444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific sealants and adhesives market represents one of the most dynamic and rapidly expanding industrial segments in the global economy. This comprehensive market encompasses a diverse range of bonding and sealing solutions that serve critical functions across multiple industries, from automotive manufacturing to construction and electronics. The region’s robust economic growth, coupled with accelerating industrialization and urbanization trends, has positioned Asia Pacific as the world’s largest consumer and producer of sealants and adhesives technologies.

Market dynamics in the Asia Pacific region are characterized by strong demand from emerging economies, particularly China, India, and Southeast Asian nations, where infrastructure development and manufacturing expansion continue at unprecedented rates. The market demonstrates remarkable resilience and adaptability, with growth rates consistently outpacing global averages at approximately 6.2% CAGR over the forecast period. This growth trajectory reflects the region’s strategic importance in global supply chains and its increasing technological sophistication.

Industrial applications span across automotive assembly, construction projects, packaging solutions, electronics manufacturing, and aerospace components. The diversity of end-use industries creates a stable foundation for sustained market expansion, while technological innovations in polymer chemistry and sustainable formulations drive product evolution. Regional manufacturers are increasingly focusing on developing eco-friendly alternatives and high-performance solutions that meet stringent international standards.

The Asia Pacific sealants and adhesives market refers to the comprehensive ecosystem of chemical bonding and sealing products manufactured, distributed, and consumed across the Asia Pacific region. These products include structural adhesives, pressure-sensitive adhesives, sealants for construction applications, automotive bonding solutions, and specialized formulations for electronics and industrial applications.

Sealants are materials designed to block the passage of fluids through surfaces, joints, or openings in materials, providing weatherproofing, insulation, and protection against environmental factors. Adhesives are substances capable of holding materials together through surface attachment, creating permanent or semi-permanent bonds that replace or supplement mechanical fastening methods. Together, these products form an essential component of modern manufacturing and construction processes.

Market scope encompasses various product categories including acrylic-based formulations, silicone sealants, polyurethane adhesives, epoxy systems, and emerging bio-based alternatives. The regional market serves diverse applications from high-volume automotive production to specialized aerospace components, reflecting the technological diversity and manufacturing capabilities present across Asia Pacific nations.

Strategic positioning of the Asia Pacific sealants and adhesives market reflects the region’s role as a global manufacturing hub and rapidly developing economic powerhouse. The market benefits from favorable demographic trends, including urbanization rates exceeding 68% in major economies, which drives construction activity and infrastructure development. Manufacturing sector growth, particularly in automotive and electronics industries, creates sustained demand for advanced bonding solutions.

Technology advancement represents a key differentiator in the regional market, with manufacturers investing heavily in research and development to create high-performance formulations. Innovation focuses on developing products that offer superior durability, environmental resistance, and application versatility while meeting increasingly stringent regulatory requirements for volatile organic compound emissions and environmental impact.

Competitive landscape features a mix of global multinational corporations and regional specialists, creating a dynamic environment that fosters innovation and competitive pricing. Local manufacturers leverage cost advantages and market proximity to compete effectively with international brands, while global players bring advanced technology and extensive research capabilities to the region.

Market outlook remains highly positive, supported by continued economic growth, infrastructure investment, and technological advancement across the region. Emerging trends toward sustainable construction practices and lightweight automotive design create new opportunities for specialized adhesive and sealant formulations.

Regional dominance in the global sealants and adhesives industry positions Asia Pacific as the primary growth engine, accounting for approximately 45% of global consumption. This leadership reflects the region’s manufacturing capabilities, economic dynamism, and strategic importance in global supply chains.

Economic growth across Asia Pacific nations creates fundamental demand drivers for sealants and adhesives across multiple sectors. Rapid industrialization, particularly in emerging economies, generates sustained demand for bonding solutions in manufacturing processes, while urbanization trends drive construction activity requiring weatherproofing and structural bonding applications.

Automotive industry expansion represents a primary growth driver, with the region producing over 52% of global vehicle output. Modern automotive manufacturing relies extensively on adhesives and sealants for lightweighting initiatives, noise reduction, structural integrity, and weather sealing. Electric vehicle production, growing rapidly across the region, requires specialized thermal management and battery sealing solutions.

Construction sector growth fueled by infrastructure development programs and urban expansion creates substantial demand for construction sealants, structural adhesives, and weatherproofing solutions. Smart building technologies and energy-efficient construction practices drive adoption of advanced sealing systems that improve building performance and durability.

Electronics manufacturing concentration in Asia Pacific generates demand for precision adhesives used in semiconductor assembly, display manufacturing, and consumer electronics production. Miniaturization trends and advanced packaging technologies require increasingly sophisticated bonding solutions with precise application characteristics.

Sustainability initiatives drive development and adoption of eco-friendly formulations, creating market opportunities for bio-based adhesives and low-emission sealants. Regulatory pressure and consumer awareness support market transition toward environmentally responsible products.

Raw material volatility presents ongoing challenges for sealants and adhesives manufacturers, with petroleum-based feedstock prices subject to global commodity market fluctuations. Supply chain disruptions and geopolitical tensions can impact material availability and pricing, affecting production costs and market stability.

Regulatory complexity across different Asia Pacific markets creates compliance challenges for manufacturers operating in multiple countries. Varying environmental standards, safety requirements, and certification processes increase operational complexity and development costs for companies seeking regional market access.

Technical barriers in specialized applications require significant research and development investment, potentially limiting market entry for smaller manufacturers. High-performance applications in aerospace, automotive, and electronics demand extensive testing and certification processes that can delay product introduction and increase development costs.

Competition intensity from both global and regional manufacturers creates pricing pressure and margin compression in commodity product segments. Market saturation in mature applications requires continuous innovation and differentiation to maintain competitive positioning.

Environmental concerns regarding volatile organic compound emissions and end-of-life disposal create regulatory pressure and market demand for alternative formulations. Transition costs and performance trade-offs associated with sustainable alternatives can impact market adoption rates.

Emerging applications in renewable energy infrastructure create substantial growth opportunities for specialized sealants and adhesives. Solar panel assembly, wind turbine construction, and energy storage systems require durable bonding solutions capable of withstanding extreme environmental conditions while maintaining long-term performance.

Smart manufacturing adoption across Asia Pacific industries generates demand for precision adhesives and automated application systems. Industry 4.0 technologies enable more sophisticated bonding processes and quality control systems, creating opportunities for advanced product formulations and application equipment.

Sustainable product development represents a significant market opportunity as environmental regulations tighten and consumer awareness increases. Bio-based adhesives, recyclable formulations, and low-emission sealants address growing sustainability requirements while potentially commanding premium pricing.

Infrastructure modernization programs across developing Asia Pacific economies create long-term demand for construction sealants and structural adhesives. Transportation infrastructure, urban development, and industrial facility construction require reliable bonding and sealing solutions.

Technology transfer opportunities exist for companies that can adapt advanced formulations to regional market requirements and cost structures. Local manufacturing partnerships and technology licensing arrangements can accelerate market penetration while reducing operational risks.

Supply chain integration across the Asia Pacific sealants and adhesives market demonstrates increasing sophistication, with manufacturers developing regional production networks that optimize cost efficiency and market responsiveness. Vertical integration strategies enable better quality control and supply security, while horizontal partnerships facilitate market expansion and technology sharing.

Innovation cycles in the market are accelerating, driven by competitive pressure and evolving application requirements. MarkWide Research analysis indicates that product development timelines have shortened by approximately 25% over recent years, reflecting increased research investment and improved development processes. This acceleration enables faster response to market opportunities and changing customer requirements.

Customer relationships are evolving toward strategic partnerships rather than transactional supply arrangements. Original equipment manufacturers increasingly seek suppliers capable of providing technical support, application development, and customized formulations rather than commodity products. This trend favors manufacturers with strong technical capabilities and regional presence.

Market consolidation continues as companies seek scale advantages and expanded geographic coverage. Mergers and acquisitions enable access to new technologies, distribution channels, and customer relationships while creating operational synergies. Regional players often become acquisition targets for global companies seeking market entry or expansion.

Digital transformation impacts market dynamics through improved customer engagement, supply chain optimization, and product development processes. Digital tools enable better market intelligence, customer service, and operational efficiency while supporting development of smart adhesive systems with embedded sensors and monitoring capabilities.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of market insights. Primary research includes extensive interviews with industry executives, technical specialists, and end-user representatives across major Asia Pacific markets. Secondary research encompasses analysis of industry publications, regulatory filings, patent databases, and trade statistics.

Data collection processes utilize both quantitative and qualitative research approaches to capture market dynamics and trends. Quantitative analysis includes market sizing, growth rate calculations, and statistical modeling based on historical data and forward-looking indicators. Qualitative research explores market drivers, competitive dynamics, and emerging trends through expert interviews and industry analysis.

Market segmentation analysis examines the sealants and adhesives market across multiple dimensions including product type, application, end-use industry, and geographic region. Cross-tabulation analysis identifies growth opportunities and market patterns while enabling detailed competitive positioning assessment.

Validation procedures ensure data accuracy through triangulation of multiple sources and expert review processes. Market estimates undergo rigorous verification against industry benchmarks and alternative data sources to confirm reliability and consistency.

Forecasting methodology combines statistical modeling with expert judgment to project future market trends and growth patterns. Scenario analysis examines potential market developments under different economic and regulatory conditions to provide comprehensive market outlook.

China dominates the Asia Pacific sealants and adhesives market, representing approximately 38% of regional consumption due to its massive manufacturing base and ongoing infrastructure development. The Chinese market benefits from strong domestic demand across automotive, construction, and electronics sectors, while also serving as a major export hub for global markets.

Japan maintains technological leadership in high-performance applications, particularly in automotive and electronics sectors. Japanese manufacturers excel in developing advanced formulations for specialized applications, while the domestic market emphasizes quality and performance over cost considerations. Innovation in sustainable technologies and precision applications drives market development.

India represents the fastest-growing major market in the region, with expansion driven by infrastructure development, automotive industry growth, and increasing manufacturing activity. Government initiatives promoting domestic manufacturing and infrastructure investment create substantial opportunities for sealants and adhesives suppliers.

South Korea demonstrates strong market sophistication, particularly in electronics and automotive applications. The country’s advanced manufacturing capabilities and technology focus create demand for high-performance bonding solutions, while export-oriented industries drive volume growth.

Southeast Asian markets including Thailand, Indonesia, Malaysia, and Vietnam show robust growth potential driven by industrial development and foreign investment. These markets benefit from manufacturing relocation trends and regional supply chain integration, creating opportunities for both local and international suppliers.

Australia and New Zealand represent mature markets with stable demand patterns focused on construction and industrial applications. Regulatory emphasis on environmental performance and sustainability creates opportunities for eco-friendly product development.

Market leadership in the Asia Pacific sealants and adhesives industry features a competitive environment with both global multinational corporations and strong regional players. The competitive landscape demonstrates increasing consolidation as companies seek scale advantages and expanded geographic coverage.

Competitive strategies emphasize innovation, regional manufacturing, and customer partnership development. Companies invest heavily in research and development to create differentiated products while building local manufacturing capabilities to serve regional markets efficiently.

Product-based segmentation reveals diverse market composition reflecting varied application requirements and performance characteristics across the Asia Pacific region. Each product category serves specific market needs while contributing to overall market growth and development.

By Technology:

By Application:

By End-Use Industry:

Structural adhesives represent the highest-growth category within the Asia Pacific market, driven by automotive lightweighting initiatives and advanced manufacturing processes. These high-performance formulations enable manufacturers to replace mechanical fasteners while improving product performance and reducing weight. Growth rates in this category exceed 8.5% annually, reflecting strong demand from automotive and aerospace applications.

Silicone sealants maintain strong market position due to their versatility and durability across diverse applications. Construction industry demand drives volume growth, while automotive and electronics applications require increasingly sophisticated formulations. Innovation focuses on improving adhesion properties and developing specialized grades for extreme service conditions.

Pressure-sensitive adhesives benefit from packaging industry growth and expanding applications in electronics and automotive sectors. Label and tape applications drive volume demand, while technical applications require specialized formulations with precise performance characteristics. Market development emphasizes sustainable formulations and improved recyclability.

Polyurethane systems demonstrate strong growth potential in construction and automotive applications due to their excellent flexibility and durability characteristics. These formulations excel in applications requiring movement accommodation and long-term environmental resistance. Innovation focuses on reducing isocyanate content and improving sustainability profiles.

Epoxy formulations serve high-performance applications requiring exceptional strength and chemical resistance. Electronics and aerospace applications drive demand for specialized grades, while construction applications utilize standard formulations for structural bonding. Market development emphasizes faster curing systems and improved handling characteristics.

Manufacturers benefit from the Asia Pacific market’s scale and growth potential, enabling efficient production operations and market expansion opportunities. Regional manufacturing capabilities provide cost advantages while proximity to major end-use industries ensures responsive customer service and technical support.

End-users gain access to comprehensive product portfolios and competitive pricing through the region’s diverse supplier base. Local manufacturing presence ensures reliable supply chains and technical support, while innovation capabilities enable development of customized solutions for specific application requirements.

Distributors leverage the market’s growth dynamics to expand their business operations and customer base. Regional market development creates opportunities for value-added services including technical support, inventory management, and application development assistance.

Technology providers find substantial opportunities for licensing and partnership arrangements with regional manufacturers seeking to enhance their product capabilities. Knowledge transfer and joint development programs enable market entry while reducing operational risks and investment requirements.

Investors benefit from the market’s strong growth prospects and defensive characteristics across economic cycles. Diversified end-use applications provide stability while emerging market exposure offers growth potential exceeding developed market alternatives.

Research institutions collaborate with industry participants to develop next-generation formulations and application technologies. These partnerships accelerate innovation while providing funding for advanced research programs and technology development initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend reshaping the Asia Pacific sealants and adhesives market. Manufacturers increasingly focus on developing bio-based formulations, reducing volatile organic compound emissions, and improving end-of-life recyclability. This trend reflects both regulatory pressure and changing customer preferences toward environmentally responsible products.

Digital integration transforms traditional manufacturing and application processes through smart technologies and data analytics. Internet of Things sensors enable real-time monitoring of adhesive performance, while artificial intelligence optimizes formulation development and application parameters. These technologies improve quality control and enable predictive maintenance strategies.

Customization demand increases as end-users seek specialized formulations tailored to specific application requirements. Mass customization capabilities enable manufacturers to serve niche markets while maintaining production efficiency. This trend favors companies with strong technical capabilities and flexible manufacturing systems.

Lightweighting initiatives across automotive and aerospace industries drive demand for high-strength, low-density bonding solutions. Advanced composite materials and multi-material construction require specialized adhesives capable of bonding dissimilar substrates while maintaining structural integrity.

Automation adoption in manufacturing processes requires adhesives and sealants compatible with robotic application systems and automated quality control processes. Products must demonstrate consistent performance characteristics and reliable application properties to support lights-out manufacturing operations.

Circular economy principles influence product development toward formulations that support recycling and reuse initiatives. MWR analysis indicates that approximately 32% of manufacturers are actively developing recyclable adhesive systems to support circular economy objectives.

Technology partnerships between global and regional companies accelerate innovation and market development across the Asia Pacific region. These collaborations combine international expertise with local market knowledge to develop products specifically designed for regional requirements and applications.

Manufacturing investments continue expanding across the region as companies build local production capabilities to serve growing markets efficiently. New facility construction and capacity expansion projects demonstrate confidence in long-term market growth prospects and enable improved customer service.

Regulatory harmonization efforts across Asia Pacific markets aim to reduce compliance complexity and facilitate trade. Standardization initiatives create opportunities for regional product platforms while reducing development and certification costs for manufacturers.

Research collaborations between industry and academic institutions accelerate development of next-generation formulations and application technologies. These partnerships leverage academic research capabilities while providing industry funding and practical application expertise.

Sustainability initiatives gain momentum as companies commit to reducing environmental impact and developing eco-friendly alternatives. Carbon neutrality goals and circular economy principles drive investment in sustainable technologies and manufacturing processes.

Digital transformation projects enhance customer engagement, supply chain efficiency, and product development capabilities. Companies invest in digital platforms that improve market intelligence, customer service, and operational performance while supporting development of smart adhesive systems.

Strategic positioning recommendations emphasize the importance of regional manufacturing presence and local market expertise for success in the Asia Pacific sealants and adhesives market. Companies should prioritize building relationships with key end-users while developing products specifically designed for regional applications and requirements.

Innovation investment should focus on sustainable formulations and high-performance applications that command premium pricing. Research and development priorities should align with regulatory trends and customer sustainability requirements while maintaining performance standards expected in demanding applications.

Partnership strategies can accelerate market entry and expansion through joint ventures, licensing agreements, and strategic alliances with regional companies. These arrangements provide market access and local expertise while reducing investment risks and operational complexity.

Supply chain optimization becomes increasingly important as raw material costs and availability fluctuate. Companies should develop diverse supplier relationships and consider backward integration for critical materials while building inventory management capabilities that balance cost and service requirements.

Digital capabilities development should encompass customer engagement, operational efficiency, and product innovation. Investment in digital platforms and data analytics capabilities enables better market intelligence and customer service while supporting development of smart adhesive systems.

Regulatory compliance preparation should anticipate tightening environmental standards and safety requirements across the region. Proactive product development and certification efforts can create competitive advantages while ensuring market access as regulations evolve.

Long-term growth prospects for the Asia Pacific sealants and adhesives market remain highly positive, supported by continued economic development, infrastructure investment, and technological advancement across the region. MarkWide Research projects sustained growth momentum with the market expanding at robust rates through the forecast period, driven by diverse end-use applications and emerging technology opportunities.

Technology evolution will continue reshaping market dynamics as manufacturers develop increasingly sophisticated formulations and application systems. Smart adhesives with embedded sensors and self-healing capabilities represent emerging opportunities, while sustainable formulations become standard rather than premium offerings. These developments will create new market segments while transforming existing applications.

Market consolidation is expected to continue as companies seek scale advantages and expanded geographic coverage. Merger and acquisition activity will likely accelerate, particularly involving regional companies with strong market positions and innovative technologies. This consolidation will create larger, more capable organizations while potentially reducing competitive intensity in some segments.

Sustainability requirements will become increasingly stringent, driving continued innovation in eco-friendly formulations and manufacturing processes. Companies that successfully develop and commercialize sustainable alternatives will gain competitive advantages, while those that fail to adapt may face market share erosion and regulatory challenges.

Regional integration will deepen as trade agreements and economic cooperation initiatives reduce barriers to market access and technology transfer. This integration will create larger addressable markets while enabling more efficient supply chain operations and technology sharing arrangements.

Emerging applications in renewable energy, electric vehicles, and advanced manufacturing will create new growth opportunities requiring specialized formulations and application expertise. Companies that successfully identify and develop these emerging opportunities will achieve above-average growth rates and market positioning advantages.

The Asia Pacific sealants and adhesives market represents a dynamic and rapidly evolving industry segment with exceptional growth prospects and strategic importance in the global economy. The region’s combination of manufacturing scale, technological capabilities, and market diversity creates a compelling investment and business development opportunity for industry participants.

Market fundamentals remain strong, supported by continued economic growth, infrastructure development, and technological advancement across major Asia Pacific economies. The diversity of end-use applications provides stability while emerging technologies and sustainability requirements create new growth opportunities for innovative companies.

Success factors in this market include regional manufacturing presence, strong technical capabilities, customer partnership development, and commitment to sustainable product development. Companies that can effectively combine global expertise with local market knowledge will be best positioned to capitalize on the region’s growth potential.

Future developments will likely emphasize sustainability, digitalization, and high-performance applications as the market continues maturing and evolving. The Asia Pacific sealants and adhesives market will remain a critical component of global industrial supply chains while driving innovation and technological advancement in bonding and sealing technologies.

What is Sealants and Adhesives?

Sealants and adhesives are substances used to bond materials together or to seal gaps and joints. They are widely utilized in construction, automotive, and manufacturing industries for various applications such as waterproofing, insulation, and structural bonding.

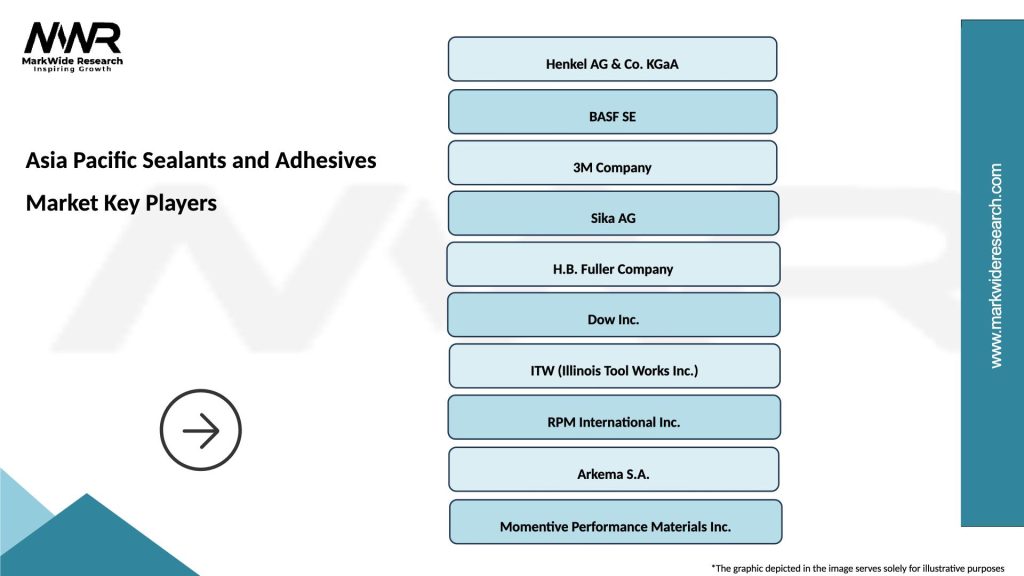

What are the key players in the Asia Pacific Sealants and Adhesives Market?

Key players in the Asia Pacific Sealants and Adhesives Market include Henkel AG, Sika AG, Bostik, and 3M Company. These companies are known for their innovative products and extensive distribution networks, catering to diverse industries such as construction and automotive, among others.

What are the growth factors driving the Asia Pacific Sealants and Adhesives Market?

The growth of the Asia Pacific Sealants and Adhesives Market is driven by increasing construction activities, rising demand for automotive manufacturing, and the expansion of the electronics sector. Additionally, the trend towards sustainable and eco-friendly products is also contributing to market growth.

What challenges does the Asia Pacific Sealants and Adhesives Market face?

The Asia Pacific Sealants and Adhesives Market faces challenges such as fluctuating raw material prices and stringent regulatory requirements. Additionally, competition from alternative bonding technologies can hinder market growth.

What opportunities exist in the Asia Pacific Sealants and Adhesives Market?

Opportunities in the Asia Pacific Sealants and Adhesives Market include the development of bio-based adhesives and sealants, as well as advancements in technology that enhance product performance. The growing demand for lightweight materials in automotive and aerospace applications also presents significant opportunities.

What trends are shaping the Asia Pacific Sealants and Adhesives Market?

Trends shaping the Asia Pacific Sealants and Adhesives Market include the increasing adoption of smart adhesives that respond to environmental changes and the rise of automation in manufacturing processes. Additionally, the focus on sustainability is driving innovation in eco-friendly adhesive formulations.

Asia Pacific Sealants and Adhesives Market

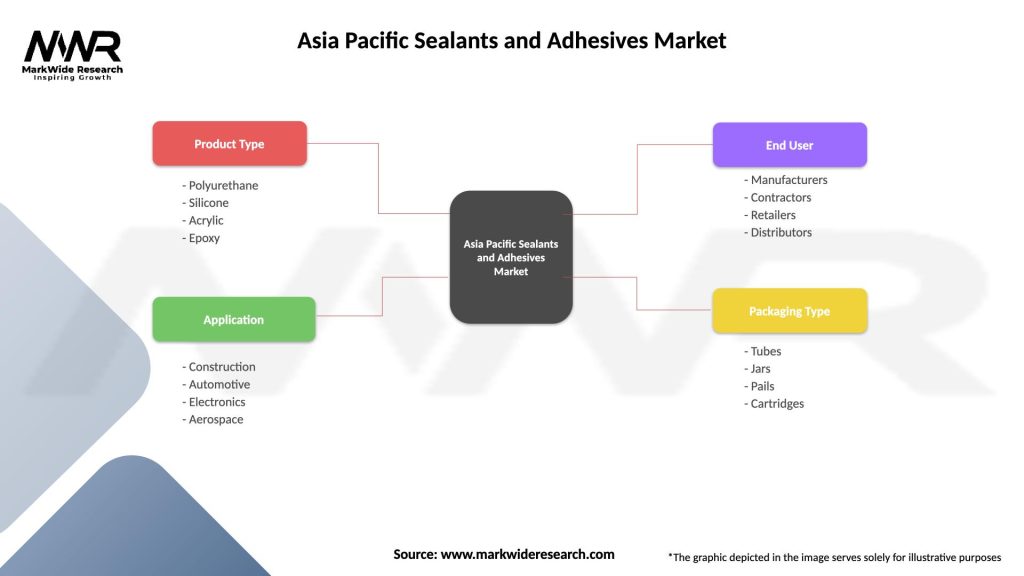

| Segmentation Details | Description |

|---|---|

| Product Type | Polyurethane, Silicone, Acrylic, Epoxy |

| Application | Construction, Automotive, Electronics, Aerospace |

| End User | Manufacturers, Contractors, Retailers, Distributors |

| Packaging Type | Tubes, Jars, Pails, Cartridges |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Sealants and Adhesives Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at