444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific lithium-ion battery separator for electric vehicle application market represents one of the most dynamic and rapidly expanding segments within the global automotive battery ecosystem. This specialized market encompasses the production, distribution, and application of advanced separator materials that serve as critical components in lithium-ion batteries specifically designed for electric vehicles across the Asia Pacific region. Market dynamics indicate unprecedented growth driven by the region’s aggressive electric vehicle adoption policies, substantial manufacturing capabilities, and increasing environmental consciousness among consumers.

Regional leadership in this sector is particularly evident in countries such as China, Japan, South Korea, and India, where government initiatives and private sector investments have created a robust ecosystem for electric vehicle battery component manufacturing. The market encompasses various separator technologies including polyethylene (PE), polypropylene (PP), and ceramic-coated separators, each offering distinct advantages for different electric vehicle applications. Growth projections suggest the market will experience a compound annual growth rate of 12.8% CAGR through the forecast period, reflecting the accelerating transition toward sustainable transportation solutions.

Manufacturing excellence across the Asia Pacific region has positioned local companies as global leaders in separator technology innovation, with significant investments in research and development driving continuous improvements in separator performance, safety, and cost-effectiveness. The market’s expansion is further supported by the region’s established supply chain networks, skilled workforce, and favorable regulatory environment that encourages clean energy technology development.

The Asia Pacific lithium-ion battery separator for electric vehicle application market refers to the specialized industry segment focused on manufacturing and supplying separator materials used in lithium-ion batteries specifically designed for electric vehicles within the Asia Pacific geographical region. These separators are thin, porous membranes that physically separate the positive and negative electrodes while allowing ionic conductivity, serving as critical safety and performance components in electric vehicle battery systems.

Separator functionality encompasses preventing direct contact between electrodes while facilitating lithium-ion movement during charge and discharge cycles, making them essential for battery safety, efficiency, and longevity. The market includes various separator types such as microporous polyolefin separators, ceramic-coated separators, and advanced composite materials, each engineered to meet specific performance requirements for different electric vehicle applications including passenger cars, commercial vehicles, and two-wheelers.

Geographic scope covers major Asia Pacific markets including China, Japan, South Korea, India, Southeast Asian countries, and Australia, where electric vehicle adoption is accelerating rapidly. The market encompasses the entire value chain from raw material suppliers and separator manufacturers to battery producers and electric vehicle original equipment manufacturers, creating a comprehensive ecosystem that supports the region’s transition to sustainable mobility solutions.

Strategic positioning within the global electric vehicle battery supply chain has established the Asia Pacific region as the dominant force in lithium-ion battery separator manufacturing and innovation. The market demonstrates exceptional growth momentum driven by supportive government policies, substantial private sector investments, and rapidly increasing electric vehicle adoption rates across multiple countries. Technology advancement remains a key differentiator, with regional manufacturers leading developments in high-performance separator materials that enhance battery safety, energy density, and operational lifespan.

Market concentration is particularly strong in China, which accounts for approximately 68% market share of regional separator production, followed by Japan and South Korea as significant contributors to technology innovation and high-end separator manufacturing. The competitive landscape features both established multinational corporations and emerging local players, creating a dynamic environment that fosters continuous innovation and cost optimization.

Investment trends indicate substantial capital allocation toward expanding manufacturing capacity, developing next-generation separator technologies, and establishing strategic partnerships throughout the electric vehicle value chain. According to MarkWide Research analysis, the market benefits from strong fundamentals including robust demand growth, technological advancement, and favorable regulatory support that collectively create an attractive investment environment for both domestic and international stakeholders.

Technology evolution represents a fundamental driver of market transformation, with manufacturers increasingly focusing on developing advanced separator materials that offer superior thermal stability, enhanced safety characteristics, and improved electrochemical performance. The following key insights define the current market landscape:

Market maturation is evident through the establishment of comprehensive quality standards, standardized testing procedures, and robust supply chain networks that support consistent product delivery to electric vehicle manufacturers across the region.

Government policy support serves as the primary catalyst driving market expansion, with numerous Asia Pacific countries implementing comprehensive electric vehicle promotion strategies that include purchase incentives, infrastructure development programs, and manufacturing support initiatives. These policies create substantial demand for lithium-ion batteries and their components, directly benefiting separator manufacturers throughout the region.

Environmental regulations increasingly mandate reduced vehicle emissions and promote clean energy adoption, compelling automotive manufacturers to accelerate electric vehicle development and production. This regulatory pressure translates into sustained demand growth for high-performance battery separators that enable efficient and safe electric vehicle operation across diverse climate conditions and usage patterns.

Technological advancement in electric vehicle design and battery chemistry continues to drive demand for specialized separator materials that can support higher energy densities, faster charging capabilities, and extended operational lifespans. Manufacturing innovations have enabled the production of thinner, more efficient separators that contribute to overall battery performance improvements while maintaining critical safety standards.

Cost competitiveness of electric vehicles compared to traditional internal combustion engine vehicles has reached a tipping point in many Asia Pacific markets, accelerating consumer adoption and creating sustained demand for battery components. The region’s manufacturing expertise and economies of scale contribute to cost-effective separator production that supports broader electric vehicle market accessibility.

Infrastructure development including charging networks, battery recycling facilities, and maintenance services creates a supportive ecosystem that encourages electric vehicle adoption and sustains long-term demand for battery separators throughout the region.

Raw material availability presents ongoing challenges for separator manufacturers, particularly regarding specialized polymer materials and ceramic coating compounds that require consistent quality and supply reliability. Price volatility in key raw materials can impact manufacturing costs and profit margins, creating uncertainty for long-term business planning and investment decisions.

Technical complexity associated with separator manufacturing requires substantial expertise, specialized equipment, and stringent quality control processes that can create barriers to entry for new market participants. The need for continuous research and development investment to maintain competitive positioning places significant financial pressure on manufacturers, particularly smaller companies with limited resources.

Quality requirements for electric vehicle applications demand extremely high standards for separator performance, safety, and reliability, necessitating extensive testing and certification processes that can delay product launches and increase development costs. Any quality issues or safety concerns can have severe consequences for manufacturer reputation and market position.

Competition intensity from both regional and international players creates pricing pressure and margin compression, particularly in commodity separator segments where differentiation is limited. The need to balance cost competitiveness with performance requirements presents ongoing challenges for manufacturers seeking to maintain profitability while supporting market growth.

Regulatory compliance requirements vary across different Asia Pacific countries, creating complexity for manufacturers serving multiple markets and potentially increasing operational costs associated with meeting diverse certification and testing standards.

Next-generation technologies present substantial opportunities for separator manufacturers to develop advanced materials that support emerging battery chemistries, solid-state battery designs, and ultra-fast charging applications. Innovation in separator design and materials science can create competitive advantages and premium pricing opportunities for companies that successfully commercialize breakthrough technologies.

Market expansion into emerging Asia Pacific countries offers significant growth potential as these markets develop their electric vehicle infrastructure and manufacturing capabilities. Early market entry and strategic partnerships can establish strong competitive positions in countries experiencing rapid economic development and increasing environmental awareness.

Vertical integration opportunities allow separator manufacturers to expand their value chain participation through partnerships or acquisitions involving raw material suppliers, battery manufacturers, or electric vehicle producers. Such integration can improve margin capture, ensure supply security, and enhance customer relationships throughout the ecosystem.

Recycling initiatives create new business opportunities as the electric vehicle market matures and battery recycling becomes increasingly important. Separator manufacturers can develop specialized products for recycled battery applications and participate in circular economy initiatives that support sustainable industry development.

Export potential beyond the Asia Pacific region enables manufacturers to leverage their competitive advantages in global markets, particularly as other regions accelerate their electric vehicle adoption and seek reliable separator suppliers with proven track records and competitive pricing.

Supply chain evolution continues to reshape the market landscape as manufacturers optimize their operations for efficiency, quality, and responsiveness to customer needs. The integration of digital technologies, automation, and advanced manufacturing processes has enabled significant improvements in production capacity and product consistency while reducing operational costs.

Customer relationships have become increasingly strategic as battery manufacturers seek long-term partnerships with separator suppliers who can provide consistent quality, reliable delivery, and continuous innovation support. These relationships often involve collaborative research and development efforts, joint investment in manufacturing capabilities, and shared risk management strategies.

Technology transfer between different industry segments and geographic regions accelerates innovation and creates opportunities for cross-pollination of ideas and best practices. The movement of skilled personnel, licensing agreements, and joint ventures facilitate knowledge sharing that benefits the entire industry ecosystem.

Market consolidation trends indicate increasing merger and acquisition activity as companies seek to achieve greater scale, expand their technology portfolios, and strengthen their competitive positions. This consolidation can create more efficient market structures while potentially reducing competition in certain segments.

Investment flows from both private and public sources continue to support market expansion, with particular emphasis on capacity building, technology development, and supply chain optimization. The availability of capital enables companies to pursue growth opportunities and maintain their competitive positioning in this rapidly evolving market.

Comprehensive analysis of the Asia Pacific lithium-ion battery separator market employs multiple research approaches to ensure accuracy and reliability of findings. Primary research involves direct engagement with industry participants including separator manufacturers, battery producers, electric vehicle manufacturers, and key suppliers throughout the value chain to gather firsthand insights on market trends, challenges, and opportunities.

Secondary research encompasses extensive review of industry publications, government reports, company financial statements, patent filings, and academic research to validate primary findings and provide comprehensive market context. This approach ensures thorough coverage of all market segments and geographic regions within the Asia Pacific area.

Data validation processes include cross-referencing information from multiple sources, conducting expert interviews, and applying statistical analysis techniques to ensure data accuracy and reliability. Market sizing and forecasting methodologies incorporate both top-down and bottom-up approaches to provide robust projections that account for various market scenarios and potential disruptions.

Industry expertise from experienced analysts and subject matter experts provides critical insights into market dynamics, competitive positioning, and future trends that may not be apparent from quantitative data alone. This qualitative analysis enhances the overall research quality and provides actionable insights for market participants.

Continuous monitoring of market developments ensures that research findings remain current and relevant, with regular updates to account for new product launches, policy changes, and other significant market events that may impact future market evolution.

China dominates the Asia Pacific lithium-ion battery separator market with approximately 68% regional market share, driven by massive electric vehicle production volumes, substantial government support, and comprehensive manufacturing infrastructure. Chinese manufacturers have achieved significant cost advantages through economies of scale while continuously improving product quality and performance characteristics to meet international standards.

Japan maintains a strong position in high-end separator technologies, contributing approximately 18% market share with focus on premium applications requiring superior performance and reliability. Japanese companies excel in advanced materials science and precision manufacturing, creating products that command premium pricing in specialized applications such as high-performance electric vehicles and energy storage systems.

South Korea represents approximately 12% market share with particular strength in integrated battery manufacturing and close relationships with major electric vehicle producers. Korean companies benefit from strong domestic demand and strategic partnerships with global automotive manufacturers, enabling them to develop customized separator solutions for specific applications.

India emerges as a rapidly growing market with increasing domestic manufacturing capabilities and substantial government support for electric vehicle adoption. The country’s large automotive market and growing environmental awareness create significant opportunities for separator manufacturers, though the market remains in early development stages compared to more established regional players.

Southeast Asian countries including Thailand, Indonesia, and Vietnam are developing their electric vehicle manufacturing capabilities and creating opportunities for separator suppliers. These markets benefit from foreign investment, technology transfer, and growing domestic demand for sustainable transportation solutions.

Market leadership is distributed among several key players who have established strong positions through technology innovation, manufacturing excellence, and strategic customer relationships. The competitive environment encourages continuous improvement and innovation while maintaining focus on cost competitiveness and quality consistency.

Strategic partnerships between separator manufacturers and battery producers have become increasingly important for ensuring supply security, quality consistency, and technology development collaboration. These relationships often involve long-term supply agreements and joint investment in manufacturing capabilities.

By Material Type:

By Application:

By Manufacturing Process:

Premium separator categories demonstrate strong growth potential driven by increasing demand for high-performance electric vehicles that require superior battery safety and energy density. Ceramic-coated separators represent the fastest-growing segment with projected growth rates exceeding 15.2% annually, reflecting their critical role in next-generation battery designs that prioritize safety and performance.

Standard separator categories maintain significant market share due to their cost-effectiveness and proven performance in mainstream electric vehicle applications. Polyethylene-based separators continue to dominate volume applications where cost optimization is prioritized while maintaining acceptable performance standards for consumer electric vehicles.

Application-specific categories show increasing differentiation as electric vehicle manufacturers seek optimized solutions for different use cases. Commercial vehicle applications demand separators with enhanced durability and thermal management capabilities, while passenger vehicle applications focus on balancing performance with cost considerations.

Technology categories reflect the industry’s evolution toward more sophisticated separator designs that incorporate advanced materials science and manufacturing techniques. Composite separators and multi-layer designs are gaining traction for applications requiring specific performance characteristics that cannot be achieved with traditional single-material approaches.

Regional categories demonstrate varying preferences and requirements based on local market conditions, regulatory requirements, and customer preferences. Chinese markets emphasize cost competitiveness and high-volume production, while Japanese and Korean markets prioritize advanced technology and premium performance characteristics.

Separator manufacturers benefit from sustained demand growth driven by electric vehicle market expansion, opportunities for technology differentiation, and potential for premium pricing in specialized applications. The market’s growth trajectory provides visibility for long-term investment planning and capacity expansion decisions while encouraging continuous innovation and improvement.

Battery producers gain access to advanced separator technologies that enable improved battery performance, enhanced safety characteristics, and cost optimization opportunities. Strong supplier relationships provide supply security and collaborative development opportunities that support their competitive positioning in the electric vehicle market.

Electric vehicle manufacturers benefit from the availability of high-quality, cost-effective separator solutions that enable them to develop competitive electric vehicle products with superior performance and safety characteristics. The robust supplier base provides flexibility in sourcing strategies and supports their production scaling requirements.

Raw material suppliers experience increased demand for specialized materials used in separator manufacturing, creating opportunities for business expansion and technology development. The market’s growth provides incentives for investment in production capacity and quality improvement initiatives.

Technology providers find opportunities to license advanced separator technologies, provide manufacturing equipment, and offer consulting services to support industry development. The market’s emphasis on innovation creates demand for specialized expertise and cutting-edge solutions.

Investors can participate in a high-growth market with strong fundamentals, clear demand drivers, and significant long-term potential. The market offers opportunities across the value chain from raw materials to finished products, enabling diversified investment strategies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability focus is driving increased emphasis on environmentally friendly separator materials and manufacturing processes, with companies investing in recyclable materials and reduced environmental impact production methods. This trend reflects growing environmental consciousness among consumers and regulatory pressure for sustainable manufacturing practices throughout the electric vehicle supply chain.

Performance enhancement continues as a primary trend with manufacturers developing separators that offer improved thermal stability, enhanced safety characteristics, and better electrochemical performance. Advanced materials science and nanotechnology applications are enabling breakthrough improvements in separator functionality while maintaining cost competitiveness.

Manufacturing automation is transforming production processes through the implementation of advanced robotics, artificial intelligence, and quality control systems that improve consistency, reduce costs, and enhance production flexibility. These technological improvements enable manufacturers to respond more effectively to changing market demands and quality requirements.

Supply chain localization is becoming increasingly important as companies seek to reduce transportation costs, improve supply security, and respond more quickly to customer needs. This trend is driving investment in regional manufacturing capabilities and local supplier development initiatives throughout the Asia Pacific region.

Customization capabilities are expanding as manufacturers develop the ability to provide application-specific separator solutions that meet unique customer requirements. This trend enables premium pricing opportunities and stronger customer relationships while supporting the development of specialized electric vehicle applications.

Capacity expansion initiatives across the region reflect strong confidence in market growth prospects, with major manufacturers announcing substantial investments in new production facilities and equipment upgrades. These expansions are designed to meet growing demand while incorporating latest manufacturing technologies and quality control systems.

Technology partnerships between separator manufacturers, battery producers, and research institutions are accelerating innovation and commercialization of advanced separator technologies. These collaborations leverage complementary expertise and resources to develop breakthrough solutions that address emerging market needs.

Acquisition activity has increased as companies seek to strengthen their market positions, expand their technology portfolios, and achieve greater operational scale. Strategic acquisitions enable rapid market entry, technology access, and enhanced competitive positioning in key market segments.

Certification achievements demonstrate the industry’s commitment to quality and safety standards, with manufacturers obtaining international certifications that enable global market access and customer confidence. These certifications are becoming increasingly important for suppliers seeking to serve multinational electric vehicle manufacturers.

Research breakthroughs in separator materials and manufacturing processes continue to advance the state of the art, with particular focus on solid-state battery applications, ultra-fast charging capabilities, and enhanced safety performance. These developments position the industry for future growth opportunities and technological leadership.

Investment prioritization should focus on advanced separator technologies that offer clear performance advantages and differentiation opportunities in premium market segments. Companies should balance investment in current production capabilities with research and development efforts targeting next-generation applications and breakthrough technologies.

Strategic partnerships with key customers and suppliers can provide competitive advantages through improved supply security, collaborative innovation, and shared risk management. MWR analysis suggests that companies with strong partnership networks are better positioned to navigate market volatility and capitalize on growth opportunities.

Geographic diversification within the Asia Pacific region can help companies reduce market concentration risk while accessing growth opportunities in emerging markets. Early market entry and local partnership development can establish competitive advantages before markets become highly competitive.

Quality excellence must remain a top priority given the critical safety and performance requirements of electric vehicle applications. Companies should invest in advanced quality control systems, employee training, and continuous improvement processes to maintain their competitive positioning and customer confidence.

Sustainability initiatives should be integrated into business strategies to address growing environmental concerns and regulatory requirements. Companies that proactively develop sustainable products and processes will be better positioned for long-term success as environmental standards continue to evolve.

Market evolution toward higher-performance separator technologies will continue as electric vehicle manufacturers demand improved battery safety, energy density, and charging capabilities. The transition to next-generation battery chemistries and solid-state technologies will create new opportunities for separator manufacturers who can develop appropriate solutions for these advanced applications.

Regional dynamics are expected to shift as emerging Asia Pacific markets develop their electric vehicle manufacturing capabilities and domestic demand. Countries such as India, Thailand, and Indonesia represent significant growth opportunities that will reshape the competitive landscape and create new market dynamics over the forecast period.

Technology convergence between different separator technologies and applications will create opportunities for cross-pollination of innovations and development of hybrid solutions that combine the best characteristics of different approaches. This convergence will enable more sophisticated separator designs that can meet increasingly demanding application requirements.

Supply chain optimization will become increasingly important as the market matures and competition intensifies. Companies that can achieve superior supply chain efficiency, quality consistency, and customer responsiveness will gain competitive advantages that translate into market share growth and improved profitability.

Growth projections indicate the market will maintain strong momentum with expected compound annual growth rates of 12.8% CAGR through the forecast period, driven by sustained electric vehicle adoption, technology advancement, and expanding applications across different vehicle segments and geographic markets.

The Asia Pacific lithium-ion battery separator for electric vehicle application market represents a dynamic and rapidly expanding industry segment with exceptional growth prospects driven by the region’s leadership in electric vehicle adoption and manufacturing excellence. The market benefits from strong fundamentals including supportive government policies, substantial private investment, and continuous technology innovation that collectively create a favorable environment for sustained expansion.

Competitive positioning within this market requires a balanced approach that emphasizes technology leadership, operational excellence, and strategic customer relationships while maintaining focus on cost competitiveness and quality consistency. Companies that successfully navigate these requirements while investing in next-generation technologies and market expansion opportunities are well-positioned to capitalize on the significant growth potential ahead.

Future success in this market will depend on the ability to adapt to evolving customer requirements, regulatory changes, and technological developments while maintaining operational efficiency and financial performance. The market’s trajectory toward higher-performance applications and geographic expansion creates substantial opportunities for companies with the vision and capabilities to execute effective growth strategies in this transformative industry segment.

What is Lithium-ion Battery Separator for Electric Vehicle Application?

Lithium-ion Battery Separator for Electric Vehicle Application refers to a critical component that prevents short circuits in batteries while allowing the flow of lithium ions. These separators are essential for enhancing the safety and efficiency of electric vehicle batteries.

What are the key players in the Asia Pacific Lithium-ion Battery Separator for Electric Vehicle Application Market?

Key players in the Asia Pacific Lithium-ion Battery Separator for Electric Vehicle Application Market include companies like Asahi Kasei, Toray Industries, and Celgard, among others. These companies are involved in the production and innovation of battery separator technologies.

What are the growth factors driving the Asia Pacific Lithium-ion Battery Separator for Electric Vehicle Application Market?

The growth of the Asia Pacific Lithium-ion Battery Separator for Electric Vehicle Application Market is driven by the increasing demand for electric vehicles, advancements in battery technology, and the push for sustainable energy solutions. Additionally, government initiatives promoting electric mobility contribute to market expansion.

What challenges does the Asia Pacific Lithium-ion Battery Separator for Electric Vehicle Application Market face?

Challenges in the Asia Pacific Lithium-ion Battery Separator for Electric Vehicle Application Market include the high cost of advanced materials, competition from alternative battery technologies, and regulatory hurdles related to manufacturing processes. These factors can impact market growth and innovation.

What opportunities exist in the Asia Pacific Lithium-ion Battery Separator for Electric Vehicle Application Market?

Opportunities in the Asia Pacific Lithium-ion Battery Separator for Electric Vehicle Application Market include the development of next-generation separators with improved thermal stability and performance. Additionally, the rising trend of electric vehicle adoption presents significant growth potential for manufacturers.

What trends are shaping the Asia Pacific Lithium-ion Battery Separator for Electric Vehicle Application Market?

Trends in the Asia Pacific Lithium-ion Battery Separator for Electric Vehicle Application Market include the increasing focus on lightweight materials, innovations in separator coatings, and the integration of smart technologies in battery management systems. These trends aim to enhance battery performance and safety.

Asia Pacific Lithium-ion Battery Separator for Electric Vehicle Application Market

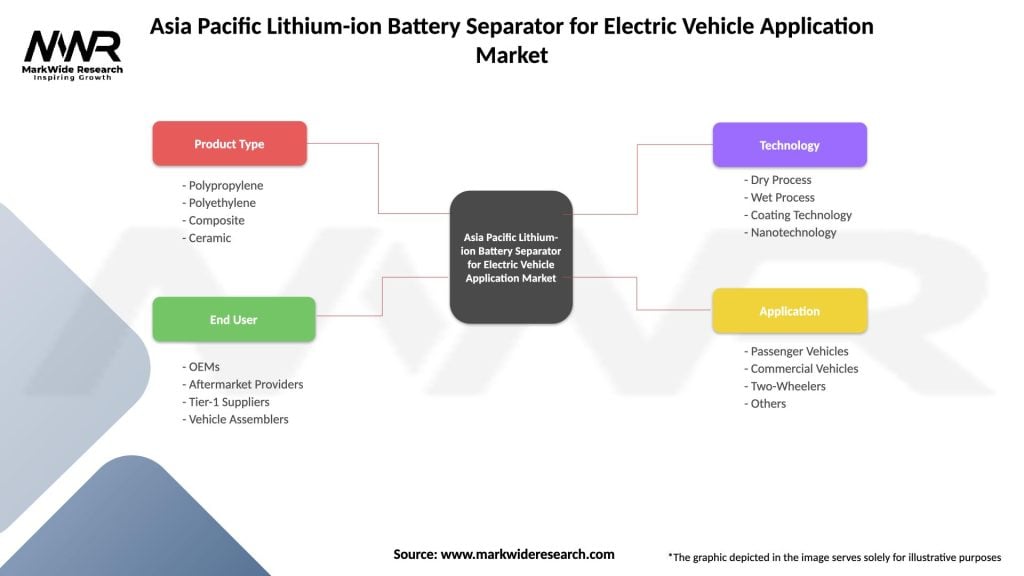

| Segmentation Details | Description |

|---|---|

| Product Type | Polypropylene, Polyethylene, Composite, Ceramic |

| End User | OEMs, Aftermarket Providers, Tier-1 Suppliers, Vehicle Assemblers |

| Technology | Dry Process, Wet Process, Coating Technology, Nanotechnology |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Lithium-ion Battery Separator for Electric Vehicle Application Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at