444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Asia-Pacific Polyphenylene Sulfide (PPS) Composites Market is experiencing significant growth and is expected to expand further in the coming years. PPS composites are high-performance thermoplastics that offer excellent thermal, mechanical, and electrical properties. These composites find extensive applications in various industries, including automotive, electrical and electronics, aerospace, and industrial manufacturing.

Meaning

Polyphenylene Sulfide (PPS) composites are a type of advanced thermoplastic material that is reinforced with fillers or fibers to enhance its mechanical and thermal properties. PPS is known for its high temperature resistance, excellent dimensional stability, flame retardancy, and chemical resistance. These properties make PPS composites highly suitable for demanding applications in industries such as automotive, electrical, and aerospace.

Executive Summary

The Asia-Pacific Polyphenylene Sulfide (PPS) Composites Market is witnessing robust growth due to the increasing demand for high-performance materials across various industries in the region. The market is driven by the need for lightweight, durable, and cost-effective materials that can withstand harsh operating conditions. The automotive sector is a major contributor to the market, followed by electrical and electronics and aerospace industries.

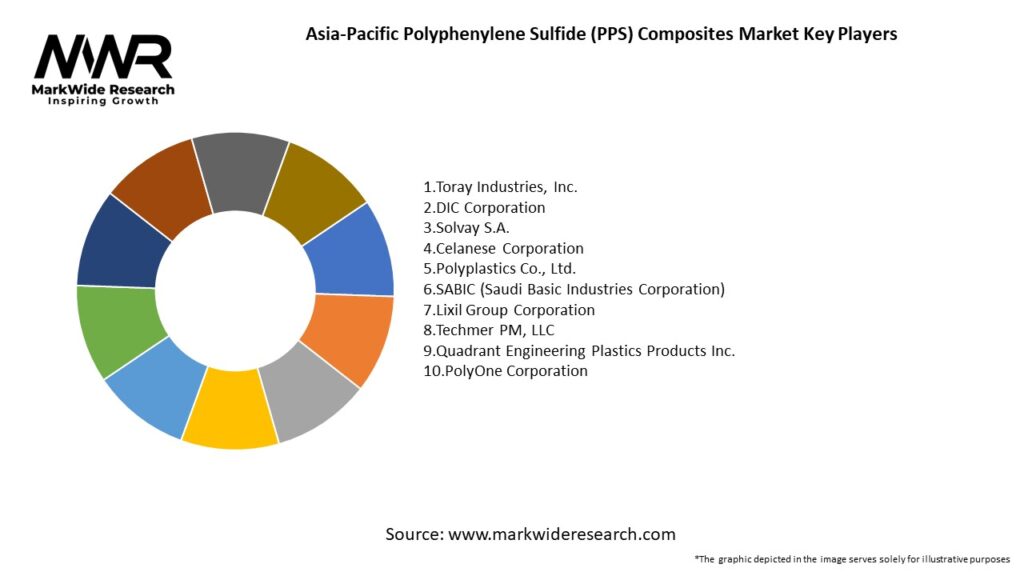

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Material Penetration: Glass-fiber–reinforced PPS accounts for over 65% of regional composite volume, while carbon-fiber variants are growing at 12% CAGR due to EMI-shielding applications.

Price Trends: PPS resin costs have moderated by 5–8% over the past two years following feedstock price stabilization, improving composite cost competitiveness versus high-temperature nylons and liquid crystal polymers.

Manufacturing Footprint: Asia-Pacific hosts over 50% of global PPS compounding capacity, with major plants in China’s Guangdong and Jiangsu provinces, and new lines planned in India and Southeast Asia for localized supply.

Application Mix: Automotive remains the largest end-use (~40% share), followed by electrical & electronics (~30%) and industrial‐equipment (~20%), with energy and consumer goods comprising the remainder.

Sustainability Drivers: Emerging bio-based PPS precursors and recycled-fiber composites are in early commercialization, reflecting industry focus on circularity and carbon-footprint reduction.

Market Drivers

EV and Hybrid Vehicle Growth: As Asia-Pacific EV sales surpass 10 million units by 2030, the need for high-temperature, chemical-resistant composite parts in battery cooling systems and power inverters rises sharply.

5G Telecom Expansion: Deployment of 5G base stations and small cells—especially in China, South Korea, and Japan—creates demand for PPS composites with low dielectric loss and precise molding tolerances.

Smart Manufacturing: Automated factories require materials for rollers, gears, and sensor enclosures that can withstand continuous operation at elevated temperatures and oil exposures.

Regulatory Emissions Standards: Stricter automotive under-the-hood emission regulations necessitate materials able to tolerate engine-Bay chemical exposure and higher coolant temperatures.

Infrastructure Investments: Government stimulus in India and Southeast Asia to upgrade roads, railways, and power networks drives equipment manufacturing that relies on PPS composites.

Market Restraints

High Resin Costs: PPS remains a relatively expensive resin compared to conventional engineering plastics, limiting adoption in cost-sensitive segments.

Fiber Handling Complexity: High fiber loadings require specialized molding equipment and process controls to avoid fiber breakage and ensure uniform dispersion.

Supply-Chain Concentration: Dependence on a few global resin suppliers poses risk of feedstock shortages or price spikes if production is disrupted.

Recycling Challenges: PPS composite recycling infrastructure is nascent; current mechanical-grind recycling can degrade fiber length and performance.

Competitive Materials: Liquid crystal polymers (LCPs) and high-temperature nylons sometimes serve as substitutes when ultra-thin walls or bi-axial flow properties are needed.

Market Opportunities

Nanocomposite Integration: Incorporating nano-fillers (e.g., graphene, nanoclays) with PPS can enhance barrier properties, conductivity, and mechanical strength for advanced electronics and barrier applications.

Bio-Derived PPS: Development of renewable feedstocks (e.g., biomass-derived phenol or sulfide precursors) can reduce carbon footprint and appeal to eco-conscious OEMs.

Closed-Loop Recycling: Investing in chemical-recycling processes to depolymerize PPS composites back to monomers or oligomers offers long-term circularity prospects.

Automotive Aftermarket: Rapid growth of EV retrofits and service parts creates demand for PPS composite replacements in cooling-system components and electrical connectors.

Modular 3D Printing: PPS-based filament and pellet feedstocks for high-performance additive manufacturing can serve aerospace and industrial prototyping needs.

Market Dynamics

Vertical Integration: Resin producers acquiring compounding and distribution assets to capture margin and control quality throughout the supply chain.

Strategic Partnerships: Collaborations between OEMs and compounding specialists to co-develop application-specific grades with optimized fiber treatments and additives.

Regional Manufacturing Shifts: New compounding facilities in India and Southeast Asia reduce lead times and import dependencies for local OEMs.

Digital Process Control: Adoption of Industry 4.0 monitoring tools—melt-flow sensors, real-time fiber-dispersion analytics—to consistently produce high-quality composites.

Sustainability Certification: Introduction of eco-labels (e.g., UL ECOLOGO®, TÜV OK BIOBASED) for PPS composites incorporating recycled or bio-based content.

Regional Analysis

China: Largest regional market; government incentives for EVs, 5G, and industrial automation underpin capacity expansions in Jiangsu and Guangdong.

Japan & South Korea: High adoption in consumer electronics and telecom equipment; stringent quality standards drive demand for ultra-pure, low-moisture PPS composites.

India: Emerging adoption in automotive and appliance sectors; rising local compounding capacity reduces import costs and fosters indigenous applications.

Southeast Asia: Thailand, Vietnam, and Indonesia growing as manufacturing hubs for automotive wiring harnesses and home appliances, adopting PPS composites for thermal and chemical stability.

Australia & New Zealand: Niche applications in mining-equipment components exposed to corrosive slurries, leveraging PPS composite’s chemical resistance.

Competitive Landscape

Leading Companies in the Asia-Pacific Polyphenylene Sulfide (PPS) Composites Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Asia-Pacific Polyphenylene Sulfide (PPS) Composites Market is segmented based on product type, end-use industry, and geography. By product type, the market is divided into glass fiber-filled, carbon fiber-filled, mineral-filled, and others. By end-use industry, the market is categorized into automotive, electrical and electronics, aerospace, industrial, and others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the Asia-Pacific Polyphenylene Sulfide (PPS) Composites Market. The region witnessed disruptions in the supply chain, production shutdowns, and reduced demand from end-use industries. However, the market showed signs of recovery as industries resumed operations and implemented safety measures. The pandemic also highlighted the importance of resilient and sustainable supply chains, driving the demand for PPS composites in the post-pandemic scenario.

Key Industry Developments

Solvay’s New PPS Line in China (2023): Commissioned a 30 ktpa compounding facility in Jiangsu province to serve domestic automotive and electronics markets.

MGC’s Carbon-Fiber PPS Launch (2022): Introduced a 40 wt% carbon-fiber composite grade with surface-modified fibers for improved mold flow and EMI performance.

DIC’s Recycled PPS Trial (2024): Completed pilot line producing 30% post-consumer recycled PPS composite filament for 3D printing applications.

Ensinger’s Tepex® Automotive Partnership (2021): Collaborated with a major EV OEM to qualify PPS-based continuous-fiber composites for battery-module frames.

Analyst Suggestions

Future Outlook

The Asia-Pacific Polyphenylene Sulfide (PPS) Composites Market is expected to witness substantial growth in the coming years. Factors such as increasing industrialization, infrastructure development, and the demand for high-performance materials will drive market expansion. The automotive and electrical and electronics industries will continue to be the major consumers of PPS composites, while opportunities in the aerospace sector and emerging applications in renewable energy will contribute to market growth.

Conclusion

The Asia-Pacific Polyphenylene Sulfide (PPS) Composites Market is poised for significant growth, driven by the demand for high-performance materials in various industries. PPS composites offer excellent thermal, mechanical, and electrical properties, making them suitable for a wide range of applications. The market is characterized by intense competition, with key players focusing on product development and strategic collaborations. Despite challenges such as high manufacturing costs and limited awareness in certain regions, the market presents lucrative opportunities, particularly in electric vehicles, aerospace, and renewable energy sectors. With continued advancements in technology and a focus on sustainability, the future outlook for the Asia-Pacific PPS Composites Market looks promising.

What is Polyphenylene Sulfide (PPS) Composites?

Polyphenylene Sulfide (PPS) Composites are high-performance materials known for their excellent thermal stability, chemical resistance, and mechanical properties. They are widely used in automotive, aerospace, and electrical applications due to their ability to withstand harsh environments.

What are the key players in the Asia-Pacific Polyphenylene Sulfide (PPS) Composites Market?

Key players in the Asia-Pacific Polyphenylene Sulfide (PPS) Composites Market include companies like Toray Industries, Solvay, and BASF, which are known for their innovative solutions and extensive product portfolios in the composites sector, among others.

What are the growth factors driving the Asia-Pacific Polyphenylene Sulfide (PPS) Composites Market?

The growth of the Asia-Pacific Polyphenylene Sulfide (PPS) Composites Market is driven by increasing demand from the automotive and electronics industries, where lightweight and durable materials are essential. Additionally, the rise in industrial applications requiring high-performance materials contributes to market expansion.

What challenges does the Asia-Pacific Polyphenylene Sulfide (PPS) Composites Market face?

Challenges in the Asia-Pacific Polyphenylene Sulfide (PPS) Composites Market include high production costs and the complexity of processing these materials. Furthermore, competition from alternative materials can hinder market growth.

What opportunities exist in the Asia-Pacific Polyphenylene Sulfide (PPS) Composites Market?

Opportunities in the Asia-Pacific Polyphenylene Sulfide (PPS) Composites Market include the increasing adoption of PPS composites in renewable energy applications and advancements in manufacturing technologies that enhance material performance. The growing focus on lightweight materials in transportation also presents significant potential.

What trends are shaping the Asia-Pacific Polyphenylene Sulfide (PPS) Composites Market?

Trends in the Asia-Pacific Polyphenylene Sulfide (PPS) Composites Market include the development of bio-based PPS composites and innovations in recycling technologies. Additionally, there is a growing emphasis on sustainability and reducing environmental impact in the production of these materials.

Asia-Pacific Polyphenylene Sulfide (PPS) Composites Market

| Segmentation Details | Description |

|---|---|

| Product Type | Unfilled, Glass Fiber Reinforced, Carbon Fiber Reinforced, Mineral Filled |

| End Use Industry | Aerospace, Automotive Components, Electrical & Electronics, Industrial Equipment |

| Form | Granules, Powders, Sheets, Films |

| Application | Thermal Insulation, Chemical Processing, Automotive Interiors, Electrical Insulation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Asia-Pacific Polyphenylene Sulfide (PPS) Composites Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at