444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific pharmaceutical glass packaging market represents one of the most dynamic and rapidly expanding segments within the global pharmaceutical packaging industry. This market encompasses a comprehensive range of glass containers, vials, ampoules, bottles, and specialized packaging solutions designed specifically for pharmaceutical applications across the Asia Pacific region. Market dynamics indicate robust growth driven by increasing healthcare expenditure, expanding pharmaceutical manufacturing capabilities, and stringent regulatory requirements for drug safety and efficacy.

Regional expansion across key markets including China, India, Japan, South Korea, and Southeast Asian nations has created substantial opportunities for pharmaceutical glass packaging manufacturers. The market benefits from growing pharmaceutical production in the region, with Asia Pacific accounting for approximately 42% of global pharmaceutical manufacturing. Quality standards and regulatory compliance requirements continue to drive demand for premium glass packaging solutions that ensure product integrity and patient safety.

Technological advancements in glass manufacturing processes, including enhanced barrier properties, improved chemical resistance, and specialized coatings, have positioned Asia Pacific as a critical hub for pharmaceutical glass packaging innovation. The region’s manufacturing capabilities support both domestic pharmaceutical companies and international brands seeking cost-effective, high-quality packaging solutions with projected growth rates of 8.5% CAGR through the forecast period.

The Asia Pacific pharmaceutical glass packaging market refers to the comprehensive ecosystem of glass-based packaging solutions specifically designed and manufactured for pharmaceutical products across the Asia Pacific region. This market encompasses primary packaging containers that come into direct contact with pharmaceutical formulations, including vials, ampoules, bottles, cartridges, and syringes made from various grades of pharmaceutical glass.

Pharmaceutical glass packaging serves as the critical interface between drug products and the external environment, providing essential protection against contamination, moisture, light, and chemical interactions that could compromise drug stability and efficacy. These packaging solutions must meet stringent regulatory standards established by agencies such as the FDA, EMA, and regional regulatory bodies across Asia Pacific countries.

Market scope includes both borosilicate and soda-lime glass formulations, with specialized treatments and coatings designed to enhance chemical compatibility, reduce extractables and leachables, and improve overall pharmaceutical product safety. The market serves diverse pharmaceutical applications including injectable drugs, oral medications, vaccines, biologics, and specialty pharmaceutical formulations requiring precise containment and protection.

Market performance in the Asia Pacific pharmaceutical glass packaging sector demonstrates exceptional growth momentum, driven by expanding pharmaceutical manufacturing capabilities and increasing healthcare investments across the region. Key growth drivers include rising demand for injectable medications, growing biologics market, and stringent regulatory requirements that favor glass packaging over alternative materials for critical pharmaceutical applications.

Regional leadership is evident in countries such as China and India, which have emerged as major pharmaceutical manufacturing hubs, contributing to approximately 38% of regional market demand. Japan and South Korea maintain strong positions in high-value pharmaceutical glass packaging segments, particularly for biologics and specialty medications requiring advanced packaging technologies.

Competitive dynamics feature both international glass manufacturers and regional players expanding their presence across Asia Pacific markets. Innovation focus centers on developing enhanced glass formulations, improving manufacturing efficiency, and meeting evolving regulatory requirements for pharmaceutical packaging safety and sustainability.

Future prospects indicate continued market expansion supported by demographic trends, healthcare infrastructure development, and increasing pharmaceutical R&D investments across the region. Market opportunities are particularly strong in emerging segments such as prefilled syringes, vaccine packaging, and specialized containers for cell and gene therapies.

Strategic insights reveal several critical factors shaping the Asia Pacific pharmaceutical glass packaging market landscape. Primary packaging applications dominate market demand, with injectable drug containers representing the largest segment due to increasing preference for parenteral drug delivery systems and growing biologics market.

Pharmaceutical industry expansion across Asia Pacific serves as the primary catalyst for pharmaceutical glass packaging market growth. Healthcare infrastructure development in emerging economies, combined with increasing healthcare expenditure and growing pharmaceutical manufacturing capabilities, creates substantial demand for high-quality packaging solutions that ensure drug safety and efficacy.

Regulatory requirements continue to drive market demand as pharmaceutical companies must comply with stringent packaging standards for drug approval and market access. Glass packaging advantages including chemical inertness, barrier properties, and recyclability make it the preferred choice for critical pharmaceutical applications, particularly injectable drugs and biologics.

Demographic trends including aging populations, increasing chronic disease prevalence, and growing healthcare awareness contribute to rising pharmaceutical consumption across the region. Biologics market expansion particularly drives demand for specialized glass packaging solutions that can maintain product stability and prevent contamination throughout the supply chain.

Manufacturing cost advantages in Asia Pacific countries attract international pharmaceutical companies to establish production facilities in the region, creating additional demand for local pharmaceutical glass packaging suppliers. Technology transfer and knowledge sharing between international and regional manufacturers continue to enhance local capabilities and market competitiveness.

High capital investment requirements for pharmaceutical glass manufacturing facilities present significant barriers to market entry, particularly for smaller regional players seeking to establish production capabilities. Technical complexity associated with pharmaceutical-grade glass production requires specialized expertise and advanced manufacturing equipment that may limit market participation.

Regulatory compliance costs continue to challenge manufacturers as they must invest substantially in quality systems, testing capabilities, and certification processes to meet international pharmaceutical packaging standards. Competition from alternative materials including plastic and polymer-based packaging solutions poses ongoing challenges, particularly in cost-sensitive market segments.

Supply chain vulnerabilities became apparent during recent global disruptions, highlighting dependencies on raw material suppliers and potential risks to production continuity. Environmental regulations regarding glass manufacturing processes and energy consumption create additional compliance requirements that may impact operational costs.

Market fragmentation across diverse Asia Pacific countries with varying regulatory requirements, quality standards, and market preferences creates complexity for manufacturers seeking regional expansion. Price pressure from pharmaceutical companies seeking cost reduction in packaging components continues to challenge profit margins across the industry.

Emerging pharmaceutical segments present substantial growth opportunities for glass packaging manufacturers, particularly in areas such as cell and gene therapies, personalized medicine, and advanced biologics requiring specialized containment solutions. Prefilled syringe market expansion offers significant potential as healthcare systems increasingly adopt convenient, ready-to-use drug delivery systems.

Sustainability initiatives create opportunities for manufacturers to develop environmentally friendly glass packaging solutions, including increased recycled content, reduced material usage, and improved manufacturing efficiency. Smart packaging technologies integration with glass containers opens new possibilities for drug authentication, temperature monitoring, and patient compliance tracking.

Regional market expansion into emerging Asia Pacific countries with developing pharmaceutical industries provides growth opportunities for established manufacturers. Contract manufacturing services for international pharmaceutical companies seeking local production capabilities represent expanding business opportunities across the region.

Technology partnerships between glass manufacturers and pharmaceutical companies can drive innovation in specialized packaging solutions tailored to specific drug formulations and delivery requirements. Regulatory harmonization efforts across Asia Pacific countries may simplify market access and reduce compliance complexity for regional manufacturers.

Supply and demand dynamics in the Asia Pacific pharmaceutical glass packaging market reflect the complex interplay between growing pharmaceutical production and evolving packaging requirements. Demand patterns show strong growth in injectable drug packaging, driven by increasing preference for parenteral drug delivery and expanding biologics market across the region.

Competitive pressures continue to intensify as both international and regional manufacturers expand their presence in key Asia Pacific markets. Price competition remains significant, particularly in standard packaging segments, while premium applications command higher margins due to specialized requirements and limited supplier base.

Technology evolution drives market dynamics as manufacturers invest in advanced glass formulations, improved manufacturing processes, and enhanced quality control systems. Customer relationships between glass packaging suppliers and pharmaceutical companies become increasingly strategic, with long-term partnerships driving product development and market expansion.

Regulatory landscape changes continue to influence market dynamics as authorities implement new requirements for pharmaceutical packaging safety, environmental impact, and supply chain security. Market consolidation trends may emerge as smaller manufacturers seek partnerships or acquisitions to achieve scale and technological capabilities necessary for competitive success.

Comprehensive market analysis for the Asia Pacific pharmaceutical glass packaging market employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with industry executives, pharmaceutical companies, glass manufacturers, regulatory officials, and market participants across key Asia Pacific countries.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, trade publications, and government statistics related to pharmaceutical manufacturing and packaging industries. Market data validation involves cross-referencing multiple sources and conducting follow-up interviews to verify key findings and market estimates.

Regional analysis covers major Asia Pacific markets including China, India, Japan, South Korea, Australia, Thailand, Singapore, Malaysia, Indonesia, and other emerging pharmaceutical markets. Segmentation analysis examines market dynamics across product types, applications, end-users, and geographic regions to provide comprehensive market understanding.

Quantitative analysis includes statistical modeling, trend analysis, and market forecasting based on historical data and identified market drivers. Qualitative insights from industry experts provide context for market trends, competitive dynamics, and future growth opportunities across the pharmaceutical glass packaging sector.

China dominates the Asia Pacific pharmaceutical glass packaging market, representing approximately 35% of regional market share due to its massive pharmaceutical manufacturing base and growing domestic healthcare demand. Chinese manufacturers have invested heavily in advanced glass production technologies and quality systems to serve both domestic and international pharmaceutical companies.

India maintains the second-largest market position with 22% regional market share, driven by its position as a global pharmaceutical manufacturing hub and growing domestic pharmaceutical consumption. Indian glass packaging companies have expanded capabilities to serve generic drug manufacturers and international pharmaceutical companies with cost-effective, high-quality packaging solutions.

Japan represents a premium market segment with 18% market share, characterized by high-value pharmaceutical applications, advanced technology adoption, and stringent quality requirements. Japanese manufacturers focus on specialized glass packaging solutions for biologics, vaccines, and innovative drug delivery systems.

South Korea accounts for 12% of regional market share, with strong capabilities in pharmaceutical glass packaging for both domestic and export markets. Southeast Asian countries collectively represent 13% market share, with growing pharmaceutical industries driving demand for glass packaging solutions across Thailand, Singapore, Malaysia, and Indonesia.

Market leadership in the Asia Pacific pharmaceutical glass packaging sector features a combination of international glass manufacturers and strong regional players competing across various market segments. Competitive strategies focus on technological innovation, quality excellence, regulatory compliance, and strategic partnerships with pharmaceutical companies.

Competitive differentiation increasingly depends on technological capabilities, regulatory compliance, customer service, and ability to provide customized solutions for specific pharmaceutical applications. Market consolidation trends may emerge as companies seek to achieve scale advantages and technological capabilities necessary for long-term competitiveness.

Product segmentation in the Asia Pacific pharmaceutical glass packaging market encompasses diverse container types designed for specific pharmaceutical applications and drug delivery requirements. Market analysis reveals distinct growth patterns and competitive dynamics across different product categories and application segments.

By Product Type:

By Glass Type:

By Application:

Injectable packaging category represents the most dynamic segment within the Asia Pacific pharmaceutical glass packaging market, driven by growing demand for biologics, vaccines, and parenteral drug delivery systems. Vials and ampoules dominate this category, with increasing preference for ready-to-use formats that reduce contamination risks and improve healthcare efficiency.

Prefilled syringe segment shows exceptional growth potential as healthcare systems adopt convenient, pre-measured drug delivery solutions that improve patient compliance and reduce medication errors. Technical requirements for prefilled syringes include precise dimensional tolerances, specialized coatings, and integrated closure systems that ensure product integrity throughout shelf life.

Biologics packaging represents a high-value market category requiring specialized glass formulations and advanced manufacturing processes to prevent protein aggregation and maintain drug stability. Cold chain compatibility and thermal shock resistance become critical factors for biologics packaging applications across diverse Asia Pacific climate conditions.

Vaccine packaging has gained increased importance following recent global health challenges, with demand for multi-dose vials and single-dose containers supporting immunization programs across the region. Regulatory requirements for vaccine packaging emphasize sterility assurance, container closure integrity, and compatibility with cold storage requirements.

Pharmaceutical companies benefit from high-quality glass packaging solutions that ensure drug product integrity, regulatory compliance, and patient safety throughout the supply chain. Product protection provided by pharmaceutical glass packaging helps maintain drug efficacy, prevent contamination, and support shelf life requirements critical for pharmaceutical product success.

Healthcare providers gain advantages from reliable, sterile packaging systems that reduce medication preparation time, minimize contamination risks, and improve patient care efficiency. Ready-to-use formats such as prefilled syringes and pre-measured doses enhance healthcare workflow and reduce potential medication errors.

Patients benefit from pharmaceutical glass packaging through improved drug safety, consistent dosing accuracy, and convenient delivery systems that enhance medication compliance. Packaging innovations including user-friendly designs and integrated safety features contribute to better patient outcomes and treatment adherence.

Glass manufacturers participate in a growing market with opportunities for technological innovation, capacity expansion, and strategic partnerships with pharmaceutical companies. Value-added services including custom packaging design, regulatory support, and supply chain optimization create additional revenue opportunities and competitive differentiation.

Regulatory authorities benefit from standardized, compliant packaging systems that support drug safety oversight and public health protection. Traceability features and quality documentation associated with pharmaceutical glass packaging facilitate regulatory monitoring and post-market surveillance activities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend across the Asia Pacific pharmaceutical glass packaging market, with manufacturers increasing recycled glass content and implementing energy-efficient production processes. Environmental responsibility considerations influence purchasing decisions as pharmaceutical companies seek packaging solutions that align with corporate sustainability goals and regulatory requirements.

Smart packaging technologies gain traction through integration of digital features such as temperature indicators, authentication systems, and patient compliance monitoring capabilities. Connected packaging solutions provide valuable data for pharmaceutical companies while enhancing patient safety and treatment outcomes through real-time monitoring capabilities.

Customization demand increases as pharmaceutical companies seek differentiated packaging solutions that support brand identity, improve patient experience, and address specific drug formulation requirements. Personalized medicine trends drive demand for flexible packaging solutions that can accommodate varying dose strengths and patient-specific requirements.

Regulatory harmonization efforts across Asia Pacific countries simplify market access and reduce compliance complexity for pharmaceutical glass packaging manufacturers. Quality standardization initiatives promote consistent manufacturing practices and facilitate trade across regional markets, benefiting both manufacturers and pharmaceutical companies.

Manufacturing capacity expansion continues across major Asia Pacific markets as glass packaging companies invest in new production facilities and technology upgrades to meet growing demand. MarkWide Research analysis indicates substantial investments in automated production lines and quality control systems that enhance manufacturing efficiency and product consistency.

Strategic partnerships between international glass manufacturers and regional pharmaceutical companies create opportunities for technology transfer, market expansion, and product development collaboration. Joint ventures and licensing agreements facilitate knowledge sharing and accelerate market penetration across diverse Asia Pacific countries.

Technology innovations include development of enhanced glass formulations with improved chemical resistance, reduced extractables and leachables, and specialized coatings for specific pharmaceutical applications. Research investments focus on addressing emerging pharmaceutical packaging challenges and supporting next-generation drug delivery systems.

Regulatory approvals for new glass packaging products and manufacturing facilities demonstrate continued market confidence and expansion opportunities. Quality certifications and compliance achievements by regional manufacturers enhance their competitiveness in international markets and support export growth initiatives.

Market participants should prioritize investment in advanced manufacturing technologies and quality systems to maintain competitiveness in the evolving pharmaceutical glass packaging landscape. Automation adoption can improve production efficiency, reduce costs, and enhance product quality consistency critical for pharmaceutical applications.

Strategic partnerships with pharmaceutical companies offer opportunities for long-term growth through collaborative product development and market expansion initiatives. Customer relationship management becomes increasingly important as pharmaceutical companies seek reliable, innovative packaging partners that can support their global expansion strategies.

Sustainability initiatives should be integrated into business strategies as environmental considerations become more prominent in purchasing decisions and regulatory requirements. Circular economy principles including increased recycled content and waste reduction can provide competitive advantages and cost savings opportunities.

Regional expansion strategies should consider emerging Asia Pacific markets with developing pharmaceutical industries and growing healthcare infrastructure investments. Market entry approaches may include partnerships with local distributors, joint ventures, or direct investment in manufacturing facilities depending on market characteristics and regulatory requirements.

Long-term growth prospects for the Asia Pacific pharmaceutical glass packaging market remain highly positive, supported by continued pharmaceutical industry expansion, demographic trends, and increasing healthcare investments across the region. Market evolution will be shaped by technological innovations, regulatory developments, and changing pharmaceutical industry requirements for packaging solutions.

Emerging opportunities in specialized pharmaceutical segments including cell and gene therapies, personalized medicine, and advanced biologics will drive demand for innovative glass packaging solutions. MWR projections indicate sustained growth momentum with particular strength in injectable packaging and prefilled syringe segments throughout the forecast period.

Technology integration will continue advancing with smart packaging features, enhanced glass formulations, and improved manufacturing processes that address evolving pharmaceutical industry needs. Digital transformation across the pharmaceutical supply chain will create new requirements for packaging solutions that support connectivity, traceability, and data collection capabilities.

Regional market development in emerging Asia Pacific countries will provide additional growth opportunities as healthcare infrastructure improves and pharmaceutical manufacturing capabilities expand. Market maturation in developed countries will shift focus toward premium applications, specialized solutions, and value-added services that support pharmaceutical innovation and patient care improvements.

The Asia Pacific pharmaceutical glass packaging market demonstrates exceptional growth potential driven by expanding pharmaceutical manufacturing, increasing healthcare demand, and stringent regulatory requirements for drug safety and efficacy. Market dynamics favor continued expansion across diverse product segments, applications, and geographic regions throughout the Asia Pacific area.

Competitive advantages for market participants will increasingly depend on technological innovation, quality excellence, regulatory compliance, and strategic partnerships with pharmaceutical companies. Sustainability considerations and smart packaging technologies represent emerging opportunities for differentiation and market leadership in the evolving pharmaceutical packaging landscape.

Future success in the Asia Pacific pharmaceutical glass packaging market will require continued investment in manufacturing capabilities, technology development, and customer relationships that support pharmaceutical industry growth and innovation. Market participants who effectively address these requirements while maintaining focus on quality, compliance, and customer service will be well-positioned for long-term success in this dynamic and growing market segment.

What is Pharmaceutical Glass Packaging?

Pharmaceutical Glass Packaging refers to the use of glass containers and packaging solutions specifically designed for the storage and protection of pharmaceutical products, including liquids, powders, and injectables.

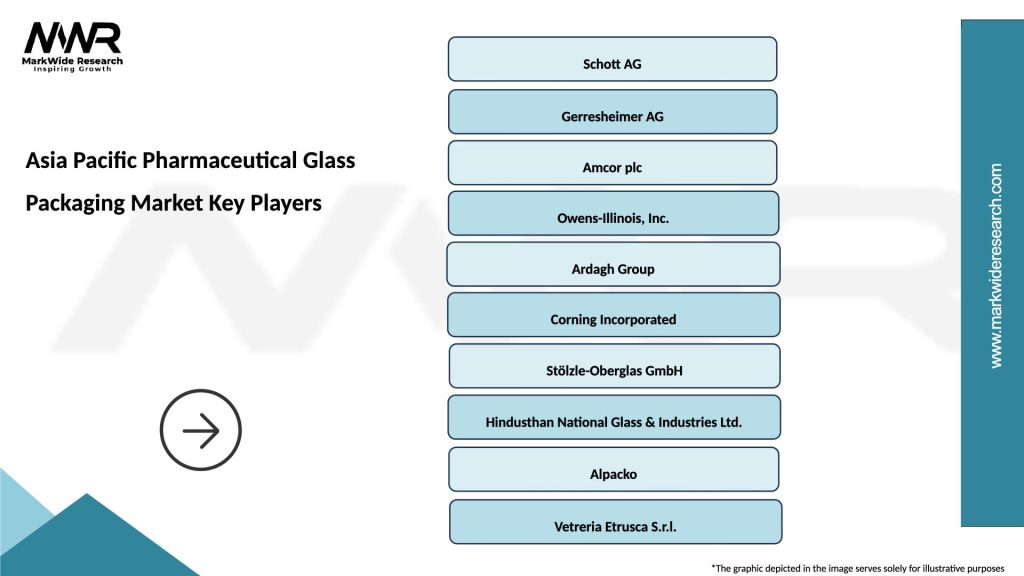

What are the key players in the Asia Pacific Pharmaceutical Glass Packaging Market?

Key players in the Asia Pacific Pharmaceutical Glass Packaging Market include Schott AG, Gerresheimer AG, and Nipro Corporation, among others.

What are the main drivers of the Asia Pacific Pharmaceutical Glass Packaging Market?

The main drivers of the Asia Pacific Pharmaceutical Glass Packaging Market include the increasing demand for biologics, the rise in chronic diseases requiring injectable medications, and the growing focus on sustainable packaging solutions.

What challenges does the Asia Pacific Pharmaceutical Glass Packaging Market face?

Challenges in the Asia Pacific Pharmaceutical Glass Packaging Market include the high cost of glass production, competition from alternative packaging materials, and stringent regulatory requirements for pharmaceutical packaging.

What opportunities exist in the Asia Pacific Pharmaceutical Glass Packaging Market?

Opportunities in the Asia Pacific Pharmaceutical Glass Packaging Market include advancements in glass manufacturing technologies, the increasing trend towards personalized medicine, and the expansion of the pharmaceutical industry in emerging markets.

What trends are shaping the Asia Pacific Pharmaceutical Glass Packaging Market?

Trends shaping the Asia Pacific Pharmaceutical Glass Packaging Market include the growing adoption of eco-friendly packaging solutions, innovations in glass design for enhanced safety, and the integration of smart packaging technologies.

Asia Pacific Pharmaceutical Glass Packaging Market

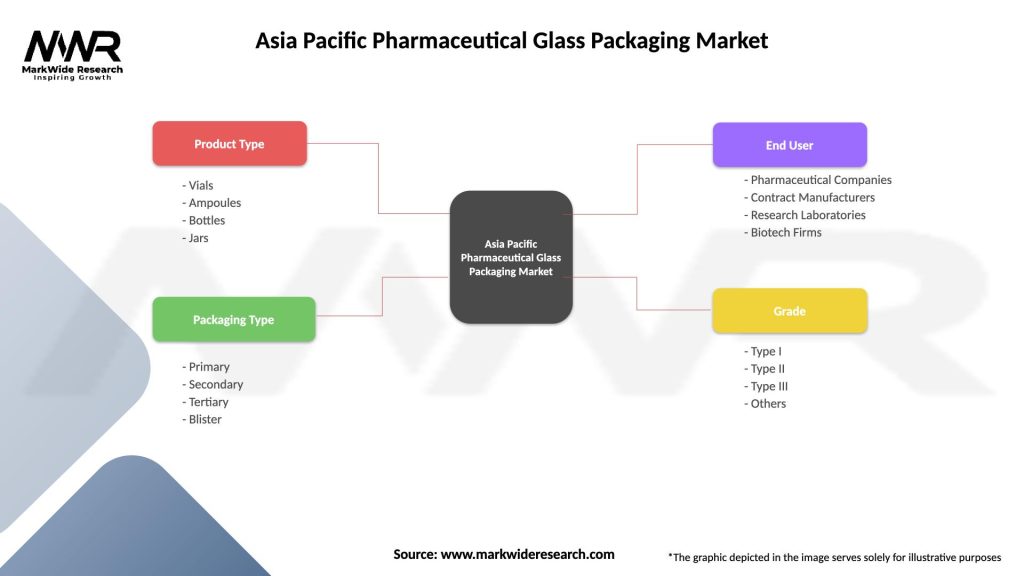

| Segmentation Details | Description |

|---|---|

| Product Type | Vials, Ampoules, Bottles, Jars |

| Packaging Type | Primary, Secondary, Tertiary, Blister |

| End User | Pharmaceutical Companies, Contract Manufacturers, Research Laboratories, Biotech Firms |

| Grade | Type I, Type II, Type III, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Pharmaceutical Glass Packaging Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at