444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific lithium-ion battery for electric vehicle market represents one of the most dynamic and rapidly evolving sectors in the global automotive industry. This region has emerged as the epicenter of electric vehicle adoption and battery manufacturing, driven by supportive government policies, technological advancements, and increasing environmental consciousness among consumers. The market encompasses a comprehensive ecosystem of battery manufacturers, automotive companies, and technology providers working collaboratively to accelerate the transition from traditional internal combustion engines to electric powertrains.

Market dynamics in the Asia-Pacific region are characterized by intense competition, rapid technological innovation, and substantial investments in research and development. Countries like China, Japan, South Korea, and India have established themselves as key players in the lithium-ion battery manufacturing landscape, with China leading global production capacity. The region benefits from a well-established supply chain for critical raw materials, advanced manufacturing capabilities, and strong government support through subsidies, tax incentives, and regulatory frameworks favoring electric vehicle adoption.

Growth projections indicate that the market is experiencing unprecedented expansion, with analysts forecasting a robust CAGR of 18.5% over the next decade. This growth trajectory is supported by declining battery costs, improving energy density, and expanding charging infrastructure across major metropolitan areas. The region’s commitment to carbon neutrality goals and sustainable transportation solutions continues to drive investment in next-generation battery technologies and manufacturing facilities.

The Asia-Pacific lithium-ion battery for electric vehicle market refers to the comprehensive industry ecosystem encompassing the design, manufacturing, distribution, and integration of lithium-ion battery systems specifically engineered for electric vehicles within the Asia-Pacific geographical region. This market includes various battery chemistries, cell formats, and energy storage solutions that power battery electric vehicles, plug-in hybrid electric vehicles, and hybrid electric vehicles across passenger cars, commercial vehicles, and two-wheelers.

Key components of this market definition include battery cells, battery management systems, thermal management solutions, and associated hardware and software technologies. The market spans the entire value chain from raw material sourcing and processing to battery pack assembly and end-of-life recycling. It encompasses both original equipment manufacturer applications and aftermarket replacement batteries, serving diverse vehicle segments and performance requirements across different Asia-Pacific countries and territories.

Strategic analysis reveals that the Asia-Pacific lithium-ion battery for electric vehicle market is positioned at the forefront of global automotive electrification trends. The region’s dominance in battery manufacturing, combined with rapidly growing electric vehicle adoption rates, creates a compelling investment landscape for industry stakeholders. Government initiatives promoting clean energy transportation, coupled with declining battery costs and improving performance metrics, are accelerating market penetration across diverse vehicle categories.

Technological advancements in battery chemistry, energy density, and charging capabilities are reshaping competitive dynamics within the market. Leading manufacturers are investing heavily in next-generation technologies including solid-state batteries, silicon anodes, and advanced battery management systems. The integration of artificial intelligence and machine learning in battery optimization is enhancing performance, safety, and longevity characteristics.

Market consolidation trends indicate increasing collaboration between automotive manufacturers and battery suppliers through joint ventures, strategic partnerships, and vertical integration initiatives. This collaborative approach is enabling faster technology development, cost optimization, and supply chain resilience. According to MarkWide Research analysis, the market is witnessing a shift toward localized production strategies to reduce dependency on single-source suppliers and improve supply chain sustainability.

Critical market insights highlight several transformative trends shaping the Asia-Pacific lithium-ion battery landscape:

Government initiatives across Asia-Pacific countries serve as primary catalysts for market growth. China’s New Energy Vehicle mandate, Japan’s carbon neutrality commitment, and India’s FAME scheme are creating substantial demand for lithium-ion batteries. These policy frameworks include purchase subsidies, tax exemptions, and infrastructure development programs that directly support electric vehicle adoption and battery demand.

Environmental consciousness among consumers is driving preference shifts toward sustainable transportation solutions. Urban air quality concerns, particularly in major metropolitan areas, are motivating both individual consumers and fleet operators to transition to electric vehicles. This environmental awareness is supported by increasing media coverage of climate change impacts and corporate sustainability initiatives.

Technological improvements in battery performance are addressing traditional barriers to electric vehicle adoption. Enhanced energy density is extending driving ranges, while faster charging capabilities are reducing charging times to levels comparable with conventional refueling. Battery management system innovations are improving safety, reliability, and longevity, making electric vehicles more attractive to mainstream consumers.

Cost competitiveness is emerging as batteries achieve price parity with traditional powertrains. Manufacturing scale efficiencies, supply chain optimization, and technological advancements are driving down per-kWh costs. Industry projections suggest that total cost of ownership for electric vehicles will become favorable compared to internal combustion engine vehicles across most vehicle segments.

Supply chain vulnerabilities present significant challenges for market growth, particularly regarding critical raw materials like lithium, cobalt, and nickel. Price volatility and supply concentration in specific geographical regions create risks for battery manufacturers. Geopolitical tensions and trade restrictions can disrupt material flows and impact production schedules.

Infrastructure limitations continue to constrain market expansion in many Asia-Pacific regions. Insufficient charging networks, particularly in rural and suburban areas, create range anxiety among potential electric vehicle buyers. Grid capacity constraints and electricity generation from fossil fuels in some regions also limit the environmental benefits of electric vehicle adoption.

Technical challenges related to battery performance in extreme weather conditions affect market acceptance. Temperature sensitivity impacts battery efficiency and longevity, particularly in regions with harsh climates. Safety concerns regarding thermal runaway and fire risks, although rare, continue to influence consumer perceptions and regulatory requirements.

Economic factors including higher upfront costs for electric vehicles compared to conventional alternatives remain barriers for price-sensitive consumers. Despite improving cost competitiveness, the initial purchase price premium continues to limit market penetration in certain segments and regions. Economic uncertainties and reduced consumer spending power can also impact adoption rates.

Emerging applications beyond traditional passenger vehicles present substantial growth opportunities. Commercial vehicle electrification, including buses, trucks, and delivery vehicles, represents a rapidly expanding market segment. Two-wheeler electrification in countries like India and Southeast Asian nations offers significant volume potential due to large existing markets and supportive policies.

Technology innovation opportunities include development of next-generation battery chemistries, solid-state batteries, and advanced manufacturing processes. Companies investing in breakthrough technologies can achieve competitive advantages and premium pricing. Integration of artificial intelligence, IoT connectivity, and predictive analytics in battery systems creates opportunities for value-added services and recurring revenue models.

Circular economy initiatives present new business models around battery recycling, refurbishment, and second-life applications. As the installed base of electric vehicle batteries grows, opportunities for material recovery and repurposing in stationary energy storage applications will expand. Companies developing efficient recycling technologies can capture value from end-of-life batteries while supporting sustainability goals.

Regional expansion opportunities exist in emerging markets across Southeast Asia, where electric vehicle adoption is accelerating. Countries like Thailand, Indonesia, and Vietnam are implementing supportive policies and attracting manufacturing investments. Early market entry in these regions can provide competitive advantages and market share gains.

Competitive intensity within the Asia-Pacific lithium-ion battery market is driving rapid innovation and cost reduction. Leading manufacturers are engaged in technology races to develop superior battery chemistries, improve manufacturing efficiency, and achieve scale advantages. This competition benefits end consumers through better products and lower prices while challenging companies to maintain profitability.

Supply and demand dynamics are evolving rapidly as electric vehicle adoption accelerates. Battery manufacturers are expanding production capacity to meet growing demand, while automotive companies are securing long-term supply agreements to ensure availability. The market is experiencing a transition from supply constraints to more balanced supply-demand dynamics as new production facilities come online.

Value chain evolution is characterized by increasing vertical integration and strategic partnerships. Automotive manufacturers are investing in battery production capabilities, while battery companies are expanding into materials processing and recycling. These vertical integration trends are reshaping traditional supplier-customer relationships and creating more integrated value chains.

Innovation cycles are accelerating as companies compete to develop next-generation technologies. Research and development investments are increasing, with focus areas including energy density improvements, fast-charging capabilities, safety enhancements, and cost reduction. The pace of technological advancement is creating both opportunities for market leaders and risks for companies that fail to keep pace with innovation.

Comprehensive analysis of the Asia-Pacific lithium-ion battery for electric vehicle market employs multiple research methodologies to ensure accuracy and reliability. Primary research includes extensive interviews with industry executives, technology experts, and market participants across the value chain. These interviews provide insights into market trends, competitive dynamics, and future outlook from key stakeholders.

Secondary research encompasses analysis of company financial reports, government publications, industry associations, and technical literature. Patent analysis provides insights into technology development trends and competitive positioning. Market data is triangulated across multiple sources to validate findings and ensure consistency.

Quantitative analysis includes statistical modeling of market trends, growth projections, and scenario analysis. Historical data analysis identifies patterns and cyclical trends that inform future projections. Regional and segment-specific analysis provides granular insights into market dynamics across different geographical areas and application segments.

Expert validation processes ensure research findings are accurate and relevant. Industry experts review analysis and provide feedback on market insights, competitive assessments, and growth projections. This validation process enhances the credibility and reliability of research conclusions.

China dominates the Asia-Pacific lithium-ion battery market with approximately 75% market share, driven by massive manufacturing capacity and strong domestic electric vehicle demand. The country hosts major battery manufacturers and has established comprehensive supply chains for raw materials and components. Government support through subsidies and regulatory mandates continues to drive market growth, while investments in gigafactories are expanding production capacity significantly.

Japan maintains a strong position in high-performance battery technologies and premium vehicle applications. Japanese manufacturers focus on advanced chemistries and safety innovations, serving both domestic and export markets. The country’s emphasis on hybrid vehicle technology has created expertise in battery systems that translates to pure electric vehicle applications.

South Korea has emerged as a major battery manufacturing hub, with companies like LG Energy Solution and Samsung SDI establishing significant global market presence. The country benefits from advanced manufacturing capabilities and strong relationships with global automotive manufacturers. Korean companies are investing heavily in next-generation technologies and international expansion.

India represents a rapidly growing market opportunity with government initiatives promoting electric vehicle adoption and local manufacturing. The country’s large automotive market and supportive policies create substantial growth potential. Local and international companies are establishing manufacturing facilities to serve the domestic market and export to other regions.

Southeast Asian countries including Thailand, Indonesia, and Vietnam are emerging as important markets and manufacturing locations. These countries offer cost advantages, growing domestic markets, and strategic locations for serving regional demand. Government incentives and foreign investments are accelerating market development in these regions.

Market leadership in the Asia-Pacific lithium-ion battery sector is characterized by intense competition among established manufacturers and emerging players. The competitive landscape includes both pure-play battery companies and vertically integrated automotive manufacturers developing in-house capabilities.

Strategic partnerships between battery manufacturers and automotive companies are reshaping competitive dynamics. Joint ventures, technology licensing agreements, and long-term supply contracts are becoming common as companies seek to secure supply chains and share development risks.

By Battery Type:

By Vehicle Type:

By Application:

Passenger car applications dominate the lithium-ion battery market, accounting for approximately 65% of total demand. This segment benefits from increasing consumer acceptance of electric vehicles, expanding model availability, and improving charging infrastructure. Premium vehicle manufacturers are driving demand for high-performance NMC batteries, while mass-market vehicles increasingly adopt cost-effective LFP solutions.

Commercial vehicle electrification represents the fastest-growing segment with CAGR exceeding 25% in many Asia-Pacific markets. Fleet operators are motivated by total cost of ownership advantages, regulatory requirements, and corporate sustainability goals. Electric buses and delivery vehicles are leading adoption, supported by government incentives and urban emission regulations.

Two-wheeler electrification offers substantial volume potential, particularly in India where electric scooter adoption is accelerating rapidly. Government subsidies, improving battery performance, and expanding charging networks are driving growth. The segment typically uses smaller battery packs but high volumes create significant market opportunities.

Battery chemistry preferences vary by application and market segment. LFP batteries are gaining share due to cost advantages and safety characteristics, particularly in commercial vehicles and entry-level passenger cars. NMC batteries maintain dominance in premium applications requiring maximum energy density and performance capabilities.

Battery manufacturers benefit from rapidly growing demand, opportunities for scale economies, and premium pricing for advanced technologies. The market expansion enables capacity utilization improvements and justifies investments in next-generation manufacturing facilities. Strategic partnerships with automotive companies provide long-term revenue visibility and collaborative development opportunities.

Automotive manufacturers gain access to enabling technologies for electric vehicle production, opportunities for vertical integration, and competitive differentiation through battery performance. In-house battery capabilities can provide cost advantages, supply chain control, and faster innovation cycles. Partnership strategies enable risk sharing and technology access without full vertical integration.

Raw material suppliers experience increased demand for lithium, cobalt, nickel, and other critical materials. Long-term supply agreements provide revenue stability and justify capacity expansion investments. Vertical integration opportunities into battery manufacturing can capture additional value chain margins.

Technology providers benefit from demand for battery management systems, thermal management solutions, and manufacturing equipment. The rapidly evolving technology landscape creates opportunities for innovative solutions and premium pricing. Software and services opportunities are expanding as batteries become more connected and intelligent.

Investors and stakeholders gain exposure to high-growth market with strong long-term fundamentals. The transition to electric mobility represents a multi-decade investment theme supported by regulatory trends and technological advancement. Early-stage investments in breakthrough technologies offer potential for significant returns.

Strengths:

Weaknesses:

Opportunities:

Threats:

Solid-state battery development represents a transformative technology trend with potential to revolutionize electric vehicle performance. Leading manufacturers are investing heavily in solid-state technology promising higher energy density, faster charging, and improved safety characteristics. Commercial deployment is expected within the next five years, initially in premium applications.

Battery-as-a-Service (BaaS) business models are gaining traction, particularly in commercial vehicle applications. This approach separates battery ownership from vehicle ownership, reducing upfront costs and providing flexibility for fleet operators. Service providers manage battery performance, maintenance, and replacement, creating recurring revenue opportunities.

Circular economy initiatives are becoming increasingly important as the installed base of electric vehicle batteries grows. Companies are developing capabilities for battery recycling, refurbishment, and second-life applications in stationary energy storage. These initiatives support sustainability goals while creating new revenue streams from end-of-life batteries.

Artificial intelligence integration is enhancing battery performance through predictive analytics, optimal charging algorithms, and preventive maintenance. AI-powered battery management systems can extend battery life, improve safety, and optimize performance based on usage patterns and environmental conditions.

Gigafactory proliferation continues across the Asia-Pacific region as manufacturers scale production to meet growing demand. These large-scale facilities achieve economies of scale, reduce per-unit costs, and enable automation of manufacturing processes. Strategic location selection considers proximity to automotive manufacturers and raw material sources.

Strategic partnerships between automotive manufacturers and battery companies are accelerating, with joint ventures and long-term supply agreements becoming common. These partnerships enable risk sharing, technology development collaboration, and supply chain security. Recent examples include major automotive companies investing in battery manufacturing facilities and technology development programs.

Manufacturing capacity expansion is occurring rapidly across the region, with multiple gigafactory projects under construction or planning phases. Companies are investing billions in new production facilities to meet projected demand growth. These investments include both greenfield facilities and expansion of existing manufacturing sites.

Technology breakthroughs in battery chemistry and manufacturing processes are being announced regularly. Recent developments include improvements in silicon anode technology, advanced electrolyte formulations, and manufacturing process innovations. These breakthroughs promise better performance, lower costs, and enhanced safety characteristics.

Regulatory developments continue to shape market dynamics, with governments implementing new policies supporting electric vehicle adoption and battery manufacturing. Recent policy initiatives include updated subsidy programs, emission regulations, and local content requirements for battery manufacturing.

Supply chain investments are addressing raw material security concerns, with companies investing in mining operations, processing facilities, and recycling capabilities. These vertical integration initiatives aim to reduce dependency on external suppliers and ensure stable material supplies for battery production.

Investment priorities should focus on companies with strong technology capabilities, established customer relationships, and scalable manufacturing operations. MarkWide Research analysis suggests that companies investing in next-generation technologies while maintaining cost competitiveness are best positioned for long-term success. Vertical integration strategies can provide competitive advantages but require careful execution and substantial capital investments.

Risk management strategies should address supply chain vulnerabilities, technology obsolescence risks, and market volatility. Companies should diversify supplier bases, invest in recycling capabilities, and maintain flexible manufacturing operations. Long-term supply agreements can provide stability but should be balanced with flexibility to adapt to changing market conditions.

Market entry strategies for new participants should consider partnership approaches rather than standalone development. The capital requirements and technology complexity favor collaborative approaches with established players. Focus on specialized applications or emerging markets can provide entry opportunities without direct competition with established leaders.

Technology development investments should prioritize safety, performance, and cost reduction simultaneously. Companies should maintain balanced portfolios of incremental improvements and breakthrough technologies. Collaboration with research institutions and participation in industry consortiums can accelerate technology development while sharing costs and risks.

Long-term growth prospects for the Asia-Pacific lithium-ion battery market remain exceptionally strong, driven by accelerating electric vehicle adoption and supportive policy environments. Industry projections indicate sustained growth rates exceeding 15% annually through the next decade, supported by declining costs and improving performance characteristics. The market is expected to achieve mainstream adoption across all vehicle segments within the next five to seven years.

Technology evolution will continue reshaping competitive dynamics, with solid-state batteries expected to begin commercial deployment by 2028-2030. Advanced manufacturing processes including dry electrode coating and structural battery packs will improve cost competitiveness and performance. Integration of artificial intelligence and machine learning will enhance battery optimization and predictive maintenance capabilities.

Market consolidation is likely to accelerate as scale advantages become increasingly important. Smaller manufacturers may struggle to compete with large-scale producers, leading to merger and acquisition activity. Vertical integration trends will continue as automotive manufacturers seek greater control over critical battery supply chains.

Sustainability initiatives will become increasingly important, with circular economy principles driving investment in recycling and second-life applications. Regulatory requirements for battery recycling and responsible sourcing will influence supply chain strategies. Companies demonstrating strong environmental, social, and governance practices will gain competitive advantages in customer selection and investor support.

Regional dynamics will evolve as emerging markets in Southeast Asia and India accelerate electric vehicle adoption. Manufacturing capacity will continue expanding to serve both domestic and export markets. Trade policies and geopolitical considerations will influence supply chain strategies and market access decisions.

The Asia-Pacific lithium-ion battery for electric vehicle market represents one of the most compelling growth opportunities in the global automotive industry. The region’s combination of manufacturing leadership, supportive government policies, and rapidly growing domestic demand creates a favorable environment for sustained market expansion. Companies positioned to capitalize on this growth through technology innovation, strategic partnerships, and operational excellence are likely to achieve significant success.

Market fundamentals remain exceptionally strong, with multiple drivers supporting long-term growth including environmental regulations, declining costs, and improving performance characteristics. The transition from early adoption to mainstream market penetration is accelerating, creating substantial opportunities for industry participants across the value chain. However, success will require continuous innovation, strategic positioning, and effective risk management in a rapidly evolving competitive landscape.

Strategic priorities for market participants should focus on technology leadership, supply chain security, and customer relationship development. The companies that successfully navigate the challenges of scaling production, managing costs, and delivering superior products will emerge as long-term winners in this transformative market. As the electric vehicle revolution continues to unfold across Asia-Pacific, the lithium-ion battery market will remain at the center of this historic transformation in global transportation.

What is Lithium-ion Battery for Electric Vehicle?

Lithium-ion batteries for electric vehicles are rechargeable batteries that use lithium ions as a key component of their electrochemistry. They are widely used in electric vehicles due to their high energy density, efficiency, and longevity compared to other battery types.

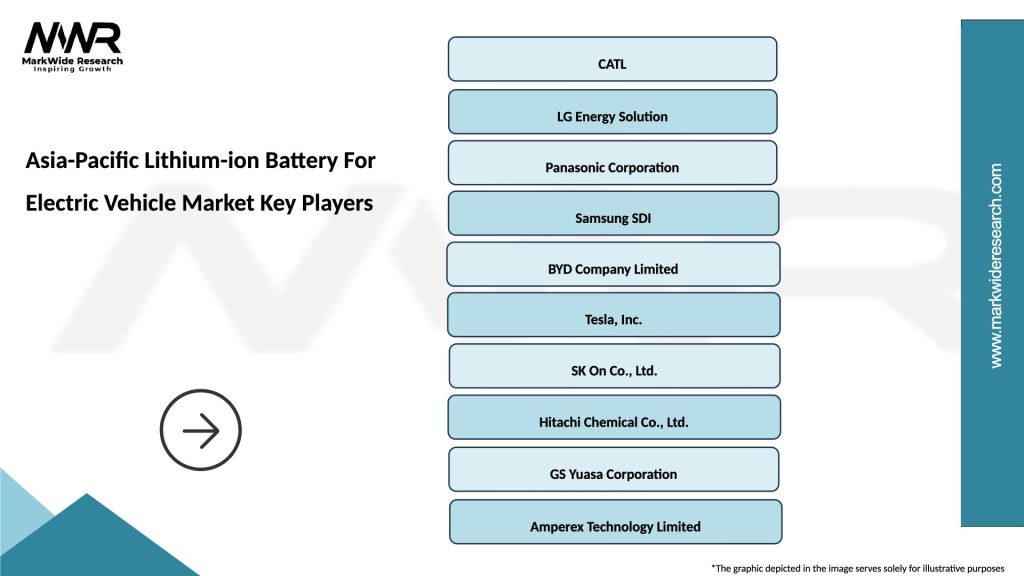

What are the key players in the Asia-Pacific Lithium-ion Battery For Electric Vehicle Market?

Key players in the Asia-Pacific Lithium-ion Battery for Electric Vehicle market include Panasonic, LG Chem, and CATL, which are known for their advanced battery technologies and significant market share in the electric vehicle sector, among others.

What are the growth factors driving the Asia-Pacific Lithium-ion Battery For Electric Vehicle Market?

The growth of the Asia-Pacific Lithium-ion Battery for Electric Vehicle market is driven by increasing demand for electric vehicles, advancements in battery technology, and supportive government policies promoting clean energy and sustainable transportation.

What challenges does the Asia-Pacific Lithium-ion Battery For Electric Vehicle Market face?

Challenges in the Asia-Pacific Lithium-ion Battery for Electric Vehicle market include the high cost of raw materials, supply chain disruptions, and environmental concerns related to battery disposal and recycling.

What opportunities exist in the Asia-Pacific Lithium-ion Battery For Electric Vehicle Market?

Opportunities in the Asia-Pacific Lithium-ion Battery for Electric Vehicle market include the development of solid-state batteries, increased investment in charging infrastructure, and the growing trend of electric vehicle adoption among consumers and businesses.

What trends are shaping the Asia-Pacific Lithium-ion Battery For Electric Vehicle Market?

Trends shaping the Asia-Pacific Lithium-ion Battery for Electric Vehicle market include the shift towards higher capacity batteries, innovations in battery management systems, and the integration of renewable energy sources for charging electric vehicles.

Asia-Pacific Lithium-ion Battery For Electric Vehicle Market

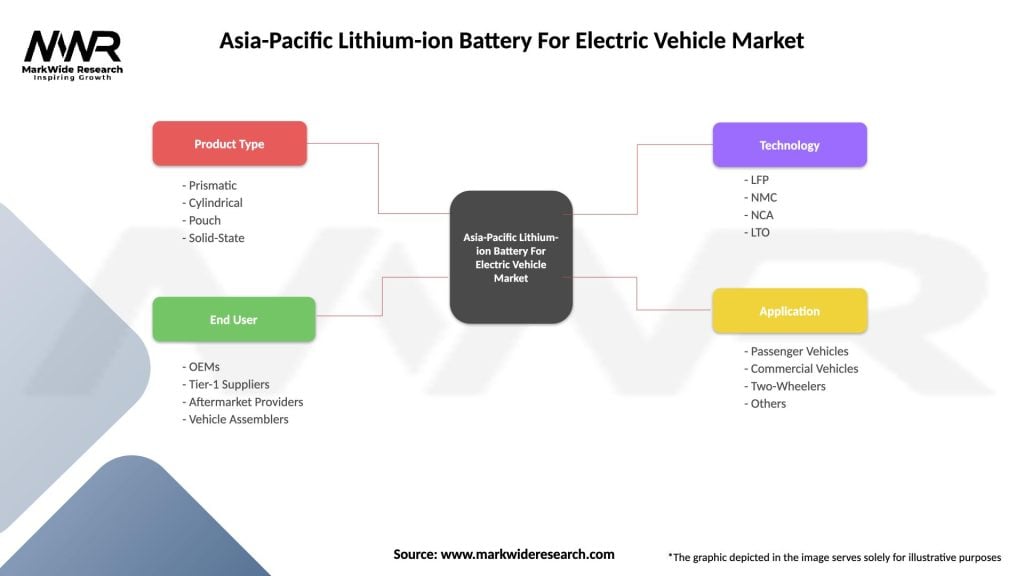

| Segmentation Details | Description |

|---|---|

| Product Type | Prismatic, Cylindrical, Pouch, Solid-State |

| End User | OEMs, Tier-1 Suppliers, Aftermarket Providers, Vehicle Assemblers |

| Technology | LFP, NMC, NCA, LTO |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Lithium-ion Battery For Electric Vehicle Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at