444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific life and non-life insurance market represents one of the most dynamic and rapidly expanding insurance sectors globally, driven by increasing economic prosperity, demographic shifts, and evolving consumer awareness about financial protection. This comprehensive market encompasses diverse insurance products ranging from traditional life insurance policies to sophisticated non-life coverage including property, casualty, health, and specialty insurance lines across multiple countries and territories.

Market dynamics in the Asia Pacific region are characterized by significant heterogeneity, with developed markets like Japan and Australia demonstrating mature insurance penetration rates exceeding 10% of GDP, while emerging economies such as India, Indonesia, and Vietnam present substantial growth opportunities with penetration rates below 4% of GDP. The region’s insurance landscape is experiencing transformative changes driven by digitalization, regulatory reforms, and shifting consumer preferences toward comprehensive coverage solutions.

Regional growth patterns indicate robust expansion across both life and non-life segments, with the overall market demonstrating resilience despite periodic economic volatility. Key growth drivers include rising disposable incomes, urbanization trends, increasing life expectancy, and growing awareness of insurance benefits among middle-class populations. The market is projected to maintain a compound annual growth rate of 8.2% through the forecast period, significantly outpacing global insurance market growth rates.

Technology adoption is revolutionizing traditional insurance operations, with insurtech innovations, artificial intelligence, and digital distribution channels transforming customer engagement and operational efficiency. Mobile-first strategies and data analytics are enabling insurers to develop personalized products and streamline claims processing, particularly appealing to tech-savvy younger demographics across the region.

The Asia Pacific life and non-life insurance market refers to the comprehensive ecosystem of insurance products, services, and companies operating across the Asia Pacific region, encompassing both life insurance coverage that provides financial protection against mortality risks and non-life insurance products that protect against property, liability, and other general insurance risks.

Life insurance components include term life policies, whole life insurance, universal life products, endowment policies, annuities, and unit-linked insurance plans designed to provide financial security for beneficiaries and policyholders. These products serve multiple purposes including income replacement, estate planning, retirement savings, and wealth transfer strategies tailored to diverse cultural and economic contexts across Asian markets.

Non-life insurance segments encompass property insurance covering residential and commercial buildings, motor insurance for vehicles, health insurance providing medical coverage, travel insurance, marine insurance for shipping and cargo, professional indemnity coverage, and specialized commercial lines addressing unique business risks. These products protect individuals and businesses against financial losses from accidents, natural disasters, theft, liability claims, and other unforeseen events.

Market participants include domestic insurance companies, multinational insurers, reinsurers, insurance brokers, agents, bancassurance partners, and emerging insurtech companies leveraging technology to deliver innovative insurance solutions. The ecosystem also encompasses regulatory bodies, rating agencies, and supporting service providers that facilitate market operations and consumer protection.

Strategic market positioning reveals the Asia Pacific insurance market as a critical growth engine for the global insurance industry, characterized by diverse market maturity levels, regulatory environments, and consumer preferences across different countries. The region’s insurance sector benefits from favorable demographic trends, economic development, and increasing financial literacy that drive sustained demand for both life and non-life insurance products.

Key performance indicators demonstrate robust market fundamentals, with insurance penetration rates showing steady improvement across emerging markets while developed markets focus on product innovation and digital transformation. The life insurance segment maintains dominance in terms of premium volume, accounting for approximately 68% of total insurance premiums across the region, while non-life insurance exhibits faster growth rates driven by economic expansion and regulatory mandates.

Competitive dynamics feature a mix of established domestic players with strong local market knowledge and international insurers bringing global expertise and capital resources. Market consolidation trends are evident in mature markets, while emerging economies present opportunities for new entrants and partnerships. Digital disruption is reshaping competitive advantages, with technology-enabled insurers gaining market share through superior customer experience and operational efficiency.

Future growth prospects remain highly favorable, supported by continuing urbanization, rising middle-class populations, infrastructure development, and evolving risk awareness. Climate change concerns are driving demand for catastrophe insurance, while aging populations create opportunities for retirement and health insurance products. Regulatory harmonization efforts and cross-border insurance initiatives are expected to facilitate market integration and expansion opportunities.

Demographic transformation across the Asia Pacific region is fundamentally reshaping insurance demand patterns, with aging populations in developed markets driving annuity and health insurance growth while younger demographics in emerging economies fuel life insurance adoption. The following key insights highlight critical market dynamics:

Market segmentation trends reveal increasing sophistication in product offerings, with insurers developing specialized solutions for specific demographic groups, industries, and risk profiles. Customization capabilities enabled by data analytics and artificial intelligence are allowing insurers to offer personalized pricing and coverage options that better align with individual customer needs and risk characteristics.

Economic prosperity growth across the Asia Pacific region serves as the primary catalyst for insurance market expansion, with rising GDP per capita levels directly correlating with increased insurance penetration rates. Growing disposable incomes enable consumers to allocate resources toward financial protection products, while business expansion drives commercial insurance demand across various industry sectors.

Demographic shifts are creating substantial insurance opportunities, particularly the emergence of large middle-class populations in countries like China, India, and Southeast Asian nations. These demographic groups demonstrate higher propensity for insurance purchases, driven by increased financial literacy, asset accumulation, and desire for family financial security. Additionally, aging populations in developed markets are generating significant demand for retirement planning and healthcare coverage solutions.

Urbanization trends contribute significantly to insurance market growth, as urban populations typically exhibit higher insurance awareness and purchasing power compared to rural communities. Urban environments also present greater exposure to risks requiring insurance protection, including property damage, liability claims, and health-related expenses, thereby driving comprehensive coverage adoption.

Regulatory support from government initiatives promoting insurance sector development, financial inclusion, and consumer protection is facilitating market expansion. Mandatory insurance requirements for motor vehicles, professional services, and certain business activities are creating stable demand foundations, while tax incentives for life insurance and retirement savings are encouraging voluntary coverage adoption.

Technology advancement is revolutionizing insurance accessibility and affordability through digital platforms, automated underwriting, and streamlined claims processing. These innovations are reducing operational costs, improving customer experience, and enabling insurers to serve previously underserved market segments effectively.

Economic volatility and periodic financial market instability can significantly impact insurance demand, particularly for discretionary life insurance products and investment-linked policies. Currency fluctuations, inflation pressures, and economic downturns may reduce consumer spending on insurance premiums, while also affecting insurer investment returns and capital adequacy ratios.

Regulatory complexity across different Asia Pacific markets creates operational challenges for insurers seeking regional expansion, with varying licensing requirements, capital adequacy standards, and product approval processes increasing compliance costs and market entry barriers. Regulatory uncertainty and frequent policy changes can also impact long-term business planning and investment decisions.

Cultural barriers and traditional attitudes toward insurance in certain markets may limit adoption rates, particularly where cultural beliefs discourage discussing mortality or where informal family support systems are perceived as adequate alternatives to formal insurance coverage. Low financial literacy levels in some regions also constrain market development potential.

Infrastructure limitations in emerging markets, including inadequate telecommunications networks, limited banking infrastructure, and insufficient distribution channels, can restrict insurance accessibility and market penetration. These challenges are particularly pronounced in rural areas where traditional distribution models may be economically unviable.

Competitive pressures from both traditional insurers and new market entrants are compressing profit margins and requiring significant investments in technology, distribution, and product development. Price competition in commoditized insurance lines may undermine profitability and limit resources available for market expansion initiatives.

Digital transformation opportunities present substantial potential for insurers to enhance operational efficiency, expand market reach, and develop innovative products. Artificial intelligence, machine learning, and big data analytics enable personalized underwriting, fraud detection, and customer service improvements that can differentiate insurers in competitive markets while reducing operational costs.

Underinsured market segments across the region offer significant growth potential, particularly in emerging economies where insurance penetration rates remain well below global averages. Small and medium enterprises, rural populations, and younger demographics represent substantial untapped markets that can be accessed through innovative distribution channels and affordable product offerings.

Climate change adaptation creates opportunities for insurers to develop specialized products addressing environmental risks, including catastrophe insurance, parametric coverage, and green insurance solutions. Growing awareness of climate-related risks is driving demand for comprehensive protection against natural disasters, extreme weather events, and environmental liabilities.

Healthcare sector expansion presents substantial opportunities for health insurance growth, driven by aging populations, rising healthcare costs, and increasing health consciousness. Partnerships with healthcare providers, telemedicine integration, and preventive care programs can create value-added insurance solutions that address evolving consumer needs.

Cross-border integration initiatives and regional trade agreements are facilitating insurance market harmonization and creating opportunities for insurers to expand operations across multiple countries. Standardized regulatory frameworks and mutual recognition agreements can reduce market entry barriers and enable economies of scale in product development and operations.

Supply-side dynamics in the Asia Pacific insurance market are characterized by increasing competition among domestic and international insurers, driving innovation in product offerings, distribution channels, and customer service capabilities. Insurers are investing heavily in digital transformation initiatives to improve operational efficiency and customer engagement, with technology spending representing approximately 12% of total operational expenses for leading market participants.

Demand-side factors are influenced by evolving consumer preferences toward comprehensive coverage, digital convenience, and personalized insurance solutions. According to MarkWide Research analysis, consumer willingness to purchase insurance online has increased by 35% over the past three years, reflecting growing comfort with digital financial services and expectation for seamless omnichannel experiences.

Market concentration patterns vary significantly across different countries, with some markets dominated by a few large insurers while others feature fragmented competitive landscapes with numerous smaller players. Consolidation trends are evident in mature markets, while emerging economies continue to attract new entrants seeking to capitalize on growth opportunities.

Pricing dynamics reflect the balance between competitive pressures and risk-based underwriting, with insurers leveraging advanced analytics and alternative data sources to improve pricing accuracy. Catastrophe modeling and climate risk assessment are becoming increasingly sophisticated, enabling more precise risk evaluation and appropriate premium setting for property and casualty insurance lines.

Distribution evolution is transforming traditional agency models through digital channels, bancassurance partnerships, and direct-to-consumer platforms. Multi-channel distribution strategies are becoming essential for market success, with insurers developing integrated approaches that combine traditional and digital touchpoints to serve diverse customer preferences effectively.

Comprehensive data collection methodologies employed in analyzing the Asia Pacific insurance market incorporate both primary and secondary research approaches to ensure accuracy and reliability of market insights. Primary research involves structured interviews with industry executives, regulatory officials, distribution partners, and consumers across major markets to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research sources include regulatory filings, company annual reports, industry publications, government statistics, and academic research papers that provide quantitative data and qualitative insights into market performance, competitive dynamics, and regulatory developments. Cross-referencing multiple sources ensures data validation and reduces potential bias in market analysis.

Market sizing methodologies utilize bottom-up and top-down approaches to validate market estimates, incorporating premium volume data, penetration rates, demographic analysis, and economic indicators. Statistical modeling techniques account for market variations across different countries and insurance segments to provide accurate regional and segment-specific projections.

Competitive analysis frameworks evaluate market participants based on multiple criteria including market share, product portfolio breadth, distribution capabilities, financial strength, and innovation capacity. SWOT analysis and Porter’s Five Forces models provide structured assessment of competitive positioning and market attractiveness across different segments and geographies.

Trend analysis techniques incorporate time-series analysis, regression modeling, and scenario planning to identify emerging market patterns and project future developments. Expert opinion synthesis and Delphi method applications ensure comprehensive consideration of qualitative factors that may influence market evolution beyond quantitative indicators.

China market leadership positions the country as the largest insurance market in the Asia Pacific region, accounting for approximately 42% of total regional premium volume. The Chinese market demonstrates strong growth momentum driven by government policy support, rising middle-class wealth, and increasing insurance awareness. Digital innovation and fintech integration are particularly advanced, with mobile insurance platforms achieving significant market penetration.

Japan market maturity represents the most developed insurance market in the region, characterized by high penetration rates, sophisticated product offerings, and established distribution networks. Despite demographic challenges from an aging population, the market maintains stability through product innovation focusing on retirement planning, long-term care, and health insurance solutions.

India growth potential presents exceptional opportunities with low insurance penetration rates below 4% of GDP and a large, young population driving future demand. Regulatory reforms, digital payment infrastructure development, and increasing financial inclusion initiatives are facilitating rapid market expansion across both life and non-life segments.

Southeast Asian markets including Indonesia, Thailand, Malaysia, Philippines, and Vietnam demonstrate diverse growth patterns influenced by economic development levels, regulatory environments, and cultural factors. These markets collectively represent significant growth potential with improving economic conditions and increasing insurance awareness among expanding middle-class populations.

Australia and New Zealand constitute mature markets with well-established regulatory frameworks, sophisticated product offerings, and high consumer awareness. These markets focus on product innovation, digital transformation, and addressing evolving risk profiles including climate change impacts and cyber security threats.

Market leadership dynamics in the Asia Pacific insurance sector feature a diverse mix of domestic champions and international players, each leveraging distinct competitive advantages to maintain market position. The competitive landscape is characterized by ongoing consolidation in mature markets and new entrant activity in emerging economies.

Competitive strategies focus on digital transformation, product innovation, distribution expansion, and strategic partnerships to enhance market position. Leading insurers are investing significantly in technology infrastructure, data analytics capabilities, and customer experience improvements to differentiate their offerings in increasingly competitive markets.

Market entry approaches for international insurers typically involve joint ventures, acquisitions, or strategic partnerships with local players to navigate regulatory requirements and leverage local market knowledge. Successful market entry requires understanding of cultural preferences, regulatory compliance, and effective distribution channel development.

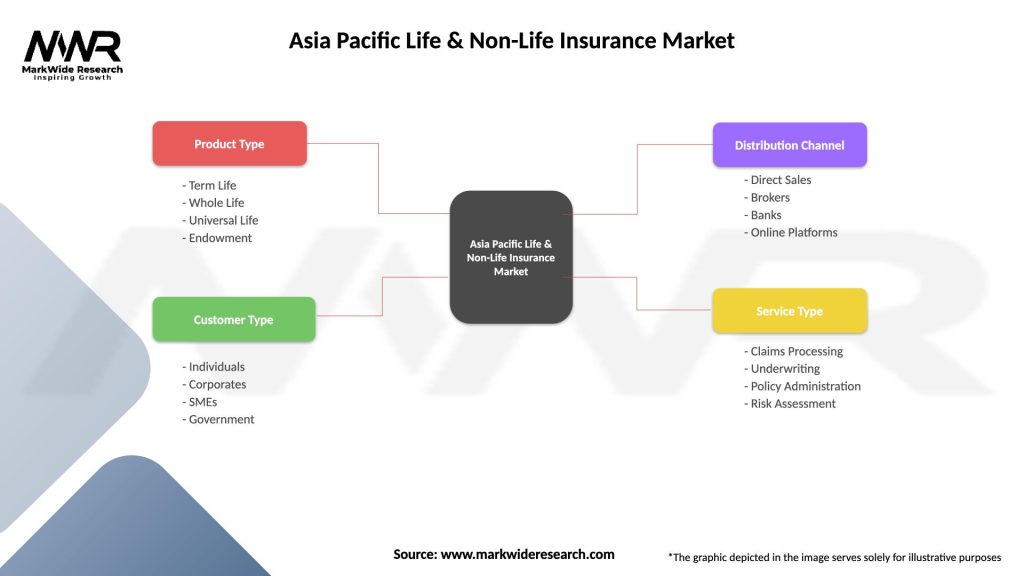

Product segmentation reveals distinct growth patterns and market dynamics across different insurance categories, with life insurance maintaining the largest market share while non-life segments demonstrate faster growth rates driven by economic expansion and regulatory requirements.

By Product Type:

By Distribution Channel:

By Customer Segment:

Life Insurance Dominance: The life insurance segment continues to represent the largest portion of the Asia Pacific insurance market, driven by cultural emphasis on family financial security, government tax incentives, and growing wealth accumulation needs. Traditional whole life and endowment policies remain popular in many markets, while unit-linked insurance plans are gaining traction among younger, investment-oriented consumers.

Health Insurance Acceleration: Health insurance is experiencing the fastest growth among all insurance categories, with market expansion rates exceeding 15% annually in several key markets. Rising healthcare costs, aging populations, and increased health awareness following the pandemic are driving robust demand for comprehensive medical coverage and critical illness protection.

Motor Insurance Stability: Motor insurance provides stable premium income for non-life insurers, supported by mandatory insurance requirements and growing vehicle ownership across the region. Telematics-based insurance and usage-based pricing models are emerging trends that enable more accurate risk assessment and personalized premium pricing.

Property Insurance Growth: Property insurance demand is increasing with urbanization, infrastructure development, and growing awareness of natural disaster risks. Climate change concerns are driving demand for comprehensive catastrophe coverage, while commercial property insurance benefits from business expansion and foreign investment activities.

Specialty Lines Development: Emerging specialty insurance lines including cyber liability, directors and officers coverage, and environmental liability are gaining importance as businesses face evolving risk landscapes. Professional indemnity insurance is expanding with the growth of service industries and increasing litigation trends.

Insurance Companies benefit from substantial growth opportunities in underserved markets, enabling revenue expansion and market share gains through innovative product development and digital distribution strategies. Access to large, growing populations with increasing disposable incomes provides sustainable long-term growth potential while diversification across multiple markets reduces concentration risk.

Consumers gain access to comprehensive financial protection products that safeguard against various risks while providing investment and savings opportunities. Improved product accessibility through digital channels, competitive pricing from increased competition, and enhanced customer service capabilities deliver superior value propositions for insurance purchasers.

Regulatory Authorities achieve improved financial stability, consumer protection, and economic development objectives through well-functioning insurance markets that provide risk transfer mechanisms and long-term investment capital. Insurance market development supports broader financial sector stability and contributes to economic resilience against various shocks.

Distribution Partners including agents, brokers, and bancassurance partners benefit from expanding product portfolios, improved commission structures, and enhanced technology support that enables more effective customer service and business growth. Digital tools and training programs improve distribution efficiency and customer satisfaction levels.

Reinsurers access growing primary insurance markets that require capacity support for catastrophe risks, specialty lines, and emerging coverage areas. Regional market development creates opportunities for local reinsurance capacity building and risk sharing arrangements that support sustainable market growth.

Technology Providers find significant opportunities to support insurance industry digital transformation through core system modernization, data analytics platforms, and customer engagement solutions. Insurtech innovation drives efficiency improvements and enables new business models that benefit all market participants.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-First Strategies are transforming insurance operations across the Asia Pacific region, with insurers investing heavily in mobile applications, artificial intelligence, and automated underwriting systems. MWR data indicates that digital insurance sales are growing at rates exceeding 30% annually in major markets, driven by consumer preference for convenient, self-service insurance purchasing and claims experiences.

Parametric Insurance Innovation is gaining momentum as insurers develop index-based products that provide rapid payouts based on objective triggers such as weather data, earthquake magnitude, or economic indicators. These products address coverage gaps in traditional insurance and provide more efficient risk transfer mechanisms for catastrophic events and emerging risks.

Ecosystem Integration trends show insurers partnering with technology companies, healthcare providers, automotive manufacturers, and e-commerce platforms to embed insurance into broader service offerings. These partnerships create new distribution channels and enable insurers to reach customers at the point of need with relevant, contextual insurance solutions.

Sustainability Focus is driving development of green insurance products, environmental risk assessment capabilities, and sustainable investment strategies. Insurers are incorporating environmental, social, and governance factors into underwriting decisions while developing products that support climate change adaptation and mitigation efforts.

Personalization Advancement through big data analytics and machine learning enables insurers to offer customized products, pricing, and services based on individual risk profiles and preferences. Usage-based insurance, behavioral analytics, and real-time risk monitoring are creating more accurate and fair insurance pricing models.

Regulatory Technology Adoption is streamlining compliance processes and enabling more efficient regulatory reporting through automated systems and standardized data formats. RegTech solutions are reducing compliance costs while improving regulatory oversight and consumer protection capabilities.

Strategic Acquisitions and partnerships are reshaping the competitive landscape, with major insurers acquiring insurtech companies, expanding into new markets through joint ventures, and forming strategic alliances to enhance digital capabilities. These transactions are accelerating innovation adoption and market expansion across the region.

Regulatory Modernization initiatives across multiple countries are updating insurance laws, capital requirements, and consumer protection standards to align with international best practices. Sandbox regulations are enabling insurtech innovation while maintaining appropriate oversight and consumer safeguards.

Product Launch Activity is intensifying with insurers introducing innovative coverage solutions addressing emerging risks such as cyber security, pandemic protection, and climate change impacts. Hybrid products combining insurance with investment, savings, and wellness services are gaining market acceptance among diverse consumer segments.

Technology Infrastructure Investment by insurers is reaching unprecedented levels, with core system modernization, cloud migration, and data analytics platform development receiving priority funding. These investments are essential for supporting digital transformation and improving operational efficiency in competitive markets.

Distribution Channel Evolution continues with expansion of bancassurance partnerships, development of digital-only insurance brands, and integration of insurance into e-commerce and mobility platforms. Multi-channel strategies are becoming essential for reaching diverse customer segments effectively.

Talent Development Programs are addressing skill gaps in digital technology, data analytics, and customer experience management through comprehensive training initiatives, university partnerships, and recruitment of technology professionals from other industries.

Digital Transformation Acceleration should be the top priority for insurers seeking sustainable competitive advantage in evolving markets. Investment in mobile-first platforms, artificial intelligence capabilities, and automated processes will enable superior customer experience while reducing operational costs. Insurers should develop comprehensive digital strategies that integrate all customer touchpoints and internal operations.

Market Segmentation Focus requires insurers to develop specialized products and services for distinct customer segments rather than pursuing one-size-fits-all approaches. Understanding unique needs of different demographic groups, income levels, and geographic regions will enable more effective product development and marketing strategies that drive higher conversion rates and customer satisfaction.

Partnership Strategy Development should emphasize collaboration with technology companies, healthcare providers, and other ecosystem participants to create integrated value propositions. Strategic partnerships can accelerate innovation, expand distribution reach, and provide access to new customer segments while sharing development costs and risks.

Risk Management Enhancement must incorporate emerging risks including cyber threats, climate change impacts, and pandemic-related exposures into comprehensive risk assessment and pricing models. Advanced analytics, catastrophe modeling, and scenario planning capabilities are essential for maintaining profitability while providing adequate coverage for evolving risk landscapes.

Regulatory Compliance Preparation requires proactive engagement with regulatory developments and investment in compliance infrastructure that can adapt to changing requirements across multiple markets. Insurers should participate in regulatory consultations and maintain flexible systems that can accommodate new regulations efficiently.

Talent Acquisition Strategy should focus on attracting professionals with digital technology, data science, and customer experience expertise while developing existing workforce capabilities through comprehensive training programs. Building internal innovation capabilities is essential for long-term competitive success.

Growth trajectory projections for the Asia Pacific insurance market remain highly favorable, with sustained expansion expected across both life and non-life segments driven by continuing economic development, demographic trends, and increasing insurance awareness. The market is positioned to maintain growth rates significantly above global averages, with emerging economies contributing disproportionately to overall expansion.

Technology integration will fundamentally transform insurance operations over the next decade, with artificial intelligence, blockchain, and Internet of Things technologies enabling new business models, improved risk assessment, and enhanced customer experiences. Insurers that successfully leverage these technologies will gain substantial competitive advantages in efficiency, customer satisfaction, and market reach.

Market consolidation trends are expected to continue in mature markets while emerging economies may see new entrant activity and market fragmentation before eventual consolidation. Cross-border mergers and acquisitions will likely increase as regulatory barriers diminish and insurers seek regional scale advantages.

Product evolution will focus on comprehensive solutions that integrate insurance with financial services, healthcare, and lifestyle management. Parametric insurance, usage-based pricing, and real-time risk monitoring will become standard features as technology capabilities advance and consumer expectations evolve.

Regulatory harmonization efforts across the region will facilitate market integration and enable more efficient cross-border operations. Standardized capital requirements, mutual recognition agreements, and coordinated supervision will reduce regulatory complexity and compliance costs for regional insurers.

Sustainability integration will become increasingly important as climate change impacts intensify and environmental awareness grows. Insurers will need to develop sophisticated climate risk models, sustainable investment strategies, and green insurance products to meet evolving stakeholder expectations and regulatory requirements.

The Asia Pacific life and non-life insurance market represents one of the most dynamic and promising sectors in the global insurance industry, characterized by substantial growth potential, technological innovation, and evolving consumer needs. With diverse market conditions across different countries and insurance segments, the region offers exceptional opportunities for insurers willing to adapt their strategies to local requirements while leveraging regional scale advantages.

Market fundamentals remain strong, supported by favorable demographic trends, economic growth, and increasing insurance awareness across emerging and developed markets. The combination of large underserved populations, rising disposable incomes, and digital technology adoption creates an ideal environment for sustained insurance market expansion over the coming decades.

Success factors for market participants will increasingly depend on digital transformation capabilities, customer-centric product development, and strategic partnerships that enable comprehensive value propositions. Insurers that can effectively combine traditional insurance expertise with modern technology and distribution capabilities will be best positioned to capture growth opportunities while managing evolving risks.

The future of the Asia Pacific insurance market will be shaped by continued innovation, regulatory evolution, and changing consumer expectations that demand more personalized, accessible, and comprehensive insurance solutions. Market participants who embrace these changes and invest appropriately in capabilities development will find substantial rewards in this dynamic and expanding market environment.

What is Life & Non-Life Insurance?

Life & Non-Life Insurance refers to the two main categories of insurance products. Life insurance provides financial protection to beneficiaries upon the policyholder’s death, while non-life insurance covers various risks such as property damage, liability, and health-related expenses.

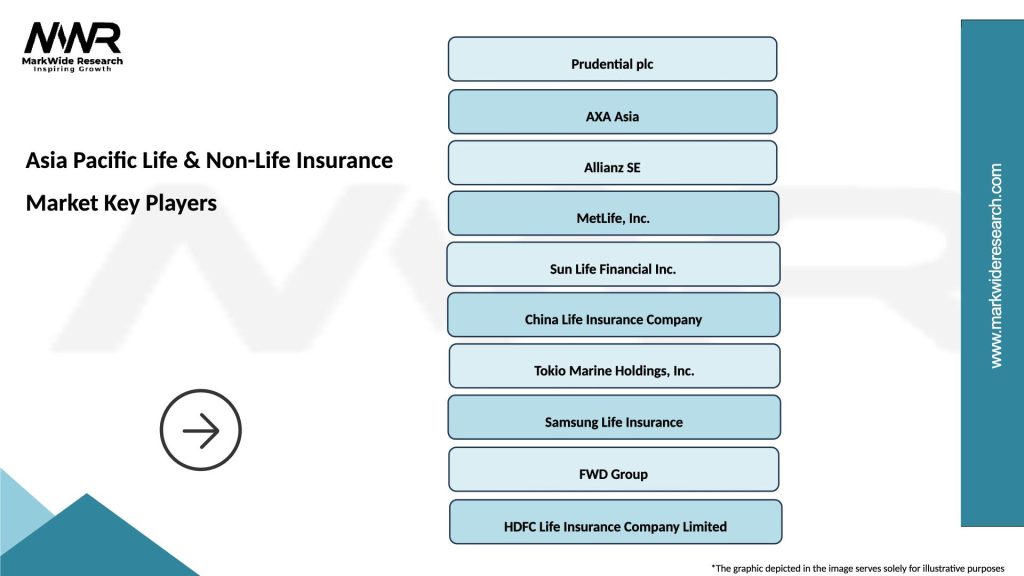

What are the key players in the Asia Pacific Life & Non-Life Insurance Market?

Key players in the Asia Pacific Life & Non-Life Insurance Market include AIA Group, Prudential, Allianz, and Manulife, among others. These companies offer a range of insurance products tailored to meet the diverse needs of consumers in the region.

What are the growth factors driving the Asia Pacific Life & Non-Life Insurance Market?

The growth of the Asia Pacific Life & Non-Life Insurance Market is driven by increasing awareness of insurance products, rising disposable incomes, and a growing middle class. Additionally, advancements in technology are facilitating easier access to insurance services.

What challenges does the Asia Pacific Life & Non-Life Insurance Market face?

The Asia Pacific Life & Non-Life Insurance Market faces challenges such as regulatory compliance, intense competition among insurers, and the need for digital transformation. These factors can impact profitability and market growth.

What opportunities exist in the Asia Pacific Life & Non-Life Insurance Market?

Opportunities in the Asia Pacific Life & Non-Life Insurance Market include the expansion of digital insurance platforms, the introduction of innovative products, and the increasing demand for personalized insurance solutions. These trends are expected to enhance customer engagement and satisfaction.

What trends are shaping the Asia Pacific Life & Non-Life Insurance Market?

Trends shaping the Asia Pacific Life & Non-Life Insurance Market include the rise of insurtech companies, the integration of artificial intelligence in underwriting processes, and a focus on sustainability in insurance offerings. These trends are transforming how insurance products are developed and delivered.

Asia Pacific Life & Non-Life Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Term Life, Whole Life, Universal Life, Endowment |

| Customer Type | Individuals, Corporates, SMEs, Government |

| Distribution Channel | Direct Sales, Brokers, Banks, Online Platforms |

| Service Type | Claims Processing, Underwriting, Policy Administration, Risk Assessment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Life & Non-Life Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at