among major players, with leading companies expanding their operations across the value chain from mining and processing to distribution and specialized applications. Technology adoption has accelerated, with approximately 35% of major producers implementing advanced processing technologies to enhance product quality and operational efficiency.

Regulatory landscape across the region has evolved to address environmental concerns and sustainability requirements, influencing operational practices and investment strategies. Market participants are increasingly focusing on sustainable mining practices, environmental compliance, and circular economy principles to maintain competitive advantages.

Market segmentation reveals diverse application areas driving demand across the Asia-Pacific region. The following key insights provide comprehensive understanding of market dynamics:

Quality specifications vary significantly across applications, with high-purity silica sand commanding premium pricing in electronics and specialized industrial applications. Supply chain dynamics emphasize proximity to end-users, transportation cost optimization, and reliable delivery schedules as critical success factors.

Industrial expansion across the Asia-Pacific region serves as the primary catalyst for silica sand market growth. Manufacturing sector development in countries like China, India, and Vietnam has created unprecedented demand for industrial minerals, with silica sand playing a crucial role in supporting various production processes.

Infrastructure development initiatives throughout the region drive substantial consumption in construction applications. Government investments in transportation networks, urban development projects, and industrial facilities create sustained demand for construction-grade silica sand. Urbanization trends show approximately 68% of the regional population expected to reside in urban areas by 2030, further amplifying infrastructure requirements.

Technology sector growth represents another significant driver, particularly in electronics manufacturing and renewable energy applications. Semiconductor production requires ultra-high-purity silica sand, while solar panel manufacturing creates demand for specialized grades. The region’s position as a global electronics manufacturing hub ensures continued growth in these high-value applications.

Automotive industry expansion contributes to foundry operations and glass manufacturing demand. Electric vehicle adoption and traditional automotive production both require substantial quantities of silica sand for various components and manufacturing processes.

Environmental regulations pose significant challenges for silica sand extraction and processing operations across the Asia-Pacific region. Mining restrictions in environmentally sensitive areas limit resource access, while emission standards require substantial investments in pollution control technologies.

Transportation costs represent a major constraint, particularly for bulk commodity applications where freight expenses can significantly impact overall product economics. Infrastructure limitations in certain regions create logistical challenges and increase delivery costs to end-users.

Quality consistency issues affect market development, as varying geological conditions across the region result in different silica sand characteristics. Processing requirements to achieve consistent quality specifications increase operational costs and complexity.

Competition from alternative materials in certain applications limits market expansion opportunities. Synthetic alternatives and recycled materials increasingly compete with natural silica sand in specific use cases, particularly where environmental considerations influence material selection decisions.

Emerging applications in advanced manufacturing and technology sectors present substantial growth opportunities for silica sand producers. 3D printing technologies require specialized silica sand formulations, while advanced ceramics and composite materials create new market segments with premium pricing potential.

Sustainability initiatives across industries drive demand for high-quality, responsibly sourced silica sand. Green building standards and environmental certifications create opportunities for suppliers who can demonstrate sustainable practices and product traceability.

Regional trade agreements and economic partnerships facilitate market access and reduce trade barriers. ASEAN integration and bilateral trade agreements create opportunities for cross-border expansion and market diversification strategies.

Value-added processing opportunities allow producers to capture higher margins through specialized product development. Custom formulations and application-specific processing create differentiation opportunities and stronger customer relationships.

Supply-demand equilibrium in the Asia-Pacific silica sand market reflects complex interactions between resource availability, production capacity, and end-user requirements. Market forces demonstrate cyclical patterns influenced by construction activity, industrial production levels, and global economic conditions.

Price volatility characterizes certain market segments, particularly those linked to commodity cycles and seasonal demand variations. Premium applications maintain more stable pricing structures due to specialized requirements and limited supplier bases.

Competitive intensity varies across different market segments and geographical regions. Local suppliers often maintain advantages in bulk commodity applications, while specialized producers compete on quality, consistency, and technical support capabilities.

Technology adoption influences market dynamics through improved processing efficiency, product quality enhancement, and cost reduction initiatives. Automation levels in processing facilities have increased by approximately 28% over recent years, improving operational efficiency and product consistency.

Comprehensive analysis of the Asia-Pacific silica sand market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research involves direct engagement with industry participants, including producers, processors, distributors, and end-users across the region.

Secondary research encompasses analysis of industry publications, government statistics, trade association reports, and regulatory filings. Data validation processes ensure consistency and accuracy across multiple information sources.

Market modeling techniques incorporate statistical analysis, trend extrapolation, and scenario planning to develop comprehensive market projections. Regional analysis considers country-specific factors including resource availability, regulatory environment, and economic conditions.

Industry expert consultations provide qualitative insights and validate quantitative findings. Stakeholder interviews with key market participants offer perspectives on market trends, challenges, and opportunities.

China dominates the Asia-Pacific silica sand market with extensive production capabilities and substantial domestic consumption. Manufacturing concentration in eastern provinces creates significant demand clusters, while resource availability in various regions supports local supply chains. Government policies promoting industrial development and infrastructure investment continue driving market growth.

India represents the second-largest market with rapid industrial expansion and infrastructure development. Glass manufacturing and construction sectors drive primary demand, while foundry operations contribute substantially to consumption patterns. Regional distribution shows concentration in industrial states with established manufacturing bases.

Japan maintains a mature market characterized by high-quality requirements and technological sophistication. Electronics applications and precision manufacturing create demand for ultra-high-purity silica sand grades. Import dependence for certain specifications creates opportunities for regional suppliers.

Southeast Asian countries demonstrate strong growth potential driven by industrialization and economic development. ASEAN integration facilitates regional trade and creates opportunities for market expansion. Infrastructure investments across the region support sustained demand growth.

Australia contributes significant production capacity with high-quality resources and established mining operations. Export orientation serves regional markets while domestic consumption supports local industries. Regulatory stability and mining expertise provide competitive advantages.

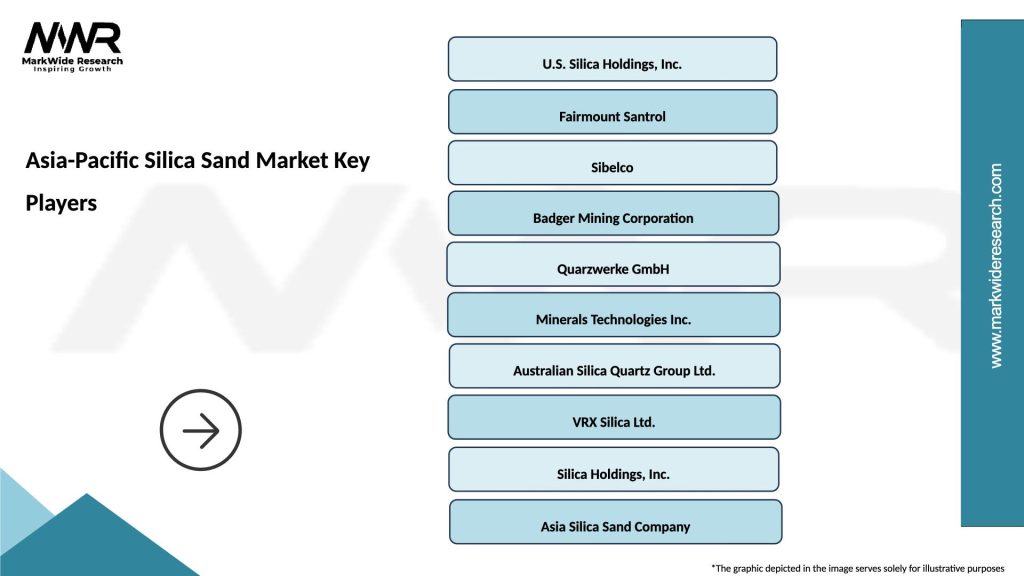

Market leadership in the Asia-Pacific silica sand sector is distributed among several major players with distinct competitive advantages and market positioning strategies. The competitive environment reflects both regional specialists and international corporations with diverse operational approaches.

Competitive strategies emphasize vertical integration, quality differentiation, and customer service excellence. Market consolidation trends show increasing merger and acquisition activity as companies seek to expand geographic coverage and application expertise.

Innovation focus centers on processing technology advancement, product quality improvement, and sustainable mining practices. Customer relationships and technical support capabilities increasingly differentiate suppliers in competitive market segments.

Application-based segmentation provides comprehensive understanding of market dynamics and growth opportunities across different end-use sectors:

By Application:

By Grade:

By Particle Size:

Glass manufacturing applications demonstrate consistent demand patterns with seasonal variations linked to construction activity and consumer goods production. Quality requirements emphasize low iron content and consistent particle size distribution. Supply relationships typically involve long-term contracts with established glass manufacturers.

Foundry operations require specialized sand characteristics including high refractoriness, thermal stability, and appropriate permeability. Automotive industry demand drives significant consumption in this category, with electric vehicle production creating new requirements for specialized casting applications.

Construction applications represent high-volume, price-sensitive market segments with emphasis on local supply sources. Infrastructure projects create substantial demand spikes, while residential construction provides steady baseline consumption.

Electronics applications command premium pricing due to stringent purity requirements and specialized processing needs. Semiconductor manufacturing drives demand for ultra-high-purity grades, while solar panel production creates opportunities for specialized formulations.

Hydraulic fracturing applications depend on oil and gas industry activity levels and regulatory environments. Proppant sand specifications require specific strength characteristics and particle size distributions.

Producers benefit from diverse application opportunities and growing regional demand across multiple industry sectors. Operational advantages include economies of scale, vertical integration opportunities, and long-term customer relationships that provide revenue stability and growth potential.

End-users gain access to reliable supply sources with consistent quality specifications and competitive pricing structures. Technical support from suppliers enhances application performance and operational efficiency. Regional sourcing reduces transportation costs and supply chain risks.

Investors find attractive opportunities in a growing market with diverse application segments and geographic expansion potential. Infrastructure requirements and industrial development across the region support long-term demand growth and investment returns.

Government stakeholders benefit from economic development, employment creation, and export revenue generation. Resource utilization supports industrial policy objectives while contributing to regional economic growth and development goals.

Technology providers find opportunities in processing equipment, quality control systems, and environmental management solutions. Innovation requirements drive demand for advanced technologies and specialized equipment.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents a fundamental trend reshaping the Asia-Pacific silica sand market. Environmental stewardship requirements drive adoption of responsible mining practices, rehabilitation programs, and circular economy principles. Corporate sustainability initiatives increasingly influence supplier selection and procurement decisions.

Technology advancement accelerates across processing operations, quality control systems, and automation implementation. Digital transformation initiatives improve operational efficiency, reduce costs, and enhance product consistency. Industry 4.0 technologies enable predictive maintenance, real-time monitoring, and optimized production processes.

Quality differentiation becomes increasingly important as end-users demand higher specifications and consistent performance characteristics. Premium applications drive investment in advanced processing capabilities and quality assurance systems. Certification programs and quality standards gain prominence across various application segments.

Regional consolidation trends show increasing merger and acquisition activity as companies seek scale advantages and market expansion opportunities. Vertical integration strategies allow companies to capture additional value across the supply chain while improving customer relationships.

Application diversification reduces dependence on traditional market segments while creating opportunities in emerging technology sectors. Innovation partnerships with end-users drive product development and application optimization initiatives.

Capacity expansion projects across the region reflect growing demand and market confidence. Major producers have announced significant investments in new mining operations, processing facilities, and logistics infrastructure to meet projected demand growth.

Technology partnerships between silica sand producers and equipment suppliers drive innovation in processing capabilities and product quality enhancement. Research collaborations focus on developing specialized grades for emerging applications and improving operational efficiency.

Regulatory developments across various countries influence operational practices and investment strategies. Environmental standards continue evolving, requiring adaptation of mining and processing operations to meet new requirements.

Market consolidation activities include strategic acquisitions, joint ventures, and partnership agreements aimed at expanding geographic coverage and application expertise. Cross-border investments facilitate technology transfer and market access.

Sustainability initiatives gain momentum with companies implementing comprehensive environmental management systems, community engagement programs, and biodiversity conservation measures. Certification achievements demonstrate commitment to responsible business practices.

Strategic positioning recommendations emphasize the importance of diversification across application segments and geographic markets to reduce risk and capture growth opportunities. Market participants should focus on developing capabilities in high-value applications while maintaining competitive positions in traditional market segments.

Investment priorities should emphasize technology advancement, quality improvement, and sustainability initiatives. Processing capabilities that enable production of specialized grades command premium pricing and stronger customer relationships. Environmental compliance investments protect long-term operational viability.

Partnership strategies can accelerate market development and technology advancement. Collaboration opportunities with end-users, technology providers, and research institutions create competitive advantages and innovation capabilities.

Supply chain optimization remains critical for maintaining cost competitiveness and service levels. Logistics efficiency improvements and strategic location decisions significantly impact overall market positioning and profitability.

Market intelligence capabilities enable proactive response to changing market conditions and customer requirements. MarkWide Research analysis indicates that companies with robust market monitoring and customer engagement systems achieve superior performance metrics compared to industry averages.

Long-term prospects for the Asia-Pacific silica sand market remain highly favorable, supported by continued industrial development, infrastructure investment, and technology sector growth. Demand projections indicate sustained growth across multiple application segments with particular strength in electronics and renewable energy applications.

Technology evolution will continue driving market transformation through improved processing capabilities, product quality enhancement, and operational efficiency gains. Automation adoption is expected to reach 55% penetration across major processing facilities by 2030, improving consistency and reducing operational costs.

Sustainability requirements will increasingly influence market dynamics, creating opportunities for companies that demonstrate environmental leadership and responsible business practices. Circular economy principles and resource efficiency initiatives will become standard operational requirements.

Regional integration trends will facilitate market expansion and create opportunities for cross-border trade and investment. Economic partnerships and trade agreements will reduce barriers and enable more efficient market development strategies.

Application innovation in emerging technology sectors will create new market segments with premium pricing potential. Advanced manufacturing, renewable energy, and specialized industrial applications will drive demand for high-quality, customized silica sand products.

The Asia-Pacific silica sand market represents a dynamic and rapidly evolving sector with substantial growth potential across multiple application segments and geographic regions. Market fundamentals remain strong, supported by continued industrialization, infrastructure development, and technology advancement throughout the region.

Strategic opportunities exist for market participants who can effectively navigate the complex landscape of regulatory requirements, quality specifications, and customer demands while maintaining competitive cost structures. Success factors include operational excellence, technology adoption, sustainability leadership, and customer relationship management.

Future growth will be driven by emerging applications in technology sectors, continued infrastructure investment, and regional economic development initiatives. Market participants who position themselves effectively across the value chain and invest in capabilities that meet evolving customer requirements will capture the greatest opportunities in this expanding market.

What is Silica Sand?

Silica sand is a granular material composed of finely divided quartz crystals. It is widely used in various applications, including glass manufacturing, construction, and hydraulic fracturing.

What are the key players in the Asia-Pacific Silica Sand Market?

Key players in the Asia-Pacific Silica Sand Market include U.S. Silica Holdings, Sibelco, and Mitsubishi Corporation, among others. These companies are involved in the extraction, processing, and distribution of silica sand for various industrial applications.

What are the growth factors driving the Asia-Pacific Silica Sand Market?

The growth of the Asia-Pacific Silica Sand Market is driven by increasing demand from the construction industry, rising glass production, and the expansion of the oil and gas sector for hydraulic fracturing.

What challenges does the Asia-Pacific Silica Sand Market face?

The Asia-Pacific Silica Sand Market faces challenges such as environmental regulations, depletion of high-quality silica sand reserves, and competition from alternative materials.

What opportunities exist in the Asia-Pacific Silica Sand Market?

Opportunities in the Asia-Pacific Silica Sand Market include the growing demand for silica sand in emerging economies, advancements in processing technologies, and the increasing use of silica in the production of high-performance materials.

What trends are shaping the Asia-Pacific Silica Sand Market?

Trends in the Asia-Pacific Silica Sand Market include a shift towards sustainable mining practices, innovations in silica sand processing, and the rising popularity of silica in the manufacturing of eco-friendly products.

Asia-Pacific Silica Sand Market

| Segmentation Details | Description |

|---|---|

| Product Type | Glass Grade, Foundry Grade, Chemical Grade, Construction Grade |

| Application | Glass Manufacturing, Foundry Molding, Water Filtration, Construction |

| End User | Construction Industry, Automotive Sector, Electronics Manufacturers, Chemical Producers |

| Packaging Type | Bulk Bags, 50kg Bags, 25kg Bags, Containers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Silica Sand Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at