444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific MPU market represents one of the most dynamic and rapidly expanding semiconductor segments globally, driven by unprecedented demand for advanced computing solutions across diverse industries. Microprocessor units serve as the computational backbone for everything from smartphones and automotive systems to industrial automation and artificial intelligence applications throughout the region.

Market dynamics in the Asia-Pacific region reflect a unique combination of manufacturing prowess, technological innovation, and growing consumer demand. The region’s dominance in electronics manufacturing, coupled with increasing investments in research and development, has positioned it as a critical hub for MPU technology advancement. Countries like China, Japan, South Korea, and Taiwan continue to lead in both production capacity and technological sophistication.

Growth trajectories indicate sustained expansion driven by emerging technologies such as 5G networks, Internet of Things (IoT) devices, and edge computing applications. The region’s commitment to digital transformation across industries has created substantial demand for high-performance microprocessor solutions. Additionally, government initiatives supporting semiconductor development and strategic investments in advanced manufacturing capabilities are accelerating market growth at an impressive 8.2% CAGR.

Regional leadership in consumer electronics manufacturing has established Asia-Pacific as a dominant force in the global MPU landscape. The concentration of major technology companies, coupled with robust supply chain infrastructure, creates a competitive advantage that continues to attract international investment and foster innovation in microprocessor technologies.

The Asia-Pacific MPU market refers to the comprehensive ecosystem encompassing the design, manufacturing, distribution, and application of microprocessor units across countries in the Asia-Pacific region, including advanced computing chips that serve as central processing units in electronic devices and systems.

Microprocessor units represent sophisticated integrated circuits designed to execute instructions and perform computational tasks across a wide range of applications. These semiconductor devices function as the primary processing engines in computers, mobile devices, automotive systems, industrial equipment, and emerging technologies such as artificial intelligence and machine learning platforms.

Market scope encompasses various MPU categories, including general-purpose processors, application-specific processors, embedded processors, and specialized computing units designed for specific industry applications. The Asia-Pacific region’s unique position combines high-volume manufacturing capabilities with cutting-edge research and development initiatives, creating a comprehensive value chain from chip design to end-user applications.

Technological evolution within this market includes advancements in processor architecture, manufacturing processes, power efficiency, and integration capabilities. The region’s focus on innovation has led to significant developments in areas such as multi-core processing, advanced node technologies, and specialized processors for emerging applications like autonomous vehicles and smart city infrastructure.

Strategic positioning of the Asia-Pacific MPU market reflects a mature yet rapidly evolving landscape characterized by intense competition, technological innovation, and expanding application domains. The region’s established manufacturing infrastructure, combined with growing domestic demand and export capabilities, creates a robust foundation for sustained growth and market leadership.

Key market drivers include accelerating digital transformation initiatives across industries, increasing adoption of artificial intelligence and machine learning technologies, and growing demand for high-performance computing solutions. The proliferation of 5G networks and IoT devices has created substantial opportunities for specialized microprocessor applications, with mobile device processors accounting for approximately 42% market share within the region.

Competitive dynamics feature a mix of established global players and emerging regional companies, each contributing unique strengths in design capabilities, manufacturing efficiency, and market reach. The region’s emphasis on research and development has fostered innovation in areas such as energy-efficient processing, advanced packaging technologies, and specialized computing architectures.

Market challenges include supply chain complexities, geopolitical considerations, and the need for continuous technological advancement to maintain competitive positioning. However, strong government support, substantial private investment, and collaborative industry initiatives continue to drive positive market momentum and technological progress.

Fundamental market insights reveal several critical trends shaping the Asia-Pacific MPU landscape:

Market maturation indicators suggest a transition from volume-focused growth to value-added innovation, with emphasis on specialized processors and advanced computing capabilities. This evolution reflects the region’s strategic shift toward higher-value semiconductor products and technological leadership in emerging application areas.

Digital transformation initiatives across Asia-Pacific countries serve as primary catalysts for MPU market expansion. Organizations throughout the region are implementing comprehensive digitization strategies that require advanced computing capabilities, driving substantial demand for high-performance microprocessor solutions. Enterprise adoption of cloud computing, big data analytics, and artificial intelligence applications creates sustained growth opportunities for processor manufacturers.

Consumer electronics demand continues to fuel market growth as smartphone penetration increases and device sophistication advances. The region’s position as a global manufacturing hub for mobile devices, tablets, and consumer electronics generates substantial volume requirements for various MPU categories. Additionally, emerging technologies such as foldable displays, augmented reality devices, and wearable technology create new processor application opportunities.

Automotive industry evolution toward electric vehicles and autonomous driving systems represents a significant growth driver for specialized automotive MPUs. The region’s automotive manufacturers are increasingly integrating advanced driver assistance systems, infotainment platforms, and vehicle connectivity features that require sophisticated processing capabilities. This trend is expected to accelerate as regulatory requirements and consumer expectations continue to evolve.

Industrial automation expansion across manufacturing sectors drives demand for embedded processors and industrial computing solutions. Smart factory initiatives, robotics integration, and Industry 4.0 implementations require reliable, high-performance microprocessor units capable of handling complex control and monitoring tasks in demanding industrial environments.

Supply chain vulnerabilities present significant challenges for the Asia-Pacific MPU market, particularly regarding raw material availability and manufacturing capacity constraints. Global semiconductor shortages have highlighted the industry’s dependence on complex supply networks and the potential for disruptions to impact production schedules and market growth trajectories.

Geopolitical tensions and trade policy uncertainties create market volatility and strategic planning challenges for MPU manufacturers and customers. Export restrictions, tariff implementations, and technology transfer limitations can affect market access, collaboration opportunities, and long-term business relationships across the region.

Technology complexity and development costs associated with advanced processor design and manufacturing present barriers to market entry and expansion. The substantial investments required for next-generation fabrication facilities and research and development capabilities limit the number of companies capable of competing effectively in high-end MPU segments.

Skilled workforce shortages in semiconductor design and manufacturing disciplines constrain industry growth potential. The specialized knowledge required for advanced microprocessor development creates competition for qualified professionals and may limit innovation speed and market expansion capabilities across the region.

Artificial intelligence applications present substantial growth opportunities for specialized AI-optimized MPUs designed to handle machine learning workloads efficiently. The increasing adoption of AI across industries such as healthcare, finance, manufacturing, and transportation creates demand for processors with enhanced parallel processing capabilities and optimized architectures for neural network computations.

Edge computing expansion offers significant market potential as organizations seek to process data closer to its source for improved performance and reduced latency. This trend drives demand for compact, energy-efficient microprocessors capable of handling complex computations in distributed computing environments, from smart cities to industrial IoT applications.

5G network deployment creates opportunities for specialized processors designed to handle high-speed data processing and network management tasks. Base station equipment, network infrastructure, and 5G-enabled devices require advanced MPU solutions optimized for telecommunications applications and high-bandwidth data handling.

Sustainable technology initiatives drive demand for energy-efficient processors that support environmental goals while maintaining performance requirements. Green computing initiatives and carbon reduction targets create market opportunities for low-power MPUs and processors designed with sustainability considerations throughout their lifecycle.

Competitive intensity within the Asia-Pacific MPU market reflects a complex ecosystem of established global leaders and emerging regional players, each pursuing distinct strategies for market positioning and growth. Technology differentiation serves as a primary competitive factor, with companies investing heavily in advanced architectures, manufacturing processes, and specialized capabilities to maintain market relevance.

Innovation cycles continue to accelerate as market demands evolve and new application opportunities emerge. The traditional Moore’s Law progression faces physical limitations, driving industry focus toward alternative approaches such as specialized processor architectures, advanced packaging technologies, and system-level optimization strategies. These developments create both challenges and opportunities for market participants.

Customer relationships and ecosystem partnerships play increasingly important roles in market success. Collaborative development programs between processor manufacturers and system integrators enable customized solutions and accelerate time-to-market for new applications. According to MarkWide Research analysis, strategic partnerships account for approximately 35% of new product developments in the region.

Market consolidation trends reflect the industry’s evolution toward larger, more integrated companies capable of supporting comprehensive product portfolios and global market reach. Mergers and acquisitions activity continues to reshape competitive dynamics while creating opportunities for specialized companies to focus on niche applications and emerging technologies.

Comprehensive market analysis employs multiple research approaches to ensure accurate and reliable insights into the Asia-Pacific MPU market landscape. Primary research activities include structured interviews with industry executives, technology experts, and key stakeholders across the semiconductor value chain, providing firsthand perspectives on market trends, challenges, and opportunities.

Secondary research components encompass extensive analysis of industry publications, company financial reports, patent filings, and regulatory documents to establish comprehensive market understanding. Government statistics, trade association data, and academic research contribute additional context and validation for market assessments and projections.

Quantitative analysis methods utilize statistical modeling and trend analysis to identify patterns and project future market developments. Data validation processes ensure accuracy and reliability through cross-referencing multiple sources and applying rigorous analytical frameworks to market information and insights.

Expert consultation with semiconductor industry specialists, technology analysts, and regional market experts provides additional validation and context for research findings. This collaborative approach ensures comprehensive coverage of market dynamics and emerging trends that may impact future market development trajectories.

China dominates the Asia-Pacific MPU market with substantial manufacturing capacity and growing domestic demand across multiple application segments. The country’s strategic focus on semiconductor self-sufficiency has driven significant investments in domestic processor development and manufacturing capabilities, with government initiatives supporting technology advancement and market expansion. Chinese market share represents approximately 45% of regional MPU consumption.

Japan maintains technological leadership in specialized processor applications and advanced manufacturing processes. Japanese companies excel in automotive MPUs, industrial processors, and high-reliability applications where precision and quality requirements are paramount. The country’s emphasis on innovation and technological excellence continues to drive market influence despite relatively smaller production volumes.

South Korea contributes significantly through memory-processor integration and mobile device processors. The country’s strength in consumer electronics and telecommunications equipment creates substantial demand for advanced microprocessor solutions. Korean companies have established strong positions in mobile processors and specialized computing applications.

Taiwan serves as a critical manufacturing hub with world-class foundry capabilities and design services. The island’s semiconductor ecosystem supports both domestic and international companies with advanced manufacturing processes and comprehensive supply chain infrastructure. Taiwanese foundries handle approximately 28% of global MPU production capacity.

Southeast Asian countries are emerging as important assembly and testing centers, providing cost-effective manufacturing solutions and growing domestic markets. Countries like Malaysia, Thailand, and Vietnam offer strategic advantages for semiconductor companies seeking to diversify their manufacturing footprint and access growing regional markets.

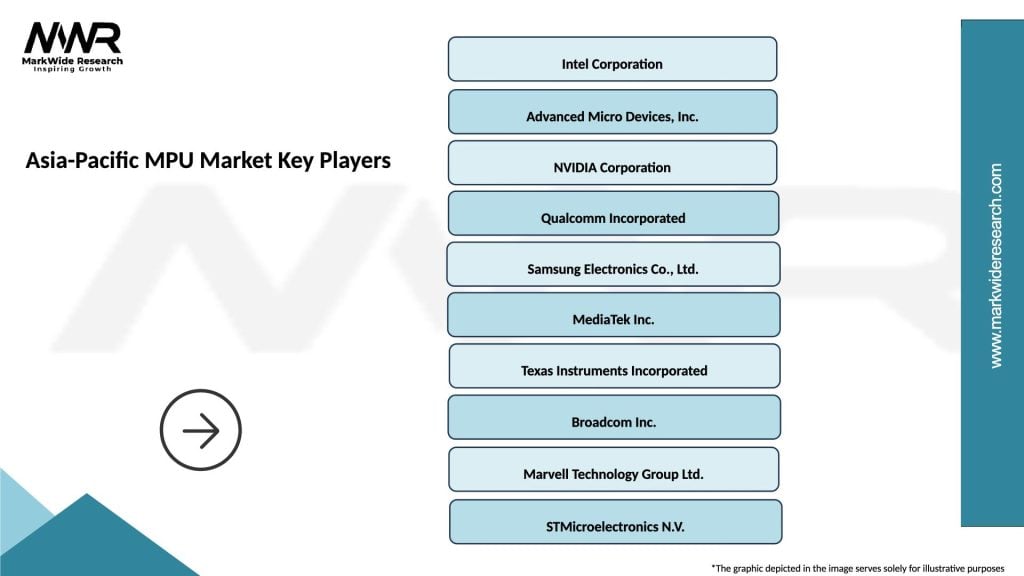

Market leadership in the Asia-Pacific MPU sector features a diverse mix of global technology giants and specialized regional players, each contributing unique strengths and capabilities to the competitive landscape:

Competitive strategies emphasize technological differentiation, manufacturing efficiency, and strategic partnerships to maintain market positioning and drive growth. Companies are increasingly focusing on specialized applications and vertical market solutions to differentiate their offerings and capture value in emerging segments.

By Technology:

By Application:

By End-User Industry:

Mobile processors represent the largest segment within the Asia-Pacific MPU market, driven by massive smartphone production and increasing device sophistication. Performance improvements in areas such as AI processing, camera capabilities, and 5G connectivity continue to drive innovation and market growth. The segment benefits from the region’s dominance in mobile device manufacturing and growing consumer demand for advanced features.

Server processors experience robust growth driven by cloud computing expansion and data center investments throughout the region. High-performance computing requirements for artificial intelligence, big data analytics, and enterprise applications create substantial demand for advanced server MPUs. The segment’s growth is supported by increasing digitization across industries and expanding cloud service adoption.

Automotive processors emerge as a high-growth segment reflecting the automotive industry’s transformation toward electric and autonomous vehicles. Advanced driver assistance systems and vehicle connectivity features require sophisticated processing capabilities, creating opportunities for specialized automotive MPUs. The segment benefits from strong automotive manufacturing presence in countries like Japan, South Korea, and China.

Industrial processors support the region’s manufacturing automation initiatives and Industry 4.0 implementations. Embedded computing solutions for factory automation, process control, and monitoring applications drive steady demand for reliable, industrial-grade processors. The segment’s growth aligns with the region’s focus on manufacturing efficiency and technological advancement.

Manufacturers benefit from the Asia-Pacific region’s comprehensive semiconductor ecosystem, including advanced fabrication facilities, skilled workforce, and established supply chains. Cost advantages through economies of scale and manufacturing efficiency enable competitive positioning in global markets while supporting innovation investments and technology development initiatives.

Technology companies gain access to cutting-edge processor technologies and collaborative development opportunities with leading semiconductor firms. Partnership opportunities with regional manufacturers enable faster time-to-market for new products and access to specialized expertise in processor design and optimization for specific applications.

End-users across industries benefit from access to advanced microprocessor solutions that enable digital transformation and competitive advantage. Performance improvements in areas such as processing speed, energy efficiency, and specialized capabilities support innovation and operational excellence across diverse application domains.

Investors and stakeholders participate in a dynamic market with substantial growth potential and technological advancement opportunities. Market expansion driven by emerging technologies and increasing digitization creates attractive investment prospects while supporting economic development and technological progress throughout the region.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents a transformative trend driving demand for specialized processors optimized for machine learning workloads. AI-specific architectures and neural processing units are becoming essential components in applications ranging from autonomous vehicles to smart city infrastructure. This trend is reshaping processor design priorities and creating new market segments focused on AI acceleration capabilities.

Edge computing proliferation drives demand for compact, energy-efficient processors capable of handling complex computations in distributed environments. Decentralized processing requirements for IoT devices, smart sensors, and real-time applications create opportunities for specialized edge processors that balance performance with power consumption constraints.

Heterogeneous computing architectures gain prominence as system designers combine different processor types to optimize performance for specific workloads. System-on-chip integration incorporating CPUs, GPUs, and specialized accelerators enables more efficient and capable computing solutions for diverse applications.

Sustainability considerations increasingly influence processor design and manufacturing decisions. Energy efficiency improvements and environmentally responsible manufacturing processes become competitive differentiators as organizations prioritize carbon reduction and sustainable technology adoption. MWR data indicates that energy-efficient processors show 23% higher adoption rates in enterprise applications.

Advanced manufacturing processes continue to drive industry evolution with leading foundries developing next-generation fabrication technologies. Process node advancement toward 3nm and beyond enables higher transistor density and improved performance while addressing power efficiency requirements for mobile and edge computing applications.

Strategic partnerships between processor companies and system integrators accelerate innovation and market penetration across diverse application segments. Collaborative development programs enable customized solutions and faster time-to-market for emerging technologies such as autonomous vehicles and smart infrastructure systems.

Investment expansion in regional manufacturing capabilities reflects industry commitment to supply chain resilience and market growth. Facility construction and capacity expansion projects throughout Asia-Pacific strengthen the region’s position as a global semiconductor manufacturing hub while supporting domestic market development.

Technology acquisitions and intellectual property developments enhance competitive positioning and expand capability portfolios. Strategic acquisitions enable companies to access specialized technologies and market segments while accelerating innovation in areas such as AI processing and automotive applications.

Strategic focus on emerging application segments such as artificial intelligence, automotive electronics, and edge computing offers substantial growth opportunities for MPU manufacturers. Investment priorities should emphasize specialized processor architectures and application-specific solutions that address unique market requirements and performance characteristics.

Partnership development with system integrators and end-user companies enables deeper market penetration and collaborative innovation opportunities. Ecosystem building through strategic alliances and joint development programs can accelerate market adoption and create competitive advantages in specialized application domains.

Manufacturing diversification strategies should address supply chain resilience while maintaining cost competitiveness and quality standards. Geographic distribution of production capabilities can mitigate risks while supporting regional market development and customer proximity requirements.

Technology roadmap alignment with industry standards and customer requirements ensures long-term market relevance and competitive positioning. Innovation investments in areas such as energy efficiency, security features, and specialized computing capabilities will drive future market success and differentiation opportunities.

Market evolution toward specialized processors and application-specific solutions will continue driving innovation and growth opportunities throughout the Asia-Pacific region. Technology advancement in areas such as artificial intelligence, 5G communications, and autonomous systems creates substantial demand for next-generation microprocessor capabilities.

Regional market leadership is expected to strengthen as countries invest in domestic semiconductor capabilities and technology development initiatives. Government support for strategic industries and innovation programs will continue fostering market growth and technological advancement across the region.

Application diversification beyond traditional computing markets into automotive, industrial, and emerging technology segments offers substantial growth potential. Market expansion into new application domains will drive innovation and create opportunities for specialized processor solutions tailored to specific industry requirements.

Sustainability initiatives and energy efficiency requirements will increasingly influence processor design and market adoption decisions. Environmental considerations are projected to drive 18% growth in demand for energy-efficient processors over the next five years, according to MarkWide Research projections. Green technology adoption will become a key competitive factor as organizations prioritize carbon reduction and sustainable technology solutions.

The Asia-Pacific MPU market stands at the forefront of global semiconductor innovation and manufacturing excellence, representing a dynamic ecosystem that continues to drive technological advancement and economic growth throughout the region. Market fundamentals remain strong, supported by robust manufacturing capabilities, growing domestic demand, and strategic investments in next-generation technologies.

Growth prospects are particularly promising in emerging application segments such as artificial intelligence, automotive electronics, and edge computing, where specialized processor requirements create opportunities for innovation and market expansion. Regional advantages in manufacturing scale, technology development, and supply chain integration position Asia-Pacific as a continued leader in the global MPU landscape.

Strategic considerations for market participants include focusing on application-specific solutions, building strategic partnerships, and investing in sustainable technology development. Future success will depend on the ability to adapt to evolving market requirements while maintaining technological leadership and competitive positioning in an increasingly complex and dynamic market environment.

What is MPU?

MPU stands for Microprocessor Unit, which is a critical component in computing devices, enabling processing and control functions in various applications such as consumer electronics, automotive systems, and industrial automation.

What are the key players in the Asia-Pacific MPU Market?

Key players in the Asia-Pacific MPU Market include companies like Intel Corporation, Advanced Micro Devices (AMD), and Qualcomm, which are known for their innovative microprocessor solutions, among others.

What are the main drivers of growth in the Asia-Pacific MPU Market?

The main drivers of growth in the Asia-Pacific MPU Market include the increasing demand for smart devices, advancements in IoT technology, and the rising need for high-performance computing in sectors like telecommunications and automotive.

What challenges does the Asia-Pacific MPU Market face?

The Asia-Pacific MPU Market faces challenges such as supply chain disruptions, intense competition among manufacturers, and the rapid pace of technological change that requires constant innovation.

What opportunities exist in the Asia-Pacific MPU Market?

Opportunities in the Asia-Pacific MPU Market include the expansion of AI and machine learning applications, growth in the automotive electronics sector, and increasing investments in smart city initiatives.

What trends are shaping the Asia-Pacific MPU Market?

Trends shaping the Asia-Pacific MPU Market include the shift towards energy-efficient processors, the integration of AI capabilities in microprocessors, and the growing adoption of edge computing solutions.

Asia-Pacific MPU Market

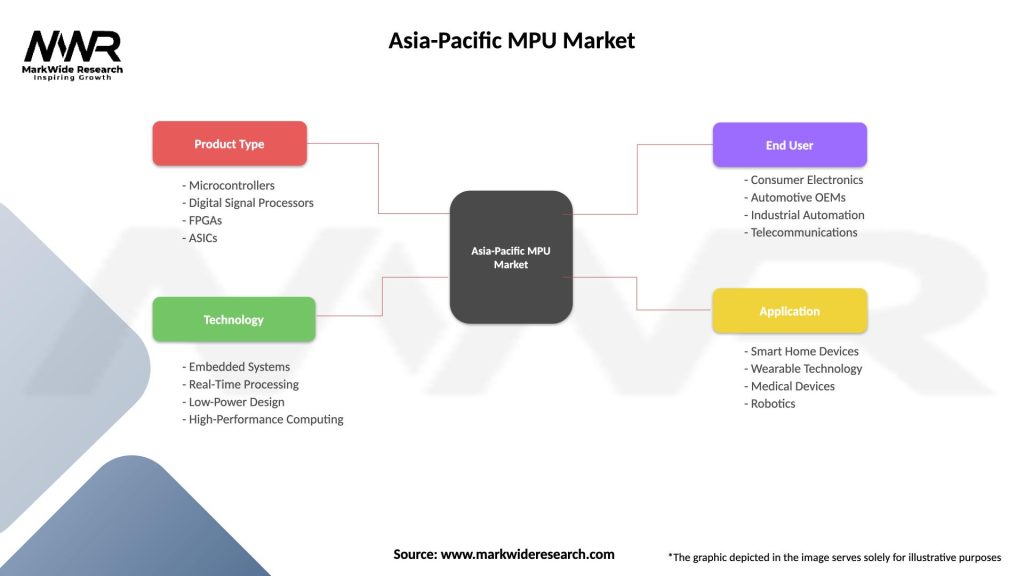

| Segmentation Details | Description |

|---|---|

| Product Type | Microcontrollers, Digital Signal Processors, FPGAs, ASICs |

| Technology | Embedded Systems, Real-Time Processing, Low-Power Design, High-Performance Computing |

| End User | Consumer Electronics, Automotive OEMs, Industrial Automation, Telecommunications |

| Application | Smart Home Devices, Wearable Technology, Medical Devices, Robotics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific MPU Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at