444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific satellite attitude and orbit control system market represents one of the most dynamic and rapidly expanding segments within the global aerospace industry. This sophisticated market encompasses advanced technologies that enable precise positioning, orientation, and orbital maintenance of satellites throughout their operational lifecycle. The region’s growing space ambitions, coupled with increasing commercial satellite deployments, have positioned Asia-Pacific as a critical hub for satellite control system innovation.

Market dynamics in the Asia-Pacific region are driven by substantial investments from both government space agencies and private sector entities. Countries including China, India, Japan, and South Korea have significantly expanded their space programs, creating robust demand for advanced attitude and orbit control systems. The market is experiencing remarkable growth, with projections indicating a compound annual growth rate of 8.2% through the forecast period.

Technological advancement remains at the forefront of market development, with manufacturers focusing on miniaturization, enhanced precision, and improved fuel efficiency. The integration of artificial intelligence and machine learning algorithms into control systems has revolutionized satellite operations, enabling autonomous decision-making and optimized orbital maneuvers. These innovations have attracted significant attention from satellite operators seeking to maximize mission success rates while minimizing operational costs.

Regional market distribution shows China commanding approximately 35% market share, followed by India with 22%, and Japan holding 18%. This distribution reflects the varying levels of space program maturity and commercial satellite deployment across different Asia-Pacific nations. The market’s expansion is further supported by increasing international collaborations and technology transfer agreements between regional players and global aerospace leaders.

The Asia-Pacific satellite attitude and orbit control system market refers to the comprehensive ecosystem of technologies, components, and services designed to maintain precise satellite positioning and orientation within the Asia-Pacific region. These systems encompass sophisticated hardware and software solutions that enable satellites to maintain their designated orbital positions, adjust their attitude for optimal communication or observation angles, and execute complex maneuvers throughout their operational lifetime.

Attitude control systems specifically manage the orientation of satellites in three-dimensional space, ensuring proper alignment of solar panels, communication antennas, and scientific instruments. Meanwhile, orbit control systems maintain the satellite’s position within its designated orbital slot, compensating for natural orbital decay and external perturbations. Together, these systems form the backbone of successful satellite operations, directly impacting mission effectiveness and operational longevity.

System components typically include reaction wheels, momentum wheels, thrusters, gyroscopes, star trackers, and sophisticated control algorithms. The integration of these components requires precise engineering and extensive testing to ensure reliable performance in the harsh space environment. Modern systems increasingly incorporate redundancy features and autonomous operation capabilities to minimize ground intervention requirements and enhance mission reliability.

Strategic market positioning within the Asia-Pacific satellite attitude and orbit control system sector reveals a landscape characterized by rapid technological evolution and increasing commercial opportunities. The market has demonstrated exceptional resilience and growth potential, driven by expanding satellite constellations, emerging space economies, and advancing technological capabilities across the region.

Key growth drivers include the proliferation of small satellite deployments, increasing demand for Earth observation services, and expanding telecommunications infrastructure requirements. Government initiatives supporting space technology development have contributed to a 42% increase in regional satellite launches over the past three years, directly correlating with increased demand for control system solutions.

Market segmentation analysis reveals distinct opportunities across various satellite categories, including geostationary communication satellites, low Earth orbit constellations, and specialized scientific missions. Each segment presents unique technical requirements and market dynamics, creating diverse opportunities for system manufacturers and service providers.

Competitive landscape features a mix of established international players and emerging regional manufacturers, with increasing emphasis on technology localization and indigenous capability development. Strategic partnerships and joint ventures have become common approaches for market entry and expansion, facilitating technology transfer and market access.

Market intelligence reveals several critical insights that shape the Asia-Pacific satellite attitude and orbit control system landscape:

Emerging trends indicate growing interest in electric propulsion systems, which offer superior fuel efficiency and extended mission durations. These systems are particularly attractive for commercial satellite operators seeking to maximize return on investment through extended operational lifespans.

Primary market drivers propelling the Asia-Pacific satellite attitude and orbit control system market encompass a diverse range of technological, economic, and strategic factors that collectively create substantial growth momentum.

Government space initiatives represent the most significant driver, with regional governments investing heavily in space technology development and satellite deployment programs. China’s ambitious space program, India’s cost-effective satellite solutions, and Japan’s advanced technology development have created substantial demand for sophisticated control systems. These programs often require indigenous technology development, driving local manufacturing capabilities and expertise.

Commercial satellite deployment has accelerated dramatically, with telecommunications companies, Earth observation service providers, and emerging space startups launching increasingly complex satellite constellations. The demand for reliable, cost-effective control systems has grown proportionally, creating opportunities for both established manufacturers and innovative newcomers.

Technological advancement in related fields, including materials science, microelectronics, and software development, has enabled the creation of more sophisticated and reliable control systems. These advances have reduced system mass, improved performance, and enhanced operational flexibility, making satellite missions more attractive to commercial operators.

Regional connectivity requirements drive demand for communication satellites equipped with advanced control systems. As Asia-Pacific economies continue expanding their digital infrastructure, the need for reliable satellite communication services grows correspondingly, creating sustained demand for control system technologies.

Market constraints within the Asia-Pacific satellite attitude and orbit control system sector present significant challenges that industry participants must navigate to achieve sustainable growth and market penetration.

High development costs represent a primary constraint, particularly for smaller manufacturers and emerging market entrants. The sophisticated engineering requirements, extensive testing protocols, and certification processes associated with space-qualified systems create substantial financial barriers. These costs are further amplified by the need for specialized facilities, equipment, and expertise.

Regulatory complexity across different Asia-Pacific jurisdictions creates challenges for manufacturers seeking regional market expansion. Varying certification requirements, export control regulations, and technology transfer restrictions can significantly complicate business operations and increase compliance costs.

Technical complexity associated with modern control systems requires highly specialized expertise that remains scarce in many regional markets. The shortage of qualified engineers and technicians with space systems experience creates bottlenecks in product development and manufacturing scaling efforts.

Supply chain vulnerabilities have become increasingly apparent, particularly for specialized components and materials required for space applications. Geopolitical tensions and trade restrictions can disrupt established supply chains, forcing manufacturers to develop alternative sourcing strategies or invest in local production capabilities.

Market concentration among established players creates competitive challenges for new entrants, who must overcome significant technological and financial barriers to gain market acceptance. The conservative nature of the space industry often favors proven solutions over innovative alternatives, limiting opportunities for disruptive technologies.

Emerging opportunities within the Asia-Pacific satellite attitude and orbit control system market present substantial potential for growth and innovation across multiple dimensions of the industry ecosystem.

Small satellite revolution creates unprecedented opportunities for control system manufacturers to develop specialized solutions for CubeSats, microsatellites, and nanosatellites. These platforms require miniaturized, cost-effective control systems that maintain high performance standards while meeting strict mass and power constraints. The growing popularity of small satellite constellations for Earth observation, communications, and scientific research drives sustained demand for innovative control solutions.

Commercial space economy expansion offers significant opportunities for private sector participation in satellite control system development and manufacturing. As traditional government-dominated space activities increasingly involve commercial partners, new business models and market segments emerge, creating opportunities for innovative companies to establish market presence.

Technology localization initiatives across various Asia-Pacific countries create opportunities for international companies to establish local partnerships, joint ventures, and manufacturing facilities. These initiatives often include government support, favorable policies, and access to emerging markets, making them attractive for strategic expansion.

Green propulsion technologies represent a growing opportunity as environmental considerations become increasingly important in space operations. Electric propulsion systems, green chemical propellants, and advanced ion drives offer superior performance characteristics while addressing environmental concerns, creating market opportunities for innovative manufacturers.

Artificial intelligence integration presents opportunities to develop next-generation control systems with autonomous decision-making capabilities, predictive maintenance features, and optimized performance algorithms. These advanced systems can command premium pricing while offering superior operational benefits to satellite operators.

Market dynamics within the Asia-Pacific satellite attitude and orbit control system sector reflect complex interactions between technological innovation, regulatory frameworks, competitive pressures, and evolving customer requirements.

Supply and demand equilibrium continues evolving as satellite deployment rates accelerate across the region. Current demand growth of approximately 12% annually outpaces traditional manufacturing capacity expansion, creating opportunities for new suppliers while potentially straining existing production capabilities. This dynamic has encouraged investment in manufacturing capacity expansion and technology development.

Competitive intensity has increased significantly as traditional aerospace companies face competition from emerging technology firms and startups. This competition drives innovation while potentially compressing profit margins, forcing companies to differentiate through superior technology, customer service, or cost efficiency.

Technology evolution cycles are accelerating, with new generations of control systems incorporating advanced materials, improved algorithms, and enhanced capabilities. Companies must balance investment in current product lines with development of next-generation technologies to maintain competitive positioning.

Customer requirements are becoming increasingly sophisticated, with satellite operators demanding higher performance, greater reliability, and enhanced flexibility from control systems. These evolving requirements drive continuous innovation while creating opportunities for companies that can deliver superior solutions.

Regulatory environment changes across the region influence market dynamics through evolving certification requirements, export controls, and technology transfer policies. Companies must adapt their strategies to navigate these regulatory changes while maintaining compliance and market access.

Comprehensive research methodology employed in analyzing the Asia-Pacific satellite attitude and orbit control system market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability of market insights.

Primary research activities included extensive interviews with industry executives, technical specialists, and market participants across the Asia-Pacific region. These interviews provided valuable insights into market trends, competitive dynamics, and future outlook perspectives from key stakeholders directly involved in satellite control system development and deployment.

Secondary research encompassed analysis of industry reports, government publications, technical papers, and company financial statements to establish comprehensive market understanding. This research included examination of patent filings, technology development trends, and regulatory changes affecting the market landscape.

Market modeling techniques utilized statistical analysis, trend extrapolation, and scenario planning to develop market projections and identify key growth drivers. These models incorporated multiple variables including technological advancement rates, satellite deployment schedules, and economic factors affecting market development.

Data validation processes ensured research accuracy through triangulation of multiple data sources, expert review, and consistency checking across different analytical approaches. This rigorous validation process helps ensure the reliability and credibility of market insights and projections.

Regional analysis methodology incorporated country-specific research to understand local market dynamics, regulatory environments, and competitive landscapes. This approach enables comprehensive understanding of market variations across different Asia-Pacific jurisdictions.

Regional market distribution across the Asia-Pacific satellite attitude and orbit control system market reveals distinct characteristics and growth patterns that reflect varying levels of space program development and commercial activity.

China dominates the regional market with approximately 35% market share, driven by ambitious government space programs and rapidly expanding commercial satellite activities. The country’s significant investments in space technology development, including indigenous control system manufacturing capabilities, have established China as a major market force. Recent achievements in satellite constellation deployment and deep space missions demonstrate the sophistication of Chinese control system technologies.

India represents the second-largest market with 22% market share, characterized by cost-effective satellite solutions and innovative mission approaches. The Indian Space Research Organisation’s success in developing reliable, affordable satellite technologies has created substantial demand for control systems. India’s growing commercial space sector and international satellite launch services further contribute to market expansion.

Japan maintains a significant market position with 18% market share, focusing on advanced technology development and high-precision applications. Japanese companies excel in developing sophisticated control system components and have established strong partnerships with international satellite manufacturers. The country’s emphasis on technology innovation and quality manufacturing supports premium market positioning.

South Korea accounts for approximately 12% market share, with growing government support for space technology development and increasing commercial satellite activities. The country’s advanced electronics and manufacturing capabilities provide strong foundations for control system development and production.

Other regional markets including Australia, Indonesia, Thailand, and emerging space nations collectively represent the remaining 13% market share, with varying levels of space program development and commercial activity.

Competitive landscape within the Asia-Pacific satellite attitude and orbit control system market features a diverse mix of established international corporations, regional manufacturers, and emerging technology companies competing across multiple market segments.

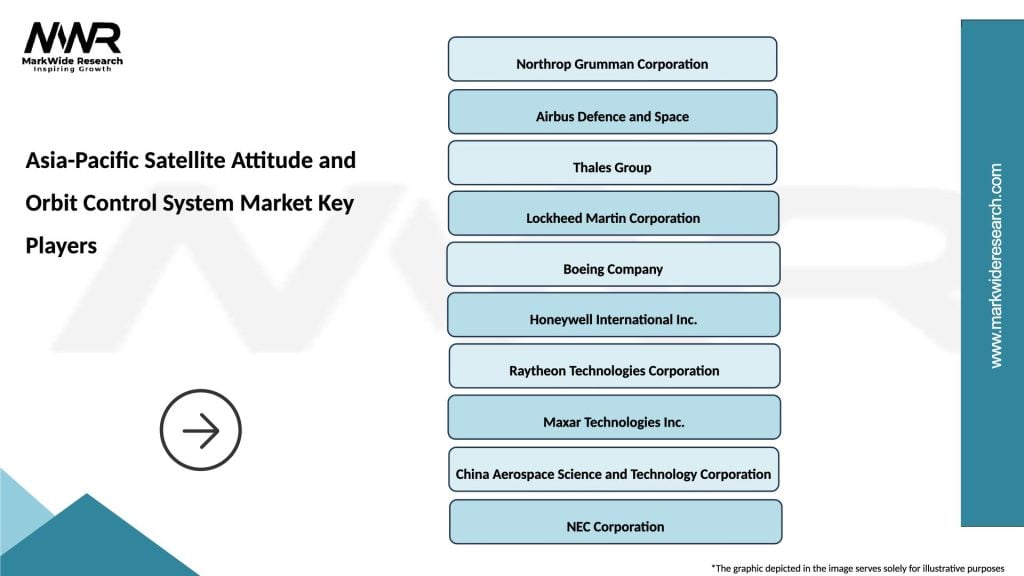

Leading market participants include:

Market competition intensifies as traditional aerospace giants face challenges from agile technology companies and regional manufacturers offering innovative solutions at competitive prices. This competitive pressure drives continuous innovation while creating opportunities for strategic partnerships and market consolidation.

Strategic positioning varies among competitors, with some focusing on high-performance applications while others target cost-sensitive commercial markets. Technology differentiation, customer relationships, and manufacturing capabilities represent key competitive advantages in this dynamic market environment.

Market segmentation analysis reveals distinct categories within the Asia-Pacific satellite attitude and orbit control system market, each characterized by unique technical requirements, customer needs, and growth dynamics.

By System Type:

By Satellite Type:

By Application:

By Technology:

Attitude control systems represent the largest market segment, accounting for approximately 45% of total market share. This category encompasses reaction wheels, momentum wheels, star trackers, and gyroscopes that enable precise satellite orientation control. The segment benefits from increasing demand for high-precision pointing requirements in Earth observation and communication applications.

Orbit control systems constitute approximately 35% of the market, driven by growing requirements for satellite constellation management and orbital debris mitigation. Electric propulsion systems within this category are experiencing particularly strong growth due to their superior fuel efficiency and extended operational capabilities.

Integrated control systems represent an emerging category with 20% market share, combining attitude and orbit control functions in unified platforms. These systems offer operational simplicity and cost advantages, making them attractive for commercial satellite operators and small satellite applications.

Small satellite control systems demonstrate the highest growth rates within the market, driven by the proliferation of CubeSat and microsatellite deployments. These systems require innovative miniaturization approaches while maintaining performance standards, creating opportunities for specialized manufacturers.

Communication satellite applications continue dominating market demand, requiring sophisticated control systems to maintain precise orbital positions and antenna pointing accuracy. The segment benefits from expanding telecommunications infrastructure requirements across the Asia-Pacific region.

Earth observation applications show strong growth potential, driven by increasing demand for remote sensing data and environmental monitoring services. These applications require high-precision pointing systems capable of rapid target acquisition and tracking.

Industry participants and stakeholders within the Asia-Pacific satellite attitude and orbit control system market realize substantial benefits through participation in this dynamic and growing sector.

Technology manufacturers benefit from sustained demand growth, premium pricing for advanced solutions, and opportunities for technology leadership. The market’s technical complexity creates barriers to entry that protect established players while rewarding innovation and quality. Manufacturers can leverage regional growth to expand global market presence and develop next-generation technologies.

Satellite operators gain access to increasingly sophisticated control systems that enhance mission reliability, extend operational lifespans, and reduce operational costs. Advanced control systems enable more flexible mission profiles, rapid orbital adjustments, and autonomous operations that minimize ground control requirements.

Government space agencies benefit from expanding commercial capabilities that reduce program costs while maintaining technical performance standards. Competitive market dynamics drive innovation and cost reduction, enabling more ambitious space programs within constrained budgets.

Research institutions gain access to advanced technologies for scientific missions while contributing to technology development through collaborative programs. These partnerships facilitate knowledge transfer and capability development that benefits the broader space community.

Supply chain partners participate in a growing market with opportunities for specialization and value-added services. Component suppliers, testing facilities, and service providers benefit from increased activity levels and expanding technical requirements.

Regional economies benefit from technology development, high-skilled employment opportunities, and export potential. The space industry’s high-technology nature creates spillover benefits for related industries and educational institutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping the Asia-Pacific satellite attitude and orbit control system market reflect broader technological evolution and changing industry dynamics that influence strategic decision-making across the sector.

Artificial Intelligence Integration represents a fundamental trend transforming control system capabilities. Modern systems increasingly incorporate machine learning algorithms for autonomous decision-making, predictive maintenance, and performance optimization. This trend has resulted in 40% reduction in ground control intervention requirements while improving overall system reliability.

Miniaturization and Integration continue driving product development as manufacturers develop increasingly compact control systems for small satellite applications. Advanced materials, improved manufacturing techniques, and innovative design approaches enable sophisticated control capabilities in dramatically reduced form factors.

Electric Propulsion Adoption accelerates as satellite operators recognize the superior efficiency and operational benefits of ion and plasma propulsion systems. These systems offer significantly extended mission durations and reduced fuel requirements, making them particularly attractive for commercial applications.

Standardization Initiatives gain momentum as industry participants seek to reduce costs and improve interoperability. Common interfaces, standardized components, and modular architectures enable more efficient manufacturing and simplified integration processes.

Green Technology Focus intensifies as environmental considerations become increasingly important in space operations. Development of environmentally friendly propellants, improved fuel efficiency, and end-of-life disposal capabilities address growing regulatory and customer requirements.

Commercial Market Expansion continues as private companies increasingly participate in satellite control system development and manufacturing. This trend brings innovation, competitive pricing, and new business models to traditionally government-dominated markets.

Recent industry developments within the Asia-Pacific satellite attitude and orbit control system market demonstrate the dynamic nature of technological advancement and market evolution across the region.

Technology Breakthroughs include the successful demonstration of advanced electric propulsion systems with significantly improved efficiency ratings. Several regional manufacturers have achieved important milestones in ion thruster development, enabling extended mission durations and reduced operational costs for satellite operators.

Strategic Partnerships have emerged between international aerospace companies and regional manufacturers, facilitating technology transfer and market access. These collaborations enable knowledge sharing while providing established companies with cost-effective manufacturing capabilities and regional market presence.

Government Initiatives across multiple Asia-Pacific countries have announced significant funding increases for space technology development, including specific support for satellite control system advancement. These initiatives often include requirements for technology localization and indigenous capability development.

Commercial Milestones include successful deployment of large satellite constellations equipped with advanced control systems developed by regional manufacturers. These achievements demonstrate the maturation of local technical capabilities and growing customer confidence in regional suppliers.

Regulatory Changes have streamlined certification processes in several countries while maintaining safety and performance standards. These changes reduce time-to-market for new control system technologies while encouraging innovation and competition.

Investment Activities show increased venture capital and private equity interest in space technology companies, particularly those developing innovative control system solutions for small satellites and commercial applications.

Strategic recommendations for market participants in the Asia-Pacific satellite attitude and orbit control system sector focus on positioning for sustained growth while navigating competitive challenges and technological evolution.

Technology Investment Priorities should emphasize artificial intelligence integration, electric propulsion advancement, and miniaturization capabilities. Companies investing in these areas position themselves for long-term competitive advantage as market requirements continue evolving toward more sophisticated, autonomous systems.

Market Entry Strategies for international companies should consider partnerships with established regional players rather than independent market entry. These partnerships provide market access, regulatory navigation support, and cost-effective manufacturing capabilities while reducing investment requirements and market risks.

Product Development Focus should prioritize modular, scalable control system architectures that can address multiple market segments efficiently. This approach enables cost-effective customization while maintaining economies of scale in manufacturing and development.

Regional Expansion strategies should recognize the distinct characteristics of different Asia-Pacific markets, with tailored approaches for government and commercial customers. Understanding local regulatory requirements, customer preferences, and competitive dynamics enables more effective market penetration.

Supply Chain Optimization becomes increasingly critical as market growth strains existing production capabilities. Companies should invest in supply chain resilience, alternative sourcing strategies, and local manufacturing capabilities to ensure reliable product delivery.

Customer Relationship Management should emphasize long-term partnerships and comprehensive service offerings beyond basic product sales. Providing ongoing support, maintenance services, and technology upgrades creates customer loyalty and recurring revenue opportunities.

Future market prospects for the Asia-Pacific satellite attitude and orbit control system sector indicate continued robust growth driven by expanding space activities, technological advancement, and increasing commercial participation across the region.

Growth projections suggest the market will maintain strong expansion momentum, with MarkWide Research analysis indicating sustained growth rates exceeding 8% annually through the next decade. This growth reflects continued government investment in space programs, expanding commercial satellite deployments, and increasing demand for advanced control system capabilities.

Technology evolution will likely focus on increased automation, improved efficiency, and enhanced reliability. Artificial intelligence integration will become standard across control system platforms, enabling autonomous operations and predictive maintenance capabilities that reduce operational costs while improving performance.

Market structure changes may include increased consolidation as smaller companies seek partnerships or acquisition opportunities with larger players. This consolidation could accelerate technology development while creating more comprehensive solution providers capable of addressing diverse customer requirements.

Regional capability development will continue expanding as Asia-Pacific countries invest in indigenous space technology development. This trend will create opportunities for technology transfer partnerships while potentially increasing competitive pressure on established international suppliers.

Application diversification will expand beyond traditional satellite categories to include emerging applications such as space debris removal, asteroid mining, and deep space exploration missions. These applications will require specialized control system capabilities, creating new market segments and opportunities.

Regulatory evolution will likely streamline certification processes while maintaining safety standards, potentially accelerating innovation cycles and market entry for new technologies. International harmonization of standards could facilitate cross-border trade and technology transfer.

Market analysis of the Asia-Pacific satellite attitude and orbit control system sector reveals a dynamic, rapidly expanding market characterized by strong growth fundamentals, technological innovation, and increasing commercial opportunities. The region’s commitment to space technology development, combined with growing commercial satellite activities, creates a robust foundation for sustained market expansion.

Key success factors for market participants include technology leadership, strategic partnerships, and customer-focused solution development. Companies that invest in advanced technologies while building strong regional relationships position themselves for long-term success in this competitive market environment.

Strategic positioning requires balancing innovation investment with market access strategies, recognizing that success depends on both technological capabilities and effective market penetration approaches. The market rewards companies that can deliver reliable, cost-effective solutions while maintaining high performance standards.

Future opportunities remain substantial as the Asia-Pacific region continues expanding its space capabilities and commercial space activities. The satellite attitude and orbit control system market will play a critical role in enabling these ambitious space programs while creating significant value for industry participants and stakeholders across the region.

What is Satellite Attitude and Orbit Control System?

Satellite Attitude and Orbit Control System refers to the technology and processes used to control the orientation and position of satellites in space. This includes systems that manage satellite stabilization, maneuvering, and orbital adjustments to ensure proper functionality and mission success.

What are the key players in the Asia-Pacific Satellite Attitude and Orbit Control System Market?

Key players in the Asia-Pacific Satellite Attitude and Orbit Control System Market include Airbus, Northrop Grumman, Thales Alenia Space, and Lockheed Martin, among others. These companies are involved in developing advanced control systems for various satellite applications.

What are the growth factors driving the Asia-Pacific Satellite Attitude and Orbit Control System Market?

The growth of the Asia-Pacific Satellite Attitude and Orbit Control System Market is driven by increasing demand for satellite-based services, advancements in satellite technology, and the rising need for precise positioning in applications such as telecommunications and Earth observation.

What challenges does the Asia-Pacific Satellite Attitude and Orbit Control System Market face?

Challenges in the Asia-Pacific Satellite Attitude and Orbit Control System Market include the high costs associated with satellite launches and the complexity of developing reliable control systems. Additionally, regulatory hurdles and competition from emerging technologies pose significant challenges.

What opportunities exist in the Asia-Pacific Satellite Attitude and Orbit Control System Market?

Opportunities in the Asia-Pacific Satellite Attitude and Orbit Control System Market include the growing demand for small satellites and the expansion of satellite constellations for global internet coverage. Innovations in propulsion systems and AI-driven control technologies also present significant growth potential.

What trends are shaping the Asia-Pacific Satellite Attitude and Orbit Control System Market?

Trends in the Asia-Pacific Satellite Attitude and Orbit Control System Market include the increasing integration of autonomous systems for satellite operations and the development of more efficient propulsion technologies. Additionally, there is a focus on miniaturization and cost reduction in satellite components.

Asia-Pacific Satellite Attitude and Orbit Control System Market

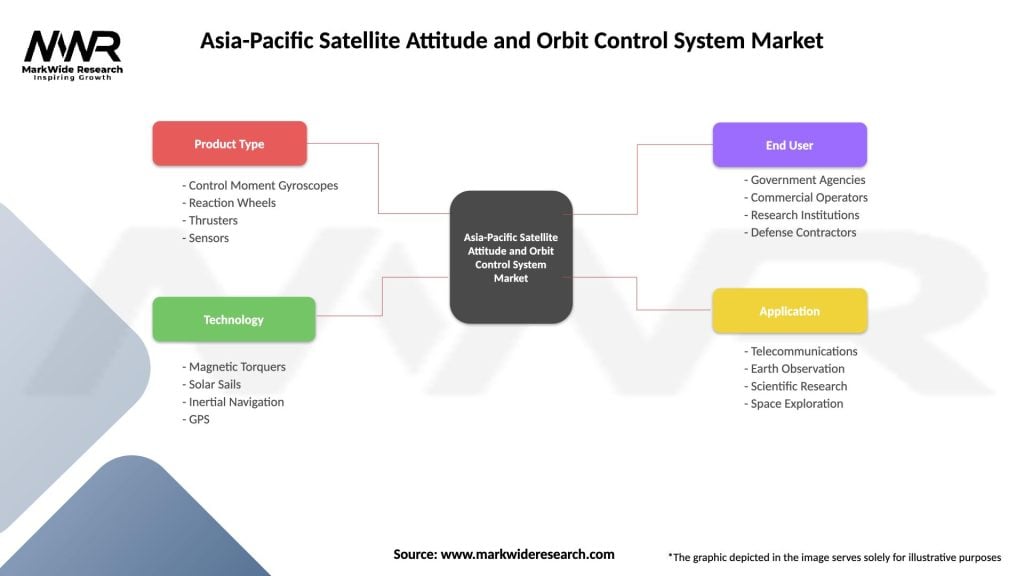

| Segmentation Details | Description |

|---|---|

| Product Type | Control Moment Gyroscopes, Reaction Wheels, Thrusters, Sensors |

| Technology | Magnetic Torquers, Solar Sails, Inertial Navigation, GPS |

| End User | Government Agencies, Commercial Operators, Research Institutions, Defense Contractors |

| Application | Telecommunications, Earth Observation, Scientific Research, Space Exploration |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Satellite Attitude and Orbit Control System Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at