444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific Logic IC market represents one of the most dynamic and rapidly expanding segments within the global semiconductor industry. This region has emerged as a powerhouse for logic integrated circuit development, manufacturing, and consumption, driven by robust technological advancement and increasing digitalization across multiple industries. The market encompasses a wide range of logic ICs including microprocessors, microcontrollers, digital signal processors, and field-programmable gate arrays that serve as the fundamental building blocks of modern electronic systems.

Market dynamics in the Asia Pacific region are characterized by strong demand from consumer electronics, automotive, telecommunications, and industrial automation sectors. The region’s strategic position as a global manufacturing hub, combined with significant investments in research and development, has positioned it at the forefront of logic IC innovation. Countries such as China, Japan, South Korea, Taiwan, and Singapore have established themselves as key players in the semiconductor ecosystem, contributing to the market’s impressive growth trajectory of approximately 8.5% CAGR over recent years.

Technological evolution continues to drive market expansion, with emerging applications in artificial intelligence, Internet of Things, 5G communications, and autonomous vehicles creating substantial demand for advanced logic ICs. The region’s commitment to semiconductor self-sufficiency and technological sovereignty has resulted in increased domestic production capabilities and reduced dependence on external suppliers, further strengthening the market’s foundation for sustained growth.

The Asia Pacific Logic IC market refers to the comprehensive ecosystem encompassing the design, manufacturing, distribution, and application of logic integrated circuits across the Asia Pacific region. Logic ICs are semiconductor devices that perform digital processing functions, executing logical operations such as AND, OR, NOT, and more complex computational tasks that form the core of digital electronic systems.

These integrated circuits serve as the computational engines in virtually all modern electronic devices, from smartphones and computers to industrial control systems and automotive electronics. The market includes various categories of logic ICs such as standard logic devices, programmable logic devices, microprocessors, microcontrollers, and application-specific integrated circuits (ASICs) that cater to diverse industry requirements and performance specifications.

Regional significance of the Asia Pacific Logic IC market extends beyond mere consumption, as the region houses some of the world’s largest semiconductor foundries, design houses, and technology companies. This market represents the intersection of advanced manufacturing capabilities, innovative design expertise, and substantial end-user demand, creating a comprehensive value chain that supports global technology advancement and digital transformation initiatives.

The Asia Pacific Logic IC market stands as a cornerstone of the global semiconductor industry, demonstrating remarkable resilience and growth potential despite various economic and geopolitical challenges. The market’s strength lies in its diverse ecosystem of manufacturers, designers, and end-users, supported by robust government initiatives and substantial private sector investments in semiconductor technology development.

Key growth drivers include the accelerating adoption of artificial intelligence and machine learning applications, which require high-performance logic ICs capable of handling complex computational workloads. The proliferation of 5G networks across the region has created significant demand for advanced communication processors and signal processing ICs, contributing approximately 25% of total market growth in recent periods.

Market segmentation reveals strong performance across multiple application areas, with consumer electronics maintaining the largest share, followed by automotive electronics and industrial automation. The automotive sector, in particular, has shown exceptional growth potential with the increasing adoption of electric vehicles and autonomous driving technologies, requiring sophisticated logic ICs for power management, sensor processing, and real-time decision-making capabilities.

Competitive landscape features both established global players and emerging regional champions, creating a dynamic environment that fosters innovation and technological advancement. The market’s future outlook remains highly positive, supported by continued digitalization trends, government support for semiconductor development, and the region’s strategic importance in global technology supply chains.

Strategic market positioning of the Asia Pacific region in the global Logic IC landscape reveals several critical insights that shape industry dynamics and future growth trajectories. The region’s dominance in semiconductor manufacturing, combined with increasing design capabilities, has created a self-reinforcing cycle of technological advancement and market expansion.

These insights collectively demonstrate the Asia Pacific Logic IC market’s evolution from a primarily manufacturing-focused region to a comprehensive innovation hub that drives global semiconductor advancement and technological progress.

Digital transformation initiatives across the Asia Pacific region serve as the primary catalyst for Logic IC market expansion, with organizations increasingly adopting advanced technologies to enhance operational efficiency and competitive positioning. The widespread implementation of Industry 4.0 concepts has created substantial demand for intelligent logic ICs capable of supporting real-time data processing, predictive analytics, and automated decision-making systems.

Consumer electronics proliferation continues to drive significant market growth, with the region’s position as both a major manufacturer and consumer of electronic devices creating sustained demand for various logic IC categories. The increasing sophistication of smartphones, tablets, wearable devices, and smart home appliances requires advanced processors and controllers that can deliver enhanced performance while maintaining energy efficiency.

Automotive industry transformation represents another crucial growth driver, as the shift toward electric vehicles, autonomous driving systems, and connected car technologies demands sophisticated logic ICs for power management, sensor fusion, and real-time processing capabilities. The automotive electronics segment is experiencing rapid expansion, with logic IC content per vehicle increasing substantially as vehicles become more electronically sophisticated.

Infrastructure modernization across emerging economies in the region creates additional demand for logic ICs in telecommunications, transportation, energy management, and smart city applications. Government investments in 5G networks, high-speed rail systems, and renewable energy infrastructure require advanced logic ICs to support complex control and communication functions.

Artificial intelligence adoption has emerged as a transformative force, driving demand for specialized logic ICs optimized for machine learning workloads, neural network processing, and edge computing applications. The growing implementation of AI across various industries requires high-performance processors capable of handling intensive computational tasks efficiently.

Supply chain complexities pose significant challenges to the Asia Pacific Logic IC market, particularly in light of recent global disruptions and geopolitical tensions that have highlighted vulnerabilities in semiconductor supply networks. The industry’s reliance on specialized materials, equipment, and manufacturing processes creates potential bottlenecks that can impact production capacity and delivery schedules.

High capital requirements for advanced semiconductor manufacturing facilities represent a substantial barrier to entry and expansion, with cutting-edge fabrication plants requiring investments that can exceed several billion dollars. These capital intensity requirements limit the number of companies capable of participating in leading-edge logic IC production, potentially constraining market competition and innovation.

Technological complexity continues to increase as logic ICs advance to smaller process nodes and incorporate more sophisticated features, creating challenges in design, manufacturing, and testing. The growing complexity requires specialized expertise and advanced tools, which can limit the ability of smaller companies to compete effectively in high-performance segments.

Regulatory uncertainties and trade restrictions have created additional challenges for market participants, particularly regarding technology transfer, export controls, and market access. These regulatory factors can impact supply chain planning, technology development strategies, and market expansion initiatives across different countries in the region.

Environmental concerns related to semiconductor manufacturing processes and electronic waste management are increasingly influencing market dynamics, requiring companies to invest in cleaner production technologies and sustainable practices. These environmental considerations can increase operational costs and complexity while potentially limiting certain manufacturing approaches.

Emerging technology applications present substantial growth opportunities for the Asia Pacific Logic IC market, particularly in areas such as quantum computing, neuromorphic processors, and advanced AI accelerators. These next-generation technologies require specialized logic ICs with unique architectural features and performance characteristics, creating new market segments with significant revenue potential.

Edge computing expansion offers considerable opportunities as organizations seek to process data closer to its source, reducing latency and improving real-time decision-making capabilities. The proliferation of edge computing applications across industries such as manufacturing, healthcare, and transportation creates demand for power-efficient, high-performance logic ICs optimized for distributed computing environments.

Internet of Things proliferation continues to generate substantial opportunities, with billions of connected devices requiring specialized logic ICs for sensing, processing, and communication functions. The IoT market’s growth trajectory suggests sustained demand for low-power, cost-effective logic ICs that can support diverse application requirements while maintaining reliable connectivity.

Automotive electronics evolution presents significant opportunities as vehicles become increasingly sophisticated, incorporating advanced driver assistance systems, infotainment platforms, and connectivity features. The transition to electric and autonomous vehicles requires specialized logic ICs for battery management, motor control, sensor processing, and real-time decision-making systems.

5G infrastructure deployment across the Asia Pacific region creates substantial opportunities for logic IC suppliers, as next-generation wireless networks require advanced processors for base stations, network equipment, and user devices. The ongoing 5G rollout represents a multi-year opportunity that will drive sustained demand for high-performance communication processors and signal processing ICs.

Competitive intensity within the Asia Pacific Logic IC market has reached unprecedented levels, with established global players and emerging regional companies vying for market share across various application segments. This competitive environment drives continuous innovation, price optimization, and customer service improvements, ultimately benefiting end-users through enhanced product offerings and competitive pricing structures.

Technology convergence is reshaping market dynamics as traditional boundaries between different types of logic ICs become increasingly blurred. The integration of processing, memory, and connectivity functions on single chips creates new product categories and market opportunities while challenging conventional market segmentation approaches.

Customer requirements evolution reflects changing market dynamics, with end-users increasingly demanding customized solutions, shorter development cycles, and comprehensive support services. This shift toward customer-centric approaches requires logic IC suppliers to develop more flexible business models and enhanced technical capabilities to meet diverse application requirements.

Supply chain resilience has become a critical factor in market dynamics, with companies investing in diversified supplier networks, regional production capabilities, and strategic inventory management. The focus on supply chain security and reliability is driving structural changes in how companies approach sourcing, manufacturing, and distribution strategies.

Sustainability considerations are increasingly influencing market dynamics, with customers and regulators placing greater emphasis on energy efficiency, environmental impact, and circular economy principles. These sustainability requirements are driving innovation in low-power logic IC designs and environmentally responsible manufacturing processes, creating new competitive differentiators and market opportunities.

Comprehensive market analysis for the Asia Pacific Logic IC market employs a multi-faceted research approach that combines primary and secondary research methodologies to ensure accuracy, reliability, and depth of insights. The research framework incorporates quantitative and qualitative analysis techniques to provide a holistic understanding of market dynamics, competitive landscape, and future growth prospects.

Primary research activities include extensive interviews with industry executives, technology experts, and key stakeholders across the logic IC value chain. These interviews provide firsthand insights into market trends, technological developments, competitive strategies, and future outlook perspectives from companies directly involved in logic IC design, manufacturing, and application development.

Secondary research components encompass comprehensive analysis of industry reports, company financial statements, patent filings, regulatory documents, and academic publications. This secondary research provides historical context, market sizing information, competitive intelligence, and technological trend analysis that supports and validates primary research findings.

Market modeling techniques utilize advanced statistical methods and forecasting models to project future market growth, segment performance, and regional trends. These models incorporate multiple variables including economic indicators, technology adoption rates, industry growth patterns, and regulatory developments to generate reliable market projections.

Data validation processes ensure research accuracy through triangulation of multiple data sources, expert review panels, and continuous monitoring of market developments. The validation methodology includes cross-referencing findings with industry benchmarks, conducting sensitivity analysis, and incorporating feedback from market participants to refine and improve research outcomes.

China dominates the Asia Pacific Logic IC market with approximately 45% regional market share, driven by its massive electronics manufacturing base, substantial government investments in semiconductor development, and growing domestic demand across multiple application sectors. The country’s strategic focus on semiconductor self-sufficiency has resulted in significant capacity expansion and technological advancement initiatives.

Japan maintains a strong position in high-performance and specialized logic IC segments, leveraging its advanced technology capabilities and strong presence in automotive electronics, industrial automation, and consumer electronics markets. Japanese companies continue to lead in areas requiring precision engineering and advanced manufacturing processes, contributing approximately 20% of regional market value.

South Korea represents a significant market presence with approximately 18% regional share, supported by major semiconductor companies and strong demand from memory, display, and mobile device industries. The country’s technological expertise in advanced process nodes and system-on-chip designs positions it as a key player in high-performance logic IC segments.

Taiwan serves as a critical hub for logic IC manufacturing and design services, with its foundry ecosystem supporting global semiconductor companies and contributing substantially to regional production capacity. The island’s strategic position in the global semiconductor supply chain makes it essential for logic IC availability and technological advancement.

Southeast Asian countries including Singapore, Malaysia, Thailand, and Vietnam are experiencing rapid growth in logic IC consumption and assembly operations, driven by expanding electronics manufacturing, automotive production, and infrastructure development initiatives. These markets represent significant growth opportunities for logic IC suppliers seeking to expand their regional presence.

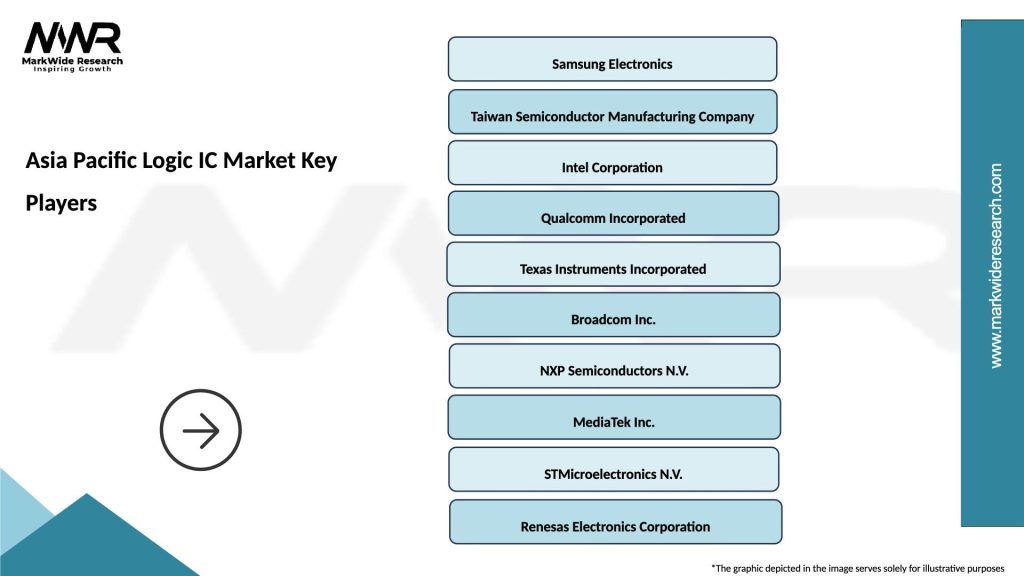

Market leadership in the Asia Pacific Logic IC sector is characterized by intense competition among global technology giants and emerging regional players, each leveraging unique strengths in technology, manufacturing, and market access to capture market share and drive innovation.

Competitive strategies focus on technological differentiation, manufacturing excellence, customer partnerships, and market expansion initiatives. Companies are investing heavily in research and development, advanced manufacturing capabilities, and strategic acquisitions to strengthen their competitive positions and capture emerging market opportunities.

Innovation leadership remains a key differentiator, with companies competing on process technology advancement, power efficiency improvements, integration capabilities, and specialized features for target applications. The competitive landscape continues to evolve as new technologies emerge and market requirements change.

By Technology: The Asia Pacific Logic IC market demonstrates diverse technological segmentation reflecting varying performance requirements and application needs across different industry sectors.

By Product Type: Market segmentation by product categories reveals distinct growth patterns and application focus areas.

By Application: End-use application segmentation highlights market demand drivers and growth opportunities.

Consumer Electronics segment maintains the largest market share within the Asia Pacific Logic IC market, driven by the region’s position as a global manufacturing hub for smartphones, tablets, and other portable devices. This segment benefits from continuous product innovation, shorter replacement cycles, and increasing feature sophistication that requires advanced logic processing capabilities.

Automotive Electronics category demonstrates the highest growth rate, with logic IC content per vehicle increasing substantially as automotive systems become more electronically sophisticated. The transition to electric vehicles and autonomous driving technologies creates significant demand for specialized processors, power management ICs, and real-time control systems.

Industrial Automation applications show steady growth driven by Industry 4.0 initiatives, smart manufacturing implementations, and increasing adoption of robotics and artificial intelligence in production environments. This category requires robust, reliable logic ICs capable of operating in harsh industrial conditions while providing precise control and communication capabilities.

Telecommunications infrastructure represents a high-value segment with substantial growth potential, particularly with ongoing 5G network deployments across the region. This category demands high-performance logic ICs for base stations, network equipment, and edge computing applications that support next-generation wireless communication services.

Computing applications continue to evolve with cloud computing expansion, data center growth, and edge computing adoption. This segment requires high-performance processors optimized for server applications, artificial intelligence workloads, and distributed computing environments that can deliver exceptional performance while maintaining energy efficiency.

Manufacturers benefit from the Asia Pacific Logic IC market’s robust growth through expanded revenue opportunities, economies of scale, and access to diverse customer bases across multiple industry sectors. The region’s manufacturing ecosystem provides cost advantages, supply chain efficiency, and proximity to key markets that enhance competitive positioning.

Technology companies gain access to advanced manufacturing capabilities, skilled workforce, and collaborative research environments that accelerate innovation and product development cycles. The region’s emphasis on technology advancement and government support for semiconductor development creates favorable conditions for research and development investments.

End-users benefit from competitive pricing, rapid product availability, and customized solutions that meet specific application requirements. The region’s diverse supplier base and manufacturing capabilities ensure reliable supply chains and responsive customer support services that enhance operational efficiency.

Investors find attractive opportunities in the Asia Pacific Logic IC market through exposure to high-growth technology sectors, emerging market expansion, and technological innovation trends. The market’s strong fundamentals and growth prospects provide potential for substantial returns while supporting technological advancement initiatives.

Governments benefit from semiconductor industry development through job creation, technology transfer, export revenue generation, and strategic technology capabilities that enhance national competitiveness. The logic IC industry’s contribution to economic development and technological sovereignty makes it a priority sector for policy support and investment promotion.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence integration represents the most significant trend shaping the Asia Pacific Logic IC market, with AI capabilities being embedded across various application segments from mobile devices to industrial systems. This trend drives demand for specialized processors optimized for machine learning workloads, neural network processing, and edge computing applications that can deliver AI functionality efficiently.

Power efficiency optimization continues as a critical trend, with logic IC designers focusing on reducing power consumption while maintaining or improving performance levels. This trend is particularly important for mobile devices, IoT applications, and data center equipment where energy efficiency directly impacts operational costs and environmental sustainability.

System integration advancement involves combining multiple functions on single chips to reduce system complexity, improve performance, and lower costs. This trend toward system-on-chip solutions creates opportunities for logic IC suppliers to develop highly integrated products that address complete application requirements rather than individual functions.

Customization and flexibility trends reflect increasing demand for application-specific solutions and programmable logic devices that can be tailored to specific customer requirements. This trend supports market differentiation and enables logic IC suppliers to address niche applications with specialized performance characteristics.

Security enhancement has become increasingly important as logic ICs are integrated into critical systems and connected devices. This trend drives development of hardware-based security features, encryption capabilities, and secure boot mechanisms that protect against cyber threats and unauthorized access.

Advanced process node development continues to drive industry evolution, with leading manufacturers investing in 3nm and 2nm process technologies that enable higher performance, lower power consumption, and increased integration density. These technological advances create new possibilities for logic IC applications while maintaining competitive differentiation.

Strategic partnerships and alliances are reshaping the competitive landscape as companies collaborate to address complex technological challenges, share development costs, and accelerate time-to-market for new products. These partnerships often combine complementary strengths in design, manufacturing, and market access to create competitive advantages.

Capacity expansion initiatives across the region reflect strong market confidence and growing demand expectations. Major manufacturers are investing in new fabrication facilities, upgrading existing equipment, and expanding production capabilities to meet increasing market requirements and reduce supply chain risks.

Sustainability programs are gaining prominence as companies implement environmentally responsible manufacturing processes, develop energy-efficient products, and establish circular economy practices. These initiatives respond to regulatory requirements, customer expectations, and corporate responsibility commitments while potentially creating competitive advantages.

Talent development programs address critical skill shortages through partnerships with educational institutions, specialized training initiatives, and international recruitment efforts. These programs ensure adequate human resources for continued industry growth and technological advancement while building long-term competitive capabilities.

MarkWide Research recommends that logic IC companies prioritize investment in artificial intelligence and machine learning capabilities to capitalize on the growing demand for AI-enabled applications across multiple industry sectors. Companies should develop specialized processors optimized for AI workloads while maintaining compatibility with existing software ecosystems and development tools.

Supply chain diversification emerges as a critical strategic priority, with analysts suggesting that companies establish multiple sourcing options, regional production capabilities, and strategic inventory management to enhance resilience against potential disruptions. This approach should balance cost optimization with supply security considerations.

Customer collaboration intensification is recommended to better understand evolving application requirements and develop customized solutions that address specific market needs. Companies should invest in customer support capabilities, application engineering resources, and co-development programs that strengthen customer relationships and market positioning.

Sustainability integration should be embedded throughout business operations, from product design and manufacturing processes to supply chain management and end-of-life considerations. Companies that proactively address environmental concerns and develop sustainable solutions will likely gain competitive advantages and meet evolving regulatory requirements.

Technology roadmap alignment with emerging trends such as quantum computing, neuromorphic processing, and advanced packaging technologies will position companies for future growth opportunities. Strategic research and development investments should focus on next-generation technologies that will define future market leadership positions.

Market growth trajectory for the Asia Pacific Logic IC market remains highly positive, with sustained expansion expected across multiple application segments and geographic regions. MarkWide Research projects continued strong performance driven by technological advancement, increasing digitalization, and emerging application opportunities that will support long-term market development.

Technology evolution will continue to drive market transformation, with advances in process technology, architectural innovation, and application-specific optimization creating new product categories and market opportunities. The integration of artificial intelligence, 5G communications, and Internet of Things capabilities will generate substantial demand for advanced logic ICs with specialized performance characteristics.

Regional market dynamics are expected to evolve with increasing domestic capabilities, technology transfer initiatives, and government support programs that strengthen local semiconductor ecosystems. This evolution will likely result in more balanced regional development and reduced dependence on external suppliers for critical technology components.

Application diversification will expand market opportunities beyond traditional segments, with emerging applications in autonomous vehicles, smart cities, renewable energy systems, and healthcare technologies creating new demand drivers. These applications often require specialized logic ICs with unique performance, reliability, and integration requirements.

Competitive landscape evolution will likely feature continued consolidation, strategic partnerships, and technology specialization as companies focus on core competencies and collaborative development approaches. Market success will increasingly depend on innovation capabilities, customer relationships, and operational excellence rather than scale alone.

The Asia Pacific Logic IC market represents a dynamic and rapidly evolving sector that plays a crucial role in global technology advancement and digital transformation initiatives. The market’s strong fundamentals, including robust demand drivers, technological innovation, and supportive government policies, position it for continued growth and development across multiple application segments and geographic regions.

Strategic opportunities abound for market participants who can effectively navigate the complex competitive landscape, invest in emerging technologies, and develop solutions that address evolving customer requirements. The market’s emphasis on artificial intelligence, 5G communications, automotive electronics, and industrial automation creates substantial growth potential for companies with appropriate technological capabilities and market positioning.

Future success in the Asia Pacific Logic IC market will depend on companies’ ability to balance innovation with operational excellence, sustainability with profitability, and global competitiveness with regional market requirements. Organizations that can effectively integrate these considerations while maintaining focus on customer value creation will be best positioned to capitalize on the market’s substantial growth opportunities and contribute to the region’s continued technological leadership in the global semiconductor industry.

What is Logic IC?

Logic ICs, or integrated circuits, are electronic components that perform logical operations and are essential in digital devices. They are widely used in applications such as computers, smartphones, and automotive systems.

What are the key players in the Asia Pacific Logic IC Market?

Key players in the Asia Pacific Logic IC Market include companies like Intel Corporation, Texas Instruments, and NXP Semiconductors, among others.

What are the main drivers of growth in the Asia Pacific Logic IC Market?

The growth of the Asia Pacific Logic IC Market is driven by the increasing demand for consumer electronics, advancements in automotive technology, and the rise of IoT applications.

What challenges does the Asia Pacific Logic IC Market face?

Challenges in the Asia Pacific Logic IC Market include supply chain disruptions, rapid technological changes, and intense competition among manufacturers.

What opportunities exist in the Asia Pacific Logic IC Market?

Opportunities in the Asia Pacific Logic IC Market include the expansion of smart devices, the growth of artificial intelligence applications, and the increasing adoption of automation in various industries.

What trends are shaping the Asia Pacific Logic IC Market?

Trends in the Asia Pacific Logic IC Market include the miniaturization of components, the integration of AI capabilities in ICs, and a growing focus on energy-efficient designs.

Asia Pacific Logic IC Market

| Segmentation Details | Description |

|---|---|

| Product Type | Analog ICs, Digital ICs, Mixed-Signal ICs, Power Management ICs |

| Technology | CMOS, BiCMOS, GaN, SiGe |

| End User | Consumer Electronics, Telecommunications, Automotive OEMs, Industrial Automation |

| Application | Signal Processing, Data Conversion, Power Management, Communication |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Logic IC Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at