444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific MCU market represents one of the most dynamic and rapidly expanding segments in the global semiconductor industry. This region has emerged as a powerhouse for microcontroller unit development, manufacturing, and consumption, driven by robust industrial automation, consumer electronics proliferation, and automotive sector transformation. Market dynamics indicate sustained growth momentum with the region experiencing a compound annual growth rate of 8.2% across various MCU applications.

Regional leadership in electronics manufacturing has positioned Asia-Pacific as the epicenter of MCU innovation and deployment. Countries including China, Japan, South Korea, Taiwan, and India contribute significantly to both supply and demand sides of the market ecosystem. The region’s manufacturing capabilities combined with increasing domestic consumption create a unique market environment where local production meets growing regional requirements.

Technology advancement across multiple sectors drives MCU adoption rates throughout Asia-Pacific. Smart manufacturing initiatives, Internet of Things implementations, and automotive electrification programs fuel demand for sophisticated microcontroller solutions. The market demonstrates remarkable resilience and adaptability, with adoption rates reaching 72% in industrial automation applications across major economies.

The Asia-Pacific MCU market refers to the comprehensive ecosystem encompassing design, manufacturing, distribution, and application of microcontroller units across the Asia-Pacific geographical region. This market includes various MCU architectures, performance categories, and application-specific solutions serving diverse industry verticals from consumer electronics to automotive systems.

Microcontroller units represent integrated circuits containing processors, memory, and input/output peripherals designed for embedded system applications. Within the Asia-Pacific context, these components serve as fundamental building blocks for smart devices, industrial equipment, automotive systems, and consumer appliances. The regional market encompasses both indigenous development capabilities and international technology integration.

Market scope extends beyond traditional semiconductor boundaries to include software development tools, design services, and comprehensive solution packages. Asia-Pacific’s unique position combines high-volume manufacturing expertise with emerging market demands, creating opportunities for both established players and innovative startups to participate in the growing MCU ecosystem.

Strategic positioning of the Asia-Pacific MCU market reflects the region’s transformation from manufacturing hub to innovation center. The market demonstrates exceptional growth potential driven by digital transformation initiatives, smart city developments, and industrial modernization programs across major economies. Growth trajectories indicate sustained expansion with automotive applications showing 15.3% annual growth in MCU integration.

Key market drivers include accelerating IoT deployments, automotive electrification trends, and industrial automation adoption. The region benefits from established semiconductor manufacturing infrastructure, skilled workforce availability, and supportive government policies promoting technological advancement. Consumer electronics remain the largest application segment, while automotive and industrial sectors show the highest growth rates.

Competitive landscape features a mix of global semiconductor leaders and regional specialists, creating a dynamic environment for innovation and market development. The market’s evolution toward higher-performance, energy-efficient solutions aligns with regional sustainability goals and technological advancement objectives, positioning Asia-Pacific as a critical player in global MCU market development.

Market intelligence reveals several critical insights shaping the Asia-Pacific MCU landscape:

Industrial automation serves as a primary catalyst for MCU market expansion across Asia-Pacific. Manufacturing facilities increasingly adopt smart factory concepts, requiring sophisticated microcontroller solutions for process control, monitoring, and optimization. The region’s automation penetration rate reaches 45% in manufacturing sectors, creating substantial demand for industrial-grade MCUs with enhanced performance and reliability characteristics.

Automotive transformation drives significant MCU adoption as vehicles become increasingly electronic and connected. Electric vehicle proliferation, advanced driver assistance systems, and infotainment integration require diverse MCU solutions ranging from power management to real-time processing applications. Automotive electronics represent one of the fastest-growing segments with regional vehicle production supporting sustained MCU demand growth.

Consumer electronics innovation continues generating substantial MCU requirements across smartphones, wearables, smart home devices, and entertainment systems. The region’s position as a global electronics manufacturing hub ensures strong correlation between production volumes and MCU consumption. Smart device proliferation maintains steady demand for cost-effective, feature-rich microcontroller solutions.

IoT ecosystem development creates expanding opportunities for MCU applications in connected devices, sensor networks, and edge computing systems. Government smart city initiatives and industrial IoT implementations drive demand for specialized MCUs with wireless connectivity, security features, and energy efficiency capabilities.

Supply chain vulnerabilities present significant challenges for the Asia-Pacific MCU market, particularly regarding semiconductor shortages and geopolitical tensions affecting international trade. Component availability issues impact production schedules and increase costs for manufacturers dependent on consistent MCU supplies. Regional market participants face pressure to develop more resilient supply chain strategies.

Technical complexity in advanced MCU designs creates barriers for smaller companies seeking to enter or expand within the market. Development costs for sophisticated microcontroller solutions require substantial R&D investments, potentially limiting innovation opportunities for resource-constrained organizations. Design expertise requirements continue increasing as MCU functionality expands.

Pricing pressures from intense competition and cost-sensitive applications constrain profit margins across the MCU value chain. Manufacturers must balance performance improvements with cost optimization to maintain competitiveness in price-sensitive market segments. Economic uncertainties in some regional markets affect capital expenditure decisions and technology adoption timelines.

Regulatory compliance requirements across different countries create complexity for companies operating in multiple Asia-Pacific markets. Varying standards, certification processes, and import regulations increase operational costs and time-to-market challenges for MCU suppliers and system integrators.

Emerging technologies create substantial opportunities for MCU market expansion, particularly in artificial intelligence, machine learning, and edge computing applications. AI-enabled MCUs represent a growing segment with potential for significant market penetration as intelligent devices become mainstream across consumer and industrial applications.

Renewable energy systems offer expanding opportunities for specialized MCU applications in solar inverters, wind turbine controllers, and energy storage systems. The region’s commitment to sustainable energy development creates demand for efficient, reliable microcontroller solutions supporting clean energy infrastructure.

Healthcare digitization presents opportunities for MCU applications in medical devices, wearable health monitors, and telemedicine systems. Aging populations across several Asia-Pacific countries drive demand for innovative healthcare solutions incorporating advanced microcontroller technology.

Smart agriculture initiatives create new market segments for MCUs in precision farming, livestock monitoring, and agricultural automation systems. Government support for agricultural modernization programs provides favorable conditions for MCU adoption in farming applications.

5G infrastructure deployment generates opportunities for MCUs in base stations, network equipment, and connected device applications. The region’s leadership in 5G rollout creates demand for high-performance microcontroller solutions supporting next-generation wireless communications.

Technological evolution shapes market dynamics through continuous advancement in MCU architectures, performance capabilities, and integration levels. The transition toward higher-performance 32-bit solutions accelerates while maintaining demand for cost-effective 8-bit and 16-bit MCUs in specific applications. Performance improvements of 25% annually in processing capabilities drive adoption in demanding applications.

Competitive intensity influences pricing strategies, innovation cycles, and market positioning across the Asia-Pacific MCU landscape. Global semiconductor leaders compete with regional specialists, creating dynamic market conditions that benefit end users through improved products and competitive pricing. Market consolidation trends affect competitive dynamics while maintaining innovation momentum.

Customer requirements evolve toward more integrated solutions combining MCUs with sensors, connectivity, and software components. System-level thinking becomes increasingly important as customers seek comprehensive solutions rather than individual components. Solution integration capabilities become key differentiators for market participants.

Regional variations in market development create diverse opportunities and challenges across different Asia-Pacific countries. Developed markets focus on advanced applications while emerging markets emphasize cost-effective solutions, requiring flexible market strategies from MCU suppliers.

Comprehensive analysis of the Asia-Pacific MCU market employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes interviews with industry executives, technology experts, and key stakeholders across the MCU value chain, providing firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, and regulatory documents to establish market context and validate primary findings. Data triangulation methods ensure consistency and accuracy across different information sources and research approaches.

Market modeling techniques incorporate historical data analysis, trend extrapolation, and scenario planning to develop realistic market projections and growth estimates. Statistical analysis validates market size calculations and growth rate projections through multiple analytical frameworks.

Expert validation processes involve review and verification of research findings by industry specialists and technical experts to ensure accuracy and relevance. Continuous monitoring of market developments allows for regular updates and refinements to research conclusions and market projections.

China dominates the Asia-Pacific MCU market with 42% regional market share, driven by massive electronics manufacturing capacity and growing domestic consumption. The country’s focus on semiconductor self-sufficiency creates opportunities for local MCU developers while maintaining strong demand for international solutions. Government initiatives supporting chip development accelerate market growth and innovation.

Japan maintains technological leadership in high-performance MCU applications, particularly automotive and industrial segments. Japanese companies excel in developing specialized microcontroller solutions for demanding applications requiring exceptional reliability and performance. Automotive integration represents a key strength with 28% of regional automotive MCU production originating from Japanese manufacturers.

South Korea demonstrates strong capabilities in consumer electronics MCU applications, leveraging expertise in memory semiconductors and display technologies. The country’s position in global electronics supply chains ensures continued MCU market relevance and growth opportunities.

Taiwan serves as a critical manufacturing hub for MCU production and assembly, with established semiconductor foundry capabilities supporting both domestic and international MCU companies. The island’s strategic position in global supply chains maintains its importance in regional market dynamics.

India emerges as a significant growth market with increasing electronics manufacturing and domestic consumption. Government initiatives promoting local production create opportunities for MCU market expansion and technology transfer. Market growth rates in India exceed 12% annually across multiple application segments.

Market leadership in the Asia-Pacific MCU sector features a diverse mix of global semiconductor giants and regional specialists, creating a dynamic competitive environment that drives innovation and market development.

Competitive strategies emphasize technology differentiation, cost optimization, and customer-specific solution development. Companies invest heavily in R&D to maintain technological leadership while building strong regional partnerships and distribution networks.

By Architecture:

By Application:

By End-User Industry:

Consumer Electronics MCUs represent the largest market category, driven by smartphone production, smart home devices, and wearable technology. This segment emphasizes cost optimization while maintaining adequate performance for consumer applications. Integration levels continue increasing as manufacturers seek to reduce component counts and system complexity.

Automotive MCUs demonstrate the highest growth rates with annual expansion of 15.3% driven by vehicle electrification, advanced driver assistance systems, and infotainment integration. This category requires exceptional reliability, temperature tolerance, and real-time performance capabilities. Safety certifications become increasingly important as automotive systems become more critical.

Industrial MCUs focus on reliability, longevity, and harsh environment operation for factory automation, process control, and monitoring applications. This segment values proven technology and long-term availability over cutting-edge performance. Predictive maintenance capabilities become increasingly important for industrial applications.

IoT MCUs emphasize low power consumption, wireless connectivity, and security features for connected device applications. This emerging category shows strong growth potential as IoT deployments accelerate across various industries. Edge computing capabilities become key differentiators for IoT-focused MCU solutions.

Manufacturers benefit from the Asia-Pacific MCU market through access to cost-effective production capabilities, skilled workforce availability, and proximity to major electronics markets. Supply chain optimization opportunities reduce costs and improve delivery times for MCU-based products.

Technology companies gain advantages through collaboration opportunities with regional partners, access to emerging market segments, and participation in innovation ecosystems. R&D partnerships with regional universities and research institutions accelerate technology development and market entry.

End users benefit from competitive pricing, diverse product options, and responsive technical support from regional MCU suppliers. Customization capabilities allow for application-specific solutions that optimize performance and cost for particular use cases.

Investors find opportunities in a growing market with diverse applications and strong fundamentals supporting long-term growth. Market diversification across multiple industries and countries reduces investment risk while providing exposure to technological advancement trends.

Governments benefit from MCU industry development through job creation, technology transfer, and industrial capability building. Strategic importance of semiconductor capabilities drives supportive policies and investment incentives for MCU market development.

Strengths:

Weaknesses:

Opportunities:

Threats:

AI Integration represents a transformative trend with MCUs incorporating machine learning capabilities for edge computing applications. This development enables intelligent processing at the device level, reducing latency and improving system efficiency. AI-enabled MCUs show adoption rates of 23% in smart device applications.

Ultra-Low Power Design becomes increasingly critical as battery-powered devices proliferate across IoT and wearable applications. Advanced power management techniques and optimized architectures extend device operating life while maintaining performance requirements. Power efficiency improvements drive market differentiation and customer preference.

Security Enhancement gains prominence as connected devices face increasing cybersecurity threats. Hardware-based security features, encryption capabilities, and secure boot mechanisms become standard requirements for MCU solutions. Security-focused MCUs represent a growing market segment with premium pricing opportunities.

Wireless Connectivity integration simplifies system design and reduces component counts for IoT applications. Built-in Wi-Fi, Bluetooth, and cellular capabilities eliminate the need for separate communication modules. Connected MCUs demonstrate strong growth momentum across multiple application segments.

Automotive Specialization drives development of MCUs specifically designed for vehicle applications with enhanced temperature tolerance, reliability, and safety features. Automotive-grade MCUs command premium pricing while addressing stringent industry requirements.

Strategic partnerships between global MCU leaders and regional companies accelerate technology transfer and market development. These collaborations combine international expertise with local market knowledge and manufacturing capabilities. Joint ventures create opportunities for technology localization and capacity expansion.

Manufacturing investments in advanced semiconductor facilities enhance regional MCU production capabilities. New fabrication plants and assembly facilities improve supply chain resilience while reducing costs. Capacity expansion projects address growing demand and strategic supply chain considerations.

R&D initiatives focus on next-generation MCU architectures incorporating AI, advanced connectivity, and enhanced security features. MarkWide Research indicates that regional R&D spending on MCU technologies increased by 18% annually over the past three years.

Acquisition activities reshape competitive dynamics as companies seek to expand capabilities and market reach. Strategic acquisitions provide access to specialized technologies, customer relationships, and geographic markets. Market consolidation trends continue while maintaining innovation momentum.

Government initiatives supporting semiconductor development create favorable conditions for MCU market growth. Policy measures include research funding, tax incentives, and infrastructure development programs. Public-private partnerships accelerate technology development and commercialization efforts.

Technology Investment should prioritize AI-enabled MCUs, ultra-low power designs, and security-enhanced solutions to capture emerging market opportunities. Companies should allocate resources toward developing differentiated capabilities in high-growth application segments. Innovation focus on next-generation architectures provides competitive advantages.

Market Positioning strategies should emphasize application-specific solutions rather than generic MCU products. Developing deep expertise in target industries enables premium pricing and stronger customer relationships. Vertical specialization creates barriers to entry and sustainable competitive advantages.

Partnership Development with regional companies, research institutions, and government agencies accelerates market entry and technology development. Strategic alliances provide access to local expertise, distribution channels, and customer relationships. Ecosystem participation becomes increasingly important for market success.

Supply Chain Resilience requires diversification of manufacturing locations and supplier relationships to mitigate disruption risks. Companies should develop flexible supply chain strategies that balance cost optimization with risk management. Local sourcing capabilities provide strategic advantages in uncertain environments.

Talent Development investments in engineering capabilities and technical expertise support long-term competitiveness. Companies should establish training programs, university partnerships, and retention strategies to build skilled workforce capabilities. Human capital represents a critical success factor in technology-intensive markets.

Market evolution toward more intelligent, connected, and energy-efficient MCU solutions will drive continued growth across the Asia-Pacific region. Technology convergence between MCUs, sensors, and connectivity creates opportunities for integrated solutions that simplify system design and improve performance.

Application expansion into emerging sectors including smart agriculture, renewable energy, and healthcare creates new growth avenues for MCU suppliers. These markets offer opportunities for specialized solutions with premium pricing and strong growth potential. Market diversification reduces dependence on traditional consumer electronics applications.

Regional capabilities in MCU design and manufacturing will continue strengthening through technology development initiatives and strategic investments. MWR analysis projects that regional MCU design capabilities will achieve 65% self-sufficiency by 2028, reducing dependence on international technology licensing.

Sustainability considerations will increasingly influence MCU development priorities, emphasizing energy efficiency, recyclability, and environmental responsibility. Green technology initiatives create opportunities for MCUs supporting renewable energy systems and energy-efficient applications.

Market maturation in developed countries will be balanced by continued growth in emerging markets, maintaining overall regional expansion momentum. The combination of established markets seeking advanced solutions and emerging markets adopting basic MCU applications provides diverse growth opportunities for market participants.

The Asia-Pacific MCU market represents a dynamic and rapidly evolving landscape with substantial growth opportunities across diverse application segments. Regional strengths in manufacturing, innovation, and market scale position Asia-Pacific as a critical player in global MCU market development. Technology advancement toward AI-enabled, ultra-low power, and security-enhanced solutions creates opportunities for market differentiation and premium positioning.

Market drivers including industrial automation, automotive transformation, and IoT proliferation provide sustained growth momentum while emerging applications in healthcare, agriculture, and renewable energy create new opportunities. The region’s established electronics ecosystem and supportive government policies create favorable conditions for continued market expansion and technology development.

Success factors for market participants include technology innovation, application specialization, strategic partnerships, and supply chain resilience. Companies that effectively combine global expertise with regional market knowledge and manufacturing capabilities will be best positioned to capitalize on growth opportunities in this dynamic market environment.

What is MCU?

MCU stands for Microcontroller Unit, which is a compact integrated circuit designed to govern a specific operation in an embedded system. MCUs are widely used in applications such as automotive systems, consumer electronics, and industrial automation.

What are the key players in the Asia-Pacific MCU Market?

Key players in the Asia-Pacific MCU Market include NXP Semiconductors, Microchip Technology, STMicroelectronics, and Texas Instruments, among others. These companies are known for their innovative microcontroller solutions catering to various industries.

What are the main drivers of growth in the Asia-Pacific MCU Market?

The growth of the Asia-Pacific MCU Market is driven by the increasing demand for automation in industries, the rise of IoT applications, and the expansion of the automotive sector. These factors contribute to a higher need for efficient and versatile microcontroller solutions.

What challenges does the Asia-Pacific MCU Market face?

The Asia-Pacific MCU Market faces challenges such as supply chain disruptions, rapid technological changes, and intense competition among manufacturers. These factors can impact production efficiency and market stability.

What opportunities exist in the Asia-Pacific MCU Market?

Opportunities in the Asia-Pacific MCU Market include the growing adoption of smart home devices, advancements in automotive electronics, and the increasing focus on energy-efficient solutions. These trends are likely to drive innovation and market expansion.

What trends are shaping the Asia-Pacific MCU Market?

Trends shaping the Asia-Pacific MCU Market include the integration of artificial intelligence in microcontrollers, the shift towards low-power consumption designs, and the rise of 5G technology. These trends are influencing product development and consumer preferences.

Asia-Pacific MCU Market

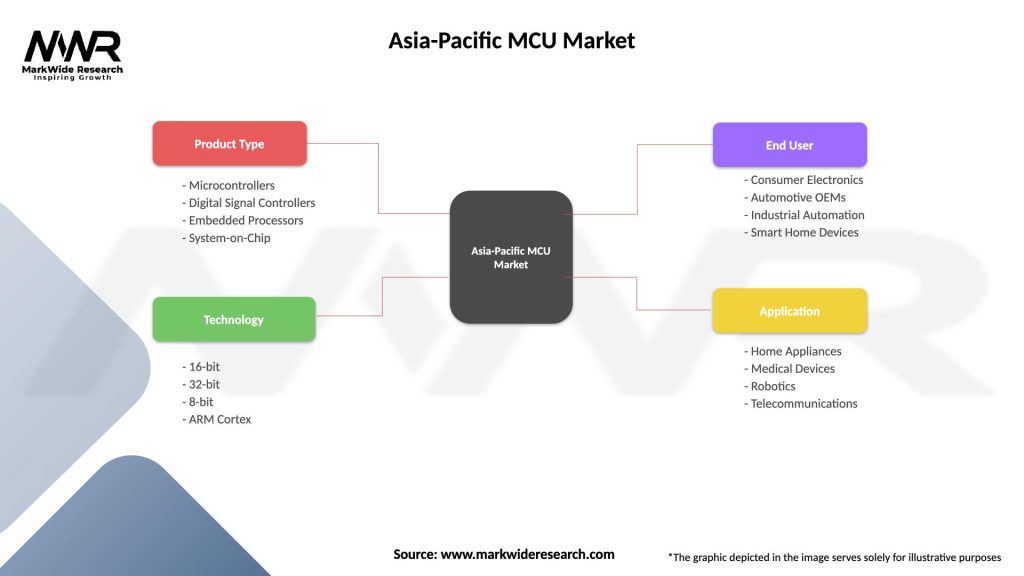

| Segmentation Details | Description |

|---|---|

| Product Type | Microcontrollers, Digital Signal Controllers, Embedded Processors, System-on-Chip |

| Technology | 16-bit, 32-bit, 8-bit, ARM Cortex |

| End User | Consumer Electronics, Automotive OEMs, Industrial Automation, Smart Home Devices |

| Application | Home Appliances, Medical Devices, Robotics, Telecommunications |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific MCU Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at