444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific luxury yacht market represents one of the most dynamic and rapidly expanding segments within the global maritime industry. This sophisticated market encompasses premium recreational vessels, superyachts, and ultra-luxury maritime experiences across diverse economies including China, Japan, Australia, Singapore, and emerging markets throughout Southeast Asia. Market dynamics indicate unprecedented growth driven by increasing wealth concentration, expanding marina infrastructure, and evolving lifestyle preferences among high-net-worth individuals.

Regional characteristics demonstrate significant diversity in luxury yacht adoption patterns, with established markets like Australia and Japan showing mature demand profiles, while emerging economies such as Thailand, Malaysia, and the Philippines exhibit accelerating growth rates exceeding traditional maritime markets. The market encompasses various vessel categories from entry-level luxury yachts to custom-built superyachts, each serving distinct consumer segments with varying preferences for design, technology, and operational capabilities.

Infrastructure development across the region has reached critical mass, with new marina developments, yacht clubs, and supporting services creating comprehensive ecosystems that facilitate luxury yacht ownership and chartering. This infrastructure expansion, combined with favorable regulatory environments in key markets, has positioned the Asia Pacific region as a strategic growth hub for international yacht manufacturers and service providers seeking to capitalize on emerging opportunities.

The Asia Pacific luxury yacht market refers to the comprehensive ecosystem encompassing the design, manufacturing, sales, chartering, and maintenance of premium recreational vessels within the Asia Pacific region, serving affluent consumers seeking exclusive maritime experiences and lifestyle enhancement through yacht ownership or charter services.

Market definition extends beyond simple vessel transactions to include integrated luxury experiences, marina services, yacht management, crew services, and ancillary products that support the luxury yachting lifestyle. This holistic approach recognizes that luxury yacht consumers seek comprehensive solutions rather than isolated products, driving demand for full-service providers capable of delivering seamless experiences across multiple touchpoints.

Luxury yacht categories within this market typically range from premium day cruisers and weekend vessels to expedition yachts and custom superyachts, each designed to meet specific consumer preferences for comfort, performance, and prestige. The market also encompasses charter services, allowing consumers to experience luxury yachting without ownership commitments, thereby expanding the addressable market beyond traditional yacht buyers to include experiential luxury consumers.

Strategic positioning of the Asia Pacific luxury yacht market reveals exceptional growth potential driven by demographic shifts, economic development, and cultural evolution toward experiential luxury consumption. The region’s diverse economic landscape provides multiple growth vectors, from established markets with sophisticated infrastructure to emerging economies developing their luxury maritime sectors.

Key market drivers include rapid wealth creation, particularly in technology and financial sectors, increasing interest in experiential luxury over material possessions, and growing appreciation for maritime leisure activities among younger affluent demographics. These factors combine with improving marina infrastructure and regulatory frameworks to create favorable conditions for sustained market expansion at growth rates approaching 12-15% annually in key segments.

Competitive dynamics show increasing localization of luxury yacht services, with regional players developing capabilities to serve local preferences while international brands establish strategic partnerships and direct presence in key markets. This evolution creates opportunities for both established maritime companies and emerging regional specialists to capture market share through differentiated positioning and localized service delivery.

Consumer behavior analysis reveals distinct preferences among Asia Pacific luxury yacht consumers, with emphasis on technology integration, environmental sustainability, and multi-generational usage patterns that differ significantly from traditional Western yacht markets. These preferences drive demand for innovative features and services tailored to regional consumer expectations.

Wealth concentration across Asia Pacific economies represents the primary driver for luxury yacht market expansion, with high-net-worth individual populations growing at rates exceeding 8-10% annually in key markets. This wealth creation, particularly concentrated in technology, finance, and real estate sectors, generates substantial demand for luxury lifestyle products and experiences that demonstrate success and provide exclusive recreational opportunities.

Infrastructure development has reached critical thresholds in major markets, with new marina projects, yacht clubs, and supporting services creating comprehensive ecosystems that reduce barriers to yacht ownership and operation. These developments include advanced maintenance facilities, crew training programs, and integrated luxury services that enhance the overall yacht ownership experience while reducing operational complexity for owners.

Cultural evolution toward experiential luxury consumption drives increasing interest in yacht ownership and charter services among affluent consumers seeking unique experiences and lifestyle enhancement. This shift reflects broader changes in luxury consumption patterns, where experiences and exclusive access become more valued than traditional material possessions, particularly among younger wealthy demographics who prioritize lifestyle flexibility and authentic experiences.

Regulatory improvements across multiple jurisdictions have simplified yacht registration, operation, and movement between countries, reducing traditional barriers that previously limited market development. These regulatory enhancements, combined with bilateral agreements facilitating yacht movement and temporary importation, create more favorable operating environments that encourage both domestic and international yacht activity within the region.

High capital requirements for luxury yacht ownership create significant barriers for many potential consumers, with total ownership costs including purchase, maintenance, crew, and operational expenses representing substantial ongoing financial commitments. These costs, combined with depreciation factors and seasonal usage patterns in many markets, can limit market expansion to only the most affluent consumer segments.

Infrastructure limitations persist in emerging markets where marina capacity, maintenance facilities, and supporting services remain underdeveloped relative to demand. These constraints can limit yacht operations and reduce ownership satisfaction, particularly for larger vessels requiring specialized facilities and services that may not be readily available in all regional markets.

Regulatory complexity continues to challenge yacht operations across multiple jurisdictions, with varying requirements for registration, taxation, crew certification, and operational compliance creating administrative burdens for owners and operators. These complexities can discourage yacht ownership or limit operational flexibility, particularly for consumers seeking to use vessels across multiple countries within the region.

Skilled labor shortages in yacht maintenance, management, and crew services limit service quality and availability, potentially constraining market growth as demand exceeds the supply of qualified professionals. This challenge is particularly acute in emerging markets where yacht service industries are still developing and training programs for specialized maritime skills remain limited.

Charter market expansion presents exceptional opportunities for growth as consumers increasingly seek experiential luxury without ownership commitments. This trend creates demand for diverse charter options, from day trips to extended cruising experiences, allowing service providers to capture broader market segments while optimizing vessel utilization rates and revenue generation.

Technology integration opportunities span multiple areas including autonomous navigation systems, advanced entertainment platforms, environmental monitoring, and connectivity solutions that enhance the yacht experience while improving operational efficiency. These technological advances can differentiate service providers while addressing consumer preferences for innovation and convenience.

Sustainable yachting represents emerging opportunities as environmental consciousness grows among luxury consumers, driving demand for hybrid propulsion systems, renewable energy integration, and eco-friendly operational practices. Companies developing sustainable yacht technologies and services can capture market share while addressing regulatory trends toward environmental responsibility.

Regional manufacturing opportunities exist for yacht builders establishing local production capabilities to serve regional preferences while reducing costs and delivery times. This localization can provide competitive advantages through customization capabilities, reduced logistics costs, and closer customer relationships that enhance service delivery and market responsiveness.

Supply chain evolution demonstrates increasing regionalization as manufacturers and service providers establish local capabilities to serve growing demand while reducing dependence on traditional European and American suppliers. This trend creates opportunities for regional companies while improving service responsiveness and cost competitiveness for consumers throughout the Asia Pacific market.

Consumer sophistication continues advancing as yacht owners and charter clients develop deeper understanding of vessel capabilities, service requirements, and operational considerations. This evolution drives demand for higher service standards, greater customization options, and more comprehensive support services that address the full spectrum of yacht ownership and operation requirements.

Competitive intensity increases as both international and regional players recognize market opportunities and establish strategic positions through direct investment, partnerships, and service expansion. This competition benefits consumers through improved service offerings, competitive pricing, and innovation while creating challenges for companies seeking to establish or maintain market leadership positions.

Market integration accelerates as regional economies develop stronger connections through trade agreements, infrastructure projects, and regulatory harmonization that facilitate yacht movement and operations across multiple countries. These developments create larger addressable markets for service providers while enhancing the value proposition for yacht owners seeking operational flexibility across the region.

Comprehensive analysis of the Asia Pacific luxury yacht market employs multiple research methodologies to ensure accuracy and completeness of market insights. Primary research includes extensive interviews with yacht manufacturers, dealers, marina operators, and service providers across key regional markets to gather firsthand insights into market conditions, trends, and consumer preferences.

Secondary research encompasses analysis of industry publications, regulatory filings, trade association data, and economic indicators that influence luxury yacht market development. This research provides quantitative foundations for market analysis while identifying broader economic and social trends that impact consumer behavior and market dynamics.

Market validation processes include cross-referencing multiple data sources, conducting expert interviews, and analyzing historical trends to ensure research findings accurately reflect current market conditions and provide reliable foundations for future projections. MarkWide Research methodology emphasizes data triangulation and expert validation to maintain research quality and reliability.

Regional analysis methodology addresses the diverse characteristics of Asia Pacific markets through country-specific research that recognizes unique economic, cultural, and regulatory factors influencing yacht market development. This approach ensures that regional insights accurately reflect local market conditions while identifying broader trends that span multiple markets within the region.

China represents the largest growth opportunity within the Asia Pacific luxury yacht market, driven by rapid wealth creation and increasing interest in luxury lifestyle products among affluent consumers. The market benefits from government initiatives supporting marine industry development and infrastructure investments in coastal regions that enhance yacht accessibility and operational capabilities.

Australia maintains market leadership in terms of mature infrastructure and established yacht culture, with comprehensive marina networks, service capabilities, and regulatory frameworks that support diverse yacht operations. The Australian market demonstrates stable growth patterns with approximately 35% regional market share while serving as a hub for yacht services throughout the South Pacific region.

Japan exhibits sophisticated demand for luxury yachts with emphasis on technology integration and precision engineering that aligns with cultural preferences for quality and innovation. The Japanese market shows particular strength in premium segments with consumers willing to invest in advanced features and comprehensive service packages that enhance yacht ownership experiences.

Southeast Asian markets including Singapore, Thailand, Malaysia, and the Philippines demonstrate accelerating growth rates exceeding 15% annually as infrastructure development and wealth creation drive luxury yacht adoption. These markets benefit from tropical climates enabling year-round yacht operations and strategic locations facilitating regional cruising and charter activities.

South Korea emerges as a significant market with growing interest in luxury yachting among technology and business leaders, supported by marina development projects and increasing integration with regional yacht networks. The market shows particular potential for technology-advanced vessels that appeal to sophisticated consumers seeking innovation and performance.

Market leadership within the Asia Pacific luxury yacht sector demonstrates diverse competitive dynamics with international brands establishing regional presence alongside emerging local players developing specialized capabilities. This competitive environment creates opportunities for differentiation through service excellence, technological innovation, and cultural adaptation to regional preferences.

Strategic positioning among competitors emphasizes service excellence, technological innovation, and regional adaptation as key differentiators in capturing market share. Companies achieving success demonstrate strong understanding of local preferences, comprehensive service capabilities, and ability to deliver customized solutions that address specific regional requirements and consumer expectations.

By Yacht Size: Market segmentation reveals distinct consumer preferences across different vessel categories, with each segment serving specific usage patterns and consumer demographics. Size categories influence pricing, operational requirements, and target market characteristics that shape competitive strategies and service offerings.

By Application: Usage patterns demonstrate diverse consumer motivations for yacht ownership and charter, influencing design requirements, service needs, and operational considerations that shape market development and competitive positioning strategies.

Motor yacht segment dominates the Asia Pacific luxury yacht market with approximately 75% market share, driven by consumer preferences for convenience, speed, and comprehensive onboard amenities. These vessels appeal to time-conscious consumers seeking efficient transportation combined with luxury experiences, particularly for business and entertainment applications where schedule flexibility is essential.

Sailing yacht category maintains specialized appeal among consumers seeking authentic maritime experiences and environmental sustainability, representing approximately 20% market share with particular strength in Australia and New Zealand markets. This segment benefits from growing environmental consciousness and desire for traditional sailing experiences among certain consumer demographics.

Hybrid and electric yachts represent emerging categories with accelerating adoption rates exceeding 25% annually as environmental regulations and consumer preferences drive demand for sustainable propulsion systems. These technologies appeal particularly to younger affluent consumers and markets with strong environmental awareness, creating opportunities for early-adopting manufacturers and service providers.

Expedition yacht segment shows strong growth potential in the Asia Pacific region due to diverse cruising destinations and consumer interest in adventure travel combined with luxury accommodations. These specialized vessels serve consumers seeking unique experiences in remote locations while maintaining comfort and safety standards expected in luxury yacht operations.

Yacht manufacturers benefit from expanding market opportunities that justify investment in regional production capabilities, service networks, and product customization to serve local preferences. The growing market provides volume opportunities while regional presence enables closer customer relationships and reduced logistics costs that improve competitive positioning.

Service providers including marina operators, maintenance companies, and crew services experience growing demand that supports business expansion and specialization in luxury yacht services. This demand growth enables service providers to invest in advanced capabilities and facilities that enhance service quality while generating attractive returns on investment.

Regional economies benefit from luxury yacht market development through job creation, infrastructure investment, tourism revenue, and tax generation that contribute to economic development. The yacht industry creates high-value employment opportunities while attracting affluent visitors who contribute to broader hospitality and service sectors.

Consumers gain access to expanding yacht options, improved service quality, and competitive pricing as market development increases choice and drives service innovation. Growing infrastructure and service networks enhance yacht ownership experiences while charter options provide flexible access to luxury yachting without ownership commitments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization trends transform yacht operations through advanced navigation systems, integrated entertainment platforms, and remote monitoring capabilities that enhance safety, convenience, and user experiences. These technological advances appeal particularly to tech-savvy consumers while enabling more efficient yacht management and maintenance operations.

Sustainability focus drives increasing adoption of hybrid propulsion systems, renewable energy integration, and eco-friendly operational practices as environmental consciousness grows among luxury consumers. This trend creates opportunities for companies developing sustainable yacht technologies while addressing regulatory pressures for environmental responsibility.

Experiential luxury emphasis shifts consumer preferences toward unique experiences and exclusive access rather than traditional ownership models, driving growth in charter services, yacht clubs, and shared ownership arrangements. This evolution expands the addressable market while creating new business models for yacht industry participants.

Customization demand increases as consumers seek personalized yacht features, layouts, and services that reflect individual preferences and usage patterns. This trend benefits companies offering flexible design capabilities and comprehensive customization services while supporting premium pricing strategies.

Regional integration accelerates as improved infrastructure, regulatory harmonization, and economic cooperation facilitate yacht movement and operations across multiple Asia Pacific countries. This integration creates larger addressable markets while enhancing the value proposition for yacht ownership and charter services throughout the region.

Marina expansion projects across major markets create comprehensive yacht infrastructure supporting larger vessels and enhanced service capabilities. Recent developments include advanced facilities in Singapore, Hong Kong, and Australian markets that provide full-service capabilities for superyachts while improving operational efficiency and customer experiences.

Regulatory harmonization initiatives simplify yacht operations across multiple jurisdictions through bilateral agreements and standardized procedures that reduce administrative burdens. These developments facilitate regional yacht movement while encouraging cross-border charter operations and yacht tourism that benefit the broader industry ecosystem.

Technology partnerships between yacht manufacturers and technology companies accelerate innovation in navigation systems, connectivity solutions, and onboard entertainment platforms. According to MarkWide Research analysis, these collaborations drive product differentiation while addressing consumer demands for advanced yacht technologies and integrated digital experiences.

Sustainability initiatives include development of hybrid propulsion systems, renewable energy integration, and eco-friendly operational practices that address environmental concerns while maintaining luxury standards. These initiatives position companies for future regulatory requirements while appealing to environmentally conscious consumers seeking sustainable luxury options.

Service network expansion by international yacht companies establishes comprehensive regional capabilities through direct investment, partnerships, and franchise arrangements. These developments improve service accessibility while reducing operational complexity for yacht owners seeking reliable maintenance and support services throughout the Asia Pacific region.

Market entry strategies should emphasize regional partnerships and localized service capabilities rather than purely export-based approaches, as successful companies demonstrate strong understanding of local preferences and comprehensive service delivery. Companies entering the Asia Pacific luxury yacht market benefit from establishing regional presence through partnerships, service centers, and local expertise that enhance customer relationships and operational efficiency.

Investment priorities should focus on technology integration, sustainability features, and service excellence as key differentiators in competitive markets. MWR analysis indicates that companies achieving market leadership invest significantly in advanced yacht technologies, comprehensive service networks, and customization capabilities that address evolving consumer preferences and regulatory requirements.

Service development recommendations include comprehensive yacht management services, charter fleet operations, and integrated luxury experiences that address the full spectrum of consumer needs. Companies providing end-to-end solutions capture greater market share while building stronger customer relationships that support premium pricing and long-term business sustainability.

Regional expansion should prioritize markets with strong infrastructure development, favorable regulatory environments, and growing affluent populations that support sustainable business development. Strategic market selection based on infrastructure readiness, regulatory stability, and consumer demographics enables more efficient resource allocation and higher success probability in market development initiatives.

Growth projections for the Asia Pacific luxury yacht market indicate sustained expansion driven by continued wealth creation, infrastructure development, and evolving consumer preferences toward experiential luxury. Market development is expected to accelerate with compound annual growth rates approaching 10-12% across key segments as regional economies mature and yacht infrastructure reaches critical mass.

Technology evolution will continue transforming yacht capabilities through autonomous navigation systems, advanced connectivity solutions, and integrated smart yacht features that enhance safety, convenience, and user experiences. These technological advances create opportunities for differentiation while addressing consumer expectations for innovation and operational efficiency in luxury yacht operations.

Market maturation is expected to drive consolidation among service providers while creating opportunities for specialized companies offering unique capabilities or serving specific market segments. This evolution benefits consumers through improved service quality and competitive pricing while creating strategic opportunities for companies with strong market positions and differentiated capabilities.

Sustainability integration will become increasingly important as environmental regulations evolve and consumer preferences shift toward eco-friendly luxury options. Companies developing sustainable yacht technologies and operational practices are positioned to capture market share while addressing regulatory trends that may impact traditional yacht operations and consumer acceptance.

The Asia Pacific luxury yacht market represents exceptional growth opportunities driven by rapid economic development, expanding affluent populations, and evolving consumer preferences toward experiential luxury consumption. Market dynamics indicate sustained expansion potential as infrastructure development, regulatory improvements, and cultural shifts create favorable conditions for yacht industry growth across diverse regional economies.

Strategic success factors include comprehensive service capabilities, technology integration, and deep understanding of regional consumer preferences that enable companies to differentiate their offerings while building sustainable competitive advantages. The market rewards companies that invest in local presence, service excellence, and innovation while adapting to unique characteristics of Asia Pacific luxury consumers and operational environments.

Future market development will be shaped by continued wealth creation, infrastructure expansion, and technology evolution that enhance yacht capabilities while improving operational efficiency and environmental sustainability. Companies positioning themselves to capitalize on these trends through strategic investments, regional partnerships, and service innovation are well-positioned to capture market share in this dynamic and expanding luxury market segment.

What is Luxury Yacht?

Luxury yachts are high-end recreational boats that offer premium amenities and services, catering to affluent individuals seeking leisure and adventure on the water. They often feature luxurious interiors, advanced technology, and various recreational facilities.

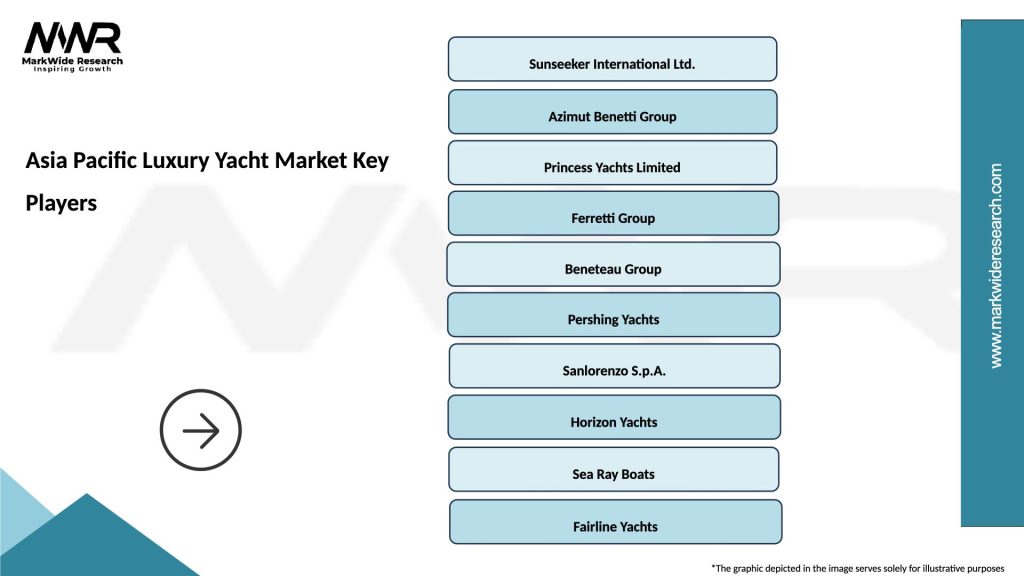

What are the key players in the Asia Pacific Luxury Yacht Market?

Key players in the Asia Pacific Luxury Yacht Market include Sunseeker, Azimut Yachts, and Princess Yachts, which are known for their innovative designs and high-quality craftsmanship. These companies compete to capture the growing demand for luxury yachts in the region, among others.

What are the main drivers of the Asia Pacific Luxury Yacht Market?

The main drivers of the Asia Pacific Luxury Yacht Market include increasing disposable incomes among the affluent population, a growing interest in leisure boating activities, and the rise of luxury tourism in coastal regions. Additionally, advancements in yacht technology and design are attracting more buyers.

What challenges does the Asia Pacific Luxury Yacht Market face?

The Asia Pacific Luxury Yacht Market faces challenges such as high maintenance costs, regulatory hurdles related to maritime laws, and environmental concerns regarding yacht emissions. These factors can deter potential buyers and impact market growth.

What opportunities exist in the Asia Pacific Luxury Yacht Market?

Opportunities in the Asia Pacific Luxury Yacht Market include the expansion of yacht charter services, increasing interest in eco-friendly yachts, and the potential for new markets in emerging economies. These trends can drive innovation and attract new customers.

What trends are shaping the Asia Pacific Luxury Yacht Market?

Trends shaping the Asia Pacific Luxury Yacht Market include a growing preference for sustainable and eco-friendly yacht designs, the integration of smart technology for enhanced user experience, and an increase in personalized yacht services. These trends reflect changing consumer preferences and environmental awareness.

Asia Pacific Luxury Yacht Market

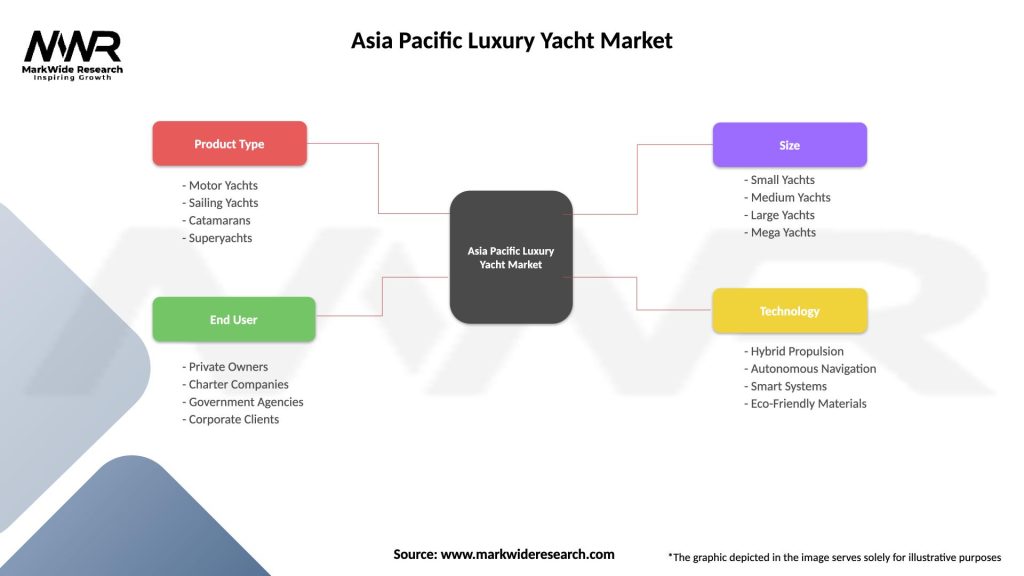

| Segmentation Details | Description |

|---|---|

| Product Type | Motor Yachts, Sailing Yachts, Catamarans, Superyachts |

| End User | Private Owners, Charter Companies, Government Agencies, Corporate Clients |

| Size | Small Yachts, Medium Yachts, Large Yachts, Mega Yachts |

| Technology | Hybrid Propulsion, Autonomous Navigation, Smart Systems, Eco-Friendly Materials |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Luxury Yacht Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at