444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific security services market represents one of the most dynamic and rapidly expanding sectors in the global security industry. This comprehensive market encompasses a wide range of protective services including manned guarding, electronic security systems, cash-in-transit services, and specialized security consulting across diverse industries. The region’s unique combination of economic growth, urbanization, and evolving security challenges has created unprecedented demand for professional security solutions.

Market dynamics in the Asia-Pacific region are characterized by increasing investments in infrastructure development, rising crime rates in urban areas, and growing awareness of security risks among businesses and individuals. The market demonstrates robust growth potential with a projected CAGR of 8.2% over the forecast period, driven by technological advancements and expanding commercial sectors across key economies including China, India, Japan, Australia, and Southeast Asian nations.

Regional diversity presents both opportunities and challenges for security service providers. Developed markets like Japan and Australia show strong demand for sophisticated electronic security systems, while emerging economies focus primarily on traditional manned guarding services. This segmentation creates multiple growth avenues for companies operating across different service categories and geographic markets within the Asia-Pacific region.

The Asia-Pacific security services market refers to the comprehensive ecosystem of professional security solutions and protective services offered across the Asia-Pacific region, encompassing both physical security personnel and technology-enabled security systems designed to protect people, property, and assets from various threats and risks.

Security services in this context include manned guarding operations, electronic surveillance systems, access control solutions, alarm monitoring services, cash-in-transit operations, event security management, and specialized consulting services. The market serves diverse sectors including commercial real estate, manufacturing facilities, retail establishments, financial institutions, government buildings, and residential complexes throughout the region.

Geographic scope covers major economies including China, India, Japan, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, and other emerging markets across Southeast Asia and Oceania. Each market presents unique regulatory environments, cultural considerations, and security challenges that influence service delivery approaches and market penetration strategies.

Market expansion across the Asia-Pacific security services sector reflects the region’s economic transformation and increasing security awareness among businesses and consumers. The market benefits from sustained urbanization trends, with 72% of new commercial developments incorporating comprehensive security systems as standard features rather than optional additions.

Technology integration represents a key differentiator in the evolving market landscape. Modern security service providers increasingly combine traditional manned guarding with advanced electronic systems, creating hybrid solutions that deliver enhanced protection while optimizing operational costs. This integrated approach has gained significant traction among large enterprise clients seeking comprehensive security coverage.

Regulatory developments across major Asia-Pacific markets continue to shape industry standards and service delivery requirements. Government initiatives focused on public safety and security infrastructure development have created favorable conditions for market growth, while stringent licensing requirements ensure professional service quality and operational reliability.

Competitive dynamics feature a mix of international security giants and regional specialists, each leveraging unique strengths to capture market share. Local knowledge and cultural understanding often provide competitive advantages for regional players, while global companies bring advanced technologies and standardized service methodologies to the market.

Market segmentation reveals distinct patterns in service demand across different geographic and industry segments within the Asia-Pacific region:

Industry applications span diverse sectors with varying security requirements and service preferences. Manufacturing facilities prioritize perimeter security and access control, while retail establishments focus on loss prevention and customer safety. Financial institutions require specialized cash handling and high-security protocols, creating opportunities for premium service offerings.

Economic growth across the Asia-Pacific region continues to fuel demand for professional security services as businesses expand operations and invest in asset protection. Rising disposable incomes and increased commercial activity create favorable conditions for security service adoption across multiple industry sectors.

Urbanization trends represent a fundamental driver of market expansion. Rapid urban development creates new commercial and residential complexes requiring comprehensive security coverage. The concentration of valuable assets and increased population density in urban areas naturally increases security risks and service demand.

Technological advancement enables more sophisticated and cost-effective security solutions. Integration of artificial intelligence, IoT sensors, and cloud-based monitoring systems enhances service capabilities while reducing operational costs. These technological improvements make professional security services accessible to a broader range of clients.

Regulatory compliance requirements across various industries mandate specific security standards and protocols. Financial services, healthcare, and government sectors face stringent security regulations that drive demand for certified security service providers with specialized expertise and compliance capabilities.

Rising crime rates in urban areas increase security awareness and drive demand for protective services. Property crimes, theft, and vandalism concerns motivate businesses and individuals to invest in professional security solutions rather than relying solely on basic protective measures.

Cost sensitivity remains a significant challenge, particularly in price-conscious markets where businesses prioritize cost reduction over comprehensive security coverage. Economic downturns and budget constraints can lead to reduced security spending or delays in service upgrades and expansions.

Regulatory complexity across different Asia-Pacific markets creates operational challenges for security service providers. Varying licensing requirements, labor regulations, and service standards complicate market entry and expansion strategies for companies seeking regional coverage.

Labor shortage issues affect the availability of qualified security personnel in several markets. Competition from other service industries and demographic changes in some countries create recruitment and retention challenges that impact service delivery capabilities and cost structures.

Technology adoption barriers include high initial investment costs for advanced security systems and resistance to change among traditional clients. Some businesses prefer familiar manual security approaches over technology-enabled solutions, limiting market penetration for innovative service offerings.

Cultural considerations influence service acceptance and delivery approaches across diverse Asia-Pacific markets. Language barriers, cultural sensitivity requirements, and varying business practices necessitate localized service approaches that can increase operational complexity and costs.

Smart city initiatives across major Asia-Pacific urban centers create substantial opportunities for integrated security service providers. Government investments in intelligent infrastructure and connected security systems open new market segments for companies offering comprehensive technology-enabled solutions.

E-commerce growth drives demand for specialized security services including warehouse protection, logistics security, and last-mile delivery safety. The rapid expansion of online retail creates new service categories and revenue opportunities for adaptive security providers.

Infrastructure development projects including airports, seaports, transportation hubs, and industrial complexes require specialized security expertise. Large-scale infrastructure investments create long-term service contracts and opportunities for premium security solutions.

Emerging technologies such as drone surveillance, biometric access control, and predictive analytics enable new service offerings and competitive differentiation. Early adoption of innovative technologies can provide significant market advantages and premium pricing opportunities.

Regional expansion opportunities exist for established security providers to enter underserved markets or expand service offerings in existing territories. Cross-border partnerships and acquisitions can accelerate market penetration and service capability development.

Supply chain considerations significantly impact service delivery capabilities and cost structures across the Asia-Pacific security services market. Equipment procurement, technology integration, and personnel training requirements create complex operational dynamics that influence competitive positioning and market success.

Customer expectations continue to evolve toward more sophisticated and integrated security solutions. Modern clients expect seamless technology integration, real-time monitoring capabilities, and comprehensive reporting systems that demonstrate security effectiveness and return on investment.

Competitive intensity varies significantly across different market segments and geographic regions. Established markets like Japan and Australia feature intense competition among well-established providers, while emerging markets offer greater opportunities for new entrants and innovative service approaches.

Partnership strategies play crucial roles in market development and service delivery optimization. Collaborations between security service providers, technology vendors, and local partners enable comprehensive solution offerings and improved market penetration across diverse Asia-Pacific markets.

Innovation cycles drive continuous service evolution and competitive differentiation. Companies investing in research and development, technology integration, and service innovation maintain competitive advantages and capture premium market segments with higher growth potential and profitability.

Primary research methodologies employed in analyzing the Asia-Pacific security services market include comprehensive surveys of industry participants, in-depth interviews with key stakeholders, and direct observation of market trends across major regional economies. These primary sources provide current market insights and forward-looking perspectives on industry development.

Secondary research encompasses analysis of industry reports, government publications, regulatory filings, and company financial statements to establish market baselines and validate primary research findings. This comprehensive approach ensures data accuracy and provides historical context for market trend analysis.

Market segmentation analysis utilizes both quantitative and qualitative research approaches to identify distinct customer segments, service categories, and geographic markets. This detailed segmentation enables precise market sizing and targeted strategy development for different market participants.

Competitive landscape assessment involves systematic analysis of major market players, their service offerings, market positioning, and strategic initiatives. This competitive intelligence provides insights into market dynamics and identifies opportunities for differentiation and growth.

Trend analysis combines historical data review with forward-looking projections to identify emerging market opportunities and potential challenges. This analytical approach supports strategic planning and investment decision-making for industry participants and stakeholders.

China represents the largest individual market within the Asia-Pacific region, accounting for approximately 35% of regional market activity. The Chinese market benefits from massive infrastructure development, urbanization initiatives, and increasing security awareness among businesses and consumers. Government support for security industry development and smart city projects creates favorable growth conditions.

India demonstrates the highest growth potential with expanding commercial sectors and increasing security investments across major urban centers. The Indian market shows strong demand for cost-effective security solutions, with manned guarding services maintaining dominant market position while electronic security adoption accelerates in metropolitan areas.

Japan features the most mature and sophisticated security services market in the region, with high technology adoption rates and premium service standards. The Japanese market emphasizes quality, reliability, and innovation, creating opportunities for advanced security solutions and specialized service offerings.

Australia maintains strong market fundamentals with well-established regulatory frameworks and professional service standards. The Australian market shows balanced demand across all service categories, with particular strength in commercial and industrial security applications.

Southeast Asian markets including Singapore, Thailand, Malaysia, and Indonesia demonstrate varied development stages and growth opportunities. Singapore leads in technology adoption and premium services, while other markets focus primarily on traditional security services with gradual technology integration.

Market leadership in the Asia-Pacific security services sector features a diverse mix of international corporations and regional specialists, each leveraging unique strengths to capture market share and serve specific customer segments.

Strategic positioning varies among market participants, with some companies focusing on technology leadership while others emphasize cost-effective service delivery or specialized industry expertise. This diversity creates multiple competitive dynamics and market opportunities across different segments and regions.

By Service Type:

By End-User Industry:

By Geography:

Manned Guarding Services continue to dominate the Asia-Pacific security services market, representing the largest revenue segment across most regional markets. This category benefits from relatively low labor costs in many Asia-Pacific countries and cultural preferences for human security presence. Service providers in this segment focus on training quality, professional standards, and technology integration to enhance service value and differentiation.

Electronic Security Systems demonstrate the fastest growth rates as businesses increasingly adopt technology-enabled security solutions. Advanced surveillance systems, access control technologies, and integrated monitoring platforms gain popularity among commercial clients seeking comprehensive security coverage with operational efficiency benefits.

Cash-in-Transit Services represent a specialized high-value segment serving banking and retail sectors with critical asset protection requirements. This category requires specialized equipment, trained personnel, and strict security protocols, creating barriers to entry and opportunities for premium pricing among qualified service providers.

Consulting and Risk Assessment services gain importance as businesses seek strategic security planning and compliance support. This professional services category offers high-margin opportunities for companies with specialized expertise and industry knowledge, particularly in regulated sectors with complex security requirements.

Integrated Security Solutions emerge as a key trend combining multiple service categories into comprehensive packages. Clients increasingly prefer single-source providers capable of delivering coordinated security solutions across physical, electronic, and consulting service categories.

Service Providers benefit from diverse market opportunities across multiple industry sectors and geographic regions within Asia-Pacific. The market’s growth trajectory and increasing security awareness create sustainable demand for professional security services, while technology integration enables service differentiation and operational efficiency improvements.

Technology Vendors gain access to expanding markets for security equipment, software solutions, and integrated systems. Partnership opportunities with service providers enable technology companies to reach end-users through established distribution channels while contributing to comprehensive security solutions.

End-User Clients receive enhanced security protection through professional services that combine expertise, technology, and operational efficiency. Outsourcing security functions allows businesses to focus on core activities while ensuring comprehensive asset and personnel protection through specialized service providers.

Investors find attractive opportunities in a growing market with diverse investment options across different service segments and geographic regions. The security services sector offers defensive characteristics with steady demand patterns and opportunities for consolidation and expansion.

Government Stakeholders benefit from professional security services that enhance public safety and support economic development. The industry contributes to employment generation, tax revenues, and overall security infrastructure development across Asia-Pacific markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology Integration represents the most significant trend reshaping the Asia-Pacific security services market. Service providers increasingly combine traditional manned guarding with advanced electronic systems, creating hybrid solutions that deliver enhanced protection while optimizing operational costs. This integration includes AI-powered surveillance, IoT sensors, and cloud-based monitoring platforms.

Mobile Security Solutions gain popularity as businesses seek flexible and cost-effective protection options. Mobile patrol services, rapid response capabilities, and on-demand security support enable service providers to serve diverse client needs while optimizing resource utilization across multiple locations and time periods.

Data Analytics Integration enables predictive security approaches and performance optimization. Security service providers leverage data from various sources including surveillance systems, access control logs, and incident reports to identify patterns, predict risks, and optimize service delivery approaches for improved effectiveness.

Sustainability Focus influences service delivery approaches and client selection criteria. Environmentally conscious businesses prefer security providers with sustainable practices, energy-efficient technologies, and corporate social responsibility initiatives that align with their organizational values and objectives.

Customization Demand increases as clients seek tailored security solutions that address specific industry requirements and operational challenges. Generic security services give way to specialized offerings designed for particular sectors, facility types, or risk profiles, creating opportunities for service differentiation and premium pricing.

Strategic Acquisitions continue to reshape the competitive landscape as major security companies expand their regional presence and service capabilities through targeted acquisitions of local providers. These transactions enable rapid market entry, local expertise acquisition, and service portfolio expansion across diverse Asia-Pacific markets.

Technology Partnerships between security service providers and technology companies create innovative solution offerings that combine service expertise with advanced technological capabilities. These collaborations enable comprehensive security solutions that address both physical and digital security requirements for modern enterprises.

Regulatory Developments across major Asia-Pacific markets establish new professional standards and licensing requirements that enhance industry credibility while creating barriers to entry for unqualified providers. These regulatory changes generally favor established companies with professional capabilities and compliance resources.

Training Program Investments by leading service providers focus on enhancing personnel capabilities and service quality standards. Advanced training initiatives cover technology utilization, customer service excellence, and specialized security protocols that differentiate professional providers from basic security services.

Market Expansion Initiatives by international security companies target high-growth Asia-Pacific markets through direct investment, joint ventures, and strategic partnerships. These expansion efforts bring advanced service methodologies and global best practices to regional markets while creating competitive pressure on local providers.

MarkWide Research analysis indicates that security service providers should prioritize technology integration and digital transformation initiatives to maintain competitive positioning in the evolving Asia-Pacific market. Companies investing in advanced security technologies and data analytics capabilities will capture premium market segments and achieve sustainable competitive advantages.

Market entry strategies for new participants should focus on specialized service niches or underserved geographic markets rather than competing directly with established providers in mature segments. Differentiation through industry expertise, technology innovation, or unique service approaches provides better opportunities for market penetration and growth.

Partnership development represents a critical success factor for companies seeking regional expansion or service capability enhancement. Strategic alliances with technology vendors, local service providers, and industry specialists enable comprehensive solution offerings and improved market access across diverse Asia-Pacific markets.

Investment priorities should emphasize personnel training, technology infrastructure, and quality management systems that support service differentiation and operational excellence. Companies with superior service quality and professional capabilities will capture market share from competitors focused primarily on cost competition.

Geographic expansion strategies should consider market maturity levels, regulatory environments, and competitive dynamics when prioritizing investment allocation across different Asia-Pacific countries. Emerging markets offer higher growth potential but require different approaches than mature markets with established competitive structures.

Market evolution over the next decade will be characterized by continued technology integration, service sophistication, and geographic expansion across the Asia-Pacific security services sector. The market is projected to maintain robust growth momentum with a CAGR of 8.2% driven by urbanization, economic development, and increasing security awareness.

Technology advancement will fundamentally transform service delivery approaches and competitive dynamics. Artificial intelligence, machine learning, and IoT integration will enable predictive security capabilities, automated threat detection, and optimized resource allocation that enhance service effectiveness while reducing operational costs.

Service integration trends will continue toward comprehensive security solutions that combine physical protection, electronic systems, and cybersecurity capabilities. Clients increasingly prefer single-source providers capable of addressing all security requirements through coordinated service delivery and unified management approaches.

Regional development patterns will see continued growth in emerging markets alongside service sophistication in mature economies. MWR projects that emerging Asia-Pacific markets will account for 65% of new market growth over the forecast period, while developed markets focus on premium service offerings and technology leadership.

Industry consolidation will accelerate as companies seek scale advantages, geographic coverage, and service capability expansion through strategic acquisitions and partnerships. This consolidation will create larger, more capable service providers while maintaining opportunities for specialized niche players with unique expertise or market focus.

The Asia-Pacific security services market presents exceptional opportunities for growth and development across diverse service categories and geographic regions. Strong economic fundamentals, increasing security awareness, and technology advancement create favorable conditions for sustained market expansion and innovation.

Market participants who successfully combine traditional security expertise with advanced technology capabilities will capture the most attractive growth opportunities and achieve sustainable competitive advantages. The integration of physical security services with electronic systems and data analytics represents the future direction of industry development.

Strategic success in this dynamic market requires careful attention to regional differences, regulatory requirements, and evolving customer expectations. Companies that invest in professional capabilities, technology infrastructure, and service quality will thrive in the competitive Asia-Pacific security services landscape while contributing to enhanced safety and security across the region.

What is Security Services?

Security services encompass a range of protective services designed to safeguard individuals, property, and assets. This includes physical security, cybersecurity, and risk management solutions tailored to various sectors such as commercial, residential, and governmental.

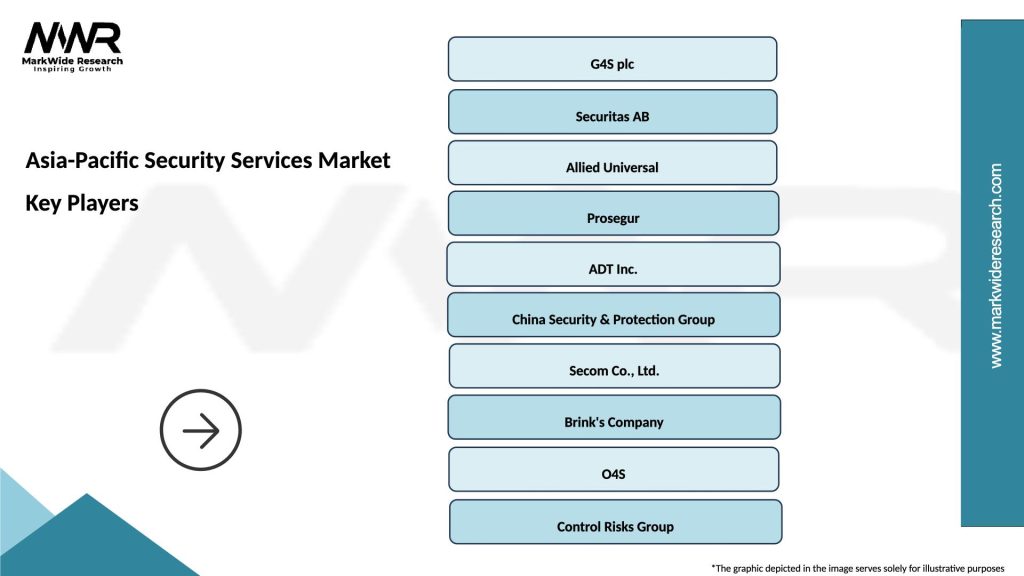

What are the key players in the Asia-Pacific Security Services Market?

Key players in the Asia-Pacific Security Services Market include G4S, Securitas, Allied Universal, and Control Risks, among others. These companies provide a variety of services, including manned guarding, electronic surveillance, and consulting services.

What are the main drivers of growth in the Asia-Pacific Security Services Market?

The growth of the Asia-Pacific Security Services Market is driven by increasing concerns over safety and security, rising crime rates, and the expansion of industries such as retail and banking. Additionally, advancements in technology, such as AI and IoT, are enhancing security solutions.

What challenges does the Asia-Pacific Security Services Market face?

The Asia-Pacific Security Services Market faces challenges such as regulatory compliance, the need for skilled personnel, and the high cost of advanced security technologies. Additionally, competition from unregulated service providers can impact market growth.

What opportunities exist in the Asia-Pacific Security Services Market?

Opportunities in the Asia-Pacific Security Services Market include the growing demand for cybersecurity services, the integration of smart technologies in security systems, and the increasing need for security in emerging sectors like e-commerce and logistics.

What trends are shaping the Asia-Pacific Security Services Market?

Trends shaping the Asia-Pacific Security Services Market include the rise of integrated security solutions, the adoption of mobile security applications, and a focus on sustainability in security practices. Additionally, there is a growing emphasis on data analytics to enhance security measures.

Asia-Pacific Security Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Physical Security, Cybersecurity, Remote Monitoring, Risk Management |

| End User | Government, Healthcare, Financial Services, Retail |

| Technology | Video Surveillance, Access Control, Intrusion Detection, Biometrics |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Security Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at