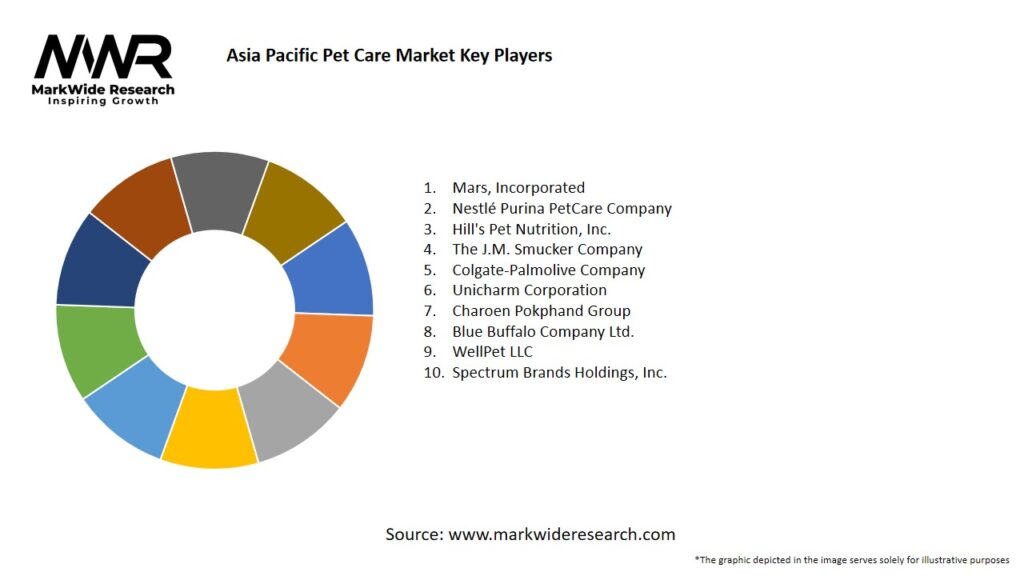

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Pet ownership rates in urban Asia Pacific reached an estimated 25% of households in 2024, with growth particularly strong in China, India, South Korea, and Southeast Asia.

-

Premium pet food (grain-free, organic, functional) now accounts for over 40% of total food expenditures in mature markets like Japan and South Korea.

-

Pet healthcare spending—including veterinary visits, diagnostics, and insurance—has grown at a 12% annual rate, reflecting increasing preventive care adoption.

-

E-commerce share of pet care sales has surpassed 30% in China and is rapidly expanding in India, Thailand, and Indonesia.

-

Pet services (grooming, boarding, training) are expanding, with franchised chains and boutique operators capturing urban consumers’ willingness to pay for convenience and quality.

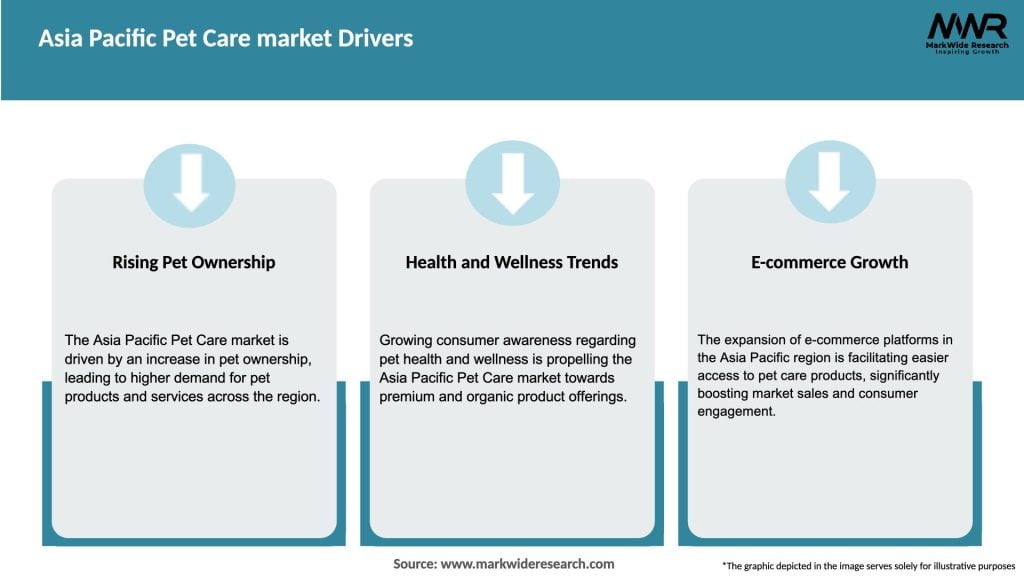

Market Drivers

-

Rising Disposable Incomes: Growing middle-class populations are allocating higher budgets toward pet-related expenditures.

-

Pet Humanization: Shifting perceptions of pets as family members drive premium product and service adoption.

-

Digital Retail Growth: E-commerce platforms and social media marketing are enhancing product accessibility and consumer engagement.

-

Health & Wellness Trends: Demand for specialized diets, supplements, and preventive healthcare is growing alongside human nutrition trends.

-

Urban Lifestyle Changes: Pet-friendly housing and workplace policies encourage ownership among younger, urban professionals.

Market Restraints

-

Price Sensitivity in Emerging Markets: Affordability concerns may limit rapid premiumization in price-sensitive regions.

-

Regulatory Complexity: Varied import regulations and labeling standards across countries can challenge multinational product launches.

-

Infrastructure Gaps: Lack of veterinary clinics and trained professionals in rural and semi-urban areas hampers service growth.

-

Supply Chain Disruptions: Reliance on imported raw materials for high-quality ingredients can create cost and availability volatility.

-

Counterfeit Products: Proliferation of unbranded or adulterated pet foods undermines consumer trust and brand equity.

Market Opportunities

-

Localized Product Innovation: Developing region-specific flavors (e.g., fish-based diets in coastal markets) and functional foods for local pet health concerns.

-

Telemedicine & Digital Health: Virtual vet consultations, remote monitoring devices, and AI-based diagnostics can bridge service gaps in underserved regions.

-

Pet Insurance Expansion: Low current penetration rates (<5% in most APAC markets) point to significant growth potential.

-

Subscription Models: Automated reordering and curated pet boxes foster customer loyalty and lifecycle value.

-

Pet-Friendly Infrastructure: Partnerships with hotels, cafes, and real-estate developers to create pet-friendly environments can stimulate service demand.

Market Dynamics

-

Premiumization vs. Mass Market: A dual strategy where premium brands target urban elites while value brands focus on broader demographics.

-

Omni-Channel Integration: Blending brick-and-mortar pet stores, veterinary clinics, and online platforms to deliver seamless shopping experiences.

-

Collaborations & Partnerships: Alliances between pet food manufacturers and veterinary chains to co-develop therapeutic diets.

-

Sustainability Focus: Rising interest in eco-friendly packaging, responsibly sourced ingredients, and carbon-neutral production.

-

Technology Adoption: Use of AI for personalized nutrition recommendations and IoT devices for activity monitoring.

Regional Analysis

-

East Asia: Japan and South Korea lead in per-capita spending, with established premium markets and advanced veterinary infrastructure.

-

Greater China: Rapidly evolving market; digital giants like Alibaba and JD.com dominate e-commerce, while local brands innovate with traditional herbal supplements.

-

Southeast Asia: Indonesia, Thailand, and Vietnam show high growth rates driven by digital adoption and rising pet adoption among millennials.

-

South Asia: India’s market is nascent but expanding quickly, with opportunity for affordable premium products and tele-vet services.

-

Oceania: Australia and New Zealand have mature markets with high organic and natural pet care penetration, setting innovation benchmarks.

Competitive Landscape

Leading Companies in the Asia Pacific Pet Care Market:

- Mars, Incorporated

- Nestlé Purina PetCare Company

- Hill’s Pet Nutrition, Inc.

- The J.M. Smucker Company

- Colgate-Palmolive Company

- Unicharm Corporation

- Charoen Pokphand Group

- Blue Buffalo Company Ltd.

- WellPet LLC

- Spectrum Brands Holdings, Inc.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

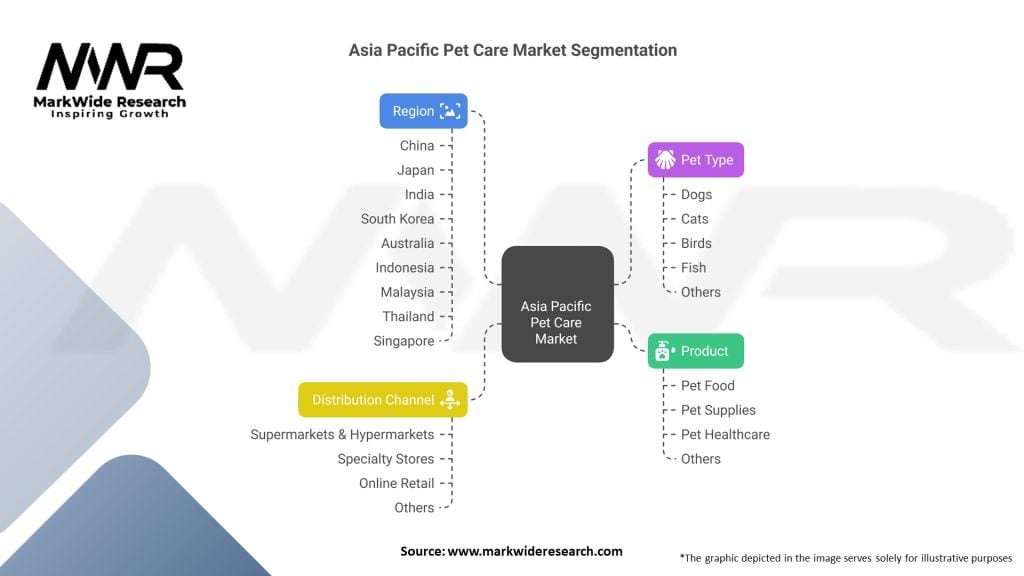

Segmentation

-

By Product Type: Dry Food, Wet Food, Treats & Snacks, Supplements, Grooming & Hygiene, Accessories & Toys

-

By Distribution Channel: Hypermarkets/Supermarkets, Specialty Pet Stores, Veterinary Clinics, E-commerce, Others (Convenience Stores)

-

By Pet Type: Dogs, Cats, Aquatic Pets, Small Mammals, Birds, Others (Reptiles, Exotic Pets)

-

By Country: China, Japan, South Korea, India, Australia & New Zealand, Southeast Asia

Category-wise Insights

-

Dry Food: Dominant segment accounting for over 50% of food sales, driven by convenience and shelf-stability.

-

Wet Food: Rapid growth in East Asia and mature Oceania markets, favored for higher palatability and moisture content.

-

Treats & Snacks: High-margin category benefiting from impulse purchases and health-oriented formulations (e.g., dental chews).

-

Supplements: Increasing adoption of joint, skin, and digestive health supplements aligns with human nutraceutical trends.

-

Grooming & Hygiene: Premium shampoos, conditioners, and dental care products gaining traction in urban centers.

-

Accessories & Toys: Growing demand for smart toys and interactive feeders that promote mental stimulation and exercise.

Key Benefits for Industry Participants and Stakeholders

-

Recurring Revenue: Food and consumable categories deliver stable, repeat-purchase income streams.

-

Brand Loyalty: Personalized nutrition plans and subscription models foster long-term customer retention.

-

Data-Driven Insights: E-commerce platforms provide rich consumer behavior data for targeted marketing and product development.

-

Service Differentiation: Integration of veterinary services, grooming, and training under one roof enhances cross-selling opportunities.

-

Sustainability Leadership: Adoption of green practices and CSR initiatives strengthens brand reputation among eco-conscious consumers.

SWOT Analysis

Strengths:

-

Rapidly growing urban pet ownership

-

Diverse product and channel ecosystems

-

Increasing willingness to spend on pet well-being

Weaknesses:

-

Fragmented market with varying regulations

-

Relatively low pet insurance penetration

-

Infrastructure gaps in veterinary care outside major cities

Opportunities:

-

Digital health: telemedicine, AI-based diagnostics

-

Expansion of premium and natural product lines

-

Development of pet-friendly real-estate and hospitality services

Threats:

-

Economic downturns affecting discretionary spending

-

Supply chain disruptions and rising raw material costs

-

Regulatory changes impacting labeling and ingredient sourcing

Market Key Trends

-

Subscription & D2C Models: Rapid growth of direct-to-consumer subscription boxes and auto-replenishment services.

-

Personalized Nutrition: AI-driven diet formulations based on breed, age, health status, and lifestyle.

-

Tele-Veterinary Services: Rising acceptance of virtual consultations and remote monitoring apps.

-

Sustainable Packaging: Shift toward biodegradable bags and refill systems for food and litter.

-

Pet Tech Integration: Wearables and smart feeders that track activity, diet, and health metrics in real time.

Covid-19 Impact

The pandemic led to a surge in pet adoption as lockdowns prompted companionship needs, boosting initial sales of food, accessories, and toys. Simultaneously, concerns over clinic visits accelerated tele-veterinary adoption and e-commerce penetration. Although supply chain constraints temporarily affected premium imports, local production and digital platforms filled gaps, creating lasting shifts toward online purchasing and home-delivery models.

Key Industry Developments

-

Nestlé Purina opened a new R&D center in Singapore in 2023 focused on Asia-specific formulations and gut-health research.

-

Mars Petcare launched subscription services via JD Health in China, integrating pet health records with purchase history.

-

Godrej Tyson expanded its manufacturing capacity in India to meet rising demand for mid-premium dry food.

-

FirstPet (Singapore) secured Series A funding to develop AI-based nutrition recommendation engines and tele-vet offerings.

Analyst Suggestions

-

Localize Product Portfolios: Tailor formulations to regional taste preferences and nutritional needs, leveraging local ingredient sourcing.

-

Strengthen Omni-Channel Strategies: Seamlessly integrate in-store, online, and mobile app experiences to capture diverse consumer touchpoints.

-

Invest in Veterinary Infrastructure: Partner with clinics and training institutes to improve service availability and quality across tier-2/3 cities.

-

Promote Pet Insurance: Develop affordable insurance products bundled with subscription packages to increase penetration.

-

Enhance Sustainability: Commit to eco-certifications, circular packaging, and carbon-neutral operations to resonate with environmentally conscious buyers.

Future Outlook

The Asia Pacific Pet Care market is expected to continue its robust expansion, outpacing global growth rates as pet humanization deepens and digital ecosystems mature. Emerging trends such as personalized nutrition, telemedicine, and sustainable practices will shape competitive dynamics. Investments in veterinary education and infrastructure will broaden service access beyond urban centers, unlocking new customer segments. Meanwhile, collaborations between pet care stakeholders, technology providers, and government bodies can foster pet-friendly policies that support long-term market development.

Conclusion

In conclusion, the Asia Pacific Pet Care market presents a compelling growth story driven by socio-cultural shifts, economic development, and technological innovation. Stakeholders who leverage data-driven insights, deliver localized and sustainable offerings, and build integrated service networks will lead in this vibrant, evolving landscape. As pets increasingly become cherished family members, the demand for high-quality products and services will remain resilient, offering abundant opportunities for market participants across the region.