444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific meal replacement market represents one of the fastest-growing segments in the global nutrition industry, driven by increasing health consciousness, busy lifestyles, and rising disposable incomes across the region. Market dynamics indicate substantial growth potential as consumers increasingly seek convenient, nutritionally balanced alternatives to traditional meals. The region’s diverse demographic profile, ranging from tech-savvy millennials in urban centers to health-conscious professionals, creates a robust foundation for market expansion.

Regional characteristics demonstrate significant variation in consumer preferences and market penetration rates across different countries. Japan and South Korea lead in market maturity with 42% adoption rates among urban professionals, while emerging markets like India and Southeast Asian nations show rapid growth trajectories. The market encompasses various product categories including protein shakes, meal bars, ready-to-drink beverages, and powder-based supplements, each targeting specific consumer segments and nutritional requirements.

Consumer behavior patterns reveal increasing acceptance of meal replacement products as legitimate nutritional solutions rather than temporary diet aids. This shift represents a fundamental change in how Asian consumers approach nutrition and meal planning, with 68% of users incorporating these products into their regular dietary routines for convenience and health benefits.

The Asia Pacific meal replacement market refers to the commercial sector encompassing nutritionally complete food products designed to substitute traditional meals while providing essential vitamins, minerals, proteins, and other nutrients required for optimal health. These products are specifically formulated to deliver balanced nutrition in convenient, portable formats that align with modern lifestyle demands.

Product categories within this market include protein-rich shakes, nutritionally dense bars, ready-to-consume beverages, and powder-based meal substitutes that can be mixed with liquids. Each category serves different consumer needs, from weight management and fitness support to general nutritional supplementation and meal convenience solutions.

Market scope extends beyond simple food replacement to encompass comprehensive nutritional solutions that address specific dietary requirements, health goals, and lifestyle preferences prevalent across Asia Pacific’s diverse population segments.

Market expansion across the Asia Pacific region demonstrates remarkable momentum, with the meal replacement sector experiencing unprecedented growth driven by urbanization, changing dietary patterns, and increased health awareness. Key market drivers include rising obesity rates, growing fitness culture, and the need for convenient nutrition solutions among time-constrained consumers.

Regional leadership varies significantly, with developed markets like Japan, Australia, and South Korea showing mature adoption patterns, while emerging economies including China, India, and Southeast Asian nations present substantial growth opportunities. The market benefits from 15.2% annual growth rates in key segments, particularly protein-based meal replacements and functional nutrition products.

Competitive dynamics feature both international brands and local manufacturers, creating a diverse ecosystem that caters to regional taste preferences and cultural dietary requirements. Innovation focuses on natural ingredients, plant-based formulations, and culturally relevant flavors that resonate with local consumer preferences.

Future projections indicate sustained growth momentum, supported by increasing disposable incomes, expanding retail distribution networks, and growing acceptance of Western nutritional concepts adapted to Asian dietary traditions and preferences.

Consumer demographics reveal distinct patterns in meal replacement adoption across the Asia Pacific region, with several key insights emerging from market analysis:

Lifestyle transformation across Asia Pacific nations serves as the primary catalyst for meal replacement market growth. Rapid urbanization and increasingly demanding work schedules create substantial demand for convenient, nutritionally balanced meal alternatives that fit busy lifestyles without compromising health goals.

Health consciousness trends demonstrate significant influence on consumer behavior, with rising awareness of nutrition’s role in preventing lifestyle diseases and maintaining optimal wellness. The growing prevalence of obesity and diabetes in the region drives consumers toward controlled-calorie, nutritionally complete meal solutions that support weight management and metabolic health.

Economic prosperity in key markets enables consumers to invest in premium nutrition products, with rising disposable incomes supporting market expansion. The expanding middle class across countries like China, India, and Southeast Asian nations creates a substantial consumer base willing to pay for quality meal replacement products.

Fitness culture adoption represents another significant driver, as Western fitness and wellness concepts gain popularity across the region. The integration of meal replacements into fitness routines and weight management programs creates sustained demand for protein-rich and performance-oriented products.

Retail infrastructure development facilitates market accessibility through expanded distribution networks, online platforms, and specialized nutrition stores that make meal replacement products readily available to consumers across urban and suburban areas.

Cultural dietary traditions present significant challenges to meal replacement adoption in many Asia Pacific markets, where traditional meal structures and family dining customs remain deeply ingrained. Consumer resistance to replacing traditional meals with processed alternatives creates barriers to market penetration in culturally conservative segments.

Price sensitivity affects market accessibility, particularly in emerging economies where premium meal replacement products may be considered luxury items rather than essential nutrition solutions. The cost differential between meal replacements and traditional food options limits adoption among price-conscious consumers.

Regulatory complexities across different countries create challenges for manufacturers seeking regional expansion. Varying food safety standards, labeling requirements, and nutritional regulations necessitate significant compliance investments and may delay product launches in new markets.

Taste and texture preferences specific to Asian palates often conflict with Western-formulated meal replacement products, requiring extensive localization efforts and potentially limiting product acceptance. Consumer expectations for familiar flavors and textures may not align with standardized international formulations.

Skepticism regarding processed foods among health-conscious consumers who prefer whole, natural foods over manufactured alternatives creates resistance to meal replacement adoption, particularly in markets with strong traditional medicine and natural health philosophies.

Emerging market penetration presents substantial growth opportunities, particularly in countries with rapidly developing economies and expanding middle-class populations. Markets like Vietnam, Indonesia, and the Philippines offer significant potential for meal replacement brands seeking new growth avenues with relatively low current penetration rates.

Product innovation opportunities exist in developing culturally relevant formulations that incorporate traditional Asian ingredients and flavors while maintaining nutritional completeness. The integration of functional ingredients popular in Asian wellness traditions, such as green tea, ginseng, and traditional herbs, could enhance product appeal.

Digital commerce expansion offers unprecedented opportunities for direct-to-consumer sales and personalized nutrition solutions. The region’s high smartphone penetration and growing e-commerce adoption create ideal conditions for online meal replacement sales and subscription-based business models.

Aging population demographics across developed Asia Pacific markets create opportunities for specialized meal replacement products targeting elderly consumers with specific nutritional needs, digestive considerations, and convenience requirements.

Corporate wellness programs represent emerging opportunities as companies increasingly invest in employee health and productivity initiatives. Partnerships with employers to provide meal replacement options in workplace settings could drive substantial volume growth.

Supply chain evolution demonstrates increasing sophistication as manufacturers develop regional production capabilities and distribution networks optimized for Asia Pacific market requirements. Local manufacturing reduces costs and enables faster response to market demands while supporting product customization for regional preferences.

Competitive intensity continues escalating as both international brands and local manufacturers vie for market share through innovation, pricing strategies, and marketing investments. The market benefits from this competition through improved product quality, expanded variety, and enhanced consumer value propositions.

Technology integration plays an increasingly important role in product development, marketing, and distribution strategies. Digital platforms enable personalized nutrition recommendations, subscription services, and direct consumer engagement that enhance brand loyalty and market penetration.

Regulatory environment evolution affects market dynamics as governments develop more comprehensive frameworks for meal replacement product oversight. Clearer regulations provide market stability while ensuring consumer safety and product quality standards.

Consumer education initiatives by manufacturers and health organizations contribute to market growth by increasing awareness of meal replacement benefits and proper usage guidelines. Educational efforts help overcome cultural barriers and skepticism while building consumer confidence in product safety and efficacy.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Asia Pacific meal replacement market. Primary research includes consumer surveys, industry expert interviews, and manufacturer consultations across key regional markets to gather firsthand market intelligence.

Secondary research components encompass analysis of industry reports, government statistics, trade publications, and company financial statements to establish market baselines and validate primary research findings. This approach ensures comprehensive coverage of market dynamics and competitive landscapes.

Data collection methods utilize both quantitative and qualitative approaches, including structured surveys with statistically significant sample sizes across different demographic segments and geographic regions. Focus groups and in-depth interviews provide qualitative insights into consumer motivations, preferences, and barriers to adoption.

Market segmentation analysis employs advanced statistical techniques to identify distinct consumer groups, regional variations, and product category performance metrics. This granular approach enables precise market sizing and growth projections for specific segments and geographic areas.

Validation processes include cross-referencing data sources, expert review panels, and statistical verification to ensure research accuracy and reliability. Multiple data points support each key finding to minimize research bias and enhance credibility of market insights.

China dominates the regional market landscape with the largest consumer base and rapidly expanding distribution infrastructure. The country’s massive urban population and growing health consciousness drive substantial demand for meal replacement products, with 34% regional market share and strong growth in tier-one and tier-two cities.

Japan represents the most mature market in the region, with well-established consumer acceptance and sophisticated product offerings. Japanese consumers demonstrate high willingness to pay premium prices for quality meal replacement products, contributing to strong per-capita consumption rates and market stability.

South Korea shows remarkable growth momentum driven by fitness culture adoption and beauty-conscious consumers seeking weight management solutions. The market benefits from strong e-commerce infrastructure and social media influence on consumer purchasing decisions.

India presents significant growth potential with its large population and expanding middle class, though market penetration remains relatively low. Cultural dietary preferences and price sensitivity create both challenges and opportunities for market development.

Australia and New Zealand demonstrate mature market characteristics with high consumer awareness and established retail distribution. These markets serve as testing grounds for new product innovations before broader regional rollouts.

Southeast Asian nations including Thailand, Malaysia, Singapore, and Indonesia show varying development stages but collectively represent substantial growth opportunities. Urban centers in these countries demonstrate increasing adoption rates and growing consumer sophistication.

Market leadership features a diverse mix of international nutrition companies and regional specialists, each leveraging different competitive advantages to capture market share across the Asia Pacific region.

Competitive strategies vary significantly, with international brands leveraging global R&D capabilities and marketing expertise, while local manufacturers focus on cultural relevance and price competitiveness. Innovation remains a key differentiator across all market participants.

Product type segmentation reveals distinct market categories with varying growth trajectories and consumer preferences across the Asia Pacific region:

By Product Type:

By Distribution Channel:

By Application:

Protein-based products dominate market preferences across most Asia Pacific countries, driven by fitness culture adoption and weight management goals. These products typically command premium pricing and demonstrate strong brand loyalty among regular users, with formulations increasingly incorporating plant-based proteins to appeal to vegetarian and environmentally conscious consumers.

Ready-to-drink segments show exceptional growth potential, particularly in urban markets where convenience takes priority over cost considerations. Product innovation focuses on taste improvement, nutritional enhancement, and packaging convenience to meet consumer expectations for grab-and-go nutrition solutions.

Meal bars category appeals strongly to younger demographics and active lifestyle consumers who value portability and taste variety. Manufacturers invest heavily in flavor innovation and texture improvement to differentiate products in this competitive segment.

Powder-based products maintain strong positions in price-sensitive markets and among consumers who prefer customizable nutrition solutions. This category benefits from lower manufacturing costs and extended shelf life, making it attractive for both manufacturers and cost-conscious consumers.

Functional ingredients integration represents a growing trend across all product categories, with manufacturers incorporating probiotics, vitamins, minerals, and traditional Asian wellness ingredients to enhance product appeal and justify premium pricing strategies.

Manufacturers benefit from expanding market opportunities across diverse Asia Pacific countries, with potential for significant revenue growth through both organic expansion and strategic acquisitions. The region’s demographic trends and economic development create favorable conditions for sustained market growth and profitability.

Retailers gain from meal replacement products’ attractive margins and growing consumer demand, with opportunities to develop private label offerings and capture additional value. The category’s growth helps drive traffic to both physical and online retail channels.

Consumers receive convenient, nutritionally balanced meal alternatives that support health goals while accommodating busy lifestyles. Product variety and innovation provide options for different dietary preferences, health conditions, and taste preferences.

Healthcare systems potentially benefit from reduced obesity rates and improved population nutrition as meal replacement products support weight management and nutritional adequacy goals. Preventive health benefits may reduce long-term healthcare costs.

Investors find attractive opportunities in a growing market with strong demographic tailwinds and increasing consumer acceptance. The sector offers potential for both established companies and innovative startups to capture market share.

Supply chain partners including ingredient suppliers, packaging companies, and logistics providers benefit from increased demand and opportunities for specialized service offerings tailored to meal replacement market requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Plant-based formulations represent the most significant trend reshaping the Asia Pacific meal replacement market, with manufacturers increasingly incorporating vegetable proteins, natural ingredients, and sustainable sourcing to appeal to environmentally conscious consumers and vegetarian dietary preferences prevalent in many Asian cultures.

Personalized nutrition emerges as a key differentiator, with companies leveraging technology to offer customized meal replacement solutions based on individual health goals, dietary restrictions, and lifestyle factors. This trend aligns with growing consumer desire for tailored health solutions.

Functional ingredient integration continues expanding, with products incorporating probiotics, adaptogens, traditional Asian herbs, and targeted nutrients to address specific health concerns beyond basic nutrition. This trend supports premium positioning and enhanced consumer value perception.

Sustainable packaging becomes increasingly important as environmental consciousness grows across the region. Manufacturers invest in eco-friendly packaging solutions and sustainable sourcing practices to meet consumer expectations and regulatory requirements.

Flavor localization drives product development as companies recognize the importance of culturally relevant taste profiles. Asian-inspired flavors and traditional ingredients help overcome taste barriers and enhance product acceptance in local markets.

Digital engagement transforms marketing and distribution strategies, with brands leveraging social media, influencer partnerships, and mobile apps to build consumer relationships and drive direct sales through digital channels.

Strategic partnerships between international brands and local distributors accelerate market penetration across Asia Pacific countries, enabling faster market entry and cultural adaptation while leveraging established distribution networks and consumer relationships.

Manufacturing localization initiatives by major brands establish regional production facilities to reduce costs, improve supply chain efficiency, and enable product customization for local market preferences. These investments demonstrate long-term commitment to regional growth.

Regulatory harmonization efforts across ASEAN countries create opportunities for streamlined product approvals and regional marketing strategies, potentially reducing compliance costs and accelerating new product launches across multiple markets simultaneously.

Technology integration advances include AI-powered nutrition recommendations, blockchain supply chain tracking, and IoT-enabled smart packaging that enhances consumer experience and builds brand trust through transparency and personalization.

Acquisition activity intensifies as larger companies seek to acquire local brands with established market presence and cultural expertise, while smaller companies gain access to resources and distribution capabilities needed for regional expansion.

Research collaborations with academic institutions and nutrition research centers advance product development capabilities and support clinical validation of health claims, enhancing product credibility and regulatory approval prospects.

MarkWide Research analysis indicates that companies seeking success in the Asia Pacific meal replacement market should prioritize cultural adaptation and local taste preferences while maintaining nutritional integrity and quality standards. Market entry strategies should emphasize gradual expansion with deep local market understanding rather than rapid regional rollouts.

Investment priorities should focus on digital marketing capabilities and e-commerce infrastructure, as online channels demonstrate the highest growth rates and offer direct consumer relationship opportunities. Companies should develop omnichannel strategies that integrate online and offline touchpoints for maximum market reach.

Product development recommendations emphasize the importance of incorporating traditional Asian ingredients and flavors while maintaining international quality standards. Successful products will balance familiar tastes with nutritional innovation to overcome cultural resistance and build consumer acceptance.

Partnership strategies should leverage local expertise through joint ventures, licensing agreements, or strategic acquisitions that provide market knowledge, distribution access, and regulatory navigation capabilities essential for sustainable market success.

Regulatory compliance requires proactive engagement with local authorities and industry associations to stay ahead of evolving standards and ensure product approvals. Companies should invest in regulatory expertise and maintain flexible formulation capabilities to adapt to changing requirements.

Market trajectory indicates sustained growth momentum across the Asia Pacific meal replacement market, driven by demographic trends, lifestyle changes, and increasing health consciousness that create favorable long-term conditions for market expansion and innovation.

Technology integration will increasingly influence product development, marketing strategies, and consumer engagement approaches. Companies that successfully leverage digital technologies for personalization, convenience, and consumer education will gain competitive advantages in the evolving market landscape.

Regulatory evolution toward more comprehensive and harmonized standards across the region will create opportunities for streamlined operations and reduced compliance costs, while ensuring consumer safety and product quality standards that support market credibility.

Consumer sophistication will continue increasing, with growing demand for transparency, sustainability, and functional benefits beyond basic nutrition. Products that address these evolving expectations while maintaining convenience and taste appeal will capture premium market positions.

Market consolidation may accelerate as successful companies expand through acquisitions and partnerships, while smaller players either achieve niche success or exit the market. This consolidation could lead to improved product quality and innovation as resources concentrate among leading companies.

Growth projections suggest the market will maintain robust expansion rates, with compound annual growth expected to continue in double digits across key segments and geographic markets, supported by favorable demographic and economic trends throughout the forecast period.

The Asia Pacific meal replacement market represents a dynamic and rapidly evolving sector with substantial growth potential driven by demographic trends, lifestyle changes, and increasing health consciousness across the region. Market fundamentals remain strong, supported by urbanization, rising disposable incomes, and growing acceptance of convenient nutrition solutions among diverse consumer segments.

Success factors for market participants include cultural sensitivity, product localization, digital engagement capabilities, and strategic partnerships that enable effective market penetration while maintaining quality and nutritional standards. Companies that balance global expertise with local market understanding will be best positioned to capture growth opportunities.

Future prospects indicate continued market expansion with evolving consumer preferences toward personalized nutrition, sustainable products, and functional ingredients that address specific health goals. The integration of technology and traditional Asian wellness concepts will likely drive the next wave of product innovation and market differentiation.

Strategic implications suggest that early market entrants with appropriate localization strategies and strong digital capabilities will establish competitive advantages that become increasingly difficult to replicate as markets mature. The Asia Pacific meal replacement market offers compelling opportunities for companies prepared to invest in long-term market development and consumer education initiatives.

What is Meal Replacement?

Meal replacement refers to products designed to substitute a full meal, often in the form of shakes, bars, or powders, providing essential nutrients and calories. These products are commonly used for weight management, convenience, and nutritional supplementation.

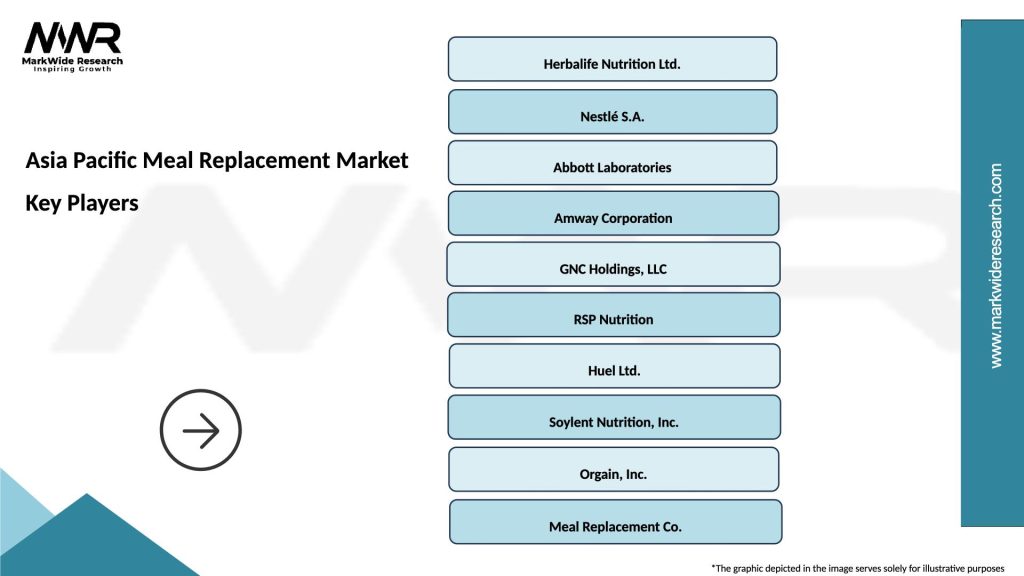

What are the key players in the Asia Pacific Meal Replacement Market?

Key players in the Asia Pacific Meal Replacement Market include Herbalife Nutrition Ltd., SlimFast, and Nestlé S.A., among others. These companies offer a variety of meal replacement products catering to different dietary needs and preferences.

What are the main drivers of the Asia Pacific Meal Replacement Market?

The main drivers of the Asia Pacific Meal Replacement Market include the increasing prevalence of obesity and lifestyle-related diseases, a growing demand for convenient meal options, and rising health consciousness among consumers. Additionally, the trend towards fitness and weight management is fueling market growth.

What challenges does the Asia Pacific Meal Replacement Market face?

The Asia Pacific Meal Replacement Market faces challenges such as regulatory scrutiny regarding health claims, competition from traditional food products, and consumer skepticism about the efficacy of meal replacements. These factors can hinder market expansion and consumer acceptance.

What opportunities exist in the Asia Pacific Meal Replacement Market?

Opportunities in the Asia Pacific Meal Replacement Market include the development of innovative flavors and formulations, the rise of plant-based meal replacements, and the potential for online sales channels. These trends can attract a broader consumer base and enhance market penetration.

What trends are shaping the Asia Pacific Meal Replacement Market?

Trends shaping the Asia Pacific Meal Replacement Market include the increasing popularity of personalized nutrition, the integration of functional ingredients like probiotics and superfoods, and the growth of subscription services for meal replacement products. These trends reflect changing consumer preferences towards health and convenience.

Asia Pacific Meal Replacement Market

| Segmentation Details | Description |

|---|---|

| Product Type | Protein Shakes, Meal Bars, Ready-to-Drink, Powdered Mixes |

| End User | Fitness Enthusiasts, Busy Professionals, Weight Watchers, Athletes |

| Distribution Channel | Online Retail, Supermarkets, Health Stores, Pharmacies |

| Form | Liquid, Solid, Powder, Gel |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Meal Replacement Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at