444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

Medium-Density Fiberboard (MDF) is a widely used engineered wood product in the construction and furniture industries. It is made by combining wood fibers and resin under high pressure and temperature, resulting in a strong and versatile material. The Asia-Pacific region has emerged as a significant market for MDF, driven by rapid urbanization, infrastructure development, and increasing demand for furniture and interior decorations. This article provides an in-depth analysis of the Asia-Pacific MDF market, including market trends, drivers, restraints, opportunities, competitive landscape, and future outlook.

Meaning

Medium-Density Fiberboard (MDF) is a type of composite wood product made from wood fibers, which are combined with resin and formed into boards under high pressure and temperature. The resulting boards have a uniform density and consistent strength, making them suitable for various applications in the construction and furniture industries. MDF is known for its smooth surface, dimensional stability, and excellent machining properties, allowing it to be easily shaped, cut, and painted. These qualities have contributed to the growing popularity of MDF in the Asia-Pacific region.

Executive Summary

The Asia-Pacific Medium-Density Fiberboard (MDF) market has witnessed significant growth in recent years, driven by the rising demand for construction and furniture materials. The market is expected to continue its upward trajectory, propelled by factors such as urbanization, infrastructure development, and increasing consumer spending on home furnishings. However, the market also faces challenges, including raw material price volatility and environmental concerns related to wood sourcing and emissions. To capitalize on the market opportunities and overcome the obstacles, industry participants need to focus on innovation, sustainability, and strategic partnerships.

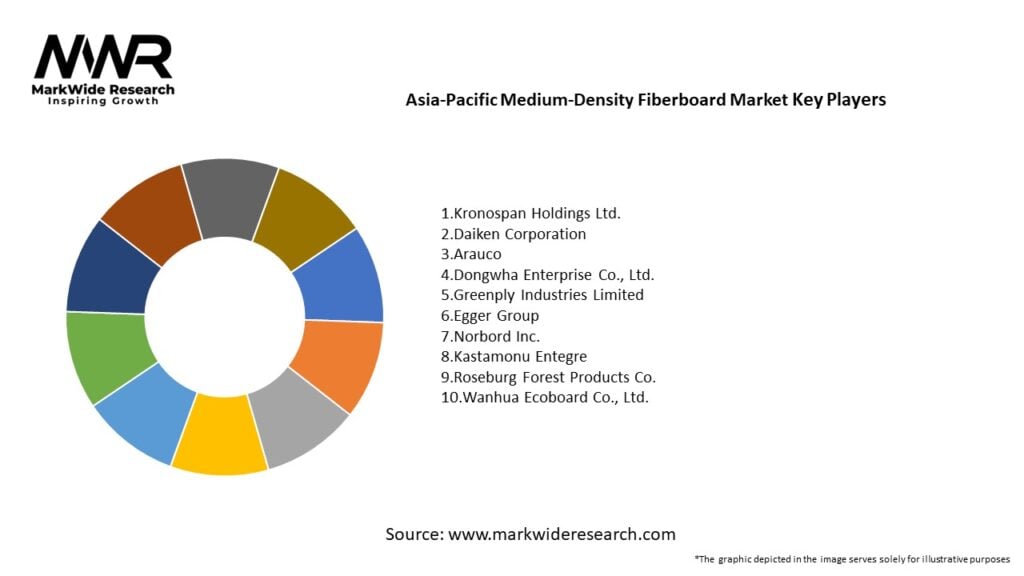

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Asia-Pacific MDF market is characterized by intense competition, technological advancements, and evolving customer preferences. Key players in the market are focusing on expanding their production capacities, investing in research and development, and forming strategic alliances to strengthen their market presence. Customer demands for sustainable and aesthetically pleasing products are driving manufacturers to improve the quality and design of MDF. Additionally, the market is witnessing a shift towards online sales channels, with increased digitalization and e-commerce penetration.

Regional Analysis

Competitive Landscape

Leading Companies in the Asia-Pacific Medium-Density Fiberboard Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Asia-Pacific MDF market can be segmented based on application, thickness, and end-use industry.

1.Application:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Asia-Pacific MDF market experienced a temporary slowdown during the COVID-19 pandemic due to disruptions in the construction and furniture industries. The lockdown measures and supply chain disruptions resulted in project delays and reduced consumer spending. However, as the economies started recovering and restrictions eased, the demand for MDF rebounded. The market benefited from the increased focus on home improvement and renovation projects during the pandemic. Additionally, the shift towards remote work and online learning increased the demand for home office furniture, further driving the MDF market.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Asia-Pacific MDF market is expected to witness steady growth in the coming years. The regionwill continue to be a key market for MDF due to factors such as urbanization, infrastructure development, and the growing demand for furniture and interior decorations. The construction sector will remain a significant driver of MDF demand, with the need for affordable housing and commercial spaces driving the market. The furniture industry will also contribute to the growth, as consumers seek modern and aesthetically pleasing designs.

Despite the growth prospects, the market will face challenges such as volatile raw material prices and environmental concerns. Manufacturers will need to adapt to these challenges by implementing sustainable practices, investing in research and development, and forming strategic partnerships. Innovation in product development, particularly in terms of enhanced properties and surface finishes, will be crucial to meet customer demands.

Geographically, China will continue to dominate the Asia-Pacific MDF market, supported by its booming construction industry and strong furniture manufacturing sector. Southeast Asian countries like Vietnam, Indonesia, and Thailand will emerge as key players, leveraging their abundant wood resources and favorable investment climate. India will present significant growth opportunities, driven by rapid urbanization and infrastructure development.

To thrive in the market, MDF manufacturers should focus on sustainable practices, product innovation, and digitalization. Building resilient supply chains and strengthening marketing efforts will also be essential. By capitalizing on the market opportunities and addressing the challenges, the Asia-Pacific MDF market is poised for a positive future outlook.

Conclusion

The Asia-Pacific Medium-Density Fiberboard (MDF) market is experiencing significant growth driven by urbanization, infrastructure development, and the demand for furniture and interior decorations. MDF offers cost-effective solutions and versatility in various applications, making it a popular choice in the construction and furniture industries. However, the market faces challenges such as volatile raw material prices and environmental concerns.

To succeed in the market, manufacturers should focus on sustainability, innovation, and strategic partnerships. Embracing sustainable practices, investing in research and development, and adopting digital marketing strategies will help companies differentiate their products and expand their customer base. The future of the Asia-Pacific MDF market looks promising, with continued growth expected in the construction and furniture sectors. By staying ahead of market trends and addressing customer demands, industry participants can capitalize on the opportunities and shape the future of the market.

What is Medium-Density Fiberboard?

Medium-Density Fiberboard (MDF) is an engineered wood product made from wood fibers, wax, and resin, which are compressed under heat and pressure. It is widely used in furniture, cabinetry, and flooring due to its smooth surface and versatility.

What are the key players in the Asia-Pacific Medium-Density Fiberboard Market?

Key players in the Asia-Pacific Medium-Density Fiberboard Market include companies like Arauco, Norbord, and Daiken Corporation, which are known for their production and innovation in MDF products, among others.

What are the growth factors driving the Asia-Pacific Medium-Density Fiberboard Market?

The Asia-Pacific Medium-Density Fiberboard Market is driven by increasing demand for sustainable building materials, growth in the furniture industry, and rising urbanization leading to more construction projects.

What challenges does the Asia-Pacific Medium-Density Fiberboard Market face?

Challenges in the Asia-Pacific Medium-Density Fiberboard Market include fluctuations in raw material prices, competition from alternative materials like particleboard, and environmental regulations affecting production processes.

What opportunities exist in the Asia-Pacific Medium-Density Fiberboard Market?

Opportunities in the Asia-Pacific Medium-Density Fiberboard Market include the growing trend of eco-friendly products, advancements in manufacturing technology, and increasing applications in automotive and construction sectors.

What trends are shaping the Asia-Pacific Medium-Density Fiberboard Market?

Trends in the Asia-Pacific Medium-Density Fiberboard Market include the rise of smart furniture, the integration of digital technologies in production, and a shift towards more sustainable and recyclable materials.

Asia-Pacific Medium-Density Fiberboard Market

| Segmentation Details | Description |

|---|---|

| Product Type | Standard MDF, Moisture Resistant MDF, Fire Retardant MDF, High-Density MDF |

| End User | Furniture Manufacturers, Construction Industry, Interior Designers, Cabinet Makers |

| Application | Flooring, Wall Panels, Furniture, Decorative Items |

| Distribution Channel | Direct Sales, Online Retail, Distributors, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Asia-Pacific Medium-Density Fiberboard Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at