444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific non-dairy milk market represents one of the most dynamic and rapidly expanding segments within the global plant-based beverage industry. This region has witnessed unprecedented growth in consumer demand for alternative milk products, driven by increasing health consciousness, environmental awareness, and dietary preferences. Market dynamics indicate substantial expansion across multiple countries, with particularly strong growth in developed economies like Japan, Australia, and South Korea, alongside emerging markets including India, Thailand, and Vietnam.

Regional consumption patterns reveal significant variations in product preferences, with almond milk dominating in urban centers while coconut milk maintains traditional popularity in tropical regions. The market encompasses diverse product categories including soy milk, almond milk, oat milk, rice milk, coconut milk, and innovative blends that cater to local taste preferences. Growth trajectories suggest the market is expanding at a robust CAGR of 8.2%, reflecting strong consumer adoption and increasing retail availability across the region.

Manufacturing capabilities have evolved significantly, with local and international companies establishing production facilities to meet growing demand. The market benefits from abundant raw material availability, particularly in countries with strong agricultural sectors. Distribution networks have expanded rapidly, encompassing traditional retail channels, modern trade formats, and increasingly popular e-commerce platforms that facilitate broader market penetration.

The Asia-Pacific non-dairy milk market refers to the comprehensive ecosystem of plant-based milk alternatives produced, distributed, and consumed across the Asia-Pacific region. This market encompasses all milk substitutes derived from plant sources, including nuts, grains, legumes, and seeds, that serve as alternatives to traditional dairy milk for various consumer segments seeking lactose-free, vegan, or health-conscious beverage options.

Product categories within this market include established varieties such as soy milk, which has deep cultural roots in many Asian countries, alongside newer innovations like oat milk and pea protein-based alternatives. The market definition extends beyond basic beverages to include flavored variants, fortified products, and specialized formulations designed for specific dietary requirements or culinary applications.

Geographic scope covers major economies including China, Japan, India, Australia, South Korea, and Southeast Asian nations, each contributing unique consumption patterns and growth dynamics. The market encompasses both traditional products with centuries-old heritage and modern innovations developed to meet contemporary consumer preferences and nutritional requirements.

Market performance in the Asia-Pacific non-dairy milk sector demonstrates exceptional momentum, with widespread adoption across diverse consumer demographics and geographic regions. The market has experienced accelerated growth following increased awareness of health benefits, environmental sustainability concerns, and expanding product availability through enhanced distribution networks.

Key growth drivers include rising lactose intolerance awareness, which affects approximately 90% of the adult population in many Asian countries, alongside growing vegan and vegetarian populations seeking plant-based alternatives. Product innovation has played a crucial role, with manufacturers introducing locally-relevant flavors, improved nutritional profiles, and convenient packaging formats that appeal to busy urban consumers.

Competitive dynamics reveal a mix of established multinational corporations and emerging local brands competing for market share through differentiated product offerings and strategic pricing. The market benefits from favorable regulatory environments in most countries, supporting product registration and marketing activities that drive consumer awareness and adoption.

Future prospects remain highly positive, with continued expansion expected across both developed and emerging markets within the region. Investment flows into production capacity, research and development, and marketing initiatives indicate strong industry confidence in long-term growth potential and market sustainability.

Consumer behavior analysis reveals significant shifts in purchasing patterns, with younger demographics leading adoption while older consumers increasingly embrace non-dairy alternatives for health reasons. Urban markets demonstrate higher penetration rates compared to rural areas, though this gap is narrowing as distribution networks expand and product awareness increases.

Market maturity levels vary significantly across the region, with developed markets showing sophisticated consumer preferences while emerging markets focus on basic product availability and affordability. Brand loyalty patterns indicate opportunities for companies that successfully establish early market presence and maintain consistent product quality.

Health consciousness trends represent the primary catalyst driving market expansion, with consumers increasingly seeking alternatives to dairy milk due to lactose intolerance, allergies, and perceived health benefits. Nutritional awareness has grown substantially, with consumers recognizing the benefits of plant-based proteins, reduced saturated fats, and added vitamins and minerals in fortified non-dairy milk products.

Environmental sustainability concerns significantly influence purchasing decisions, particularly among younger consumers who prioritize eco-friendly products. The lower carbon footprint and reduced water usage associated with plant-based milk production resonate strongly with environmentally conscious consumers across the region.

Dietary lifestyle changes including veganism, vegetarianism, and flexitarian approaches continue gaining popularity, creating sustained demand for plant-based alternatives. Religious and cultural factors also contribute to market growth, with certain communities traditionally avoiding dairy products or seeking plant-based options for specific periods.

Product accessibility improvements through expanded retail presence, competitive pricing strategies, and enhanced product variety have made non-dairy milk more convenient and appealing to mainstream consumers. Marketing initiatives by leading brands have successfully educated consumers about product benefits and usage applications, driving trial and repeat purchases.

Price premiums compared to conventional dairy milk continue to limit market penetration, particularly in price-sensitive segments and emerging economies where cost considerations significantly influence purchasing decisions. Economic factors including inflation and currency fluctuations can impact affordability and consumer spending patterns on premium plant-based products.

Taste and texture preferences remain challenging for some consumer segments accustomed to traditional dairy milk characteristics. Product consistency issues and variations in quality across different brands and production batches can affect consumer confidence and repeat purchase behavior.

Limited shelf life of many non-dairy milk products compared to UHT dairy milk creates logistical challenges and increases waste concerns for both retailers and consumers. Storage requirements and temperature sensitivity can complicate distribution in regions with inadequate cold chain infrastructure.

Regulatory complexities in some countries regarding labeling, nutritional claims, and product classification can create barriers to market entry and expansion. Cultural resistance in certain traditional communities may slow adoption rates despite growing overall market acceptance.

Emerging market penetration presents substantial growth opportunities as rising disposable incomes and urbanization drive demand for premium food and beverage products. Rural market expansion offers significant potential as distribution networks improve and product awareness campaigns reach previously underserved areas.

Product innovation opportunities include developing locally-relevant flavors, improving nutritional profiles, and creating specialized formulations for specific consumer segments such as athletes, children, or elderly populations. Functional beverage development incorporating probiotics, adaptogens, or other health-enhancing ingredients represents a growing market segment.

E-commerce expansion provides opportunities for direct-to-consumer sales, subscription models, and targeted marketing to specific demographic groups. Food service integration through partnerships with restaurants, cafes, and institutional buyers can significantly expand market reach and consumer exposure.

Sustainability positioning offers competitive advantages as consumers increasingly prioritize environmentally responsible products. Strategic partnerships with local farmers, suppliers, and distributors can create integrated value chains that improve cost efficiency and market responsiveness.

Supply chain evolution demonstrates increasing sophistication as companies invest in local sourcing, processing capabilities, and distribution networks to meet growing demand efficiently. Raw material availability varies across the region, with some countries benefiting from abundant local supplies while others rely on imports, creating different cost structures and market dynamics.

Competitive intensity continues escalating as new entrants join established players in pursuing market share through product differentiation, pricing strategies, and marketing investments. Innovation cycles are accelerating, with companies regularly introducing new products, flavors, and packaging formats to maintain competitive positioning.

Consumer education initiatives by industry participants and health organizations are expanding market awareness and driving trial among previously hesitant consumer segments. Retail partnership strategies focus on securing premium shelf space, promotional support, and category management collaboration to maximize product visibility and sales.

Technology adoption in production processes is improving product quality, consistency, and cost efficiency while enabling greater customization and faster response to market trends. Digital marketing approaches are becoming increasingly sophisticated, utilizing social media, influencer partnerships, and targeted advertising to reach specific consumer demographics effectively.

Primary research activities encompass comprehensive consumer surveys, industry expert interviews, and retail channel assessments across major Asia-Pacific markets to gather current market intelligence and trend insights. Data collection methods include structured questionnaires, focus group discussions, and in-depth interviews with key stakeholders throughout the value chain.

Secondary research sources incorporate industry reports, government statistics, trade association data, and company financial disclosures to validate primary findings and establish market context. Market sizing methodologies utilize multiple approaches including top-down analysis, bottom-up calculations, and cross-validation techniques to ensure accuracy and reliability.

Analytical frameworks employ statistical modeling, trend analysis, and comparative assessments to identify growth patterns, market dynamics, and competitive positioning factors. Quality assurance processes include data triangulation, expert validation, and peer review procedures to maintain research integrity and credibility.

Geographic coverage spans major markets including China, Japan, India, Australia, South Korea, and key Southeast Asian countries, with country-specific analysis reflecting local market conditions and consumer preferences. Temporal analysis incorporates historical data trends, current market conditions, and forward-looking projections to provide comprehensive market understanding.

China dominates the regional market with the largest consumer base and rapidly expanding urban middle class driving substantial demand growth. Market penetration in tier-one cities reaches approximately 35% of households, while tier-two and tier-three cities show accelerating adoption rates as product availability improves and consumer awareness increases.

Japan represents a mature market with sophisticated consumer preferences and premium product positioning, where quality and innovation command higher price points. Australia and New Zealand demonstrate strong growth in organic and premium segments, with consumers willing to pay premiums for high-quality, sustainably produced alternatives.

India presents enormous growth potential with its large vegetarian population and traditional acceptance of plant-based foods, though price sensitivity remains a key market consideration. Southeast Asian markets including Thailand, Malaysia, and Singapore show robust growth driven by health consciousness and increasing disposable incomes.

South Korea exhibits strong demand for innovative products and premium positioning, with consumers embracing new flavors and functional benefits. Market share distribution shows China accounting for approximately 45% of regional consumption, followed by Japan at 18% and India at 15%, with other markets comprising the remaining share.

Market leadership is distributed among several key players, each leveraging different competitive advantages and market positioning strategies to capture consumer attention and loyalty. International brands compete with established local companies that possess deep market knowledge and distribution networks.

Competitive strategies focus on product innovation, brand building, distribution expansion, and strategic partnerships to strengthen market position. Market consolidation trends include acquisitions of local brands by international companies seeking to accelerate market entry and expand product portfolios.

Innovation leadership drives competitive differentiation through new product development, packaging innovations, and marketing creativity that resonates with target consumer segments. Strategic alliances between manufacturers, retailers, and suppliers create competitive advantages through improved market access and operational efficiency.

Product type segmentation reveals distinct market dynamics across different plant-based milk categories, with each segment serving specific consumer preferences and usage occasions. Soy milk maintains the largest market share due to traditional acceptance and widespread availability, while almond milk shows rapid growth in premium segments.

By Product Type:

Distribution channel segmentation shows evolving patterns with traditional retail maintaining dominance while e-commerce and specialty stores gain market share. Packaging format preferences vary by market, with shelf-stable cartons preferred in some regions while fresh refrigerated products dominate in others.

Consumer demographic segmentation reveals distinct purchasing patterns across age groups, income levels, and lifestyle preferences, enabling targeted marketing and product development strategies.

Soy milk category benefits from established consumer familiarity and traditional usage patterns, particularly in East Asian markets where soy products have cultural significance. Product innovations within this category focus on improved taste profiles, reduced beany flavors, and enhanced nutritional fortification to maintain competitive positioning.

Almond milk segment demonstrates premium market positioning with higher price points justified by superior taste characteristics and perceived health benefits. Market expansion in this category is driven by increasing consumer willingness to pay premiums for quality and taste improvements.

Coconut milk varieties leverage natural sweetness and tropical appeal, particularly in Southeast Asian markets where coconut is a traditional ingredient. Product development focuses on reducing saturated fat content while maintaining desirable taste and texture characteristics.

Oat milk emergence represents significant growth potential with environmental sustainability positioning and excellent coffee compatibility driving adoption among younger consumers. Market penetration is accelerating as production capacity expands and retail availability improves across the region.

Specialty categories including rice milk and pea protein-based alternatives serve specific dietary requirements and allergen-free needs, creating niche market opportunities with dedicated consumer bases.

Manufacturers benefit from expanding market opportunities, premium pricing potential, and growing consumer acceptance that supports sustainable business growth and profitability. Production efficiency improvements through scale economies and technology adoption enable competitive cost structures while maintaining product quality standards.

Retailers gain from higher margin opportunities compared to traditional dairy products, increased customer traffic from health-conscious consumers, and category growth that drives overall beverage sales performance. Inventory turnover improvements result from strong consumer demand and effective marketing support from brand partners.

Suppliers and farmers benefit from new market opportunities for plant-based raw materials, premium pricing for organic and sustainably-produced ingredients, and long-term supply contracts that provide business stability. Agricultural diversification opportunities enable farmers to reduce risk through multiple crop options and value-added processing.

Consumers enjoy expanded product choices, improved nutritional options, and alignment with personal values regarding health, sustainability, and animal welfare. Health benefits include reduced lactose-related digestive issues, lower saturated fat intake, and access to fortified products with enhanced nutritional profiles.

Environmental stakeholders benefit from reduced carbon footprints, lower water usage, and decreased land requirements compared to traditional dairy production, supporting broader sustainability objectives and climate change mitigation efforts.

Strengths:

Weaknesses:

Opportunities:

Threats:

Functional enhancement trends show increasing consumer demand for non-dairy milk products fortified with vitamins, minerals, probiotics, and other health-promoting ingredients. Product development focuses on creating beverages that serve multiple nutritional purposes beyond basic milk replacement functionality.

Sustainability positioning has become a critical differentiating factor, with brands emphasizing environmental benefits, sustainable packaging, and ethical sourcing practices. Carbon footprint reduction initiatives and water conservation messaging resonate strongly with environmentally conscious consumers across the region.

Flavor innovation continues expanding beyond traditional varieties to include exotic fruits, spices, and culturally-relevant taste profiles that appeal to local preferences. Seasonal flavors and limited edition products create excitement and drive trial among existing consumers.

Convenience packaging innovations include single-serve portions, resealable containers, and on-the-go formats that align with busy urban lifestyles. Premium packaging designs communicate quality positioning and brand differentiation in competitive retail environments.

Digital engagement strategies leverage social media, influencer partnerships, and content marketing to build brand awareness and educate consumers about product benefits and usage applications.

Production capacity expansions by major manufacturers demonstrate confidence in long-term market growth, with new facilities being established across key markets to meet increasing demand. Technology investments focus on improving product quality, extending shelf life, and reducing production costs through automation and process optimization.

Strategic acquisitions and partnerships are reshaping the competitive landscape as companies seek to expand product portfolios, enter new markets, and access specialized capabilities. Local brand acquisitions by international companies provide market entry advantages and established distribution networks.

Regulatory developments in several countries are establishing clearer guidelines for non-dairy milk labeling, nutritional claims, and marketing practices, providing greater certainty for industry participants. Government support initiatives in some regions promote plant-based food production through subsidies and research funding.

Research and development investments are accelerating innovation in taste improvement, nutritional enhancement, and sustainable production methods. University partnerships and collaborative research projects are advancing scientific understanding of plant-based nutrition and processing technologies.

Retail expansion initiatives include dedicated plant-based sections in supermarkets, specialty store partnerships, and e-commerce platform development to improve product accessibility and consumer convenience.

Market entry strategies should prioritize understanding local taste preferences and cultural factors that influence consumer acceptance of plant-based alternatives. MarkWide Research analysis indicates that successful brands invest heavily in consumer education and trial programs to overcome initial resistance and build market presence.

Product development priorities should focus on taste improvement, nutritional enhancement, and shelf life extension to address key consumer concerns and competitive disadvantages. Innovation investments in processing technologies and ingredient sourcing can create sustainable competitive advantages.

Distribution strategy optimization requires balancing traditional retail channels with emerging e-commerce opportunities while ensuring adequate cold chain infrastructure for product quality maintenance. Partnership development with local distributors and retailers can accelerate market penetration and reduce entry barriers.

Pricing strategies must consider local market conditions, competitive positioning, and consumer price sensitivity while maintaining adequate margins for sustainable business growth. Value proposition communication should emphasize health benefits, environmental advantages, and quality differentiators to justify premium pricing.

Marketing approaches should leverage digital channels, influencer partnerships, and targeted campaigns that resonate with specific demographic segments and lifestyle preferences. Brand building investments are essential for long-term market success and consumer loyalty development.

Growth projections for the Asia-Pacific non-dairy milk market remain highly positive, with continued expansion expected across all major product categories and geographic regions. Market maturation in developed countries will be offset by rapid growth in emerging markets as consumer awareness and product availability continue improving.

Innovation acceleration will drive product development in functional beverages, sustainable packaging, and personalized nutrition solutions that cater to specific consumer needs and preferences. Technology adoption in production processes will improve efficiency, quality, and cost competitiveness while enabling greater product customization.

Market consolidation is expected to continue as successful brands acquire smaller competitors and expand their product portfolios and geographic reach. Strategic partnerships between manufacturers, retailers, and technology companies will create integrated value chains and enhanced consumer experiences.

Regulatory evolution will provide greater clarity and standardization across markets, facilitating international trade and reducing compliance complexities for multinational companies. Sustainability requirements may become more stringent, driving innovation in environmental performance and supply chain transparency.

Consumer sophistication will increase demand for premium products, specialized formulations, and transparent sourcing practices, creating opportunities for brands that can deliver superior value propositions and authentic brand experiences.

The Asia-Pacific non-dairy milk market represents a compelling growth opportunity characterized by strong consumer demand, expanding distribution networks, and continuous product innovation. Market fundamentals remain robust, supported by increasing health consciousness, environmental awareness, and cultural acceptance of plant-based alternatives across diverse consumer segments.

Competitive dynamics will continue evolving as established players and new entrants compete for market share through differentiated product offerings, strategic partnerships, and innovative marketing approaches. Success factors include understanding local market preferences, investing in product quality and innovation, and building strong brand recognition and consumer loyalty.

Long-term prospects remain highly favorable, with MWR projecting sustained growth driven by demographic trends, urbanization, and rising disposable incomes across the region. Industry participants who can effectively navigate market challenges while capitalizing on emerging opportunities will be well-positioned to achieve sustainable growth and profitability in this dynamic and expanding market segment.

What is Non-Dairy Milk?

Non-Dairy Milk refers to plant-based beverages that serve as alternatives to traditional dairy milk. These products are typically made from ingredients such as almonds, soy, oats, and coconut, catering to consumers seeking lactose-free or vegan options.

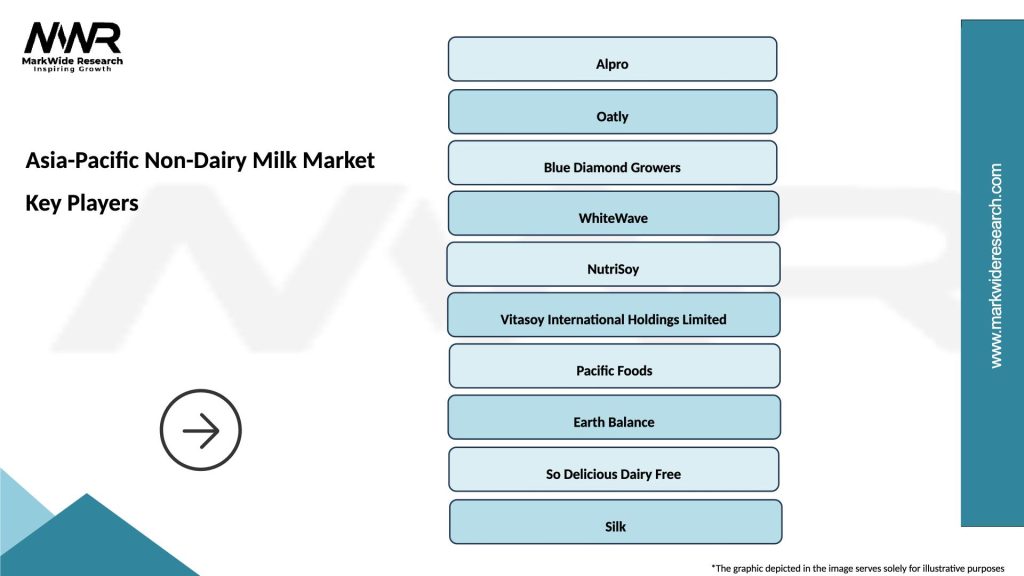

What are the key players in the Asia-Pacific Non-Dairy Milk Market?

Key players in the Asia-Pacific Non-Dairy Milk Market include companies like Alpro, Oatly, and Silk. These brands are known for their diverse range of non-dairy milk products, catering to various consumer preferences and dietary needs, among others.

What are the growth factors driving the Asia-Pacific Non-Dairy Milk Market?

The Asia-Pacific Non-Dairy Milk Market is driven by increasing health consciousness among consumers, a rise in lactose intolerance, and the growing popularity of vegan diets. Additionally, the expansion of retail channels and innovative product offerings contribute to market growth.

What challenges does the Asia-Pacific Non-Dairy Milk Market face?

Challenges in the Asia-Pacific Non-Dairy Milk Market include competition from traditional dairy products, price sensitivity among consumers, and potential supply chain disruptions. These factors can impact market penetration and consumer adoption rates.

What opportunities exist in the Asia-Pacific Non-Dairy Milk Market?

Opportunities in the Asia-Pacific Non-Dairy Milk Market include the potential for product innovation, such as fortified non-dairy options and flavored varieties. Additionally, increasing demand for sustainable and ethical food choices presents avenues for growth.

What trends are shaping the Asia-Pacific Non-Dairy Milk Market?

Trends in the Asia-Pacific Non-Dairy Milk Market include the rise of organic and clean-label products, as well as the introduction of new flavors and formulations. Consumer preferences are shifting towards healthier, environmentally friendly options, influencing product development.

Asia-Pacific Non-Dairy Milk Market

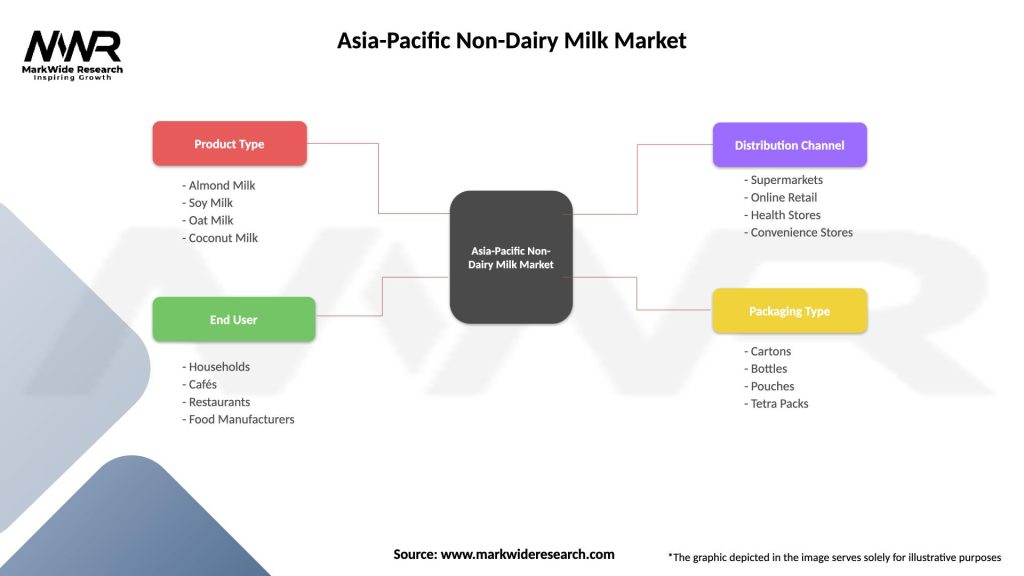

| Segmentation Details | Description |

|---|---|

| Product Type | Almond Milk, Soy Milk, Oat Milk, Coconut Milk |

| End User | Households, Cafés, Restaurants, Food Manufacturers |

| Distribution Channel | Supermarkets, Online Retail, Health Stores, Convenience Stores |

| Packaging Type | Cartons, Bottles, Pouches, Tetra Packs |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Non-Dairy Milk Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at