444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific medical waste management market represents one of the most rapidly expanding sectors within the healthcare infrastructure landscape. This dynamic market encompasses the systematic collection, treatment, and disposal of healthcare-generated waste materials across diverse medical facilities throughout the region. Healthcare institutions across Asia Pacific are increasingly recognizing the critical importance of proper medical waste management protocols to ensure environmental safety and regulatory compliance.

Market growth is being driven by expanding healthcare infrastructure, rising patient volumes, and stringent regulatory frameworks implemented by governments across the region. The market demonstrates robust expansion with a projected compound annual growth rate (CAGR) of 8.2% over the forecast period. Developing economies within Asia Pacific are experiencing particularly strong demand as healthcare systems modernize and adopt international best practices for waste management.

Regional dynamics indicate significant variations in market maturity, with developed markets like Japan and Australia leading in advanced treatment technologies, while emerging economies focus on establishing fundamental waste management infrastructure. The market encompasses various waste categories including infectious waste, pathological waste, pharmaceutical waste, and sharps, each requiring specialized handling and treatment protocols.

The Asia Pacific medical waste management market refers to the comprehensive ecosystem of services, technologies, and infrastructure dedicated to the safe collection, transportation, treatment, and disposal of healthcare-generated waste materials across the Asia Pacific region. This market encompasses all activities involved in managing potentially hazardous materials produced by hospitals, clinics, laboratories, pharmaceutical facilities, and other healthcare establishments.

Medical waste management involves multiple stages including waste segregation at source, secure collection and packaging, specialized transportation, appropriate treatment technologies such as autoclaving or incineration, and final disposal in compliance with environmental regulations. The market includes both on-site and off-site treatment solutions, with service providers offering integrated waste management programs tailored to specific healthcare facility requirements.

Regulatory compliance forms a fundamental component of this market, as healthcare facilities must adhere to strict guidelines established by national and international authorities. The market serves to protect public health, prevent environmental contamination, and ensure healthcare workers and communities are safeguarded from exposure to potentially infectious or hazardous materials.

Strategic market analysis reveals the Asia Pacific medical waste management market is experiencing unprecedented growth driven by healthcare sector expansion and regulatory enforcement. The market benefits from increasing healthcare expenditure across the region, with governments investing heavily in healthcare infrastructure development and environmental protection measures.

Technology adoption is accelerating, with healthcare facilities increasingly implementing advanced waste treatment solutions including steam sterilization, microwave treatment, and chemical treatment systems. Approximately 72% of healthcare facilities in developed Asia Pacific markets have adopted automated waste tracking systems to enhance compliance and operational efficiency.

Market segmentation shows infectious waste representing the largest category, followed by pathological waste and pharmaceutical waste. Service-based solutions dominate the market landscape, with 68% of healthcare facilities outsourcing their medical waste management requirements to specialized service providers rather than managing waste internally.

Competitive dynamics indicate market consolidation trends, with leading service providers expanding their geographic footprint through strategic acquisitions and partnerships. The market demonstrates strong growth potential across emerging economies where healthcare infrastructure development is creating substantial demand for professional medical waste management services.

Healthcare sector expansion across Asia Pacific is generating substantial volumes of medical waste, creating significant opportunities for specialized management services. The market demonstrates strong correlation with healthcare spending patterns, with regions experiencing rapid healthcare infrastructure development showing the highest growth rates in medical waste generation.

Healthcare infrastructure expansion represents the primary driver of market growth across Asia Pacific, with governments investing substantially in hospital construction and medical facility upgrades. This infrastructure development directly correlates with increased medical waste generation, creating sustained demand for professional waste management services.

Regulatory enforcement is intensifying across the region, with governments implementing stricter guidelines for medical waste handling and disposal. Healthcare facilities face significant penalties for non-compliance, driving adoption of professional waste management services to ensure regulatory adherence. Compliance requirements have increased by approximately 45% over the past five years across major Asia Pacific markets.

Population demographics contribute significantly to market growth, with aging populations requiring increased healthcare services and generating higher volumes of medical waste. Rising healthcare utilization rates, particularly in emerging economies, are creating substantial demand for comprehensive waste management solutions.

Environmental awareness is driving demand for sustainable waste treatment technologies and environmentally responsible disposal methods. Healthcare facilities are increasingly prioritizing eco-friendly solutions that minimize environmental impact while maintaining safety standards. Public health concerns regarding improper medical waste disposal are prompting stricter oversight and professional management requirements.

High implementation costs present significant challenges for healthcare facilities, particularly smaller clinics and medical practices with limited budgets. The initial investment required for proper waste management infrastructure and ongoing service costs can strain operational budgets, potentially limiting market adoption in price-sensitive segments.

Regulatory complexity varies significantly across Asia Pacific countries, creating challenges for service providers operating in multiple markets. Inconsistent regulations and varying compliance requirements increase operational complexity and costs for waste management companies seeking regional expansion.

Infrastructure limitations in certain emerging markets constrain market development, with inadequate transportation networks and limited treatment facility availability affecting service delivery. Remote healthcare facilities may face particular challenges accessing professional waste management services due to geographic constraints.

Skilled workforce shortage impacts service quality and operational efficiency, with specialized training requirements for medical waste handling creating human resource challenges. The technical nature of waste treatment operations requires qualified personnel, which may be limited in certain regional markets.

Emerging market expansion presents substantial growth opportunities as developing economies invest in healthcare infrastructure and implement modern waste management practices. Countries with rapidly expanding healthcare sectors offer significant potential for service providers willing to invest in local market development.

Technology innovation creates opportunities for advanced treatment solutions including automated sorting systems, real-time tracking technologies, and environmentally sustainable treatment methods. Healthcare facilities are increasingly interested in innovative solutions that improve efficiency while reducing environmental impact.

Public-private partnerships offer opportunities for collaborative approaches to medical waste management infrastructure development. Government initiatives to improve healthcare waste management create partnership opportunities for private sector service providers to contribute expertise and resources.

Digital transformation initiatives present opportunities for technology-enabled waste management solutions including IoT-based monitoring, blockchain tracking, and artificial intelligence-powered optimization systems. These technologies can enhance operational efficiency and provide valuable data insights for healthcare facilities.

Supply chain evolution is reshaping the medical waste management landscape, with service providers developing integrated solutions that encompass the entire waste lifecycle from generation to final disposal. This comprehensive approach enables healthcare facilities to streamline their waste management processes while ensuring regulatory compliance.

Competitive intensity is increasing as market participants expand their service offerings and geographic coverage. Leading companies are investing in technology upgrades and capacity expansion to maintain competitive advantages in this growing market. Market consolidation trends indicate approximately 35% of regional acquisitions have occurred within the past two years.

Customer expectations are evolving toward comprehensive service packages that include waste auditing, staff training, regulatory consulting, and sustainability reporting. Healthcare facilities increasingly value service providers that can offer integrated solutions addressing multiple aspects of waste management requirements.

Regulatory dynamics continue to influence market development, with governments across Asia Pacific implementing updated guidelines and enforcement mechanisms. These regulatory changes create both challenges and opportunities for market participants, requiring continuous adaptation and investment in compliance capabilities.

Comprehensive market analysis was conducted using a multi-faceted research approach combining primary and secondary research methodologies to ensure accurate and reliable market insights. The research framework incorporated quantitative and qualitative analysis techniques to provide a holistic view of the Asia Pacific medical waste management market.

Primary research involved extensive interviews with key industry stakeholders including healthcare facility administrators, waste management service providers, regulatory officials, and technology suppliers. These interviews provided valuable insights into market trends, challenges, and growth opportunities from multiple perspectives across the value chain.

Secondary research encompassed analysis of government publications, industry reports, regulatory documents, and company financial statements to gather comprehensive market data. This research included examination of healthcare spending patterns, waste generation statistics, and regulatory compliance requirements across major Asia Pacific markets.

Data validation processes ensured accuracy and reliability of research findings through cross-referencing multiple sources and conducting follow-up interviews with industry experts. The research methodology incorporated regional market variations and country-specific factors to provide accurate market assessments for diverse Asia Pacific economies.

China dominates the Asia Pacific medical waste management market, representing approximately 42% of regional market share due to its massive healthcare infrastructure and large population base. The Chinese market benefits from government initiatives promoting healthcare sector development and environmental protection measures, driving substantial demand for professional waste management services.

Japan maintains a significant market position with advanced waste treatment technologies and strict regulatory compliance requirements. The Japanese market emphasizes technological innovation and environmental sustainability, with healthcare facilities investing in state-of-the-art waste treatment systems and comprehensive management programs.

India demonstrates the highest growth potential within the region, with rapid healthcare infrastructure expansion and increasing regulatory enforcement driving market development. The Indian market represents approximately 18% of regional market share and is experiencing accelerated growth as healthcare facilities modernize their waste management practices.

Southeast Asian markets including Thailand, Malaysia, and Indonesia are experiencing robust growth driven by healthcare sector investments and regulatory improvements. These markets collectively represent 22% of regional market share and offer significant expansion opportunities for service providers.

Australia and New Zealand represent mature markets with established waste management infrastructure and advanced regulatory frameworks. These markets focus on technological innovation and sustainability initiatives, serving as models for emerging economies in the region.

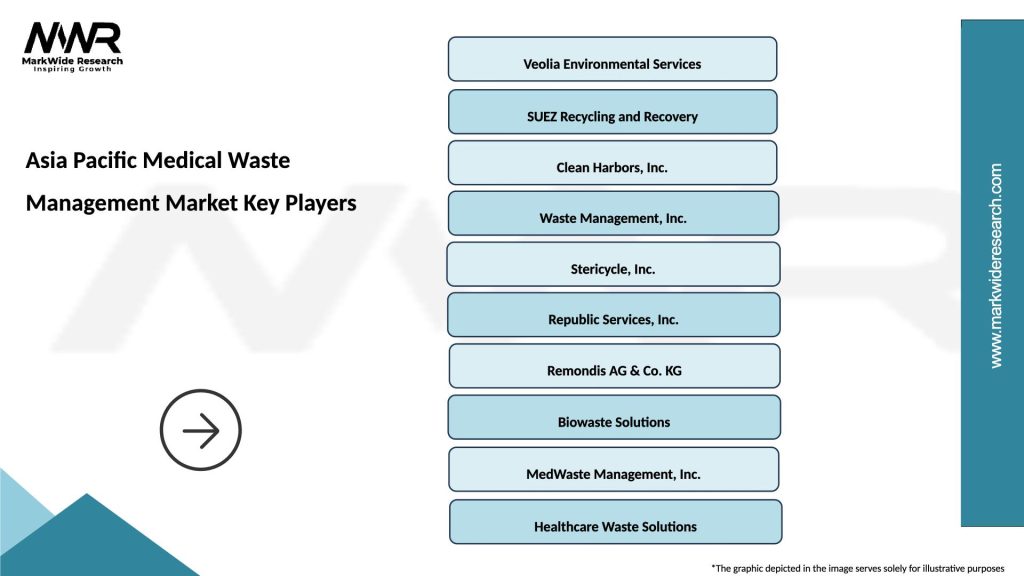

Market leadership is distributed among several key players offering comprehensive medical waste management services across the Asia Pacific region. The competitive landscape demonstrates a mix of international companies and regional specialists, each bringing unique strengths and market positioning strategies.

Strategic partnerships and acquisitions are common competitive strategies, with companies seeking to expand their geographic coverage and service capabilities through collaborative arrangements and market consolidation activities.

By Waste Type: The market segments into multiple waste categories, each requiring specialized handling and treatment protocols. Infectious waste represents the largest segment, encompassing materials contaminated with potentially infectious substances from patient care activities.

By Treatment Technology: Various treatment methods are employed based on waste type and regulatory requirements, with each technology offering specific advantages for different waste categories.

Healthcare Facilities: Hospitals represent the largest waste generation category, producing diverse waste types requiring comprehensive management solutions. Large hospitals typically generate substantial volumes requiring on-site treatment capabilities or frequent collection services.

Diagnostic Laboratories: Clinical laboratories generate significant volumes of infectious waste and sharps, requiring specialized collection and treatment services. These facilities often require customized waste management programs addressing specific laboratory waste characteristics.

Pharmaceutical Manufacturing: Drug manufacturing facilities generate pharmaceutical waste requiring specialized treatment to prevent environmental contamination. These facilities often require integrated waste management solutions addressing both manufacturing waste and expired product disposal.

Research Institutions: Medical research facilities generate diverse waste types including laboratory cultures, experimental materials, and chemical waste. These facilities require flexible waste management solutions accommodating varying waste generation patterns and specialized disposal requirements.

Long-term Care Facilities: Nursing homes and assisted living facilities generate consistent volumes of infectious waste requiring regular collection services. These facilities often prioritize cost-effective solutions while maintaining regulatory compliance.

Healthcare Facilities benefit from professional medical waste management through improved regulatory compliance, reduced liability exposure, and enhanced operational efficiency. Outsourcing waste management allows healthcare facilities to focus on core medical services while ensuring proper waste handling by specialized professionals.

Environmental Protection is achieved through proper waste treatment and disposal, preventing contamination of soil, water, and air resources. Professional waste management services implement environmentally responsible practices that minimize ecological impact while ensuring public health protection.

Cost Optimization results from efficient waste management processes that reduce overall handling costs and minimize regulatory compliance expenses. Professional services often provide cost savings compared to internal waste management programs through economies of scale and specialized expertise.

Risk Mitigation is enhanced through professional handling of potentially hazardous materials, reducing exposure risks for healthcare workers and patients. Specialized service providers maintain comprehensive insurance coverage and implement strict safety protocols to minimize liability exposure.

Regulatory Compliance is ensured through professional expertise in current regulations and best practices. Service providers maintain up-to-date knowledge of regulatory requirements and implement compliant processes that protect healthcare facilities from potential violations and penalties.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation is revolutionizing medical waste management through implementation of IoT sensors, blockchain tracking, and artificial intelligence-powered optimization systems. These technologies enable real-time monitoring of waste generation, collection efficiency, and treatment processes, providing valuable data insights for operational improvements.

Sustainability initiatives are gaining prominence as healthcare facilities prioritize environmentally responsible waste management practices. Approximately 58% of healthcare facilities are implementing sustainability programs that include waste reduction strategies, recycling initiatives, and selection of eco-friendly treatment technologies.

Automation adoption is increasing across waste management operations, with automated sorting systems, robotic handling equipment, and smart collection vehicles improving operational efficiency while reducing human exposure to potentially hazardous materials. These technologies enhance safety while optimizing resource utilization.

Integrated service models are becoming more prevalent, with service providers offering comprehensive solutions that include waste auditing, staff training, regulatory consulting, and sustainability reporting. Healthcare facilities increasingly prefer single-source providers that can address multiple waste management requirements through integrated service packages.

Regulatory harmonization efforts across Asia Pacific countries are creating more consistent compliance requirements, facilitating regional service provider expansion and operational standardization. This trend supports market consolidation and enables economies of scale for service providers operating across multiple countries.

Technology partnerships between waste management companies and technology providers are accelerating innovation in treatment processes and operational systems. These collaborations are developing advanced solutions for waste tracking, treatment optimization, and regulatory reporting that enhance service quality and operational efficiency.

Capacity expansion initiatives are underway across the region, with leading service providers investing in new treatment facilities and expanding their geographic coverage. MarkWide Research analysis indicates that treatment capacity has increased by approximately 28% over the past three years to meet growing demand.

Regulatory updates in major markets are strengthening compliance requirements and enforcement mechanisms, driving demand for professional waste management services. Recent regulatory changes in China and India have particularly impacted market dynamics by requiring enhanced waste tracking and treatment standards.

Acquisition activity continues to reshape the competitive landscape, with larger companies acquiring regional specialists to expand their market presence and service capabilities. These transactions are creating more comprehensive service networks and enabling better resource utilization across regional markets.

Sustainability certifications are becoming increasingly important, with service providers pursuing environmental management certifications and implementing carbon reduction programs. Healthcare facilities are increasingly selecting service providers based on their environmental credentials and sustainability performance.

Investment priorities should focus on technology integration and capacity expansion in high-growth emerging markets where healthcare infrastructure development is creating substantial demand for medical waste management services. Companies should prioritize markets with supportive regulatory frameworks and growing healthcare expenditure.

Service differentiation through comprehensive integrated solutions will become increasingly important as healthcare facilities seek single-source providers for their waste management requirements. Companies should develop capabilities in waste auditing, staff training, and regulatory consulting to enhance their value proposition.

Technology adoption should emphasize digital solutions that improve operational efficiency and provide valuable data insights for customers. Investment in IoT sensors, tracking systems, and automated processing equipment will enhance competitive positioning and operational capabilities.

Partnership strategies with healthcare facility operators, technology providers, and government agencies can accelerate market penetration and service development. Strategic alliances can provide access to new markets, technologies, and customer segments while sharing development costs and risks.

Sustainability initiatives should be integrated into core business strategies as environmental considerations become increasingly important for customer selection criteria. Companies should invest in eco-friendly treatment technologies and implement comprehensive environmental management programs.

Market expansion is expected to continue at robust rates driven by healthcare sector growth, regulatory enforcement, and increasing awareness of proper waste management practices. The market is projected to maintain strong growth momentum with a compound annual growth rate exceeding 8% over the next five years.

Technology evolution will transform waste management operations through advanced automation, artificial intelligence, and sustainable treatment technologies. These innovations will improve operational efficiency, reduce costs, and enhance environmental performance while maintaining high safety standards.

Regional development patterns indicate emerging markets will experience the highest growth rates as healthcare infrastructure expands and regulatory frameworks strengthen. MWR projections suggest that emerging Asia Pacific markets will represent approximately 65% of incremental market growth over the forecast period.

Service evolution toward integrated solutions will continue, with successful companies offering comprehensive waste management programs that address multiple customer requirements through single-source relationships. This trend will drive market consolidation and favor companies with broad service capabilities.

Regulatory development will continue to strengthen compliance requirements and enforcement mechanisms, creating sustained demand for professional waste management services. Harmonization efforts across countries will facilitate regional service provider expansion and operational standardization.

The Asia Pacific medical waste management market represents a dynamic and rapidly expanding sector driven by healthcare infrastructure growth, regulatory enforcement, and increasing environmental awareness. Market participants benefit from sustained demand growth, technological innovation opportunities, and expanding service requirements from healthcare facilities across the region.

Strategic success in this market requires comprehensive service capabilities, technology integration, and strong regulatory compliance expertise. Companies that can provide integrated solutions addressing multiple customer requirements while maintaining high safety and environmental standards will achieve competitive advantages in this growing market.

Future growth prospects remain highly favorable, with emerging markets offering substantial expansion opportunities and technology developments creating new service possibilities. The market’s fundamental drivers including healthcare sector expansion, regulatory enforcement, and environmental protection requirements provide a strong foundation for sustained long-term growth across the Asia Pacific region.

What is Medical Waste Management?

Medical Waste Management refers to the processes involved in handling, treating, and disposing of waste generated from healthcare facilities, including hospitals, clinics, and laboratories. This waste can include hazardous materials, sharps, and infectious waste that require specialized management to ensure safety and compliance with regulations.

What are the key players in the Asia Pacific Medical Waste Management Market?

Key players in the Asia Pacific Medical Waste Management Market include Veolia Environmental Services, Stericycle, and Clean Harbors, among others. These companies provide a range of services including waste collection, treatment, and disposal, catering to various healthcare facilities.

What are the main drivers of the Asia Pacific Medical Waste Management Market?

The main drivers of the Asia Pacific Medical Waste Management Market include the increasing volume of medical waste generated due to rising healthcare activities, stringent regulations regarding waste disposal, and growing awareness about environmental sustainability. Additionally, advancements in waste treatment technologies are also contributing to market growth.

What challenges does the Asia Pacific Medical Waste Management Market face?

The Asia Pacific Medical Waste Management Market faces challenges such as inadequate infrastructure for waste management in some regions, high operational costs, and a lack of trained personnel. These factors can hinder effective waste management practices and compliance with regulations.

What opportunities exist in the Asia Pacific Medical Waste Management Market?

Opportunities in the Asia Pacific Medical Waste Management Market include the development of innovative waste treatment technologies, increasing investments in healthcare infrastructure, and the potential for public-private partnerships. These factors can enhance waste management efficiency and sustainability.

What trends are shaping the Asia Pacific Medical Waste Management Market?

Trends shaping the Asia Pacific Medical Waste Management Market include the adoption of digital solutions for waste tracking, increased focus on recycling and waste minimization, and the implementation of stricter regulations. These trends aim to improve waste management practices and reduce environmental impact.

Asia Pacific Medical Waste Management Market

| Segmentation Details | Description |

|---|---|

| Type | Hazardous Waste, Non-Hazardous Waste, Infectious Waste, Radioactive Waste |

| End User | Hospitals, Clinics, Laboratories, Long-term Care Facilities |

| Service Type | Collection, Transportation, Treatment, Disposal |

| Technology | Incineration, Autoclaving, Chemical Treatment, Landfilling |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Medical Waste Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at