444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific power transistor market represents one of the most dynamic and rapidly evolving segments within the global semiconductor industry. This region has emerged as a powerhouse for power transistor manufacturing and consumption, driven by robust industrialization, expanding automotive sectors, and the proliferation of consumer electronics. Power transistors serve as critical components in various applications, from renewable energy systems to electric vehicles, making them indispensable for the region’s technological advancement.

Market dynamics in the Asia-Pacific region are characterized by strong demand from key industries including automotive, industrial automation, telecommunications, and consumer electronics. The region’s manufacturing capabilities, coupled with significant investments in research and development, have positioned it as a global leader in power semiconductor technology. Growth rates in this market are particularly impressive, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over recent years.

Regional leadership is evident through the presence of major semiconductor manufacturers and the concentration of electronics production facilities across countries like China, Japan, South Korea, and Taiwan. The market benefits from favorable government policies supporting semiconductor development, substantial infrastructure investments, and a skilled workforce dedicated to advancing power electronics technology.

The Asia-Pacific power transistor market refers to the comprehensive ecosystem encompassing the design, manufacturing, distribution, and application of power transistors across the Asia-Pacific region. Power transistors are semiconductor devices that control and amplify electrical power in various electronic systems, serving as fundamental building blocks for power management and conversion applications.

These devices operate by switching and controlling electrical current flow, enabling efficient power conversion, voltage regulation, and signal amplification across diverse applications. Power transistors include various technologies such as MOSFETs (Metal-Oxide-Semiconductor Field-Effect Transistors), IGBTs (Insulated Gate Bipolar Transistors), and BJTs (Bipolar Junction Transistors), each optimized for specific performance requirements and application domains.

Market significance extends beyond mere component supply, encompassing the entire value chain from raw material processing to end-user applications. The Asia-Pacific region’s dominance in this market reflects its strategic importance in global electronics manufacturing, renewable energy deployment, and emerging technology adoption.

Strategic positioning of the Asia-Pacific power transistor market demonstrates exceptional growth potential and technological leadership within the global semiconductor landscape. The region’s market strength stems from its comprehensive manufacturing ecosystem, innovative research capabilities, and diverse application portfolio spanning multiple high-growth industries.

Key performance indicators reveal robust market expansion driven by increasing demand for energy-efficient solutions, electric vehicle adoption, and renewable energy infrastructure development. The market benefits from 65% of global power transistor production being concentrated in the Asia-Pacific region, highlighting its manufacturing dominance and supply chain integration.

Technological advancement remains a cornerstone of market growth, with significant investments in next-generation power semiconductor technologies including wide bandgap materials like silicon carbide (SiC) and gallium nitride (GaN). These innovations enable higher efficiency, reduced power losses, and improved thermal performance across various applications.

Market diversification across multiple end-use industries provides stability and growth opportunities, with automotive applications representing 42% of regional demand, followed by industrial automation, consumer electronics, and renewable energy systems. This balanced portfolio ensures resilience against sector-specific fluctuations while capitalizing on emerging technology trends.

Fundamental market insights reveal the Asia-Pacific power transistor market’s exceptional positioning within the global semiconductor ecosystem. The region’s comprehensive approach to power electronics development encompasses both traditional silicon-based technologies and emerging wide bandgap semiconductors.

Primary market drivers propelling the Asia-Pacific power transistor market include the rapid expansion of electric vehicle adoption, increasing demand for energy-efficient solutions, and the proliferation of renewable energy infrastructure. These factors create substantial opportunities for power transistor applications across diverse industry segments.

Electric vehicle revolution represents a transformative driver, with the automotive sector’s transition toward electrification requiring sophisticated power management systems. Power transistors play crucial roles in electric vehicle powertrains, charging infrastructure, and battery management systems, driving significant demand growth throughout the region.

Industrial automation advancement continues accelerating across Asia-Pacific manufacturing facilities, requiring advanced power electronics for motor drives, robotics, and process control systems. The region’s focus on Industry 4.0 implementation and smart manufacturing creates substantial opportunities for high-performance power transistor solutions.

Renewable energy deployment across solar, wind, and energy storage applications drives demand for efficient power conversion systems. Power transistors enable optimal energy harvesting, grid integration, and storage management, supporting the region’s sustainability objectives and energy security goals.

Consumer electronics innovation maintains strong momentum with continuous product development in smartphones, tablets, laptops, and smart home devices. These applications require compact, efficient power management solutions that rely heavily on advanced power transistor technologies.

Market constraints affecting the Asia-Pacific power transistor market include supply chain complexities, raw material availability challenges, and intense competitive pressures. These factors require strategic management to maintain market growth momentum and profitability.

Supply chain vulnerabilities have become increasingly apparent, particularly regarding critical raw materials and specialized manufacturing equipment. Geopolitical tensions and trade restrictions can impact component availability and manufacturing continuity, affecting market stability and growth projections.

Technical complexity in advanced power transistor development requires substantial R&D investments and specialized expertise. The increasing sophistication of applications demands higher performance specifications, longer development cycles, and greater technical risks that can constrain market entry for smaller players.

Cost pressures from intense competition and customer demands for lower pricing create challenges for maintaining profit margins while investing in technology advancement. The need to balance cost competitiveness with innovation requirements presents ongoing strategic challenges for market participants.

Regulatory compliance across different Asia-Pacific countries requires navigation of varying standards, certification processes, and environmental regulations. These requirements can increase development costs and time-to-market for new power transistor solutions.

Emerging opportunities within the Asia-Pacific power transistor market are substantial, driven by technological advancement, application expansion, and regional economic development. These opportunities span multiple industry sectors and technology domains, providing diverse growth pathways for market participants.

Wide bandgap semiconductors present significant opportunities for market expansion, with silicon carbide and gallium nitride technologies offering superior performance characteristics for high-power, high-frequency applications. The transition toward these advanced materials creates new market segments and premium pricing opportunities.

5G infrastructure deployment across the Asia-Pacific region requires sophisticated power management solutions for base stations, network equipment, and edge computing facilities. This massive infrastructure investment creates substantial demand for high-performance power transistors optimized for telecommunications applications.

Smart grid development and energy storage system deployment offer expanding opportunities for power electronics applications. The region’s focus on grid modernization and renewable energy integration drives demand for advanced power conversion and management solutions.

Internet of Things (IoT) proliferation creates opportunities for low-power, high-efficiency transistor solutions in connected devices, sensors, and edge computing applications. The massive scale of IoT deployment across the region provides substantial volume opportunities for specialized power transistor products.

Market dynamics in the Asia-Pacific power transistor sector reflect complex interactions between technological advancement, competitive pressures, and evolving customer requirements. These dynamics shape market evolution and influence strategic decision-making across the value chain.

Technology convergence is driving integration between power transistors and other semiconductor components, creating system-level solutions that offer enhanced performance and reduced complexity. This trend toward integration provides opportunities for differentiation and value creation while challenging traditional component-focused business models.

Customer consolidation in key end-use industries is influencing supplier relationships and market dynamics. Large automotive manufacturers, industrial equipment producers, and electronics companies are seeking strategic partnerships with power transistor suppliers, emphasizing long-term collaboration and technology roadmap alignment.

Innovation cycles are accelerating as market demands for improved efficiency, reduced size, and enhanced performance drive continuous technology development. The pace of innovation requires sustained R&D investment and rapid commercialization capabilities to maintain competitive positioning.

Regional competition is intensifying as local manufacturers develop advanced capabilities and challenge established market leaders. This competitive dynamic drives innovation, improves cost efficiency, and accelerates technology adoption across the region.

Comprehensive research methodology employed for analyzing the Asia-Pacific power transistor market incorporates multiple data sources, analytical frameworks, and validation techniques to ensure accuracy and reliability of market insights and projections.

Primary research encompasses extensive interviews with industry executives, technology experts, and key stakeholders across the power transistor value chain. This includes manufacturers, suppliers, system integrators, and end-users to gather firsthand insights on market trends, challenges, and opportunities.

Secondary research involves systematic analysis of industry reports, company financial statements, patent databases, and regulatory filings to understand market structure, competitive dynamics, and technology evolution patterns. This comprehensive data collection provides quantitative foundation for market analysis.

Market modeling utilizes advanced analytical techniques including regression analysis, scenario planning, and Monte Carlo simulations to develop robust market forecasts and assess various growth scenarios. These models incorporate multiple variables including economic indicators, technology adoption rates, and industry-specific factors.

Validation processes ensure data accuracy through triangulation of multiple sources, expert review panels, and statistical verification techniques. This rigorous approach maintains high standards for research quality and reliability of market insights.

Regional market analysis reveals distinct characteristics and growth patterns across key Asia-Pacific countries, with each market demonstrating unique strengths, opportunities, and competitive dynamics within the power transistor ecosystem.

China dominates the regional market with 38% market share, driven by massive manufacturing capabilities, strong domestic demand, and significant government support for semiconductor development. The country’s comprehensive electronics ecosystem and growing electric vehicle market create substantial opportunities for power transistor applications.

Japan maintains technological leadership with 22% market share, focusing on high-performance applications and advanced materials research. Japanese companies excel in automotive power electronics, industrial automation, and precision manufacturing applications requiring superior quality and reliability.

South Korea represents 18% of regional market share, with strong positions in consumer electronics, automotive components, and industrial applications. The country’s advanced semiconductor manufacturing capabilities and technology innovation drive market growth and competitive positioning.

Taiwan contributes 12% market share through its world-class semiconductor foundry services and component manufacturing expertise. The region serves as a critical hub for power transistor production and technology development, supporting global supply chains.

Other Asia-Pacific markets including India, Southeast Asian countries, and Australia collectively represent 10% market share but demonstrate strong growth potential driven by industrialization, infrastructure development, and technology adoption initiatives.

Competitive landscape in the Asia-Pacific power transistor market features a diverse mix of global leaders, regional champions, and emerging innovators, each contributing unique strengths and capabilities to the market ecosystem.

Market competition is characterized by continuous innovation, strategic partnerships, and expansion into emerging application areas. Companies compete on technology performance, cost efficiency, reliability, and customer support capabilities.

Market segmentation analysis reveals diverse categories within the Asia-Pacific power transistor market, each characterized by specific performance requirements, application domains, and growth dynamics that shape overall market development.

By Technology:

By Application:

Category analysis provides detailed insights into specific market segments, revealing unique characteristics, growth patterns, and competitive dynamics that influence overall market development and strategic positioning.

MOSFET segment maintains market leadership due to versatility, efficiency, and cost-effectiveness across diverse applications. This technology excels in switching applications, power conversion, and signal amplification, making it suitable for consumer electronics, automotive, and industrial applications.

IGBT category demonstrates strong growth in high-power applications, particularly electric vehicles and renewable energy systems. These devices offer excellent performance for applications requiring high voltage and current handling capabilities with efficient switching characteristics.

Wide bandgap semiconductors represent the fastest-growing category, with silicon carbide adoption increasing by 28% annually in automotive and industrial applications. These advanced materials enable higher efficiency, reduced size, and improved thermal performance compared to traditional silicon-based devices.

Automotive applications drive significant demand growth, with electric vehicle powertrains requiring sophisticated power management solutions. The transition toward electrification creates substantial opportunities for high-performance power transistors optimized for automotive requirements.

Industrial automation continues expanding with Industry 4.0 implementation and smart manufacturing initiatives. Power transistors enable precise motor control, efficient power conversion, and reliable operation in demanding industrial environments.

Industry participants in the Asia-Pacific power transistor market benefit from numerous advantages including access to advanced manufacturing capabilities, comprehensive supply chains, and diverse application opportunities that support business growth and competitive positioning.

Manufacturers benefit from the region’s cost-effective production capabilities, skilled workforce, and established infrastructure supporting high-volume manufacturing. The concentration of electronics production facilities enables efficient supply chain integration and reduced logistics costs.

Technology developers gain access to extensive R&D resources, collaborative research opportunities, and rapid prototyping capabilities that accelerate innovation cycles and time-to-market for new power transistor solutions.

End-users advantage from competitive pricing, reliable supply, and continuous technology advancement that enables improved system performance and cost efficiency. The region’s manufacturing scale ensures stable component availability and competitive pricing structures.

Investors benefit from market growth potential, technology leadership, and diverse application portfolio that provides multiple revenue streams and risk mitigation opportunities. The market’s strong fundamentals support long-term investment attractiveness.

Supply chain partners leverage integrated ecosystems, established relationships, and efficient logistics networks that reduce operational complexity and improve business efficiency across the value chain.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the Asia-Pacific power transistor market reflect technological evolution, application expansion, and changing customer requirements that influence product development and business strategies across the industry.

Wide bandgap adoption accelerates as silicon carbide and gallium nitride technologies demonstrate superior performance in high-power, high-frequency applications. This trend toward advanced materials enables efficiency improvements of up to 15% compared to traditional silicon-based devices.

System integration becomes increasingly important as customers seek complete power management solutions rather than individual components. This trend drives collaboration between power transistor manufacturers and system designers to develop optimized solutions.

Miniaturization demands continue growing across consumer electronics and automotive applications, requiring power transistors with reduced size while maintaining or improving performance characteristics. Advanced packaging technologies enable significant size reductions without compromising functionality.

Sustainability focus influences product development and manufacturing processes, with emphasis on energy efficiency, recyclability, and environmental impact reduction. This trend aligns with regional sustainability goals and regulatory requirements.

Digitalization integration enables smart power management capabilities through embedded intelligence and connectivity features. Power transistors increasingly incorporate digital control and monitoring capabilities for enhanced system optimization.

Recent industry developments demonstrate the dynamic nature of the Asia-Pacific power transistor market, with significant investments, technological breakthroughs, and strategic initiatives shaping market evolution and competitive positioning.

Manufacturing expansion initiatives across the region include substantial investments in new fabrication facilities and capacity upgrades to meet growing demand. Major manufacturers are establishing advanced production lines optimized for next-generation power transistor technologies.

Technology partnerships between semiconductor companies, automotive manufacturers, and industrial equipment producers accelerate innovation and market adoption. These collaborations focus on developing application-specific solutions and advancing wide bandgap semiconductor technologies.

Research investments in universities and research institutes support fundamental technology advancement and workforce development. Government funding and private sector collaboration drive breakthrough research in materials science and device physics.

Acquisition activities consolidate market capabilities and expand technology portfolios, with companies seeking to strengthen their positions in high-growth application areas and emerging technology segments.

Sustainability initiatives include development of more energy-efficient manufacturing processes, recyclable packaging materials, and products designed for circular economy principles. These efforts align with regional environmental goals and customer requirements.

Strategic recommendations for Asia-Pacific power transistor market participants focus on leveraging regional strengths while addressing market challenges and capitalizing on emerging opportunities for sustainable growth and competitive advantage.

Technology investment should prioritize wide bandgap semiconductors and advanced packaging technologies that enable superior performance and differentiation. Companies should allocate R&D spending of at least 12% of revenue to maintain competitive positioning in rapidly evolving markets.

Market diversification across multiple application segments reduces risk and captures growth opportunities in emerging areas. Balanced portfolio development across automotive, industrial, consumer, and renewable energy applications provides stability and growth potential.

Supply chain resilience requires strategic planning for raw material security, manufacturing flexibility, and logistics optimization. Companies should develop multiple sourcing strategies and regional supply chain capabilities to mitigate disruption risks.

Customer collaboration through long-term partnerships and co-development programs accelerates innovation and market adoption. Close relationships with key customers enable better understanding of application requirements and faster technology commercialization.

Talent development in specialized areas including wide bandgap semiconductors, power electronics design, and system integration ensures competitive capability maintenance. Investment in workforce training and university partnerships supports long-term competitiveness.

Future market outlook for the Asia-Pacific power transistor market remains highly positive, driven by continued technology advancement, expanding application opportunities, and strong regional economic growth that supports sustained demand across multiple industry segments.

Growth projections indicate continued market expansion with projected CAGR of 9.1% over the next five years, driven by electric vehicle adoption, renewable energy deployment, and industrial automation advancement. According to MarkWide Research analysis, the market demonstrates exceptional resilience and growth potential across diverse application areas.

Technology evolution will focus on wide bandgap semiconductors, with silicon carbide and gallium nitride technologies gaining market penetration of over 25% in high-performance applications by 2028. These advanced materials enable superior efficiency and performance characteristics essential for next-generation applications.

Application expansion into emerging areas including 5G infrastructure, edge computing, and advanced driver assistance systems creates new growth opportunities. The proliferation of connected devices and autonomous systems drives demand for sophisticated power management solutions.

Regional integration will strengthen through continued investment in manufacturing capabilities, research infrastructure, and supply chain optimization. The Asia-Pacific region’s position as a global power transistor hub will be reinforced through strategic initiatives and technology leadership.

Sustainability integration becomes increasingly important, with environmental considerations influencing product design, manufacturing processes, and end-of-life management. Companies that successfully integrate sustainability principles will gain competitive advantages in environmentally conscious markets.

The Asia-Pacific power transistor market represents a dynamic and rapidly evolving sector with exceptional growth potential and technological leadership within the global semiconductor industry. The region’s comprehensive manufacturing ecosystem, innovative research capabilities, and diverse application portfolio position it as the dominant force in global power transistor development and production.

Market fundamentals remain strong, supported by robust demand from key industries including automotive, industrial automation, consumer electronics, and renewable energy systems. The transition toward electrification, digitalization, and sustainability creates substantial opportunities for advanced power transistor solutions across multiple application domains.

Technological advancement continues driving market evolution, with wide bandgap semiconductors and system integration trends reshaping competitive dynamics and value propositions. Companies that successfully navigate these technology transitions while maintaining cost competitiveness will capture the greatest market opportunities.

Strategic success in this market requires balanced approaches encompassing technology innovation, market diversification, supply chain resilience, and customer collaboration. The region’s continued investment in infrastructure, talent development, and research capabilities ensures sustained competitive advantages and market leadership in the global power transistor industry.

What is Power Transistor?

Power transistors are semiconductor devices used to amplify or switch electronic signals and electrical power. They are essential components in various applications, including power supplies, motor drives, and audio amplifiers.

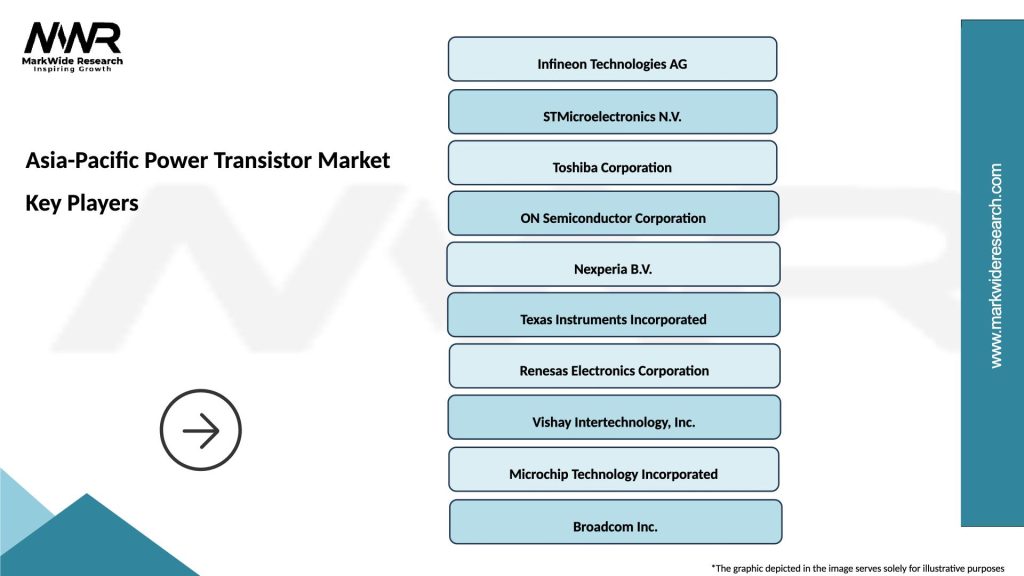

What are the key players in the Asia-Pacific Power Transistor Market?

Key players in the Asia-Pacific Power Transistor Market include Infineon Technologies, ON Semiconductor, STMicroelectronics, and Texas Instruments, among others.

What are the main drivers of the Asia-Pacific Power Transistor Market?

The main drivers of the Asia-Pacific Power Transistor Market include the increasing demand for energy-efficient devices, the growth of renewable energy sources, and the rising adoption of electric vehicles.

What challenges does the Asia-Pacific Power Transistor Market face?

Challenges in the Asia-Pacific Power Transistor Market include the high cost of advanced semiconductor materials, competition from alternative technologies, and supply chain disruptions affecting production.

What opportunities exist in the Asia-Pacific Power Transistor Market?

Opportunities in the Asia-Pacific Power Transistor Market include advancements in semiconductor technology, the expansion of the Internet of Things (IoT), and increasing investments in smart grid infrastructure.

What trends are shaping the Asia-Pacific Power Transistor Market?

Trends shaping the Asia-Pacific Power Transistor Market include the miniaturization of electronic components, the integration of power transistors in automotive applications, and the growing focus on sustainable energy solutions.

Asia-Pacific Power Transistor Market

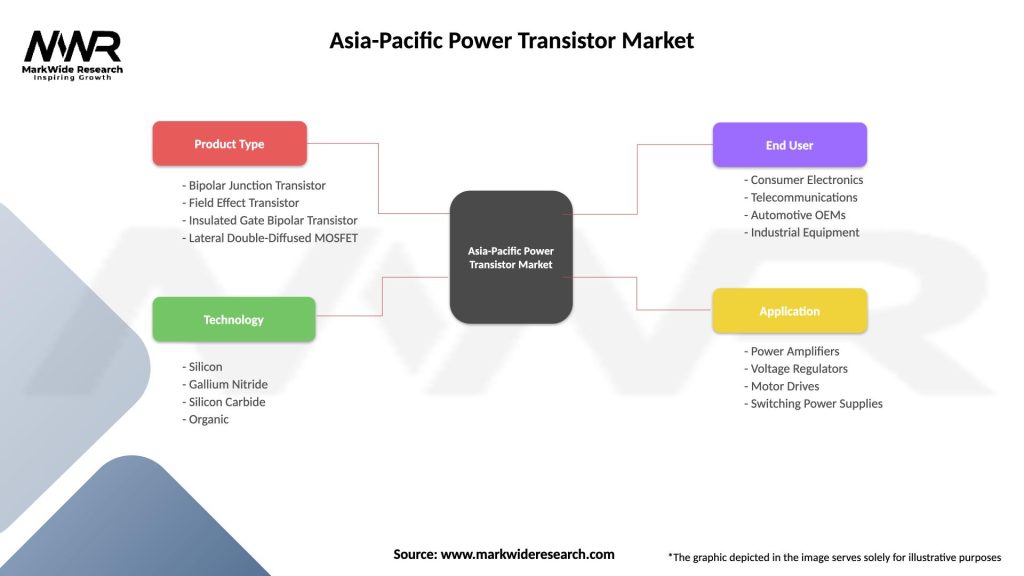

| Segmentation Details | Description |

|---|---|

| Product Type | Bipolar Junction Transistor, Field Effect Transistor, Insulated Gate Bipolar Transistor, Lateral Double-Diffused MOSFET |

| Technology | Silicon, Gallium Nitride, Silicon Carbide, Organic |

| End User | Consumer Electronics, Telecommunications, Automotive OEMs, Industrial Equipment |

| Application | Power Amplifiers, Voltage Regulators, Motor Drives, Switching Power Supplies |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Power Transistor Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at