444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific oil and gas CAPEX industry market represents one of the most dynamic and rapidly evolving sectors in the global energy landscape. This region encompasses diverse economies including China, India, Japan, Australia, Southeast Asian nations, and other emerging markets that collectively drive substantial capital expenditure in upstream, midstream, and downstream oil and gas operations. Market dynamics indicate robust growth potential driven by increasing energy demand, infrastructure modernization, and strategic investments in exploration and production activities.

Regional characteristics of the Asia Pacific oil and gas CAPEX market reflect varying levels of energy security concerns, technological advancement, and regulatory frameworks across different countries. The market experiences significant influence from both established energy companies and emerging national oil corporations seeking to expand their operational capabilities. Investment patterns show a growing emphasis on sustainable technologies, enhanced recovery techniques, and digital transformation initiatives that optimize operational efficiency.

Growth trajectories across the region demonstrate varying rates of expansion, with some markets experiencing double-digit CAGR growth while others maintain steady, sustainable development patterns. The market benefits from substantial government support, foreign direct investment, and strategic partnerships between international and domestic energy companies. Infrastructure development remains a critical component, with significant capital allocation toward pipeline networks, processing facilities, and storage systems.

The Asia Pacific oil and gas CAPEX industry market refers to the comprehensive ecosystem of capital expenditure activities, investments, and infrastructure development projects within the oil and gas sector across Asia Pacific countries. This market encompasses upstream exploration and production investments, midstream transportation and storage infrastructure, and downstream refining and petrochemical facility development.

CAPEX activities in this context include drilling operations, facility construction, equipment procurement, technology upgrades, and maintenance investments that support long-term operational capabilities. The market represents both traditional energy infrastructure development and emerging investments in cleaner technologies, enhanced recovery systems, and digital transformation initiatives that improve operational efficiency and environmental performance.

Scope definition extends beyond simple capital allocation to include strategic planning, project management, regulatory compliance, and stakeholder engagement activities that facilitate successful energy infrastructure development. The market serves as a critical indicator of regional energy security priorities, economic development strategies, and technological advancement trends across diverse Asia Pacific economies.

Market fundamentals of the Asia Pacific oil and gas CAPEX industry demonstrate strong growth momentum driven by increasing energy consumption, urbanization trends, and economic development across the region. The market benefits from supportive government policies, international investment flows, and technological innovations that enhance operational efficiency and environmental sustainability.

Key growth drivers include rising energy demand from industrial sectors, transportation infrastructure expansion, and residential consumption growth in emerging economies. The market experiences significant investment in upstream exploration activities, particularly in offshore developments, unconventional resources, and enhanced recovery technologies. Downstream investments focus on refinery upgrades, petrochemical integration, and clean fuel production capabilities.

Strategic developments highlight increasing emphasis on digital technologies, automation systems, and environmental compliance solutions that optimize operational performance while reducing environmental impact. The market demonstrates growing integration of renewable energy components, carbon capture technologies, and energy efficiency improvements that align with global sustainability objectives. Investment allocation shows approximately 60% upstream focus with remaining capital distributed across midstream and downstream activities.

Competitive landscape features both international oil companies and national energy corporations pursuing strategic expansion initiatives, technology partnerships, and infrastructure development projects. Market participants increasingly prioritize sustainable development practices, stakeholder engagement, and long-term value creation strategies that support regional energy security objectives.

Primary market insights reveal several critical trends shaping the Asia Pacific oil and gas CAPEX industry landscape:

Economic growth across Asia Pacific economies serves as the fundamental driver for oil and gas CAPEX investments, with expanding industrial sectors, urbanization trends, and rising living standards creating sustained energy demand growth. Population dynamics in major economies contribute to increasing residential and commercial energy consumption, necessitating infrastructure expansion and capacity enhancement investments.

Energy security concerns motivate governments and energy companies to invest in domestic production capabilities, strategic reserves, and diversified supply sources that reduce dependence on energy imports. Geopolitical considerations influence investment priorities toward regional energy cooperation, infrastructure connectivity, and supply chain resilience that support long-term energy security objectives.

Technological advancement opportunities drive capital allocation toward innovative exploration techniques, enhanced recovery systems, and digital transformation initiatives that improve operational efficiency and reduce production costs. Environmental regulations create investment requirements for cleaner technologies, emission reduction systems, and environmental compliance infrastructure that meet evolving regulatory standards.

Infrastructure development needs across emerging economies require substantial capital investment in pipeline networks, processing facilities, and distribution systems that support economic development and energy access expansion. Market integration initiatives facilitate cross-border energy trade, regional cooperation projects, and standardization efforts that enhance market efficiency and investment attractiveness.

Capital intensity requirements for oil and gas projects create significant financial barriers, particularly for smaller companies and emerging market participants seeking to expand their operational capabilities. Project complexity and long development timelines increase investment risks and capital commitment requirements that may deter some market participants from pursuing large-scale development projects.

Regulatory uncertainty across different Asia Pacific markets creates investment hesitation, as changing policies, environmental regulations, and fiscal terms can significantly impact project economics and return expectations. Environmental concerns and social opposition to certain energy projects may delay or prevent infrastructure development, affecting capital allocation and project implementation timelines.

Technology risks associated with emerging technologies and unproven systems can create investment uncertainty, particularly for companies adopting innovative solutions without established performance records. Market volatility in energy prices affects investment decision-making, project financing, and long-term planning strategies that require stable economic conditions for optimal capital allocation.

Skilled workforce shortages in technical and engineering disciplines limit project execution capabilities and may increase labor costs, affecting overall project economics and investment attractiveness. Supply chain constraints and equipment availability issues can delay project implementation and increase capital requirements, particularly during periods of high industry activity.

Digital transformation initiatives present substantial opportunities for companies investing in advanced technologies, automation systems, and data analytics capabilities that optimize operational performance and reduce long-term operating costs. Clean energy integration projects offer growth potential for companies developing hybrid energy systems, carbon capture technologies, and renewable energy components within traditional oil and gas operations.

Emerging market expansion provides significant opportunities for companies with expertise in frontier exploration, infrastructure development, and local partnership strategies that can navigate complex regulatory and cultural environments. Offshore development potential in deepwater and ultra-deepwater regions offers substantial resource opportunities for companies with advanced technical capabilities and financial resources.

Regional integration projects including cross-border pipelines, joint processing facilities, and shared infrastructure development create opportunities for collaborative investment and risk sharing among multiple stakeholders. Technology partnerships between international companies and local firms facilitate knowledge transfer, capability development, and market access that benefit all participants.

Sustainability investments in environmental technologies, emission reduction systems, and circular economy initiatives align with global trends while creating new revenue streams and operational efficiencies. Infrastructure modernization requirements across aging energy systems provide opportunities for companies specializing in upgrade technologies, efficiency improvements, and system integration solutions.

Supply and demand dynamics within the Asia Pacific oil and gas CAPEX market reflect complex interactions between energy consumption growth, production capacity expansion, and infrastructure development requirements. Demand drivers include industrial growth, transportation sector expansion, and residential energy consumption increases that create sustained investment opportunities across the energy value chain.

Investment cycles demonstrate varying patterns across different market segments, with upstream exploration experiencing longer development timelines while downstream projects may offer more predictable investment returns. Capital allocation strategies increasingly emphasize portfolio diversification, risk management, and sustainable development practices that balance short-term returns with long-term value creation.

Competitive dynamics feature both collaboration and competition among market participants, with joint ventures and strategic partnerships becoming increasingly common for large-scale infrastructure projects. Technology adoption rates vary across different companies and regions, with early adopters gaining competitive advantages through improved operational efficiency and reduced costs.

Regulatory influences create both opportunities and constraints, with supportive policies encouraging investment while environmental regulations require additional capital allocation for compliance systems. Market integration trends facilitate regional cooperation and standardization efforts that improve investment efficiency and reduce project risks through shared expertise and resources.

Comprehensive analysis of the Asia Pacific oil and gas CAPEX industry market employs multiple research methodologies including primary data collection, secondary source analysis, and expert consultation to ensure accurate and reliable market insights. Data collection processes involve structured interviews with industry executives, government officials, and technical experts across different Asia Pacific markets.

Primary research activities include surveys of energy companies, equipment suppliers, and service providers to gather firsthand information about investment plans, market trends, and operational challenges. Secondary research incorporates analysis of government reports, industry publications, company financial statements, and regulatory filings to validate primary findings and provide comprehensive market coverage.

Analytical frameworks utilize both quantitative and qualitative assessment methods to evaluate market trends, competitive positioning, and growth opportunities across different market segments and geographic regions. Expert validation processes ensure research findings accuracy through peer review, industry consultation, and cross-reference verification with established market intelligence sources.

Market modeling techniques incorporate statistical analysis, trend projection, and scenario planning to develop reliable forecasts and strategic insights that support decision-making processes. Quality assurance protocols maintain research integrity through systematic fact-checking, source verification, and methodological consistency across all analysis components.

China represents the largest individual market within the Asia Pacific oil and gas CAPEX industry, accounting for approximately 35% of regional investment activity. The Chinese market demonstrates strong government support for energy infrastructure development, substantial domestic energy company investments, and growing emphasis on cleaner technologies and environmental compliance systems.

India emerges as a rapidly growing market with significant investment potential driven by economic expansion, urbanization trends, and energy access improvement initiatives. Indian market dynamics reflect increasing private sector participation, foreign investment attraction, and infrastructure modernization requirements that create substantial CAPEX opportunities across upstream and downstream segments.

Southeast Asian markets including Indonesia, Malaysia, Thailand, and Vietnam collectively represent approximately 25% of regional CAPEX activity, with strong growth potential driven by economic development, energy demand increases, and regional integration initiatives. ASEAN cooperation facilitates cross-border infrastructure projects and standardization efforts that improve investment efficiency.

Australia and Japan maintain significant market positions with advanced technology adoption, substantial offshore development activities, and strong regulatory frameworks that support sustainable energy development. Developed market characteristics include emphasis on operational efficiency, environmental compliance, and technology innovation that influence regional best practices and standards.

Emerging markets across the region including Bangladesh, Pakistan, and smaller island nations present growth opportunities despite infrastructure challenges and regulatory complexity. Market development in these regions requires patient capital, local partnerships, and adaptive strategies that address unique operational and regulatory environments.

Market leadership within the Asia Pacific oil and gas CAPEX industry features a diverse mix of international oil companies, national energy corporations, and specialized service providers competing across different market segments and geographic regions.

Competitive strategies emphasize technology innovation, operational efficiency, and sustainable development practices that create long-term competitive advantages while meeting evolving market requirements and regulatory standards.

By Investment Type:

By Application Sector:

By Technology Focus:

Upstream investments dominate the Asia Pacific oil and gas CAPEX market, representing approximately 55% of total capital allocation across the region. Exploration activities focus increasingly on offshore developments, unconventional resources, and enhanced recovery techniques that maximize resource extraction from existing fields. Production infrastructure investments emphasize modular designs, standardized systems, and digital integration that improve operational efficiency and reduce long-term operating costs.

Midstream development accounts for approximately 25% of regional CAPEX activity, with significant emphasis on pipeline connectivity, storage capacity expansion, and processing facility upgrades. Transportation infrastructure investments focus on regional integration projects, cross-border connectivity, and capacity expansion that support growing energy trade flows. Storage systems development includes strategic reserves, commercial storage, and specialized facilities for LNG and refined products.

Downstream investments represent the remaining 20% of market activity, concentrating on refinery upgrades, petrochemical integration, and retail network expansion. Refining capacity investments emphasize clean fuel production, efficiency improvements, and environmental compliance systems that meet evolving regulatory requirements. Petrochemical development focuses on integrated complexes, specialty products, and value-added processing that enhance profitability and market competitiveness.

Technology integration across all categories demonstrates growing emphasis on digital solutions, automation systems, and data analytics that optimize operational performance while reducing environmental impact and operational risks.

Energy companies benefit from substantial growth opportunities, technology advancement access, and regional market expansion potential that support long-term strategic objectives and shareholder value creation. Operational advantages include improved efficiency, reduced costs, and enhanced safety performance through advanced technology adoption and best practice implementation.

Government stakeholders gain energy security improvements, economic development benefits, and tax revenue generation from increased oil and gas CAPEX activities. Strategic benefits include reduced energy import dependence, job creation, and technology transfer that support national development objectives and economic competitiveness.

Local communities experience economic development, employment opportunities, and infrastructure improvements that enhance quality of life and economic prospects. Social benefits include skills development, local business opportunities, and community investment programs that create lasting positive impact beyond direct energy sector employment.

Equipment suppliers and service providers benefit from increased demand, technology development opportunities, and long-term partnership potential with major energy companies. Business advantages include market expansion, capability development, and revenue diversification that support sustainable business growth and competitive positioning.

Financial institutions gain access to substantial project financing opportunities, risk diversification, and long-term investment returns from energy infrastructure development. Investment benefits include stable cash flows, inflation protection, and portfolio diversification that align with institutional investment objectives and risk management strategies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as the most significant trend reshaping the Asia Pacific oil and gas CAPEX industry, with companies investing heavily in artificial intelligence, machine learning, and IoT systems that optimize operational performance. Automation adoption accelerates across upstream and downstream operations, reducing labor costs while improving safety and efficiency metrics.

Sustainability integration becomes increasingly important, with companies allocating substantial capital toward carbon capture technologies, emission reduction systems, and renewable energy integration projects. Environmental compliance drives investment in advanced monitoring systems, waste management technologies, and ecosystem protection measures that meet evolving regulatory requirements.

Regional cooperation initiatives gain momentum through cross-border pipeline projects, joint development agreements, and shared infrastructure investments that optimize capital allocation and reduce individual company risks. Standardization efforts facilitate equipment interoperability, operational consistency, and cost reduction across different markets and operators.

Modular development approaches become more prevalent, allowing companies to implement scalable solutions, reduce initial capital requirements, and adapt to changing market conditions more effectively. Technology partnerships between international companies and local firms accelerate knowledge transfer, capability development, and market access while reducing investment risks and operational challenges.

Major infrastructure projects across the region demonstrate increasing scale and complexity, with several multi-billion dollar developments advancing through planning and construction phases. Cross-border initiatives including the Trans-ASEAN Gas Pipeline and various LNG terminal developments showcase regional cooperation and integration efforts that benefit multiple stakeholders.

Technology partnerships between leading energy companies and technology providers accelerate innovation adoption and capability development across the industry. Digital platform implementations enable real-time monitoring, predictive maintenance, and optimized decision-making that improve operational performance and reduce costs.

Regulatory developments across different markets create both opportunities and challenges, with some countries implementing more favorable investment frameworks while others strengthen environmental requirements. Policy coordination efforts among ASEAN members facilitate regional energy market integration and standardization initiatives.

Merger and acquisition activity increases as companies seek to optimize portfolios, access new technologies, and expand geographic presence through strategic transactions. Joint venture formations become more common for large-scale projects that require substantial capital investment and risk sharing among multiple partners.

MarkWide Research analysis indicates that companies should prioritize technology investment and digital transformation initiatives that provide sustainable competitive advantages and operational efficiency improvements. Strategic recommendations emphasize the importance of local partnerships, regulatory compliance, and stakeholder engagement in successfully navigating complex Asia Pacific markets.

Investment strategies should focus on portfolio diversification across different market segments, geographic regions, and technology applications to optimize risk-adjusted returns. Capital allocation decisions should consider long-term sustainability trends, regulatory evolution, and changing consumer preferences that influence energy demand patterns.

Operational excellence initiatives including safety management, environmental compliance, and community engagement become increasingly important for maintaining social license to operate and regulatory approval. Technology adoption should emphasize proven solutions with clear return on investment while maintaining flexibility for future upgrades and improvements.

Partnership strategies should leverage local expertise, regulatory knowledge, and market access while maintaining operational control and technology leadership. Risk management approaches should address political, regulatory, environmental, and market risks through comprehensive assessment and mitigation strategies.

Long-term prospects for the Asia Pacific oil and gas CAPEX industry remain positive, driven by sustained economic growth, urbanization trends, and energy infrastructure development requirements across the region. Market evolution will likely emphasize cleaner technologies, operational efficiency, and sustainable development practices that align with global environmental objectives.

Investment patterns are expected to shift toward more selective, technology-focused projects that demonstrate clear competitive advantages and sustainable returns. Regional integration will continue advancing through cooperative infrastructure projects, standardization initiatives, and policy coordination efforts that improve market efficiency and investment attractiveness.

Technology advancement will accelerate, with artificial intelligence, automation, and digital platforms becoming standard components of energy infrastructure development. Environmental considerations will increasingly influence investment decisions, with companies prioritizing projects that demonstrate environmental responsibility and regulatory compliance.

Growth projections suggest the market will maintain steady expansion rates of 6-8% annually over the next decade, with emerging economies contributing disproportionately to overall growth. MWR forecasts indicate that upstream investments will continue dominating capital allocation, while downstream and midstream segments will experience selective growth in high-value applications and strategic locations.

The Asia Pacific oil and gas CAPEX industry market represents a dynamic and evolving sector with substantial growth potential driven by economic development, energy demand increases, and infrastructure modernization requirements across diverse regional economies. Market fundamentals remain strong despite various challenges, with supportive government policies, technological advancement, and regional cooperation initiatives creating favorable conditions for sustained investment and development.

Strategic opportunities abound for companies with appropriate expertise, financial resources, and local market knowledge to navigate complex regulatory environments and operational challenges. Technology integration and sustainability focus will increasingly differentiate successful market participants, while regional cooperation and standardization efforts will improve overall market efficiency and investment attractiveness.

Future success in this market will require balanced approaches that combine operational excellence, environmental responsibility, and stakeholder engagement while maintaining focus on long-term value creation and sustainable development practices. The Asia Pacific oil and gas CAPEX industry market will continue serving as a critical component of regional energy security and economic development strategies for the foreseeable future.

What is Oil and Gas CAPEX?

Oil and Gas CAPEX refers to the capital expenditures made by companies in the oil and gas sector for the development and maintenance of their assets. This includes investments in exploration, drilling, production facilities, and infrastructure.

What are the key players in the Asia Pacific Oil and Gas CAPEX Industry Market?

Key players in the Asia Pacific Oil and Gas CAPEX Industry Market include companies like Royal Dutch Shell, BP, and Chevron, which are involved in various stages of oil and gas production and exploration, among others.

What are the growth factors driving the Asia Pacific Oil and Gas CAPEX Industry Market?

The growth of the Asia Pacific Oil and Gas CAPEX Industry Market is driven by increasing energy demand, technological advancements in extraction methods, and the need for infrastructure development in emerging economies.

What challenges does the Asia Pacific Oil and Gas CAPEX Industry Market face?

Challenges in the Asia Pacific Oil and Gas CAPEX Industry Market include fluctuating oil prices, regulatory hurdles, and environmental concerns that can impact investment decisions and project viability.

What opportunities exist in the Asia Pacific Oil and Gas CAPEX Industry Market?

Opportunities in the Asia Pacific Oil and Gas CAPEX Industry Market include the transition to renewable energy sources, investment in cleaner technologies, and the potential for new discoveries in untapped regions.

What trends are shaping the Asia Pacific Oil and Gas CAPEX Industry Market?

Trends shaping the Asia Pacific Oil and Gas CAPEX Industry Market include the increasing adoption of digital technologies, a focus on sustainability, and the integration of renewable energy projects into traditional oil and gas operations.

Asia Pacific Oil and Gas CAPEX Industry Market

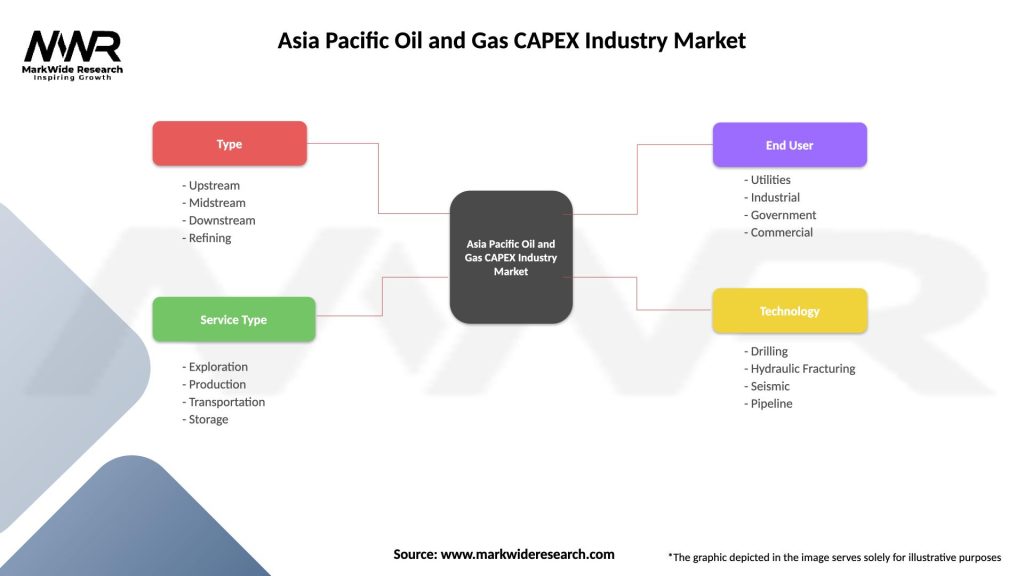

| Segmentation Details | Description |

|---|---|

| Type | Upstream, Midstream, Downstream, Refining |

| Service Type | Exploration, Production, Transportation, Storage |

| End User | Utilities, Industrial, Government, Commercial |

| Technology | Drilling, Hydraulic Fracturing, Seismic, Pipeline |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Oil and Gas CAPEX Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at