444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Asia-Pacific road assistance insurance market provides coverage and support services to drivers facing vehicle breakdowns, accidents, and emergencies while traveling on roads across the Asia-Pacific region. These insurance products offer peace of mind to motorists by providing timely roadside assistance, towing services, and other support to ensure their safety and mobility on the road.

Meaning

Road assistance insurance in the Asia-Pacific region refers to insurance policies that offer coverage and assistance services to drivers encountering vehicle-related emergencies and breakdowns while navigating roads across Asia-Pacific countries. These insurance products typically include services such as roadside assistance, vehicle recovery, towing, and other support services to address unforeseen incidents and ensure driver convenience and safety.

Executive Summary

The Asia-Pacific road assistance insurance market is experiencing robust growth, driven by increasing vehicle ownership, rapid urbanization, growing demand for mobility services, and the need for reliable roadside assistance solutions. Understanding key market insights, including consumer preferences, technological trends, and regulatory dynamics, is essential for insurance providers to capitalize on market opportunities and address competitive challenges effectively.

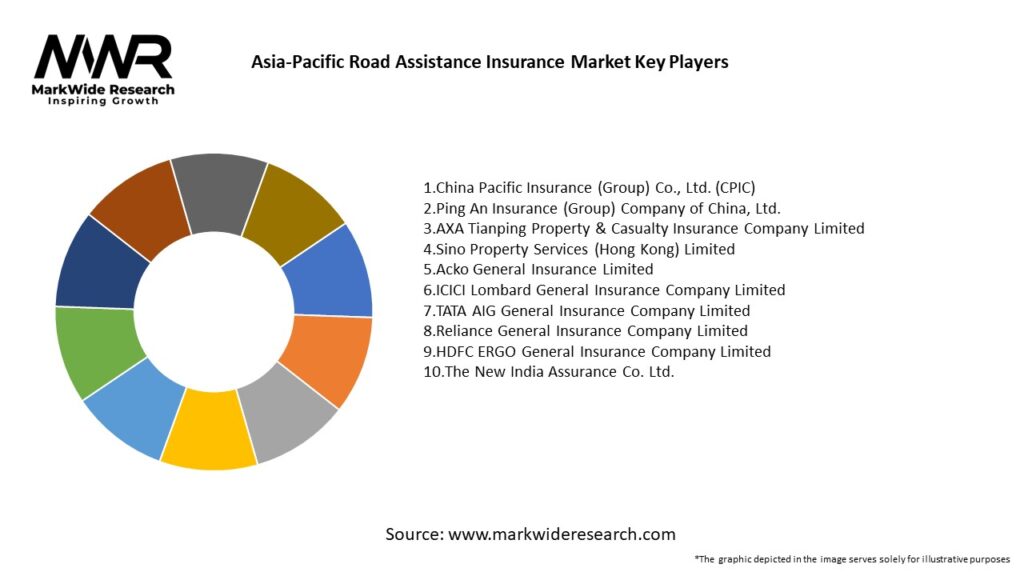

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Asia-Pacific road assistance insurance market operates within a dynamic environment influenced by evolving consumer preferences, technological innovations, regulatory developments, and competitive pressures. Adapting to these dynamics requires insurers to embrace innovation, agility, and customer-centricity to capitalize on emerging opportunities and address market challenges effectively. The dynamics of the Asia-Pacific Road Assistance Insurance Market are influenced by technological advancements, regulatory conditions, and consumer trends. Key dynamics include the impact of digital transformation on service delivery, competition among service providers, and the need for adaptation to varying regulatory environments across the region.

Regional Analysis

Competitive Landscape

Leading Companies in the Asia-Pacific Road Assistance Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The market can be segmented based on:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has impacted the Asia-Pacific Road Assistance Insurance Market by altering consumer behaviors and increasing demand for digital and contactless services. The pandemic has accelerated the adoption of technology-driven solutions and highlighted the importance of reliable roadside support during emergencies. However, it has also posed challenges related to service delivery and operational disruptions.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Asia-Pacific Road Assistance Insurance Market is expected to continue growing, driven by increasing vehicle ownership, urbanization, and technological advancements. The market presents significant opportunities for innovation and expansion, with a focus on digital transformation, customization, and strategic partnerships. Despite challenges related to competition, regulatory complexities, and evolving consumer preferences, the market is poised for long-term growth and development.

Conclusion

The Asia-Pacific Road Assistance Insurance Market is expanding rapidly, fueled by technological advancements, rising vehicle ownership, and increasing demand for reliable roadside support. The market offers substantial opportunities for growth and innovation, supported by digital transformation, strategic partnerships, and adaptation to emerging trends. The future outlook suggests continued growth, with a focus on enhancing service delivery, expanding market reach, and addressing evolving consumer needs.

What is Road Assistance Insurance?

Road Assistance Insurance provides coverage for various roadside emergencies, including breakdowns, accidents, and other vehicle-related incidents. It typically includes services such as towing, fuel delivery, and locksmith assistance.

What are the key players in the Asia-Pacific Road Assistance Insurance Market?

Key players in the Asia-Pacific Road Assistance Insurance Market include Allianz, AXA, and AIG, among others. These companies offer a range of services tailored to meet the needs of drivers in the region.

What are the growth factors driving the Asia-Pacific Road Assistance Insurance Market?

The growth of the Asia-Pacific Road Assistance Insurance Market is driven by increasing vehicle ownership, rising consumer awareness about insurance products, and the growing demand for enhanced roadside services.

What challenges does the Asia-Pacific Road Assistance Insurance Market face?

Challenges in the Asia-Pacific Road Assistance Insurance Market include regulatory hurdles, competition from alternative mobility solutions, and the need for technological advancements in service delivery.

What opportunities exist in the Asia-Pacific Road Assistance Insurance Market?

Opportunities in the Asia-Pacific Road Assistance Insurance Market include the expansion of digital platforms for service access, partnerships with automotive manufacturers, and the potential for customized insurance products tailored to specific consumer needs.

What trends are shaping the Asia-Pacific Road Assistance Insurance Market?

Trends in the Asia-Pacific Road Assistance Insurance Market include the integration of telematics for real-time assistance, the rise of mobile apps for service requests, and an increasing focus on customer experience and satisfaction.

Asia-Pacific Road Assistance Insurance Market

| Segmentation Details | Description |

|---|---|

| Service Type | Towing, Fuel Delivery, Tire Change, Lockout Service |

| Customer Type | Individual Drivers, Fleet Operators, Corporate Clients, Insurance Companies |

| Coverage Type | Basic Coverage, Comprehensive Coverage, Premium Coverage, Add-On Services |

| Vehicle Type | Passenger Cars, Motorcycles, Commercial Vehicles, Electric Vehicles |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at