444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific nonwoven fabrics market represents one of the most dynamic and rapidly expanding segments within the global textile industry. This region has emerged as a manufacturing powerhouse, driven by robust industrial growth, increasing consumer awareness about hygiene products, and significant investments in healthcare infrastructure. Nonwoven fabrics have gained tremendous traction across diverse applications, from personal care and medical products to automotive components and construction materials.

Market dynamics in the Asia Pacific region are characterized by strong demand from emerging economies, particularly China, India, and Southeast Asian nations. The region’s manufacturing capabilities have attracted global players seeking cost-effective production solutions while maintaining quality standards. Growth rates in this sector have consistently outpaced global averages, with the market experiencing a CAGR of approximately 8.2% over recent years.

Industrial expansion across key sectors including healthcare, automotive, and construction has created substantial opportunities for nonwoven fabric manufacturers. The region’s demographic advantages, including a large population base and increasing disposable income, have further accelerated market growth. Technological advancements in production processes and the development of eco-friendly alternatives have positioned Asia Pacific as a leader in nonwoven fabric innovation.

The Asia Pacific nonwoven fabrics market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of engineered fabrics made by bonding or interlocking fibers through mechanical, thermal, or chemical processes rather than traditional weaving or knitting methods. These versatile materials are characterized by their unique properties including absorbency, liquid repellency, resilience, stretch, softness, strength, flame retardancy, washability, cushioning, thermal insulation, acoustic insulation, filtration, and bacterial barrier capabilities.

Nonwoven fabrics serve as critical components across multiple industries, offering cost-effective solutions for applications requiring specific performance characteristics. The Asia Pacific market encompasses various production technologies including spunbond, meltblown, needle punch, thermal bonding, and chemical bonding processes. Regional manufacturers have developed specialized expertise in producing both commodity and high-performance nonwoven materials to meet diverse market requirements.

Strategic positioning within the Asia Pacific nonwoven fabrics market reveals a landscape characterized by intense competition, technological innovation, and expanding application areas. The region has established itself as the global manufacturing hub, accounting for approximately 62% of worldwide production capacity. Key market drivers include rising healthcare expenditure, growing awareness of hygiene products, and increasing adoption of nonwoven materials in industrial applications.

Market segmentation analysis indicates that hygiene products represent the largest application segment, followed by medical and healthcare applications. The automotive and construction sectors are emerging as high-growth areas, driven by infrastructure development and increasing vehicle production across the region. Technology adoption rates for advanced production methods have accelerated, with manufacturers investing heavily in automation and sustainable production processes.

Regional distribution shows China maintaining its position as the dominant market, representing approximately 45% of regional demand. India and Japan follow as significant markets, while Southeast Asian countries demonstrate the highest growth potential. Investment flows into the sector have increased substantially, with both domestic and international players expanding their manufacturing footprints across strategic locations.

Market intelligence reveals several critical insights that define the current and future trajectory of the Asia Pacific nonwoven fabrics market:

Primary growth drivers propelling the Asia Pacific nonwoven fabrics market encompass both demand-side and supply-side factors that create favorable conditions for sustained expansion. Healthcare infrastructure development across emerging economies has generated substantial demand for medical nonwovens, including surgical gowns, masks, and wound care products. The region’s aging population demographics contribute to increased healthcare spending and demand for hygiene products.

Industrial growth in key sectors including automotive, construction, and electronics has created new application opportunities for nonwoven materials. The automotive industry’s shift toward lightweight materials for fuel efficiency has increased adoption of nonwoven components in interior applications, filtration systems, and acoustic insulation. Construction activities across major economies have driven demand for geotextiles and building materials incorporating nonwoven technologies.

Consumer awareness regarding hygiene and health has significantly increased, particularly following recent global health challenges. This heightened awareness has translated into sustained demand for personal care products, baby diapers, feminine hygiene products, and adult incontinence products. Urbanization trends and rising disposable incomes have further accelerated adoption of convenience products utilizing nonwoven materials.

Government initiatives supporting manufacturing sector development and healthcare infrastructure improvement have created favorable policy environments. Various countries have implemented programs to attract foreign investment in textile manufacturing, including nonwoven production facilities. Trade agreements and reduced tariff barriers have facilitated market access and supply chain optimization across the region.

Significant challenges facing the Asia Pacific nonwoven fabrics market include raw material price volatility, environmental concerns, and intense competitive pressures. Petroleum-based raw materials used in synthetic fiber production are subject to price fluctuations that directly impact manufacturing costs and profit margins. This volatility creates planning challenges for manufacturers and can affect market pricing strategies.

Environmental regulations are becoming increasingly stringent across the region, particularly regarding plastic waste and disposal of synthetic nonwoven products. Many countries are implementing policies to reduce single-use plastic products, which could impact certain nonwoven applications. Sustainability requirements are forcing manufacturers to invest in alternative materials and production processes, increasing operational costs.

Competitive intensity has led to margin pressure as numerous players compete for market share. The presence of both established international companies and emerging local manufacturers has created a highly fragmented market with significant price competition. Overcapacity concerns in certain segments have resulted in reduced profitability and consolidation pressures.

Technical challenges related to product quality consistency and performance standardization continue to affect market development. Different regulatory requirements across countries create complexity in product development and market entry strategies. Skilled labor shortages in advanced manufacturing processes pose operational challenges for companies seeking to expand production capabilities.

Emerging opportunities within the Asia Pacific nonwoven fabrics market present substantial growth potential across multiple dimensions. Sustainable product development represents a significant opportunity as manufacturers develop biodegradable and recyclable nonwoven materials to meet environmental requirements. The growing demand for eco-friendly alternatives creates market space for innovative products with enhanced environmental profiles.

Healthcare sector expansion offers tremendous growth prospects, particularly in emerging markets with developing healthcare infrastructure. The increasing focus on infection control and medical safety creates demand for advanced medical nonwovens with specialized properties. Aging population demographics across developed Asian markets will drive sustained demand for healthcare and hygiene products.

Industrial applications present untapped potential in sectors such as filtration, automotive, and construction. Advanced filtration requirements for air and water purification create opportunities for high-performance nonwoven materials. Smart textiles integration and the development of functional nonwovens with embedded technologies represent emerging market segments with high value potential.

Geographic expansion into underserved markets within the region offers growth opportunities for established manufacturers. Countries with developing industrial bases present opportunities for market entry and capacity expansion. Export potential to other regions leveraging Asia Pacific’s manufacturing cost advantages creates additional revenue streams for regional producers.

Complex market dynamics shape the Asia Pacific nonwoven fabrics landscape through the interaction of supply chain factors, technological developments, and regulatory influences. Supply chain integration has become increasingly important as manufacturers seek to optimize costs and ensure quality consistency. Vertical integration strategies are being implemented to control raw material sourcing and reduce dependency on external suppliers.

Technological evolution continues to drive market transformation through improved production efficiency and product performance. Advanced manufacturing technologies enable the production of nonwoven materials with enhanced properties and reduced environmental impact. Automation adoption is increasing across production facilities to improve consistency and reduce labor costs.

Regional trade patterns influence market dynamics through changing import-export flows and supply chain configurations. Trade agreements and tariff structures affect competitive positioning and market access strategies. Currency fluctuations impact international competitiveness and profitability for companies engaged in cross-border trade.

Innovation cycles in the nonwoven industry are accelerating as companies invest in research and development to maintain competitive advantages. Collaboration between manufacturers, research institutions, and end-users is driving product development aligned with market requirements. Market feedback loops enable rapid adaptation to changing customer needs and regulatory requirements.

Comprehensive research methodology employed in analyzing the Asia Pacific nonwoven fabrics market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with industry executives, manufacturing specialists, and market participants across different segments and geographic regions. This direct engagement provides insights into market trends, challenges, and opportunities from industry practitioners.

Secondary research encompasses analysis of industry reports, company financial statements, government publications, and trade association data. This information provides quantitative foundations for market sizing and trend analysis. Market intelligence is gathered through participation in industry conferences, trade shows, and professional networking events to capture emerging developments and strategic initiatives.

Data validation processes ensure information accuracy through cross-referencing multiple sources and applying statistical analysis techniques. Market estimates are developed using bottom-up and top-down approaches to provide comprehensive market perspectives. Analytical frameworks include Porter’s Five Forces analysis, SWOT assessment, and value chain analysis to understand competitive dynamics and market structure.

Regional analysis methodology involves country-specific research to capture local market characteristics, regulatory environments, and competitive landscapes. This granular approach enables identification of regional variations and growth opportunities. Forecasting models incorporate historical trends, current market conditions, and projected developments to provide reliable market projections.

China dominates the Asia Pacific nonwoven fabrics market with the largest production capacity and consumption base, representing approximately 45% of regional market share. The country’s manufacturing infrastructure, cost advantages, and domestic demand create a favorable environment for nonwoven fabric production. Chinese manufacturers have developed expertise across all major nonwoven categories and are expanding into high-value applications.

India represents the second-largest market with significant growth potential driven by increasing healthcare expenditure and rising consumer awareness. The country’s large population base and growing middle class create substantial demand for hygiene products and medical nonwovens. Government initiatives supporting manufacturing sector development have attracted investment in nonwoven production facilities.

Japan maintains its position as a technology leader in advanced nonwoven applications, particularly in automotive and industrial segments. Japanese companies focus on high-performance materials and innovative production technologies. Market maturity in Japan drives demand for specialized and premium nonwoven products with enhanced functionality.

Southeast Asian countries including Thailand, Vietnam, and Indonesia demonstrate the highest growth rates in the region, with expanding manufacturing bases and increasing domestic consumption. These markets benefit from favorable labor costs and government support for industrial development. Regional integration through trade agreements facilitates market access and supply chain optimization.

South Korea focuses on technology-intensive nonwoven applications, leveraging its advanced manufacturing capabilities and research infrastructure. The country’s automotive and electronics industries drive demand for specialized nonwoven materials. Innovation emphasis positions South Korean companies as leaders in next-generation nonwoven technologies.

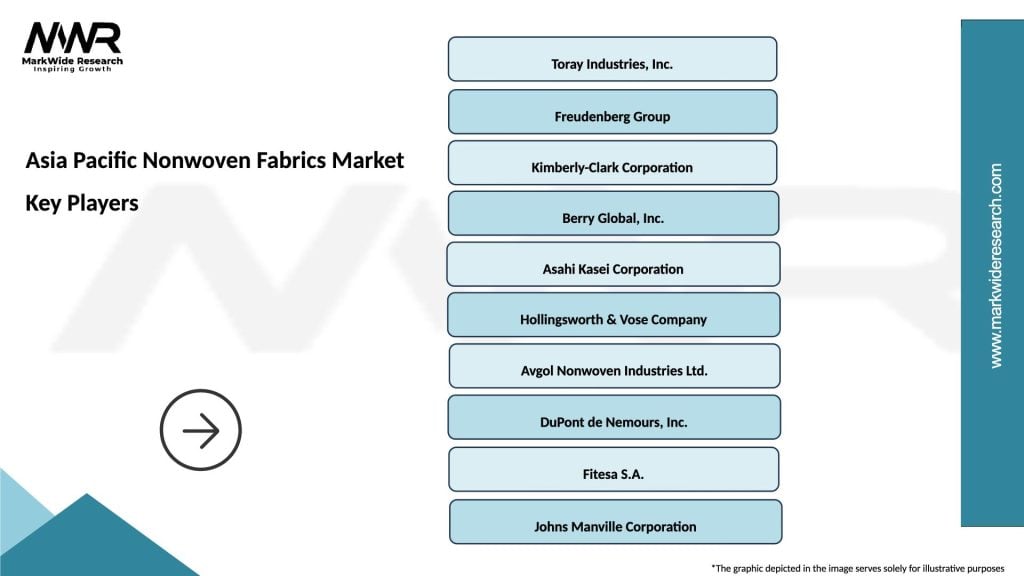

Competitive dynamics in the Asia Pacific nonwoven fabrics market are characterized by the presence of both global multinational corporations and regional specialists. Market leadership is distributed among several key players who have established strong positions through strategic investments, technological capabilities, and market expertise.

Strategic positioning among competitors varies based on technology focus, application specialization, and geographic coverage. Companies are pursuing different strategies including vertical integration, capacity expansion, and product innovation to maintain competitive advantages. Market consolidation trends are evident through mergers, acquisitions, and strategic partnerships aimed at enhancing market position and operational efficiency.

Market segmentation analysis reveals distinct categories based on technology, application, and material composition. By Technology: The market encompasses spunbond, meltblown, needle punch, thermal bonding, chemical bonding, and airlaid technologies, each serving specific application requirements and performance characteristics.

By Application: Major segments include hygiene products (diapers, feminine care, adult incontinence), medical and healthcare (surgical gowns, masks, wound care), automotive (interior components, filtration), construction (geotextiles, roofing), and industrial applications (filtration, packaging, agriculture).

By Material Type: Segmentation includes polypropylene, polyester, polyethylene, rayon, cotton, and other specialty fibers. Polypropylene dominates the market due to its versatility, cost-effectiveness, and performance characteristics across multiple applications.

By End-User Industry: Healthcare and hygiene sectors represent the largest segments, followed by automotive, construction, and industrial applications. Each sector has specific requirements for material properties, performance standards, and regulatory compliance.

Geographic segmentation reveals varying demand patterns across countries, with developed markets focusing on high-performance applications and emerging markets driving volume growth in commodity segments. Regional preferences influence product development and marketing strategies for different market segments.

Hygiene Products Category represents the largest segment within the Asia Pacific nonwoven fabrics market, driven by increasing awareness of personal hygiene and rising disposable incomes. Baby diapers constitute the primary application, with manufacturers focusing on enhanced absorbency, comfort, and skin-friendly properties. The segment benefits from demographic trends including urbanization and changing lifestyle patterns.

Medical and Healthcare Category demonstrates strong growth potential driven by healthcare infrastructure development and increased focus on infection control. Surgical nonwovens including gowns, drapes, and masks represent high-value applications with stringent quality requirements. The category benefits from aging population demographics and increased healthcare spending across the region.

Automotive Category is emerging as a high-growth segment with increasing vehicle production and demand for lightweight materials. Interior applications including seat covers, door panels, and acoustic insulation drive demand for specialized nonwoven materials. The category benefits from automotive industry growth and emphasis on fuel efficiency through weight reduction.

Construction Category encompasses geotextiles, roofing materials, and building components utilizing nonwoven technologies. Infrastructure development across emerging economies creates substantial demand for construction nonwovens. The category benefits from government investment in infrastructure projects and urbanization trends.

Industrial Category includes filtration, packaging, and agricultural applications with specialized performance requirements. Filtration applications are growing rapidly due to environmental regulations and air quality concerns. The category benefits from industrial expansion and increasing focus on environmental protection.

Manufacturing companies benefit from the Asia Pacific nonwoven fabrics market through access to cost-effective production capabilities, skilled labor resources, and growing domestic demand. Economies of scale achieved through large-scale production facilities enable competitive pricing and improved profitability. Regional manufacturing advantages include proximity to raw material suppliers and established supply chain networks.

Technology providers gain opportunities to introduce advanced production equipment and process innovations to meet growing market demand. Equipment manufacturers benefit from capacity expansion projects and technology upgrades across the region. Collaboration opportunities with local manufacturers enable technology transfer and market penetration strategies.

Raw material suppliers benefit from increased demand for synthetic and natural fibers used in nonwoven production. Polymer suppliers particularly benefit from the dominance of polypropylene and polyester in nonwoven applications. Long-term supply agreements provide revenue stability and growth opportunities.

End-user industries benefit from access to cost-effective, high-quality nonwoven materials that enhance product performance and reduce manufacturing costs. Healthcare providers gain access to advanced medical nonwovens that improve patient safety and operational efficiency. Automotive manufacturers benefit from lightweight materials that contribute to fuel efficiency and performance improvements.

Investors and financial institutions benefit from attractive growth prospects and return potential in the expanding nonwoven fabrics market. Private equity firms find opportunities in market consolidation and capacity expansion projects. Government development agencies benefit from industrial development and employment creation in the manufacturing sector.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend shaping the Asia Pacific nonwoven fabrics market. Manufacturers are increasingly investing in biodegradable materials and recyclable production processes to meet environmental regulations and consumer preferences. Bio-based nonwovens using natural fibers and biodegradable polymers are gaining market traction, with adoption rates increasing by approximately 15% annually.

Technology integration is accelerating across production facilities as manufacturers adopt automation, artificial intelligence, and IoT technologies to improve efficiency and quality control. Smart manufacturing initiatives are enabling real-time monitoring and optimization of production processes. Digital transformation is enhancing supply chain visibility and customer engagement capabilities.

Application diversification continues as nonwoven materials find new uses in emerging sectors including electronics, aerospace, and renewable energy. Functional nonwovens with embedded properties such as antimicrobial, flame retardant, and conductive characteristics are expanding market opportunities. Advanced filtration applications are growing rapidly due to air quality concerns and industrial requirements.

Regional specialization is emerging as different countries develop expertise in specific nonwoven categories based on local advantages and market focus. Value chain optimization is driving vertical integration strategies and strategic partnerships to enhance competitiveness. Cross-border collaboration is increasing through joint ventures and technology sharing agreements.

Customer-centric innovation is driving product development aligned with specific end-user requirements and performance standards. Customization capabilities are becoming competitive differentiators as manufacturers offer tailored solutions for specific applications. Market feedback loops are enabling rapid product development cycles and enhanced customer satisfaction.

Recent industry developments highlight the dynamic nature of the Asia Pacific nonwoven fabrics market and the strategic initiatives undertaken by key players. Capacity expansion projects have been announced by major manufacturers to meet growing demand and capture market opportunities. These investments focus on advanced production technologies and sustainable manufacturing processes.

Strategic acquisitions and mergers are reshaping the competitive landscape as companies seek to enhance market position and operational capabilities. Technology partnerships between manufacturers and research institutions are driving innovation in sustainable materials and advanced production processes. These collaborations aim to develop next-generation nonwoven products with enhanced performance characteristics.

Regulatory developments across the region are influencing market dynamics through new environmental standards and quality requirements. Government initiatives supporting manufacturing sector development and export promotion are creating favorable conditions for industry growth. Trade agreements and reduced tariff barriers are facilitating market access and supply chain optimization.

Product launches featuring innovative materials and enhanced performance characteristics demonstrate the industry’s commitment to meeting evolving customer needs. Sustainability initiatives including recycling programs and biodegradable product development are gaining momentum across the industry. Investment in research and development is accelerating to maintain competitive advantages and address market challenges.

Digital transformation initiatives are being implemented across the value chain to enhance operational efficiency and customer engagement. Supply chain optimization projects are improving inventory management and reducing lead times. Quality assurance programs are being strengthened to meet international standards and customer expectations.

Strategic recommendations for market participants in the Asia Pacific nonwoven fabrics market emphasize the importance of sustainable innovation and technology advancement. MarkWide Research analysis suggests that companies should prioritize investment in biodegradable materials and circular economy initiatives to address environmental concerns and regulatory requirements. This strategic focus will position companies favorably for long-term growth and market leadership.

Market entry strategies should consider regional variations in demand patterns, regulatory environments, and competitive landscapes. Geographic diversification across multiple countries can reduce market risks and capture growth opportunities in emerging markets. Companies should develop local partnerships and establish regional manufacturing capabilities to enhance competitiveness and market access.

Technology investment priorities should focus on automation, quality control systems, and sustainable production processes. Digital transformation initiatives can enhance operational efficiency and customer engagement capabilities. Research and development investments should target high-value applications and emerging market segments with growth potential.

Supply chain optimization strategies should emphasize vertical integration and strategic partnerships to ensure raw material security and cost competitiveness. Risk management approaches should address raw material price volatility, regulatory changes, and trade uncertainties. Companies should develop flexible production capabilities to adapt to changing market conditions and customer requirements.

Customer relationship management should focus on understanding specific application requirements and providing customized solutions. Market intelligence capabilities should be enhanced to identify emerging trends and competitive threats. Strategic planning should incorporate scenario analysis and contingency planning to address potential market disruptions.

Future prospects for the Asia Pacific nonwoven fabrics market remain highly positive, with sustained growth expected across multiple segments and applications. Market expansion will be driven by continued industrialization, healthcare infrastructure development, and increasing consumer awareness of hygiene and health products. The region is projected to maintain its position as the global manufacturing hub with enhanced technological capabilities and market reach.

Sustainability trends will significantly influence market development as environmental regulations become more stringent and consumer preferences shift toward eco-friendly products. Innovation cycles are expected to accelerate with increased investment in research and development focusing on biodegradable materials and advanced production technologies. The market is projected to achieve a CAGR of approximately 7.5% over the next five years.

Technology advancement will continue to drive market transformation through improved production efficiency, product performance, and cost competitiveness. Automation adoption will increase across manufacturing facilities to address labor challenges and enhance quality consistency. Digital technologies will enable better supply chain management and customer engagement capabilities.

Application diversification will create new growth opportunities as nonwoven materials find uses in emerging sectors and specialized applications. Healthcare sector growth will remain a primary driver, supported by aging population demographics and increased healthcare spending. Industrial applications will expand as manufacturers develop specialized products for automotive, construction, and filtration markets.

Regional integration will strengthen through trade agreements and supply chain optimization initiatives. Export opportunities will expand as Asia Pacific manufacturers leverage cost advantages and quality improvements to compete in global markets. According to MWR projections, the region will continue to account for the majority of global nonwoven fabric production capacity, with market leadership positions strengthening across key segments.

The Asia Pacific nonwoven fabrics market represents a dynamic and rapidly evolving industry with substantial growth potential across multiple dimensions. Market fundamentals remain strong, supported by robust demand from healthcare, hygiene, automotive, and industrial sectors. The region’s manufacturing advantages, including cost competitiveness, skilled workforce, and established supply chains, position it favorably for continued market leadership.

Strategic opportunities abound for companies that can successfully navigate the challenges of sustainability requirements, technological advancement, and competitive intensity. Innovation leadership in biodegradable materials and advanced production technologies will be critical for long-term success. Companies that invest in sustainable practices and customer-centric solutions will be best positioned to capitalize on market growth opportunities.

Market dynamics will continue to evolve as regulatory environments change, technology advances, and customer requirements become more sophisticated. Adaptability and strategic planning will be essential for companies seeking to maintain competitive advantages and achieve sustainable growth. The Asia Pacific nonwoven fabrics market offers compelling opportunities for stakeholders across the value chain, from raw material suppliers to end-user industries, creating a foundation for continued expansion and development in the years ahead.

What is Nonwoven Fabrics?

Nonwoven fabrics are engineered textile materials made from fibers that are bonded together through various methods such as heat, chemical, or mechanical processes. They are widely used in applications like hygiene products, medical supplies, and geotextiles.

What are the key players in the Asia Pacific Nonwoven Fabrics Market?

Key players in the Asia Pacific Nonwoven Fabrics Market include companies like Ahlstrom-Munksjö, Berry Global, and Freudenberg Performance Materials, among others. These companies are known for their innovative products and extensive distribution networks.

What are the growth factors driving the Asia Pacific Nonwoven Fabrics Market?

The growth of the Asia Pacific Nonwoven Fabrics Market is driven by increasing demand in the healthcare sector, rising consumer awareness regarding hygiene products, and the expansion of the automotive industry. Additionally, the shift towards sustainable materials is also contributing to market growth.

What challenges does the Asia Pacific Nonwoven Fabrics Market face?

The Asia Pacific Nonwoven Fabrics Market faces challenges such as fluctuating raw material prices, environmental concerns regarding waste management, and competition from alternative materials. These factors can impact production costs and market dynamics.

What opportunities exist in the Asia Pacific Nonwoven Fabrics Market?

Opportunities in the Asia Pacific Nonwoven Fabrics Market include the development of biodegradable nonwovens, increasing applications in the automotive and construction sectors, and the growing trend of e-commerce for hygiene products. These factors present avenues for innovation and market expansion.

What trends are shaping the Asia Pacific Nonwoven Fabrics Market?

Trends shaping the Asia Pacific Nonwoven Fabrics Market include the rise of sustainable and eco-friendly materials, advancements in manufacturing technologies, and the increasing use of nonwovens in personal protective equipment. These trends are influencing product development and consumer preferences.

Asia Pacific Nonwoven Fabrics Market

| Segmentation Details | Description |

|---|---|

| Product Type | Spunbond, Meltblown, Airlaid, Wetlaid |

| Application | Hygiene, Medical, Geotextiles, Filtration |

| End User | Healthcare, Automotive, Construction, Agriculture |

| Material | Polypropylene, Polyester, Rayon, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Nonwoven Fabrics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at