444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific outdoor LED lighting market represents one of the most dynamic and rapidly expanding segments within the global lighting industry. This region has emerged as a powerhouse for LED technology adoption, driven by massive urbanization initiatives, smart city developments, and increasing environmental consciousness across diverse economies. Market dynamics indicate sustained growth momentum with the region experiencing a 12.8% CAGR over the forecast period, significantly outpacing global averages.

Regional characteristics showcase remarkable diversity, with developed markets like Japan and South Korea leading in technological innovation, while emerging economies including India, Vietnam, and Indonesia drive volume growth through infrastructure expansion. The market encompasses various outdoor applications including street lighting, architectural illumination, sports facilities, and commercial outdoor spaces. Government initiatives across multiple countries have accelerated LED adoption through energy efficiency mandates and sustainability programs.

Technological advancement remains a cornerstone of market evolution, with smart lighting solutions, IoT integration, and advanced control systems gaining substantial traction. The region’s manufacturing capabilities, particularly in China, Taiwan, and South Korea, have established Asia Pacific as both a major consumer and global supplier of outdoor LED lighting solutions. Market penetration varies significantly across countries, with urban areas showing 78% LED adoption rates while rural regions present substantial growth opportunities.

The Asia Pacific outdoor LED lighting market refers to the comprehensive ecosystem encompassing the design, manufacturing, distribution, and installation of light-emitting diode technology for exterior illumination applications across the Asia Pacific region. This market includes various product categories such as street lights, floodlights, wall-mounted fixtures, landscape lighting, and specialized outdoor lighting solutions designed for harsh environmental conditions.

Market scope extends beyond traditional lighting applications to include smart lighting systems integrated with sensors, wireless connectivity, and automated control mechanisms. The definition encompasses both retrofit solutions for existing infrastructure and new installations in developing urban and rural areas. Geographic coverage includes major economies such as China, Japan, India, South Korea, Australia, and Southeast Asian nations, each contributing unique market characteristics and growth drivers.

Technology integration within this market includes advanced LED chips, sophisticated driver electronics, weather-resistant housing materials, and intelligent control systems. The market also encompasses related services including installation, maintenance, and energy management solutions that support the complete outdoor LED lighting ecosystem throughout the Asia Pacific region.

Strategic positioning of the Asia Pacific outdoor LED lighting market demonstrates exceptional growth potential driven by accelerating urbanization, government sustainability initiatives, and technological innovation. The region’s diverse economic landscape creates multiple growth vectors, from high-tech smart city implementations in developed markets to large-scale infrastructure projects in emerging economies. Market leadership is distributed among global manufacturers and regional players, with Chinese companies holding significant manufacturing advantages.

Key growth drivers include mandatory energy efficiency regulations affecting 85% of major cities across the region, substantial infrastructure investments, and increasing awareness of environmental benefits. The transition from traditional lighting technologies continues at an accelerated pace, with LED solutions offering superior energy efficiency, longer operational life, and reduced maintenance requirements. Smart lighting adoption represents a critical differentiator, with connected solutions gaining momentum in urban planning initiatives.

Market challenges include price sensitivity in cost-conscious markets, quality concerns with lower-tier products, and the need for skilled installation and maintenance personnel. However, these challenges are being addressed through improved manufacturing standards, competitive pricing strategies, and comprehensive training programs. Future outlook remains highly positive, with continued technological advancement and expanding application areas supporting sustained market expansion across the Asia Pacific region.

Market intelligence reveals several critical insights shaping the Asia Pacific outdoor LED lighting landscape:

Government initiatives serve as the primary catalyst for market expansion, with numerous countries implementing comprehensive LED adoption programs. These initiatives include financial incentives, regulatory mandates, and public-private partnerships designed to accelerate the transition from conventional lighting technologies. Energy efficiency requirements have become increasingly stringent, with many jurisdictions requiring significant reductions in public lighting energy consumption.

Urbanization trends across the Asia Pacific region create continuous demand for outdoor lighting infrastructure. Rapid city expansion, new residential developments, and commercial construction projects require modern lighting solutions that meet contemporary efficiency and aesthetic standards. Smart city development programs integrate outdoor LED lighting as a fundamental component of intelligent urban infrastructure, supporting data collection, connectivity, and automated management systems.

Economic development in emerging markets drives infrastructure investment, including comprehensive outdoor lighting installations for roads, public spaces, and commercial areas. Rising disposable incomes and improved living standards increase demand for quality outdoor lighting in residential and recreational applications. Environmental awareness continues growing among consumers, businesses, and government entities, creating preference for sustainable lighting technologies that reduce carbon emissions and environmental impact.

Technological advancement in LED efficiency, smart controls, and system integration creates compelling value propositions for end users. Improved product performance, extended operational life, and reduced maintenance requirements justify investment in LED technology upgrades. Cost reduction in LED manufacturing has made these solutions increasingly accessible across diverse market segments and geographic regions.

Initial investment costs remain a significant barrier for price-sensitive markets, particularly in developing economies where budget constraints limit large-scale LED adoption. While total cost of ownership favors LED technology, the higher upfront investment can deter immediate adoption, especially for projects with limited financing options. Quality concerns with lower-cost LED products have created market hesitation, as poor-quality solutions can result in premature failures and disappointing performance.

Technical complexity associated with advanced LED lighting systems requires specialized knowledge for proper installation, configuration, and maintenance. The shortage of trained technicians and engineers familiar with LED technology creates implementation challenges and can increase project costs. Infrastructure limitations in some regions may not support advanced LED lighting systems, particularly smart lighting solutions requiring robust electrical and communication networks.

Market fragmentation with numerous manufacturers offering varying quality levels creates confusion among buyers and complicates procurement decisions. The presence of counterfeit and substandard products undermines market confidence and can damage the reputation of legitimate LED solutions. Regulatory inconsistencies across different countries and regions create compliance challenges for manufacturers and limit standardization benefits.

Competition from alternative technologies and improved conventional lighting solutions can slow LED adoption in certain applications. Additionally, economic uncertainties and fluctuating currency exchange rates can impact investment decisions and project financing, particularly for large-scale infrastructure initiatives requiring substantial capital commitments.

Smart city initiatives present unprecedented opportunities for integrated outdoor LED lighting solutions that support multiple urban functions beyond basic illumination. These systems can incorporate environmental monitoring, traffic management, public safety features, and communication infrastructure, creating substantial value-added revenue streams. Rural electrification programs across developing countries offer significant market expansion potential as governments invest in basic infrastructure development.

Retrofit markets in established urban areas provide continuous opportunities for LED upgrades as existing lighting systems reach end-of-life or fail to meet new efficiency standards. The replacement cycle for outdoor lighting creates predictable demand patterns that support business planning and market development strategies. Specialized applications including sports facilities, architectural lighting, and landscape illumination offer premium pricing opportunities for advanced LED solutions.

Energy service companies (ESCOs) are creating new business models that reduce financial barriers for LED adoption through performance-based contracts and shared savings arrangements. These models enable large-scale LED deployments without requiring significant upfront investment from end users. Integration opportunities with renewable energy systems, particularly solar-powered LED lighting, align with sustainability goals and reduce operational costs.

Export potential for regional manufacturers continues expanding as Asia Pacific companies develop competitive advantages in LED technology and manufacturing efficiency. Emerging applications such as horticultural lighting, aquaculture illumination, and specialized industrial outdoor lighting create niche market opportunities with higher margins and reduced competition.

Competitive dynamics within the Asia Pacific outdoor LED lighting market reflect intense competition among global and regional players, driving continuous innovation and price optimization. Market leaders maintain advantages through advanced technology, comprehensive product portfolios, and established distribution networks, while emerging companies compete through specialized solutions and competitive pricing strategies. Supply chain integration has become increasingly important, with successful companies controlling key components and manufacturing processes.

Technology evolution continues reshaping market dynamics as LED efficiency improvements, smart lighting capabilities, and system integration advance rapidly. Companies investing in research and development maintain competitive advantages, while those relying on commodity products face increasing margin pressure. Customer expectations are evolving toward comprehensive solutions that include installation, maintenance, and performance monitoring services.

Regulatory environment changes create both opportunities and challenges, with energy efficiency mandates driving demand while quality standards increase compliance requirements. Market consolidation trends are emerging as larger companies acquire specialized manufacturers and technology developers to strengthen their competitive positions. Partnership strategies between lighting manufacturers, technology companies, and system integrators are becoming more common to deliver complete outdoor lighting solutions.

Price dynamics reflect ongoing cost reductions in LED manufacturing balanced against increasing demand for advanced features and higher quality standards. Geographic expansion strategies focus on emerging markets with substantial infrastructure development needs while maintaining presence in mature markets through premium product offerings and value-added services.

Comprehensive research approach employed for analyzing the Asia Pacific outdoor LED lighting market combines primary and secondary research methodologies to ensure accuracy and reliability of market insights. Primary research includes extensive interviews with industry executives, government officials, distributors, installers, and end users across major markets within the Asia Pacific region. This direct engagement provides current market perspectives and validates secondary research findings.

Secondary research encompasses analysis of government publications, industry reports, company financial statements, trade association data, and regulatory documents from relevant authorities across the region. Market sizing methodology utilizes multiple data sources and validation techniques to ensure accuracy of market assessments and growth projections. Cross-referencing of data sources helps eliminate inconsistencies and provides confidence in research conclusions.

Geographic coverage includes detailed analysis of major markets including China, Japan, India, South Korea, Australia, Thailand, Malaysia, Singapore, Indonesia, Philippines, and Vietnam. Segmentation analysis examines market dynamics across product types, applications, end users, and distribution channels to provide comprehensive market understanding. Competitive intelligence involves detailed profiling of key market participants, including analysis of their strategies, capabilities, and market positioning.

Data validation processes include triangulation of information sources, expert review panels, and statistical analysis to ensure research quality and reliability. Market forecasting employs econometric modeling techniques that consider historical trends, current market conditions, and future growth drivers to project market development scenarios.

China dominates the Asia Pacific outdoor LED lighting market with approximately 45% regional market share, driven by massive infrastructure development, government LED promotion policies, and strong manufacturing capabilities. The country’s smart city initiatives encompass hundreds of cities, creating substantial demand for advanced outdoor LED lighting solutions. Manufacturing concentration in China provides cost advantages and rapid innovation cycles, supporting both domestic consumption and export activities.

Japan represents a mature market characterized by high-quality standards, advanced technology adoption, and premium product preferences. The country’s focus on energy efficiency and disaster-resilient infrastructure drives demand for reliable outdoor LED lighting solutions. South Korea demonstrates strong growth in smart lighting applications, with significant investments in connected outdoor lighting systems and IoT integration.

India exhibits exceptional growth potential with government initiatives promoting LED adoption across urban and rural areas. The country’s Smart Cities Mission and street lighting replacement programs create substantial market opportunities. Southeast Asian markets including Thailand, Malaysia, Indonesia, and Vietnam show rapid growth driven by urbanization, infrastructure development, and increasing environmental awareness.

Australia and New Zealand represent developed markets with stringent quality requirements and strong preference for energy-efficient solutions. These markets emphasize long-term performance and sustainability, creating opportunities for premium LED lighting products. Regional trade dynamics facilitate technology transfer and market access, with free trade agreements supporting cross-border business development and investment flows.

Market leadership in the Asia Pacific outdoor LED lighting sector is distributed among several categories of companies, each with distinct competitive advantages and market positioning strategies. The competitive environment reflects a mix of global lighting giants, regional specialists, and emerging technology companies.

Competitive strategies vary significantly, with global companies emphasizing technology leadership and comprehensive solutions, while regional players focus on cost competitiveness and local market knowledge. Innovation focus areas include smart lighting capabilities, improved energy efficiency, and integrated system solutions that address multiple urban infrastructure needs.

Product segmentation within the Asia Pacific outdoor LED lighting market encompasses diverse categories designed for specific applications and performance requirements:

By Product Type:

By Application:

By Technology:

Street lighting category represents the largest segment within the Asia Pacific outdoor LED lighting market, driven by extensive government infrastructure programs and mandatory efficiency upgrades. This category benefits from standardized specifications, bulk procurement opportunities, and predictable replacement cycles. Smart street lighting is gaining significant traction with 28% annual growth in connected installations across major cities.

Floodlighting applications demonstrate strong growth in sports and entertainment facilities, construction projects, and industrial applications. The category benefits from increasing investment in recreational infrastructure and growing emphasis on safety and security lighting. Architectural lighting represents a premium segment with higher margins and specialized design requirements, particularly popular in developed markets with strong aesthetic preferences.

Landscape lighting shows robust growth driven by urban beautification projects, tourism development, and increasing residential outdoor lighting adoption. This category offers opportunities for creative design solutions and premium pricing strategies. Industrial outdoor lighting benefits from manufacturing sector expansion and increasing safety regulations requiring adequate facility illumination.

Solar LED lighting represents a rapidly growing category, particularly attractive for remote locations and areas with unreliable electrical infrastructure. This segment combines sustainability benefits with operational independence, making it popular for rural applications and environmentally conscious projects. Emergency and security lighting applications continue expanding as safety requirements become more stringent across various facility types.

Manufacturers benefit from expanding market opportunities driven by infrastructure development, technology advancement, and increasing environmental consciousness. The shift toward LED technology creates sustainable competitive advantages for companies investing in innovation and manufacturing efficiency. Revenue diversification opportunities exist through smart lighting solutions, maintenance services, and integrated system offerings that provide recurring income streams.

Distributors and installers gain from growing market demand and the need for specialized expertise in LED technology deployment. The complexity of modern outdoor LED lighting systems creates value-added service opportunities and stronger customer relationships. Training and certification programs help build competitive advantages and command premium pricing for specialized installation services.

End users realize substantial benefits including reduced energy consumption, lower maintenance costs, improved lighting quality, and enhanced functionality through smart lighting features. Total cost of ownership advantages make LED technology increasingly attractive despite higher initial investment requirements. Government entities achieve sustainability goals, reduce operational expenses, and improve public services through LED adoption.

Technology providers benefit from increasing demand for smart lighting components, control systems, and integration services. The convergence of lighting with IoT, sensors, and communication technologies creates new market opportunities and revenue streams. Financial institutions find opportunities in project financing, ESCO partnerships, and equipment leasing arrangements that support LED market expansion.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart lighting integration represents the most significant trend reshaping the Asia Pacific outdoor LED lighting market, with cities increasingly adopting connected lighting systems that support multiple urban functions. These systems incorporate sensors, wireless communication, and data analytics capabilities that enable remote monitoring, automated control, and integration with other smart city infrastructure. IoT connectivity is becoming standard in new installations, with 42% of new projects including smart features.

Sustainability focus continues intensifying across the region, with governments and organizations prioritizing carbon footprint reduction and environmental responsibility. This trend drives preference for energy-efficient LED solutions and creates opportunities for solar-powered lighting systems. Circular economy principles are influencing product design and end-of-life management strategies for LED lighting products.

Customization and specialization trends reflect growing demand for lighting solutions tailored to specific applications, environments, and aesthetic requirements. Manufacturers are developing specialized products for unique applications such as coastal environments, extreme weather conditions, and heritage building illumination. Human-centric lighting concepts are gaining attention, with LED systems designed to support circadian rhythms and enhance well-being.

Service-oriented business models are emerging as companies shift from product sales to comprehensive lighting solutions including design, installation, maintenance, and performance optimization. Predictive maintenance capabilities enabled by smart lighting systems are creating new service opportunities and improving system reliability. Energy management integration connects outdoor lighting with broader facility and grid management systems for optimized performance.

Technological breakthroughs in LED efficiency and smart lighting capabilities continue advancing market development. Recent innovations include improved LED chip designs achieving higher lumens per watt, advanced optical systems for better light distribution, and integrated sensors for environmental monitoring. Wireless communication protocols specifically designed for outdoor lighting applications are enabling more reliable and cost-effective smart lighting deployments.

Strategic partnerships between lighting manufacturers, technology companies, and system integrators are creating comprehensive solution offerings. These collaborations combine lighting expertise with IoT technology, data analytics, and system integration capabilities to deliver complete smart city lighting solutions. Acquisition activities reflect industry consolidation trends as larger companies acquire specialized technology developers and regional manufacturers.

Government initiatives across multiple countries are accelerating LED adoption through updated building codes, energy efficiency mandates, and financial incentive programs. MarkWide Research analysis indicates that policy support remains a critical factor in market development, with government programs directly influencing adoption rates and technology preferences. International cooperation on LED standards and best practices is improving product quality and market confidence.

Manufacturing investments in advanced production facilities and automation technologies are improving product quality while reducing costs. New manufacturing facilities incorporating Industry 4.0 technologies are enhancing production efficiency and enabling mass customization capabilities. Supply chain optimization efforts are improving component availability and reducing lead times for LED lighting products.

Market participants should prioritize smart lighting capabilities and IoT integration to remain competitive in the evolving outdoor LED lighting landscape. Companies focusing solely on basic LED products face increasing margin pressure and limited growth opportunities. Investment in research and development is essential for maintaining technological leadership and developing differentiated product offerings that command premium pricing.

Geographic expansion strategies should target emerging markets with substantial infrastructure development needs while maintaining strong positions in developed markets through premium products and value-added services. Partnership development with system integrators, technology companies, and local distributors can accelerate market penetration and reduce entry barriers in new markets.

Quality assurance and brand building efforts are crucial for differentiating legitimate products from low-quality alternatives that undermine market confidence. Companies should invest in certification programs, quality testing, and customer education initiatives that demonstrate product reliability and performance advantages. Service capabilities including installation, maintenance, and system optimization should be developed to create recurring revenue streams and strengthen customer relationships.

Sustainability positioning should be integrated into product development and marketing strategies to align with increasing environmental consciousness among customers and regulatory requirements. Financial partnership development with ESCOs and financing institutions can help overcome initial cost barriers and accelerate LED adoption in price-sensitive markets. Technology roadmap planning should anticipate future developments in LED efficiency, smart lighting, and system integration to maintain competitive advantages.

Long-term growth prospects for the Asia Pacific outdoor LED lighting market remain highly positive, supported by continued urbanization, infrastructure development, and technology advancement. The market is expected to maintain robust growth momentum with increasing penetration of smart lighting solutions and expansion into new application areas. Technology evolution will continue driving market development, with improvements in LED efficiency, smart capabilities, and system integration creating new opportunities.

Smart city initiatives across the region will increasingly integrate outdoor LED lighting as a fundamental component of intelligent urban infrastructure. These systems will support multiple functions beyond basic illumination, including environmental monitoring, traffic management, and public safety applications. Connected lighting adoption is projected to reach 65% of new installations by the end of the forecast period.

Market maturation in developed countries will shift focus toward replacement cycles, technology upgrades, and premium solution segments. Emerging markets will continue driving volume growth through new installations and infrastructure expansion projects. Regional manufacturing capabilities will strengthen, with increased local production reducing costs and improving supply chain efficiency.

Regulatory environment will continue evolving toward stricter energy efficiency requirements and quality standards, supporting LED adoption while raising barriers for substandard products. MWR projections indicate that sustainability considerations will become increasingly important in procurement decisions, favoring LED solutions with superior environmental performance. Innovation focus will expand beyond basic lighting functionality to include integrated sensors, communication capabilities, and data analytics features that support smart city objectives.

The Asia Pacific outdoor LED lighting market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by urbanization, government initiatives, and technological advancement. The region’s diverse economic landscape creates multiple growth opportunities, from high-tech smart city implementations in developed markets to large-scale infrastructure projects in emerging economies. Market fundamentals remain strong, with increasing environmental consciousness, energy efficiency mandates, and cost competitiveness supporting continued LED adoption.

Competitive dynamics reflect intense innovation and market development activities, with successful companies investing in smart lighting capabilities, quality assurance, and comprehensive solution offerings. The shift toward connected lighting systems and integrated urban infrastructure creates new revenue opportunities while requiring enhanced technical capabilities and partnership strategies. Regional manufacturing advantages provide cost competitiveness while supporting rapid innovation cycles and market responsiveness.

Future success in this market will depend on companies’ ability to adapt to evolving customer requirements, integrate advanced technologies, and deliver comprehensive solutions that address multiple stakeholder needs. The transition from basic lighting products to intelligent systems supporting smart city objectives represents both a challenge and opportunity for market participants. Strategic positioning should emphasize technology leadership, quality assurance, and service capabilities that create sustainable competitive advantages in this rapidly expanding market. The Asia Pacific outdoor LED lighting market is well-positioned for continued growth and innovation, offering substantial opportunities for companies that can effectively navigate its complexities and capitalize on emerging trends.

What is Outdoor LED Lighting?

Outdoor LED Lighting refers to lighting solutions that utilize light-emitting diodes (LEDs) for outdoor applications, including street lighting, landscape lighting, and architectural illumination. These systems are known for their energy efficiency, longevity, and ability to provide high-quality illumination in various outdoor settings.

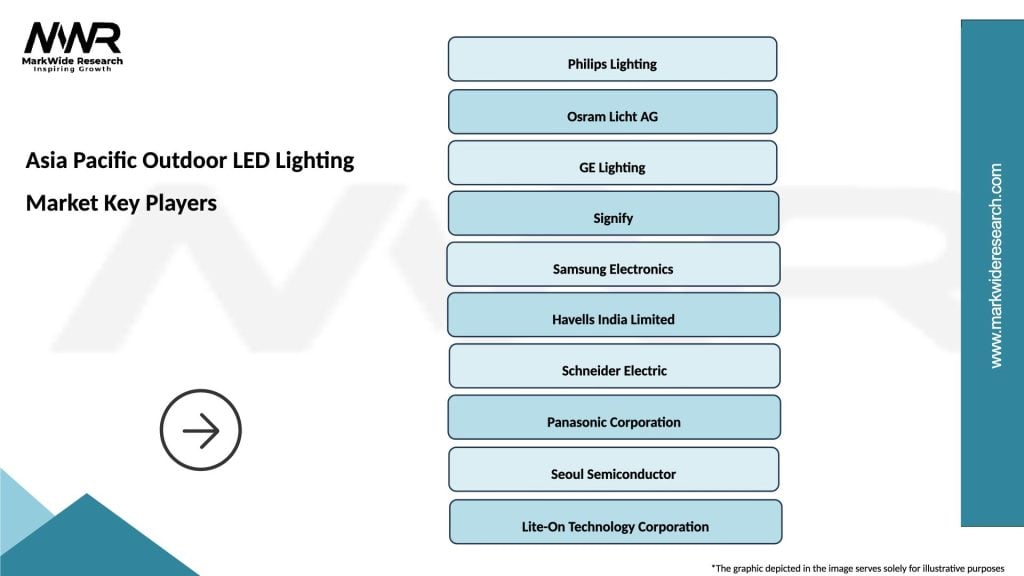

What are the key players in the Asia Pacific Outdoor LED Lighting Market?

Key players in the Asia Pacific Outdoor LED Lighting Market include Philips Lighting, Osram, Cree, and General Electric. These companies are known for their innovative lighting solutions and significant contributions to the development of outdoor LED technologies, among others.

What are the growth factors driving the Asia Pacific Outdoor LED Lighting Market?

The growth of the Asia Pacific Outdoor LED Lighting Market is driven by increasing urbanization, the need for energy-efficient lighting solutions, and government initiatives promoting the adoption of LED technology. Additionally, advancements in smart lighting systems are enhancing the appeal of outdoor LED lighting.

What challenges does the Asia Pacific Outdoor LED Lighting Market face?

Challenges in the Asia Pacific Outdoor LED Lighting Market include high initial installation costs and the presence of traditional lighting systems that are resistant to change. Furthermore, varying regulations across different countries can complicate market entry for new technologies.

What opportunities exist in the Asia Pacific Outdoor LED Lighting Market?

Opportunities in the Asia Pacific Outdoor LED Lighting Market include the growing demand for smart city initiatives and the integration of IoT technologies in lighting systems. Additionally, increasing investments in infrastructure development present significant potential for market expansion.

What trends are shaping the Asia Pacific Outdoor LED Lighting Market?

Trends in the Asia Pacific Outdoor LED Lighting Market include the shift towards smart lighting solutions, the use of solar-powered LED lights, and the increasing focus on sustainable lighting practices. These trends are driven by consumer demand for energy-efficient and environmentally friendly lighting options.

Asia Pacific Outdoor LED Lighting Market

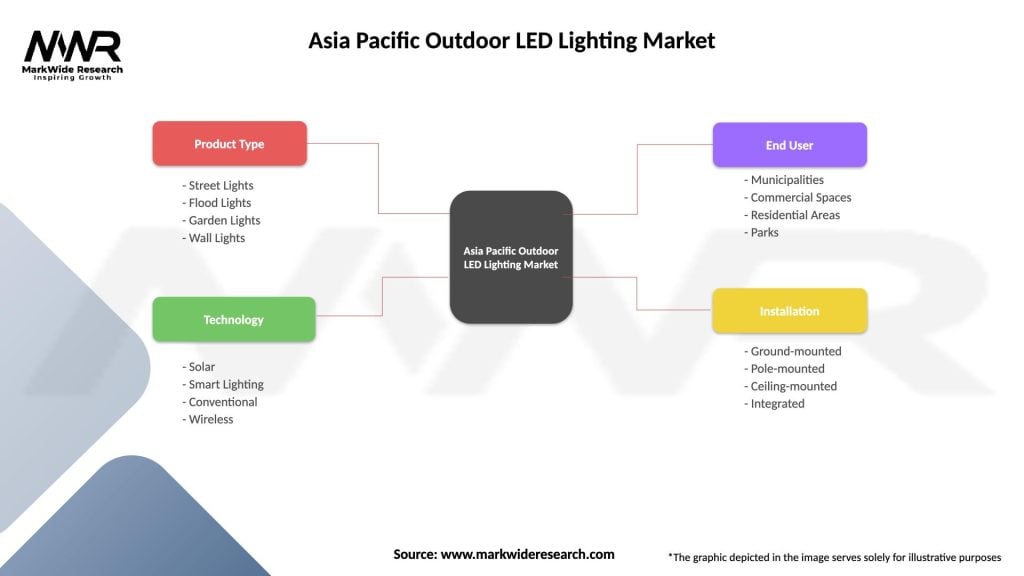

| Segmentation Details | Description |

|---|---|

| Product Type | Street Lights, Flood Lights, Garden Lights, Wall Lights |

| Technology | Solar, Smart Lighting, Conventional, Wireless |

| End User | Municipalities, Commercial Spaces, Residential Areas, Parks |

| Installation | Ground-mounted, Pole-mounted, Ceiling-mounted, Integrated |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Outdoor LED Lighting Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at