444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific PET packaging in pharmaceutical market represents a dynamic and rapidly evolving sector that has emerged as a cornerstone of modern pharmaceutical distribution and storage solutions. This market encompasses the comprehensive utilization of polyethylene terephthalate (PET) materials for packaging various pharmaceutical products, including tablets, capsules, liquid medications, and specialized drug formulations across the diverse economies of the Asia Pacific region.

Market dynamics indicate that the region is experiencing unprecedented growth in pharmaceutical packaging demand, driven by expanding healthcare infrastructure, increasing pharmaceutical manufacturing capabilities, and rising consumer awareness about medication safety. The Asia Pacific region has established itself as a global manufacturing hub for pharmaceutical products, with countries like China, India, Japan, and South Korea leading the charge in both production and consumption of PET packaging solutions.

Regional growth patterns demonstrate that the market is expanding at a robust CAGR of 8.2%, reflecting the strong demand for reliable, cost-effective, and environmentally conscious packaging solutions. The pharmaceutical industry’s shift toward sustainable packaging alternatives has positioned PET as a preferred material due to its recyclability, chemical resistance, and excellent barrier properties that ensure medication integrity and patient safety.

Manufacturing excellence across the region has been bolstered by significant investments in advanced packaging technologies, automated production lines, and quality control systems that meet stringent international pharmaceutical packaging standards. The market benefits from the region’s strategic geographic position, which facilitates efficient supply chain management and distribution networks that serve both domestic and international pharmaceutical markets.

The Asia Pacific PET packaging in pharmaceutical market refers to the comprehensive ecosystem of polyethylene terephthalate-based packaging solutions specifically designed, manufactured, and distributed for pharmaceutical applications across the Asia Pacific region. This market encompasses the entire value chain from raw material procurement and processing to final packaging product delivery and end-user application in pharmaceutical manufacturing and distribution.

PET packaging solutions in the pharmaceutical context include a diverse range of products such as bottles, containers, blister packs, vials, and specialized packaging systems that provide optimal protection for various pharmaceutical formulations. These packaging solutions are engineered to meet strict regulatory requirements, maintain product stability, prevent contamination, and ensure patient safety throughout the medication lifecycle.

Market scope extends beyond simple packaging provision to include comprehensive services such as custom packaging design, regulatory compliance consulting, supply chain optimization, and sustainability initiatives. The pharmaceutical PET packaging market serves multiple stakeholders including pharmaceutical manufacturers, contract packaging organizations, healthcare providers, and ultimately, patients who depend on safe and effective medication delivery systems.

Strategic market positioning reveals that the Asia Pacific PET packaging in pharmaceutical market has established itself as a critical component of the region’s healthcare infrastructure, supporting the growing pharmaceutical industry with innovative, reliable, and cost-effective packaging solutions. The market demonstrates strong fundamentals driven by increasing healthcare expenditure, expanding pharmaceutical manufacturing capacity, and rising demand for quality packaging that ensures medication safety and efficacy.

Key market drivers include the region’s aging population, which has increased demand for pharmaceutical products by 35% over the past five years, coupled with growing awareness of medication safety and the need for tamper-evident packaging solutions. The market benefits from significant technological advancements in PET manufacturing processes, including enhanced barrier properties, improved recyclability, and specialized coatings that extend shelf life and maintain drug stability.

Competitive landscape analysis indicates a healthy mix of established international players and emerging regional manufacturers who are investing heavily in research and development, production capacity expansion, and strategic partnerships with pharmaceutical companies. The market’s growth trajectory is supported by favorable regulatory environments, government initiatives promoting pharmaceutical manufacturing, and increasing foreign direct investment in healthcare infrastructure.

Future market prospects remain highly positive, with projected growth driven by expanding pharmaceutical exports, increasing domestic healthcare consumption, and the region’s strategic position as a global pharmaceutical manufacturing hub. The market is expected to benefit from ongoing digital transformation initiatives, sustainable packaging trends, and the growing emphasis on patient-centric packaging solutions that improve medication adherence and safety.

Market intelligence reveals several critical insights that define the current state and future direction of the Asia Pacific PET packaging in pharmaceutical market:

Demographic transformation across the Asia Pacific region serves as a fundamental driver for pharmaceutical PET packaging demand, with rapidly aging populations in developed economies like Japan and South Korea creating sustained demand for medication packaging solutions. The region’s demographic shift toward older age groups has resulted in increased chronic disease prevalence, driving pharmaceutical consumption and consequently packaging requirements.

Healthcare infrastructure expansion represents another critical driver, as governments throughout the region invest heavily in healthcare system development, hospital construction, and pharmaceutical manufacturing capabilities. These investments create downstream demand for high-quality packaging solutions that meet international standards and support the region’s ambitions to become a global pharmaceutical manufacturing hub.

Regulatory harmonization efforts across the region have standardized pharmaceutical packaging requirements, creating economies of scale for PET packaging manufacturers and reducing compliance costs for pharmaceutical companies. This regulatory alignment has facilitated cross-border trade and enabled manufacturers to develop standardized packaging solutions that serve multiple markets efficiently.

Technological advancement in PET manufacturing processes has improved material properties, reduced production costs, and enabled the development of specialized packaging solutions for complex pharmaceutical formulations. These technological improvements have expanded the addressable market for PET packaging while improving product performance and customer satisfaction.

Environmental consciousness among consumers, healthcare providers, and regulatory bodies has driven demand for sustainable packaging solutions, positioning PET as a preferred material due to its recyclability and reduced environmental impact compared to alternative packaging materials. This environmental focus has created new market opportunities for manufacturers who can demonstrate sustainability credentials.

Raw material price volatility presents a significant challenge for PET packaging manufacturers, as petroleum-based feedstock costs fluctuate based on global oil prices, geopolitical tensions, and supply chain disruptions. These price variations impact manufacturing costs and profit margins, requiring sophisticated hedging strategies and flexible pricing mechanisms to maintain competitiveness.

Regulatory complexity across different Asia Pacific markets creates compliance challenges for manufacturers seeking to serve multiple countries, as each market maintains unique pharmaceutical packaging standards, testing requirements, and certification processes. This regulatory fragmentation increases operational costs and time-to-market for new packaging solutions.

Competition from alternative materials such as glass, aluminum, and advanced polymer composites poses ongoing challenges to PET packaging market share, particularly in premium pharmaceutical applications where superior barrier properties or enhanced product presentation may justify higher material costs.

Environmental concerns regarding plastic packaging continue to influence regulatory policies and consumer preferences, creating pressure for increased recycled content, improved recyclability, and alternative sustainable packaging solutions that may challenge traditional PET packaging applications.

Supply chain vulnerabilities exposed during recent global disruptions have highlighted the risks associated with concentrated manufacturing locations and complex international supply networks, prompting pharmaceutical companies to seek more resilient and geographically diversified packaging supply solutions.

Emerging market expansion throughout Southeast Asia, particularly in countries like Vietnam, Thailand, and Indonesia, presents substantial growth opportunities as these economies develop their pharmaceutical manufacturing capabilities and healthcare infrastructure. These markets offer attractive cost structures, growing domestic demand, and strategic geographic positions for serving regional and global markets.

Specialty pharmaceutical packaging represents a high-value opportunity segment, as the pharmaceutical industry increasingly focuses on personalized medicine, biologics, and complex drug delivery systems that require specialized packaging solutions with enhanced barrier properties, temperature control, and tamper-evident features.

Sustainable packaging innovation offers significant market differentiation opportunities for manufacturers who can develop advanced recycling technologies, bio-based PET alternatives, and circular economy packaging solutions that meet growing environmental requirements while maintaining pharmaceutical-grade performance standards.

Digital integration and smart packaging technologies present emerging opportunities to add value through features like track-and-trace capabilities, temperature monitoring, patient adherence support, and anti-counterfeiting measures that enhance medication safety and supply chain transparency.

Export market development beyond the Asia Pacific region offers growth potential as regional manufacturers leverage cost advantages, quality improvements, and production scale to compete in global pharmaceutical packaging markets, particularly in emerging economies seeking reliable, cost-effective packaging solutions.

Supply and demand equilibrium in the Asia Pacific PET packaging pharmaceutical market reflects a complex interplay of factors including pharmaceutical production growth, packaging technology advancement, and evolving regulatory requirements. The market demonstrates strong demand fundamentals driven by expanding pharmaceutical manufacturing capacity and increasing healthcare consumption across the region.

Competitive dynamics are characterized by intense price competition among manufacturers, continuous innovation in packaging solutions, and strategic partnerships between packaging companies and pharmaceutical manufacturers. Market leaders maintain competitive advantages through scale economies, technological capabilities, and established customer relationships, while emerging players compete through specialization, cost efficiency, and innovative product offerings.

Value chain integration trends show increasing collaboration between PET resin suppliers, packaging manufacturers, and pharmaceutical companies to optimize costs, improve quality, and accelerate innovation. These partnerships enable better demand forecasting, supply chain coordination, and joint development of customized packaging solutions that meet specific pharmaceutical application requirements.

Market consolidation activities continue as larger players acquire smaller specialized manufacturers to expand geographic coverage, enhance technological capabilities, and achieve greater operational efficiency. This consolidation trend is balanced by the emergence of new market entrants who focus on niche applications or innovative packaging solutions.

Pricing dynamics reflect the balance between raw material costs, manufacturing efficiency, competitive pressure, and customer value requirements. Successful manufacturers differentiate through value-added services, technical support, and innovative packaging solutions rather than competing solely on price, creating sustainable competitive advantages and improved profit margins.

Comprehensive market analysis for the Asia Pacific PET packaging in pharmaceutical market employs a multi-faceted research approach that combines primary data collection, secondary research synthesis, and quantitative modeling to provide accurate and actionable market insights. The methodology ensures robust data validation and comprehensive market coverage across all major regional markets and application segments.

Primary research activities include extensive interviews with industry executives, pharmaceutical packaging managers, regulatory officials, and supply chain professionals across key Asia Pacific markets. These interviews provide qualitative insights into market trends, competitive dynamics, regulatory changes, and future growth prospects that complement quantitative data analysis.

Secondary research integration incorporates analysis of industry reports, regulatory filings, company financial statements, trade association data, and government statistics to establish comprehensive market baselines and validate primary research findings. This approach ensures data accuracy and provides historical context for market trend analysis.

Market modeling techniques utilize advanced statistical methods, trend analysis, and scenario planning to project future market developments and quantify growth opportunities. The modeling approach considers multiple variables including demographic trends, regulatory changes, technological advancement, and competitive dynamics to provide reliable market forecasts.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical verification to ensure research accuracy and reliability. The validation methodology helps identify and correct potential data inconsistencies while maintaining the integrity of market analysis and projections.

China dominates the Asia Pacific PET packaging pharmaceutical market with 38% regional market share, leveraging its massive pharmaceutical manufacturing base, advanced production capabilities, and cost-competitive manufacturing environment. The Chinese market benefits from strong government support for pharmaceutical industry development, substantial foreign investment, and growing domestic healthcare demand that drives packaging requirements.

India represents the second-largest market with 24% market share, supported by its position as a global generic pharmaceutical manufacturing hub and rapidly expanding domestic healthcare market. Indian manufacturers have established strong capabilities in cost-effective PET packaging production while maintaining international quality standards that enable both domestic supply and export market penetration.

Japan maintains a significant market position with 16% share, characterized by high-value pharmaceutical packaging applications, advanced technology adoption, and stringent quality requirements. The Japanese market emphasizes premium packaging solutions, innovative features, and sustainable materials that align with the country’s environmental consciousness and technological leadership.

South Korea accounts for 8% of regional demand, driven by its advanced pharmaceutical industry, strong regulatory framework, and emphasis on high-quality packaging solutions. Korean manufacturers focus on technology-intensive applications and export-oriented production that serves both regional and global pharmaceutical markets.

Southeast Asian markets collectively represent 14% market share, with countries like Thailand, Vietnam, and Indonesia showing rapid growth potential driven by expanding pharmaceutical manufacturing, improving healthcare infrastructure, and increasing foreign investment in pharmaceutical production capabilities.

Market leadership in the Asia Pacific PET packaging pharmaceutical sector is characterized by a diverse mix of global multinational corporations, established regional players, and emerging specialized manufacturers who compete across different market segments and geographic regions.

Competitive strategies focus on technological innovation, manufacturing efficiency, regulatory compliance, and customer service excellence. Leading companies invest heavily in research and development, production capacity expansion, and strategic partnerships to maintain market leadership and capture emerging growth opportunities.

By Product Type:

By Application:

By End User:

Bottles and Containers represent the dominant category in pharmaceutical PET packaging, accounting for the largest volume and revenue share due to their versatility, cost-effectiveness, and widespread application across various pharmaceutical formulations. This category benefits from continuous innovation in closure systems, barrier properties, and manufacturing efficiency that reduces costs while improving product performance.

Blister packaging demonstrates strong growth potential driven by increasing demand for unit-dose packaging, patient compliance features, and tamper-evident protection. This category particularly benefits from the growing generic pharmaceutical market and increasing emphasis on medication safety and dosing accuracy.

Specialty pharmaceutical packaging represents the highest-value category, serving complex drug formulations, biologics, and personalized medicine applications that require advanced packaging features such as temperature control, extended shelf life, and specialized barrier properties. This category commands premium pricing and offers significant growth opportunities.

Sustainable packaging solutions are emerging as a distinct category driven by environmental regulations, corporate sustainability commitments, and consumer preferences for environmentally responsible packaging. This category includes recycled content packaging, bio-based materials, and circular economy solutions that maintain pharmaceutical-grade performance standards.

Smart packaging integration represents an emerging category that incorporates digital technologies, sensors, and connectivity features to enhance medication safety, supply chain transparency, and patient engagement. This category offers significant differentiation opportunities and premium value positioning for innovative manufacturers.

Pharmaceutical Manufacturers benefit from reliable, cost-effective packaging solutions that ensure product integrity, regulatory compliance, and brand differentiation. PET packaging offers excellent chemical compatibility, moisture barrier properties, and manufacturing scalability that supports efficient pharmaceutical production and global distribution capabilities.

Healthcare Providers gain advantages through improved medication safety, patient compliance features, and supply chain efficiency that PET packaging solutions provide. These benefits include tamper-evident designs, clear product visibility, and standardized packaging formats that reduce medication errors and improve patient outcomes.

Patients and Consumers benefit from enhanced medication safety, convenience features, and environmental sustainability that modern PET pharmaceutical packaging delivers. These advantages include child-resistant closures, easy-open designs for elderly patients, and recyclable materials that support environmental responsibility.

Packaging Manufacturers benefit from growing market demand, technological advancement opportunities, and value-added service potential that the pharmaceutical PET packaging market provides. These benefits include stable long-term customer relationships, premium pricing for specialized applications, and expansion opportunities in emerging markets.

Supply Chain Partners gain advantages through standardized packaging formats, improved logistics efficiency, and reduced handling costs that PET packaging solutions enable. These benefits include optimized shipping configurations, reduced breakage rates, and simplified inventory management systems.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend reshaping the Asia Pacific PET packaging pharmaceutical market, with manufacturers increasingly adopting recycled content, developing bio-based alternatives, and implementing circular economy principles. This trend is driven by regulatory requirements, corporate sustainability commitments, and growing environmental consciousness among healthcare stakeholders.

Smart packaging integration is gaining momentum as pharmaceutical companies seek enhanced supply chain visibility, anti-counterfeiting protection, and patient engagement capabilities. These technologies include RFID tags, temperature sensors, and mobile connectivity features that provide real-time monitoring and data collection throughout the medication lifecycle.

Personalized medicine packaging is emerging as pharmaceutical companies develop targeted therapies and individualized treatment protocols that require specialized packaging solutions. This trend drives demand for smaller batch sizes, customized labeling, and flexible packaging formats that support personalized healthcare delivery.

Regulatory harmonization across Asia Pacific markets is simplifying compliance requirements and enabling standardized packaging solutions that serve multiple countries efficiently. This trend reduces development costs, accelerates time-to-market, and facilitates regional trade in pharmaceutical packaging products.

Digital supply chain integration is transforming pharmaceutical packaging through advanced analytics, predictive maintenance, and automated quality control systems that improve efficiency, reduce costs, and enhance product quality. These digital technologies enable real-time monitoring, optimization, and continuous improvement of packaging operations.

Manufacturing capacity expansion continues across the region as leading packaging companies invest in new production facilities, advanced equipment, and automation technologies to meet growing pharmaceutical packaging demand. These investments focus on high-speed production lines, quality control systems, and flexible manufacturing capabilities that serve diverse customer requirements.

Strategic partnerships between packaging manufacturers and pharmaceutical companies are becoming increasingly common, enabling collaborative product development, supply chain optimization, and long-term capacity planning. These partnerships facilitate innovation, reduce costs, and improve market responsiveness for both parties.

Technology advancement in PET manufacturing processes has enabled improved barrier properties, enhanced recyclability, and specialized coatings that extend pharmaceutical product shelf life and maintain drug stability. These technological improvements expand the addressable market for PET packaging while improving customer satisfaction and competitive positioning.

Regulatory compliance enhancement initiatives across the industry focus on meeting evolving pharmaceutical packaging standards, implementing quality management systems, and achieving international certifications that enable global market access. These compliance efforts require significant investment but provide competitive advantages and market expansion opportunities.

Sustainability initiatives include development of recycled content packaging, bio-based material alternatives, and closed-loop recycling systems that address environmental concerns while maintaining pharmaceutical-grade performance requirements. These initiatives position companies for future regulatory requirements and customer preferences.

MarkWide Research analysis indicates that pharmaceutical packaging companies should prioritize sustainability innovation and digital technology integration to maintain competitive advantages in the evolving Asia Pacific market. Companies that successfully combine environmental responsibility with advanced functionality will capture premium market segments and establish long-term customer relationships.

Strategic recommendations include investing in recycled content capabilities, developing bio-based material alternatives, and implementing smart packaging technologies that provide enhanced value to pharmaceutical customers. These investments require significant capital but offer substantial returns through market differentiation and premium pricing opportunities.

Market expansion strategies should focus on emerging Southeast Asian markets where pharmaceutical manufacturing is rapidly developing and packaging requirements are growing. Companies should establish local manufacturing presence, develop regional partnerships, and adapt products to meet specific market requirements and regulatory standards.

Innovation priorities should emphasize specialty pharmaceutical packaging applications, including biologics, personalized medicine, and complex drug delivery systems that require advanced packaging features and command premium pricing. These high-value segments offer significant growth potential and competitive differentiation opportunities.

Operational excellence initiatives should focus on manufacturing efficiency, quality control enhancement, and supply chain optimization to maintain cost competitiveness while improving customer service. These operational improvements provide sustainable competitive advantages and support profitable growth in competitive market segments.

Long-term growth prospects for the Asia Pacific PET packaging pharmaceutical market remain highly positive, supported by expanding pharmaceutical manufacturing, growing healthcare consumption, and increasing emphasis on medication safety and packaging innovation. The market is expected to benefit from continued economic development, demographic trends, and technological advancement across the region.

Technology evolution will continue driving market transformation through advanced materials, smart packaging features, and sustainable solutions that meet evolving customer requirements and regulatory standards. MWR projections indicate that technology-enabled packaging solutions will capture an increasing share of market demand, with growth rates exceeding 12% annually in premium segments.

Sustainability integration will become increasingly critical as environmental regulations tighten and customer preferences shift toward environmentally responsible packaging solutions. Companies that successfully develop and commercialize sustainable PET packaging alternatives will capture significant market share and establish competitive advantages in the evolving market landscape.

Regional market development will continue as emerging economies expand their pharmaceutical manufacturing capabilities and healthcare infrastructure. These markets offer substantial growth opportunities for packaging companies that can provide cost-effective, high-quality solutions while meeting local regulatory requirements and customer preferences.

Innovation acceleration will drive continued market evolution through development of specialized packaging solutions, advanced barrier properties, and integrated digital technologies that enhance pharmaceutical product safety, supply chain efficiency, and patient outcomes. Companies that maintain strong innovation capabilities will capture emerging opportunities and maintain market leadership positions.

The Asia Pacific PET packaging in pharmaceutical market represents a dynamic and rapidly evolving sector that plays a critical role in supporting the region’s expanding pharmaceutical industry and growing healthcare needs. The market demonstrates strong fundamentals driven by demographic trends, healthcare infrastructure development, and increasing emphasis on medication safety and packaging innovation.

Market growth prospects remain highly favorable, supported by expanding pharmaceutical manufacturing capacity, growing domestic healthcare consumption, and the region’s strategic position as a global pharmaceutical production hub. The market benefits from continuous technological advancement, regulatory harmonization, and increasing investment in sustainable packaging solutions that address environmental concerns while maintaining pharmaceutical-grade performance standards.

Success factors for market participants include maintaining technological leadership, achieving operational excellence, developing sustainable solutions, and building strong customer relationships that support long-term growth and profitability. Companies that successfully navigate the evolving regulatory landscape, embrace sustainability initiatives, and invest in innovation will capture the most significant opportunities in this expanding market.

Future market evolution will be characterized by continued consolidation, technological advancement, and increasing emphasis on value-added services that differentiate packaging solutions beyond basic functionality. The market will reward companies that can provide comprehensive solutions, demonstrate environmental responsibility, and support pharmaceutical customers’ evolving needs in an increasingly competitive and regulated industry environment.

What is PET Packaging in Pharmaceutical?

PET packaging in pharmaceutical refers to the use of polyethylene terephthalate materials for packaging pharmaceutical products. This type of packaging is favored for its lightweight, durability, and ability to provide a barrier against moisture and oxygen, ensuring the integrity of medications.

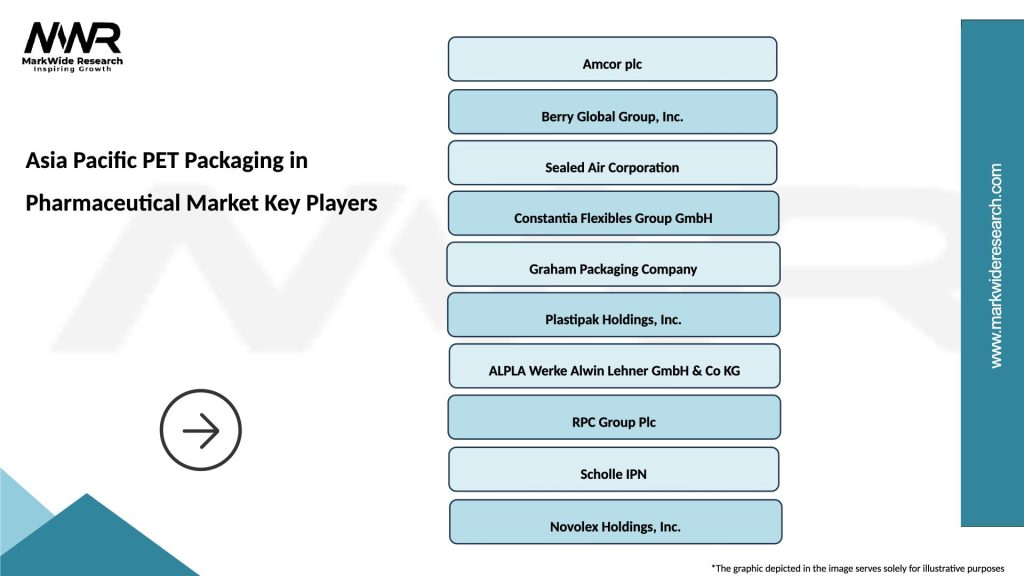

What are the key players in the Asia Pacific PET Packaging in Pharmaceutical Market?

Key players in the Asia Pacific PET Packaging in Pharmaceutical Market include Amcor, Berry Global, and Sealed Air, among others. These companies are known for their innovative packaging solutions and commitment to quality in the pharmaceutical sector.

What are the growth factors driving the Asia Pacific PET Packaging in Pharmaceutical Market?

The growth of the Asia Pacific PET Packaging in Pharmaceutical Market is driven by the increasing demand for lightweight and durable packaging solutions, the rise in pharmaceutical production, and the growing focus on patient safety and product integrity.

What challenges does the Asia Pacific PET Packaging in Pharmaceutical Market face?

Challenges in the Asia Pacific PET Packaging in Pharmaceutical Market include regulatory compliance issues, the high cost of raw materials, and competition from alternative packaging materials that may offer better sustainability profiles.

What opportunities exist in the Asia Pacific PET Packaging in Pharmaceutical Market?

Opportunities in the Asia Pacific PET Packaging in Pharmaceutical Market include the development of eco-friendly PET materials, advancements in packaging technology, and the increasing trend of personalized medicine that requires specialized packaging solutions.

What trends are shaping the Asia Pacific PET Packaging in Pharmaceutical Market?

Trends shaping the Asia Pacific PET Packaging in Pharmaceutical Market include the growing emphasis on sustainability, the adoption of smart packaging technologies, and the increasing use of PET for various pharmaceutical applications such as bottles, blisters, and pouches.

Asia Pacific PET Packaging in Pharmaceutical Market

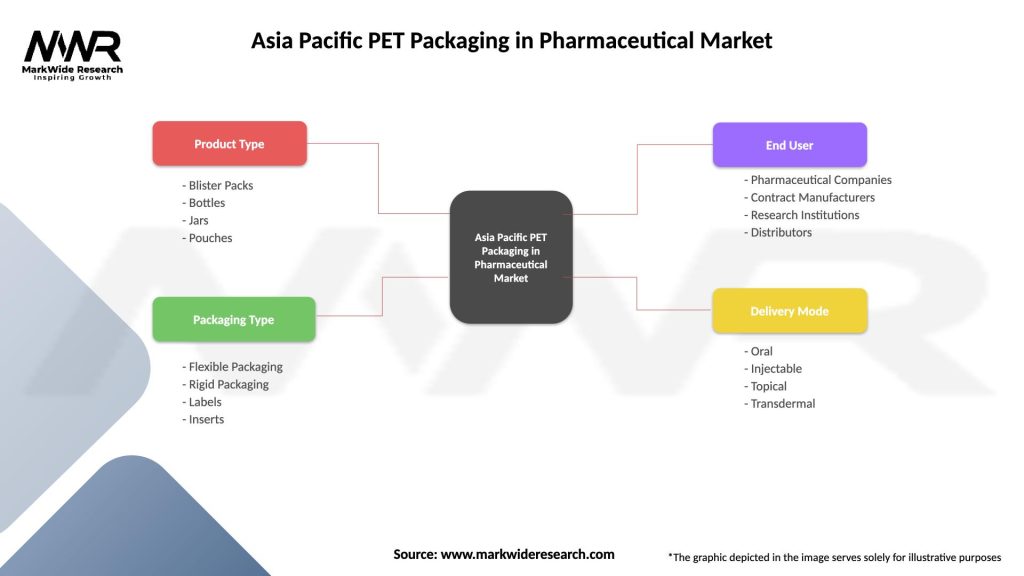

| Segmentation Details | Description |

|---|---|

| Product Type | Blister Packs, Bottles, Jars, Pouches |

| Packaging Type | Flexible Packaging, Rigid Packaging, Labels, Inserts |

| End User | Pharmaceutical Companies, Contract Manufacturers, Research Institutions, Distributors |

| Delivery Mode | Oral, Injectable, Topical, Transdermal |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific PET Packaging in Pharmaceutical Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at