444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview: The Asia-Pacific Software as a Service (SaaS) Escrow Services market stands at the forefront of ensuring the continuity and security of software applications in the region. SaaS escrow services play a pivotal role in mitigating risks associated with software deployment by safeguarding access to critical source code and other intellectual property. This comprehensive exploration delves into the market’s meaning, key market drivers, opportunities, challenges, and the overall dynamics shaping the adoption of SaaS escrow services in the Asia-Pacific region.

Meaning: In the context of the Asia-Pacific SaaS Escrow Services market, SaaS escrow refers to the contractual arrangement between software vendors, end-users, and escrow agents. This arrangement ensures that in the event of a vendor’s failure or disruption, access to the software’s source code, documentation, and other critical assets is securely held in escrow. The meaning of SaaS escrow services extends beyond a protective measure; it instills confidence among businesses relying on SaaS applications, assuring them of continued access and business continuity.

Executive Summary: The executive summary provides a concise overview of the Asia-Pacific SaaS Escrow Services market, offering insights into market players, recent trends, and the trajectory of the market. It serves as a prelude to a more detailed exploration of the market’s dynamics.

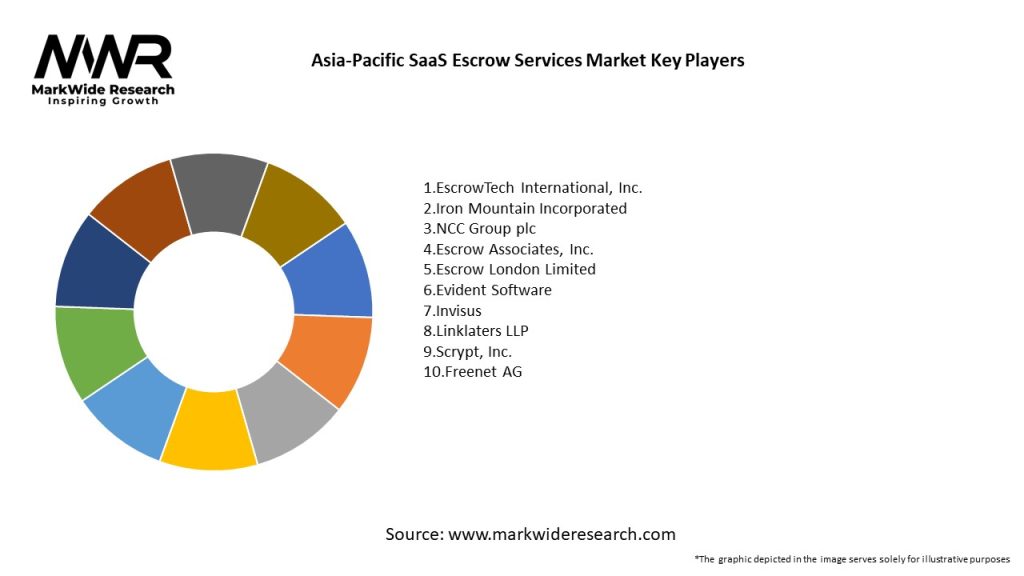

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities

Market Dynamics

The Asia-Pacific SaaS Escrow Services Market is dynamic, influenced by technological advancements, regulatory developments, and evolving business needs. The market is characterized by rapid innovation, with a focus on developing solutions that address emerging challenges and meet the needs of a diverse customer base. Companies must navigate these dynamics to stay competitive and capitalize on growth opportunities.

Regional Analysis

Competitive Landscape

Leading Companies in Asia-Pacific SaaS Escrow Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The market can be segmented based on:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has accelerated the adoption of digital and cloud-based solutions, including SaaS applications, highlighting the need for robust risk management strategies. As businesses increasingly rely on SaaS platforms, the demand for escrow services has grown to ensure continuity and data protection. The pandemic has underscored the importance of safeguarding software and data, driving interest in SaaS escrow services.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Asia-Pacific SaaS Escrow Services Market is poised for continued growth, driven by the expanding SaaS adoption, increasing regulatory requirements, and advancements in escrow technologies. The market presents significant opportunities for innovation and investment, with a focus on enhancing service offerings and addressing evolving customer needs. Companies that adapt to market trends, navigate regulatory challenges, and leverage technological advancements will be well-positioned for success in this dynamic and competitive market.

Conclusion

The Asia-Pacific SaaS Escrow Services Market is experiencing robust growth, driven by the increasing adoption of SaaS solutions and the need for data protection and business continuity. While challenges such as regulatory variations and integration complexities exist, the market offers substantial opportunities for innovation and expansion. Companies that embrace technological advancements, address emerging trends, and focus on delivering secure and reliable escrow services will be well-positioned to thrive in the evolving landscape of SaaS escrow services.

What is SaaS Escrow Services?

SaaS Escrow Services are agreements that protect software as a service (SaaS) customers by ensuring access to the source code and data in case the service provider fails to deliver or goes out of business. This service is crucial for businesses relying on SaaS solutions to mitigate risks associated with vendor lock-in and service disruptions.

What are the key players in the Asia-Pacific SaaS Escrow Services Market?

Key players in the Asia-Pacific SaaS Escrow Services Market include EscrowTech, Iron Mountain, and NCC Group, among others. These companies provide various escrow solutions tailored to the needs of SaaS providers and their customers.

What are the growth factors driving the Asia-Pacific SaaS Escrow Services Market?

The growth of the Asia-Pacific SaaS Escrow Services Market is driven by the increasing adoption of cloud-based solutions, the rising need for data security, and the growing awareness of compliance requirements among businesses. Additionally, the expansion of the digital economy in the region contributes to this growth.

What challenges does the Asia-Pacific SaaS Escrow Services Market face?

Challenges in the Asia-Pacific SaaS Escrow Services Market include the lack of awareness about escrow services among small and medium-sized enterprises and the varying regulatory environments across different countries. These factors can hinder the adoption of escrow solutions in the region.

What opportunities exist in the Asia-Pacific SaaS Escrow Services Market?

Opportunities in the Asia-Pacific SaaS Escrow Services Market include the potential for growth in emerging markets, the increasing demand for customized escrow solutions, and the rise of new technologies such as blockchain that can enhance the security and efficiency of escrow services.

What trends are shaping the Asia-Pacific SaaS Escrow Services Market?

Trends shaping the Asia-Pacific SaaS Escrow Services Market include the integration of advanced technologies like artificial intelligence for risk assessment and the growing emphasis on regulatory compliance. Additionally, there is a trend towards offering more flexible and scalable escrow solutions to meet diverse customer needs.

Asia-Pacific SaaS Escrow Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Software Escrow, Source Code Escrow, Data Escrow, Documentation Escrow |

| End User | SMEs, Large Enterprises, Startups, Government Agencies |

| Deployment | Public Cloud, Private Cloud, Hybrid Cloud, On-Premises |

| Industry Vertical | Healthcare, Finance, Education, Technology |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Asia-Pacific SaaS Escrow Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at