444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Asia-Pacific region has emerged as a thriving hub for private equity investments in recent years. With its rapidly growing economies, favorable business environment, and increasing investor interest, the Asia-Pacific private equity market has witnessed significant growth and offers lucrative opportunities for investors. This article provides an in-depth analysis of the Asia-Pacific private equity market, highlighting its meaning, executive summary, key market insights, market drivers, market restraints, market opportunities, market dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, market key trends, COVID-19 impact, key industry developments, analyst suggestions, future outlook, and conclusion.

Meaning

Private equity refers to the investment made in privately-held companies that are not publicly traded on stock exchanges. It involves providing capital to companies in exchange for ownership stakes, with the aim of generating significant returns on investment. Private equity investments are typically made by institutional investors, such as private equity firms, pension funds, and sovereign wealth funds, which pool together funds from various sources to invest in promising businesses.

Executive Summary

The Asia-Pacific private equity market has experienced robust growth in recent years, driven by several factors such as the region’s economic expansion, increasing disposable income, favorable investment climate, and rising entrepreneurial activities. This has attracted both domestic and international investors, leading to a surge in private equity deals across various sectors. The market is characterized by intense competition, evolving regulatory frameworks, and the emergence of new investment strategies. However, challenges such as market volatility, political uncertainties, and the impact of the COVID-19 pandemic have also influenced the market dynamics.

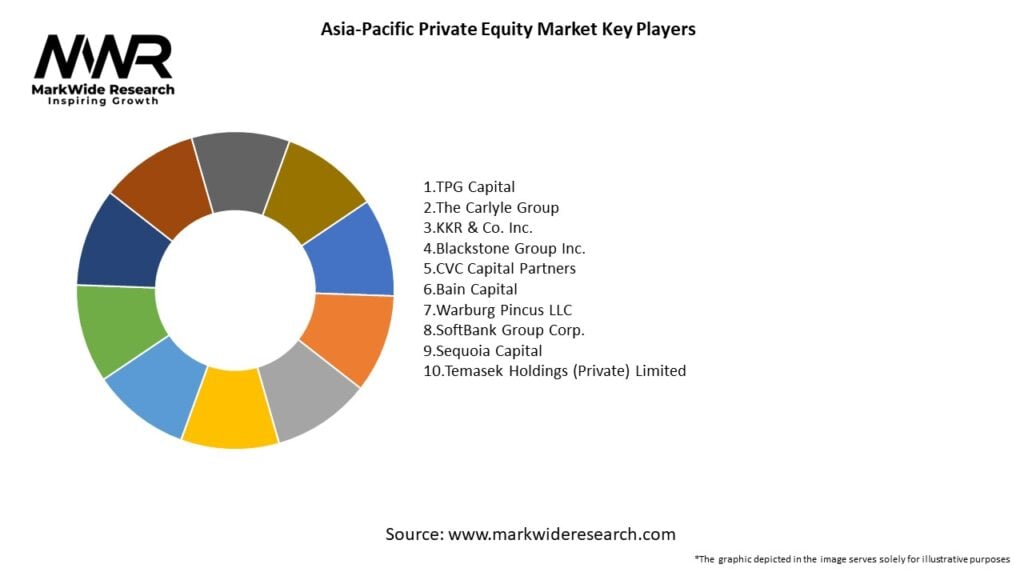

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Asia-Pacific private equity market is characterized by dynamic and evolving trends, shaped by a combination of economic, social, technological, and regulatory factors. The market dynamics are influenced by the interplay of supply and demand, investor preferences, industry trends, and the competitive landscape. Understanding these dynamics is crucial for private equity investors to identify opportunities, mitigate risks, and navigate the complexities of the market.

Regional Analysis

The Asia-Pacific private equity market is geographically diverse, encompassing countries such as China, India, Japan, Australia, South Korea, and Southeast Asian nations. Each country presents unique market characteristics, growth drivers, and investment opportunities. China and India, as the largest economies in the region, attract significant private equity investments due to their market size, consumer base, and business potential. Other countries in Southeast Asia, such as Singapore, Malaysia, and Indonesia, are also emerging as attractive investment destinations.

Competitive Landscape

Leading Companies in the Asia-Pacific Private Equity Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Asia-Pacific private equity market can be segmented based on various criteria, including investment stage, industry sector, and deal size. The investment stage includes venture capital, growth equity, and buyout investments, catering to companies at different stages of growth and development. Industry sectors commonly targeted by private equity investors include technology, healthcare, consumer goods, financial services, and manufacturing. Deal sizes can range from small-scale investments in startups to large-scale leveraged buyouts of established companies.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The Asia-Pacific private equity market offers several benefits for industry participants and stakeholders, including:

SWOT Analysis

Market Key Trends

COVID-19 Impact

The COVID-19 pandemic has had a significant impact on the Asia-Pacific private equity market, introducing both challenges and opportunities. The initial phase of the pandemic led to market volatility, disrupted supply chains, and reduced investor confidence. However, as economies recovered and adapted to the new normal, the private equity market rebounded, with investors seizing opportunities in sectors such as technology, healthcare, and e-commerce. The pandemic has also accelerated digital transformation, highlighting the importance of technology-enabled investments and driving innovations in sectors such as telemedicine, e-learning, and contactless services.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Asia-Pacific private equity market remains optimistic, driven by the region’s economic growth, technological advancements, and the increasing demand for private capital. Continued urbanization, rising consumer spending, and government initiatives to attract foreign investments will fuel market growth. The market is expected to witness further consolidation, cross-border collaborations, and the emergence of new investment strategies. As the region recovers from the impact of the COVID-19 pandemic, private equity investments in technology, healthcare, and sustainable sectors are likely to gain momentum.

Conclusion

The Asia-Pacific private equity market presents exciting opportunities for investors seeking attractive returns and exposure to vibrant economies. The region’s economic growth, favorable investment climate, and burgeoning startup ecosystem contribute to its appeal. However, challenges such as market volatility, regulatory complexities, and intense competition require careful consideration and strategic decision-making. By leveraging market insights, focusing on key trends, and embracing emerging opportunities, private equity investors can navigate the dynamic landscape of the Asia-Pacific market and unlock its potential for growth and value creation.

What is Private Equity?

Private equity refers to investment funds that buy and restructure companies that are not publicly traded. These investments typically focus on generating high returns through strategic management and operational improvements.

What are the key players in the Asia-Pacific Private Equity Market?

Key players in the Asia-Pacific Private Equity Market include firms like KKR, Blackstone, and Carlyle Group, which actively invest in various sectors such as technology, healthcare, and consumer goods, among others.

What are the growth factors driving the Asia-Pacific Private Equity Market?

The Asia-Pacific Private Equity Market is driven by factors such as increasing disposable incomes, a growing middle class, and a rise in entrepreneurial ventures. Additionally, favorable regulatory environments in several countries are encouraging investment.

What challenges does the Asia-Pacific Private Equity Market face?

Challenges in the Asia-Pacific Private Equity Market include regulatory hurdles, market volatility, and competition from other investment vehicles. These factors can impact the ability to execute successful investments.

What opportunities exist in the Asia-Pacific Private Equity Market?

Opportunities in the Asia-Pacific Private Equity Market include the potential for growth in emerging sectors such as fintech and renewable energy. Additionally, increasing interest from institutional investors presents new avenues for capital deployment.

What trends are shaping the Asia-Pacific Private Equity Market?

Trends in the Asia-Pacific Private Equity Market include a focus on technology-driven investments, increased interest in ESG (Environmental, Social, and Governance) criteria, and a shift towards more collaborative investment strategies among firms.

Asia-Pacific Private Equity Market

| Segmentation Details | Description |

|---|---|

| Investment Strategy | Buyout, Growth Capital, Venture Capital, Mezzanine |

| Fund Structure | Closed-End, Open-End, Fund of Funds, Secondary Fund |

| Asset Class | Real Estate, Infrastructure, Technology, Healthcare |

| Investor Type | Pension Funds, Sovereign Wealth Funds, Family Offices, High-Net-Worth Individuals |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Asia-Pacific Private Equity Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at