444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific marketing automation tool market represents one of the fastest-growing technology segments in the region, driven by rapid digital transformation and increasing demand for personalized customer experiences. Marketing automation platforms are revolutionizing how businesses across Asia Pacific engage with customers, streamline marketing processes, and optimize campaign performance. The region’s diverse economic landscape, spanning from developed markets like Japan and Australia to emerging economies such as India and Southeast Asian nations, creates unique opportunities for marketing automation solutions.

Digital adoption rates across Asia Pacific have accelerated significantly, with businesses increasingly recognizing the value of automated marketing workflows. The market encompasses various solutions including email marketing automation, lead nurturing platforms, customer relationship management integration, and advanced analytics tools. Enterprise adoption is growing at approximately 12.5% annually, while small and medium-sized businesses are embracing these technologies at an even faster pace.

Regional dynamics vary considerably, with countries like Singapore and South Korea leading in technology adoption, while markets such as Indonesia and Vietnam present substantial growth potential. The increasing focus on customer experience optimization and the need for data-driven marketing strategies continue to fuel market expansion across all industry verticals.

The Asia Pacific marketing automation tool market refers to the comprehensive ecosystem of software platforms, technologies, and services that enable businesses to automate, streamline, and optimize their marketing activities across the diverse Asia Pacific region. Marketing automation tools encompass sophisticated software solutions that help organizations manage customer relationships, execute targeted campaigns, and analyze marketing performance through automated workflows and intelligent data processing.

Core functionalities include email marketing automation, lead scoring and nurturing, social media management, customer segmentation, campaign orchestration, and performance analytics. These platforms integrate with existing business systems to create seamless marketing operations that can scale efficiently across different markets and customer segments. Advanced features such as artificial intelligence-powered personalization, predictive analytics, and omnichannel campaign management are becoming increasingly prevalent in modern marketing automation solutions.

Market participants range from global technology giants offering comprehensive enterprise solutions to specialized regional providers focusing on specific industry verticals or geographic markets. The ecosystem includes software vendors, system integrators, consulting services, and technology partners who collectively support the implementation and optimization of marketing automation initiatives across Asia Pacific organizations.

Strategic market positioning in the Asia Pacific marketing automation tool sector reflects a dynamic landscape characterized by rapid technological advancement and diverse regional adoption patterns. The market demonstrates robust growth momentum, with cloud-based solutions gaining particular traction among businesses seeking scalable and cost-effective marketing automation capabilities. Digital transformation initiatives across various industries are driving increased investment in marketing technology infrastructure.

Key market drivers include the growing emphasis on customer experience personalization, increasing digital marketing spend, and the need for marketing efficiency optimization. Approximately 68% of organizations in the region report improved marketing ROI following marketing automation implementation, highlighting the tangible business value these solutions provide. Mobile-first strategies are particularly important in Asia Pacific markets, where mobile device penetration rates exceed global averages.

Competitive dynamics feature both established international players and emerging regional specialists, creating a diverse vendor ecosystem that serves different market segments and customer requirements. The market continues to evolve rapidly, with new technologies such as artificial intelligence, machine learning, and advanced analytics reshaping the capabilities and applications of marketing automation platforms across the region.

Primary market insights reveal several critical trends shaping the Asia Pacific marketing automation tool landscape:

Digital transformation acceleration serves as the primary catalyst driving Asia Pacific marketing automation tool adoption. Organizations across the region are modernizing their marketing operations to remain competitive in increasingly digital marketplaces. Customer experience expectations have evolved significantly, with consumers demanding personalized, timely, and relevant interactions across all touchpoints. Marketing automation tools enable businesses to meet these expectations efficiently and at scale.

E-commerce growth throughout Asia Pacific creates substantial demand for sophisticated marketing automation capabilities. Online retailers require advanced tools to manage customer acquisition, retention, and lifecycle marketing effectively. The rise of social commerce and mobile shopping further amplifies the need for integrated marketing automation solutions that can orchestrate campaigns across multiple digital channels simultaneously.

Workforce productivity optimization drives adoption as organizations seek to maximize marketing team efficiency. Marketing automation tools eliminate repetitive manual tasks, allowing marketing professionals to focus on strategic activities and creative campaign development. Resource constraints in many Asia Pacific markets make automation particularly valuable for achieving marketing objectives with limited human resources.

Data-driven decision making requirements push organizations toward marketing automation platforms that provide comprehensive analytics and reporting capabilities. The ability to track customer behavior, measure campaign effectiveness, and optimize marketing spend based on real-time data insights has become essential for competitive advantage in dynamic Asia Pacific markets.

Implementation complexity represents a significant barrier to marketing automation adoption across Asia Pacific markets. Many organizations struggle with the technical challenges of integrating marketing automation platforms with existing systems, configuring automated workflows, and training staff to utilize advanced features effectively. Change management difficulties often slow deployment timelines and limit the realization of expected benefits from marketing automation investments.

Cost considerations constrain adoption, particularly among small and medium-sized enterprises that may find comprehensive marketing automation solutions financially challenging. Beyond initial software licensing costs, organizations must account for implementation services, ongoing maintenance, training, and potential system upgrades. Total cost of ownership calculations sometimes discourage businesses from pursuing advanced marketing automation capabilities.

Data quality challenges limit the effectiveness of marketing automation initiatives. Poor data hygiene, inconsistent customer information, and fragmented data sources can undermine automated campaign performance and lead to suboptimal customer experiences. Data integration across multiple systems and platforms remains technically challenging for many organizations in the region.

Regulatory compliance requirements vary significantly across Asia Pacific markets, creating complexity for organizations operating in multiple countries. Different data protection laws, privacy regulations, and marketing communication standards require careful consideration when implementing marketing automation tools. Compliance costs and the need for specialized legal guidance can deter some organizations from pursuing comprehensive marketing automation strategies.

Artificial intelligence integration presents substantial opportunities for marketing automation tool providers to differentiate their offerings and deliver enhanced value to customers. Machine learning capabilities can improve customer segmentation, optimize send times, personalize content recommendations, and predict customer behavior patterns. Organizations implementing AI-powered marketing automation report approximately 35% improvement in campaign performance metrics.

Emerging market expansion offers significant growth potential as developing economies across Asia Pacific increase their digital marketing investments. Countries such as Vietnam, Indonesia, and the Philippines present opportunities for marketing automation tool providers to establish market presence and capture growing demand. Localization strategies that address specific cultural, linguistic, and business practice requirements can unlock substantial market opportunities.

Industry vertical specialization creates opportunities for focused marketing automation solutions tailored to specific sector requirements. Healthcare, financial services, education, and government sectors have unique marketing automation needs that generic platforms may not address adequately. Specialized solutions can command premium pricing while delivering superior value for targeted industry segments.

Integration ecosystem development enables marketing automation platforms to become central hubs for comprehensive marketing technology stacks. Partnerships with complementary technology providers, development of robust API frameworks, and creation of marketplace ecosystems can expand platform utility and customer stickiness. Platform strategies that facilitate seamless integration with popular business applications can accelerate adoption and increase customer lifetime value.

Competitive intensity in the Asia Pacific marketing automation tool market continues to increase as both global and regional players vie for market share. Product differentiation strategies focus on advanced analytics capabilities, industry-specific features, and superior user experience design. Price competition remains significant, particularly in price-sensitive markets where cost-effective solutions can gain rapid adoption.

Technology evolution drives continuous innovation in marketing automation capabilities. The integration of artificial intelligence, machine learning, and advanced analytics transforms traditional email marketing platforms into comprehensive customer engagement orchestration systems. Innovation cycles are accelerating, with new features and capabilities being introduced regularly to maintain competitive advantage.

Customer expectations are evolving rapidly, with organizations demanding more sophisticated automation capabilities, better integration options, and enhanced reporting functionality. User experience has become a critical differentiator, with intuitive interfaces and simplified workflow creation tools gaining preference over complex, feature-rich platforms that require extensive training.

Partnership ecosystems play increasingly important roles in market dynamics. Strategic alliances between marketing automation providers, system integrators, consulting firms, and technology partners create comprehensive solution offerings that address complex customer requirements. Channel strategies that leverage partner networks can accelerate market penetration and improve customer support capabilities across diverse Asia Pacific markets.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Asia Pacific marketing automation tool market. Primary research includes extensive interviews with industry executives, marketing professionals, technology vendors, and end-users across different countries and industry sectors. Survey methodologies capture quantitative data on adoption rates, spending patterns, and technology preferences.

Secondary research incorporates analysis of industry reports, company financial statements, technology vendor documentation, and regulatory filings. Market intelligence gathering includes monitoring of product launches, partnership announcements, merger and acquisition activities, and competitive positioning strategies. Industry conference presentations and thought leadership content provide additional insights into market trends and future directions.

Data validation processes ensure information accuracy through cross-referencing multiple sources, expert review panels, and statistical analysis techniques. Regional expertise from local market analysts provides cultural and business practice context that enhances the relevance and applicability of research findings. Continuous monitoring of market developments ensures research insights remain current and actionable.

Analytical frameworks combine quantitative modeling with qualitative assessment to provide comprehensive market understanding. Forecasting methodologies incorporate historical trends, current market conditions, and future growth drivers to project market evolution. Scenario analysis considers various potential market developments and their implications for different stakeholder groups.

China dominates the Asia Pacific marketing automation tool market, accounting for approximately 42% of regional adoption. The country’s massive e-commerce ecosystem, led by platforms like Tmall and JD.com, drives substantial demand for sophisticated marketing automation capabilities. Chinese enterprises are increasingly investing in marketing technology infrastructure to support domestic market expansion and international growth initiatives.

Japan represents the second-largest market, characterized by high technology adoption rates and sophisticated marketing automation requirements. Japanese organizations prioritize integration capabilities and data security features when selecting marketing automation platforms. Enterprise adoption in Japan focuses on comprehensive solutions that support complex organizational structures and detailed reporting requirements.

India demonstrates the fastest growth rates in marketing automation tool adoption, driven by rapid digitalization and expanding technology sector. The country’s diverse business landscape creates opportunities for both enterprise-grade solutions and cost-effective platforms targeting small and medium-sized businesses. Mobile-first strategies are particularly important in the Indian market, where smartphone penetration continues to increase rapidly.

Southeast Asian markets including Singapore, Malaysia, Thailand, and Indonesia show strong growth potential. Singapore leads regional adoption with approximately 78% of enterprises utilizing some form of marketing automation technology. Cross-border e-commerce growth in Southeast Asia creates demand for marketing automation tools that can manage multi-country campaigns and diverse customer segments effectively.

Australia and New Zealand represent mature markets with high adoption rates and sophisticated feature requirements. Organizations in these markets prioritize advanced analytics, AI-powered personalization, and comprehensive integration capabilities. Regulatory compliance features addressing local privacy laws and marketing regulations are essential for market success in these countries.

Market leadership in the Asia Pacific marketing automation tool sector features a diverse mix of global technology giants and specialized regional providers. Competitive positioning strategies vary significantly, with some companies focusing on comprehensive enterprise solutions while others target specific industry verticals or geographic markets.

Regional competitors are gaining market share by offering localized solutions that address specific Asia Pacific market requirements. These providers often focus on language support, cultural customization, and integration with popular regional business applications. Competitive differentiation increasingly centers on AI capabilities, user experience design, and industry-specific functionality.

By Deployment Model:

By Organization Size:

By Industry Vertical:

Email Marketing Automation remains the foundational category, with approximately 89% of organizations utilizing automated email campaigns as their primary marketing automation application. Advanced segmentation capabilities, personalization features, and deliverability optimization tools are key differentiators in this mature category. Integration with customer relationship management systems and e-commerce platforms enhances email automation effectiveness.

Lead Management and Nurturing represents a rapidly growing category as B2B organizations seek to optimize their sales funnel efficiency. Lead scoring algorithms, progressive profiling capabilities, and automated nurturing workflows help organizations identify and develop qualified prospects. Integration with sales enablement tools and CRM platforms creates seamless lead handoff processes.

Social Media Automation gains importance as organizations seek to maintain consistent social media presence while managing resource constraints. Content scheduling, social listening capabilities, and automated response features help businesses engage effectively across multiple social platforms. Integration with social commerce features becomes increasingly important in Asia Pacific markets.

Analytics and Reporting capabilities differentiate advanced marketing automation platforms from basic email marketing tools. Real-time dashboards, attribution modeling, and predictive analytics help marketers optimize campaign performance and demonstrate ROI. Custom reporting features and data export capabilities support diverse organizational reporting requirements.

Mobile Marketing Automation addresses the mobile-first nature of many Asia Pacific markets. SMS automation, push notification management, and mobile app integration capabilities are essential for comprehensive customer engagement strategies. Location-based marketing features and mobile commerce integration enhance the relevance and effectiveness of automated campaigns.

Marketing Teams benefit from increased efficiency through automated routine tasks, enabling focus on strategic planning and creative campaign development. Workflow automation eliminates manual processes, reduces human error, and ensures consistent campaign execution. Advanced analytics capabilities provide actionable insights for continuous optimization and performance improvement.

Sales Organizations receive higher-quality leads through automated lead scoring and nurturing processes. Lead intelligence gathered through marketing automation helps sales teams prioritize prospects and personalize their outreach efforts. Seamless integration between marketing automation and CRM systems creates unified customer views and improves sales conversion rates.

Customer Service Teams leverage marketing automation data to provide more personalized and contextual support experiences. Customer journey insights help service representatives understand customer history and preferences, enabling more effective problem resolution. Automated communication workflows can handle routine inquiries and route complex issues appropriately.

Executive Leadership gains visibility into marketing performance through comprehensive reporting and analytics capabilities. ROI measurement tools demonstrate marketing contribution to business objectives and support data-driven budget allocation decisions. Scalable marketing automation platforms support business growth without proportional increases in marketing staff.

IT Departments benefit from reduced infrastructure management requirements through cloud-based marketing automation solutions. Integration capabilities simplify the technology stack and reduce maintenance overhead. Security features and compliance tools help organizations meet regulatory requirements while maintaining operational efficiency.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration transforms marketing automation from rule-based systems to intelligent platforms capable of predictive analytics and autonomous optimization. Machine learning algorithms analyze customer behavior patterns to optimize send times, personalize content, and predict customer lifetime value. AI-powered chatbots and conversational marketing tools are becoming standard features in comprehensive marketing automation platforms.

Omnichannel Orchestration evolves beyond multi-channel marketing to create truly integrated customer experiences across all touchpoints. Unified customer profiles enable consistent messaging and personalization across email, social media, mobile apps, and offline channels. Real-time decisioning capabilities ensure optimal channel selection and message timing for individual customers.

Privacy-First Marketing approaches gain prominence as organizations adapt to increasing data protection regulations and consumer privacy expectations. Consent management features, data minimization practices, and transparent communication about data usage become essential marketing automation capabilities. First-party data strategies and cookieless tracking solutions are reshaping how organizations approach customer data collection and utilization.

Account-Based Marketing Automation grows in importance for B2B organizations seeking to target high-value prospects and customers more effectively. Account intelligence features, personalized content delivery, and coordinated multi-touch campaigns help organizations engage key accounts throughout complex buying processes. Integration with sales enablement tools creates seamless account-based experiences.

Real-Time Personalization capabilities enable dynamic content optimization based on current customer behavior and context. Behavioral triggers, location-based messaging, and real-time product recommendations enhance customer engagement and conversion rates. Advanced personalization engines process multiple data sources to deliver relevant experiences at scale.

Strategic acquisitions continue to reshape the marketing automation landscape as larger technology companies acquire specialized providers to enhance their platform capabilities. Integration partnerships between marketing automation vendors and complementary technology providers create more comprehensive solution ecosystems. These developments enable customers to access broader functionality through unified platforms rather than managing multiple point solutions.

Product innovation focuses on artificial intelligence capabilities, with major vendors investing heavily in machine learning and predictive analytics features. Natural language processing improvements enable more sophisticated chatbot interactions and automated content generation. Advanced analytics capabilities provide deeper insights into customer behavior and campaign performance.

Regional expansion initiatives by global marketing automation providers include establishing local data centers, hiring regional talent, and developing market-specific features. Localization efforts address language requirements, cultural preferences, and regulatory compliance needs across diverse Asia Pacific markets. These investments demonstrate long-term commitment to regional market development.

Industry partnerships create specialized solutions for specific vertical markets such as healthcare, financial services, and education. Ecosystem development includes marketplace platforms where third-party developers can create and distribute complementary applications and integrations. These initiatives expand platform utility and create additional revenue opportunities for vendors and partners.

MarkWide Research recommends that organizations prioritize marketing automation platforms with strong artificial intelligence capabilities and comprehensive integration options. Vendor selection should emphasize solutions that can scale with business growth while maintaining performance and user experience quality. Organizations should invest in proper implementation planning and staff training to maximize marketing automation ROI.

Technology evaluation should include thorough assessment of data security features, compliance capabilities, and vendor stability. Proof of concept implementations can help organizations validate platform capabilities and identify potential integration challenges before making significant commitments. Regular platform performance reviews ensure continued alignment with evolving business requirements.

Change management strategies should address organizational culture, process modifications, and skill development requirements associated with marketing automation adoption. Cross-functional collaboration between marketing, sales, IT, and customer service teams enhances automation effectiveness and customer experience consistency. Executive sponsorship and clear success metrics support successful marketing automation initiatives.

Data strategy development should precede marketing automation implementation to ensure high-quality customer information and effective segmentation capabilities. Privacy compliance planning addresses regulatory requirements and builds customer trust through transparent data handling practices. Regular data audits and cleansing processes maintain automation effectiveness over time.

Market evolution in the Asia Pacific marketing automation tool sector will be driven by continued artificial intelligence advancement and increasing demand for personalized customer experiences. Growth projections indicate sustained expansion at approximately 14.2% annually over the next five years, with emerging markets contributing disproportionately to overall growth. Cloud-based solutions will continue to dominate new deployments while hybrid approaches gain traction among large enterprises.

Technology convergence will blur traditional boundaries between marketing automation, customer relationship management, and customer experience platforms. Integrated solutions that combine marketing automation with sales enablement, customer service, and analytics capabilities will become increasingly prevalent. API-first architectures will enable more flexible and customizable marketing technology stacks.

Regulatory developments across Asia Pacific markets will shape marketing automation practices and platform capabilities. Privacy regulations will drive demand for consent management features, data minimization tools, and transparent reporting capabilities. Vendors that proactively address compliance requirements will gain competitive advantages in regulated industries and privacy-conscious markets.

Emerging technologies such as voice interfaces, augmented reality, and Internet of Things devices will create new marketing automation opportunities and challenges. MWR analysis suggests that successful marketing automation platforms will need to adapt quickly to support these new customer touchpoints while maintaining unified customer experiences across all channels.

The Asia Pacific marketing automation tool market represents a dynamic and rapidly evolving sector with substantial growth potential across diverse regional markets. Digital transformation initiatives, increasing customer experience expectations, and the need for marketing efficiency optimization continue to drive adoption across all organization sizes and industry verticals. The market’s complexity, characterized by varying levels of technology maturity and regulatory requirements across different countries, creates both opportunities and challenges for vendors and users alike.

Successful market participation requires understanding of local market dynamics, customer preferences, and regulatory environments. Organizations that invest in comprehensive marketing automation strategies, supported by proper implementation planning and ongoing optimization efforts, can achieve significant competitive advantages through improved customer engagement and operational efficiency. Technology vendors that focus on artificial intelligence capabilities, seamless integration options, and regional market customization will be best positioned for long-term success.

Future market development will be shaped by continued innovation in artificial intelligence, evolving privacy regulations, and the emergence of new customer touchpoints and engagement channels. The Asia Pacific marketing automation tool market will continue to offer substantial opportunities for growth and innovation as organizations across the region embrace digital marketing transformation and seek to optimize their customer engagement strategies in increasingly competitive marketplaces.

What is Marketing Automation Tool?

Marketing Automation Tool refers to software platforms designed to automate marketing tasks and workflows, enabling businesses to streamline their marketing efforts, manage campaigns, and analyze customer interactions across various channels.

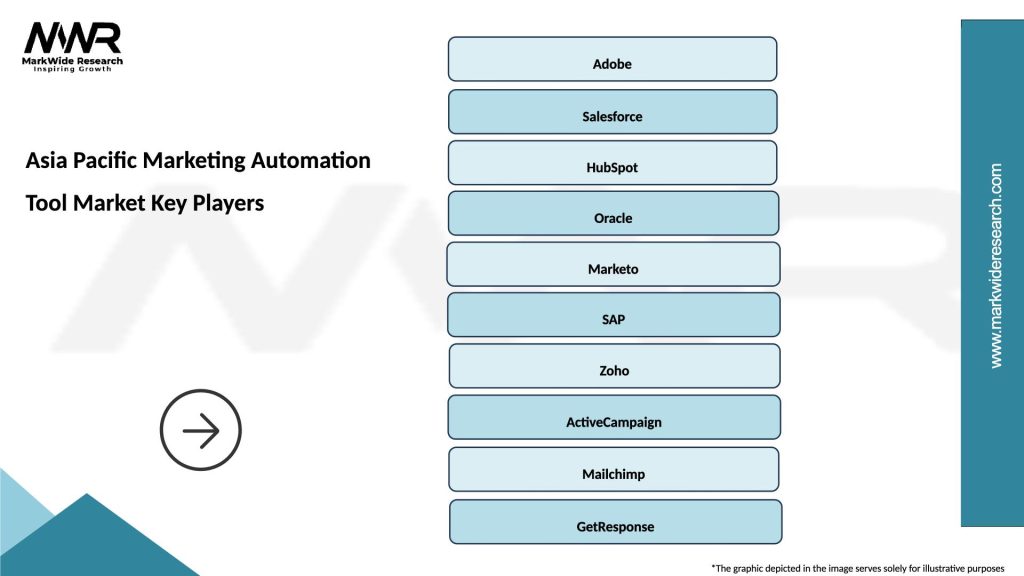

What are the key players in the Asia Pacific Marketing Automation Tool Market?

Key players in the Asia Pacific Marketing Automation Tool Market include HubSpot, Salesforce, Marketo, and Oracle, among others.

What are the main drivers of growth in the Asia Pacific Marketing Automation Tool Market?

The growth of the Asia Pacific Marketing Automation Tool Market is driven by increasing digital marketing adoption, the need for personalized customer experiences, and the rising demand for data-driven marketing strategies.

What challenges does the Asia Pacific Marketing Automation Tool Market face?

Challenges in the Asia Pacific Marketing Automation Tool Market include data privacy concerns, the complexity of integrating various marketing tools, and the need for skilled personnel to manage automation systems.

What opportunities exist in the Asia Pacific Marketing Automation Tool Market?

Opportunities in the Asia Pacific Marketing Automation Tool Market include the expansion of small and medium-sized enterprises adopting automation, advancements in artificial intelligence for better targeting, and the growing trend of omnichannel marketing.

What trends are shaping the Asia Pacific Marketing Automation Tool Market?

Trends shaping the Asia Pacific Marketing Automation Tool Market include the increasing use of AI and machine learning for predictive analytics, the rise of account-based marketing strategies, and the integration of social media platforms into marketing automation tools.

Asia Pacific Marketing Automation Tool Market

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premise, Cloud-Based, Hybrid, SaaS |

| End User | Retail, Healthcare, Education, Manufacturing |

| Solution | Email Marketing, Social Media Management, Lead Generation, Analytics |

| Customer Type | Small Business, Medium Enterprise, Large Corporation, Startups |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Marketing Automation Tool Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at