444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific REIT market represents one of the most dynamic and rapidly evolving real estate investment sectors globally, encompassing diverse property types and investment strategies across multiple jurisdictions. This sophisticated financial instrument has gained substantial momentum throughout the region, driven by increasing institutional investor interest, regulatory improvements, and growing demand for yield-generating assets. The market demonstrates remarkable diversity, spanning from established markets like Australia and Japan to emerging economies including Thailand, Malaysia, and India.

Regional growth patterns indicate that the Asia Pacific REIT sector is experiencing robust expansion, with several markets showing double-digit growth rates in assets under management. The sector benefits from strong underlying real estate fundamentals, including urbanization trends, infrastructure development, and evolving consumer preferences toward experiential retail and flexible workspace solutions. Institutional adoption has accelerated significantly, with pension funds, sovereign wealth funds, and international asset managers increasing their allocations to Asia Pacific REITs as part of diversified investment strategies.

Market maturation varies considerably across the region, with some markets featuring well-established regulatory frameworks and deep liquidity pools, while others are in early development stages. This diversity creates unique opportunities for investors seeking exposure to different risk-return profiles and growth trajectories. The sector’s resilience has been particularly evident during recent market volatility, demonstrating the defensive characteristics and income-generating potential that make REITs attractive to yield-focused investors.

The Asia Pacific REIT market refers to the collective ecosystem of Real Estate Investment Trusts operating across the Asia Pacific region, providing investors with liquid access to diversified real estate portfolios through publicly traded securities. These investment vehicles pool capital from multiple investors to acquire, develop, manage, and dispose of income-producing real estate assets, distributing the majority of their taxable income to shareholders as dividends.

REIT structures in the Asia Pacific region vary significantly based on local regulatory frameworks, tax considerations, and market development stages. Some jurisdictions follow traditional equity REIT models similar to those in the United States, while others have developed hybrid structures or specialized frameworks tailored to local market conditions. The fundamental principle remains consistent: providing retail and institutional investors with access to real estate investments that would otherwise require substantial capital commitments and specialized expertise.

Property diversification within Asia Pacific REITs encompasses various asset classes, including office buildings, retail centers, industrial facilities, residential properties, healthcare facilities, data centers, and specialized infrastructure assets. This diversification allows investors to gain exposure to different real estate sectors and geographic markets through a single investment vehicle, reducing concentration risk while potentially enhancing returns through professional management and economies of scale.

Strategic positioning of the Asia Pacific REIT market reflects its emergence as a critical component of regional capital markets, offering investors compelling opportunities to participate in the region’s continued economic growth and urbanization trends. The market has demonstrated remarkable resilience and adaptability, evolving to meet changing investor demands while maintaining focus on sustainable income generation and capital appreciation potential.

Key performance indicators suggest that the sector is experiencing a period of consolidation and quality improvement, with leading REITs focusing on portfolio optimization, operational efficiency, and strategic asset management. The market benefits from supportive demographic trends, including rapid urbanization, growing middle-class populations, and increasing demand for modern, efficiently designed real estate assets across multiple property sectors.

Investment flows into Asia Pacific REITs have shown consistent growth, with both domestic and international investors recognizing the sector’s potential for delivering stable returns in an increasingly uncertain global economic environment. The market’s evolution toward greater transparency, improved governance standards, and enhanced liquidity has attracted institutional capital, contributing to market depth and stability while supporting continued growth and development across the region.

Market dynamics within the Asia Pacific REIT sector reveal several critical trends that are shaping investment strategies and performance outcomes. The following insights highlight the most significant factors influencing market development:

Demographic transformation across the Asia Pacific region serves as a fundamental driver for REIT market growth, with rapid urbanization creating sustained demand for various types of real estate assets. The region’s expanding middle class, changing lifestyle preferences, and increasing disposable income levels contribute to robust demand for retail, office, and residential properties, supporting the underlying asset values that drive REIT performance.

Economic development and infrastructure investment throughout the region create favorable conditions for real estate appreciation and rental growth. Government initiatives to modernize transportation networks, develop smart cities, and enhance digital infrastructure generate positive spillover effects for strategically located real estate assets, benefiting REITs with well-positioned portfolios.

Institutional investor demand for yield-generating assets continues to grow as traditional fixed-income investments offer limited returns in the current interest rate environment. REITs provide attractive risk-adjusted returns and portfolio diversification benefits, making them increasingly popular among pension funds, insurance companies, and sovereign wealth funds seeking stable income streams with potential for capital appreciation.

Regulatory support from governments across the region has been instrumental in market development, with authorities implementing favorable tax treatments, streamlined listing procedures, and enhanced investor protections. These regulatory improvements have increased market credibility and attracted both domestic and international capital, supporting continued market expansion and sophistication.

Interest rate sensitivity remains a significant challenge for the Asia Pacific REIT market, as rising interest rates can negatively impact REIT valuations and increase financing costs for property acquisitions and development projects. The sector’s yield-focused nature makes it particularly vulnerable to interest rate fluctuations, which can affect investor demand and market performance during periods of monetary policy tightening.

Regulatory complexity across different jurisdictions creates operational challenges for REITs seeking regional expansion or cross-border investment opportunities. Varying tax treatments, listing requirements, and governance standards can complicate investment strategies and increase compliance costs, potentially limiting the sector’s growth potential and operational efficiency.

Market liquidity constraints in some emerging markets within the region can limit investor participation and create volatility during periods of market stress. Limited trading volumes and narrow investor bases in certain jurisdictions may result in price discovery inefficiencies and reduced market depth, affecting the attractiveness of REITs as investment vehicles.

Economic uncertainty and geopolitical tensions can impact investor confidence and capital flows into the region, affecting REIT performance and growth prospects. Trade disputes, currency fluctuations, and political instability may create headwinds for the sector, particularly for REITs with significant exposure to international markets or cross-border investment strategies.

Emerging market expansion presents significant opportunities for established REITs to enter underdeveloped markets with strong growth potential and limited competition. Countries such as Vietnam, Indonesia, and Philippines offer attractive demographic profiles and economic growth prospects, creating potential for first-mover advantages and portfolio diversification benefits for forward-thinking REIT managers.

Sector specialization in high-growth property types such as data centers, logistics facilities, and healthcare real estate offers opportunities for REITs to capture structural growth trends driven by digitalization, e-commerce expansion, and aging populations. These specialized sectors often command premium valuations and stable cash flows, making them attractive targets for REIT investment and development strategies.

Technology adoption and proptech integration create opportunities for operational efficiency improvements, cost reduction, and enhanced tenant experiences. REITs that successfully implement smart building technologies, energy management systems, and digital tenant services can achieve competitive advantages while improving their environmental sustainability profiles and attracting ESG-focused investors.

Capital market development initiatives, including the introduction of REIT structures in new markets and the enhancement of existing regulatory frameworks, create opportunities for market expansion and increased investor participation. These developments can lead to improved liquidity, enhanced price discovery, and greater institutional adoption, supporting overall market growth and maturation.

Supply and demand dynamics within the Asia Pacific REIT market reflect the complex interplay between investor appetite for yield-generating assets and the availability of high-quality real estate investment opportunities. The market experiences cyclical patterns influenced by economic conditions, interest rate environments, and regional real estate fundamentals, creating opportunities for active portfolio management and strategic asset allocation.

Competitive positioning among REITs has intensified as the market matures, with successful players differentiating themselves through specialized expertise, superior asset management capabilities, and strong stakeholder relationships. Market leaders are increasingly focusing on operational excellence, sustainable practices, and innovative investment strategies to maintain competitive advantages and attract institutional capital.

Capital allocation efficiency has become a critical success factor, with REITs optimizing their portfolio compositions to maximize risk-adjusted returns while maintaining appropriate diversification levels. According to MarkWide Research analysis, leading REITs are achieving 15-20% improvement in operational efficiency through strategic asset management and technology adoption initiatives.

Market integration across the Asia Pacific region continues to evolve, with increasing cross-border investment flows and regional partnership arrangements. This integration creates opportunities for portfolio diversification and risk management while enabling REITs to access larger capital pools and benefit from regional economic growth trends.

Comprehensive analysis of the Asia Pacific REIT market requires a multi-faceted research approach that combines quantitative data analysis with qualitative insights from industry participants, regulatory authorities, and market observers. The research methodology encompasses primary data collection through surveys and interviews with REIT managers, institutional investors, and real estate professionals across the region.

Data sources include regulatory filings, financial statements, market transaction data, and proprietary databases maintained by leading financial information providers. Secondary research incorporates analysis of academic studies, industry reports, and government publications to provide comprehensive market context and historical perspective on sector development trends.

Market segmentation analysis examines performance characteristics across different property types, geographic markets, and REIT structures to identify trends and opportunities. The methodology includes comparative analysis of regulatory frameworks, tax treatments, and market infrastructure development across various Asia Pacific jurisdictions.

Validation processes ensure data accuracy and reliability through cross-referencing multiple sources and conducting sensitivity analysis on key assumptions and projections. The research framework incorporates regular updates to reflect changing market conditions and emerging trends that may impact sector performance and investment attractiveness.

Australia and New Zealand represent the most mature REIT markets in the Asia Pacific region, with well-established regulatory frameworks, deep liquidity pools, and sophisticated institutional investor bases. The Australian REIT market commands approximately 35-40% market share of the regional sector, featuring diversified portfolios across office, retail, industrial, and residential property types. These markets benefit from stable political environments, transparent legal systems, and strong corporate governance standards.

Japan’s REIT market has experienced significant growth and development, with J-REITs becoming increasingly popular among both domestic and international investors. The market benefits from supportive monetary policy, improving corporate governance standards, and growing institutional adoption. Japanese REITs account for approximately 25-30% regional market share, with particular strength in office and retail property sectors concentrated in major metropolitan areas.

Singapore and Hong Kong serve as important regional financial centers, hosting sophisticated REIT markets that attract significant international capital flows. These markets feature high-quality assets, professional management standards, and strong regulatory oversight. Singapore REITs have gained particular recognition for their focus on yield optimization and regional diversification strategies, while Hong Kong REITs benefit from the territory’s strategic location and connections to mainland China.

Emerging markets including Malaysia, Thailand, India, and South Korea represent significant growth opportunities, with developing regulatory frameworks and increasing institutional adoption. These markets collectively account for approximately 20-25% regional market share but demonstrate strong growth potential driven by favorable demographics, economic development, and regulatory improvements.

Market leadership in the Asia Pacific REIT sector is characterized by a diverse group of established players with strong track records, professional management capabilities, and well-diversified portfolios. The competitive landscape reflects the regional nature of the market, with leading REITs typically maintaining strong positions in their home markets while selectively pursuing regional expansion opportunities.

By Property Type: The Asia Pacific REIT market demonstrates significant diversity across various property sectors, each offering distinct risk-return characteristics and growth prospects. Office REITs represent the largest segment, benefiting from stable cash flows and long-term lease structures, particularly in major metropolitan areas with strong economic fundamentals and limited supply growth.

Retail REITs constitute a substantial portion of the market, though performance varies significantly based on location, tenant mix, and format. Shopping center REITs focusing on necessity-based retail and community centers have demonstrated greater resilience compared to traditional mall formats, adapting to changing consumer preferences and e-commerce trends.

Industrial and logistics REITs have emerged as high-growth segments, driven by e-commerce expansion, supply chain optimization, and increasing demand for modern distribution facilities. These REITs benefit from structural growth trends and typically achieve higher occupancy rates and rental growth compared to traditional property sectors.

By Geographic Focus: Market segmentation by geographic concentration reveals distinct investment strategies and risk profiles. Domestic-focused REITs maintain concentrated exposure to single markets, offering investors targeted access to specific economic and real estate cycles. Regional REITs pursue diversification strategies across multiple Asia Pacific markets, potentially reducing concentration risk while capturing broader regional growth opportunities.

Office REIT Performance: Office-focused REITs across the Asia Pacific region have demonstrated varying performance patterns based on location quality, tenant diversification, and lease duration profiles. Premium office REITs in major central business districts typically command higher valuations and more stable cash flows, benefiting from limited supply growth and strong tenant demand from multinational corporations and financial services firms.

Retail REIT Evolution: The retail REIT segment has undergone significant transformation, with successful players adapting their strategies to address changing consumer behaviors and competitive pressures from e-commerce. Community-focused retail REITs have outperformed traditional mall operators, benefiting from their focus on essential services, convenience, and local market dominance.

Industrial REIT Growth: Industrial and logistics REITs represent the fastest-growing segment within the Asia Pacific market, with many achieving rental growth rates of 8-12% annually. These REITs benefit from structural demand drivers including e-commerce growth, supply chain modernization, and increasing focus on last-mile delivery capabilities.

Specialized REIT Emergence: Emerging specialized REIT categories including data centers, healthcare facilities, and student accommodation are gaining traction across the region. These sectors offer unique growth opportunities and typically command premium valuations due to their specialized nature and stable cash flow characteristics.

Investor Advantages: Asia Pacific REITs provide investors with several compelling benefits, including professional real estate management, portfolio diversification, and liquid access to otherwise illiquid real estate markets. Institutional investors particularly benefit from the ability to achieve targeted real estate exposure without direct property ownership responsibilities, while retail investors gain access to high-quality commercial real estate assets typically reserved for large institutional players.

Income Generation: The sector’s focus on distributing the majority of taxable income to shareholders creates attractive yield opportunities, with many Asia Pacific REITs offering distribution yields of 4-7% annually. This income generation capability makes REITs particularly attractive to yield-focused investors, including pension funds and retirees seeking stable cash flows.

Portfolio Diversification: REITs offer diversification benefits both within real estate sectors and across broader investment portfolios. The low correlation between REIT returns and traditional equity and fixed-income investments can help reduce overall portfolio volatility while potentially enhancing risk-adjusted returns.

Professional Management: REIT structures provide access to experienced real estate professionals with specialized expertise in property acquisition, development, leasing, and asset management. This professional management can lead to superior property performance and value creation compared to individual property ownership.

Strengths:

Weaknesses:

Opportunities:

Threats:

ESG Integration has emerged as a dominant trend across the Asia Pacific REIT sector, with leading players implementing comprehensive sustainability strategies to attract ESG-focused institutional capital. Green building certifications, energy efficiency improvements, and carbon reduction initiatives are becoming standard practices, with many REITs achieving 20-30% improvement in energy efficiency metrics through strategic capital investments.

Technology Adoption continues to accelerate throughout the sector, with REITs leveraging proptech solutions to enhance operational efficiency, improve tenant experiences, and optimize asset performance. Smart building technologies, IoT sensors, and data analytics platforms are enabling more sophisticated asset management approaches and creating competitive advantages for early adopters.

Portfolio Optimization strategies are gaining prominence as REITs focus on quality over quantity, divesting non-core assets while concentrating on high-performing properties in strategic locations. This trend toward portfolio concentration aims to improve operational efficiency and enhance returns through focused expertise and economies of scale.

Cross-Border Investment activity is increasing as established REITs seek regional diversification opportunities and access to higher-growth markets. Strategic partnerships, joint ventures, and selective acquisitions are enabling market expansion while managing regulatory complexity and local market risks.

Regulatory Evolution across multiple Asia Pacific jurisdictions has enhanced the investment attractiveness of REIT structures through improved tax treatments, streamlined listing procedures, and enhanced investor protections. Recent developments in India, Philippines, and Vietnam have created new market opportunities and expanded the regional REIT universe for international investors.

Market Consolidation activity has intensified as larger, well-capitalized REITs acquire smaller players to achieve scale advantages and market leadership positions. These transactions often result in improved operational efficiency, enhanced market presence, and stronger competitive positioning for the combined entities.

Sector Specialization trends have led to the emergence of focused REIT platforms targeting high-growth property sectors such as data centers, logistics facilities, and healthcare real estate. These specialized REITs often command premium valuations and attract dedicated investor followings due to their expertise and growth prospects.

Capital Market Innovation has introduced new financing mechanisms and investment structures, including green bonds, sustainability-linked loans, and hybrid securities that provide REITs with additional capital raising options while meeting evolving investor preferences for sustainable investments.

Investment Strategy Recommendations from MarkWide Research emphasize the importance of selective positioning within the Asia Pacific REIT sector, focusing on high-quality operators with strong management track records, diversified portfolios, and clear value creation strategies. Investors should prioritize REITs with exposure to structural growth trends and defensive characteristics that can perform well across different market cycles.

Risk Management Considerations highlight the need for careful attention to interest rate sensitivity, geographic concentration, and sector-specific risks when constructing REIT portfolios. Diversification strategies should encompass multiple property types, geographic markets, and REIT structures to optimize risk-adjusted returns and reduce concentration risk.

Due Diligence Focus Areas should include comprehensive analysis of management quality, asset quality, financial leverage levels, and competitive positioning within target markets. Investors should pay particular attention to REITs’ ability to adapt to changing market conditions and implement value-creation strategies that enhance long-term performance.

Market Timing Considerations suggest that current market conditions may present attractive entry opportunities for long-term investors, particularly in markets where REIT valuations have adjusted to reflect economic uncertainties while underlying property fundamentals remain sound.

Growth Projections for the Asia Pacific REIT market indicate continued expansion driven by favorable demographic trends, economic development, and increasing institutional adoption. The sector is expected to benefit from ongoing urbanization, infrastructure investment, and growing demand for professionally managed real estate assets across the region.

Market Evolution trends suggest increasing sophistication and integration across Asia Pacific REIT markets, with enhanced liquidity, improved governance standards, and greater cross-border investment activity. MWR analysis projects that the sector will achieve compound annual growth rates of 6-9% over the medium term, supported by strong underlying real estate fundamentals and expanding investor bases.

Sector Development is expected to continue with the emergence of new specialized REIT categories and the expansion of existing markets into previously underserved property sectors. Technology integration and sustainability initiatives will likely become increasingly important differentiating factors for successful REITs.

Investment Landscape evolution will likely feature greater institutional participation, enhanced market infrastructure, and improved price discovery mechanisms. These developments should contribute to increased market efficiency and reduced volatility while supporting continued capital formation and sector growth across the Asia Pacific region.

The Asia Pacific REIT market represents a compelling investment opportunity characterized by diverse growth prospects, professional management capabilities, and attractive yield generation potential. The sector’s continued evolution and maturation across multiple jurisdictions creates opportunities for both domestic and international investors seeking exposure to the region’s dynamic real estate markets through liquid, professionally managed investment vehicles.

Market fundamentals remain supportive of continued sector growth, with favorable demographic trends, ongoing urbanization, and increasing institutional adoption providing strong foundations for long-term performance. While challenges including interest rate sensitivity and regulatory complexity require careful consideration, the sector’s defensive characteristics and income-generating capabilities make it an attractive component of diversified investment portfolios.

Future success in the Asia Pacific REIT market will likely depend on investors’ ability to identify high-quality operators with strong competitive positions, diversified portfolios, and clear value creation strategies. The sector’s continued development and increasing sophistication suggest that well-positioned REITs will benefit from structural growth trends while providing investors with attractive risk-adjusted returns and portfolio diversification benefits in the years ahead.

What is REIT?

REIT stands for Real Estate Investment Trust, which is a company that owns, operates, or finances income-producing real estate. REITs provide a way for individual investors to earn a share of the income produced through commercial real estate ownership without actually having to buy, manage, or finance any properties themselves.

What are the key players in the Asia Pacific REIT Market?

Key players in the Asia Pacific REIT Market include companies like Link REIT, CapitaLand Integrated Commercial Trust, and Mapletree Logistics Trust, among others. These companies manage diverse portfolios that include retail, office, and industrial properties across the region.

What are the growth factors driving the Asia Pacific REIT Market?

The Asia Pacific REIT Market is driven by factors such as increasing urbanization, a growing middle class, and rising demand for commercial real estate. Additionally, favorable regulatory environments and low-interest rates contribute to the market’s expansion.

What challenges does the Asia Pacific REIT Market face?

The Asia Pacific REIT Market faces challenges such as economic fluctuations, regulatory changes, and competition from alternative investment vehicles. Additionally, the impact of global events, such as pandemics, can affect property valuations and rental incomes.

What opportunities exist in the Asia Pacific REIT Market?

Opportunities in the Asia Pacific REIT Market include the potential for growth in sectors like logistics and healthcare real estate. The increasing demand for sustainable and green buildings also presents new avenues for investment and development.

What trends are shaping the Asia Pacific REIT Market?

Trends shaping the Asia Pacific REIT Market include a shift towards digital transformation in property management and an increased focus on sustainability. Additionally, the rise of e-commerce is driving demand for logistics and warehousing spaces, influencing investment strategies.

Asia Pacific REIT Market

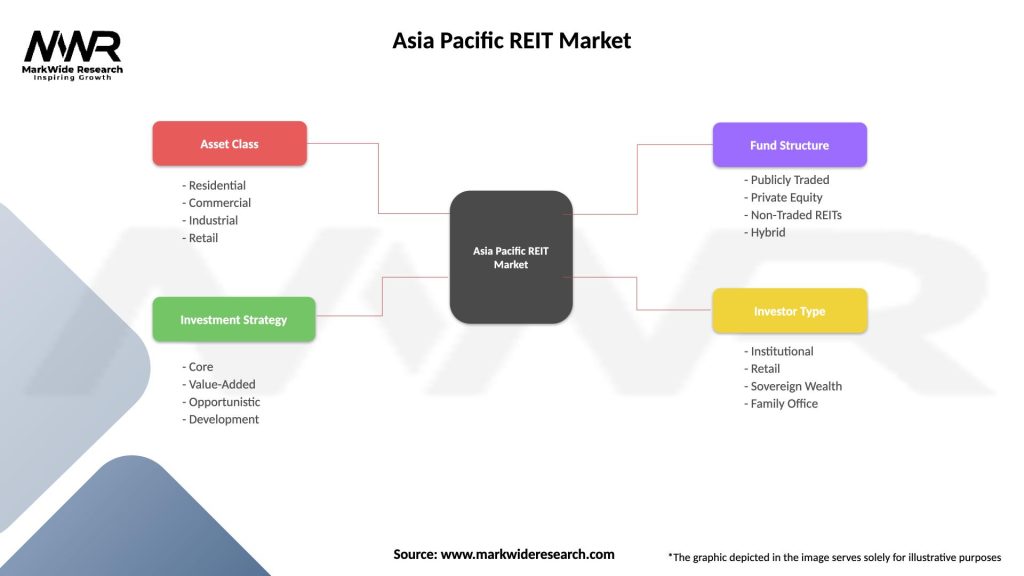

| Segmentation Details | Description |

|---|---|

| Asset Class | Residential, Commercial, Industrial, Retail |

| Investment Strategy | Core, Value-Added, Opportunistic, Development |

| Fund Structure | Publicly Traded, Private Equity, Non-Traded REITs, Hybrid |

| Investor Type | Institutional, Retail, Sovereign Wealth, Family Office |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific REIT Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at