444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific SGLT2 inhibitors market represents one of the most dynamic and rapidly expanding pharmaceutical segments in the region’s healthcare landscape. SGLT2 inhibitors, also known as sodium-glucose co-transporter-2 inhibitors, have emerged as revolutionary therapeutic agents for managing type 2 diabetes mellitus and related cardiovascular conditions. The region’s market demonstrates exceptional growth potential, driven by increasing diabetes prevalence, rising healthcare awareness, and expanding access to advanced pharmaceutical treatments across diverse economies.

Market dynamics in the Asia Pacific region reflect a compelling combination of demographic trends, economic development, and healthcare infrastructure improvements. The market encompasses major economies including China, Japan, India, South Korea, Australia, and Southeast Asian nations, each contributing unique characteristics to the overall market landscape. Growth projections indicate the market is expanding at a robust CAGR of 12.8%, significantly outpacing global averages due to regional-specific factors including urbanization, lifestyle changes, and government healthcare initiatives.

Regional adoption patterns vary considerably across Asia Pacific markets, with developed economies like Japan and Australia leading in per-capita utilization, while emerging markets such as India and China demonstrate the highest absolute growth rates. The market benefits from increasing healthcare expenditure, which has grown by approximately 8.5% annually across the region, enabling broader access to innovative diabetes treatments and supporting market expansion.

The Asia Pacific SGLT2 inhibitors market refers to the comprehensive pharmaceutical sector encompassing the development, manufacturing, distribution, and commercialization of sodium-glucose co-transporter-2 inhibitor medications across Asia Pacific countries. These innovative therapeutic agents work by blocking glucose reabsorption in the kidneys, promoting glucose excretion through urine, and providing multiple health benefits beyond glycemic control.

SGLT2 inhibitors represent a distinct class of antidiabetic medications that offer unique mechanisms of action compared to traditional diabetes treatments. The market encompasses various drug formulations, combination therapies, and delivery mechanisms designed to address the diverse needs of diabetes patients across different cultural, economic, and healthcare contexts within the Asia Pacific region.

Market scope includes prescription medications, over-the-counter formulations where applicable, and combination therapies that incorporate SGLT2 inhibitors with other antidiabetic agents. The definition extends to encompass research and development activities, regulatory frameworks, distribution networks, and healthcare provider education programs that support the effective utilization of these therapeutic agents across the region’s diverse healthcare systems.

Strategic market positioning reveals the Asia Pacific SGLT2 inhibitors market as a high-growth pharmaceutical segment with exceptional potential for sustained expansion. The market benefits from favorable demographic trends, including an aging population and increasing diabetes prevalence, which currently affects approximately 11.1% of adults across the region. Key market drivers include rising healthcare awareness, expanding insurance coverage, and growing physician acceptance of innovative diabetes treatments.

Competitive landscape features established pharmaceutical giants alongside emerging regional players, creating a dynamic environment for innovation and market penetration. The market demonstrates strong performance across multiple therapeutic applications, including type 2 diabetes management, cardiovascular risk reduction, and chronic kidney disease treatment. Regulatory environments across Asia Pacific countries continue evolving to support faster drug approvals and improved patient access to advanced therapies.

Investment opportunities remain abundant, particularly in emerging markets where healthcare infrastructure development and economic growth create expanding patient populations with increasing purchasing power. The market’s future trajectory appears highly favorable, supported by ongoing clinical research, pipeline developments, and strategic partnerships between international pharmaceutical companies and regional healthcare organizations.

Market intelligence reveals several critical insights that define the Asia Pacific SGLT2 inhibitors landscape:

Primary growth drivers propelling the Asia Pacific SGLT2 inhibitors market encompass multiple interconnected factors that create a favorable environment for sustained expansion. Diabetes prevalence continues rising across the region, driven by urbanization, sedentary lifestyles, and dietary changes associated with economic development. This epidemiological trend creates an expanding patient population requiring effective therapeutic interventions.

Healthcare infrastructure development across emerging economies significantly enhances market accessibility. Government investments in hospital construction, primary care facilities, and pharmaceutical distribution networks create pathways for broader drug availability. Insurance coverage expansion in countries like China and India improves patient affordability, with coverage rates increasing by approximately 22% annually in key markets.

Clinical evidence accumulation supports expanded therapeutic applications for SGLT2 inhibitors beyond diabetes management. Cardiovascular and renal protective benefits demonstrated in major clinical trials drive physician adoption and regulatory approvals for broader indications. Medical education initiatives and professional development programs increase healthcare provider awareness and prescribing confidence.

Technological advancement in drug delivery systems and patient monitoring tools enhances treatment effectiveness and adherence. Digital health integration, including mobile applications and remote monitoring devices, creates comprehensive care ecosystems that support optimal therapeutic outcomes and patient engagement.

Significant market challenges continue to impact the Asia Pacific SGLT2 inhibitors market despite its overall positive trajectory. Cost considerations remain a primary barrier, particularly in price-sensitive emerging markets where healthcare budgets face constraints. High drug prices relative to generic alternatives limit accessibility for substantial patient populations, especially in rural and underserved areas.

Regulatory complexities across diverse Asia Pacific countries create challenges for pharmaceutical companies seeking regional market penetration. Varying approval processes, documentation requirements, and clinical trial standards increase development costs and time-to-market delays. Healthcare provider education gaps in some markets limit optimal prescribing patterns and therapeutic utilization.

Side effect concerns and safety considerations influence physician prescribing behavior and patient acceptance. Genitourinary infections, diabetic ketoacidosis risks, and other adverse events require careful patient monitoring and management, potentially limiting broader adoption. Cultural factors and traditional medicine preferences in certain markets create resistance to modern pharmaceutical interventions.

Supply chain challenges including cold storage requirements, distribution logistics, and inventory management complexities impact market efficiency. Infrastructure limitations in remote areas and quality control concerns affect product availability and patient access to authentic medications.

Emerging opportunities within the Asia Pacific SGLT2 inhibitors market present substantial potential for growth and innovation. Untapped patient populations in rural and underserved areas represent significant expansion possibilities, particularly as healthcare infrastructure continues developing and telemedicine adoption increases. Market penetration rates in several countries remain below 25% of eligible patients, indicating substantial room for growth.

Combination therapy development offers opportunities for pharmaceutical innovation and market differentiation. Fixed-dose combinations incorporating SGLT2 inhibitors with complementary antidiabetic agents, antihypertensive medications, or lipid-lowering drugs address multiple comorbidities simultaneously, improving patient convenience and adherence while creating premium pricing opportunities.

Generic market entry as patents expire creates opportunities for local pharmaceutical companies to develop affordable alternatives, expanding market accessibility. Biosimilar development and manufacturing capabilities in countries like India and China position regional companies to capture significant market share while improving patient affordability.

Digital health integration presents opportunities for comprehensive diabetes management solutions combining SGLT2 inhibitors with monitoring devices, mobile applications, and artificial intelligence-driven treatment optimization. Personalized medicine approaches utilizing genetic testing and biomarker analysis offer potential for targeted therapy selection and improved treatment outcomes.

Complex market dynamics shape the Asia Pacific SGLT2 inhibitors landscape through interconnected forces influencing supply, demand, and competitive positioning. Demographic transitions across the region create evolving patient profiles, with aging populations and increasing obesity rates driving sustained demand growth. Economic development patterns influence healthcare spending priorities and pharmaceutical accessibility across diverse markets.

Competitive intensity continues increasing as established pharmaceutical companies expand regional presence while local manufacturers develop generic alternatives. Price competition intensifies particularly in emerging markets, with pricing pressures resulting in approximately 8-12% annual price reductions in certain segments. Innovation cycles drive continuous product development and market differentiation strategies.

Regulatory evolution across Asia Pacific countries influences market dynamics through changing approval processes, safety requirements, and market access policies. Healthcare policy reforms including insurance coverage expansions and drug pricing regulations create both opportunities and challenges for market participants. MarkWide Research analysis indicates that regulatory harmonization efforts are improving market efficiency and reducing barriers to entry.

Technology disruption through digital health platforms, artificial intelligence, and personalized medicine approaches transforms traditional pharmaceutical business models. Value-based healthcare trends emphasize treatment outcomes and cost-effectiveness, influencing prescribing patterns and reimbursement decisions across the region.

Comprehensive research methodology employed for analyzing the Asia Pacific SGLT2 inhibitors market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with healthcare professionals, pharmaceutical executives, regulatory officials, and patient advocacy groups across major Asia Pacific markets to gather firsthand insights and market intelligence.

Secondary research encompasses analysis of published clinical studies, regulatory filings, company financial reports, and industry publications to establish market baselines and identify trends. Quantitative analysis utilizes statistical modeling techniques to project market growth, segment performance, and competitive positioning across different scenarios and timeframes.

Market segmentation analysis examines various dimensions including geography, therapeutic applications, patient demographics, and distribution channels. Cross-validation techniques ensure data consistency and reliability across multiple sources and analytical methods. Expert consultation with leading endocrinologists, healthcare economists, and pharmaceutical industry specialists provides additional validation and context for market projections.

Data triangulation methods combine quantitative metrics with qualitative insights to develop comprehensive market understanding. Scenario analysis evaluates potential market outcomes under different economic, regulatory, and competitive conditions to provide robust strategic guidance for market participants.

China dominates the Asia Pacific SGLT2 inhibitors market with approximately 38% of regional market share, driven by its massive patient population and rapidly expanding healthcare infrastructure. Government initiatives including the Healthy China 2030 program support diabetes prevention and treatment, creating favorable market conditions. Local manufacturing capabilities and increasing healthcare expenditure contribute to market growth and accessibility improvements.

Japan represents the most mature market in the region, characterized by high per-capita utilization rates and advanced healthcare systems. Aging population dynamics and comprehensive insurance coverage support sustained demand growth. Innovation leadership in pharmaceutical research and development positions Japan as a key market for new product launches and clinical trials.

India demonstrates exceptional growth potential with the world’s largest diabetes population and expanding middle-class demographics. Healthcare infrastructure development and government insurance schemes improve market accessibility. Generic manufacturing capabilities position India as a potential regional supply hub for affordable SGLT2 inhibitor formulations.

Southeast Asian markets including Thailand, Malaysia, and Indonesia show increasing adoption rates supported by economic growth and healthcare system improvements. ASEAN healthcare initiatives promote regional cooperation and market harmonization. Australia and South Korea maintain stable, mature markets with high treatment penetration rates and advanced healthcare delivery systems.

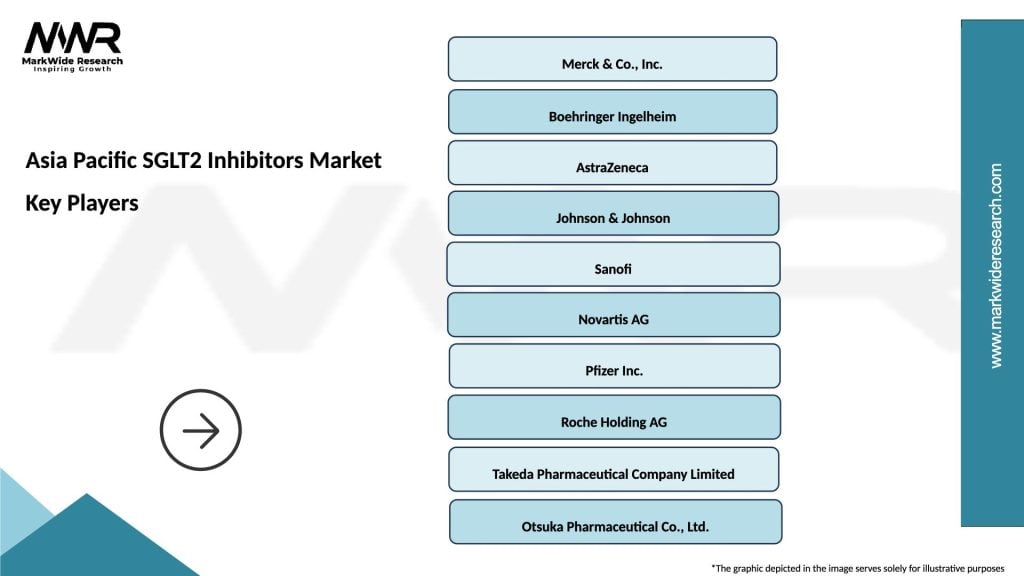

Market leadership in the Asia Pacific SGLT2 inhibitors segment is characterized by intense competition among established pharmaceutical giants and emerging regional players. Key market participants include:

Competitive strategies focus on clinical differentiation, combination product development, and strategic partnerships with regional healthcare organizations. Market consolidation trends include licensing agreements, joint ventures, and acquisition activities targeting regional market access and manufacturing capabilities.

Innovation competition drives continuous product development including novel formulations, delivery mechanisms, and combination therapies. Pricing strategies vary significantly across markets, with premium positioning in developed economies and value-based approaches in emerging markets.

Market segmentation analysis reveals distinct patterns across multiple dimensions that define the Asia Pacific SGLT2 inhibitors landscape:

By Product Type:

By Application:

By Distribution Channel:

Therapeutic category analysis provides detailed insights into specific market segments and their unique characteristics within the Asia Pacific SGLT2 inhibitors market. Monotherapy applications continue dominating market utilization, particularly for newly diagnosed patients and those with mild to moderate diabetes severity. Treatment effectiveness in monotherapy settings demonstrates HbA1c reductions of approximately 0.7-1.0% across diverse patient populations.

Combination therapy segments show accelerating growth as clinical evidence supports synergistic benefits with other antidiabetic agents. Fixed-dose combinations with metformin, DPP-4 inhibitors, and insulin formulations improve patient adherence while providing comprehensive glycemic control. Market preference increasingly favors combination products that address multiple aspects of diabetes management simultaneously.

Cardiovascular indication categories represent high-growth segments with premium pricing opportunities. Heart failure applications demonstrate exceptional clinical outcomes, with hospitalization reductions of approximately 30-35% in clinical trials. Chronic kidney disease applications show promising results with renal function preservation and progression delay benefits.

Patient demographic categories reveal varying adoption patterns across age groups, with middle-aged populations showing highest utilization rates. Elderly patient segments require careful monitoring and dosage adjustments, while younger demographics demonstrate better adherence and treatment outcomes.

Pharmaceutical companies benefit from substantial revenue opportunities in the expanding Asia Pacific SGLT2 inhibitors market. Market growth potential provides attractive returns on research and development investments, while patent protection enables premium pricing strategies during exclusivity periods. Regional partnerships facilitate market entry and distribution network development across diverse regulatory environments.

Healthcare providers gain access to innovative therapeutic options that improve patient outcomes and treatment satisfaction. Clinical benefits including cardiovascular protection and weight management advantages enhance overall diabetes care quality. Treatment flexibility through various formulations and combination options supports personalized medicine approaches.

Patients experience improved quality of life through effective glycemic control and reduced complication risks. Convenience benefits from once-daily dosing and oral administration improve treatment adherence. Cardiovascular and renal protective effects provide additional health benefits beyond diabetes management.

Healthcare systems benefit from reduced long-term complications and associated healthcare costs. Economic advantages include decreased hospitalization rates and improved productivity outcomes. Population health improvements contribute to overall healthcare system efficiency and resource optimization.

Investors find attractive opportunities in a high-growth pharmaceutical segment with favorable demographic trends and expanding market access. MWR analysis indicates strong return potential across various investment strategies including direct pharmaceutical investments and healthcare infrastructure development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as a dominant trend reshaping the Asia Pacific SGLT2 inhibitors market landscape. Telemedicine adoption accelerated significantly, with usage rates increasing by approximately 180% across major regional markets. Mobile health applications integrated with SGLT2 inhibitor therapy provide comprehensive diabetes management solutions, improving patient engagement and treatment adherence.

Personalized medicine approaches gain momentum through genetic testing and biomarker analysis to optimize SGLT2 inhibitor selection and dosing. Pharmacogenomics research reveals population-specific variations in drug metabolism and efficacy, supporting tailored treatment strategies across diverse Asia Pacific ethnicities. Precision medicine initiatives enhance treatment outcomes while reducing adverse event risks.

Combination therapy preferences drive pharmaceutical innovation toward fixed-dose formulations addressing multiple aspects of diabetes management. Triple combination products incorporating SGLT2 inhibitors with complementary mechanisms show increasing market acceptance. Polypill approaches combining diabetes, cardiovascular, and renal protective agents create comprehensive treatment solutions.

Value-based healthcare models influence prescribing patterns and reimbursement decisions across the region. Outcome-based pricing agreements link drug costs to clinical effectiveness and patient outcomes. Real-world evidence generation supports value demonstration and market access negotiations with healthcare payers.

Recent industry developments significantly impact the Asia Pacific SGLT2 inhibitors market trajectory and competitive dynamics. Regulatory approvals for expanded therapeutic indications including heart failure and chronic kidney disease create new market opportunities and revenue streams. Clinical trial completions provide additional evidence supporting broader therapeutic applications and patient populations.

Strategic partnerships between international pharmaceutical companies and regional healthcare organizations facilitate market penetration and distribution network expansion. Manufacturing investments in local production facilities reduce costs and improve supply chain reliability. Technology licensing agreements enable knowledge transfer and accelerate product development timelines.

Generic market entry as key patents expire creates competitive pressure while improving patient accessibility. Biosimilar development programs by regional manufacturers position local companies to capture significant market share. Quality assurance initiatives ensure generic alternatives meet international safety and efficacy standards.

Digital health partnerships integrate SGLT2 inhibitor therapy with comprehensive diabetes management platforms. Artificial intelligence applications optimize treatment selection and dosing recommendations. Remote monitoring solutions enhance patient safety and treatment effectiveness while reducing healthcare system burden.

Strategic recommendations for pharmaceutical companies operating in the Asia Pacific SGLT2 inhibitors market emphasize the importance of regional adaptation and local partnership development. Market entry strategies should prioritize countries with favorable regulatory environments and expanding healthcare infrastructure. Pricing strategies must balance profitability with accessibility, particularly in price-sensitive emerging markets.

Product development focus should emphasize combination therapies and novel delivery mechanisms that address regional patient preferences and healthcare system requirements. Clinical evidence generation in Asian populations strengthens regulatory submissions and physician confidence. Real-world evidence studies demonstrate value in diverse healthcare settings and support reimbursement negotiations.

Distribution network optimization requires careful consideration of regional logistics challenges and regulatory requirements. Digital health integration presents opportunities for differentiation and enhanced patient engagement. Healthcare provider education programs improve prescribing patterns and treatment optimization.

Investment priorities should focus on manufacturing capabilities, regulatory expertise, and technology platforms that support long-term market success. MarkWide Research recommends diversified approaches that balance innovation with cost-effectiveness to capture opportunities across different market segments and patient populations.

Future market trajectory for Asia Pacific SGLT2 inhibitors appears exceptionally promising, supported by favorable demographic trends and expanding therapeutic applications. Market expansion is projected to continue at robust growth rates, with penetration rates expected to reach 45-50% of eligible patients within the next decade. Innovation cycles will drive continuous product development and market differentiation opportunities.

Emerging market development presents the greatest growth potential, particularly in countries with expanding middle-class populations and improving healthcare infrastructure. Generic competition will increase market accessibility while creating pressure for branded product differentiation. Combination therapy adoption will accelerate as clinical evidence supports comprehensive diabetes management approaches.

Technology integration will transform traditional pharmaceutical business models through digital health platforms and personalized medicine approaches. Artificial intelligence applications will optimize treatment selection and monitoring protocols. Regulatory harmonization across Asia Pacific countries will facilitate market entry and reduce development costs.

Long-term sustainability depends on continued innovation, cost-effectiveness demonstration, and healthcare system integration. Population health initiatives and preventive care programs will create new opportunities for SGLT2 inhibitor applications. Market maturation in developed economies will shift focus toward emerging markets and novel therapeutic applications.

The Asia Pacific SGLT2 inhibitors market represents a dynamic and rapidly evolving pharmaceutical segment with exceptional growth potential and strategic importance. Market fundamentals remain strong, supported by increasing diabetes prevalence, expanding healthcare infrastructure, and growing clinical evidence for diverse therapeutic applications. Regional diversity creates opportunities for tailored market strategies that address specific country requirements and patient populations.

Competitive dynamics continue intensifying as established pharmaceutical companies expand regional presence while local manufacturers develop generic alternatives. Innovation leadership through combination therapies, digital health integration, and personalized medicine approaches will determine long-term market success. Regulatory evolution and healthcare policy reforms create both opportunities and challenges for market participants.

Strategic success in this market requires comprehensive understanding of regional variations, patient needs, and healthcare system requirements. Investment opportunities remain abundant across various market segments, from premium branded products to affordable generic alternatives. The market’s future trajectory appears highly favorable, positioning Asia Pacific as a critical region for global SGLT2 inhibitor growth and innovation.

What is SGLT2 Inhibitors?

SGLT2 inhibitors are a class of medications used primarily to manage type two diabetes by preventing glucose reabsorption in the kidneys, thus promoting its excretion through urine. They also have cardiovascular and renal protective effects, making them significant in diabetes management.

What are the key players in the Asia Pacific SGLT2 Inhibitors Market?

Key players in the Asia Pacific SGLT2 Inhibitors Market include AstraZeneca, Boehringer Ingelheim, and Johnson & Johnson, among others. These companies are actively involved in the development and marketing of SGLT2 inhibitors, contributing to the market’s growth.

What are the growth factors driving the Asia Pacific SGLT2 Inhibitors Market?

The Asia Pacific SGLT2 Inhibitors Market is driven by the rising prevalence of diabetes, increasing awareness about diabetes management, and the growing adoption of innovative therapies. Additionally, supportive government initiatives and healthcare infrastructure improvements are contributing to market expansion.

What challenges does the Asia Pacific SGLT2 Inhibitors Market face?

Challenges in the Asia Pacific SGLT2 Inhibitors Market include stringent regulatory requirements, high costs of drug development, and competition from alternative diabetes treatments. These factors can hinder market entry for new players and affect overall growth.

What opportunities exist in the Asia Pacific SGLT2 Inhibitors Market?

Opportunities in the Asia Pacific SGLT2 Inhibitors Market include the potential for new product launches, expansion into emerging markets, and the development of combination therapies. Additionally, increasing investment in diabetes research presents avenues for innovation.

What trends are shaping the Asia Pacific SGLT2 Inhibitors Market?

Trends in the Asia Pacific SGLT2 Inhibitors Market include a shift towards personalized medicine, the integration of digital health technologies, and a focus on patient-centric approaches. These trends are influencing how treatments are developed and delivered to patients.

Asia Pacific SGLT2 Inhibitors Market

| Segmentation Details | Description |

|---|---|

| Product Type | Dapagliflozin, Empagliflozin, Canagliflozin, Ertugliflozin |

| Therapy Area | Type 2 Diabetes, Heart Failure, Chronic Kidney Disease, Obesity |

| End User | Hospitals, Clinics, Homecare, Pharmacies |

| Route of Administration | Oral, Injectable, Subcutaneous, Intravenous |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific SGLT2 Inhibitors Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at