444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific military satellite market represents one of the most dynamic and rapidly evolving sectors within the global defense technology landscape. This region has witnessed unprecedented growth in military satellite deployment, driven by escalating geopolitical tensions, territorial disputes, and the increasing need for advanced surveillance and communication capabilities. Military satellites in the Asia-Pacific region serve critical functions including intelligence gathering, secure communications, navigation support, and strategic reconnaissance operations.

Regional dynamics indicate that countries across Asia-Pacific are investing heavily in indigenous satellite capabilities to reduce dependence on foreign systems and enhance national security infrastructure. The market encompasses various satellite types including communication satellites, reconnaissance satellites, navigation satellites, and early warning systems. Growth projections suggest the market is expanding at a compound annual growth rate of 8.2%, reflecting the region’s commitment to space-based defense capabilities.

Strategic importance of military satellites has intensified as nations recognize the critical role these systems play in modern warfare and defense operations. The Asia-Pacific region’s unique geographical challenges, including vast ocean territories and diverse terrain, make satellite-based solutions particularly valuable for comprehensive defense coverage. Technological advancement in satellite miniaturization, enhanced payload capabilities, and improved orbital mechanics continues to drive market innovation and adoption across the region.

The Asia-Pacific military satellite market refers to the comprehensive ecosystem of space-based defense technologies, systems, and services deployed by military and defense organizations across the Asia-Pacific region for strategic, tactical, and operational purposes. This market encompasses the development, manufacturing, launch, operation, and maintenance of military-grade satellites designed specifically for defense applications including surveillance, communication, navigation, and intelligence gathering.

Military satellites in this context represent sophisticated space-based platforms equipped with advanced sensors, communication arrays, and specialized payloads designed to support various defense missions. These systems operate in different orbital configurations, from low Earth orbit reconnaissance satellites to geostationary communication platforms, each serving specific military requirements. Market participants include government defense agencies, military contractors, satellite manufacturers, launch service providers, and ground system operators.

Operational scope extends beyond traditional satellite hardware to include ground control systems, data processing capabilities, cybersecurity measures, and integration services that ensure seamless military satellite operations. The market also encompasses emerging technologies such as small satellites, constellation networks, and artificial intelligence-enhanced satellite systems that are revolutionizing military space capabilities across the Asia-Pacific region.

Market dynamics in the Asia-Pacific military satellite sector reveal a landscape characterized by rapid technological advancement, increasing defense budgets, and growing emphasis on space-based military capabilities. The region’s diverse security challenges, ranging from maritime disputes to border tensions, have accelerated demand for sophisticated satellite-based surveillance and communication systems. Key market drivers include modernization of defense infrastructure, need for real-time intelligence, and strategic competition among regional powers.

Technological trends shaping the market include the adoption of small satellite constellations, integration of artificial intelligence in satellite operations, and development of multi-mission platforms capable of supporting various military functions simultaneously. Regional adoption rates show that approximately 75% of major Asia-Pacific nations have either deployed or are actively developing indigenous military satellite capabilities, reflecting the strategic importance of space-based defense systems.

Investment patterns indicate substantial government funding directed toward satellite development programs, with particular emphasis on reducing foreign dependency and establishing sovereign space capabilities. The market is witnessing increased collaboration between government agencies and private sector partners, fostering innovation and accelerating deployment timelines. Future projections suggest continued expansion driven by evolving security threats and technological advancement in satellite miniaturization and payload sophistication.

Strategic positioning of military satellites has become a critical component of national defense strategies across the Asia-Pacific region. The following key insights highlight the market’s fundamental characteristics and growth drivers:

Market maturation is evident in the increasing sophistication of satellite payloads and the integration of multiple mission capabilities within single platforms. Regional competition has intensified innovation cycles, leading to rapid advancement in satellite technologies and operational capabilities across the Asia-Pacific military satellite ecosystem.

Primary market drivers propelling the Asia-Pacific military satellite market stem from a combination of geopolitical, technological, and strategic factors that collectively create sustained demand for advanced space-based defense capabilities. These drivers reflect the region’s unique security challenges and the evolving nature of modern military operations.

Geopolitical tensions across the Asia-Pacific region serve as the most significant driver, with territorial disputes, maritime conflicts, and strategic competition creating urgent requirements for enhanced surveillance and communication capabilities. Border security concerns and the need for real-time intelligence gathering have accelerated military satellite deployment programs across multiple nations. The strategic importance of monitoring vast ocean territories and remote border regions makes satellite-based solutions indispensable for comprehensive defense coverage.

Technological advancement in satellite miniaturization and payload capabilities has made military satellite systems more accessible and cost-effective, enabling broader adoption across the region. Defense modernization programs prioritize space-based assets as force multipliers that enhance overall military effectiveness. The integration of artificial intelligence and machine learning technologies into satellite systems provides unprecedented analytical capabilities, driving demand for next-generation military satellite platforms.

Strategic autonomy initiatives across Asia-Pacific nations emphasize the development of indigenous satellite capabilities to reduce dependency on foreign systems and ensure operational security. Economic growth in the region has enabled increased defense spending, with significant portions allocated to space-based military programs. The recognition that space dominance is crucial for future military superiority continues to drive substantial investments in military satellite technologies and infrastructure development.

Significant challenges constrain the Asia-Pacific military satellite market despite its robust growth trajectory. These restraints encompass technical, financial, regulatory, and strategic limitations that impact market development and deployment timelines across the region.

High development costs associated with military-grade satellite systems present substantial barriers, particularly for smaller nations with limited defense budgets. The complexity of satellite design, testing, and qualification processes requires significant upfront investments and extended development timelines. Launch dependencies create vulnerabilities, as limited indigenous launch capabilities force many nations to rely on foreign launch services, potentially compromising operational security and mission timing.

Technical complexity of military satellite systems demands specialized expertise and advanced manufacturing capabilities that may not be readily available across all Asia-Pacific nations. Regulatory challenges related to space debris mitigation, orbital slot allocation, and international space law compliance add complexity to military satellite programs. The need for sophisticated ground infrastructure and trained personnel creates additional barriers to market entry and operational effectiveness.

Cybersecurity threats pose increasing risks to military satellite operations, requiring substantial investments in protective measures and secure communication protocols. Space debris concerns and the growing congestion in popular orbital regions limit deployment options and increase operational risks. Technology transfer restrictions and export controls limit access to advanced satellite technologies, forcing nations to develop indigenous capabilities that may require extended timeframes and substantial resources.

Emerging opportunities within the Asia-Pacific military satellite market present significant potential for growth and innovation. These opportunities arise from technological advancement, changing operational requirements, and evolving strategic priorities across the region.

Small satellite constellations represent a transformative opportunity, offering cost-effective alternatives to traditional large satellite platforms while providing enhanced coverage and redundancy. Commercial-military partnerships create opportunities for leveraging existing commercial satellite infrastructure and technologies for military applications, reducing development costs and deployment timelines. The growing demand for multi-mission satellites capable of supporting various military functions simultaneously presents opportunities for innovative platform designs and integrated solutions.

Artificial intelligence integration offers substantial opportunities for enhancing satellite data processing, autonomous operations, and predictive maintenance capabilities. Regional cooperation initiatives create potential for collaborative satellite programs that share costs and capabilities among allied nations. The development of quantum communication technologies for satellite applications presents opportunities for ultra-secure military communications that cannot be intercepted or compromised.

Manufacturing localization opportunities exist for establishing regional satellite production capabilities, reducing costs and improving supply chain security. Advanced sensor technologies including hyperspectral imaging, synthetic aperture radar, and electronic intelligence gathering systems offer opportunities for next-generation reconnaissance capabilities. The growing emphasis on space situational awareness creates opportunities for specialized satellite systems designed to monitor and protect space assets from threats and debris.

Complex market dynamics shape the Asia-Pacific military satellite landscape, reflecting the interplay between technological innovation, geopolitical factors, and strategic defense requirements. These dynamics create a constantly evolving environment that influences investment decisions, technology development, and operational deployment strategies across the region.

Competitive dynamics among regional powers drive continuous innovation and capability enhancement, with nations seeking to maintain technological advantages in space-based military systems. Supply chain considerations have become increasingly important, with emphasis on developing resilient, secure supply networks that can support military satellite programs without foreign dependencies. The integration of dual-use technologies from commercial satellite sectors accelerates development timelines while reducing costs through shared research and development investments.

Operational dynamics reflect the evolving nature of military missions, with satellites increasingly required to support multi-domain operations and provide real-time intelligence for rapid decision-making. Technology refresh cycles are accelerating as satellite capabilities advance rapidly, requiring continuous upgrades and modernization programs to maintain operational effectiveness. Market consolidation trends show increasing collaboration between traditional defense contractors and emerging technology companies specializing in satellite systems and space technologies.

Regulatory dynamics continue to evolve as governments develop policies and frameworks for military space operations, balancing security requirements with international obligations and commercial interests. Investment dynamics show sustained government funding combined with growing private sector participation, creating hybrid funding models that accelerate innovation and deployment. According to MarkWide Research analysis, approximately 60% of military satellite programs in the region now incorporate some form of public-private partnership structure.

Comprehensive research methodology employed for analyzing the Asia-Pacific military satellite market incorporates multiple data sources, analytical frameworks, and validation processes to ensure accuracy and reliability of market insights. The methodology combines quantitative analysis with qualitative assessments to provide a holistic understanding of market dynamics and trends.

Primary research involves extensive interviews with key stakeholders including military officials, defense contractors, satellite manufacturers, and technology providers across the Asia-Pacific region. Secondary research encompasses analysis of government defense budgets, procurement announcements, technical publications, and industry reports from authoritative sources. Data triangulation methods ensure consistency and accuracy across multiple information sources.

Market sizing methodology utilizes bottom-up and top-down approaches, analyzing individual country markets and regional aggregations to develop comprehensive market assessments. Trend analysis incorporates historical data patterns, current market conditions, and forward-looking indicators to identify growth trajectories and market evolution patterns. Competitive analysis examines market participants, technology capabilities, strategic partnerships, and market positioning to understand competitive dynamics.

Validation processes include expert reviews, cross-referencing with multiple data sources, and consistency checks to ensure research findings meet high standards of accuracy and reliability. Forecasting methodology incorporates scenario analysis, sensitivity testing, and Monte Carlo simulations to develop robust market projections that account for various potential outcomes and market conditions.

Regional market dynamics across the Asia-Pacific military satellite sector reveal significant variations in adoption patterns, investment levels, and strategic priorities among different countries and sub-regions. These variations reflect diverse security challenges, economic capabilities, and technological development levels across the expansive Asia-Pacific geography.

East Asia dominates the regional market, accounting for approximately 45% of military satellite deployments across the Asia-Pacific region. This sub-region demonstrates the most advanced satellite capabilities, with substantial investments in indigenous development programs and sophisticated multi-mission platforms. Northeast Asian nations have established comprehensive satellite constellations supporting various military functions, while also developing advanced manufacturing capabilities for satellite systems and components.

Southeast Asia represents a rapidly growing segment, with market share increasing by 12% annually as nations in this sub-region expand their military satellite capabilities. Maritime security concerns drive significant demand for surveillance and communication satellites capable of monitoring vast ocean territories and supporting naval operations. Regional cooperation initiatives are fostering collaborative satellite programs that share costs and capabilities among allied nations.

South Asia shows strong growth potential, with increasing investments in military satellite programs driven by border security requirements and strategic competition. Oceania maintains steady demand for military satellite capabilities, focusing on surveillance systems that support territorial monitoring and maritime domain awareness. The diverse geographical and strategic requirements across these sub-regions create varied market opportunities and drive innovation in satellite technologies and operational concepts.

Competitive landscape in the Asia-Pacific military satellite market features a diverse mix of established defense contractors, emerging technology companies, and government-owned enterprises that collectively drive innovation and market development across the region.

Market competition intensifies as traditional aerospace companies face challenges from innovative startups and technology firms entering the military satellite sector. Strategic partnerships between established contractors and emerging technology companies create new competitive dynamics and accelerate innovation cycles. Government-industry collaboration remains crucial for market success, with companies that effectively navigate regulatory requirements and security clearance processes maintaining competitive advantages.

Market segmentation of the Asia-Pacific military satellite sector reveals distinct categories based on satellite type, application, orbit type, and end-user requirements. This segmentation provides insights into specific market dynamics and growth opportunities across different satellite categories and applications.

By Satellite Type:

By Orbit Type:

By Application:

Communication satellites represent the largest segment within the Asia-Pacific military satellite market, driven by the critical need for secure, reliable communication networks that support military operations across vast geographical areas. These satellites incorporate advanced encryption technologies and anti-jamming capabilities to ensure operational security. Market demand for military communication satellites continues to grow as forces become increasingly networked and require real-time coordination capabilities.

Reconnaissance satellites demonstrate rapid technological advancement, with new platforms offering unprecedented resolution and multi-spectral imaging capabilities. Intelligence gathering requirements drive continuous innovation in sensor technologies, data processing capabilities, and autonomous operation features. The integration of artificial intelligence enables automated target recognition and anomaly detection, significantly enhancing operational effectiveness.

Navigation satellites focus on providing secure, jam-resistant positioning services that ensure military operations can continue even in contested electromagnetic environments. Regional navigation systems are being developed to reduce dependency on foreign GPS services while providing enhanced accuracy for military applications. Timing applications for navigation satellites extend beyond positioning to support synchronized military operations and secure communication protocols.

Early warning satellites incorporate sophisticated sensor arrays capable of detecting missile launches, aircraft movements, and other strategic threats across the Asia-Pacific region. Threat detection capabilities continue to evolve with improved sensor sensitivity and faster data processing systems that reduce warning times and enhance defensive responses. These systems play crucial roles in strategic defense architectures and missile defense networks.

Strategic advantages for industry participants in the Asia-Pacific military satellite market encompass multiple dimensions of value creation, from technological leadership to market expansion opportunities. These benefits reflect the growing importance of space-based military capabilities and the substantial investment opportunities within this dynamic sector.

Technology leadership opportunities enable companies to develop cutting-edge satellite technologies that can be applied across both military and commercial markets. Market expansion potential exists for companies that successfully establish presence in the Asia-Pacific military satellite sector, with opportunities to leverage regional expertise for global market penetration. Long-term contracts with government customers provide stable revenue streams and predictable cash flows that support sustained research and development investments.

Innovation acceleration results from the demanding requirements of military satellite applications, driving technological advancement that benefits broader satellite industry segments. Strategic partnerships with government agencies and defense organizations create opportunities for collaborative development programs and shared risk arrangements. Intellectual property development in military satellite technologies can generate licensing opportunities and competitive advantages in related market segments.

Supply chain integration opportunities exist for companies that can provide specialized components, subsystems, and services supporting military satellite programs. Workforce development benefits include building specialized expertise in satellite technologies that supports broader company capabilities and market competitiveness. Regional presence establishment through military satellite programs can facilitate expansion into other defense and aerospace market segments across the Asia-Pacific region.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping the Asia-Pacific military satellite market reflect the convergence of technological innovation, evolving operational requirements, and changing strategic priorities across the region. These trends indicate fundamental shifts in how military satellites are designed, deployed, and operated.

Constellation architectures are becoming the preferred approach for military satellite deployments, offering enhanced coverage, redundancy, and resilience compared to traditional single-satellite solutions. Small satellite adoption accelerates as military organizations recognize the cost-effectiveness and rapid deployment capabilities of smaller platforms. Multi-mission integration trends show satellites being designed to support multiple military functions simultaneously, maximizing operational value and reducing deployment costs.

Artificial intelligence integration represents a significant trend, with AI technologies being incorporated into satellite operations for autonomous decision-making, predictive maintenance, and enhanced data analysis capabilities. Commercial-military convergence continues as military organizations leverage commercial satellite technologies and services to supplement dedicated military systems. Quantum technology adoption emerges as a key trend for ultra-secure military communications that cannot be intercepted or compromised.

Manufacturing localization trends reflect growing emphasis on developing indigenous satellite production capabilities to reduce foreign dependencies and enhance supply chain security. Rapid refresh cycles are becoming standard as satellite technologies advance quickly, requiring more frequent upgrades and modernization programs. MarkWide Research data indicates that 85% of new military satellite programs now incorporate at least three of these key trends in their design and operational concepts.

Recent industry developments in the Asia-Pacific military satellite market demonstrate accelerating innovation and expanding capabilities across multiple technology domains. These developments reflect the dynamic nature of the market and the rapid pace of technological advancement driving military satellite evolution.

Advanced sensor integration developments include the deployment of hyperspectral imaging systems, synthetic aperture radar capabilities, and multi-band communication arrays that significantly enhance satellite operational effectiveness. Launch capability expansion across the region includes new indigenous launch vehicles and commercial launch services that reduce deployment costs and improve schedule flexibility for military satellite programs.

International collaboration developments feature new partnership agreements between Asia-Pacific nations for shared satellite programs, technology development, and operational coordination. Cybersecurity enhancement initiatives include implementation of advanced encryption technologies, secure communication protocols, and anti-jamming capabilities that protect military satellite operations from cyber threats and electronic warfare.

Manufacturing innovation developments encompass new production techniques, advanced materials, and automated assembly processes that reduce satellite manufacturing costs and improve quality consistency. Ground system modernization includes deployment of advanced control centers, data processing facilities, and communication networks that support next-generation military satellite operations. Technology demonstration programs across the region are validating new satellite concepts, operational procedures, and integration approaches that will shape future military satellite deployments.

Strategic recommendations for stakeholders in the Asia-Pacific military satellite market focus on positioning for long-term success while addressing current market challenges and opportunities. These suggestions reflect comprehensive analysis of market dynamics, competitive positioning, and future growth potential.

Investment prioritization should focus on developing core satellite technologies that can be applied across multiple mission types and customer segments. Partnership development with regional governments, defense organizations, and commercial satellite operators creates opportunities for shared risk, reduced costs, and enhanced market access. Technology roadmap alignment with emerging military requirements ensures product development efforts address future operational needs and maintain competitive relevance.

Market entry strategies should consider regional variations in requirements, regulatory environments, and competitive dynamics when developing business plans and market approach. Capability building in critical areas such as cybersecurity, AI integration, and small satellite technologies positions companies for future market opportunities. Supply chain optimization through regional partnerships and localized manufacturing reduces costs and improves market responsiveness.

Risk management strategies should address cybersecurity threats, technology transfer restrictions, and geopolitical uncertainties that could impact market development. Innovation investment in breakthrough technologies such as quantum communications, advanced sensors, and autonomous operations creates differentiation opportunities and competitive advantages. Customer relationship development with key military and government stakeholders ensures alignment with evolving requirements and procurement priorities across the Asia-Pacific region.

Future prospects for the Asia-Pacific military satellite market indicate sustained growth driven by evolving security challenges, technological advancement, and increasing recognition of space-based capabilities as essential military assets. The market outlook reflects optimistic projections based on current trends and anticipated developments across the region.

Growth trajectory projections suggest the market will continue expanding at a robust pace of 8.5% annually over the next decade, driven by increasing defense budgets and growing emphasis on space-based military capabilities. Technology evolution will focus on enhanced automation, improved sensor capabilities, and integration of emerging technologies such as quantum communications and advanced artificial intelligence systems.

Market expansion opportunities will emerge from new applications, evolving operational concepts, and increasing demand for specialized satellite capabilities supporting multi-domain military operations. Regional cooperation initiatives are expected to increase, creating opportunities for collaborative satellite programs that share costs and enhance collective defense capabilities. Commercial integration will continue growing as military organizations leverage commercial satellite technologies and services to supplement dedicated military systems.

Innovation acceleration will be driven by competitive pressures, evolving threats, and rapid technological advancement in satellite systems and space technologies. MWR analysis suggests that next-generation military satellites will incorporate significantly enhanced capabilities compared to current systems, with operational effectiveness improvements of 40-60% expected within the next five years. The future market landscape will be characterized by increased sophistication, enhanced integration, and expanded operational capabilities that support evolving military requirements across the Asia-Pacific region.

The Asia-Pacific military satellite market represents a dynamic and rapidly evolving sector that plays an increasingly critical role in regional defense strategies and military capabilities. The comprehensive analysis reveals a market characterized by strong growth fundamentals, technological innovation, and expanding operational requirements that collectively drive sustained demand for advanced satellite systems and services.

Market dynamics reflect the complex interplay between geopolitical factors, technological advancement, and strategic defense priorities that shape investment decisions and capability development across the region. The diverse security challenges facing Asia-Pacific nations, combined with growing defense budgets and emphasis on space-based military capabilities, create a favorable environment for continued market expansion and innovation.

Future success in this market will depend on the ability to navigate technological complexity, regulatory requirements, and competitive dynamics while delivering advanced satellite capabilities that meet evolving military requirements. The integration of emerging technologies, development of strategic partnerships, and focus on cost-effective solutions will be crucial for stakeholders seeking to capitalize on the substantial opportunities within the Asia-Pacific military satellite market. As the region continues to prioritize space-based defense capabilities, the market outlook remains highly positive with significant potential for growth, innovation, and strategic value creation across all market segments.

What is Military Satellite?

Military satellites are space-based systems used for defense purposes, including reconnaissance, communication, and navigation. They play a crucial role in modern warfare by providing real-time data and enhancing situational awareness for military operations.

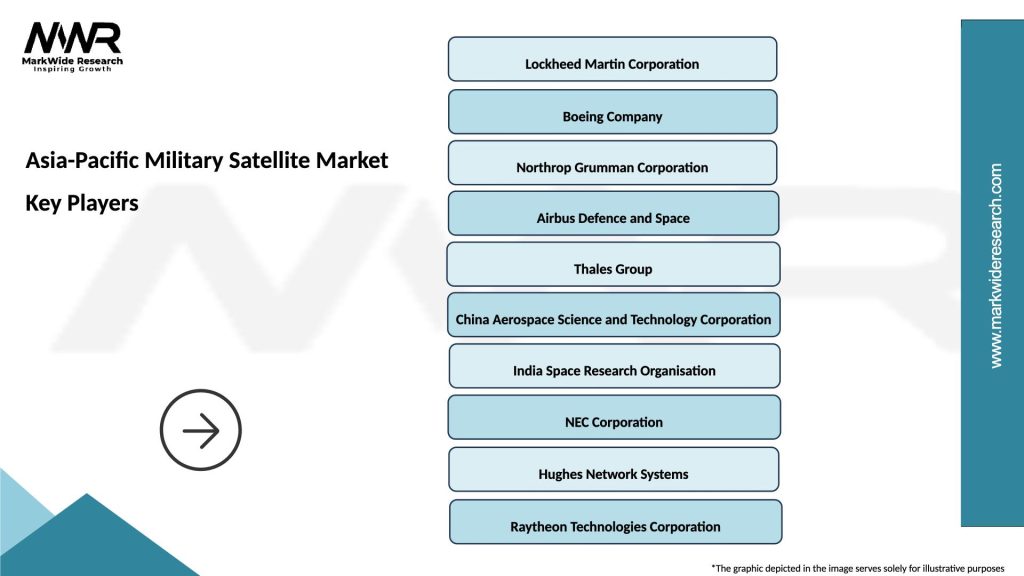

What are the key players in the Asia-Pacific Military Satellite Market?

Key players in the Asia-Pacific Military Satellite Market include Lockheed Martin, Boeing, Northrop Grumman, and Thales Group, among others. These companies are involved in the development and deployment of advanced satellite systems for military applications.

What are the growth factors driving the Asia-Pacific Military Satellite Market?

The growth of the Asia-Pacific Military Satellite Market is driven by increasing defense budgets, the rising need for advanced surveillance capabilities, and the growing importance of secure communication systems. Additionally, geopolitical tensions in the region are prompting nations to enhance their military satellite capabilities.

What challenges does the Asia-Pacific Military Satellite Market face?

The Asia-Pacific Military Satellite Market faces challenges such as high development costs, technological complexities, and regulatory hurdles. Additionally, the rapid pace of technological advancements can make it difficult for companies to keep up with the latest innovations.

What opportunities exist in the Asia-Pacific Military Satellite Market?

Opportunities in the Asia-Pacific Military Satellite Market include the increasing demand for satellite-based intelligence, surveillance, and reconnaissance (ISR) capabilities. Furthermore, advancements in satellite technology, such as miniaturization and improved launch systems, are opening new avenues for market growth.

What trends are shaping the Asia-Pacific Military Satellite Market?

Trends shaping the Asia-Pacific Military Satellite Market include the integration of artificial intelligence for data analysis, the development of small satellite constellations, and the focus on enhancing cybersecurity measures. These trends are expected to transform how military operations utilize satellite technology.

Asia-Pacific Military Satellite Market

| Segmentation Details | Description |

|---|---|

| Product Type | Communication Satellites, Earth Observation Satellites, Navigation Satellites, Reconnaissance Satellites |

| Technology | Geostationary Orbit, Low Earth Orbit, Medium Earth Orbit, Hybrid Systems |

| End User | Defense Forces, Government Agencies, Research Institutions, Private Contractors |

| Application | Surveillance, Reconnaissance, Communication, Weather Monitoring |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Military Satellite Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at