444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific paints and coatings additives market represents one of the most dynamic and rapidly expanding sectors within the global chemical industry. This comprehensive market encompasses a diverse range of specialized chemical compounds designed to enhance the performance, durability, and aesthetic properties of paints and coatings across multiple applications. The region’s robust industrial growth, coupled with increasing urbanization and infrastructure development, has positioned Asia-Pacific as a dominant force in the global paints and coatings additives landscape.

Market dynamics in the Asia-Pacific region are characterized by strong demand from emerging economies, particularly China, India, and Southeast Asian nations. The market is experiencing substantial growth driven by expanding construction activities, automotive manufacturing, and industrial production. Growth projections indicate the market is expanding at a compound annual growth rate (CAGR) of 6.8%, significantly outpacing global averages and reflecting the region’s economic vitality.

Regional leadership in manufacturing capabilities has established Asia-Pacific as both a major consumer and producer of paints and coatings additives. Countries like China and India account for approximately 62% of regional market share, while emerging markets in Southeast Asia contribute an additional 18% market penetration. The market’s expansion is further supported by increasing environmental regulations that drive demand for eco-friendly and sustainable additive solutions.

The Asia-Pacific paints and coatings additives market refers to the comprehensive ecosystem of specialized chemical compounds, agents, and materials that are incorporated into paint and coating formulations to enhance their functional properties, performance characteristics, and application efficiency across the Asia-Pacific geographical region.

These additives serve multiple critical functions including improving flow and leveling properties, enhancing durability and weather resistance, providing antimicrobial protection, optimizing color stability, and facilitating easier application processes. The market encompasses various additive categories such as rheology modifiers, dispersants, defoamers, biocides, UV stabilizers, and anti-corrosion agents that are essential for modern paint and coating formulations.

Geographical scope includes major economies such as China, Japan, India, South Korea, Australia, and Southeast Asian nations including Thailand, Malaysia, Indonesia, and Vietnam. The market serves diverse end-use industries including architectural coatings, automotive refinish, industrial coatings, marine applications, and specialty coating segments that require enhanced performance characteristics.

The Asia-Pacific paints and coatings additives market demonstrates exceptional growth momentum driven by rapid industrialization, urbanization trends, and increasing quality standards across multiple application sectors. The market benefits from strong demand fundamentals supported by expanding construction activities, growing automotive production, and rising consumer awareness regarding high-performance coating solutions.

Key market drivers include infrastructure development initiatives, particularly in emerging economies, which account for approximately 45% of total demand growth. The automotive sector represents another significant growth catalyst, with electric vehicle production and advanced coating requirements driving innovation in additive technologies. Environmental regulations promoting sustainable and low-VOC formulations are reshaping product development strategies across the region.

Technological advancement remains a critical success factor, with manufacturers investing heavily in research and development to create next-generation additives that meet evolving performance requirements. The market is characterized by increasing consolidation among major players, strategic partnerships, and expansion of production capabilities to serve growing regional demand. Market penetration of advanced additive technologies has reached 73% adoption rates in developed markets within the region.

Strategic market insights reveal several critical trends shaping the Asia-Pacific paints and coatings additives landscape. The following key insights provide comprehensive understanding of market dynamics:

Primary market drivers propelling the Asia-Pacific paints and coatings additives market include robust economic growth, expanding industrial base, and increasing infrastructure investments across the region. The construction sector serves as a fundamental growth engine, with massive urbanization projects and smart city initiatives creating substantial demand for high-performance coating solutions.

Automotive industry expansion represents another significant driver, particularly with the region’s leadership in electric vehicle manufacturing and advanced automotive technologies. The growing emphasis on vehicle aesthetics, durability, and environmental performance is driving demand for specialized additives that enhance coating properties. Manufacturing growth in electronics, machinery, and consumer goods sectors further amplifies market demand.

Environmental consciousness and regulatory compliance are increasingly important drivers, pushing manufacturers toward sustainable and eco-friendly additive solutions. Government initiatives promoting green building standards and environmental protection are creating new market opportunities for bio-based and low-emission additives. Quality standards evolution in emerging markets is also driving adoption of advanced additive technologies previously limited to developed economies.

Technological advancement in coating applications, including smart coatings, self-healing materials, and multifunctional surfaces, is creating demand for innovative additive solutions. The region’s strong research and development capabilities, combined with favorable manufacturing costs, position Asia-Pacific as a global innovation hub for paints and coatings additives.

Market restraints affecting the Asia-Pacific paints and coatings additives market include volatile raw material prices, stringent environmental regulations, and increasing competition from alternative technologies. Raw material volatility poses significant challenges for manufacturers, particularly regarding petroleum-based chemicals and specialty compounds that form the backbone of many additive formulations.

Regulatory complexity across different countries within the Asia-Pacific region creates compliance challenges for manufacturers operating in multiple markets. Varying environmental standards, safety requirements, and registration procedures increase operational costs and complexity. The transition toward more stringent environmental regulations requires substantial investment in research and development of compliant formulations.

Technical challenges associated with developing additives that meet diverse performance requirements while maintaining cost-effectiveness present ongoing constraints. The need to balance functionality, environmental compliance, and economic viability requires continuous innovation and significant research investment. Market fragmentation in some regional markets also limits economies of scale and increases distribution costs.

Competition from substitute materials and alternative coating technologies poses potential threats to traditional additive demand. The emergence of powder coatings, UV-cured systems, and other advanced coating technologies may reduce dependence on certain traditional additives. Additionally, economic uncertainties and trade tensions can impact market growth and investment decisions across the region.

Significant market opportunities exist within the Asia-Pacific paints and coatings additives market, driven by emerging applications, technological innovations, and expanding end-use industries. The development of smart coatings and functional surfaces presents substantial growth potential, particularly in electronics, healthcare, and advanced manufacturing applications.

Sustainability trends create opportunities for bio-based and renewable additive solutions that meet environmental requirements while delivering superior performance. The growing emphasis on circular economy principles and waste reduction opens new avenues for recycled and upcycled additive materials. Green building initiatives across the region are driving demand for low-emission and environmentally friendly coating additives.

Infrastructure development in emerging economies presents massive opportunities for market expansion, particularly in countries investing heavily in transportation, energy, and urban development projects. The region’s leadership in renewable energy installations, including solar and wind power, creates demand for specialized protective coatings and associated additives.

Digital transformation opportunities include development of smart additives with sensing capabilities, self-reporting properties, and adaptive functionality. The integration of Internet of Things (IoT) technologies with coating systems opens new possibilities for monitoring, maintenance, and performance optimization. Customization trends in various industries create opportunities for specialized additive solutions tailored to specific application requirements.

Market dynamics in the Asia-Pacific paints and coatings additives sector are characterized by complex interactions between supply chain factors, technological evolution, regulatory changes, and economic conditions. The region’s manufacturing excellence and cost advantages continue to attract global investment and production capacity expansion.

Supply chain dynamics are influenced by raw material availability, logistics infrastructure, and trade relationships within the region. The concentration of chemical manufacturing in key countries like China and India creates both opportunities and vulnerabilities in supply chain management. Demand patterns show increasing sophistication, with end-users requiring more specialized and high-performance additive solutions.

Competitive dynamics involve both global multinational corporations and regional players competing across different market segments. Innovation cycles are accelerating, with companies investing heavily in research and development to maintain competitive advantages. Price dynamics reflect raw material costs, manufacturing efficiency, and competitive positioning strategies.

Regulatory dynamics continue evolving toward stricter environmental and safety standards, influencing product development and market access requirements. The harmonization of standards across different countries within the region presents both challenges and opportunities for market participants. Technology adoption rates vary significantly across different countries and applications, with developed markets showing 85% penetration of advanced additive technologies compared to 45% adoption in emerging markets.

Research methodology employed for analyzing the Asia-Pacific paints and coatings additives market incorporates comprehensive primary and secondary research approaches to ensure accuracy, reliability, and depth of market insights. The methodology combines quantitative analysis with qualitative assessment to provide holistic market understanding.

Primary research involves extensive interviews with industry executives, technical experts, end-users, and key stakeholders across the value chain. This includes manufacturers, distributors, application specialists, and regulatory authorities to gather firsthand insights into market trends, challenges, and opportunities. Survey methodologies target specific market segments and geographical regions to ensure representative data collection.

Secondary research encompasses analysis of industry reports, company financial statements, patent databases, regulatory filings, and trade statistics. This approach provides comprehensive market sizing, competitive landscape analysis, and trend identification. Data validation processes include cross-referencing multiple sources and expert verification to ensure accuracy and reliability.

Analytical frameworks include market modeling, trend analysis, competitive benchmarking, and scenario planning to provide forward-looking insights. The methodology incorporates both bottom-up and top-down approaches for market sizing and segmentation analysis. Quality assurance measures ensure data integrity and analytical rigor throughout the research process.

Regional analysis of the Asia-Pacific paints and coatings additives market reveals significant variations in market maturity, growth rates, and application preferences across different countries and sub-regions. China dominates the regional market with approximately 42% market share, driven by massive manufacturing capacity and domestic demand from construction and automotive sectors.

India represents the second-largest market with 20% regional share, characterized by rapid growth in infrastructure development and increasing quality standards in coating applications. The country’s expanding automotive industry and growing awareness of high-performance coatings drive substantial demand for specialized additives. Japan maintains technological leadership with focus on advanced and specialty additive solutions.

Southeast Asian markets collectively account for 23% of regional demand, with Thailand, Malaysia, and Indonesia leading growth in industrial and architectural applications. These markets show strong potential for expansion driven by economic development and infrastructure investments. South Korea demonstrates strength in automotive and electronics applications, while Australia focuses on architectural and marine coating segments.

Growth patterns vary significantly across the region, with emerging markets showing higher growth rates compared to mature economies. The regional distribution reflects economic development levels, industrial base strength, and regulatory environment differences. Market penetration of advanced additives shows 78% adoption in developed markets versus 34% penetration in emerging economies.

The competitive landscape of the Asia-Pacific paints and coatings additives market features a mix of global multinational corporations, regional leaders, and specialized niche players competing across different market segments and geographical areas. Market leadership is characterized by technological innovation, manufacturing scale, and distribution network strength.

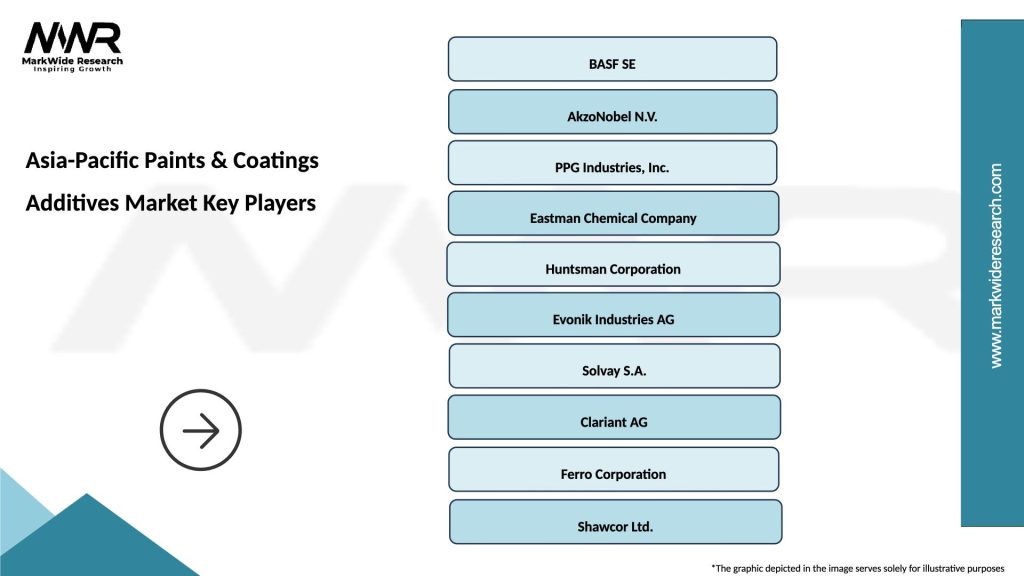

Major market participants include:

Competitive strategies focus on innovation, strategic partnerships, capacity expansion, and market penetration in emerging economies. Companies are investing heavily in research and development to create next-generation additive solutions that meet evolving market requirements. Market consolidation continues through mergers, acquisitions, and strategic alliances to strengthen market positions and expand geographical reach.

Market segmentation of the Asia-Pacific paints and coatings additives market provides detailed analysis across multiple dimensions including product type, application, end-use industry, and geographical distribution. This comprehensive segmentation enables precise market understanding and targeted strategy development.

By Product Type:

By Application:

By End-Use Industry:

Category-wise analysis reveals distinct market dynamics and growth patterns across different additive types and application segments within the Asia-Pacific paints and coatings additives market. Each category demonstrates unique characteristics, growth drivers, and competitive dynamics.

Rheology Modifiers represent the largest category, driven by increasing demand for improved application properties and surface finish quality. This segment benefits from growing sophistication in coating applications and user expectations for enhanced performance. Innovation focus centers on developing modifiers that provide multiple benefits including improved flow, leveling, and sag resistance.

Dispersants category shows strong growth driven by increasing use of high-performance pigments and fillers in coating formulations. The segment benefits from trends toward higher opacity, improved color development, and enhanced durability requirements. Technology advancement focuses on developing dispersants that work effectively with a broader range of pigment types and coating systems.

Biocides segment demonstrates rapid growth driven by increasing awareness of antimicrobial properties and preservation requirements. This category benefits from healthcare facility expansion, food processing industry growth, and consumer awareness of hygiene importance. Regulatory compliance remains a critical factor influencing product development and market access in this segment.

UV Stabilizers show increasing importance driven by outdoor application growth and durability requirements. The segment benefits from infrastructure development, automotive industry expansion, and increasing quality standards. Performance enhancement focuses on developing stabilizers that provide long-term protection while maintaining coating aesthetics and functionality.

Industry participants and stakeholders in the Asia-Pacific paints and coatings additives market benefit from numerous advantages including access to rapidly growing markets, technological innovation opportunities, and diverse application potential across multiple end-use industries.

For Manufacturers:

For End Users:

For Investors:

SWOT Analysis provides comprehensive evaluation of the Asia-Pacific paints and coatings additives market’s internal strengths and weaknesses, along with external opportunities and threats that influence market development and competitive positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the Asia-Pacific paints and coatings additives market reflect evolving customer requirements, technological advancement, regulatory changes, and sustainability considerations that influence product development and market dynamics.

Sustainability Integration represents the most significant trend, with increasing demand for bio-based, renewable, and environmentally friendly additive solutions. Manufacturers are investing heavily in developing sustainable alternatives that maintain performance while reducing environmental impact. Circular economy principles are driving innovation in recycled and upcycled additive materials.

Smart Coating Technologies are gaining momentum with development of additives that enable self-healing, self-cleaning, and responsive coating properties. These advanced technologies find applications in automotive, electronics, and architectural segments where enhanced functionality provides competitive advantages. Nanotechnology integration is enabling development of additives with superior performance characteristics.

Digitalization and Industry 4.0 trends are transforming manufacturing processes, quality control, and customer interaction. Digital technologies enable precise additive dosing, real-time quality monitoring, and predictive maintenance capabilities. Data analytics are improving formulation optimization and application performance prediction.

Customization and Specialization trends reflect increasing demand for application-specific additive solutions tailored to unique performance requirements. This trend drives development of specialized products for niche applications and creates opportunities for premium pricing. Technical service integration becomes increasingly important for market differentiation.

Key industry developments in the Asia-Pacific paints and coatings additives market include strategic investments, technological breakthroughs, regulatory changes, and market expansion initiatives that shape competitive dynamics and growth prospects.

Capacity Expansion Projects represent significant industry developments, with major manufacturers investing in new production facilities and expanding existing operations to meet growing regional demand. These investments focus on advanced manufacturing technologies and sustainable production processes. Strategic locations are selected to optimize supply chain efficiency and market access.

Technology Partnerships and collaborations are increasing between additive manufacturers, coating companies, and end-users to develop innovative solutions for specific applications. These partnerships accelerate innovation cycles and ensure market relevance of new product developments. Research collaborations with academic institutions are advancing fundamental understanding of additive technologies.

Regulatory Developments include implementation of new environmental standards, safety regulations, and quality requirements that influence product development and market access. Companies are investing in compliance capabilities and developing products that exceed regulatory requirements. Harmonization efforts across different countries are simplifying market access and reducing compliance complexity.

Acquisition Activities continue reshaping the competitive landscape, with companies acquiring specialized technologies, expanding geographical presence, and strengthening market positions. MarkWide Research analysis indicates that merger and acquisition activity has increased by 35% year-over-year, reflecting industry consolidation trends and strategic positioning efforts.

Analyst recommendations for stakeholders in the Asia-Pacific paints and coatings additives market emphasize strategic positioning, innovation investment, and market expansion approaches that capitalize on growth opportunities while managing inherent risks and challenges.

For Market Participants: Focus on developing sustainable and high-performance additive solutions that meet evolving customer requirements and regulatory standards. Invest in research and development capabilities to maintain technological leadership and create differentiated product offerings. Strategic partnerships with end-users and coating manufacturers can accelerate innovation and ensure market relevance.

Geographic Strategy: Prioritize expansion in high-growth emerging markets while maintaining strong positions in developed economies. Develop localized production capabilities and technical support infrastructure to serve regional customers effectively. Market entry strategies should consider regulatory requirements, competitive dynamics, and customer preferences in different countries.

Technology Investment: Allocate significant resources to developing next-generation additive technologies including smart materials, bio-based solutions, and multifunctional additives. Digital transformation initiatives should focus on manufacturing efficiency, quality control, and customer engagement capabilities.

Sustainability Focus: Integrate sustainability considerations into product development, manufacturing processes, and business strategies. Develop comprehensive sustainability portfolios that address environmental concerns while delivering superior performance. Circular economy principles should guide long-term strategic planning and product development initiatives.

Future outlook for the Asia-Pacific paints and coatings additives market remains highly positive, supported by strong economic fundamentals, technological innovation, and expanding application opportunities across multiple end-use industries. The market is positioned for sustained growth driven by urbanization, industrialization, and increasing quality standards.

Growth projections indicate the market will continue expanding at robust rates, with emerging economies leading growth while developed markets focus on high-value and specialized applications. MarkWide Research forecasts suggest the market will maintain a compound annual growth rate of 6.8% over the next five years, reflecting strong demand fundamentals and favorable market conditions.

Technology evolution will drive market transformation with increasing adoption of smart additives, sustainable solutions, and multifunctional materials. The integration of digital technologies will enhance manufacturing efficiency, quality control, and customer service capabilities. Innovation cycles are expected to accelerate with shorter development times and faster market introduction of new products.

Market structure will continue evolving through consolidation, strategic partnerships, and vertical integration initiatives. Companies that successfully combine technological innovation, market presence, and sustainability leadership will capture the greatest market opportunities. Competitive advantages will increasingly depend on innovation capabilities, technical service quality, and sustainability credentials.

Regulatory environment will become more stringent with increasing focus on environmental protection, worker safety, and product quality. Companies that proactively address regulatory requirements and exceed compliance standards will benefit from competitive advantages and market access opportunities.

The Asia-Pacific paints and coatings additives market represents a dynamic and rapidly expanding sector with exceptional growth potential driven by robust economic development, technological innovation, and increasing quality standards across multiple application areas. The market benefits from strong demand fundamentals, manufacturing excellence, and favorable cost structures that position the region as a global leader in both production and consumption.

Market dynamics reflect the complex interplay of economic growth, technological advancement, regulatory evolution, and sustainability trends that create both opportunities and challenges for industry participants. The region’s diversity in terms of economic development, market maturity, and application preferences requires sophisticated strategies that address local market conditions while leveraging regional scale advantages.

Strategic success in this market requires focus on innovation, sustainability, and customer collaboration to develop solutions that meet evolving performance requirements while addressing environmental and regulatory considerations. Companies that successfully combine technological leadership, market presence, and operational excellence will capture the greatest opportunities in this expanding market. The future outlook remains highly positive, with sustained growth expected across all major market segments and geographical areas within the Asia-Pacific region.

What is Paints & Coatings Additives?

Paints & Coatings Additives are substances added to paint formulations to enhance properties such as durability, appearance, and application performance. These additives can include surfactants, thickeners, and anti-foaming agents, among others.

What are the key players in the Asia-Pacific Paints & Coatings Additives Market?

Key players in the Asia-Pacific Paints & Coatings Additives Market include BASF SE, Evonik Industries AG, and Dow Inc. These companies are known for their innovative solutions and extensive product portfolios in the coatings sector, among others.

What are the growth factors driving the Asia-Pacific Paints & Coatings Additives Market?

The growth of the Asia-Pacific Paints & Coatings Additives Market is driven by increasing construction activities, rising demand for decorative paints, and the need for environmentally friendly coatings. Additionally, advancements in technology are enhancing product performance.

What challenges does the Asia-Pacific Paints & Coatings Additives Market face?

The Asia-Pacific Paints & Coatings Additives Market faces challenges such as fluctuating raw material prices and stringent environmental regulations. These factors can impact production costs and limit the availability of certain additives.

What opportunities exist in the Asia-Pacific Paints & Coatings Additives Market?

Opportunities in the Asia-Pacific Paints & Coatings Additives Market include the growing trend towards sustainable and eco-friendly products, as well as the increasing demand for high-performance coatings in automotive and industrial applications. Innovations in additive technologies also present new avenues for growth.

What trends are shaping the Asia-Pacific Paints & Coatings Additives Market?

Trends shaping the Asia-Pacific Paints & Coatings Additives Market include the rise of water-based coatings, advancements in nanotechnology, and the increasing focus on sustainability. These trends are influencing product development and consumer preferences in the coatings industry.

Asia-Pacific Paints & Coatings Additives Market

| Segmentation Details | Description |

|---|---|

| Product Type | Emulsifiers, Thickeners, Dispersants, Surfactants |

| Application | Architectural Coatings, Industrial Coatings, Automotive Coatings, Wood Coatings |

| End Use Industry | Construction, Automotive, Furniture, Marine |

| Packaging Type | Drums, Bags, Pails, Containers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Paints & Coatings Additives Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at